Farm loans and their 'waivers': India

This is a collection of articles archived for the excellence of their content. Readers will be able to edit existing articles and post new articles directly |

Contents |

RBI to study UPA-1’s farm loan sop success of 2008

New Delhi: The government has initiated a study to ascertain how effectively the farm loan waiver, announced by UPA-1 in 2008, was implemented and whether the ‘aam admi’ actually benefited from the Rs 70,000 crore scheme.

The Reserve Bank of India (RBI) has been asked to provide all related banking data to the government’s auditor, the Comptroller and Auditor General (CAG), which will scan the disbursements made by public sector banks across the country with sample field visits. The opposition parties had alleged that only large farmers and those with perennial credit default history had benefited from the waiver, while the marginal farmers were kept away from any credit facility. “We are examining how effectively the agricultural debt waiver scheme was implemented,” CAG Vinod Rai told reporters in Shimla.

“We do not audit banks as it is done by the RBI and chartered accountants. But we decided to do this audit. So, now, we will look into the books of the banks also,” he added.

The debt waiver scheme was announced in the Union budget 2008-09 and covered all agricultural loans disbursed by commercial banks, regional rural banks and cooperative credit institutions to farmers. According to finance ministry, at least 3.69 crore farmers benefited from the scheme till November 2009. The government has claimed that all eligible farmers were covered.

Andhra Pradesh topped the chart of 35 states and Union Territories (UTs) for having extended the maximum waiver of Rs 11,353 crore with about 77.55 lakh farmers benefiting from the scheme. Till December 2009, various public sector banks had written off Rs 65,318 crore across the country.

Among other states, UP was second in the list of largest disbursements, while Maharashtra came at the third position for having waived more than Rs 8,900 crore to 42 lakh farmers. For bringing more farmers under the credit facility, the government had increased farm credit from Rs 87,000 crore in 2003-04 to Rs 3.25 lakh crore in 2009-10 and also lowered the rate of interest on such loans.

Impact of waivers

Waivers will not help marginal farmers

Subodh Varma, Few Avail Of Bank Loans Due To Hassles Involved, April 11, 2017: The Times of India

“In this whole terai belt you will find very few small farmers who have got bank loans. There is too much headache, too many procedures and then, people take cuts.If we need money we have to go to the money lender,“ laments the elderly farmer. About 86 lakh small and marginal farmers will have their bank debts up to Rs.1 lakh waived, as per the UP government's claims. This is not a small number and has cheered up a large number of small farmers suffering from financial crunch brought on by droughts and dwindling incomes.

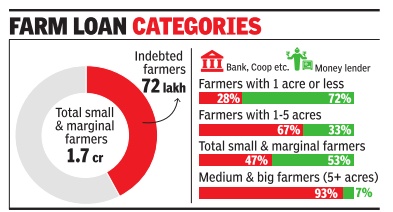

But NSSO data shows that less than half of the small and margi nal farmers in the vast state owe money to banks. Majority of such indebted farmers have taken loans from informal or non-institutional sources like local money lenders, traders, friends and relatives or bigger farmers.

The smaller the farmer in terms of land holding, the less likely that he or she will get a bank loan, the data shows. Among farmers with less than one acre of land, just 28% have outstanding bank loans with the remaining 72% owing money to non-formal creditors, mainly money lenders.Among farmers holding one to five acres, the share of those with bank loans rises to 67%.

So, while Yogi Aditya Nath will probably derive political mileage for fulfilling an election promise, on the ground this policy may not provide the much needed relief to the poorest sections of farmers.

Experience with previous debt waivers has been similar. The biggest such scheme was announced by the UPA in 2008, with Rs 52,520 cr waived off across the country . According to a study done by R Ramkumar of the Tata Institute of Social Sciences (TISS), in most of the states the benefits were cornered by farmers with bigger land holdings. In UP , there is a clear possibility that this is what will happen given the nature of loan disbursals.Another issue troubling farmers is that this is a one-off scheme. What happens afterwards?

“With rising costs, we don't get enough returns on the harvested produce. While this scheme will give some relief, the future is still murky ,“ says Sohan Lal, a farmer in Gonda, smirking at the prospect of Rs.45,000 loan getting waived.

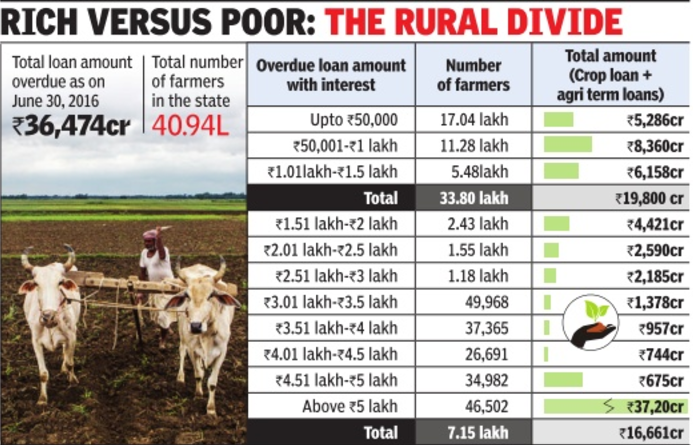

17% Maha farmers account for 46% of all loans due for waiver

7 Lakh Have Dues Of Over Rs 1.5L Each

The fear that rich farmers may corner a substantial portion of the largesse under the farm loan waiver scheme is not without basis.Statistics accessed by TOI from Maharashtra government's co-operation department shows that just 17% of all defaulting farmers account for 46% of total amount owed to banks in the rural sector. There are nearly 41 lakh farmers in the state who have bank debts that add up to an outstanding of Rs 36,474 crore as on June 30, 2016, the cut-off date set for the loan waiver. Of these, 7.15 lakh cultivators (17%) have loans that add up to Rs 16,669 crore. Each of them have an outstanding of more than Rs 1.5 lakh.

The rest have loans of less than Rs 1.5 lakh to repay . They are overwhelmingly in the ma jority (33.8 lakh) and are eligible for a full write-off. However, their cumulative debt at Rs 19,804 crore is just a shade over those who make up the 17% group.

Officials said a significant chunk of loans are from district central co-operative (DCC) banks and these are run by politicians. It is likely that bulk of loans which are being waived would have gone to those linked to their party or families. “We have come across cases where loans of more than Rs 5 lakh were given without even a piece of paper,“ said an official, underscoring the potential for misuse of the waiver scheme.

He also said that there are 13 DCC banks in the state that are financially weak and a large number of their defaulters are influential people. A crop loan of Rs 3 lakh can be availed of at 11% interest, of which a farmer has to pay only 4%, the rest being borne by the state and Centre. Hence, funds are often wrongly sourced as crop loans, said an official.