Insurance, life and general: India

This article has been sourced from an authoritative, official readers who wish to update or add further details can do so on a ‘Part II’ of this article. |

The source of this article

INDIA 2012

A REFERENCE ANNUAL

Compiled by

RESEARCH, REFERENCE AND TRAINING DIVISION

PUBLICATIONS DIVISION

MINISTRY OF INFORMATION AND BROADCASTING

GOVERNMENT OF INDIA

Insurance

Since opening up, the number of participants in the industry has gone up from six insurers (including Life Insurance Corporation of India, four public sector general insurers and General Insurance Corporation of India as the National Reinsurer) in the year 2000 to 47 insurers as on March 2010 operating in the life, non-life and reinsurance segments (including specialized insurers, viz., Export Credit Guarantee Corporation and Agriculture Insurance Company of India Ltd. AICIL). Three of the general insurance companies, viz., Star Health and Alliance Insurance Company; Apollo Munich Health Insurance Company; and Max BUPA Health Insurance Co. Ltd. function as standalone health insurance companies.

Of the 22 life insurance companies which have set up operations in the life segment post opening up of the sector, 20 are in joint venture with foreign partners. Of the 17 who have commenced operations in the non-life segment, 16 had been set up in collaboration with foreign partners. Thus, 36 companies in the private sector are operating in the country in collaboration with established foreign insurance companies from across the globe as on 31st March, 2010.

Life Insurance Corporation of India (LIC)

The Life Insurance Corporation with its Central Office in Mumbai, 8 Zonal Offices at Mumbai, Kolkata, Delhi, Chennai, Hyderabad, Kanpur, Bhopal and Patna, 109 Divisional Offices including one Salary Savings Schemes (SSS) Division at Mumbai, 2048 Branch Offices and 1004 Satellite Offices as on 31 March 2010, spreads the message of Insurance through the length and breadth of India, with the help of 14,02,807 agents.

LIC also transacts business abroad. International Operations were set up with an endeavor to establish global presence and also to acquire the best practices being followed internationally so that LIC may become a world class organization. LIC's endeavour is to further consolidate their Brand Image across the world. At present LIC is operating internationally through Branch Offices in Fiji, Mauritius and UK and through Joint Venture Companies in Bahrain Nepal, Sri Lanka, Kenya and Saudi Arabia. Its Representative Office in Singapore was opened on 06.11.2008. LIC is now in the process of establishing a Wholly-Owned Subsidiary (WOS) there.

In 2009-10, all foreign units put together procured new business of 82,794 policies with First Premium income of Rs 207.92 crores, registering a growth of 31.75 per cent (NOP) and 23.81 per cent (FPI). The total Premium Income of all units in 2009-10 was Rs 736.61 crores.

During the financial year 2009-10, the total First Year Premium under Individual Assurances was approximately Rs 50,527.31 crores under 368.38 lakh policies. The Group Insurance brought a new business premium of approximately Rs 20,542.11 crore under 18,573 schemes covering 2,37,57,262 lives.

The Life Fund, as on 31.3.2010, amounts to approximately Rs 9.98,501 crores. The Corporation made payments of around Rs 7,031.62 crores under Death Claim cases, around Rs 46,917.93 crores under Maturity Claims and around Rs 3,770.41 crores under annuities.

(i) JANASHREE BIMA YOJANA

The Janashree Bima Yojana (JBY) was launched in 10 August 2000. The Scheme has replaced Social Security Group Insurance Scheme (SSGIS) and Rural Group Life Insurance Scheme (RGLIS). 45 occupational groups have been covered under this schme.

