Information Technology, India: I

This is a collection of articles archived for the excellence of their content. |

Contents |

Apps created by Indians

2018-19: India vis-à-vis China

Sindhu Hariharan, Dec 26, 2019 The Times of India

With majority private capital raised by new-age tech businesses going towards user acquisition and marketing, Indian apps managed to claim more installs than key Chinese rivals in 2019, despite TikTok and PUBG’s global domination. Chinese app downloads dominated Indian ones in 2018.

An analysis of India’s top 200 apps by install volume, by app intelligence firm AppsFlyer, showed that 41% were developed by local developers and firms in 2019 compared to 38% in 2018. The share of Chinese apps dropped to 38% in 2019 from 43% last year.

“Whereas 2018 marked the dramatic rise of Chinese apps in India, the momentum this year has shifted back in favour of local players such as Indian payment apps,” AppsFlyer’s noted.

However, the “blue-sky” potential of the Indian market will bring in more foreign competitors in the coming years, the study said.

With 6.5 billion installs in second and third quarter (up to September) of 2019 in India, foreign markets have started to take note of rise of Indian app economy, analysts at AppsFlyer said, adding that the Chinese continue to gain on popularity in categories where they do well such as news, entertainment and gaming.

`The rise of app market has also led to growth of non-organic installs (NOI) — app installs arising from a brand’s marketing activity and spends, and not spontaneous. The average NOI per app grew by 38%, with hyper-competitive finance (107%), gaming (51%) and food and drink (51%) categories, spending most to add installs. App retention rates, though on an upward trend from 2018, are still at dismal levels in India, as only two out of 100 apps remain on users’ phones by day 30. In 2019, retention rate was 23.4% on day 1 and it fell to 2.6% by day 30.

This is an increase from 22.8% and 2.3% in 2018 respectively.

“Retention rate is a function of high competition across categories, quality of apps, and average storage space in an Indian user’s device, among others,” Deepak Abbot, an analyst in the app market, said.

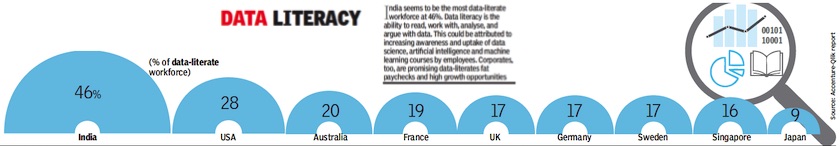

Data literacy

India most literate in [2019?]

From: February 22, 2020: The Times of India

See graphic:

Data literacy in India, Germany, Japan, the UK, the USA and other countries, presumably as in 2019.

Employment in India

2020: over 1 lakh Americans in Indian IT industry

Shilpa Phadnis, April 2, 2022: The Times of India

BENGALURU: The top four Indian IT firms have over 55,000 American employees in the US. The number is sharply up from a few years ago, and reflects the companies’ efforts to overcome visa barriers and become more global in their operations. Including Cognizant, which is US headquartered but has an India heritage, the tally of American employees is over 1 lakh. Cognizant employs 46,400 people in North America.

Data from a variety of sources shows that TCS has 20,000 such employees, Infosys 14,000, HCL 13,400, and Wipro 10,000. For all of them, these numbers are about 70% of their overall US employee strength (including those on visas).

Infosys had committed in 2017 to hire 10,000 American workers at its US operations. The data shows it is now well over that target.

TCS HR head Milind Lakkad recently told TOI that the company is hiring 1,500 freshers from campuses in the US and Europe this year, one of the highest in recent times.

Including those on visas, the Indian IT industry had 1.7 lakh employees in the US in fiscal 2018, as per estimates by research firm IHS Markit Research. This is up from 1.5 lakh in fiscal 2015.

TOI reported recently that Indian IT firms are estimated to have paid an average compensation of $96,300 to its US employees in 2018, higher than the average wage of $94,800 that IT professionals get in the country. This is also data from IHS Markit Research.

While visas is one reason to have local hires, the other is the newer kinds of digital and outcome-based work that IT companies are now doing, and which require client proximity. Infosys, for instance, has set up half a dozen technology centres across Indiana, Connecticut, Rhode Island, Texas, North Carolina and Arizona.

