Digital payments, transactions (Inc;uding wallets, mobile banking): India

Contents |

Digital payments, transactions

Towards a cashless future

November 13, 2016: The Times of India

See graphic:

Top cashless countries, IMPS payments-% growth from 2012-17, year-wise and % share in total transactions, 2012-17, year-wise

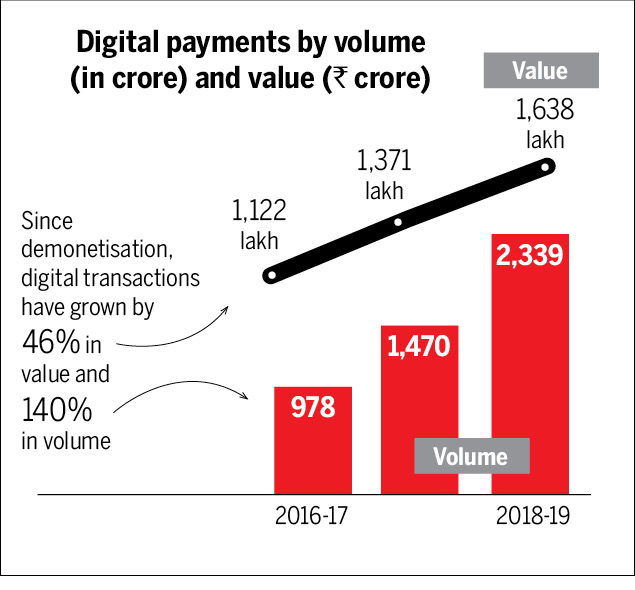

2011–22

Nov 9, 2022: The Times of India

From: Nov 9, 2022: The Times of India

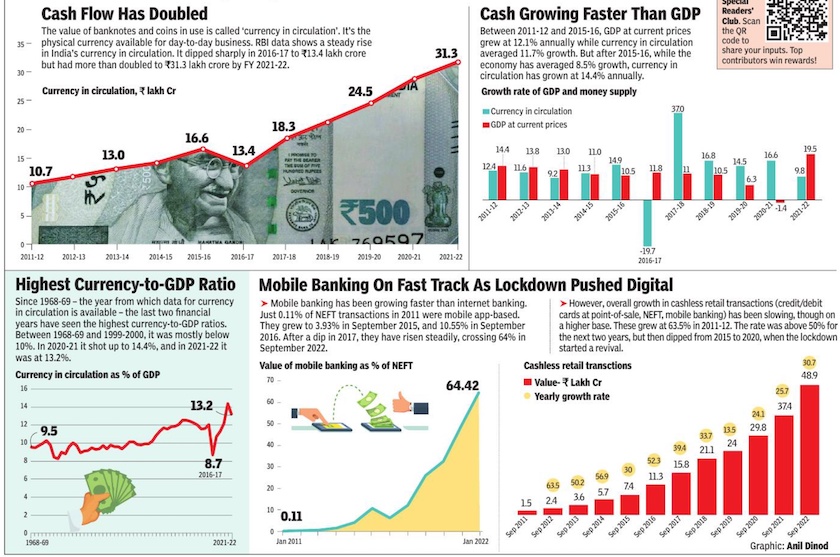

Cashless payments had been rising steadily in the past decades, but it was the Covid-19 pandemic that spurred the big switch to digital transactions. However, Atul Thakur finds that Indians still love cash and its circulation is growing like never before.

