Aadhaar/ Unique Identification Number (UID)

This is a collection of articles archived for the excellence of their content. |

UID/ Aadhaar: A backgrounder

The Times of India, Oct 09 2015

Mahendra Singh

Aadhaar not mandatory, but makes life easier

The Aadhaar number is not a mandatory ID and the government is willing to reiterate this commitment but inability to link the UID platform with a plethora of central and state welfare schemes will severely disadvantage a large chunk of 92 crore persons enrolled in the scheme who have no other reliable means of identification. While the rules make it clear that Aadhaar is not mandatory for various services, requests will be processed much faster with a UID number as it provides definitive proof of identity through biometrics and eliminates duplication and fraud.

Usage of Aadhaar suggests that the initiative has gained momentum because of an individual's preference as it offers benefits either in terms of convenience, time, money , andor transparency .

While many in urban areas may have alternative IDs, a very large number of Aadhaar enrolled persons, mainly poor and rural masses, have no other ID and will be hit hard if Aadhaar is ruled out as a link to welfare.

Aadhaar, considered a valid proof of address and identity across various domains including the government, has emerged as a key tool as UID offers a ubiquitous platform to authenticate anyone, anytime so long as there is internet connectivity .

As on date, around 92 crore people have been issued Aadhaar, which is much higher than 5.7 crore passports, over 17 crore PAN cards, over 60 crore election photo identity cards (EPIC), over 15 crore ration cards and over 17 crore driving licences.

Aadhaar has emerged as a key tool for preventing leaks.One such case is saving of around Rs 19,000 crore in the direct benefit transfer scheme. Over 2.50 crore payments (transactions) have taken place in schemes like MGNREGA, pensions and scholarships while over 70,000 appointments have been booked at leading hospitals in Delhi such as AIIMS by outstation people by using Aadhaar-linked KYC service.

History

A BRIEF HISTORY OF A UNIQUE IDENTITY PROJECT, September 27, 2018: The Times of India

12 years after it was conceived, Aadhaar overcomes several legal challenges to become constitutionally valid

1 AADHAAR IS BORN

In March 2006, the ministry of communications and information technology approves a Unique ID (UID) scheme for poor families. At its first meeting in 2007, the empowered group of ministers (EGoM) recognises need to create a residents’ database. This leads to the creation of Aadhaar

2 ENTER NILEKANI

The Unique Identification Authority of India (UIDAI) is created in 2009 to issue unique identification numbers. Nandan Nilekani appointed the first chairman

3 PRIVACY FIRST

In December 2010, the National Identification Authority of India (NIAI) Bill, 2010 is introduced in Parliament. But a year later, the standing committee on finance rejects the bill in its initial form; recommends requirement of privacy legislation and data protection law before the scheme is continued

4 LEGAL BATTLE BEGINS

KS Puttaswamy, a retired judge of the Karnataka high court, mounts the first legal challenge to Aadhaar in 2012, says it violates fundamental rights of equality and privacy

5 SC STEPS IN

Supreme Court passes an interim order in September 2013 stating no person should suffer for not having an Aadhaar card. In August 2015, three-judge SC bench limits Aadhaar use to certain welfare schemes, orders that no one should be denied benefits for lack of an Aadhaar card

6 BUT AADHAAR BECOMES A MUST

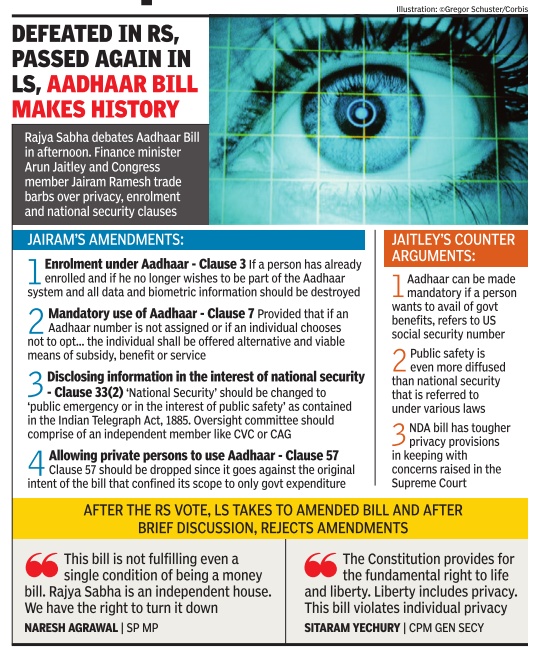

In March 2016, government introduces Aadhaar (Targeted Delivery of Financial & Other Subsidies, Benefits & Services) Bill as a money bill in Lok Sabha. Bill passed by Parliament; receives presidential assent. By early 2017, various ministries make Aadhaar mandatory for welfare, pension, and employment schemes. Aadhaar made mandatory for filing of income tax returns

7 OVER TO CONSTITUTION BENCH

On July 7, 2017, SC says all Aadhaar issues will be addressed by a constitution bench. On January 17, 2018, a five-judge constitution bench begins hearing 30 petitions challenging Aadhaar’s validity. In March, after 2 months of arguments against Aadhaar, the Centre begins its defense. On May 10, court reserves verdict. The 38-day hearing is the second longest oral hearing after the 1973 Keshavananda Bharti case

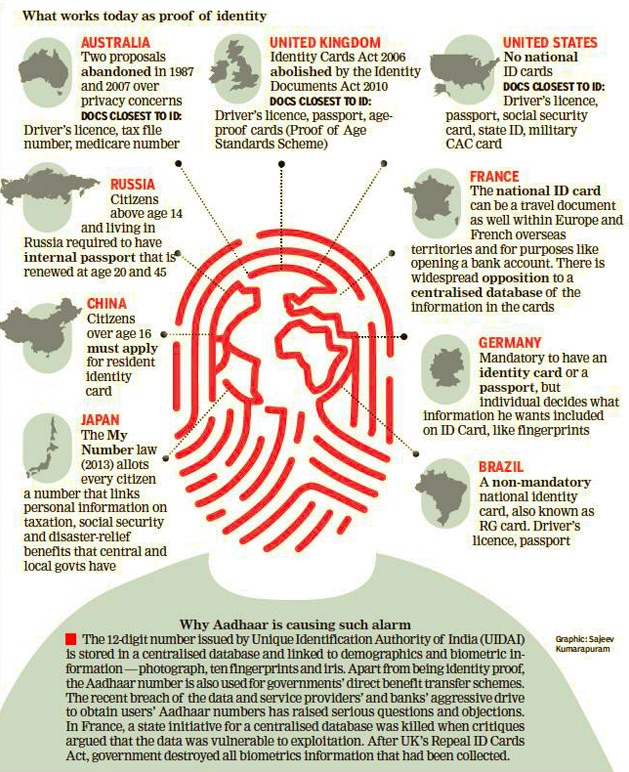

How the world identifies its citizens

From: September 27, 2018:The Times of India

See graphic:

How the world identifies its citizens, as in 2018

A history of identity cards across the world

From: September 27, 2018: The Times of India

From: September 27, 2018: The Times of India

See graphics:

First identification cards in the world- under Napoleon era and Ottoman emperor Sultan Mahmud II

Identity cards in the world- before-during World War II and post World War II

Aadhaar has no parallel in any country

January 15, 2018: The Times of India

From: January 15, 2018: The Times of India

See graphic:

The proof of identity required in other countries, as of 2018

The idea of a single over-arching identity number for all citizens issued by the state is not new, but in most developed countries, passport and driver's licence remain the most-accepted IDs. Here is a look at why Aadhaar is really unique.

ID cards started as a tool to track citizens.

France was 1803-04 the first country in the modern world to issue identity cards. Introduced during Napoleon's time, the card was issued mostly to the working class to control their movement and keep wages down. Workers had to submit their cards (livret ID) to employers and take it back if they wanted a change of job — getting the card back was difficult

1839: Ottoman emperor Sultan Mahmud II was witnessing a decline in influence amid increasing interference of other European countries in his territories. In his bid to enhance the state's power on citizens, Mahmud's Tanzimat introduced a national ID card

WW : In the pre-World War II era UK and Germany made it mandatory for citizens to have ID cards in 1938. Vichy France introduced cards in 1940. Cards issued in Germany and Vichy France were used to identify and target Jews. In UK, the national registry act was repealed after the war

Post WW II: In 1949 Hong Kong and Taiwan introduced the card to check immigration from mainland China. In 1958 China introduced Hukou Registration Regulation, used to provide the underprivileged benefits to underprivileged citizens and was also used to restrict movement inside the country. In 1960s South Korea and Singapore also introduced national identity cards

What does Aadhaar collect?