Indian IT’s local hiring will also serve to reduce subcontracting costs, which have been soaring in recent years. To meet people requirements quickly, the companies depend on subcontractors who supply staff. But these expenses can be prohibitive. For Infosys, this expense rose by 40% to Rs 6,031 crore in 2018-19, compared to Rs 4,298 crore in the year before. For TCS, subcontracting expenses rose by 26% to Rs 11,330 crore in 2018-19.

Financial services

Banks’ in-house staff replaces outsourcing, hurts Indian IT/ 2018

From: Shilpa Phadnis, Avik Das & Sujit John, New enemy of outsourcing: DIY by banks, August 15, 2018: The Times of India

From: Shilpa Phadnis, Avik Das & Sujit John, New enemy of outsourcing: DIY by banks, August 15, 2018: The Times of India

Here’s the big reason why most of the big IT services companies are still struggling to accelerate: Many large banks have got into a do-it-yourself mode for their IT. Where once they outsourced work, they are now choosing to do more of it in-house, mostly in their own global inhouse centres (GICs) in countries like India.

The financial vertical has long been the bread & butter of the IT services business, but the sector’s contribution to overall revenue has fallen for most of the big vendors over the past few years.

For TCS, financial services was 33.4% of overall revenue in 2016-17 — it was down to 31.1% in the last quarter. For Cognizant, it’s down 3 percentage points in the past two years, and for Infosys it’s down 1.4 percentage points.

There are also no signs of a reversal in this trend. In the last quarter, TCS’ financial services vertical grew at 4% year-on-year, when its overall revenue grew 10%. The corresponding figures for Cognizant were 4.5% and 9.2%, and for Infosys 2% and 6.8%. Compared to the preceding quarter too, growth was anaemic, far lower than the overall quarter-on-quarter growth, suggesting that the sector continues to weigh on the IT industry.

At the last quarter earnings announcement, Infosys COO U B Pravin Rao admitted as much when he said the company had a negative impact in the quarter from two of its clients due to insourcing. The company’s revenue from financial services declined by 1.5% compared to the preceding quarter. HCL Technologies’ revenue from the financial vertical shrunk by 1.4% in the June quarter and the company said it was due to some of its clients insourcing work Neither Rao nor HCL named the clients that are insourcing, but it is possible to make some guesses based on who outsources to whom.

‘Bank IT staff more efficient than outsourced employees’

Deutsche Bank, Bank of America, Citibank and UBS have been some of the biggest outsourcers of IT, according to IT advisory firms TOI spoke to. Deutsche Bank has an annual outsourcing spend of $6 billion and counts DXC, IBM, Atos, Wipro and Infosys as IT partners. Bank of America outsources $5 billion of IT annually and has contracts with IBM, Accenture, Infosys and TCS, among others. Citibank is estimated to outsource between $1.1 billion and $1.5 billion, to vendors including TCS, Wipro, HCL and NTT Data. UBS outsources about $1 billion and its vendors include Capgemini, Epam, Luxoft, HCL and Genpact.

All of these financial institutions are now insourcing, as also those like RBS, Credit Suisse, ANZ. “Citi had sold their captive business to TCS and Wipro (in 2008) and now they again have a captive business with 4,500 people in Pune alone, and plan to be 8,000-strong there,” said an industry executive who did not want to be named. Citi has centres in Pune, Mumbai and Chennai, employing about 16,000 people, and is growing everywhere. Citi declined to provide a comment for the story.

A UBS spokesperson disputed the outsourcing figure provided by third parties to TOI, but acknowledged that the bank had insourced around 2,000 jobs in the last six months, with the primary objective of improving effectiveness and efficiency. The spokesperson said, “UBS’ business solution centres abroad and in Switzerland have grown in recent years. We now have a global and consistent network that includes India, the US, Poland, and China, as well as the nearshore centres in Switzerland (Schaffhausen, Biel and Ticino). This has created the conditions for insourcing where it makes sense.”

The bank told TOI that one of the main reasons for insourcing is that it wants to retain and strengthen strategic and market-differentiating expertise within the bank — activities that differentiate the bank as a financial services provider from its competitors. “In the technology area, there are topics such as blockchain, digitisation or artificial intelligence. Or operational activities that generate added value for our clients. Or also positions in research, analytics, finance and risk management,” the spokesperson said, with reference to strategic and market differentiating areas.

