Soap industry: India

This is a collection of articles archived for the excellence of their content. |

Contents |

Fragrance

As in 2020

Namrata Singh, February 24, 2020: The Times of India

From: Namrata Singh, February 24, 2020: The Times of India

‘What’s visible would sell’ has been the basic principle followed by marketers. On a deeper, sensorial connect, it’s: ‘What smells good would sell good as well’. Sensorials play a very critical role when it comes to consumers’ choice of products.

While over the years traditionally rooted fragrances like jasmine and sandalwood have had a distinct contribution, especially for soaps, a combination of fruity-floral fragrances are now gaining traction with marketers wooing younger consumers. Today, the more exotic the fragrance, the better the connect, say experts. CKC Aromas CEO Rishabh Kothari said there is a lot of experimentation happening in the fruity-floral space and some oriental notes such as ‘oud’ are catching up among the more affluent Indians who are looking for something different. “With the trend of naturals in FMCG, we also see a huge demand for notes which smell natural,” said Kothari, who is one of the leading players in the sensory market.

Dabur recently launched a ‘floral bliss’ variant, which is a complex floral fragrance, and a ‘daffodil’ variant under its Odonil brand. Dabur India marketing head (home & personal care) Rajeev John said popular fragrances like jasmine and sandalwood continue to be relevant today, and these have also extended beyond beauty to enter the home care space. However, he added, one is now seeing the younger generation embracing newer exotic fragrances and floral fusions.

“Fragrance is highly important as it is usually the first point of contact for any individual with a product. You tend to smell the product first before touching or experiencing it. Many a times, particularly in categories like personal care and home care, a fragrance becomes one of the most important factors when it comes to final product selection,” said John, who claims that the Odonil Zipper range has been a success mainly because it got the fragrance right.

Godrej Consumer Products CEO (India & SAARC) Sunil Kataria said, “A product has to appeal to all senses of consumers to gain approval, with look-feel-smell forming a critical role. This is the very reason why some air freshener brands or variants have done well, while others haven’t — be it in personal care or air fresheners. When we test for fragrance in our products, we check for fragrance liking, fragrance strength (just right), fragrance spread (especially for air fresheners) and how long lasting the fragrance is.”

Affluence is one of the reasons for the growing demand for newer experiences in fragrances. Over the years, as multiple brands of FMCG products moved into urban Indian households, traditional fragrances gave way to newer ones. Wipro Consumer Care and Lighting CEO Vineet Agrawal, however, said non-metro markets are still a one-soap household and often decision on the brand is made by the home maker. Jasmine and sandalwood products, thus, continue to have a stronger hold in these markets.

According to Kataria, the occasion or space also determines which fragrance works well and where. “If the objective is to counter malodour like in a bathroom, consumers prefer stronger fruity fragrances. However, if the objective is to enjoy me-time in one’s bedroom or have a relaxing time with friends or partners in the living room, people prefer softer notes like aqua, fougere,” said Kataria.

Some brands command a loyal consumer base owing to fragrance, like Dettol Original, Cinthol Original and Pears original soap. On the other hand, Lifebuoy — known by its strong carbolic smell — underwent a complete makeover and continued to maintain a leadership position.

“There is a loyal market for certain fragrances and flavours — for instance, Colgate dental cream. Whenever a marketer feared that an alteration could negatively impact sales, they introduced variants. Liril is known for its predominant lemon-freshness, but the brand has experimented with different notes in lemon to keep it contemporary,” said Kothari.

2018

From: Namrata Singh, Has Santoor overtaken Lux as India’s No. 2 soap brand?, June 13, 2018: The Times of India

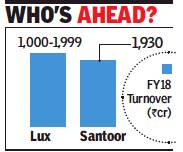

The toilet soaps market may have become slippery for some brands to hold on to their positions in the pecking order. Santoor, from Wipro Consumer Care & Lighting (WCCL), is within striking distance of the Rs 2,000-crore turnover mark — a feat so far achieved only by Hindustan Unilever’s (HUL’s) Lifebuoy soap, the leading brand of the category.