Srikanth Nadhamuni, March 2, 2018: The Times of India

Claims, insinuations and even jokes have done the rounds on print and social media about how the Aadhaar system could lead to a surveillance state. There are worries that unsuspecting Aadhaar carrying residents will be closely tracked by the government while they authenticate themselves as they pay for their pizza or buy rice at a ration shop.

We need to understand what data Aadhaar collects and more importantly what it doesn’t, to determine whether the above dystopian scenarios are likely or even possible. Aadhaar does only two things. First, enrolment, wherein an applicant is processed and issued an Aadhaar number. Second, online authentication where the Aadhaar holder is accurately verified during a transaction such as buying rations.

Back in December 2009, a government appointed committee with representatives from several ministries, regulators and NGOs met to determine which demographic fields should be collected to issue an Aadhaar. After lengthy deliberations, the committee came up with a simple rule – UIDAI should only collect the minimal amount of information in order to protect the privacy of the people. The four mandatory fields were, ‘Name’, ‘Address’, ‘Gender’ and ‘Date-of-birth’. ‘Email’ and ‘mobile number’ were left optional.

Similarly, a government appointed biometric committee decided that ten fingerprints, two irises, and a photo of the face were needed to accurately de-duplicate the entire population and issue a unique ID, thus ensuring that a resident does not get multiple Aadhaar IDs. This was the bane of earlier systems, where programme-based ID cards which lacked uniqueness (one person, one ID) resulted in duplicates and ghost IDs, leading to resource capture, leakage and other fraudulent transactions.

Based on the above demographic and biometric data that is collected, the enrolment system issues an Aadhaar number after a de-duplication process to ensure that the resident is unique and does not already possess an Aadhaar number.

Once the resident is enrolled in the Aadhaar system, she can now authenticate herself at various points to prove her identity. Just as one would enter a user-ID and password to login to one’s email account, the Aadhaar holder can now authenticate herself by entering her Aadhaar-number (user-ID) and one of the demographic/ biometric details (password). This online verification proves to be very useful in a host of services, be it government service delivery, banking/ payments or even renting a bicycle.

Now let’s look at Aadhaar authentication.

During authentication, the user enters the Aadhaar number and one or more of the biometric (fingerprint/ iris) or demographic (name/ address/ gender/ date of birth) fields and Aadhaar returns a Yes/ No response. It does not return other details about the person, hence protecting the privacy of the individual.

The Aadhaar system does not collect the specific purpose of your authentication, or the location of your transaction so there is no way the system can construct where you were and what you were doing. As can be seen in Section 3.3 of the ‘Aadhaar Authentication API Specification’, there is no input field in the data format that collects the location or type of transaction being carried out (example, paying for your pizza or buying rice at a ration shop).

Delving deeper into privacy and accountability, let’s look at the audit trail feature Aadhaar provides so that you can view your Aadhaar transactions and ensure that they were all bonafide – just as you reconcile your bank statements. It can be argued that if the history of Aadhaar transactions contained details such as what (specific transaction type), where (location information) and by whom (authenticating entity), the user would be empowered with context against potential frauds by more accountability in the system. In fact, an earlier version of the Authentication API spec did collect the location information for this very reason. On the contrary, it can also be argued that collecting the where and what and who would compromise the Aadhaar holder’s privacy.

The point i’m making is that a line has to be drawn somewhere between privacy and accountability and you can’t have both independent of each other. A measured, balanced approach between the two is in the interest of citizens and this, i believe, is what Aadhaar offers.

An average smartphone user can be tracked by the telecom provider who can triangulate the user’s location through telecom base stations. Apps from Google, Facebook, Apple and thousands of other companies are also able to track smartphone user location using GPS sensors. Surveys show that over 75% of smartphone users enable location services. This is the reality of the digital world we live in. In contrast, the Aadhaar authentication system is designed to protect people’s privacy by not collecting such information.

India is coming to terms with privacy in this increasingly digital world for the first time. The debate around Aadhaar privacy is a precursor to the larger privacy debate. It is a good thing that people are becoming aware of the issues around privacy.

Aadhaar brings tremendous benefits to our country, be it in plugging the leaky pipes of the government’s benefits delivery, or convenient pension payments. The passing of a robust privacy bill and Aadhaar compliance to it would hopefully help alleviate concerns as we strive to build systems of better service delivery in a data rich and digital India.

Aadhaar gets a new incarnation under PM Modi

Around the end of June (2014), (Nandan) Nile kani (then chairman, Unique Identification Authority of India (UIDAI)) and his wife Rohini, who runs a social foundation, were vacating their Delhi residence on Safdarjang Lane, packing up to return to their Bengaluru base. They invited (Ram Sevak) Sharma (then CEO, UIDAI) for lunch. Over lunch Sharma told Nilekani about his presentation to the PM and the response to it. Nilekani was happy to hear this and thanked Sharma for the effort. Then Sharma said, `Why don't you go and meet the Prime Minister? Aadhaar is your idea; it has so much potential, why don't you make this last attempt for it?' Nilekani found himself on the horns of a dilemma.On the one hand, he had lost the election on a Congress ticket and there was the history of campaign rhetoric, all the stuff that had been said. On the other, `the thought that Aadhaar could be irretrievably shut down was heart-breaking'.

On 28 June, Nilekani telephoned the PMO and sought time on 1 July . He was given an appointment for noon, 1 July, at South Block, the office of the Prime Minister.

It was a one-on-one meeting. In those thirty minutes, Nilekani outlined the potential of Aadhaar. `I explained the platform, its expansion across many states, the applications that had been developed, the possibilities recommended by task forces and committees.' The PM had a clear understanding of the technology and had questions about migrants and the status of cases in the courts.Nilekani allayed the fears around data security and verification. He pointed to the low cost at which the platform had been developed. He underlined the fact that Aadhaar as a platform `could help resolve many issues, including the targeting of subsidies and curbing corruption. It could lead to huge savings to the exchequer.' Modi met Nilekani . On Thursday , the home ministry was preparing to merge UIDAI and NPR, following a meeting with Rajnath Singh, IT, telecom and law minister Ravi Shankar Prasad and planning minister Rao Inderjeet Singh. On Saturday , 5 July, Prime Minister Modi revived Aadhaar.

This followed a meeting with Jaitley and Rajnath Singh, attended by officials of the UIDAI, home ministry, Planning Commission and the PMO. A committee was formed to look into the issues. Modi asked finance minister Jaitley , the legal luminary in the government, to look into legal issues since there were cases pending in the Supreme Court. He also called for the revival of the National Identification Authority of India Bill that had been trashed by the Yashwant Sinha-led parliamentary standing committee.

Prime Minister Modi, when asked by this author, about the revival of Aadhaar and his earlier criticism of it, says, `The need for a common identity card was felt since the Vajpayee government was in power. A group of ministers even worked on this.However, not much was done during UPA I to carry forward this vision. Eventually Aadhaar was launched only in the second term of the UPA government.' According to the Prime Minister, `When Aadhaar was launched there were multiple issues and inadequacies with it. They simply could not envisage it holistically as an empowering mechanism for the masses.For them, it was just another scheme. I had suggested many ideas but the UPA regime simply didn't want to accept any suggestions from Narendra Modi.' Elaborating on his party's earlier opposition, Modi says, `Our problem was not with the idea of Aadhaar, but with the inadequacies of Aadhaar. We have never opposed anything for the sake of opposition. I do not believe in that kind of politics. The UPA government had a problem of imagination and an even bigger problem of implementation.

I knew Aadhaar had potential. For years they ran Aadhaar, but it still didn't have any parliamentary backing, nor integration with public service delivery.' Explaining how his government took it forward, the Prime Minister adds, `We took a decision to separate the security issues that were raised by home ministry from the issue of Direct Benefit Transfer. We created a committee to look into the legal and technology issues, and we fixed it. We expanded the scope of Aadhaar, amplified the scale and augmented the speed. In a short span of time, the country has already saved about Rs 50,000 crores due to Aadhaar-based systems.' Narendra Modi is not bound by conventional definitions of ideology . His approach is based on political entrepreneurship, and policy is essentially an instrument to consolidate and expand political subscription.Modi invests a lot of faith in the use of technology-for politics and for public policy .For Modi, therefore, Aadhaar was about using technology , a means to empower outcomes.

How rural India received Aadhaar

From: September 27, 2018: The Times of India

See graphic:

How rural India received Aadhaar, presumably as in 2016-18

2011-18: statistics

From: September 27, 2018: The Times of India

From: September 27, 2018: The Times of India

See graphics:

2011-18- The number Indians enrolled in Aadhaar

2016-18- The number and value of digital transactions authenticated by Aadhaar

Aadhaar is essential for…

KYC compliance

Mayur Shetty, RBI makes :: Aadhaar key to KYC compliance, April 21, 2018: The Times of India

The Reserve Bank of India (RBI) on Friday amended its ‘know your customer’ (KYC) guidelines, making Aadhaar key to conducting customer due diligence by banks and finance companies. The RBI has also done away with sections relating to the use of other “officially valid documents” by lenders for address and identity proof but has said that the new norms are subject to the final judgment of the Supreme Court on Aadhaar.