Deutsche Bank declined to provide a comment for this story. But former Deutsche Bank COO Kim Hammonds told TOI last year that when she came to the bank in 2013, about 80% of the tech was outsourced, and she had since brought it down to 50%. The bank had during that period hired some 4,500 engineers, many of them in its India technology centre. Hammonds, who left the bank in May, had told TOI that she intended to insource some more.

Deval Shah, MD of Danske Bank’s IT and support services centre in India, said a lot of the banks have started realising that their productivity is much higher when they insource. “In this day of digitisation, the time to market is very important. So now when we are working in a very agile environment, with the business, with IT, the ability of your own IT staff to comprehend the business is 10 times more than the ability of a contractor to understand the business. I don’t see vendors building that kind of expertise to help any bank reduce their time to market,” he said.

As for the traditional areas of IT, where vendors have expertise, much of it is getting automated. And even that work some banks are choosing to do in-house. “Service providers that do billing on FTE (hours worked by one employee on a full-time basis) have no motivation to do automation. We (Danske India) are not a revenue centre, but a value centre. From our perspective, we are always focused on automation,” said Shah. The Danish bank had in 2006 outsourced much of its IT to L&T Infotech, but took back the entire operation in 2014, and has since been building up its own centre in India.

Phil Fersht, CEO of IT research firm HFS Research, said a study they had done with KPMG on the state of outsourcing found only 30% are seeking to renew similar contracts with their current providers, while a similar percentage will only stay with their current provider if they can shift to more outcome-based pricing and have more automation to reduce cost and headcount. Another 44% will either pull work back in-house or change provider.

Peter Bendor-Samuel, CEO of IT research & consulting firm Everest Group, said the Indian players have been living in denial. “They have all been forecasting good years in banking and we have been telling them that for many reasons this was unlikely to happen. The banks’ GICs have matured and they are clearly growing them at the expense of third parties. For some functions, they are also bringing work back on-shore and this work they are keeping in-house. They have largely decided that they like the big Indian firms as their legacy (partners to maintain their traditional IT),” he said.

Bendor-Samuel said that even when companies are seeing some growth in the financial services vertical, it’s coming from areas other than banking — for instance, TCS’ deals in insurance, including the $2-billion Transamerica deal.

However, K Krithivasan, president of the banking and financial services business unit of TCS, said that things are changing even in banking, with players moving from a compliance mindset to a growth mindset. Banks, especially those in Europe, have been bogged down in dealing with compliance issues, including the General Data Protection Regulation (GDPR), forcing them to take their eye away from IT investments. “Banks that are focusing on leveraging technology for growth and transformation are engaging with us very strongly because of our investment in cloud, AI, automation and location-independent agile,” Krithivasan said.

But as the European banks return to IT investments, the big question is, will they prefer to do more of it in-house? The message from Deutsche, Danske and UBS — as indeed the American banks — isn’t good for Indian IT.

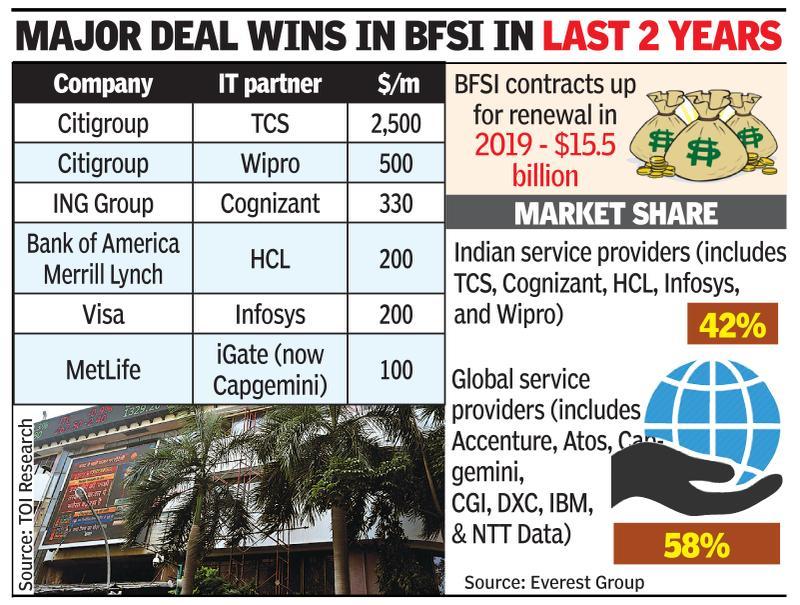

From: Shilpa Phadnis, Avik Das, Indian IT expands market share in global banking services, January 23, 2019: The Times of India

Indian IT services companies are winning a bigger share of the outsourcing by the banking, financial services and insurance (BFSI) vertical, indicating that the companies are managing to win the confidence of customers even in the new digital world.