2014-19, year-wise

Source: RBI, Worldpay Global Payments Report, March 3, 2020 The Times of India

From: Source: RBI, Worldpay Global Payments Report, March 3, 2020 The Times of India

From: Source: RBI, Worldpay Global Payments Report, March 3, 2020 The Times of India

From: Source: RBI, Worldpay Global Payments Report, March 3, 2020 The Times of India

From: Source: RBI, Worldpay Global Payments Report, March 3, 2020 The Times of India

See graphics:

Currency in circulation, 2014-19, year-wise

Methods as % of total payments in 2017

Card usage trends (in %), cash withdrawal and payments, 2016-19, year-wise

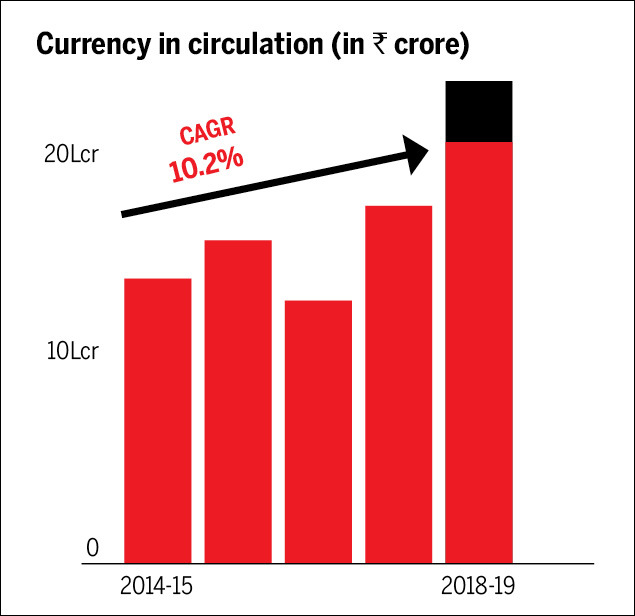

No. of payment cards in circulation, debit cards and credit cards, 2014-19, year-wise

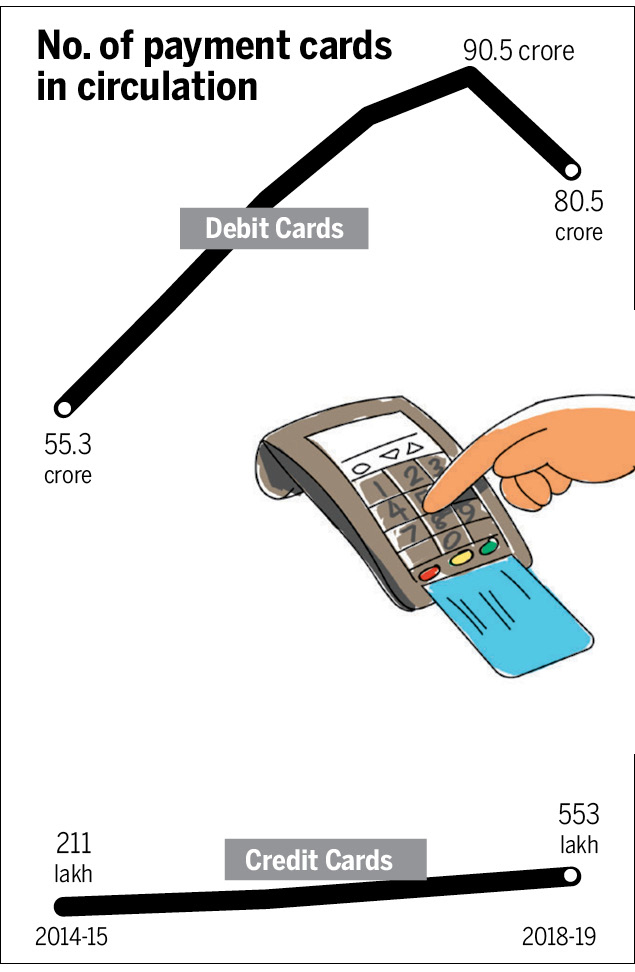

Digital payments by volume (in crore) and value (Rs. crore), 2016-19, year-wise

What demonetisation did to cash

In 2016-17, when demonetisation kicked in, it brought down the currency in circulation. However, the latter rebounded the very next year. Between 2014-15 and 2018-19, currency in circulation grew at an annual rate of 10.2%. However, without demonetisation, currency in circulation would have been Rs 3.5 lakh crore more than what it was in 2018-19.

