State Bank of India

(Created page with "{| Class="wikitable" |- |colspan="0"|<div style="font-size:100%"> This is a collection of articles archived for the excellence of their content.<br/> </div> |} [[Category:Ind...") |

|||

| Line 13: | Line 13: | ||

[https://timesofindia.indiatimes.com/business/india-business/sbi-reports-first-quarterly-loss-in-nearly-two-decades/articleshow/62859690.cms February 10, 2018: ''The Times of India''] | [https://timesofindia.indiatimes.com/business/india-business/sbi-reports-first-quarterly-loss-in-nearly-two-decades/articleshow/62859690.cms February 10, 2018: ''The Times of India''] | ||

| + | [[File: Total deposits, total advances, operating profit, provisions and net profit- State Bank of India (Q3, 2017-18).jpg|Total deposits, total advances, operating profit, provisions and net profit- State Bank of India (Q3, 2017-18) <br/> From: [https://timesofindia.indiatimes.com/business/india-business/sbi-reports-first-quarterly-loss-in-nearly-two-decades/articleshow/62859690.cms February 10, 2018: ''The Times of India'']|frame|500px]] | ||

'''HIGHLIGHTS''' | '''HIGHLIGHTS''' | ||

| − | Country’s largest bank SBI has reported its first quarterly loss in nearly two decades | + | |

| + | Country’s largest bank SBI on Thursday has reported its first quarterly loss in nearly two decades | ||

| + | |||

| + | Bad loans of the lender rose after the RBI directed the bank to classify loans worth Rs 23,000 crore, largely in the power sector, as non-performing asset | ||

| + | |||

| + | |||

| + | The country's largest bank SBI has reported its first quarterly loss in nearly two decades following a surge in provisioning for bad loans and losses on bond valuation. Bad loans rose after the RBI directed the bank to classify loans worth Rs 23,000 crore, largely in the power sector, as non-performing assets (NPAs). | ||

| + | |||

| + | The lender reported a net loss of Rs 2,416 crore for the quarter ended December 31, versus a profit of Rs 1,820 crore a year earlier. The quarter turned out to be the perfect storm for the bank as it was simultaneously hit by Rs 700-crore provisions towards imminent wage revisions and costs related to merger of associate banks with itself. | ||

| + | |||

| + | The rise in bond yields resulted in a double whammy for the bank — the value of bonds dipped by Rs 2,000 crore, requiring provisioning, and profits from trading in securities dipped to Rs 1,026 crore from Rs 4,900 crore in Q3FY17. | ||

| + | |||

| + | Overall, Rs 25,830 crore of fresh loans slipped into the NPA category. "We have done an account-by-account assessment and NPA provisions have peaked and will be coming down in subsequent quarters," said SBI chairman Rajnish Kumar. | ||

| + | |||

| + | According to Kumar, the large loan accounts against which the bank has initiated insolvency proceedings have advances amounting to Rs 78,000 crore. The bank has already made all the statutory provisioning in respect of these loans and most of these were expected to get resolved in the first quarter of FY19. | ||

| + | |||

| + | SBI has taken a tough stance against borrowers. In addition to initiating insolvency proceedings against them, the bank has invoked the personal guarantee of the promoters, Kumar said. | ||

| + | |||

| + | Announcing the results, Kumar said that 90% of the accounts that slipped into the NPA category were from those classified as stressed and there were no more stressed loans left. "We are at the end of the NPA cycle and the overall scenario looks very good," he said. | ||

| + | |||

| + | Another positive development according to Kumar was the shift in customer engagement to alternate (nonbranch) channels, which now account for 84% of all transactions — up from 76% earlier. "The benefits of the branch rationalisation that we have undergone will be felt in coming quarter," said Kumar. | ||

| + | |||

| + | SBI will also announce its new minimum balance requirement by the end of the month or early March. Kumar said that the bank is conducting an annual review of charges and was relooking at the minimum balance requirements as part of the review. "We will definitely keep in mind what our customers want," said Kumar. | ||

Revision as of 13:16, 11 February 2018

This is a collection of articles archived for the excellence of their content. |

Profitability

2017-18/ Q3: 1st quarterly loss in 2 decades

February 10, 2018: The Times of India

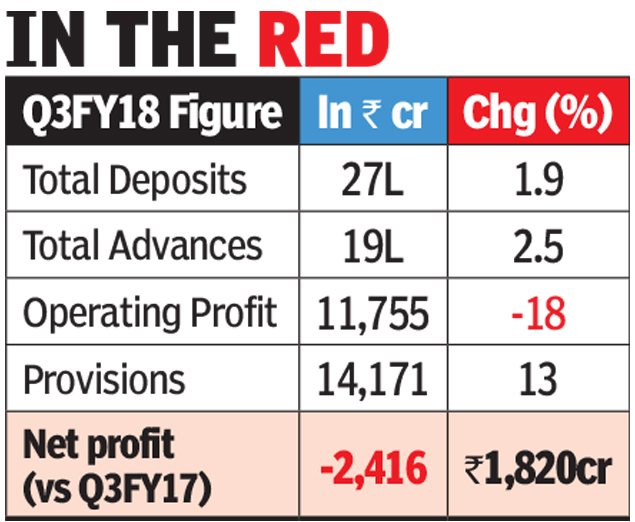

From: February 10, 2018: The Times of India

HIGHLIGHTS

Country’s largest bank SBI on Thursday has reported its first quarterly loss in nearly two decades

Bad loans of the lender rose after the RBI directed the bank to classify loans worth Rs 23,000 crore, largely in the power sector, as non-performing asset

The country's largest bank SBI has reported its first quarterly loss in nearly two decades following a surge in provisioning for bad loans and losses on bond valuation. Bad loans rose after the RBI directed the bank to classify loans worth Rs 23,000 crore, largely in the power sector, as non-performing assets (NPAs).

The lender reported a net loss of Rs 2,416 crore for the quarter ended December 31, versus a profit of Rs 1,820 crore a year earlier. The quarter turned out to be the perfect storm for the bank as it was simultaneously hit by Rs 700-crore provisions towards imminent wage revisions and costs related to merger of associate banks with itself.

The rise in bond yields resulted in a double whammy for the bank — the value of bonds dipped by Rs 2,000 crore, requiring provisioning, and profits from trading in securities dipped to Rs 1,026 crore from Rs 4,900 crore in Q3FY17.

Overall, Rs 25,830 crore of fresh loans slipped into the NPA category. "We have done an account-by-account assessment and NPA provisions have peaked and will be coming down in subsequent quarters," said SBI chairman Rajnish Kumar.

According to Kumar, the large loan accounts against which the bank has initiated insolvency proceedings have advances amounting to Rs 78,000 crore. The bank has already made all the statutory provisioning in respect of these loans and most of these were expected to get resolved in the first quarter of FY19.

SBI has taken a tough stance against borrowers. In addition to initiating insolvency proceedings against them, the bank has invoked the personal guarantee of the promoters, Kumar said.

Announcing the results, Kumar said that 90% of the accounts that slipped into the NPA category were from those classified as stressed and there were no more stressed loans left. "We are at the end of the NPA cycle and the overall scenario looks very good," he said.

Another positive development according to Kumar was the shift in customer engagement to alternate (nonbranch) channels, which now account for 84% of all transactions — up from 76% earlier. "The benefits of the branch rationalisation that we have undergone will be felt in coming quarter," said Kumar.

SBI will also announce its new minimum balance requirement by the end of the month or early March. Kumar said that the bank is conducting an annual review of charges and was relooking at the minimum balance requirements as part of the review. "We will definitely keep in mind what our customers want," said Kumar.