The Scheme provides for an insurance cover of Rs 30,000 on natural death. On death/total permanent disability due to accident, the benefit is Rs 75,000/-. On partial permanent disability due to accident, the benefit is Rs 37,500/-. The premium for the scheme is Rs 200/- per member per annum, 50 per cent of which is met out of Social Security Fund. The balance premium is to be borne by the member and/or Nodal Agency. As on 31 March 2010, about 184.43 lakh have been covered. The balance in Social Security Fund as on 31 March 2010 is Rs 618.83 crore. (Provisional)

(ii) SHIKSHA SAHAYOG YOJANA

The Scheme was launched on 31 December 2001, with the object to lessen the burden of parents in meeting the educational expenses of their children. It provides scholarships to students of parents living below or marginally above poverty line and who are covered under Janashree Bima Yojana and children are studying in 9th to 12th standard (including ITRI courses).

A scholarship amount of Rs 600/- per half year per child is paid for a maximum period of four years and for maximum two children of a member covered under Janashree Bima Yojana.

No premium is charged for this benefit. During the financial year 2006-2010 scholarship were disbursed to 9,13,281 beneficiaries amounting to Rs 67.58 crores.

(iii) AAM ADMI BIMA YOJANA

AAM ADMI BIMA YOJNA, a new Social Security Scheme for rural landless households was launched on 2nd October, 2007 by the then Union Finance Minister at Shimla. The head of the family or one earning member in the family of rural landless household is covered under the Scheme.

The premium of Rs 200/- per person per annum is shared equally by the Central Government and the State Government. Head of the family or one earning member of the family aged between 18 and 59 years is covered for an amount of Rs 30,000/- under the Scheme. In case of death or total disability (including loss of 2 eyes/2 limbs) due to accident, a sum of Rs 75,000/- and in case of partial permanent disability (loss 1 eye/1 limb) due to accident, a sum of Rs 37,500/- is payable to the nominee/ beneficiary. As on 31 March 2010, 1,30,45,666 heads of the families of rural landless households were covered under the Scheme.

A free add-on benefit for the children of the members of AAM ADMI BIMA YOJANA is provided under the Scheme in the form of a scholarship at the rate of Rs 100/- per month and is given to maximum two children studying between IX to XII Standard payable half yearly on 1st July and 1st January each year. During the financial year 2009-2010, scholarship were disbursed to 86,906 children amounting to Rs 54.48 Crores.

General Insurance Corporation of India (GIC Re)

The General Insurance Corporation of India (GIC Re) was approved as the ‘‘Indian Reinsurer’’ on 3rd November 2000. As an ‘‘Indian Reinsurer’’ GIC Re has been giving reinsurance support to non-life Insurance companies in India. It continues its role as a reinsurance facilitator by managing Marine Hull Pool, Terrorism Pool and Indian Motor Third Party Insurance Pool on behalf of Indian Insurance industry. The Reinsurance programme of GIC Re aims at optimizing the retention within the country and developing adequate reinsurance capacity.

The Corporation continued to offer maximum support for all classes of business to the Indian insurers. Property and Engineering Risks are covered up to Rs 1500 crore. Whenever there is a requirement to cover a Large Risk beyond Rs 1500 crore, specific Excess of Loss cover is arranged beyond the said limit. The per location capacity of the Terrorism Pool managed by GIC Re has increased to Rs 750 crore with effect from 1.4.2008 from the earlier limit of Rs 600 crore.

Since 1.4.2007, the GIC Re administers the market initiative in respect of Commercial Vehicle Market Third Party Liability policies as a multi-lateral reinsurance arrangement among the participating non-life insurance companies in India. The GIC Re continues to lead the reinsurance programme of the companies in Kenya, Malaysia, Mauritius, Middle-East, Africa and Sri Lanka. In the process, it has emerged as a preferred Reinsurer in the Afro-Asian region. GIC Re is expanding its global presence and now plans to enter the Latin American market having got the 'Eventual Reinsurer' status in Brazil. GIC Re has been selected as the Manager for Nat Cat Pool promoted by the Federation of Afro-Asian Insurers and Reinsurers (FAIR).

