Banking, India: II (government data)

This article has been sourced from an authoritative, official readers who wish to update or add further details can do so on a ‘Part II’ of this article. |

The source of this article

INDIA 2012

A REFERENCE ANNUAL

Compiled by

RESEARCH, REFERENCE AND TRAINING DIVISION

PUBLICATIONS DIVISION

MINISTRY OF INFORMATION AND BROADCASTING

GOVERNMENT OF INDIA

Banking :India

The first bank of limited liability managed by Indians was Oudh Commercial Bank founded in 1881. Subsequently, Punjab National Bank was established in 1894. Swadeshi movement, which began in 1906, encouraged the formation of a number of commercial banks. Banking crisis during 1913 -1917 and failure of 588 banks in various parts of the country during the decade ended 1949 underlined the need for regulating and controlling commercial banks. The Banking Companies Act was passed in February 1949, which was subsequently amended to read as Banking Regulation Act, 1949. This Act provided the legal framework for regulation of the banking system in India.

The largest bank - Imperial Bank of India - was nationalised in 1955 and renamed as State Bank of India, followed by formation of its 7 Associate Banks in 1959. With a view to bringing commercial banks into the mainstream of economic development with definite social obligations and objectives, the Government of India issued an ordinance on 19 July 1969 acquiring ownership and control of 14 major banks in the country. Six more commercial banks were nationalised from 15 April 1980.

As certain rigidities and weaknesses were found to have developed in the banking system during the late eighties, the Government of India felt that these had to be addressed to enable the financial system to play its role in ushering in a more efficient and competitive economy. Accordingly, a high-level Committee on the Financial System (CFS) was set up on 14 August 1991 to examine all aspects relating to the structure, organization, functions and procedures of the financial systems. Based on the recommendations of the Committee (Chairman: Shri M.Narasimham), a comprehensive reform of the banking system was introduced in 1992-93.

To review the record of implementation of financial system reforms recommended in 1991 by the Committee on Financial System and chart the path of reforms in the years ahead, a high-level Committee on Banking Sector Reforms, under the Chairmanship of Shri M.Narasimham was constituted by the Government of India in December 1997. The Committee submitted its report in April 1998. Some of the recommendations of the Committee, on prudential norms, Capital Adequacy Ratio, classification of Government guaranteed advances, provisioning requirements on standard advances and more disclosures in the Balance Sheets of banks were accepted and implemented.

Recent major initiatives undertaken for strengthening the financial sector in pursuance to the recommendations of the above Committee relate to guidelines to banks on Asset-Liability Management and integrated risk management systems, compliance with Accounting Standards, consolidated accounting and supervision, fine-tuning of prudential norms for income recognition, asset classification and provisioning for NPAs, etc. The guidelines on setting-up of Off-shore Banking Units in Special Economic Zones, Fair Practices Code for Lenders, Corporate Governance, Anti-Money Laundering measures, Know Your Customer (KYC) norms, Corporate Debt Restructuring (CDR) derivatives, guidance notes on Credit Risk, Market Risk, Operational Risk, etc., are other important developments introduced in the banking sector in recent years. RBI has also issued revised guidelines on migration to Basel II Framework on Capital Adequency.

The Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 has facilitated NPA management by banks more effectively. In 1993, in recognition of the need to introduce greater competition, new private sector banks were allowed to be set up. Licenses were issued to 10 banks which had satisfied the necessary regulatory requirements. Subsequently in 2001, fresh guidlines for setting up new private sector were issued and two banks were issued license under those guidelines.

A draft comprehensive policy framework for ownership and governance in private sector banks was put in the public domain on 2 July 2004 for discussion and feedback. After taking into consideration the feedback received from all concerned and in consultation with Government of India, RBI issued detailed Guidelines on ownership and governance in private sector banks on 28 February 2005. The underlying principles of the guidelines inter alia are to ensure that the all banks in the private sector have a networth of Rs 300 crore, ultimate ownership and control of private sector banks is well diversified, important shareholders (i.e., shareholding of 5 per cent and above) conform to the ‘fit and proper’ criteria. The directors and the CEO who manage the affairs of the bank should also satisfy the ‘fit and proper’ criteria.

The guidelines also provide for restrictions on cross holding of 5 per cent above by one bank/Financial Institution (FI) in another bank/FI and observance of sound corporate governance principles.