Cash still the preferred payment option

But, although non-cash payments have risen, for payments made in person, cash remains, by far, the most preferred option. Even for online transactions, a fifth of payments are made by options like cash on delivery.

But Indians' love for cash slowing declining

Gradually, more and more Indians are turning towards cards. Use of debit cards is not confined to cash withdrawal alone, but is also being used as a mode of payment.

Between 2014-15 and 2018-19, debit and credit card payments grew 44% in volume and 40% in value terms.

In 2014-15, the number of debit cards stood at 55.3 crore. In a span of four years (2018-19), it nearly doubled to 90.6 crore before falling to 80.5 crore in December 2019, because of large-scale deactivation of old cards to make all cards chip and PIN compliant. During the same period, credit card numbers more than doubled.

Fondness for digital increasing

Since demonetisation, digital transactions have grown by 46% in value and 140% in volume thanks to a favourable regulatory environment, infrastructure upgrades and wider smartphone penetration. The most significant growth has been in Unified Payments Interface (UPI) and e-money transactions, which were a small share of total digital payments in 2016-17. Since then, UPI has become the largest mode of digital payments by volume, followed by e-money and debit card payments. In value, though, bank transfers still account for the largest chunk.

2017: 11% growth

Digital payments grow 11% in Dec YoY, January 18, 2018: The Times of India

Digital transactions for the month of December 2017 are 11% higher than the figure for December 2016, when transactions had shot up due to a withdrawal of cash from the system due to demonetisation.

According to data released by the NPCI, total electronic payment transactions crossed 1 billion in December 2017 to 1.06 billion compared to 957 million a year earlier. In value terms, the total transactions amounted to Rs 125.53 lakh crore, 20% higher than Rs 104 lakh crore last year.

Transactions in most segments were higher than the earlier year, except card payments. Payments using debit and credit cards fell to 263 million in December 2017 as compared to 311

million in December 2016. In value terms, however, card payments amounted to Rs 52,800 crore compared to Rs 52,200 crore in the previous year. The bump up in the number of digital transactions came from payments made using the Unified Payments Interface (UPI). Transactions using this account-to-account transfer platform rose 2 million to 145 million.

According to bankers, transactions on the UPI platform has got a big boost due to the entry of Google Tez and Paytm, which were running promotion campaigns to get users to switch to their platform.

The bump up in e-transactions came from payments made using UPI

2017- 22

From: Dec 12, 2022: The Times of India

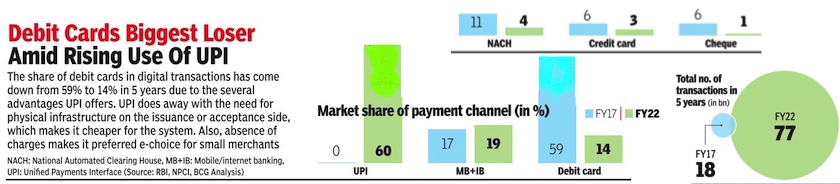

See graphic:

Market share of payment channel, 2017- 22

2020

India Vis-a-vis the world

From: Oct 28, 2021: The Times of India

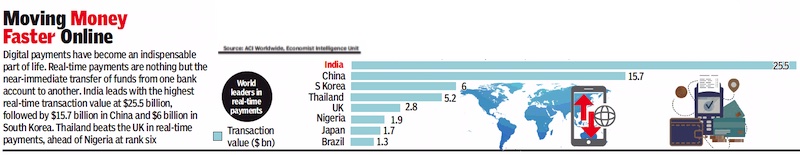

See graphic:

The value of real time payments in India and comparable countries, presumably in 2020

Digital wallets, digital payments

Limited liability

Ombudsman, limited liability cover to make e-wallets safer, December 6, 2018: The Times of India

To inspire confidence among users of digital payments, the RBI has said that it will introduce the concept of limited liability for prepaid instruments, which includes digital wallets. Also, a new office of ombudsman for digital transaction is being created to take up complaints from individuals for prepaid instruments.

