Mutual Funds: India

| Line 10: | Line 10: | ||

=2015: Equity MFs beat FIIs= | =2015: Equity MFs beat FIIs= | ||

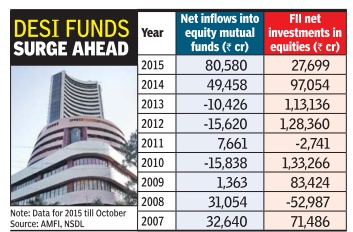

| − | [[File: 2007-2015, investments in mutual funds, and investments by FIIs in equities.jpg|2007-2015, investments in mutual funds, and investments by FIIs in equities; Graphic courtesy: [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml= | + | [[File: 2007-2015, investments in mutual funds, and investments by FIIs in equities.jpg|2007-2015, investments in mutual funds, and investments by FIIs in equities; Graphic courtesy: [http://epaperbeta.timesofindia.com//Article.aspx?eid=31808&articlexml=Equity-MF-investors-beat-FIIs-in-15-20112015023019 ''The Times of India''], November 20, 2015|frame|500px]] |

| − | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml= | + | [http://epaperbeta.timesofindia.com//Article.aspx?eid=31808&articlexml=Equity-MF-investors-beat-FIIs-in-15-20112015023019 ''The Times of India''], November 20, 2015 |

Allirajan M | Allirajan M | ||

| − | ''' | + | '''Equity MF investors beat FIIs in 2015''' |

| + | | ||

| + | For years, equity mutual funds (MFs) were the poor cousins of the stock markets as foreign institutional investors (FIIs) always poured more money into direct equities. But for the first time ever, equity MF investors are overshadowing their overseas peers, having pumped nearly three times more funds into equity schemes in the current year than FIIs. | ||

| + | Equity MFs (including equity-linked savings schemes, or ELSS) have seen net inflows of Rs 80,580 crore, or about $12.5 billion, so far in 2015 (till October) -the highest on record. In contrast, FIIs have made net investments of Rs 27,699 crore, or around $4.25 billion, during the period. | ||

| − | + | In fact, net investments made by MF investors have al ready surpassed the highs hit in 2014. The surge in inflows into equity schemes has prompted fund houses to deploy money in shares in a big way .Equity MFs have deployed about $950 million per month on an average in 2015. Fund deployments peaked to an all-time monthly high in August af ter the stock markets plunged in the wake of the global turmoil in equity markets amid a sharp selloff in China. | |

| − | + | “Investors are gradually realizing that equities are the best option on a tax-adjusted basis over the long term. So they are putting a bigger portion of their savings in equiti es,“ says Sunil Singhania, head (equities), Reliance Capital Asset Management. | |

| − | + | Gopal Agrawal, CIO, Mirae Asset Global Investments India, says, “Interest (in equities) has been quite consistent among investors. Other asset classes such as gold and real estate have not done well and this has also helped. There is a clear shift in investment patterns. Investors have become a lot more mature. The attractiveness of other asset classes has diminished to a large extent. But the long-term outlook is quite positive for equities.“ | |

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| + | Barring odd instances such as the market meltdown in 2008 when the rout that followed the global financial crisis triggered a massive pullout by FIIs, overseas investors have stood head and shoulders above their domestic peers in investments into Indian stocks. | ||

=See also= | =See also= | ||

[[Sensex ]] <> [[The stock market: India]] <> [[Mutual Funds: India ]] <> [[Rupee: India ]] | [[Sensex ]] <> [[The stock market: India]] <> [[Mutual Funds: India ]] <> [[Rupee: India ]] | ||

Revision as of 15:44, 4 December 2015

This is a collection of articles archived for the excellence of their content. |

2015: Equity MFs beat FIIs

The Times of India, November 20, 2015

Allirajan M

Equity MF investors beat FIIs in 2015 For years, equity mutual funds (MFs) were the poor cousins of the stock markets as foreign institutional investors (FIIs) always poured more money into direct equities. But for the first time ever, equity MF investors are overshadowing their overseas peers, having pumped nearly three times more funds into equity schemes in the current year than FIIs. Equity MFs (including equity-linked savings schemes, or ELSS) have seen net inflows of Rs 80,580 crore, or about $12.5 billion, so far in 2015 (till October) -the highest on record. In contrast, FIIs have made net investments of Rs 27,699 crore, or around $4.25 billion, during the period.

In fact, net investments made by MF investors have al ready surpassed the highs hit in 2014. The surge in inflows into equity schemes has prompted fund houses to deploy money in shares in a big way .Equity MFs have deployed about $950 million per month on an average in 2015. Fund deployments peaked to an all-time monthly high in August af ter the stock markets plunged in the wake of the global turmoil in equity markets amid a sharp selloff in China.

“Investors are gradually realizing that equities are the best option on a tax-adjusted basis over the long term. So they are putting a bigger portion of their savings in equiti es,“ says Sunil Singhania, head (equities), Reliance Capital Asset Management.

Gopal Agrawal, CIO, Mirae Asset Global Investments India, says, “Interest (in equities) has been quite consistent among investors. Other asset classes such as gold and real estate have not done well and this has also helped. There is a clear shift in investment patterns. Investors have become a lot more mature. The attractiveness of other asset classes has diminished to a large extent. But the long-term outlook is quite positive for equities.“

Barring odd instances such as the market meltdown in 2008 when the rout that followed the global financial crisis triggered a massive pullout by FIIs, overseas investors have stood head and shoulders above their domestic peers in investments into Indian stocks.

See also

Sensex <> The stock market: India <> Mutual Funds: India <> Rupee: India