On a review of corporate governance practices in Banks in 2007, RBI advised banks in private sector to ensure that their Memorandum and Articles of Association conform to the above mentioned stipulations. Banks in private sector were also advised to split the posts of Chairman/MD/CEO and have a part time Chairman of the Board of Directors and a separate Chief Executive Officer/Managing Director who would be responsible for day-to-day management/activities of the bank. Reserve Bank of India issued guidelines on May 11, 2005 for merger/ amalgamation of private sector banks for consolidation in the banking sector. The guidelines are application where the merger takes place between two banking companies or between a banking company and a non-banking financial company.

RESERVE BANK OF INDIA

The Reserve Bank of India (RBI) was established under the Reserve Bank of India Act, 1934 on 1 April 1935 and nationalised on 1 January 1949. The Bank is the sole authority for issue of currency in India other than one-rupee coins and subsidiary coins. As the agent of the Central Government, the Reserve Bank undertakes distribution of one-rupee coin as well as small coins issued by the Government of India. It acts as banker to the Central Government, and State Governments by virtue of agreements entered into with them. It also handles the borrowing programme of the Central and State Governments.

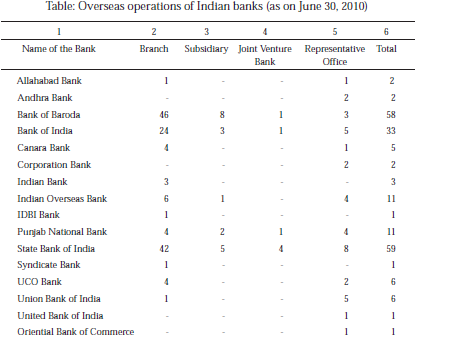

It formulates and administers monetary policy with a view to ensuring price stability while promoting growth in the real sector through proper deployment of credit. It plays an important role in maintaining and managing the country's foreign exchange reserves and ensures orderly conditions in the foreign exchange market. It also acts as an agent of the Government of the India in respect of India’s membership of International Monetary Fund. It regulates and supervises commercial banks, Urban Co-operative Banks, Non-banking Financial Companies (NBFCs) and select All India Financial Institutions. It also performs a variety of developmental and promotional functions. Recently, it has taken a lot of measures / initiatives in promoting financial stability, financial inclusion and financial literacy in the country as a whole. The RBI celebrated its Platinum Jubilee in the year 2009-10 and initiated its outrearch programme to make its presence felt in a more effective and broad-based manner amongst the members of the general public.

Composition of Banking System

The Indian banking system consists of commercial banks both in public and private sector, Regional Rural Banks (RRBs) and cooperative banks. As on June 30, 2009, Commercial Banking system in India consisted of 171 Scheduled Commercial Banks out of which 113 were in public sector, including 86 RRBs. The remaining 27 banks, other than RRBs, in the public sector consist of 19 nationalized banks, 7 banks in SBI group and IDBI Bank Ltd. Public sector banks (excluding RRBs) accounted for about 76.6 per cent of the deposits of all scheduled commercial banks.

Amongst the public sector banks, the nationalised banks (including IDBI Ltd.) group is the biggest unit with 33,095 offices, deposits aggregating Rs 19,93,305 crore and advances of Rs 14,17,121 crore as on 30th June 2009. The State Bank of India group (SBI and its six Associates) with 16,260 offices, deposit aggregating Rs 10,07,042 crore and advances Rs 7,39,606 crore was the second largest.