Last year, the central bank had introduced the concept of ‘zero liability’ for card users, provided they acted prudently in not divulging credentials and reported frauds in time. Under this policy, cardholders who lost money due to a thirdparty breach and who reported the loss within three days would get all their money back.

Even where there is some negligence on the part of the customer in not responding to alerts and not notifying the bank, the maximum liability was capped at Rs 5,000 for a basic savings account and Rs 10,000 for most other accounts. For credit cards with limits above Rs 5 lakh, the maximum liability has been fixed at Rs 25,000. However, where the customer has shared his password, he will be liable for all the losses until he reports it to the bank.

On Wednesday, the RBI said that the same limited liability concept will be extended to users of prepaid instruments. The liability limits will be announced by the RBI. According to banks, the liability limits for e-wallets is likely to be lower, considering the smaller transaction size and lower balances.

The creation of an ombudsman for digital transactions, besides providing a platform for customers, will enable the RBI to keep track of discrepancies.

“RBI’s endeavours to promote a less-cash society has resulted in a significant rise in the volume, value and channels for conducting digital transactions. For promoting the level of trust, a dedicated and empowered grievance redressal system is a pre-requisite,” said RBI deputy governor M K Jain. “It will cover all entities falling within RBI’s jurisdiction, which means nonbanks as well,” said Jain.

The usage of digital wallets/ e-wallets

2016-18

From: Ombudsman, limited liability cover to make e-wallets safer, December 6, 2018: The Times of India

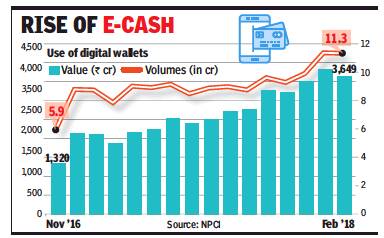

See graphic:

The use of Digital wallets, 2016-18

2018: Indians install e-wallets, but don’t use them

Rachel Chitra, January 28, 2019: The Times of India

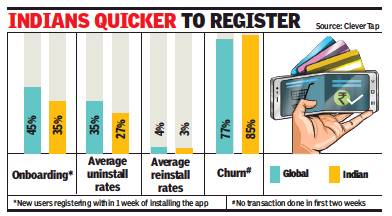

From: Rachel Chitra, January 28, 2019: The Times of India

As many as 85% of Indian users install e-wallets and fintech apps like MobiKwik and Paytm, only to let them remain dormant, according to a study.

“Companies spend huge sums of money to advertise, market themselves, offer discounts and cashbacks to get users on board. But after getting them on board, if usage is low, then it is an indicator that the apps aren’t doing enough to keep customers engaged. And the churn rate (defined by no transaction done in the first two weeks) for India at 85% is worrisome — and is higher than the global average of 77%,” said Almitra Karnik, head of marketing and global growth at CleverTap, which conducted the study.

CleverTap is a Californiabased behavioural analytics company that measured usage patterns in 700 million mobile devices globally for the study. Karnik said if the app is not used in the first two weeks, it will invariably remain dormant thereafter, until a day when the user decides to uninstall it.

About 27% of Indian users uninstall e-wallets within two weeks of usage. But Indian apps seem to have better retention power than their global peers, who have a higher uninstallation rate of 35%. The average rate of reinstallation in India was a low 3%, showing that when a customer has a bad experience with a financial services app, s/he is unlikely to ever return to it.

Paytm did not respond to a request for a comment. Payment services firm PhonePe’s CEO Sameer Nigam said its app retention numbers are much healthier than what the CleverTap study shows. He said that was because a large percentage of its installs are organic (without providing incentives for the download) or referral-driven. “More than 75% of uninstalls happen when the installs are driven by low-quality digital marketing,” he said.