Data from IT outsourcing advisory Everest Group shows that the Indian service provider group (including TCS, Cognizant, Infosys, HCL Technologies, and Wipro) gained a market share of 1.5-2% over the global service provider group (including Accenture, Atos, Capgemini, CGI, DXC Technology, IBM, and NTT Data) between 2016 and 2018. The former now is estimated to have a market share of 42%, and the latter 58%.

Recent commentaries from TCS, Infosys and Wipro too suggest that the companies are making significant gains in the banking sector in North America. BFSI is by far the biggest vertical for IT services companies, accounting in many cases for 30% or more of total revenue. The industry had significantly slowed down on IT spending for about two years, as they dealt with various regulatory issues. But their outsourcing has now once again picked up smartly. Over $15 billion of BFSI contracts are up for renewal this year, and a lot more of discretionary spends are expected. Indian service providers are expected to get a good part of this.

"Indian-heritage IT services majors are continuing to increase their wallet share at the expense of IBM, DXC and others, due to strong execution capabilities, aggressive pricing and a genuine empathy from IT leaders to working with Indian firms, which has been 20 years in the making. Plus, we see firms like TCS, Wipro and Infosys prepared to take more risks to win clients over and also take more complex projects, and commit to outcomes," said Phil Fersht of IT consultancy HfS Research.

Ronak Doshi, practice director at Everest Group, said the centre of this shift to Indian service providers is the fundamental war for talent, as BFSI enterprises need a talent alternative at speed and scale. “Investments in building this scaled talent pool helped the India pure-play service provider group to bounce back in 2018. With the exception of Capgemini and Accenture, the rest of the global players are not keeping up with their competition to make these investments, leading to wallet share shifts," he said.

For TCS, the growth in revenue over the last five quarters has been driven primarily by BFSI. In the latest quarter, BFSI grew by 8.6% on a constant currency basis year-over-year, compared to 4.1% in the first quarter. Wipro has shown the best growth amongst the three, growing its BFSI sector at 14.4%, 16% and 17.5% in the three quarters of this year.

Doshi expects the number of deal signings (volume) to continue to go up in 2019, but said that the size of deals (average total contract value) is on the decline. Many of the digital deals are smaller, though some are also coming as part of larger infrastructure deals. Peter Bendor-Samuel of Everest Group said clients are also demanding 30-50% reduction in pricing for older contracts, when they come for renewal, given that there has been significant efficiency gains through adoption of automation and other means over the past few years. Indian providers are generally well placed to offer such pricing.

Lobbying

USA, 2015-17

From: Rachel Chitra, Indian IT cos’ lobbying spends jump nearly 40% in Trump era, December 10, 2018: The Times of India

The Indian IT industry’s lobbying spends have increased sharply from the time Donald Trump became US President. It rose by nearly 40% in the first three quarters of fiscal year 2018, compared to the same period in the previous year. The spends are largely going toward dealing with immigration issues, including the higher rejection of H-1B visa applications.

A report by investment firm CLSA shows that IT majors TCS, Wipro, Cognizant, Infosys and industry body Nasscom were collectively spending up to $2.4 million for lobbying in the US in fiscal year 2015. That number increased to $2.9 million in FY16 and then to $3.3 million in FY17 — the fiscal year when Trump assumed power. In the first three quarters of FY18, the figure is already at $3.2 million (it was $2.3 million in the same period in FY17).

The need for such lobbying efforts might increase going forward as the Department of Homeland Security (DHS) last month proposed to make certain changes for filing new H-1B visas. The focus appears to be on ensuring H-1B visas go to the most skilled or highest paid petition beneficiaries.

Analysts also point out the increased difficulties with administrative processes for Indian companies. “Overall, the visa environment is becoming onerous and eventually, if the cost of doing business in the US increases, it could be detrimental to margins (of IT majors),” said Parag Gupta, equity analyst, Morgan Stanley.