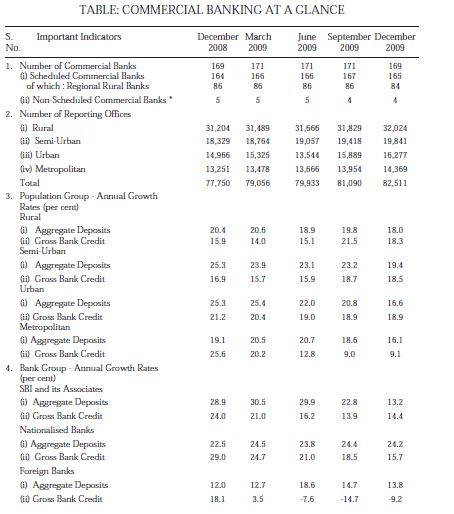

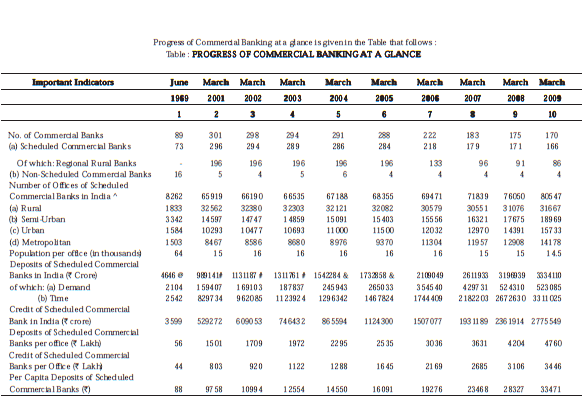

Nationalised banks as a group, accounted for more than one-half (50.9 per cent) of the aggregate deposits, while State Bank of India and its Associates accounted for 23.4 per cent. The shares of other Scheduled Commercial Banks, Foreign Banks and Regional Rural Banks in aggregate deposits was 17.1 per cent, 5.5 per cent and 3.0 per cent, respectively. As regards gross bank credit, Nationalized Banks held the highest share of 50.6 per cent in the total bank credit followed by the SBI Group at 23.8 per cent and other Scheduled Commercial Banks at 17.8 per cent. Foreign banks and Regional Rural Banks had relatively lower shares in the total bank credit at 5.3 per cent and 2.5 per cent, respectively. Some important indicators in regard to progress of commercial banking in India since 2000 are given in the Table that follows:

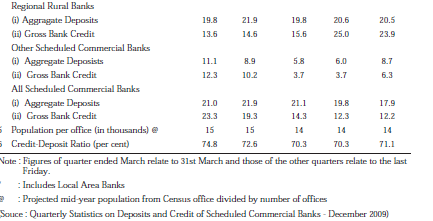

Indian Banks' Operations Abroad

Indian banks continued to expand their presence overseas. Twenty two Indian banks (16 from public sector and 6 from private sector) operated a network of 232 offices. (148 branches 22 subsidiaries, 7 joint venture banks and 55 representative offices) abroad in 52 countries at end June 2010. The details are given in the table given below:

Deposit Mobilisation and Development

There has been a substantial increase in the deposits of Scheduled Commercial Banks in the post-nationalisation period. At the end of June 1969, deposits of these banks aggregated to only Rs 4,646 crore. As on 31st March 2009, this amount has increased to Rs 39.21,981 crore. Deposit amount with Public Sector Banks was Rs 3,871 crore in June 1969. As on 31st March 2009, this amount stood at Rs 28,84,457 crore.

Deposite mobilized by the Banks are utilized for : (i) loans and advances; (ii) investments in government and other approved securities in fulfillment of the liquidity stipulations; and (iii) investment in commercial paper, shares, debentures, etc. up to a stipulated ceiling. There has been a significant increase in the investments of banks in governments and other approved securities from Rs 1,361 crore in June 1969 to Rs 11,66410 crore as at the end of March 2009 (last reporting Friday). The Bank credit of scheduled Commercial Banks have grown from Rs 3,599 crore in June 1969 to Rs 27,75,549 crore as at the end of March 2009.

Banking Ombudsman Scheme

Banking Ombudsman Scheme is in operation since 1995. The Scheme works under the control and supervision of Reserve Bank of India (RBI). Banking Ombudsman is an independent body with legal powers to settle disputes quickly and inexpensively. RBI has appointed 15 Banking Ombudsman all over the country.

The system is designated to ensure, in normal course, satisfactory resolution of complaints as early as possible. Any customer whose grivance has not been resolved by banks to his satisfaction can approach Banking Ombudsman. The Banking Ombudsman Scheme 2006 has been further amended by RBI in consultation with Government of India on 3rd February, 2009. The coverage of the Scheme has been widened to include new grounds of complaints. The grounds of complaint broadly covered under Banking Ombudsman Scheme are:-

1. Credit Card complaints;

2. Pension Complaints;

3. Complaints relating to failure in providing the promised facilities, including through the direct selling agents;

4. Complaints relating to nonadherence to fair practices code as adopted by individuals banks;

5. Non-payment or inordinate delay in the payment or collection of cheques, drafts, bills etc.;

6. Non-Payment or delay in payment of inward remittances.

7. Failure to issue or delay in issue of drafts, pay orders or bankers' cheques;

8. Non-adherence to prescribed working hours.

9. Complaints from Non-Resident Indians having accounts in India in relation to their remittances from abroad, deposits and other bank-related matters;

10. Levying of charges without adequate prior notice to the customer.

11. Non-observance of Reserve Bank guidelines on engagement of recovery agents by banks; and

12. Any other matter relating to the violation of the directives issued by the Reserve Bank in relation to banking or other services.