Fintech firm PayU’s CEO Jitendra Gupta also said 85% of downloads of its consumer-facing app LazyPay is organic. The user, he said, sees a clear proposition and is not driven by things like cashbacks. He admitted that the uninstall rate is 28-30%, but said this cannot be the only criterion to judge an app by. “On an average, every user is using LazyPay six times a month. We have 90% repeat users on a monthly basis. Besides, our uninstalls happen in cases where we don’t provide credit facility to the user, and those are obvious cases for uninstallation,” he said. LazyPay provides personal loans and pay-later options.

The legal positions

HC: Paytm to pay damages to victims of hackers

Sureshkumar k, May 13, 2023: The Times of India

Chennai : The Madras high court has ordered the RBI to ask Paytm to compensate a doctor who lost Rs 3 lakh to hackers through the digital payment portal, issuing the directive while deprecating the tendency of one institution after another kicking the can down the road when bilked customers seek redress.

“Even though the public is encouraged to use Paytm, Google Pay, Amazon Pay, etc. , the customer is made to run from pillar to post in case they are affected due to any third-party violations or fraudulent intervention,” the court said.

The order was issued tothe RBI as Paytm is a private entity and such a directive cannot be issued to it under a writ petition. The HC made itclear that the portal is liable to protect its customers. “What is surprising is that even when the RBI has issued master directions for both banks and prepaid payment instruments, every institution shifts the blame upon the other and no one has come up with a concrete idea as to who has to bear the loss suffered by the petitioner, for none of her mistakes,” the HC said, referring to the doctor, R Pavithra.

Pavithra’s banker, City Union Bank, argued the money was stolen from her Paytm account and the bank cannot be held responsible. Paytm claimed transactions on the platform are “very secure” and do not go through without the customer’s knowledge orsharing of account details.

The RBI pointed out that “it does not interfere” in transactions between regulated entities and their customers.

The HC expressed displeasure that all the institutions were passing the buck. It stressed that the petitioner must not suffer while pointing out that she had promptly complained to her bank which, in turn, had sent it to Paytm.

“As per RBI circulars, Paytm had to establish within 90 days of the incident that the petitioner was liable for the loss. However, it failed to do so. Thus, as per RBI guidelines, the amount was to be repaid to the customer irrespective of whether negligence was on her part or not,” the HC said.

Mobile banking

See Digital wallets, digital payments, Mobile banking, UPI: India

Bank Board Bureau/ 2016

The Hindu, February 29, 2016

Prime Minister Narendra Modi approved the setting up of the Bank Board Bureau with former Comptroller and Auditor-General of India Vinod Rai as its first Chairman.

The Bureau is mandated to play a critical role in reforming the troubled public sector banks by recommending appointments to leadership positions and boards in those banks and advise them on ways to raise funds and how to go ahead with mergers and acquisitions.

“With a view to improve the governance of public sector banks, the government had decided to set up an autonomous Bank Board Bureau. The bureau will recommend for selection the heads of public sector banks and financial institutions and help banks in developing strategies and capital raising plans,” the government said in a release.

The bureau was announced in August 2015 as part of the seven-point Indradhanush plan to revamp these banks. It will constantly engage with the boards of all 22 public sector banks to formulate appropriate strategies for their growth and development.

The bureau, led by Mr Rai, will select the heads of public sector banks (even from the private sector, if need be) and aid them in formulating strategies to raise additional capital. It will select and appoint non-executive chairmen and non-official directors.

The non-performing assets of public sector banks are estimated at almost Rs. 4 lakh crore, and they need to raise capital of Rs. 2.4 lakh crore by 2018 to conform to Basel-III capital requirement norms, according to the government.

While some questions have been raised on Mr. Rai's appointment as a CAG cannot hold a government office post-retirement, former senior civil servants say the role is advisory in nature and a part-time position. The government release said the appointments have been made for a period of two years.

The bureau will have three ex-officio members and three expert members, in addition to the Chairman.

2016: Mobile banking transactions

The Economic Times, Mar 22, 2016

Mayur Shetty

Top 5 banks generate 92% of mobile banking value

Mobile banking penetration in India is concentrated among customers of five banks. According to data released by the Reserve Bank of India, the top five banks account for more than 92% of the entire value of mobile banking transactions in the country.