In a circular, the RBI said the norms have been revised because the government had amended laws on prevention of money laundering through a gazette notification on June 2017. However, it’s not clear when the new guidelines would come into force.

Last month, the Supreme Court struck down a March 31 deadline for mandatory linking of Aadhaar to avail of various services until its constituent bench came up with a verdict on the validity of the unique identification number. The removal of the deadline applied to bank accounts and telecom services in addition to other government schemes.

The circular states that for the purpose of doing customer due diligence, all RBI regulated entities must obtain “from an individual who is eligible for enrolment of

Aadhaar”, the Aadhaar number, PAN or Form No. 60 as defined in income tax rules. Since every citizen is eligible for Aadhaar, the rule will apply to all Indians. The Aadhaar requirement though is relaxed for residents of Jammu & Kashmir, Assam and Meghalaya.

It is still not clear how banks are expected to deal with customer due diligence considering that the new circular amends several of the earlier directions dated February 25, 2016. For instance, the new norms do not include an earlier section allowing a copy of the marriage certificate issued by the state government or a gazette notification, indicating change in name together with a certified copy of the ‘officially valid document’ in the existing name of the person as proof of address and identity. This means that Aadhaar would be the only proof of identity for KYC purpose.

It also does away with the flexibility of a declaration from a relative certifying that the account holder is living with him/her as proof of address. Until now customers who are identified as ‘low risk’ by banks were allowed to be given six months to complete the due diligence process. This has been discontinued. So also the relaxation which allows existing customers to open additional accounts without repeating the KYC process.

The new norms are subject to the final judgment of the Supreme Court on Aadhaar

For I-Tax returns: 2019 onw

PAN-Aadhaar link must to file I-T returns from this year, February 7, 2019: The Times of India

Putting to rest all doubt, the Supreme Court has said that linking the permanent account number with Aadhaar is mandatory for filing income tax returns.

A bench comprising Justices A K Sikri and S Abdul Nazeer said the top court has already decided the matter and upheld Section 139AA of the Income Tax Act. The court’s order came on an appeal filed by the Centre against a Delhi high court ruling allowing Shreya Sen and Jayshree Satpute to file income tax returns for assessment year 2018-19 (financial year 2017-18) without linking their Aadhaar number and PAN.

There were some other individuals too who had been given relief last year.

‘Majority of PANs already linked to Aadhaar’

The aforesaid order was passed by the HC having regard to the fact that the matter was pending consideration in this court. Thereafter, this court has decided the matter and upheld the vires of Section 139AA of the Income Tax Act. In view thereof, linkage of PAN with Aadhaar is mandatory,” the bench said.

Sen and Satpute had filed their returns following the court order and the assessment has also been completed. The SC made it clear that for the current assessment year, returns have to be filed after linking PAN and the unique ID. The order flows from the September 26 verdict, which declared Aadhaar legally valid and allowed its use for getting subsidies and linking with PAN.

While several taxpayers wanted to opt out of Aadhaar and did not want to link their PAN, the government has maintained that it is critical to ensure that individuals don’t evade taxes with multiple PANs. A majority of PANs have already been linked to Aadhaar, government sources said. Activists were not very happy with the latest verdict. Suman Sengupta, activist and civil engineer, said, “We need to ask if Aadhaar is verified data or has it been audited. Then if someone links PAN with a fraudulent Aadhaar and subsequently links it with a phone number, how can UIDAI or income tax department verify that?”

Aadhaar is NOT essential for…

Ayushman Bharat National Health Protection Scheme (NHPS)

Govt: Aadhaar ‘desirable’, not must for NHPS, July 13, 2018: The Times of India

Clearing the air around requirement of Aadhaar to avail benefits under Ayushman Bharat National Health Protection Scheme (NHPS), the health ministry said Aadhaar is “desirable” but not mandatory to avail benefits under the insurance scheme.

“Notification of the Ayushman Bharat — National Health Protection Mission being issued by the health ministry under Section 7 of the Aadhaar Act, merely enables the implementation agencies to ask for the beneficiary Aadhaar Card to authenticate their identity. In order to authenticate the identity of beneficiaries accurately, the use of Aadhaar card is preferable, but it is not a “must”...,” the ministry said in a statement.

“We will provide services to all eligible beneficiaries with or without Aadhaar cards,” health minister J P Nadda said.

The draft notification also provides for exception handling mechanism — production of alternative identification mechanisms like ration card, voter ID card, MGNREGA card in case the beneficiary does not have Aadhaar number.

Not essential for school admission

Aadhaar not must for school admission: UIDAI, September 6, 2018: The Times of India

Government agency UIDAI asked schools not to refuse admission to students for lack of Aadhaar and said such denials are “invalid” and “not permitted under the law”.

Taking a stern view of cases where few schools had denied admission to children in absence of Aadhaar, the Unique Identification Authority of India (UIDAI) said “it must be ensured that no children are deprived/denied of their due benefits or rights for want of Aadhaar”.

The move by the UIDAI is expected to offer relief to parents and students who are left in a lurch when schools insist on Aadhaar number at the time of admission.

For children who are not yet assigned an Aadhaar number or those whose biometrics are not updated, the UIDAI said that under Aadhaar rules it will be the “responsibility” of schools to arrange for enrolments and biometric update facility.

Aadhaar: voluntary use

Aadhaar-enabled payment system in banks

Can’t stop Aadhaar-enabled payment system: UIDAI to banks, December 1, 2018: The Times of India

The UIDAI has told banks that it is obligatory to continue Aadhaar-enabled payment system (AePS)facility for customers as there was nothing in the Supreme Court order that barred voluntary use of Aadhaar for payment and receipt by account holders for purposes other than welfare benefits.

Responding to a move by State Bank of India intimating its intention to discontinue AePS, the UIDAI said in a circular on Friday, “Any action to discontinue such payments or receipt mechanism (AePS, BHIM Aadhaar Pay) or bank accounts on the grounds that it is not possible to distinguish their use for delivery of welfare benefits or other purposes may be held contrary to Section 7 of the Aadhaar Act and the (SC) judgment.”

The UIDAI clearly stated that withdrawal of AePS would amount to creating an obstruction in delivery or benefits and may cause denial in deserving cases. The authority quoted the SC order that the purpose of authentication was to ensure that only rightful persons received benefits. “Non-action is not costly. It’s affirmative action which costs the government. And that money comes from the exchequer. So, it becomes the duty of the government to ensure that it goes to deserving persons,” the circular quoted the SC as saying.

Benefits

Till 2018: Centre saved ₹90,000 crore using Aadhaar

From: September 29, 2018: The Times of India

See graphic:

How the Centre saved 90,000 crore using Aadhaar, presumably till Sept 2018

Direct benefit transfer and other governance reforms, which helped remove duplicate and fake beneficiaries and plugged leakages, saved the government 90,000cr in various schemes.

Haryana: ousts fake ration beneficiaries

Dipak Dash, Aadhaar ousts fake ration beneficiaries, June 30, 2017: The Times of India

Stops 30% Pilferage Of Grain In Haryana

The Centre's push to Aadhaar seeding of ration cards and installation of electronic Point of Sale (e-POS) machines at the ration shops has helped Haryana to stop at least 30% pilferage of highly subsidised food grains for the poor.State government officials said this could help save about Rs 500 crore annually.

All the 9,600 ration shops in Haryana have got the e-PoS machine and the Aadhaar coverage is about 105%. It has also become the first state where a beneficiary can pick up the grain from any ration shop across Haryana irrespective of his place of residence.

“Nearly 42 lakh beneficiaries under the food security law out of 1.35 crore did not pick up subsidised grains in the past couple of months due to the transparent process of distribution. We deleted about 16 lakh beneficiaries after detecting that many of the Aadhaar numbers were getting repeated in the beneficiary list,“ said a Haryana government official.

He added that about 4.5-5 lakh beneficiaries of the other 26 lakh, who were not picking up foodgrains, have now seeded their Aadhaar number.

“Now we have also made it a rule that there will be no carry over of the foodgrains for the next month in case a beneficiary does not pick up his allocation in that particular month. This is aimed at putting more pressure on them to submit details of their Aadhaar number at ration shops,“ the official said.

Food minister Ram Vilas Paswan said Aadhaar seeding and installation of ePoS machines at ration shops have yielded results.“In manual system there was no mechanism to find whether the ration shop owner actually distributed foodgrains to all the beneficiaries. Now it's not possible to fudge any figure as the details are captured electronically. We have asked states to fast track installation of ePoS devices at ration shops and to go for 100% Aadhaar seeding,“ he added.