During the financial year 2008-09 total number of 75009 complaints, relating to the above matters, were handled by various Banking Ombudsman offices. This includes pending complaints from previous period. The Banking Ombudsman have disposed off 65576 complaints during the same period.

Advances to Priority Sector

Extension of credit to small borrowers in the hitherto neglected sectors of the economy has been one of the key tasks assigned to the public sector banks in the post-nationalisation period. To achieve this objective, banks have drawn up schemes to extend credit to small borrowers in sectors such as agriculture, micro and small enterprises (manufacturing and services) retail trade and micro credit which traditionally had very little share in the credit extended by banks.

The scope and extent of priority sector had undergone several changes with several new areas and sectors being brought within the purview of this sector. While there had been demands to include new areas, such as infrastructure, within the ambit of priority sector, views had also been expressed that the focus on the needy sectors of economy and weaker sections of the society would be completely lost because of such inclusions. In this background, an Internal Working Group was set up in Reserve Bank (Chairman Shri C.S. Murthy) to examine the need for continuance of priority sector lending prescriptions, review the existing policy on priority sector lending including the segments constituting the priority sector, targets and subtargets etc. and to recommend changes, if any, required in this regard.

Based on the draft Technical Paper submitted by the Internal Working Group on Priority Sector Lending in September 2005, the guidelines on lending to priority sector were revised with effect from April 30, 2007. The revised guidelines on lending the priority sector envisages to ensure adequate flow of bank credit to those sectors of the society/economy that impact large segments of the population, the weaker sections, and to enterprises. The broad categories of advances under priority sector now include agriculture, micro and small enterprises sector, microcredit, education and housing.

The priority sector lending targets of 40 per cent and 32 per cent as also other sub-targets have been retained for the domestic and foreign banks respectively.

Regional Rural Banks have a target of 60 per cent of their outstanding advances for priority sector lending. However, these are now calculated as a percentage of Adjusted Net Bank Credit (ANBC) (Net Bank Credit plus investments made by banks in non-SLR bonds held in HTM category) or credit equivalent amount of Off- Balance Sheet Exposures (OBE), whichever is higher, as on March 31 of the preceding accounting year, instead of as a percentage of net bank credit as earlier. The Progress of Commercial Banking at a glance is given in the Table that follows :

outstanding FCNR (B) and NRNR deposits balances would no longer be deducted

for computation of ANBC for priority sector lending purposes. The revised

guidelines also take into account the revised definition of small and micro exterprises

contained in the Micro, Small and Medium Enterprises Development Act, 2006.

Thus, the services sector has been included in the definition of micro, small and

medium-enterpprises.

In order to improve the credit delivery to priority sector, including agriculture and micro and small enterprises (both manufacturing and services), the following policy initiatives were taken recently:

l Commercial banks/sponsor banks of RRBs were allowed to classify, in their Books, loans granted to RRBs for co-lending to the agriculture and allied activities sectors, as indirect finance to agriculture;

l Bank were advised that loans granted to housing finance companies (HFCs) for onlending to individuals for purchase/construction of a dwelling unit per family, could be classified as housing loans under priority sector, provided the loans granted by the HFCs did not exceed Rs 20 lakh per dwelling unit. The maximum amount of loans granted by banks to HFCs that would be eligible for classification as housing loans under priority sector in the books of banks, however, could not exceed 5.0 per cent of the individual bank's total priority sector lending on an ongoing basis.

The above special dispensation is applicable for loans granted by banks to HFCs up to March 31, 2010. Such loans granted till March 31, 2010 will continue to be classified under priority sector till they are repaid. It has been further advised that banks should link the tenor of the loans granted by them to HFCs in line with the average protfolio maturity of housing loans, up to Rs 20 lakh, granted by the HFCs to the individual borrowers. If the tenors of such loans granted by banks to HFCs is not co-terminus with the on-lending of HFCs, these loans would not be eligible for classification under priority sector;

l Banks have been advised to categorize loans granted for agricultural and allied activities, irrespective of whether the borrowing entity is engaged in export or otherwise. under priority sector lending as direct advances to agriculture sector;

l Loans granted by commercial banks to micro and small enterprises (MSE) (manufacturing and services) are eligible for classification under priority sector, provided such enterprises satisfy the definition of MSC sector as contained in MSMED Act, 2006, irrespective of whether the borrowing entity is engaged in export or otherwise.

