Company directors: India

This is a collection of articles archived for the excellence of their content. the Facebook community, Indpaedia.com. All information used will be acknowledged in your name. |

Contents |

Age

If above 70...

Incumbent directors above 70 need 75% shareholders' nod to stay: HC The Times of India, Feb 19 2016

Reeba Zachariah & Boby Kurian India Inc's septuage narian leaders have to clear another hurdle to continue in corporate boardrooms. The Bombay high court, in a recent order, has ruled that incumben directors who are 70 years old and above will face automatic disqualification if they are no elected by a special resolution and supported by three-fourths of the shareholders. The order, by justices V M Kanade and Shalini Phansal kar-Joshi, with regard to Srid har Sundarajan vs Ultramari ne & Pigments, stated that a person who was appointed MD before April 1, 2014, when he was below 70, can continue to be on the board after turning 70 only if the company passes a special resolution to that effect. The ruling has created a flutter in corporate boardrooms with companies examining its implications.

About 100 directors, aged 70 to 73, will now be forced to seek reappointment through a special resolution. Moreover, in an era of growing shareholder activism, it may not be easy to secure an approval for directors of companies where promoter holdings are low .

The court order follows the new Companies Act that prescribes that board members, including chairman and directors, who have attained 70 years, will have to be elected by a special resolution and with 75% shareholder approval. The rule, which came into force on April 1, 2014, lacked clarity whether it impacted the tenures of those already elected.

“The order makes it clear that the rule is applicable prospectively ,“ said Viral Shukla, lawyer at Shukla & Associates.

Some of the well-known senior executives who will be im pacted include N Srinivasan (71), VC & MD, India Cements; Pracheta Majumdar (71), director, Birla Corp; Jawahar Lal Oswal (72), CMD, Monte Carlo; and Suneel Advani, CMD, Blue Star Infotech.

“We are examining the or der. We are in the process of obtaining legal opinion,“ said an India Cements spokesperson.

The rationale behind the approval through special resolutions is to have younger board members, but at the same time have experienced heads provided a majority of the shareholders feel that such people can add value to the company .

“The regulators -MCA and Sebi -should immediately put out a clarification on the Companies Act, and hold companies responsible for noncompliance. Companies have chosen to ignore this nuance of directors' age limit. Minority shareholders' interest and rights cannot be taken for granted,“ said Shriram Subramanian, MD, InGovern Research, a proxy advisory firm.

Educational qualifications

2017

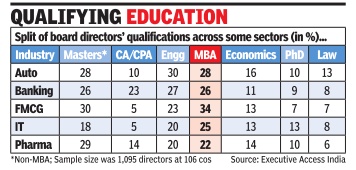

Namrata Singh, Over 25% of India Inc's directors have an MBA, June 26, 2017: The Times of India

Given the popularity of an MBA degree in India, an MBAMBA-equivalent is the most commonly held qualification among directors on boards of companies. A study by executive search firm Executive Access India -done exclusively for TOI -says more than a quarter (26%) of directors, on an average, hold an MBAMBAequivalent degree, followed by a non-MBA master's degree (22%). An engineering degree comes in third with only a fifth of board members holding such an educational qualification.

In terms of subjects of specialisation, economics stood out with around 10% having either a graduate or higher degree in the subject. In what reflects poorly on diversity on boards, nearly half the directors (47%) across industries were specialists in their respective fields. Retail and financial services have close to 67% of directors with significant experience within their respective industries.

While most corporate boards are seen to be taking measures to move the needle with respect to gender diversity , the Executive Access study covering 1,095 directors across 106 companies from across industries reveals a lack of general diversity on boards with respect to education, age and region. Auto industry had the highest composition of engineering graduates (30%) as directors, while in FMCG, 34% directors had MBA degrees. In banking, chartered accountants (CAs) held almost 30% of board positions.

Retail saw the lowest percentage (11%) in master's degree (not including the MBA), while it was the highest for the MBAMBA-equivalent (38%), indicating a strong preference for MBAs on the boards of these companies. Hotels, on the other hand, saw the lowest MBA degree holders (14%), engineering degree holders (6%) and PhD holders (2%).

Ronesh Puri, MD, Executive Access India, said, “Moving towards diverse boards is the next stage of evolution for organisations as they face bigger challenges of disruptions going for ward. Boards need to help the management to innovate more and faster as shelf life of any product or service is reducing fast. For ensuring this, boards will get better outcomes when they have more diversity of backgrounds and mindsets.“

Among companies with greater board diversity , Dr Reddy's Laboratories (DRL) had the highest representation of people from different industry backgrounds. As against the industry average of 35% of board directors with non-pharma background, DRL has 60%. Bajaj Finserv has a mix of 80% directors from the non-finance space while the industry average is at 35%. ICICI Prudential's board is composed of 42% engineers while the industry average is only 15%.

As against the FMCG industry average of 5% CA directors, Nestle has almost 30% of CAs on its board. A Nestle In dia spokesperson said the company's policy is to have broad experience and diversity on the board of directors, which embraces knowledge and understanding of relevant diverse geographies, people and their background, diverse culture, personality and work-style.

Rajeev Dubey , group president (HR & corporate services), Mahindra Group, said, “There are many dimensions of board diversity and education mix is just one of them. The other dimensions could be business experience, functional expertise, age, gender and nationality .“

Removal of independent directors

2018: second term directors’ removal

Tough norms for removing second term ind directors, February 23, 2018: The Times of India

Independent directors appointed for a second term at corporates can now be removed only by a special resolution passed by shareholders, with the government tightening the rules for the same. Before removal, such independent directors should also be given “reasonable opportunity of being heard”, according to the corporate affairs ministry.