Earlier, about 70 lakh of the 4.2 crore identified beneficiaries in Rajasthan did not lift highly subsided foodgrain over the last couple of months. Rajasthan has also completed Aadhaar seeding of ration cards and majority of the FPS are ePOS-enabled.

Till June end, little over 2.2 lakh of the total 5.27 lakh ration shops had e-PoS machines, which are used to check the identity of ration card owners. About 18 crore ration cards have been seeded with Aadhaar.

Unique ID Had Slashed Customer Acquisition Costs By 85%

Digital biz models hobble without Aadhaar support, September 27, 2018: The Times of India

From: Digital biz models hobble without Aadhaar support, September 27, 2018: The Times of India

Unique ID Had Slashed Customer Acquisition Costs By 85%

Many business models of both conventional finance firms and fintechs will collapse if private players cannot use Aadhaar for onboarding customers. The ability to pull up an individual’s details in an instant had dramatically reduced the time and cost of onboarding customers — what cost over Rs 100 for acquiring customers earlier had come down to Rs 15 due to Aadhaar. As a result, not only private enterprises like Paytm’s e-wallet but government entities such as SBI and India Post Payments Bank had built their digital accounts around Aadhaar.

SBI chairman Rajnish Kumar said, “If a customer wants to open a bank account on our digital platform using Aadhaar, it can be done instantly.” He added that the convenience is drawing 27,000 customers to its online ‘YONO’ account.

This view is echoed by Virat Diwanji, president (retail liabilities) at Kotak Mahindra Bank. According to Diwanji, Kotak’s 811 is built on RBI’s Aadhaar-based OTP authentication guideline and is convenient, instant and paperless. He does not foresee any adverse impact of the Supreme Court ruling on account opening as Aadhaar continues to be available as a KYC document, if the customer voluntarily chooses to submit the same.

But fintechs feel that the government will have to come out with a solution, otherwise the business use-case for Aadhaar would go away and it will be only a social welfare tool. Cyrus Khambata, CEO of security depository CDSL Ventures, said, “Online brokerage houses will definitely be affected as nearly 100% of their customer onboarding is via e-KYC. Even for traditional broking houses — such as Angel Broking, Motilal Oswal, ICICI Securities and HDFC Securities, that have a physical presence in multiple cities — this will have an impact. Non-online broking houses source 35-40% of business through e-onboarding, as the time taken is 10 minutes versus the physical mode that takes three-four days.”

Online players say they will now look at partnerships with third-party service providers for verification, like banks and NBFCs do. “We are yet to get full clarity on whether virtual ID (VID) can be used in lieu of Aadhaar number. But we’d definitely look at partnerships on the ground, if that’s the way forward,” said Abhinandan Sangam, CTO of Finzy, a peer-to-peer lending platform.

Harshil Mathur, founder and CEO of Razorpay, said that it will be challenging for lenders to service small-sized loans. Adhil Shetty, founder of online financial marketplace BankBazaar, welcomed the SC decision, noting that customers now have a choice. “Do I wait for five-six days for my loan to get processed or do I use Aadhaar to get a loan in 5 minutes?” is the question Shetty thinks customers would ask themselves.

Nithin Kamath, founder of online brokerage Zerodha, expressed confidence that the SC verdict would have no impact on his business. “It (Aadhaar verification) is an easy, fast, seamless way of doing business,” he said.

Caste records linked with Aadhaar

The Times of India, Jun 22 2016

Aadhaar to be linked with caste records State governments have been asked to link Aadhaar with caste and domicile certificates to be issued to school students, as part of a first-of-its-kind initiative by the Centre. All states have been told to ensure that such certificates are issued within 60 days time to students when they are studying in Class V or VIII.

The development assumes significance as there have been complaints of delay in grant of scholarship to students belonging to Scheduled Caste and Scheduled Tribes.Besides, people have often complained of harassment allegedly by government officials in getting caste and domicile certificates issued.

States may also try to get the information of students fed into the meta data to be made online and may link it to Aadhaar enabled data, if feasible. “Sincere efforts be made to issue these certificates along with Aadhaar number,“ reads Frequently Asked Questions (FAQs) released by personnel ministry on issuance of caste and certificates in schools. The responsibility of collecting the documents from the students will be of the school head.

Direct Benefit Transfer (DBT)

Prevents Rs 27,000cr leakage in 2015-16

The Times of India, May 11 2016

Usage of Aadhaar for Direct Benefit Transfer (DBT) has led to savings across several government welfare schemes, including Rs 27,000 crore in PDS, LPG distribution and MNREGS.

At a review meeting on the progress of DBT, PM Narednra Modi was informed that in 2015-16, Rs 61,000 crore was distributed to over 30 crore beneficiaries using DBT.

The PMO said over 1.6 crore bogus ration cards have been deleted, resulting in savings of about Rs 10,000 crore and 3.5 crore duplicate beneficiaries were weeded out in the PAHAL scheme, resulting in savings of over Rs 14,000 crore. In MGNREGS too, a saving of Rs 3,000 crorehas been estimated in 2015-16.

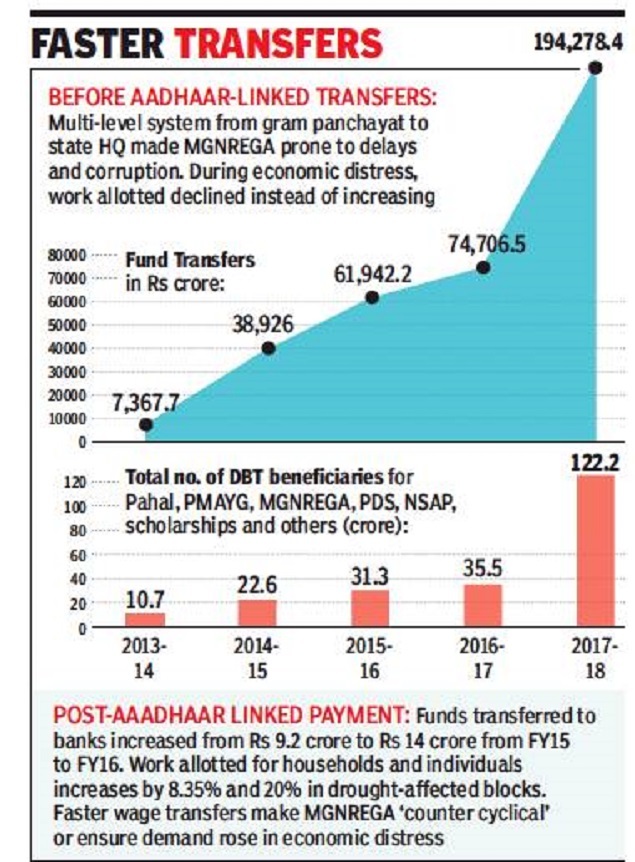

2014-18/ Aadhaar linking reduced wage delays, increased fund transfers

Rajeev Deshpande, June 27, 2018: The Times of India

From: Rajeev Deshpande, June 27, 2018: The Times of India

HIGHLIGHTS

On a broad scale, irrespective of distress conditions, there was an increase of over Rs 2 crore in amount disbursed in banks after Aadhaar-linked payment

In the post-ALP period, the average of individuals and households allotted work increased by 12,597 and 7,579

Linkage of MGNREGS accounts with an Aadhaar-linked payment (ALP) system significantly boosted efficiency of wage transfers, doubling funds transferred and increasing work allotted in times of distress as compared to previous years when demand actually dropped during economic stress due to leakage and delays in payments.

An Indian School of Business study that examined annual data for blocks which had drought conditions in financial years 2012-2017 showed clear changes in the pre- and post-ALP system with regard to work generated, individuals and households benefited and the speed and volume of bank transfers that point to an increased uptake of the workfare programme.

On a broad scale, irrespective of distress conditions, there was an increase of over Rs 2 crore in amount disbursed in banks after ALP. There was a manifold rise in direct transfer beneficiaries with funds transferred in FY 2015 totalling over Rs 9 crore and the figure rising to Rs 14 crore in FY 2016, a 50% jump in a year.

In the post-ALP period, the average of individuals and households allotted work increased by 12,597 and 7,579. In the pre-ALP period, households and persons demanding work declined across blocks facing drought — delayed payments and leakages made those seeking succour look for more immediate, even if less paying, options to tide over the bad times.

“We have looked at the annual data and analysed distress in terms of a 75% or 50% deficiency of rainfall and also in terms of high temperatures. These can be seen to be conditions that cause rural distress,” said ISB’s Prof Ashwini Chhatre, who said ALP made the scheme “counter cyclical” — higher demand in times of economic distress.