l All Scheduled Commercial Banks were advised that loans granted by banks for Retail Trade (i.e. advances granted to retail traders dealing in essential commodities (fair price shops), consumer co-operative stores, and advances granted to private retail traders with credit limits not exceeding Rs 20 lakh) would henceforth be part of the Small (Service) Enterprises.

l All Scheduled Commercial Banks, including RRBs, were advised that banks may waive margin/security requirements for agricultural loans from the existing level of Rs 50,000/- to Rs 1,00,000.

l Regional Rural Banks (RRBs) have been allowed to sell loan assets held by them under priority sector categories in excess of the prescribed priority sector lending target of 60 per cent. RRBs can also issue Inter-Bank Participation Certificates (IBPCs) of tenor of 180 days on risk sharing basis to scheduled commercial banks against their priority sector advances in excess of 60 per cent of their outstanding advances.

l In November 2009, banks were advised to draw up a roadmap by March 2010 to provide banking services through a banking outlet in every village having a population of over 2,000 which will result in extending financial inclusion to more than one lakh villages. Such banking services may not necessarily be extended through a brick and mortar branch but can be provided through any of the various forms of ICT-based models, including through Business Correspondents (BCs).

l In January 2010, all domestic commercial banks- public and private sector were advised to draw up specific Board approved Financial Inclusion Plans (FIP) by March 2010, incorporating some basic minimum qualitative features, and quantitative indicators with a view to rolling them out over the next three years. Banks have been advised that the top managements need to emphasize financial inclusion and make it an integral part of their business plans. Accordingly, banks have prepared their FIPs for the period 2010-13 and submitted to the Reserve Bank. The FIPs are being monitored by the Reserve Bank on a regular basis.

Amount outstanding under priority sector lending by public sector banks during the period June 1969 to March 2010 (provisional) increased from Rs 441 crore to Rs 8,64,564.29 crore and accounted for 41.7 per cent of Adjusted Net Bank Credit (ANBC) or credit equivalent of off-balance sheet exposures, whichever is higher, as on the last reporting Friday of March 2010.

Credit Flow to Weaker Scections

With a view to augment credit flow to small and poor borrowers, commercial banks were advised by the Reserve Bank of India to provide at least 10 per cent of their net bank credit or 25 per cent of their priority sector advances to weaker sections comprising small and marginal farmers, landless labourers, tenant farmers and share croppers, artisans, village and cotton industries where individual credit limits do not exceed Rs 50000, beneficiaries of Government sponsored schemes such as the Swarna Jayanti Gram Swarozgar Yojana (SGSY) for rural poverty, Swarna Jayanti Shahari Rozgar Yojana (SJSRY) and the Scheme of Rehabilitation of Manual Scavengers (SRMS), beneficiaries of the Differential Rate of Interest (DRI) scheme Scheduled Castes and Scheduled Tribes; advances to Self-Help Groups and loans to distressed poor to prepay their debt to informal sector, against appropriate collateral or group security.

Loans granted under above sub-heads to persons from minority communities would also comprise of loans given to weaker sections. As on the last reporting Friday of March 2010 (provisional), the amount of outstanding advances extended by public sector banks to the weaker sections under the priority sector amounted to Rs 2,12,214.83 crore and accounted for 10.2 per cent of their net bank credit.

Credit Flow to Agriculture

Banks were initially given a target of extending 15 per cent of the total advances as direct finance to the agriculture sector to be achieved by March 1985. This target was subsequently raised to 18 per cent, to be achieved by March 1990. In terms of the guidelines issued by the Reserve Bank of India in October 1993, both direct and indirect advances for agriculture are taken together for assessing the target of 18 per cent, with the condition that for the purpose of computing their performance in lending to agriculture, lending under the "indirect" category in excess of 4.5 percent of net bank credit would not be rackoned in computing performance under the sub-target of 18 percent, so as to ensure that the focus of banks on direct lending to agriculture is not diluted. However, all agricultural advances under the categories 'Direct' and Indirect' will be reckoned in computing performance under the overall priority sector target of 40 percent of the net bank credit.

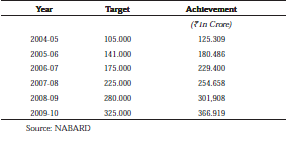

The Union Finance Minister announced certain measures on 18 June 2004, which, inter-alia, included a target for doubling of flow of credit to agriculture and allied activities within a period of three years commencing from 2004-05, over the amount disbursed during the year 2003-04. This goal was achieved in two years.