Nomura analyst Ashwin Mehta sees “pressure from pricing in legacy, onsite staffing due to immigration tightening and recent appreciation of the rupee”.

CLSA notes that for Infosys and Wipro, lobbying spend has gone from negligible sums to a run-rate of $320,000 and $200,000 a year respectively. “While TCS has increased its lobbying 4X to $380,000 from $80,000, Cognizant has long outspent Indian peers with a $3-4 million budget and extensive engagement at senior levels in Washington. It has had the most extensively staffed immigration office and is the largest sponsor for green cards,” said Ankur Rudra, analyst, CLSA. Citi analyst Suvendra Goyal said the visa renewal process is already creating cost/ flexibility challenges.

Software developers in India

1/3rd of developers are self-taught/ 2017

Shalina Pillai, 1/3rd desi developers self-taught: Survey, January 25, 2018: The Times of India

From: Shalina Pillai, 1/3rd desi developers self-taught: Survey, January 25, 2018: The Times of India

See graphic:

Top languages, modes of learning to code and preferred resources used by software developers in India, as in January 2018

The majority of Indian developers are learning to code through websites like YouTube, coding sites like Git-Hub and Stack Overflow, and online courses, rather than relying on educational institutes. As high as 70 per cent of around 3,700 Indian developers surveyed recently said they had taught themselves how to code, either exclusively, or in addition to school. And 33 per cent (around 1,217 developers) said they were exclusively self-taught, without any academic help.

The survey, done globally among 40,000 developers across 42 countries, was conducted by talent evaluation company HackerRank. HackerRank is a technical hiring platform that helps businesses evaluate software developers based on skill. It has a leader board that hosts talented coders with a live score board that gets updated on a real time basis. Most industry biggies, including Amazon, LinkedIn, Quora and Facebook, keep an eye on this leaderboard to hire the best of coders across the globe.

Stack Overflow, an online community of developers to code and learn, was the most popular platform to learn coding, with over 70 per cent of Indian developers and students choosing it (over 8,000 deveopers and students were surveyed for this). This was followed by YouTube.

MOOCs (massive open online courses) like Udemy, Udacity, Coursera, and online tutorial websites like Pluralsights and Lynda were also more popular than books among students trying to learn coding.

About 11 per cent of Indians start coding before they are 15 years old (that's lower than the global figure of 31 per cent), and 71 per cent do before they are 20.

India is somewhat old school in terms of the programming languages that developers know. C, one of the oldest known programming language, was the most known language among Indian developers - 80 per cent of the 3,700 surveyed knew the language. C++, Java, and JavaScript were languages that more than half the Indian developers knew.

Vivek Ravisankar, co-founder & CEO of HackerRank, said that it is good that Indian developers were still wellversed with the old languages. "Languages like Python is easier to learn since it's the closest programming language to English. But C and C++ are tougher and it's good that Indian developers know those basics," he said.

However, 42 per cent of Indian programmers also know Python, though that is less than the average of 54 per cent for all other countries surveyed.

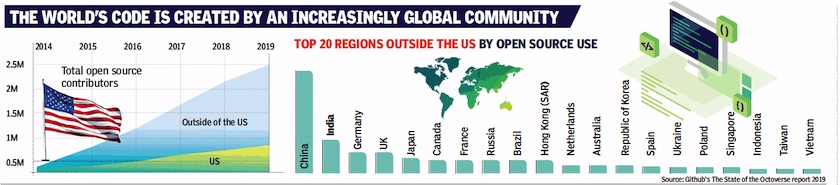

2014-19/ Open source usage: India is no.3

From: Nov 26, 2019: The Times of India

See graphic:

Open source usage in India and the world, 2014-19.

The most attractive IT/ITeS outsourcing locations

2013-14

Bangalore top IT hub, Mumbai slips to No. 3

Manila At No. 2 As Philippines Gains | 6 Indian Cities Among Top 10, Tier-2 Centres Move Up

Sujit John & Shilpa Phadnis TNN

Bangalore: Bangalore remains by far the most attractive IT/ITeS outsourcing location in the world, and six Indian cities are part of the top 10 most attractive outsourcing locations, says the latest annual ranking by consulting firm Tholons. The other cities are Mumbai, Delhi NCR, Chennai, Hyderabad and Pune.