This was in contrast to the scheme being “cyclical” (demand dropping when economic activity shrinks) which defeated the purpose of MGNREGS. The target population seemed to have learned of quicker payments with the provision of jobs becoming counter cyclical, with an increase of 625.62 (households) and 2,492.84 (persons) allotted work. When compared to an average of 7,477 households and 12,433 individuals, there was an increase of 8.5% and 20%.

The study, ‘A Friend Indeed: Does the Use of Biometric Digital Identity Make Welfare Programmes Counter-Cyclical’, was authored by Shradhey Parijat Prasad, Nishka Sharma and Prasanna Tantri. “The magnitude of increased work in distressed blocks is higher in post-ALP. We also find that the total muster rolls filled and total persons worked increases in distressed block years only after implementation of ALP,” they wrote.

Chhatre said the paper did not examine exclusions and there were reports of delays in terms of transfers between the Centre, states and banks. But on the whole, the volume and speed of transfers, as seen by annual data, had gone up, aided by rules requiring fund transfer orders to be prepared within 15 days of work done.

The policy implications are significant as with MGNREGS becoming counter-cyclical, any increase in demand could well indicate signs of stress. These need not be related to deficient rainfall, that can be mapped through meteorological means, but also point to specific and localised reasons that can prompt governments to launch closer investigations.

The big difference in ALP is that it does away with the cumbersome old payment system that was multi-layered — gram panchayats notified mandal offices which passed on the payment demand to state offices which then crosschecked and released funds that travelled down from district to mandal offices and were transferred to gram panchayat accounts for final distribution to beneficiaries.

The government’s drive to generate bank accounts through the Jan Dhan Yojana that also sought linkage with mobile phones and Aadhaar made verification of identity and the poor beneficiary’s access to her account a much more efficient and foolproof process while eliminating a host of intermediaries.

Post-ALP, the increase in average number of muster rolls filled was 5,727 and the average of households that reached 100 days went up to 621 households. The average person days worked was 3,26,019 days. On an average, amount disbursed to bank accounts was Rs 2.7 crore.

Foreigners/ expatriates and Aadhaar

Eligible if stayed in India for 182 days

Himanshi Dhawan, Aadhaar please, we aren’t Indian, March 11, 2018: The Times of India

While many Indians are in a tizzy over Aadhaar (to get one or not, to link your bank account or not), several foreigners based in India have quietly opted for the 12-digit identification number.

Not many know this, but the Aadhaar (Targeted Delivery of Financial and Other Subsidies, Benefits and Services) Act, 2016, says that any resident of India who has stayed in the country for 182 days or more in the 12 months before applying for the card, is eligible for one.

Freelance writer and blogger Christine Pemberton, who has been living in India for 12 years and is a British passport holder, was an early adopter. “I use the card whenever I am asked to produce my ID, whether it is at monuments or at the airport,” she says.

Though acquiring a card and using it has been “painless’’, Pemberton says she did have one weird experience. “I was asked for my Aadhaar when I went for a test to a private hospital. When I refused to give it, the person asked for my husband’s Aadhaar. It was just absurd. But they backed off when I refused to give it,’’ she says, adding that it is not so much the project but its implementation that is being used as a stick to beat people with, which was upsetting.

How rural India received Aadhaar

From: September 27, 2018: The Times of India

See graphic:

How rural India received Aadhaar, presumably as in 2016-18

Linking Aadhaar card with PDS and LPG subsidies

SC permits linking

The Times of India, Aug 12 2015

SC allows linking Aadhaar with PDS & LPG subsidies

But tells govt not to use it for other schemes

The Supreme Court allowed the use of Aadhaar identities for public distribution system beneficiaries and cooking gas users but withheld permission for linking the biometric identification scheme to other social welfare programmes. No one would be denied benefits under social welfare schemes for want of the unique identification number, said a bench of Justices J Chelameswar, S A Bobde and C Nagappan even as it permitted the government to link PDS and LPG subsidies to the Aadhaar card to check possible pilferage.

Though the order can be seen as partial validation of Aadhaar, its status as the principal identity number remains far from settled as the bench said the number could not be made a must for other purposes. The bench further asked the government to make citizens aware of the non-mandatory nature of the unique identification number (UID).

The court was informed by the petitioner that many gov ernment agencies, including RBI and Election Commission, were making Aadhaar cards mandatory identification for banking and voting purposes.

The three-judge bench also referred the petitions challenging the validity of making Aadhaar mandatory to a fivejudge constitution bench. The court also added a critical question whether right to privacy was part of citizen's fundamental right to life.

“The unique identification number or the Aadhaar card will not be used by the respondents for any purpose other than the PDS scheme and, in particular, for the purpose of distribution of foodgrains etc and cooking fuel, such as kerosene. The Aadhaar card may also be used for the purpose of the LPG distribution scheme,“ the bench said. It also directed the government not to share information collected by UIDAI with anybody or any authority except on the direction of the court for the purpose of criminal investigation. It asked the Centre to make people aware through public advertisements that Aadhaar card was not mandatory .

Aadhaar helps cancel 2 crore ration cards, 2013-16

Nov 26 2016 : The Times of India

The Times of India

See graphic:

Aadhaar helped cancel 2 crore ration cards, 2013-16

One important way to check leakages in the public distribution system is through digitised ration cards. Although all states have digitised these cards, which allow access to essentials at subsidised prices, the entire northeast has a poor Aadhaar seeding record, as has Bihar, with just 0.1% of ration cards linked with Aadhaar

2018: HC lets 2 lawyers file tax returns without Aadhaar

April 5, 2018: The Times of India

The Delhi high court questioned the Centre and Income Tax (I-T) authorities why it was mandatory to link/quote Aadhaar for online filing of income tax returns (ITR) when the deadline had been extended.

A bench of justices S Ravindra Bhat and AK Chawla sought replies from the Centre and the Central Board of Direct Taxes (CBDT) on a petition filed by two lawyers, Mukul Talwar and Vrinda Grover, challenging the requirement of quoting Aadhaar number or linking it with PAN for e-filing of tax returns.

Hearing their petition, the bench issued notices to the authorities and allowed the two lawyers to file their returns without quoting Aadhaar number. At the same time, the court also directed the I-T department to accept their returns.

The bench made it clear that the I-T department would not insist on linking of Aadhaar or quoting of Aadhaar number or its enrolment number in the returns filed by the petitioners. It listed the matter for further hearing on May 14.

The petitioners argued that when the Supreme Court itself had extended the time limit for Aadhaar-linking till further orders, how could the I-T department insist on quoting of Aadhaar to allow e-filing of returns. They termed ‘arbitrary’ the refusal by I-T department’s Centralised Processing Centre (CPC) to accept tax returns without Aadhaar number.

The petition challenged sub-Rule 12 (3) of the I-T Rules, saying that it “constitutes an unconstitutional fetter on the administrative discretion and, therefore, was violative of Article 14 of the Constitution to the extent that it does not contemplate accepting returns of assessees which are filed in the manual mode”.

The petitioners maintained that insistence on Aadhaar enrolment in order to file tax returns was “arbitrary, unreasonable and violative of Articles 14 and 21 of the Constitution”.

The petition further noted that though on March 27 this year CBDT extended till June 30 the last date for linking Aadhaar with PAN, yet the online filing refuses to accept ITR without Aadhaar.

Meanwhile, the I-T department’s lawyer said there was no clarity on whether hard copies of tax returns without Aadhaar number could be accepted or processed.

The petition has sought directions to the Centre and the CBDT not to “penalise or prosecute individual assessees for being unable to electronically file their returns of income due to the e-filing portal not accepting retur ns for non-quoting of Aadhaar number or Aadhaar enrolment number”.

Government's views

The Hindu, August 28, 2015

The Supreme Court on Aug.11, 2015 told the government to give wide publicity in media that Aadhar was not mandatory to get benefits which are otherwise due to citizens. However, governments — Centre and States — have tried to press Aadhar on people by making it mandatory to access select services. Here are 10 instances where governments insisted on people having an Aadhar card when you actually didn't:

Jan Dhan Yojana

The scheme to open bank accounts for all, launched immediately after Prime Minister Narendra Modi's maiden Independence Day speech last year, says an Aadhaar card is enough to open an account on the spot. However, the government clarified later that the card is not mandatory.

Passport verification

In Nov. 2014, a month after batting for Aadhaar, the Ministry of External Affairs issued a note saying plans were afoot to make Aadhaar number mandatory for issue of passport. This was later withdrawn but the fact remains that having an Aadhar card eliminates the routine police verification and speeds up the passport issue process.

Provident fund transactions

The government in October 2013 said salaried employees in the organised sector would have to provide their Aadhaar numbers for seeking benefits under the EPF scheme. The mandate was later withdrawn.

Road Transport Authority

Were you asked to produce your Aadhaar card for any transaction in any Road Transport Authority office across Andhra Pradesh? Since July 29, it has been made mandatory in the interest of better service and security.