Table ends

People belonging to the Scheduled Castes and Scheduled Tribes have been recognised as the most vulnerable sections. Banks have been asked to make special efforts to assist them with adequate credit to enable them to undertake selfemployment ventures for acquiring income generating capital assets so as to improve their standard of living. At the end of March 2010, the total outstanding loan extended to scheduled castes/ scheduled tribes by public sector banks under priority sector lending was Rs 50,720.00 crore in 86.75 lakh borrowal accounts.

Differential Rate of Interest Scheme (DRI)

Under the DRI Scheme, introduced in 1972, Public Sector Banks are required to fulfil the target of lending of at least one per cent of the advances as at the end of the previous year to the weakest of the weaker sections of the society at an interest rate of four per cent per annum. The scheme covers poor borrowers having a family income of not more than Rs18,000 in rural areas and Rs 24,000 in urban and semiurban areas and not having more than 2.5 acres of un-irrigated or one acre of irrigated land. They are given credit support of Rs 15,000 as term loan and working capital loan for productive ventures.

In addition to the term loan SC/ST beneficiaries satisfying the income and land holding criteria under the Scheme can also avail of housing loan upto Rs 20,000/- per beneficiary. The public sector banks have an outstanding of DRI credit amounting to Rs 752.07 crore as at the end of March 2010. Swarnjayanti Gram Swarojgar Yojana (SGSY)

The Union Ministry of Rural Development launched a restructured poverty alleviation programme, Swarnjayanti Gram Swarozgar Yojana (SGSY) with effect from 1 April 1999, which replaced IRDP and its allied schemes, viz., Training of Rural Youth for self Employment (TRYSEM), Development of Women and Children in Rural Areas (DWCRA), Supply of improved Tool kits to Rural Artisans (SITRA), Ganga Kalyan Yojana (GKY) and Million Wells Scheme (MWS).

The scheme aims at establishing a large number of micro enterprises in the rural areas of the country. The objective of the scheme is to bring every assisted BPL family, above the poverty line in three years by providing them income generating assets through a mix of bank credit and government subsidy.

SGSY is a holistic poverty alleviation scheme covering all aspects of self employment such as organisation of poor into self help groups, training, credit, technology, infrastructure and marketing. The scheme is funded on 75:25 basis by central and the respective State Governments and is implemented by DRDAs through Panchayat Samitis. Major share of assistance is for 4-5 key activities identified at the block level.

Financial year 2008-09 was the tenth year of implementation of the scheme.

Total number of 13,72,238 swarozgaris have received bank credit amounting to Rs 1,282.75 crore and Government Subsidy amounting to Rs 416.69 crore under SGSY as at the end of March 2009. Of the Swarozgaris assisted, 4,36,541 (31.80 per cent) belonged to Scheduled Castes and Scheduled Tribes (SC/ST), while 6,47,228 (47.16 per cent) were women and 9,881 (0.72 per cent) were physically handicapped.

Swarna Jayanti Shahari Rozgar Yojana (SJSRY)

The SJSRY Scheme is in operation since 1.12.1997 in all urban and semi-urban towns of India. The programme is applicable to all the cities and towns on a whole town basis. The target population under SJSRY is the urban poor, those living below the poverty lines as defined by the Planning Commission from time to time. Under the scheme, women are to be assisted to the extent of not less than 30 per cent. Differentlyabled at 3 per cent and SC/STs at least to the extent of the proportion of their strength in the local population. The scheme is funded on a 75:25 basis by the Central and the respective State Government.

The scheme has five components as under:

(i) Urban Self Employment Programme (USEP)

(ii) Urban Women Self-help Programme (UWSP)

(iii) Skill Training for Employment promotion amongst Urban Poor (STEP-UP)

(iv) Urban Wage Employment Programme (UWEP)

(v) Urban Community Development Network (UCDN).

During the year 2008-09, (up to March 2009), disbursements amounting to Rs 282.25 crore were made in 73,837 cases (out of 1,33,668 applications received). Of the above, Rs 72.29 crore was disbursed to 20,399 SC/STs, Rs 63.70 crore were disbursed to 16,676 women and Rs 3.29 crore were disbursed to 792 disabled persons.