But the 2014 edition of this survey, which ranks the top 100 locations, also points to some interesting trends – several Indian tier-2 cities, as also cities in the Philippines, Poland, and South America, have significantly improved their attractiveness over the past year.

Chandigarh (at No 23), Kolkata (25), Jaipur (38) and Ahmedabad (63) have all improved their rankings. Ahmedabad rose the most, by six ranks, compared to last year’s ranking, suggesting that Gujarat chief minister Narendra Modi’s economic initiatives are paying off even for the IT/ITeS industry. It is seen to be particularly good in finance & accounting BPO and in certain aspects of IT. However, Coimbatore (31), Bhubaneswar (55) and Thiruvananthapuram (68) slipped a little.

“Efforts by Nasscom (IT industry body) and others to promote tier-2 & 3 cities are paying off,” said Vikrant Khanna, principal at Tholons. But he said it remains to be seen whether these cities can evolve to service a diverse portfolio of services.

Manila, capital of the Philippines, has risen to the No. 2 spot, dislodging Mumbai, which is down to No. 3. Other cities in the Philippines, including Davao City, Santa Rosa (Laguna) and Bacolod City, all rose up the ranks, while Cebu City maintained its No. 8 position.

“The Philippines was predominantly in voice-based BPO, but now, non-voice BPO is also growing significantly,” said Khanna. Global companies, he said, are showing a lot of interest in doing work there, as also service providers in India who want to derisk their business.

The Philippines’ close cultural ties with the US has helped, but it has less than a tenth of India’s population, so those established centres there are looking at building strengths of 1,500-2,000 people over three years. That’s unlike in India where companies are able to scale quickly to many thousands of employees.

Industry analysts say India has no reason to have any immediate worries about the Philippines. “The India story is compelling with 3.5 million graduates coming out of colleges every year. A lot of heavy lifting will be done from India. The Philippines still has a lot of catching up to do in nonvoice areas,” said Keshav Murugesh, CEO of business process management company WNS Global Services.

Tholons ranks cities based on six parameters – scale & quality of talent; cost; business catalyst (economic profile of city); infrastructure; risks (political and social risk, risk of natural disasters etc); and quality of life.

As many as 39 of the top 100 locations in the latest survey are from Asia Pacific. But other continents too are seeing more action now.

Point of sales terminals

As in 2019

May 30, 2020: The Times of India

From: May 30, 2020: The Times of India

See graphic:

Point of sales terminals in use in India, as in 2019.

Salaries

Specialisation in languages fetches top dollar

Shilpa Phadnis, June 2, 2018: The Times of India

From: Shilpa Phadnis, June 2, 2018: The Times of India

HIGHLIGHTS

Techies who can code in languages like Clojure, Erlang, and Haskell are poised to earn the most in the industry, according to a survey

India reportedly has 5 million developers, only a 5 per cent of which know these languages

If you’re a programming ace in Clojure, Erlang, and Haskell, then you would be earning top dollars in India, according to the developer survey by Stackoverflow, an online community for developers. This small, exclusive club of developers currently get fat paycheques because of the demand-supply gap and a steep learning curve. Undergrads in India are still not exposed to these languages.

Most are still largely in the Java and C++ environments, though many are also now beginning to use languages like Ruby, R and Python.

Stackoverflow did not call out salaries of Indian developers separately this year, but in the 2017 report, it said the survey respondents using Python received an average of $8,809 (Rs 5.8 lakh) annually, those using Java got $7,341(Rs 4.8 lakh) and Javascript $7,047 (Rs 4.6 lakh). Stackoverflow surveyed 1 lakh respondents from 183 countries with European developers making up for 39,000 respondents, followed by North America and Asia with 25,016 and 24,700 respondents respectively.

In the US, Erlang and Scala developers are the highest paid, at $115,000. Globally, respondents who use F#, Ocaml, Clojure, and Groovy earn the highest salaries, with median salaries above $70,000. Python respondents get $56,000. F# is an open source cross-platform programming language that runs on Linux, Mac OS, Android, Windows and iOS.

Erlang, Haskell and Clojure are a smaller community in India, for several reasons. These are called functional languages and follow a different coding paradigm. A Quora post two years ago by Tikhon Jelvis, a professional Haskeller, said that Haskell is increasingly used in the financial sector. He gave examples of how Haskell is used by JP Morgan for projects in the new product development group and, Barclays in their equity derivatives quality assurance group.

