Remittances: South Asia

This is a collection of articles archived for the excellence of their content. |

Contents |

Quantum of remittances

2012

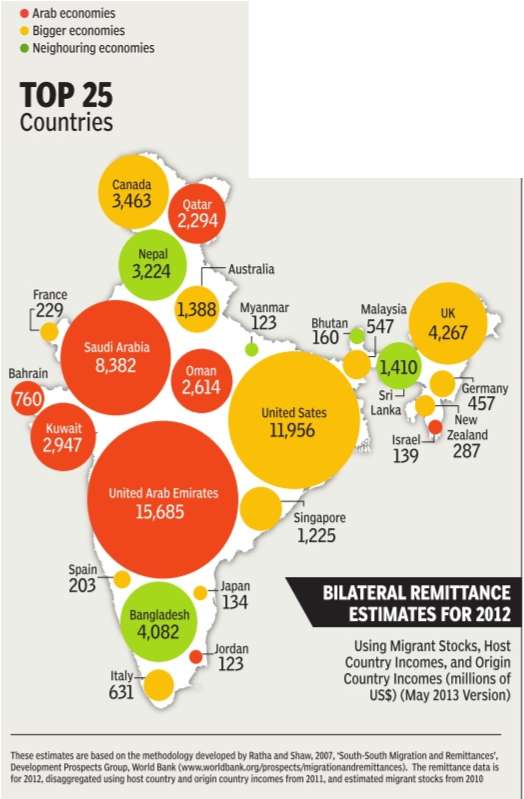

See graphic, 2012: Top 25 source countries

BRIDGING THE GULF

The Times of India Dec 01 2014

India gets the highest amount of remittances in the world at roughly $70 billion, almost three times the amount of FDI that comes into the country. Where does all this money come from? Data shows that the bulk of remittances come from three different categories of countries: Middle Eastern monarchies such as Qatar, Western developed nations such as the US or Australia, and next door neighbors such as Bangladesh and Nepal. By far the largest amount comes from the Gulf countries -Qatar, Bahrain, Oman, Saudi Arabia, and Kuwait -which sent a combined $32.7 billion, almost half of all remittances received.

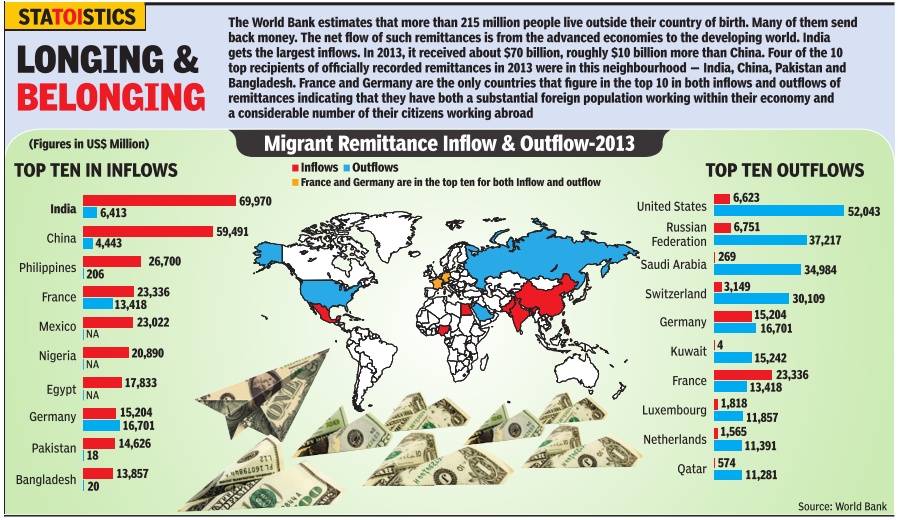

Migrant remittances: 2013

From: The Times of India

See graphic

Migrant remittances: South Asia and the world

2015-17: a decline in emigration

Lubna Kably, Indian workers in Gulf down by half since 2015, July 4, 2018: The Times of India

From: Lubna Kably, Indian workers in Gulf down by half since 2015, July 4, 2018: The Times of India

UAE Replaces Saudi As Most-Preferred Destination

The number of emigration clearances granted to Indians headed to the Gulf for employment halved to 3.7 lakh in 2017 from 7.6 lakh in 2015. There has been a steady decline over the past few years and recent immigration policies adopted by Gulf countries are a mixed bag for Indians.

In 2017, the UAE emerged as the preferred destination for Indian workers, with nearly 1.5 lakh emigration clearances. Saudi Arabia relinquished its preferred destination status, with around 78,000 emigration clearances, a 74% drop from around 3 lakh in 2015. The fall in jobs for expats is attributed to both, the Nitaqat scheme, aimed at promoting job opportunities for locals, which was tightened last September, and economic conditions.

According to a recent World Bank report, India continued to be the top recipient of remittances from overseas, which added up to $69 billion in 2017, and roughly 56% of it came from the GCC (Gulf Cooperation Council) countries Saudi Arabia, Kuwait, UAE, Qatar, Bahrain and Oman.