Self Help Groups (SHGs)

The SHG-Bank Linkage Programme was started in the year 1992 as a flagship programme by NABARD and ably supported by RBI through policy support. The programme envisages organization of the rural poor into Self-Help Groups (SHGs) building their capacities to manage their own finances and then negotiating bank credit on commercial terms. The poor are encouraged to voluntarily come together to save small thrift regularly and extend micro-loans among themselves. Once the group attains required maturity of handing larger resources, the bank credit follows. After phases of (i) pilot testing during 1992 to 1995 (ii) mainstreaming during 1996 to 1998 and (iii) expansion from 1998 onwards, the SHG-Bank Linkage programme has now assumed the shape of a movement in the country. The programme has been well supported by a large number of NGOs and several Government organisations. The phenomenal outreach of the programme has enabled an estimated 86 million poor households to gain access to microfinance.

PROGRESS IN 2008-09

Small Industries Development Bank of India (SIDBI)

The Small Industries Development Bank of India (SIDBI) was established as the principal financial institution for promotion, financing and development of industries in the small scale sector. SIDBI started its operations from April 02, 1990 and is engaged in providing assistance to Micro, Small and Medium Enterprises (MSMEs) in the country. directly and through other institutions like State Financial Corporations, Commercial Banks, State Industrial Development Corporations, etc. The financial assistance sanctioned and disbursed by SIDBI during FY 2009-10 aggregated to Rs 421 crore during FY 2009-10.

Table

Progress under Microfinance -Savings of SHGs with Banks (Amount in Rs Lakh)

Name of the Agency Total Savings of SHGs in the Out of Total - Under SGSY Out of Total - Exclusive

No. of SHGs Amount of No. of SHGs Amount of No. of SHGs Amount of

Savings Savings Savings

Commercial Banks 3549509 277298.94 931422 68160.25 2843932 216003.51

Regional Rural Banks 1628588 198975.08 433912 77454.74 1336219 177115.36

Cooperative Banks 943050 78287.80 140247 10723.52 683770 50284.15

Total 6121147 554561.82 1505581 156338.51 4863921 443403.02

Progress under Microfinance -Bank Loans disbursed to SHGs

(Amount in Rs Lakh)

Name of the Agency SHGs Loans disbursed by Out of Total - Under SGSY Out of Total - Exclusive

No. of SHGs Amount of No. of SHGs Amount of No. of SHGs Amount of

Loan Loan Loan

Commercial Banks 1004587 806053.10 133117 110237.87 862527 696517.77

Regional Rural Banks 405569 319349.01 81662 65527.74 355184 283439.65

Cooperative Banks 199430 99949.28 49874 25756.83 156868 72780.16

Total 1609586 1225351.39 264653 201552.44 1374579 1052737.58

Progress under Microfinance -Bank Loans Outstanding against SHGs

(Amount in Rs Lakh)

Name of the Agency Total Loans of Outstanding Out of Total - Under SGSY Out of Total - Exclusive

No. of SHGs Amount of No. of SHGs Amount of No. of SHGs Amount of

O/S Loans U/S Loans O/S Loans

Commercial Banks 2831374 1614942.90 6451.45 396153.06 2245564 1350912.69

Regional Rural Banks 977834 522441.61 258890 150810.18 724179 414723.74

Cooperative Banks 415130 130599.84 72852 39209.31 307619 92717.14

Total 4224338 2267984.25 976887 586172.55 3277362 1858353.57

Table ends

HOUSING FINANCE

National Housing Bank (NHB)

The National Housing Bank (NHB), the apex institution of housing finance in India, was set up as wholly owned subsidiary of the Reserve Bank of India. The NHB started its operations from July, 1988. The authorized paid-up capital of NHB stood at Rs 450 crore and the reserves were Rs 1972 crore as on June 30, 2009. The Bank had made a profit of Rs 236 crores in the year 2008-09 (July-June). The total loan sanctions were Rs 15737.30 crores and the disbursements were Rs 10899 crores. A special liquidity package of Rs 4000 crores was provided to HFCs for financing housing loans to the customers. A fund know as Rural Housing Fund has been established in NHB. The contribution to the fund for the year amounting to Rs 1760 crores was made by the Banks which fell short of their priority sector lending obligations.

Total refinance extended by NHB to all housing institutions including HFCs, commercial banks and co-operative sector institutions stood at Rs 16208 crore as on 20 June 2009. NHB minitors the performance of the Golden Jubilee Rural Housing Finance Scheme being implemented through Scheduled Commercial Banks, HFCs and co-operative sector institutions. Against a target of 3.50 lakh dwelling units set by Government of India for the year 2009-10, 3,87,546 units were financed during the period. In addition to that, National Housing Bank has introduced a Reverse Mortgage product for senior citizens, under which a senior citizen, who is the owner of a house can avail a monthly stream of increase against the mortgage of his/her house, while remaining the owner and occupying the house throughout his/her lifetime, without repayment or servicing of the loan.