During the year 2009-10, the net premium income of the Corporation was Rs 8776.87 crore as against Rs 7402.33 crore in the previous year. The net incurred claims were at Rs 6,856.39 crore, i.e., 84.9 per cent as against Rs 6217.14 crore in the previous year, i.e., 79.6 per cent. Profit after tax was Rs 1774.60 crore as on 31st March 2010 compared to Rs 1407.20 crore as on 31st March 2009. The total assets and networth as on 31st March 2010 was Rs 43842.13 crore and Rs 9133.26 crore, respectively.

The Corporation has its presence in foreign reinsurance business through its Branch offices in Dubai and Londan and a Representative Office in Moscow. A branch office is also being opened shortly in Kuala Lumpur, Malaysia. Apart from reinsurance business, GIC Re continues to participate in the share capital of Kenindia Assurance Company Ltd. Kenya; India International Insurance Pvt Ltd. Singapore; LIC (Mauritius) Offshore Ltd, Mauritius; Asian Reinsurance Corporation. Thailand; East Africa Reinsurance Company Ltd.; Kenya; and Agriculture Insurance Company of India Limited.

Public Sector General Insurers' Companies (GIPSA)

After opening up of the insurance sector and de-linking from GIC in 2000, the four General Insurance Companies, namely, National Insurance Company Ltd., New India Assurance Company Ltd., Oriental Insurance Company Ltd., and United India Insurance Company Ltd., are functioning independently. The four Public Sector General Insurance Companies have a network of 101 Regional Offices, 1395 Divisional Offices, 2880 Branch Offices in India and 55 Overseas Offices.

The gross premium income of the four Public Sector General Insurance Companies during 2008-09 was Rs 19,107 crore as against Rs 17,813 crore during 2007- 08. Profit after Tax for 2008-09 was Rs 508.85 crore as against Rs 2205 crore in 2007-08. The companies have paid a total dividend of Rs141 crore in 2008-09 to the government as against Rs 449 crores in 2007-08.

Universal Health Insurance Scheme (UHIS)

The four Public Sector General Insurance Companies have been implementing UHIS for improving health care access to poor families from the year 2003-04 onwards; The Scheme, applicable to BPL families, provides for reimbursement of medical expenses up to Rs 30,000 towards hospitalisation floated amongst the entire family; death cover due to accident for Rs 25,000/- to the earning head of the family and compensation due to loss of earning of the earning member or spouse @ Rs 50/- per cent per day upto a maximum of 15 days of hospitalization. The coverage also includes pre-existing diseases. Maternity benefits up to Rs 2,500/- for normal delivery are reimbursed and expenses for the new born are also covered. The entry into the Scheme is available for persons upto the age of 70 years.

The subsidy amounting to Rs 200/- for an individual, Rs 300/- for a family of five and Rs 400/- for a family of seven members is provided by the Central Government. The premium rest of subsidy Rs 100/- for individuals, Rs 150/- for a family of five and Rs 200/- only for a family of seven members.

Agriculture Insurance Company of India Ltd (AIC)

A separate organization for agriculture insurance viz. Agriculture Insurance Company of India Ltd. (AIC) was incorporated under the Companies Act, 1956 on 20 December, 2002 with the capital participation from General Insurance Corporation of India (GIC), four public sector general insurance companies viz., (i) National Insurance Company Ltd., (ii) New India Assurance Company Ltd., (iii) Oriental Insurance Company Ltd., and (iv) United India Insurance Company Ltd. and NABARD. The promoter’s subscription to the paid-up capital is 35 per cent by GIC, 30 per cent by NABARD and 8.75 per cent each by the four public sector general insurance companies.

The authorised capital of the AIC is Rs 1,600 crore, while the initial paid-up capital is Rs 200 crore. The company had commenced business from 1 April 2003. While AICIL underwrote crop insurance to begin with, it has covered other allied rural/agricultural risks also. National Agriculture Insurance Scheme (NAIS) which was being implemented by the General Insurance Corporation of India (GIC) was transferred to the AICIL, in addition to NAIS. AICIL is also implementing Weather Based Crop Insurance Scheme (WBCIS).

