Ramaprasad Goenka

This is a collection of articles archived for the excellence of their content. |

In brief

Nandini Vaish

December 19, 2008

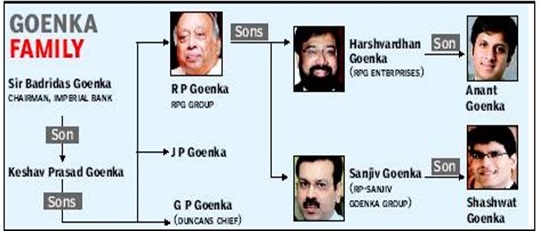

The RPG Group led by ‘takeover wizard’R.P. Goenka made a series of acquisitions, kicked off by the Duncan buy in 1959 to the offshore holdings of tyre-maker Dunlop India in 1980, Ceat Tyres in 1982, the Gramophone Co.of India (nowSaregama) in 1986, and Noida Power Company (NPCL) in 1992 among many others.The latest in the list was Canara Electric Controls in 2002.“I gamble only in companies,”Goenka told India Today in August 1984. Starting in the 1950s, the group patriarch and R.P.Goenka’s father, K.P.Goenka, along with his three sons, made over 30 acquisitions in 25 years.

A profile

From the archives of The Times of India

April 15, 2013

Ramaprasad Goenka, the doyen of Bengal industry, passed away at 6 am on Sunday at his Belvedere residence after a protracted illness. He was 83 and is survived by his wife Sushila, sons Harsh Vardhan and Sanjiv and foster-daughter Yashodhara. Almost a decade before the country ushered in economic reforms and liberalization, Ramaprasad Goenka expanded his empire through a series of big-ticket acquisitions. In 11 years, between 1981 and 1992, the original take-over tycoon of India Inc bought 10 business entities. RPG always believed that acquisition was the best way for fast growth. Goenka established RPG Enterprises in 1979 with four companies in his kitty and a combined turnover of only Rs 105 crore. These were Phillips Carbon Black Ltd (PCBL), Asian Cable, Agarpara Jute and Murphy India. Much before the merger-acquisition (M&A) market became a hot place in India, the visionary baron from Bengal embarked on a highly accelerated entrepreneurial adventure almost immediately after setting up RPG Enterprises. Under his guidance, the group has grown manifold and crossed Rs 15,000crore mark before it was split into two between sons — Harsh Vardhan and Sanjiv — in 2010. RPG's buying spree began with Ceat Tyres in 1981, one of the leading multinationals operating in India then. The acquisition of Ceat remained close to his heart even after 32 years. In an interview with TOI, his last to any media, Goenka said that Ceat was his biggest acquisition. He visited Turin 11 times to convince the Italian management that if they wanted to sell the company, he was their best choice. Finally, Goenka became successful and bought the company despite bids from other leading tyre manufacturers from India. In 1982, RP Goenka bought KEC International, an engineering and infrastructure company, followed by Searle India (now RPG Life Sciences) in 1983. RPG then joined hands with Jumbo Group in 1984 to acquire Dunlop India, from which he exited in 1986. In 1985, Goenka bought Gramophone Company of India (GCIL), which has the biggest repertoire of Indian music. GCIL, not doing too well at that time, made a turnaround under Goenka. Later on it was renamed Saregama India. In 1988, he acquired plantation major Harrisons Malayalam that had interests in tea, coffee, rubber and pineapple. The same year, he took over IT company Fujitsu ICIM, now known as Zensar Technologies. The next year saw two big acquisitions — Calcutta Electric Supply Corporation, retail player Spencer & Co. (now Spencer’s) — as well as Raychem that is engaged in manufacture of transmission products and accessories. In 1991, he decided to retire from active business and hand over the reins to his two sons. He became the chairman emeritus of the group while Harsh became chairman and Sanjiv the deputy chairman. RPG had one regret, though. In the interview late last year, RPG told TOI that his only regret was the exit of RPG Enterprises from the telecom sector in December 2003. The group had formed RPG Cellular, a JV with Vodafone and Cellphone UK, but sold it to Aircel despite doing very well. RPG had told TOI on the eve of his 82nd birthday that telecom and oil and gas were the biggest growth sectors and the decision to sell RPG Cellular was abad one. RPG continued to grow. In 1992, it acquired Noida power Co Ltd and in 1996, bought a carbon black unit in Gujarat that it merged with PCBL. Next year, the group acquired the Kochi-based Carbon & Chemicals and also merged the unit with PCBL. In 2009, the group took over Dhariwal Infrastructure Pvt Ltd that is engaged in power generation. The last acquisition was the takeover of Firstsource Solutions, a BPO, by RP-Sanjiv Goenka Group, the entity created by Sanjiv after the distribution of the group’s assets between the two brothers in 2010. Harsh Vardhan has retained the RPG Enterprises name for his group.