Export-Import Bank of India (EXIM Bank)

Export-Import Bank of India (EXIM Bank) was established for financing, facilitating and promoting foreign trade in India. During the year 2009-10, EXIM Bank received share capital of Rs 300 crore from Government of India. As on 31 March 2010 EXIM Bank's paid up capital was Rs 1700 crore. During the year ended 31 March 2010, EXIM Bank sanctioned loans of Rs 38,843 crore while disbursements amounted to Rs 33,249 crore. Profit after tax of the EXIM Bank for the year 2009-10 amounted to Rs 513 crore. The broad range of products includes deferred credit arrangements for exporters, equity and loan support for overseas investments and finance for technology imports, and RandD Expenditure.

India Infrastructure Finance Company Ltd. (IIFCL)

IIFCL, a wholly owned Government of India company, was set up on 5 January 2006 and commenced operations from April, 2006. The company provides long term debt to commercially viable infrastructure projects as per the Scheme for Financing Viable Infrastructure Projects through IIFCL (SIFTI). The authorized capital of the company is Rs. 2000 crore and the paid-up capital as on 31.3.2010 was Rs 1800 crore. Since commencement of operations in April, 2006 till March, 2010 the Company has sanctioned Rs 24,378 crore in 139 projects in sectors like Roads, Power, Airport, ports and urban infrastructure.

National Bank for Agriculture and Rural Development (NABARD)

National Bank for Agriculture and Rural Development (NABARD) came into existence on 12 July, 1982. NABARD was established for providing credit for promotion of agriculture, small-scale industries, cottage and village industries, handicrafts and other allied economic activities in rural areas with a view to promoting integrated rural development and securing prosperity of rural areas.

The paid-up capital of NABARD stood at Rs 2000 crore as on 31 March 2010. The profit after tax amounted to Rs 1558 crore during the year 2009-10 as against Rs 1390 crore during the year 2008-09.

Since 1995-96, NABARD has been providing finance to the State Governments for rural infrastructure projects under Rural Infrastructure Development Fund (RIDF). Total sanctions by NABARD under RIDF (RIDF-I to RIDF-XV), as on 31 March 2010, aggregate to Rs 1,03,718.00 crore while the comulative disbursements stand at Rs 68,439.74 crore. This fund is meeting the financing needs of the State Governments for 31 approved activities, important among which include projects covering irrigation, rural roads and bridges, health and education, soil conservation, drinking water schemes, etc.

In 2006-07, a separate window of Bharat Nirman for construction of Rural Roads under PMGSY was started. Total sanctions by NABARD to National Rural Road Development Agency (NRRDA) under RIDF as on 31 March 2010, aggregate to Rs 18,500 crore and the entire amount has been released to NRRDA.

Regional Rural Banks (RRBs)

Regional Rural Banks (RRBs) were set up to take banking services to the doorsteps of rural masses especially in remote rural areas with no access to banking services. These banks were originally intended to provide institutional credit to the weaker sections of the society called ‘target groups’. The (RRBs) were conceived as institutions that combine the local feel and familiarity with rural problems, which the co-operatives possess, and the degree of business organisation as well as the ability to mobilise deposits, which the commercial banks possess. The RRBs were also intended to mobilise and channelise rural savings for supporting productive activities in the rural areas.

However, with effect from April 1997, the concept of priority sector lending was made applicable to RRBs. The interest rates on term deposits offered and interest rates on loans charged by RRBs have also been freed. RRBs which comply with certain prescribed conditions are also permitted to open and maintain non-resident accounts in rupees. With a view to consolidating and strengthening RRBs, the Government of India initiated, in September 2005, the process of amalgamation of RRBs, in a phased manner.

Accordingly as on 31st March, 2010 the total number of RRBs stood at 82 (46 amalgamated and 36 standalone) including one new RRB viz. Puduval Bhathiar Grama Bank established in Puducherry on 26th March, 2008. Further, as part of the financial strengthening of RRBs, recapitalization of 27 RRBs having negative networth as on 31st March, 2007 was initiated in 2007-08. As on 31st March, 2010, these 27 RRBs have been recapitalized with total funding support of Rs 1795.97 crore by Government of India, State Governments and sponsor banks.

The credit outstanding of all the 196 RRBs stood at Rs 60,159.74 crore as at the end of March 2009 and deposit of Rs 105568.13 crore had been mobilized by the RRBs by that date.