A favourable change in policy is likely to help UAE remain the most preferred destination. The country announced by the end of 2018, it will issue residency visas to global investors or professionals for up to 10 years. Further, temporary visas will be issued to expat workers who have lost jobs to enable them to scout for another job. “The proposal regarding residency visas is a strategic move to attract highly qualified and talented professionals. It is estimated at least 50-60% of key finance positions across GCC countries are held by Indians. With the recent introduction of the VAT regime, the demand for finance and tax professionals is on the rise,” says Piyush Bhandari, managing partner, Intuit Management Consultancy, a cross-border business advisory firm.

While blue-collar Indian workers dominated the labour scene in the GCC states till now, industry watchers say there is now a gradual shift, with more white-collar workers from India also showing interest in the Gulf.

Fragomen, a global firm specialising in immigration laws, says the UAE cabinet has also approved a low-cost insurance scheme to replace the bank guarantee system. “The new scheme may ease monetary burdens for companies employing foreign nationals,” adds Fragomen. On the other hand, Oman extended the suspension of recruitment of foreign nationals in 87 occupations to December 2018.

2017

ii) Top ten remittance receivers in 2017

From: May 9, 2018: The Times of India

See graphic:

i) Countries most dependent on overseas population;

ii) Top ten remittance receivers in 2017

2018: India, China, Pakistan, Bangladesh

From: July 8, 2019: The Times of India

See graphic, ' Top remittance recipients in 2018 ($ Bn) '

2020

From: Sep 18, 2023: The Times of India

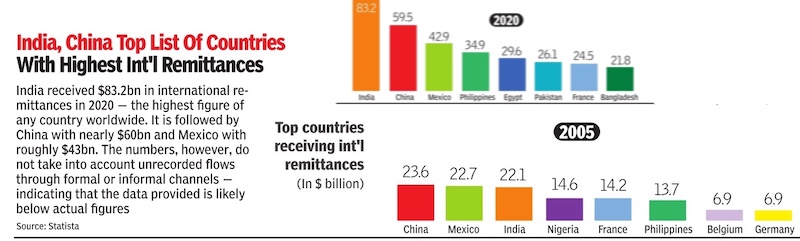

See graphic:

Top countries receiving international remittances, 2020

Remittances: Inward and reverse

The Times of India, Dec 03 2015

Vibhor Mohan Reverse Remittances: Survey Finds 9% Of Punjabi Households Send Money Abroad

The success of NRIs is often judged by the amount of money they send back home as remittances.But now, perhaps for the first time, an out-migration survey of 10,000 households in Punjab has found that 9% of them send money to their relatives in different parts of the world.

As expected, 71% of the respondents having family members abroad confirmed regular receipts. But that a substantial number send money outside India -reverse remittance -indicates that the foreign dream may not always be as rosy as it is made out to be.

The study -`Dynamics of International Out-Migration from Punjab', sponsored by the Centre for Research in Rural and Industrial Development (CRRID), Chandigarh and the Institut Nation al d'Études Démographiques (INED), Paris -points out that among those doing re verse remittance, the highest rates were recorded among households with a large landholding (21%).

“Reserve remittance is a relatively untouched aspect of the migration story and even the Central government often doesn't have figures on it,“ said Professor Aswini Kumar Nanda of CRRID, who conducted the study with Jacques Véron (INED). “There are households in Punjab that are obsessed with the idea of settling their child abroad and would sell off property to realise this dream.“

Households with the highest standard of living (14%), those in south Punjab's Malwa region (13%) and general caste (non-SCnonOBC) households (12%) are among those that show reserve remittance.

“Such a pattern of reverse remittance among the households with out-migration experience points to a presence of a section of wealthy or highly networked emigrants -with capacity to raise required resources from market or non-market sources,“ says the report.

Around one-tenth of all the surveyed households in Punjab received remittances at some point. NRI-rich Doa ba -Hoshiarpur, Kapurthala, Jalandhar and Nawanshahr -reports higher incidence of remittance receipts (21%).

If, instead of all households only those that have at least one current interna tional out-migrant are considered, the incidence of remittances increases substantially -from 10% to 71%. The study reveals that three-fifths (roughly 6,000) of households send money abroad to meet the immediate needs of the `departing' member or to provide some support initially after landing on foreign soil for accommodation, food, communica tion, clothing and transport.

69% of families `3L to sent `1.5L-` kin abroad earlier

Data indicates that during the five-year period before the survey, 69% of households sending remittances abroad had sent up to a total of Rs 1.5 lakh each, followed by 23% of households sending amounts ranging from Rs 1.5 lakh to Rs 3 lakh each. The share of households with high volume of reverse remittance (more than Rs 3 lakh) was estimated to be around 8%.

Also, 12% of households received as little as Rs 10,000 or even less as transfer receipts from their family members or relatives abroad.

Remittances used for daily needs, debt repayment

Four-fifths of the households used remittances for day-to-day consumption (including for food, fuel, clothing, footwear, etc.), followed by two-fifths for debt repayment.

Also, 34% and 31% of the households used income from abroad for seeking health care and education.

Remittances are also used for savings, housing (construction, repair and renovation) and social ceremonies such as weddings by 14%, 10% and 7% of households, respectively.

See also

Remittances: South Asia