Ration card & LPG subsidy

In the past two years, all ration-card holders were asked by governments in Karnataka, Andhra Pradesh and Puducherry to produce their Aadhaar numbers to avail PDS benefits. In the same year, Indian Oil Corporation informed consumers that they would not get their LPG subsidy if they did not provide Aadhaar details.

Real estate transactions

In a recent interview, Finance Minister Arun Jaitley said the government was considering making the use of Aadhaar mandatory so it “could provide a trail of all real estate transactions by an individual.” This, according to the FM, would aid in the crackdown on black money.

Mobile numbers

In Oct. 2014, the Central government said it would start linking mobile SIM cards with Aadhaar numbers. It was said this would be an advantage for subscribers as they can get a host of services including financial transactions. It later clarified that it was not a mandatory process.

Matrimonial sites

In Dec. 2014, a report said the Minister for Women and Child Development Maneka Gandhi, in the wake of the Uber taxi rape incident, wanted all matrimonial sites to make it compulsory for users to provide their Aadhaar numbers for profile authentication.

Jail visits in Telangana

Faced with the daunting task of screening criminals posing as visitors to jails, the Telangana Prisons Department (TPD) has found a solution: In the near future, all those visiting prison inmates should carry their Aadhaar cards, it said on Aug.11, 2015.

Property tax

In Dec. 2014, officials of Greater Visakhapatnam Municipal Corporation came under criticism for insisting on Aadhaar numbers for payment of property tax. This practice by corporation officials has also been reported in Chennai.

Judiciary's view

Aadhaar for aid must be voluntary: SC

The Times of India, Oct 16 2015

Dhananjay Mahapatra & Amit Anand Choudhary

It will not be basis to debar anybody: Govt

The Supreme Court permitted citizens to voluntarily use Aadhaar cards to avail benefits under the Mahatma Gandhi National Rural Employment Guarantee Scheme, along with Pradhan Mantri Jan Dhan Yojana and schemes related to pension and PF after the government promised that absence of Aadhaar would not debar people from benefiting from the schemes concerned. The relief came from a bench of Chief Justice H L Dattu and Justices M Y Eqbal, C Nagappan, Arun Mishra and Amitava Roy, which clarified the August 11 interim order of a three-judge bench and allowed linking of Aadhaar on a voluntary basis to these four schemes. The interim order had restricted voluntary use of Aadhaar card to LPG subsidy and getting ration under PDS.

The concession came after attorney general Mukul Rohatgi furnished an undertaking to the court that no citizen would be denied benefits under social welfare schemes for want of Aadhaar card. The court for its part laid down two pre-conditions government would not force citizens to enroll for Aadhaar card, and they would not make it the eligibility criterion for benefits under various schemes.

Petitioners' counsel -senior advocates Shyam Divan, Soli J Sorabjee and Gopal Subramaniam -reluctantly agreed to allow voluntary use of Aadhaar to these four schemes after the five-judge bench remained struck to its point -if the card could be voluntarily used for availing LPG subsidy and ration, why should it be not true for other schemes.

The petitioners had challenged the biometric data-fingerprints and iris image -in the Aadhaar card as gross violation of privacy.

To counter the petitioners, the Centre had cited two SC judgments holding that citizens did not have a fundamental right to privacy .

Finding confusion in the judicial rulings, a three-judge bench had on August 11 referred the petitions to a larger bench for determining whether right to privacy was a fundamental right and whether Aadhaar cards violated it.

But the interim order came in the way of the government extending benefits to the target group without linking it to Aadhaar. This made the Centre rush to the three-judge bench with an application seeking clarification of the August 11 order.

Rohatgi asked, “why should the 92 crore card holders who are ready to use their cards voluntarily to avail benefits under social welfare schemes be restrained by the Supreme Court from exercising the option merely because 20-odd petitioners are opposing it”.

Divan and Subramaniam argued that it was more a question of propriety. “No Constitution or court could allow a government to play with the personal details of citizens to enable it to track their every movement,” they said.

But the bench was firm that if Aadhaar could be used for LPG subsidy and ration purposes, it could also be used for important social welfare schemes.

Aadhaar can't be made compulsory for welfare schemes' benefits: Supreme Court

Mar 27, 2017: The Times of India

HIGHLIGHTS

Earlier this month, the government said individuals can use alternate means of identification to receive benefits

The SC in 2015 permitted the voluntary use of Aadhaar cards for welfare schemes like MGNREGA

DELHI: Having an Aadhaar card cannot be made mandatory+ by the government for giving out benefits from its welfare schemes, the Supreme Court said today, PTI reported. It did add though that the government can't be stopped from making it compulsory to have one for things like opening bank accounts. The top court also said that while a seven-judge bench needs to be set up to hear the pleas challenging Aadhaar+ , but that is not possible at this time. Earlier this month, the government said nobody will be deprived of benefits because they don't have an Aadhaar card. It reiterated that until an Aadhaar number is assigned to an individual, they can use alternate means of identification to receive benefits linked to the card. The Centre also directed departments to provide Aadhaar enrolment facilities to beneficiaries under Regulation 12 of the Aadhaar (Enrolment and Update) Regulations 2016.

The apex court had on October 15, 2015, lifted its earlier restrictions and permitted the voluntary use of Aadhaar cards for welfare schemes like MGNREGA, all pension schemes, the provident fund and flagship programmes like the 'Pradhan Mantri Jan Dhan Yojna' of the NDA government. These were in addition to LPG and PDS schemes, for which the court had allowed the voluntary use of these cards. Critics have alleged that the Unique Identification Authority of India (UIDAI), which runs the Aadhaar scheme, is getting biometric details through private agencies, which violated citizens' fundamental rights.

The UIDAI was established by UPA-2 in 2009.

Criminal probes: Aadhaar not conclusive proof/ HC

Aadhaar card details — such as name, gender, address and date of birth — cannot be taken as conclusive proof during an investigation into a criminal case, the Lucknow bench of Allahabad high court has said. These entries may be subject to verification in case of doubt, the court said in a January 9 ruling, which was made public on Friday night.

The court clarified that an Aadhaar card was a document that provided a conclusive link between the cardholder’s photograph, his/her fingerprints and iris scan with Aadhaar number.

A bench of justices Ajai Lamba and Rajeev Singh said, “If a person relies on Aadhaar entries as proof of address and date of birth, these cannot be considered conclusive proof under the Evidence Act.”

The verdict came during the hearing of a writ petition in which a woman challenged an FIR lodged by her mother about her kidnapping with Sujauli police station in Bahraich. In her FIR, the mother had said that her minor daughter was abducted by a man and his relatives. In her writ petition, the woman pleaded that she was a major and was not kidnapped but had married on her own free will. She alleged that her mother did not accept her marriage and lodged a false FIR against her husband and his family members. On the high court’s intervention, police investigated the case and gave a clean chit to the woman’s husband and her in-laws. The case was closed.

However, during the hearing, the court took cognisance of the aggrieved woman and her husband’s Aadhaar card details, which mentioned her date of birth as ‘January 1, 1999’ and his as ‘January 1, 1997’. The court was intrigued by ‘January 1’ in both the Aadhaar cards and said it found same date of birth in many such cards. Therefore, the court said, this must be clarified with the Unique Identification Authority of India (UIDAI).

On the court’s direction, UIDAI Lucknow regional office deputy director Jasmine filed an affidavit and appeared in the court. In the affidavit, she said, “Aadhaar is only proof that a person obtaining subsidy or service by identifying himself/herself on the basis of Aadhaar number is the same person who enrolled after providing biometrics and documents. If a resident does not have a valid date of birth document, it’s recorded on the basis of a declared date. If the date is approximate, the age is verbally communicated by the resident to the operator, based on which the year of birth is calculated. By default, the date of birth is recorded as January 1 of that calendar year.”

After this clarification by UIDAI, the court said name, gender, address and date of birth on the Aadhaar card can’t be taken as conclusive proof.

The Allahabad high court, in a January 9 ruling, clarified that entries like name, gender, address and date of birth may be subject to verification in case of doubt

Govt can make Aadhaar must for opening bank accounts: SC

Dhananjay Mahapatra, Mar 28, 2017: The Times of India

HIGHLIGHTS

Govt can make Aadhaar mandatory for opening bank accounts, getting mobile connections or passports

SC clarified, its earlier interim order asking the govt to make Aadhaar optional only related to obtaining benefits under social welfare schemes

NEW DELHI: The Centre's plan to make Aadhaar a basic identity document got a shot in the arm when the Supreme Court on Monday said it would not be wrong on the part of the government to make the unique ID mandatory for opening bank accounts, getting mobile connections or passports. The court clarified that its earlier interim order asking the government to make Aadhaar optional only related to obtaining benefits under social welfare schemes. Even among such schemes, the court had allowed the Centre to insist on Aadhaar for programmes such as MGNREGA, gas subsidies, PDS rations and Jan Dhan Yojna.