State Bank of India leads the pack with 36% market share, followed by ICICI Bank (21.5%), HDFC Bank (17.8%), Axis Bank (12.8%) and Kotak Bank (4.7%). These banks have managed to increase the number of mobile transactions by being proactive in development of mobile apps and making mobile banking feature-rich.

According to Deepak Sharma, head of digital banking at Kotak Mahindra Bank, his customers are leapfrogging to mobile banking directly from branch banking without using the browser. "Around 35% of our online banking customers are coming in from their mobile phones without having used net banking," he said. As against its market share of 1.4% of deposits, the bank has over 4.5% share of mobile banking. He said that online has already become the primary channel for most of the customers in the bank.

"Overall, 60% of fixed deposits have moved online. But if you look at only retail, nearly 80% of FDs are opened online," said Sharma. He added that it was largely bu sinesses that were obtaining fixed deposits in the branch.

"In terms of number of logins, mobile banking had overtaken net banking more than six months ago. Now mobile banking is ahead of net banking in terms of transactions as well," said Sharma. He said that the fastest growing segment is online recharge, which is driving transactions.

"We are now getting more and more categories online, like bill pay and IPO subscription. We are also seeing systematic investment plans (SIPs) gaining traction. We feel that any simple product that is easy to start, liquidate and monitor will pick up online," said Sharma.

In terms of volumes, the top five banks account for more than 85% of all mobile banking transactions. While the banks are the same as the toppers in transaction value, the rankings and consequent market shares vary slightly for volumes.State Bank of India again led the pack with a 38.5% market share, followed by ICICI Bank at 17.7%, Axis (15.3%), HDFC Bank (9.9%) and Kotak Bank (4.3%).

2018: mobile banking increases

Mayur Shetty, When m-app matters more than branches, December 5, 2018: The Times of India

From: Mayur Shetty, When m-app matters more than branches, December 5, 2018: The Times of India

Mobile Is Primary Channel For Transactions At HDFC Bank

HDFC Bank’s mobile banking outage has caused a bigger stir than the usual closure of all bank branches on weekends.

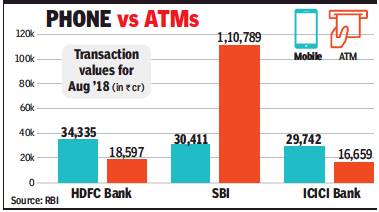

A glitch had made HDFC Bank’s new mobile app nonfunctional for six days. Why was the HDFC Bank mobile app blackout such a major issue? The reason is the sheer volume of transactions that take place through this channel. HDFC Bank’s mobile app accounted for Rs 34,335 crore of transactions in August, which is almost twice the Rs 18,597 crore that its customers conducted through ATMs.

If non-financial aspects such as balance enquiry are included, more than twothirds of all transactions today take place through the mobile app for HDFC Bank. According to a source in the bank, the mobile app has become the primary channel for many customers with all the functionalities of internet banking available within it.

Meanwhile, HDFC Bank finally restored its mobile services on Tuesday evening by providing its older app on Android Play and Apple’s App Store, thereby restoring the m-banking channel.

In terms of value, HDFC Bank accounts for 15% of all mobile banking transactions in the country. Also, HDFC Bank and other private lenders have been most successful in digitising their customers compared to PSU peers. For instance, while State Bank of India records a higher volume of mobile banking transactions, the value of its m-banking transactions at Rs 30,411 crore is less than a third of the value of ATM transactions at Rs 1.10 lakh crore.

According to bankers, the security level in banking through mobile applications is also higher because there are several levels of authentication, including the device and mobile number. “In India, many customers have leapfrogged to mobile banking without using internet banking. Even in internet banking — where customers log into the bank’s website — it is the mobile device that is being used,” said an executive with a private bank. Given that many customers do not visit the bank branch even once a month, savings account holders are more affected by a mobile banking downtime than a bank strike, he added.