Viral Shah, CEO of Julia Computing and co-creator of the Julia programming language, said that most Indian developers are still focused on Java and C++ that power a majority of the world’s infrastructure. “Languages like Erlang, Scala, Haskell, and Clojure are not mainstream. I believe that the number of programmers is naturally small compared to the popular and widely used tools, and they usually attract programmers who are passionate about computer science and like to experiment with new ideas. The kinds of systems implemented in these also tend to be special purpose and mission critical,” he said.

Vivek Prakash, co-founder of HackerEarth, a hub for 1.5 million developers, said these specialized languages are not taught to undergraduates in engineering colleges. “These languages are still new to the Indian developer ecosystem. These languages (Erlang, Haskell) are functional languages with a different programming and learning curve compared to Java or Python,” he said. Prakash said that India has 5 million developers out of which less than 5% know these functional languages.

Software imports

No need to deduct tax at source/ SC, 2021

Lubna Kably, March 3, 2021: The Times of India

The Supreme Court (SC) ruled that payments made by resident Indian end users or distributors (such as technology companies) to overseas suppliers on import of ‘shrink-wrapped’ software — generally known as off-theshelf software — is not a ‘royalty’ payment. Thus, no withholding tax obligations arise in India against such payments.

During assessment and at various levels of judicial appeals, payments made for import of shrink-wrapped software to overseas suppliers were held assessable to tax as ‘royalty’ under section 9(1)(vi) of the I-T Act and Article12 of the respective tax treaties. This classification as ‘royalty’ required tax to be deducted at source (TDS) when making payment to the overseas suppliers.

As TDS obligations were not met, the Indian distributors were held to be ‘assessees in default’ and heavy tax demands, which included penalties, were raised on them. They will now be able to file for refunds which, according to industry observers, could run into several lakhs.

Over several days in February, the apex court heard more than 80 appeals covering this issue of ‘royalty’ payment. The companies involved in this prolonged litigation that lasted nearly 20 years included Samsung Electronics, IBM India, Sonata Information Technology, Infineon Technologies and GE India Technology Centre, to name a few.

In short, the contention of the companies was that the use of software by the Indian importer was limited to making a backup copy and/ or redistribution. They did not have the right to modify the shrink-wrapped software that was imported.

So, the payment made to overseas supplier could only be treated as business income in the hands of the entity — instead of as ‘royalty’ — and no tax withholding obligations arose. On Tuesday, in an order spanning 226 pages, the Supreme Court upheld this stand and set aside high court judgments that had held otherwise.

KPMG India senior partner Hitesh Gajaria said, “This welcome judgment ends the controversy and gives relief to Indian companies who were being pursued by the I-T department for alleged non-withholding of tax. Even as a new Equalisation Levy on non-resident e-commerce operators selling goods and services has come into force with a mind-bogglingly vast scope and coverage, thankfully here the burden has been cast on overseas companies to comply with the provisions of this new levy.”

Sources of revenue

2020: legacy technology; aerospace and defence

Legacy technology-based services and products will continue to constitute a meaningful part of revenue for IT service providers even as the share of digital business is growing at a faster pace – this was the general view at an ET roundtable organised at the Nasccom summit on Friday.

CP Gurnani of Tech Mahindra, Keshav Murugesh of WNS Global Services and Cyient BVR’s Mohan Reddy discussed how their companies, and the industry in general, were handling legacy businesses when the focus is increasingly turning towards emerging technologies in areas like cloud, blockchain, machine learning, artificial intelligence, cyber security, quantum computing and IoT.

“The old has not extinguished as fast as people have always thought. Mainframe still exists,” Tech Mahindra managing director Gurnani said.

“The transformation or digital adoption is not new. What we have noticed is that if there is a job replacement, it is substituted by a better job. If there is a process change, it has only created a better demand.” His company reported a 10.6-percentage-point increase in digital revenue in the quarter through December from three months earlier, accounting for 41% of overall revenue.

Cyient chairman Reddy said clients of the engineering and technology solutions company were continuing to improve upon their legacy software and hardware infrastructures rather than replacing those entirely with new, digital products.

