Initial Public Offerings (IPOs): India

This is a collection of articles archived for the excellence of their content. |

Contents |

Trends

2007-2017

Aarati Krishnan, October 22, 2017: The Hindu

From: Aarati Krishnan, October 22, 2017: The Hindu

57% of offers that vacuumed up investor money over the last decade have made losses. Timing matters

Action in the Indian primary market, lukewarm for the past six years, is warming up of late. Recent Initial Public Offerings (IPOs) from MAS Financial Services and Dixon Technologies attracted bids for more than a 100 times the shares on offer. New listings such as AU Financial Services and CDSL have delivered a big pop of 51% and 75% respectively to lucky allottees on their trading debut. The BSE IPO Index, which tracks the fortunes of newly listed IPO stocks has outperformed the broad market so far this year. There’s a fat pipeline of IPOs from well-known names queued up to solicit your money over the next few months.

If you are longing to be part of the action, it is useful to assess the long-term return record of IPOs first. An analysis of returns delivered by 536 IPOs made over the last decade serves as a cautionary tale to investors who think that IPOs are the easy route to stock market riches.

Few multi-baggers

Many first-time investors prefer to punt on IPOs, rather than dabble in the secondary market, because they believe that new listings give them a better shot at unearthing multi-baggers. But a look-back at the last ten years tells us that the odds of zeroing in on multi-bagger IPOs are pretty low for the lay investor.

To assess the return record of IPOs over the past decade, we compiled a list of all the major IPOs made in the ten-year period between October 2006 and October 2016, for which data was readily available. We then compared their current market price (as of October 20) to the offer price during their IPO, to arrive at the compounded annual returns over the holding period. We assumed that IPO investors held on to the stock till date. We excluded offers made in the last twelve months because it is too early to assess their performance.

The analysis showed that 114 of the 536 IPOs or one in every five, turned out to be blockbusters for their original investors. They delivered a hefty 20% annual return over the holding period. Some of these winning IPOs were Page Industries (45% annual return), Jubilant Foodworks (36%), ICRA (26%), Insecticides India (22%) and Lumax Auto Tech (21% annual return). For investors whose return expectations were more modest at 15%, 26% of the IPOs managed to meet that expectation.

But you had to be quite discerning to unearth these gems because a majority of the offers made over the past decade, 74% to be precise, have failed to get their investors even to the 15% mark. The key takeaway here is that, if making reasonable returns is the object, well-managed equity mutual funds offer far better odds for first-timers than IPOs.

Losses more likely

Forget multi-baggers. You had to be quite lucky (or smart) to pocket a positive return from an IPO. Of the 536 IPOs that have vacuumed up investor money in the last ten years, as many as 306 (57%) have turned out to be lemons, resulting in capital losses for their investors. Those who were particularly unlucky may even have landed up with the 122 absolute duds that halved or more than halved from their offer price.

One of the positive trends here is that IPOs made in the last five years had a far better return record than those made in the preceding five-year period (2006-2010). While 45% of the IPOs in 2011-2016 made losses, the proportion was 74% in 2006-2010.

This is likely attributable to SEBI tightening the screws on offerors, improving the vetting process for IPOs and calling for greater accountability from merchant bankers from 2011.

But some of the most over-subscribed IPOs of the past decade feature in the loss-makers list. Reliance Power (down 85% from the adjusted offer price), DLF (down 67%), Parsvnath Developers (down 85%) and Religare Enterprises (down 74%) are instances.

This return distribution clearly tells us that a ‘monkey-throwing-darts’ approach, of applying to every IPO in the hope of getting lucky with a few can be quite injurious to the investor’s wealth. Bidding frenzy during the offer is also a poor indicator of future returns.

Business prospects

So what is the secret sauce to sifting the blockbusters from the duds? Well, given that the IPO winners hail from a variety of sectors (innerwear, pizza delivery, rating agency, crop protection and auto components, to name a few), assessing the prospects for each business seems more important than making the right sector choice.