"Minus the benefits under social welfare schemes, we think the government can insist on Aadhaar as identification document. If someone wants to open a bank account or get a mobile phone connection, it can insist on Aadhaar as there is no welfare scheme benefit involved in it. Why cannot the government insist on Aadhaar for filing of income tax returns? For availing benefits under schemes, Aadhaar cannot be insisted, but for other purposes we think it can be," the court said. The remark came from a bench of Chief Justice J S Khehar and Justices D Y Chandrachud and Sanjay K Kaul when senior advocate Shyam Divan, appearing for petitioners who have challenged Aadhaar as intrusion into citizens' right to privacy, questioned the government's decision to make it mandatory despite the SC's interim order that UID should be voluntary.

Divan said a three-judge bench headed by Justice J Chelameswar had on August 1, 2015 categorically stated that Aadhaar would not be made mandatory. A five-judge constitution bench on October 15, 2015 had said the issue was important as it involved interpretation of the right to privacy, which was part of right to life guaranteed under Article 21 of the Constitution.

"The issue has assumed tremendous urgency as the government is violating the interim orders by making Aadhaar mandatory even when the substantive challenge to its constitutional validity is pending," Divan said.

…but Aadhaar won’t stop bank frauds, systemic ills: SC

Dhananjay Mahapatra, Aadhaar can’t stop frauds: SC to govt, April 6, 2018: The Times of India

The Supreme Court stopped the Centre on Thursday from projecting Aadhaar as panacea for all systemic ills, including bank frauds worth billions of rupees, and said the unique number as a tool for authentication of identity could not stop bank scams even if it might be useful in uplifting the poor.

Listing Aadhaar’s utilities, attorney general K K Venugopal said it functioned as an impeccable identity authentication tool to effectively prevent use of multiple identities to siphon off financial benefits meant for people living below the poverty line, to evade tax, launder money and defraud banks of crores of rupees.

A bench of Chief Justice Dipak Misra and Justices A K Sikri, A M Khanwilkar, D Y Chandrachud and Ashok Bhushan, which was patient with the AG’s detailed reading of judgments and written submission, protested when the top law officer said Aadhaar could prevent bank frauds, a phenomenon much in discussion due to the cases of Vijay Mallya and Nirav Modi.

Sikri said, “As far as bank frauds are concerned, it is not because fraudsters used multiple identities, which Aadhaar can prevent. The banks knew the identity of the person who repeatedly borrowed and defaulted. Aadhaar may have other utilities but will not be able to stop frauds. Fraud happens because bank officials are hand in glove with borrowers... when bank officials are mixed up with fraudsters, it has to be tackled at a different level, and not through Aadhaar.”

The bench did, however, clarify: “Aadhaar does not become unconstitutional just because it cannot address all problems. Use of Aadhaar to uplift those at the bottom of the pyramid is welcome.”

The SC said despite Aadhaar’s utility, concerns remained. “The targeted persons must get financial benefits, and corrupt means need to be stopped. Problem is how far can the net be cast? Many feel Aadhaar per se may not be objectionable, but linking it to every activity is,” it said.

When the court asked the AG about apprehensions of violations of privacy, he said Aadhaar had enrolled over 1.2 billion people and they had given biometrics voluntarily. “The biometrics are stored in the safest manner possible. Those who give biometrics voluntarily cannot complain about privacy violation. Moreover, Aadhaar is an enabler of right to life like food and shelter to millions of impoverished. Surely, when one uses Aadhaar to get these basic elements to sustain life, he could not be seen complaining about violation of right to privacy,” he said.

The bench termed this a “Marxist argument”, as it amounted to saying “if you are getting food and shelter, you keep quiet about violation of other rights”. It suggested that the AG stick to the argument that Aadhaar, an enabler of food and shelter to the poor, invaded privacy to the minimum level.

SC: Never directed Aadhaar-mobile number linkage

‘Observation Was Misinterpreted By Union Govt’

The mad rush to link mobile phone numbers with Aadhaar supposedly to comply with a directive of the Supreme Court was uncalled for. The apex court clarified that it had not ordered mandatory linkage, and said the government misinterpreted its February 6, 2017, observation and insisted on doing it.

“In the Lokniti Foundation case, the SC has not directed linking of SIM with UID. But the Union government’s circular says so. There was no direction by the court...” Justice D Y Chandrachud said during the hearing before a bench that included Chief Justice Dipak Misra and Justices A K Sikri, A M Khanwilkar and Ashok Bhushan.

‘Merely recorded AG’s submission’

The CJI-led bench pointed out that the February 6, 2017, order merely recorded then Attorney General Mukul Rohatgi’s submission that Aadhaar was one of the documents used for verification of subscriber identity.

Significantly, senior advocate Rakesh Dwivedi, who appeared for UIDAI, agreed with the bench and said the government appeared to have taken the SC’s observations for verification of mobile phone subscribers seriously. Drawing Dwivedi’s attention to the February 6 order, the bench said the court merely recorded the AG’s submission that “an effective programme for the same would be devised at the earliest and the process of identity verification will be completed within one year”.

The bench set the record straight when Dwivedi argued that one-time seeding of mobile number with Aadhaar was not a big ask and would not lead to intrusion into citizens’ privacy as no call records were maintained through Aadhaar.

UIDAI’s insistence that the Supreme Court had mandated that all mobile connections be linked with Aadhaar had led to a scramble of sorts, with mobile service providers, nudged by the government, inundating subscribers with dire messages on the need to abide by the alleged order.

The SC on March 13 had indefinitely extended the deadline for linkage of Aadhaar with mobile numbers and bank accounts of individuals and asked the government to wait till the constitution bench decided the validity of Aadhaar to take further steps in this regard. The Centre had in the interim agreed to extend the deadline for bank account linkage with Aadhaar till March 31.

SC upholds law making linking Aadhaar with PAN

Those Without Aadhaar Can File Returns in 2017

In a major victory for the Modi government, which is set on making Aadhaar compulsory for several sorts of transactions, the Supreme Court upheld on Friday the law making the UID number a must for filing income tax returns and its linkage to PAN card. In what could cheer up the government, which has had anxious times in defending the validity of Section 139AA of the Income Tax Act introduced through the Finance Act, 2017, a bench of Justices A K Sikri and Ashok Bhushan, in a 155page judgment, ruled: “We hold that Parliament was fully competent to enact Section 139AA of the I-T Act and its authority to make this law was not diluted by the orders of this court.“

However, it clarified that “those assessees who are not Aadhaar card holders and do not comply with the provision of Section 139(2), their PAN cards be not treated as invalid for the time being“. This means that those who have a PAN but have not yet got Aadhaar can still file their income tax returns this year. The SC ordered that Section 139AA would be applied prospectively and said the government needed to take urgent measures to assuage citizens' apprehensions about the leakage of data concerning Aadhaar and PAN linkage. Justice Sikri, who wrote the judgment for the bench, said, “A person who is holder of PAN and if his PAN is invalidated (for want of Aadhaar linkage as he did not have Aadhaar number), he is bound to suffer immensely in his day-today dealings, which situation should be avoided till the Constitution bench of the SC authoritatively determined the validity of Aadhaar.“

In addition, the court also said: “If failure to intimate the Aadhaar number renders PAN void ab initio with the deeming provision that the PAN allotted would be invalid as if the person had not applied for allotment of PAN, it would have rippling effect of unsettling settled rights of parties. It has the effect of undoing all the acts done by a person on the basis of such a PAN.“ “It may have even the effect of incurring other penal consequences under the Act for earlier period on the ground that there was no PAN registration by a particular assessee. Hence, the law would apply prospectively ,“ it said.

Petitioner Binoy Viswam had questioned the enactment of Section 139AA at a time when the validity of Aadhaar itself was pending consideration before a Constitution bench of the SC.The petitioner had said that when the SC had in its interim order made enrolment in Aadhaar a voluntary exercise, how could the government make it mandatory for filing of income tax returns and for getting PAN card?

The bench said though it was upholding the validity of mandatory linking of Aadhaar with I-T returns and PAN card, it has not expressed any opinion on the validity of Aadhaar. “Constitutional validity of Section 139AA is upheld subject to the outcome of batch of petitions referred to the Constitution bench where the said issue is to be examined on the touchstone of Right to Life under Article 21 of the Constitution, which encompasses Right to Privacy ,“ Justices Sikri and Bhushan said.