Appreciating the importance of agriciulture insurance the Government of India while approving the National Policy for Farmers 2007, has taken into account the recommendations of National Commission on Farmers for inclusion of crop insurance as a part of a comprehensive approach towards development and sustenance of the farm sector.

National Agricultural Insurance Scheme (NAIS)

NAIS was implemented from Rabi 1999-2000 season replacing Comprehensive Crop Insurance Scheme (CCIS). The Scheme is being implemented by the Agriculture Insurance Company of India Ltd. on behalf of Ministry of Agriculture. The main objective of the Scheme is to protect the farmers against the losses suffered by them due to crop failure on account of natural calamities, such as drought, food, hailstorm, cyclone, fire, pest/diseases, etc, so as to restore their credit worthiness for the ensuring seasons.

The Scheme is available to all the farmers both, loanee and non loanee irrespective of the size of their holding. The Scheme envisages coverage of all crops including cereals, millets, pulses, oilseeds and annual commercial and horticulture crops in respect of which past yield data of 10 years, is available.

At present, 70 different Food and Oilseed crops are covered during Kharif and Rabi seasons. Sugarcane, Potato, Ginger, Onion, Turmeric, Chilly, Jute, Tapioca, Banana, Pineapple, Brinjal, Coriander, Cumin, Fennel, French Bean, Garlic, Isabgol, Fenugreek and Tomato have been brought under insurance coverage among the annual commercial/horticultural crops.

As per the provisions of National Agriculture Insurance Scheme, the flat premium rates are 3.5 per cent for Bajra and Oilseeds, 2.5 per cent for other Kharif crops; 1.5 per cent for Wheat, and 2 per cent for other Rabi crops. In case actuarial rates are less than prescribed flat premium rates, the lower rate is applicable for food crops and oilseeds.

In case of annual commercial and horticulture crops, actuarial rates are charged. At present, 10 per cent subsidy in premium is allowed for small and marginal farmers, shared equally by Central and State government.

However, some State and Union Territory governments are also providing higher subsidy to small and marginal farmers and subsidy to other farmers. The Scheme operates on the basis of 'Area Approach' for widespread calamities. The unit of insurance may be Gram Panchayat, Mandal, Hobli, Circle, Phirka, Block, Taluka etc., to be decided by the respective State/UT Government.

At present, 25 States and 2 Union Territories are implementing the Scheme. Some of the states have notified lower unit of insurance such as village. Till kharif 2009 season, 15.23 crore farmers were covered with area insurance of 23.63 crore hectares, sum insured of Rs 174910 crore, compensating 4.28 crore farmers with claim amount of Rs 18725.27 crore since the inception of the scheme.

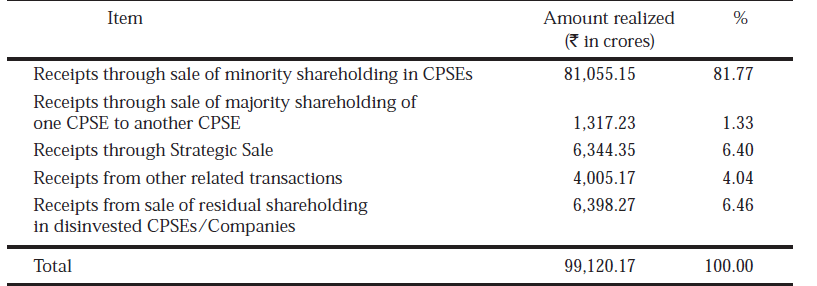

Disinvestment

The disinvestment of Government equity in Central Public Sector Enterprises (CPSEs) began in 1991-1992. Since then, it has emerged as a common ground across the polity and as an integral part of Public Finances in India's economic growth story. The year-wise resources mobilized through disinvestment are given in the Table. From 1999-2000 till 2003-04, the emphasis of disinvestment changed in favour of Strategic Sale viz., sale of large block of shares along with transfer of management control to a Strategic Partner identified through a process of competitive bidding. After 2004-2005, disinvestment realizations have been through sale of small portions of equity. The total proceeds from disinvestment between 1991-1992 and 31st March, 2011 amounted to Rs. 99,120.17 crore, consisting of the following:

Item Amount realized %

(Rs. in crores)

Receipts through sale of minority shareholding in CPSEs 81,055.15 81.77

Receipts through sale of majority shareholding of one CPSE to another CPSE 1,317.23 1.33

Receipts through Strategic Sale 6,344.35 6.40

Receipts from other related transactions 4,005.17 4.04

Receipts from sale of residual shareholding in disinvested CPSEs/Companies 6,398.27 6.46

Total 99,120.17 100.00

Policy Framework

I. One of the main objectives of the disinvestment policy is to develop people's ownership of Central Public Sector Enterprises so as to let them directly share in the wealth and prosperity accruing to the country's economy through the combined enterprise of the business ventures in the Public Sector. The policy inter alia ensures that Government equity does not fall below 51% and Government retains management control.

II. The Government, on 5th November 2009 approved an action plan for disinvesting Government equity in profit making CPSEs.

III. Approach for disinvestment

(i) Already listed profitable Central Public Sector Enterprises (CPSEs) not meeting the mandatory public shareholding of 10% are to be made compliant by public offering out of Government shareholding or issues of fresh equity by the CPSEs concerned or a combination of both;

(ii) All unlisted CPSUs having positive net worth, no accumulated losses and having earned net profit for three preceding consecutive years, are to be listed through public offerings out of Government shareholding or issue of fresh equity by the company or a combination of both; and

(iii) Further public offerings by listed CPSEs taking into consideration their capital investment requirements with GoI simultaneously or independenty offering a portion of its shareholding in such CPSEs;

(iv) All cases of disinvestment are to be decided on a case by case basis as each CPSE has different equity structure, financial strength, fund requirement, sector of operation, etc., factors that will not permit a uniform pattern;

(v) Government retains at lease 51 per cent equity and management control in all cases of disinvestment through public offerings.

Constitution of National Investment Fund

The Government has constituted a "National Investment Fund" (NIF) in 2005-06, into which the proceeds from disinvestment of Government equity in CPSEs would flow in. NIF is maintained outside the Consolidated Fund of India and is professionally manged to provide sustainable returns without depleting the corpus. Of the annual income of the Fund, 75% is envisaged to be used to finance selected social sector schemes, which promote education, health and employment.

The residual 25% of the annual income of the Fund is envisaged to be used to meet the capital investment requirements of profitable and revivable CPSEs that yield adequate returns, in order to enlarge their capital base to finance expansion/ diversification. The corpus of the Fund as on 31st March, 2010 is Rs. 1814.45 crore. In view of difficult economic situation, the disinvestment proceeds channelised into NIF from April 2009 to March 2012 (three years) would be used in full to support specific social sector schemes identified by Planning Commission/Department of Expenditure. Status quo ante of NIF will thus get restored after three years, i.e., after April 2012.

Use of Disinvestment Proceeds

From April 2009, the disinvestment proceeds are being used for funding the capital expenditure under the social sector schemes of the Government, namely:-

(i) Mahatma Gandhi National Rural Employment Guarantee Scheme;

(ii) Indira Awas Yojana;

(iii) Rajiv Gandhi Gramin Vidyutikaran Yojana;

(iv) Jawaharlal Nehru National Urban Renewal Mission;

(v) Accelerated Irrigation Benefits Programme;

(vi) Accelerated Power Development Reform Programme.

