Ashok Soota

This is a collection of articles archived for the excellence of their content. |

A brief biography

The early years

Shilpa Phadnis & Partha Sinha, September 9, 2020: The Times of India

From: Shilpa Phadnis & Partha Sinha, September 9, 2020: The Times of India

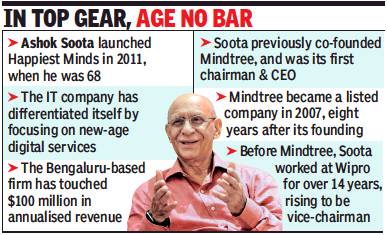

Soota did engineering from IIT-Roorkee, and was in Shriram Refrigeration Industries when Azim Premji, in 1985, hired him to build Wipro’s then nascent IT business. Over the next 14 years, Soota became almost the face of Wipro, given Premji’s proclivity to stay in the background, and rose to be vice-chairman of the company.

In 1999, Soota led a group of 10 senior executives, from Wipro and other companies, to found Mindtree. The going was good for the next decade, and the successful IPO in 2007 only increased the optimism.

But then there emerged differences between the founders, and it looked like it was Soota on one side and all the rest on the other. It’s still not very clear what the differences were. Some attribute it to Soota’s push for an entry into the mobile handset business, which ended up losing a lot of money. Some say there were differences around the allocation of responsibilities among the founders.

Eventually, Soota quit Mindtree. He sold off all his shares in the company, and in 2011, at the age of 68, in a remarkable display of grit and perseverance, he founded Happiest Minds.

Soota told TOI in an earlier interview that he named the company Happiest Minds to suggest that they are in the business of making customers happy through happy employees. But since Happiest Minds did not quite indicate what the company did, Soota added the tagline — The Mindful IT Company, which conveyed that it was an IT company that would be mindful in its approach to its people, customers and community.

2020

The company’s biggest differentiator, Soota said, was its focus on digital — while most of the big IT services companies today categorise about 30% to 50% of their business as digital, for Happiest Minds, it’s 100%. Soota believes there are only four firms in the world that can be called 100% digital — Happiest Minds, Epam Systems, Endava and Globant.

Soota said last week that he had always preferred to run public companies. He said there’s pressure to improve corporate governance when a company goes public. Depending too much on private capital, he said, doesn’t help. He points to the experience of heavily funded companies like Uber and Lyft. “They have been trading below their IPO price,” he said.

It’s rare for entrepreneurs to succeed a second time. To do that in their 70s — almost never. Ashok Soota, 77, is one of those exceptional ones. The Rs 700-crore initial public offer (IPO) of his IT services company Happiest Minds, which concluded on Wednesday, has been oversubscribed 150 times.

About 13 years ago, he took his previous company, Mindtree, to an IPO, and that issue was oversubscribed 103 times.

“People thought we were crazy to file for an IPO in the middle of a lockdown,” Soota told TOI last week. But he said he was confident, given the nature of his business. He said almost 76% of his revenue is not affected by the pandemic and lockdown.

More than half of that revenue comes from edutech and hi-tech sectors. He said the company’s focus on digital services also puts it on a very different footing from traditional IT companies. This is what enables, he said, Happiest Minds to grow at nearly 21% (last three years’ compounded annual growth rate, or CAGR), when the IT industry has slowed down to 8-10%.

The Happiest Minds IPO raised Rs 316 crore from anchor investors last week, before the issue opened. The IPO closed with a book size of nearly Rs 58,300 crore. The institutional part has been subscribed over 77 times, the non-institutional part — also called the HNI or the high net worth investors’ portion — 352 times, and the retail portion 71 times. This is the second IPO since the lockdown started in March. The first, of Rossari Biotech in July, was oversubscribed 79 times.