“It’s not like they are dumping off old design work and asking us to make new products… The legacy continues. There are a few areas where the new technologies are disrupting the old. Otherwise they are augmenting it and they will work with each other,” he said.

Aerospace and defence contributes close to a third of Cyient’s revenue.

Reddy said clients in the sector were looking at rewiring existing aeroplane engine architecture, which costs about $3 billion to build, with new digital technologies. Engines typically have a life space of 40 years, he said.

“They are at this point making sure to incorporate new digital technologies to get new applications. A good example could be engine health monitoring systems — sensors are placed to provide the ability to crunch data to understand the behaviour of the engine during a flight.”

Supercomputers

The most powerful supercomputer systems

See graphic:

World’s 500 most powerful supercomputer systems

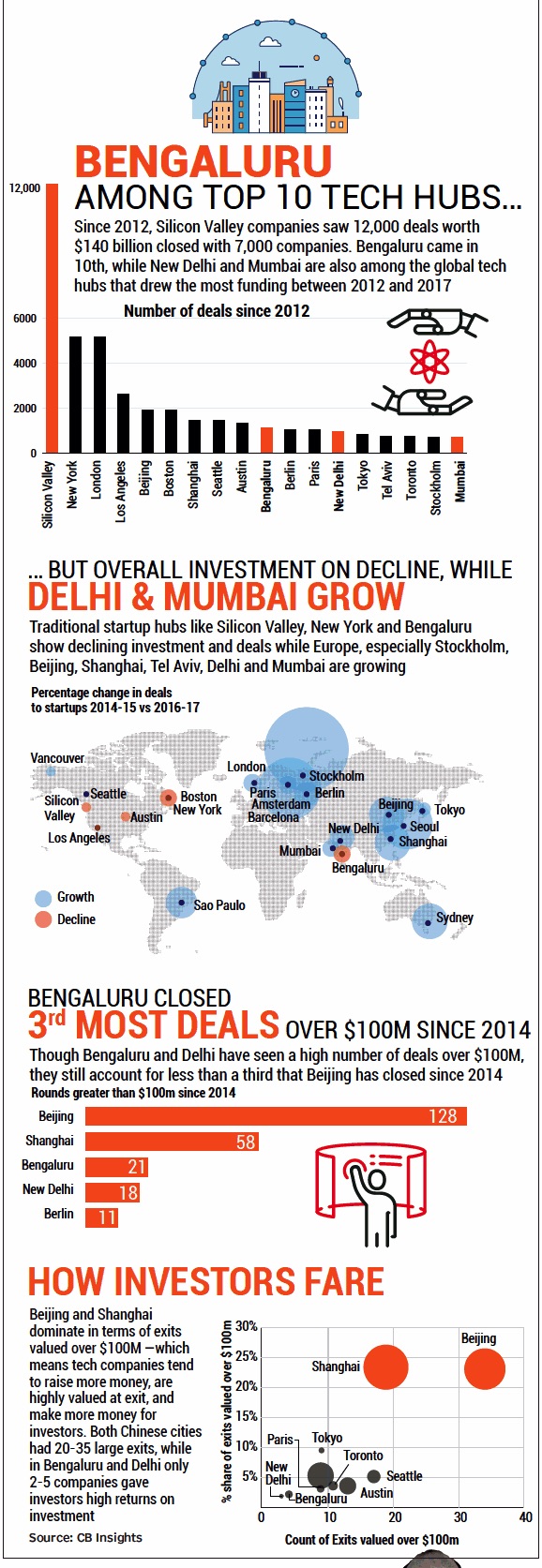

Technology hubs

2012, 2014-17

July 29, 2018: The Times of India

ii) 2014-17: growth/ decline in investment in start-ups in the Technology hubs of the world;

iii) 2014-17: Major deals closed in Bengaluru, New Delhi and other major Technology hubs; iv) Fate of investments in Bengaluru, New Delhi and other major Technology hubs.

From: July 29, 2018: The Times of India

See graphic :

i) 2012-17: There were 3 Indian cities among the world’s Top 18 Technology hubs;

ii) 2014-17: growth/ decline in investment in start-ups in the Technology hubs of the world;

iii) 2014-17: Major deals closed in Bengaluru, New Delhi and other major Technology hubs; iv) Fate of investments in Bengaluru, New Delhi and other major Technology hubs.