During 2004-05, Government realized t 2,684.07 crore from the sale of 43.29 crore equity share of t 10 each of National Thermal Power Corporation Ltd., t 64.81 crore from the sale of shares to employees of IPCL and t15.99 crore as balance amount of realization from the Offer for Sale in ONGC.

During the year 2005-06, the Government realized a sum of t1,567.60 crore from the sale of 8 per cent of equity, out of its shareholding of 18.28 per cent, in Maruti Udog Limited (MUL), to public sector financial institutions and banks. The average realization was t 678.24 per share. Further, t 2.08 crore were received by the Government, from the sale of 31,507 equity shares in MUL to officers/employees of MUL at a price of t 660 per share.

During the year 2007-08, the Government realized a sum of t4,181.39 crore from the sale of 10.27 per cent equity of Maruti Udyog Limited (MUL); and 10% paid up equity each of Power Grid Corporation of India Ltd. and Rural Electrification Corporation India Ltd.

During the year 2009-10, the Government realized an amount of t23,552.93 crore from sale of 5 per cent equity in NHPC Ltd., 10 percent in Oil India Ltd., 5 per cent in NTPC Ltd., 5 per cent in REC Ltd. and 8.38 per cent in NMDC Ltd. During the year 2010-11, the Government realized an amount of t22,144.21 crore from sale of 10.03 per cent in SJVN Ltd., 10 per cent equity each in Engineers India Ltd., Coal India Ltd., Power Grid Corporation of India Ltd., MOIL Ltd., and Shipping Corporation of India Ltd.

Weather Based Crop Insurance Scheme (WBCIS)

From the season Kharif 2007-08, AIC has started implementing WBCis as a pilot risk mitigation scheme as an alternative to NAIS. WBCIS is a parametric insurance product designed to provide insurance protection to the cultivator against adverse weather incidence during the cultivation period, such as deficit and excess rainfall, frost, heat (temperature), relative humidity, wind speed etc. which are deemed to adversely impact the crop yield.

Crops and Reference Unit Areas (RUA) are notified before the commencement of the season by the State Governments. Each RUA is linked to a Reference Weather Station (RWS), on the basis of which payout/claims are processed. The payouts are made on the basis to adverse variations in the current season's weather parameters as measured at Reference Weather Station (RWS). Claim under WBCIS is area-based and automatic. Insured cultivators are not needed to intimate losses or lodge claims to the insurers.

During Kharif 2007 season, the scheme was implemented in Karnataka covering 70 Hoblis. During Rabi 2007-08 season, the Scheme was implemented in the State of Rajasthan, Chattisgarh, Madhya Pradesh and Bihar.

During the Kharif 2008 season, the Scheme was implemented in 10 States, namely, Madhya Pradesh, Haryana, Punjab, Bihar, Rajasthan, Jharkhand, Maharashtra, Karnataka, Orissa and Tamilnadu. During Rabi 2008-09 season, the Scheme was again implemented in 10 States, namely, Haryana, Bihar, Rajasthan, Jharkhand, Karnataka, Tamil Nadu, Kerala, West Bengal, Chhattisgarh and Himachal Pradesh.

During Kharif 2009 season, the Scheme was implemented in 13 States, namely, Madhya Pradesh, Haryana, Bihar, Rajasthan, Jharkhand, Maharashtra, Karnataka, Orissa, Tamilnadu, Gujarat, West Bengal, Andhra Pradesh and Kerala.

During the Rabi 2009-10 season, the Scheme was again implemented in 11 States, namely, Haryana, Bihar, Madhya Pradesh, Rajasthan, Jharkhand, Karnataka, Tamilnadu, Kerala, West Bengal, Andhra Pradesh and Himachal Pradesh. The coverage so far under WBCIS is shown in the table below:

Table ends

Besides the above, AIC has designed and implemented various crop insurance products to cater to the diverse needs of farming community of India such as Apple Insurance, Cardamon Insurance, Rubber Insurance, etc.