Santoor closed the financial year 2018 with a turnover of Rs 1,930 crore and chances are it may have overtaken HUL’s beauty soap brand Lux to become the secondlargest toilet soap brand in the country. While there is no confirmation on Lux’s exact annual turnover, it figures in the list of HUL’s Rs 1,000-crore-plus brands. The turnover of Lux could thus be anywhere in the Rs 1,000-1,999 crore range. Even if one were to presume Lux closed the previous fiscal with a turnover that was more than Santoor’s Rs 1,930 crore, the gap between the two brands would be very narrow, making the race to the Rs 2,000-crore mark a close one.

WCCL CEO Vineet Agrawal told TOI, “Santoor has clocked Rs 1,930 crore in financial year 2017-18.” He said the brand’s rural market shares are significantly higher than urban. “In Telangana and Andhra Pradesh (AP), our market share is 38-40%. The No. 2 brand would be onefourth our size in this market. Santoor is No. 1 in AP, Karnataka, Maharashtra and Gujarat (rural), and in AP & Telangana (urban and rural combined),” he added.

An HUL spokesperson said Lux has grown well in the last year. “It (Lux) is the second-largest soap brand in India after Lifebuoy,” said the HUL spokesperson, without commenting on or disclosing individual brand growth numbers. Agrawal said, “The advertising (of Santoor) has stuck to the ‘younger looking skin’ platform for the last 25+ years. Even in rural India, we stuck to the same communication. This is because India had opened up and rural people were exposed to urban aspects.”

2019/ Q1

Namrata Singh, June 26, 2019: The Times of India

From: Namrata Singh, June 26, 2019: The Times of India

Santoor 1st desi soap to hit ₹2k-cr sales

Mumbai:

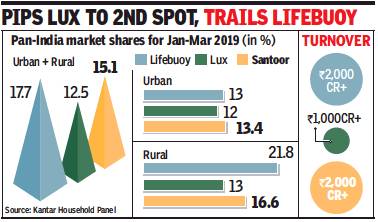

Santoor has become the first soap brand from an Indian FMCG company to breach annual sales of Rs 2,000 crore. Wipro Consumer Care, the maker of Santoor, confirmed the number to TOI. With a turnover of over Rs 2,000 crore, Santoor has clearly overtaken HUL’s soap brand Lux, and is now challenging the numero uno Lifebuoy. HUL’s latest annual report places Lifebuoy and Lux in the Rs 2,000-crore and Rs 1,000-crore plus sales bracket, respectively.

Wipro Consumer Care and Lighting CEO Vineet Agrawal said, “Santoor has grown consistently across urban and rural markets. It is now among the Rs 2,000-crore plus consumer brands — first and only Indian soap brand to do so.”

According to industry sources quoting Kantar Household panel data, Santoor’s all-India market share in January-March 2019, at 15.1%, has exceeded Lux’s 12.5%, but is less than Lifebuoy’s 17.7%. The urban market data, however, shows Santoor (13.4%) ahead of both Lux (12%) and Lifebuoy (13%). Kantar declined to comment on this data. Industry sources quoting Nielsen data said Santoor (9.3%) is the third-largest brand after Lifebuoy (13.7%) and Lux (12%) for January-March 2019. When contacted, an HUL company spokesperson said, “Lux continues to be the second-largest soap brand in India after Lifebuoy. As a policy, we do not comment on market shares.”

Insights into data from Worldpanel Division of Kantar reveal that Santoor’s penetration is much higher than Lux in South and parts of West regions. However, at a national level, Santoor has a much lesser penetration than Lux (34% against 60%).

Lux’s penetration is driven by the Rs 10-pack (about 55g), with 60% of Lux-buying homes purchasing this pack. On the other hand, Santoor’s penetration is driven largely by its 75g+ pack, with 70% of Santoor-buying homes purchasing this pack. According to the data from Worldpanel Division of Kantar, Santoor also has a higher number of buying occasions than Lux (Santoor buyers purchase about 45% more times than Lux buyers). As a result, the overall volumes of Santoor have gone ahead of Lux in recent times.