Except this caveat, it was a clear thumbs-up from SC for Section 139AA, which had drawn flak from the opposition parties and social media.The SC said: “Section 139AA of the I-T Act is not discriminatory nor it offends equality clause enshrined in Article 14 of the Constitution.“

“Section 139AA is also not violative of (right to profession and business under) Article 19(1)(g) of the Constitution insofar as it mandates giving Aadhaar enrolment number for applying PAN cards in the income tax returns or notifying Aadhaar enrolment number to the designated authorities,“ it said. Post offices to update UID details

The government has decided to hand over the updation of Aadhaar details such as change in address or updating mobile number and correcting errors to post offices across the country.Post offices are likely to be entrusted the task of Aadhaar enrolment in future.

According to initial estimates, the decision will help in postal department getting a business of around Rs 1,000 crore every year.

As the government has decided to use Aadhaar in most of the welfare schemes as well as linking the unique number with PAN, the Aadhaar initiative is facing flak for `silly' mistakes of private enrolment agencies at the crucial juncture. Some private enrolment centres collecting biometric information are reportedly charging people as high as Rs 200 for enrolment which must be free of cost. Others are also taking Rs 100 or more for updating Aadhaar details, much more than the stipulated Rs 25.

SC asks- Pension is a right, not subsidy. How can it be linked to Aadhaar

Dhananjay Mahapatra, March 22, 2018: The Times of India

UIDAI Exposed Many Bogus Pensioners: AG

The Supreme Court questioned the Centre about its decision to link Aadhaar with pensions, reasoning that it is not a subsidy but an entitlement of a person for years of service he or she has rendered to the government in discharge of official duties.

Referring to the argument of petitioners that many pensioners have been denied their only subsistence in old age due to technical and physical reasons, a bench of Chief Justice Dipak Misra and Justices A K Sikri, A M Khanwilkar, D Y Chandrachud and Ashok Bhushan asked attorney general K K Venugopal whether the Centre was going to deny pension, a rightful entitlement, just for want of Aadhaar.

Venugopal said Aadhaar has been instrumental in eliminating many bogus pensioners drawing post-retirement benefits for years.

AG: Pension has a subsidy component

Justice Sikri said: “Pension is an entitlement and not a benefit under the social welfare schemes. How is it included under Section 7 of the Aadhaar Act, 2016? Pension is a return for services rendered. There are many pensioners who live with their children who are settled abroad. Can such category of pensioners be told that they would not be granted pension unless they have an Aadhaar card?”

Justice Chandrachud said, “There is another category of persons who suffer from Alzheimer’s disease and may have serious dementia. There are those old persons whose biometrics do not match with the Aadhaar data. Where do they go? Pension is a rightful entitlement and not a bounty given by the state”.

He said there are many instances where biometrics of manual labourers do not match, where in remote areas authentication fails because of lack of electricity or network connectivity, should the beneficiary be denied financial benefits? “We will appreciate if the government can come and tell us upfront that there is a serious issue of financial exclusion. The cabinet secretariat had flagged this issue. The government must explain what steps are taken to eliminate financial exclusion of legitimate beneficiaries,” Chandrachud said. AG Venugopal said Aadhaar has been instrumental in eliminating many bogus pensioners drawing the post-retirement benefits for years. He said there is provision in the Aadhaar law not to deny social welfare benefits to even blind leperosy patients, who cannot provide either an iris scan or finger prints for Aadhaar. The method of their enrolment is different, he added.

The AG also said pension has a subsidy component and that Aadhaar would authenticate the actual pensioner numbers. “We will know who are actual beneficiaries. If in future it is required to amend the Aadhaar law, we will do that. But, for this reason the whole project need not be condemned.”

Referring to series of questions posed by the bench, the AG said no such person or class of persons have come before the court alleging that they have been denied pension because of want of Aadhaar or their physical biometrics not matching with Aadhaar data. “Unless they come and make an issue, we will really be groping in dark to find a solution to a hypothetical problem,” he said.

SC acknowledges state interest linking Aadhaar with welfare schemes

2-Judge Bench: Govt Has No Suspect Motives

At a time when a constitution bench of the Supreme Court is hearing the privacy plea in the Aadhaar case, a two-judge bench of the apex court in a recent order acknowledged “legitimate state interest“ in the government's decision to make Aadhaar mandatory for welfare benefits and PAN cards.

The two-judge bench held that the state was not indulging in overreach or was motivated by suspect motives in lin king Aadhaar to various transactions. The SC in its order upheld Parliament's power to legislate the relevant laws.

“Parliament was fully competent to enact Section 139AA of the Income Tax Act (introduced through the Finance Act, 2017),“ the court said. The court addressed the criticism that the law was pushed through even when the SC was to dispose of the challenge to Aadhaar and also that the UID law was designated as a money bill. The crucial aspect on which the constitution bench is expected to pronounce upon is whether the use of Aadhaar poses a “reasonable restraint“ on the right to privacy or whether it is the draconian and intrusive instrument of state as its critics allege.

The two-judge bench of A K Sikri and Ashok Bhushan did not see a sinister intent behind the law passed by Parliament though it clarified that it was not touching upon the privacy issue.

In its 155-page order, the judges said it was the duty of a welfare state to come out with schemes to take care of needs of the deprived classes and ensure adequate opportunities are provided to them.

Talking of corruption and leakages in welfare schemes, the bench said, “It can't be doubted that with UID-Aadhaar, much of the malaise in this field can be taken care of.“ The court said Aadhaar could take care of duplicate beneficiaries reaping fruits meant for the genuinely deprived classes.

The apex court further noted that use of Aadhaar would help enforcement agencies tackle terrorism, crime and money laundering along with curbing corruption and black money .

“The Aadhaar or UID, which has come to be known as most advanced and sophisticated infrastructure, may facilitate law enforcement agencies to take care of problem of terrorism to some extent and may also be helpful in checking the crime and also help investigating agencies in cracking the crimes,“ the SC said. Noting that in many cases, PAN holders had claimed that a particular transaction did not relate to them, the SC said there was a need to strengthen PAN by linking it with Aadhaar and biometric information.

Observing that multiple cards in fictitious names were obtained with the motive of indulging in money laundering, tax evasion, creation and channelising of black money , the court said, “Parliament in its wisdom thought that one PAN to one person can be ensured by adopting Aadhaar for allotment of PAN to individuals.“

An official said the order has given some relief to those who use PAN as an ID for purposes other than filing income tax returns and this is a very small subset which is not a tax assessee and does not have Aadhaar.

SC, 2018: Constitutionally Valid; but not mandatory at banks, examinations, phones, schools

September 26, 2018: The Times of India

All eyes will be on the Supreme Court when a five-judge constitution bench led by CJI Dipak Misra delivers the judgment on constitutional validity of Aadhaar, challenged by 31 petitions on grounds that it violated the right to privacy of citizens.

The SC order will have implications for linking Aadhaar to government welfare and financial inclusion schemes, bank accounts and PAN cards, UID authentication by private entities and also address concerns over exclusion, privacy and security as regards storage and use of biometric data of 122 crore individuals currently enrolled by the Unique Identification Authority of India (UIDAI).

A bench of CJI Misra + and Justices A K Sikri, A M Khanwilkar, D Y Chandrachud and Ashok Bhushan will determine if use of Aadhaar violates right to privacy and should be struck down. On an alternative, there is a possibility the SC could uphold validity of Aadhaar and yet call for robust data protection regime to safeguard personal data linked to Aadhaar and rule out a big brother regime.

On August 24, 2017, while delivering its ruling giving right to privacy the status of a fundamental right, the SC had said the Centre may have justifiable reasons, apart from security concerns, for collection and storage of data. If on one hand, the SC rejected the Centre's argument that privacy could not be treated as a fundamental right to scuttle right to food of millions through Aadhaar-linked welfare schemes, it conceded the need for collection of personal data to ensure essential items reached needy.

Justice Chandrachud, writing the main judgment in the right to privacy issue, had said, “In a social welfare state, the government embarks upon programmes which provide benefits to impoverished and marginalised sections of society. There is a vital state interest in ensuring that scarce public resources are not dissipated by diversion of resources to persons who do not qualify as recipients.”

But the fate of Aadhaar remains in the realm of speculation till the five-judge bench delivers its verdict on Wednesday. The government has argued that Aadhaar linkage will curb tax evasion and crime as use of multiple PAN cards and fictitious bank accounts will be checked by UID’s near-foolproof identity authentication.

Wednesday will be a mega day in the Supreme Court as it would also deliver a verdict on whether to refer to a seven-judge bench the request for reconsideration of the 2006 judgment in the Nagraj case, in which the apex court had inserted three caveats while upholding validity of quota in promotion for Scheduled Castes and Tribes government employees.

The Supreme Court will also give its decision on PILs seeking live streaming of court proceedings. During the hearing, the court had agreed with attorney general K K Venugopal to start delayed live streaming on an experimental basis in the Chief Justice of India’s courtroom pertaining to important constitutional issues.