But one factor that has made a big difference to performance is timing. Looking back, IPOs unveiled amid the big bull phases had significantly lower odds of delivering good returns than those launched in bear markets. Only 25% of 101 IPOs that made their debut in 2007 resulted in long-term profits for investors. But 38% of the 2009 crop (just 32 IPOs) delivered the goods. IPOs introduced in euphoric markets often bite the dust because it is in such markets that promoters are tempted to price their offers steeply.

The lesson clearly, is that small investors should think thrice before jumping into the fray when swarms of IPOs accompany a bull market.

2011-21

From: April 24, 2021: The Times of India

See graphic:

Initial Public Offerings (IPOs) in India, 2011-21

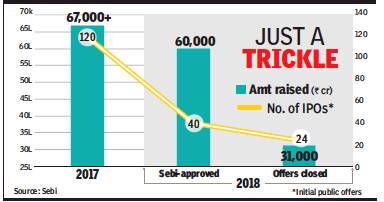

2017, 18: IPO slowdown

IPO slowdown worrying: Sebi chief, December 19, 2018: The Times of India

From: IPO slowdown worrying: Sebi chief, December 19, 2018: The Times of India

The current slow pace of fund-raising through the IPO route, despite relatively good market conditions, is bothering markets regulator Sebi. On Tuesday, Sebi chairman Ajay Tyagi said it was a cause of worry that the IPO market was not picking up. He also said that investment bankers should do a better due diligence of public offers to arrive at a price that is mutually acceptable to both investors and the ones who are offering shares.

The Sebi chief was speaking at the annual meeting of investment bankers.

“That IPOs are not taking place is something that’s a cause of worry,” Tyagi said.

He pointed out that a large number of companies are using the preferential allotment route to raise funds. Tyagi also said “merchant bankers have a role to see that an issue is reasonably priced and which is acceptable to both issuers and investors”.

The Sebi chief, however, said that he was impressed by the way the dedicated platform for small and medium enterprises to raise funds has taken off. He pointed out that in fiscal 2019, about Rs 1,500 crore has already been raised compared to Rs 800 crore raised in fiscal 2018. At the same meeting, Tyagi said 30 PSUs were yet to meet Sebi’s mandatory minimum shareholding norm, which is pegged at 25%.

In another conference, Sebi’s executive director S V Muralidhar Rao said asset management companies should strengthen their in-house credit research capabilities for fixed income products rather than relying solely on the opinion given by rating agencies. He also said that Sebi will soon come out with rules for ‘segregated portfolio’, or ‘side pocketing’, for mutual fund schemes.

Last week, the Sebi board had cleared a long-standing industry demand that allows fund managers to separate bonds of defaulting companies from good ones to insulate investors from a sharp fall in net asset values. Rao was speaking at CII’s annual mutual fund summit.

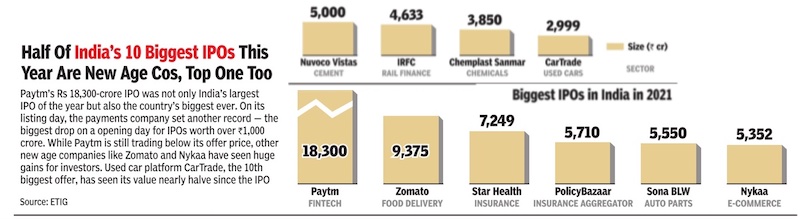

2021

From: The Times of India

See graphic:

The biggest IPOs in India in 2021.

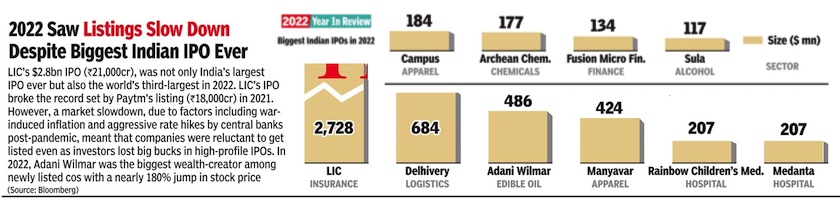

2022

From: Dec 23, 2022: The Times of India

See graphic:

Biggest Indian IPOs in 2022

See also

Companies/ corporations: India

Initial Public Offerings (IPOs): India