Automated Teller Machines (ATMs): India

This is a collection of articles archived for the excellence of their content. |

Contents |

Automated teller machine numbers

2012-13

ATM cos see scope for more growth

Mayur Shetty TNN

The Times of India 2013/08/16

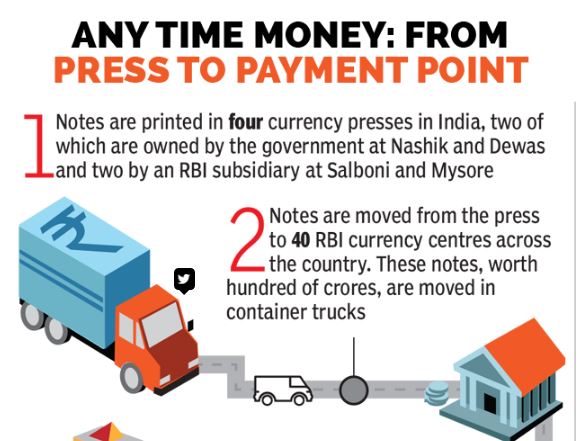

Given above are the logistics involved in moving new notes from the presses to ATMs. Considering that India over 200,000 ATMs across the country (Nov 2016) this is undoubtedly a challenging and complex business.

The Times of India

Given above are the logistics involved in moving new notes from the presses to ATMs. Considering that India over 200,000 ATMs across the country (Nov 2016) this is undoubtedly a challenging and complex business.

The Times of India

Given above are the logistics involved in moving new notes from the presses to ATMs. Considering that India over 200,000 ATMs across the country (Nov 2016) this is undoubtedly a challenging and complex business.

The Times of India

Mumbai: Despite public sector banks adding another 18,906 ATMs to their network in 2012-13 — an increase of 26% — the average number of transactions per machine is keeping pace, indicating that there is scope for growth.

RBI data shows that in June 2012, public sector banks had deployed 56,801 ATMs with average transactions of 183 per day and average daily withdrawals worth of Rs 4.9 lakh per machine. A year later, the number of ATMs has jumped to 75,707 machines and the average number of transactions continues to be close at 167 with average daily withdrawal of Rs 4.8 lakh.

This is good news for the nine companies that have been awarded contracts by public sector banks to invest in ATMs on their behalf and earn a return out of transaction charges they receive from banks. Exactly one year ago, the finance ministry carved the nation into 13 zones and auctioned off each zone to companies that agreed to the lowest transaction charge. All PSU banks have signed contracts with nine firms which include startups, and giants like the Tata group and US-based NCR.

Although average daily transactions have dropped from 183 to 167, bankers say that this is explained by the fact that a large chunk of deployments took place in the second half of the year. “Inadequacy of servicing the entire demand through traditional banking methods and pressure on banks to reduce costs has led to growth of ATM industry in India,” said Vidya Mani, promoter of Electronic Payments and Services India, which has received the contract for installing ATMs in Maharashtra.

June 2015-June 2016, year-on year growth: 10.5%

The Indian Express, December 20, 2016

Cash machines: Uneven spread, slowing growth

Written by Apurva

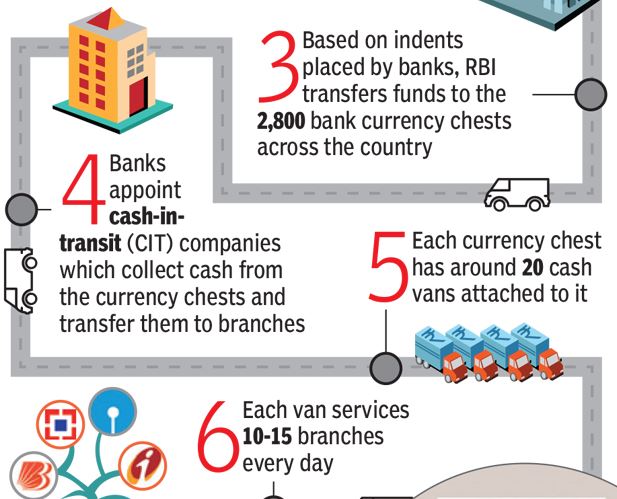

Bihar, with 6 times Delhi’s population, has fewer ATMs than the national capital and 7 times more people per machine. Maharashtra and TN are home to over a fifth of all India’s ATMs. RBI and Census numbers demonstrate a stark skew.

Since 2014, the growth rate of ATMs in the country has been falling steadily. The year-on-year growth between June 2015 and June 2016 (till when Reserve Bank of India data is available) was just 10.5%, significantly slower than the corresponding growth of 16.6% between 2014 and 2015. Between June 2013 and June 2014, ATM growth had galloped at 36.97%.

An RBI report titled Trend and Progress of Banking in India, 2014-15 noted, “…There was a decline in growth of ATMs of both PSBs (public sector banks) as well as PVBs (private sector banks). PSBs recorded a growth of 16.7 per cent during 2014-15 maintaining a share of around 70 per cent in total number of ATMs. FBs (foreign banks) continued to record a negative growth in number of ATMs.”

There is also a pronounced skew in the distribution of India’s ATMs — just two states, Maharashtra and Tamil Nadu, account for 22.5% of the total number of cash machines, according RBI data on ATMs and banking. In June 2016, India had 2,15,039 ATMs, 48,557 of which were in these two states.

The RBI data also show a skew in favour of metropolitan and urban areas. For example, Delhi (9,070) had more money machines than 25 states, including Rajasthan, Bihar, Punjab, Haryana, Odisha and Jharkhand. Delhi is the 18th most populated state in India according to the 2011 Census, with 1.39% of the population — however, the RBI data show it has 4.22% of India’s ATMs. Juxtaposed with Census data, RBI’s ATM data show a stark divide between the urban and rural populations with regard to access to ATMs. 69% of the country is classified as rural, but they have access to 45.93% of ATMs; 31% of the population is urban, but it has access to 54.07% of ATMs.

The slowdown in the growth of ATMs has hit rural India the hardest. Between 2013 and 2014, ATMs in rural India grew by 100%; the following year, that growth fell to 37% and, last year, rural India recorded an increase of a little under 14%.

On this, the Trend and Progress of Banking in India, 2014-15 report said: “In recent years, the shares of ATMs in rural and semi-urban areas have been rising, though urban and metropolitan centres still dominate. In 2015, about 44 per cent of the ATMs were located in rural and semi-urban centres.”

RBI data also show that some of India’s most populated states — Uttar Pradesh, Bihar and West Bengal — had to accommodate far more people per ATM than the country average of 5,631 people/ATM. In UP, Bihar and West Bengal, that figure in 2016 was 10,438, 13,563 and 7,815.

2016: Out of two lakh ATMs, only 1.2 lakh operational

Out of two lakh ATMs, only 1.2 lakh operational, Nov 13 2016 : The Times of India

Out of two lakh ATMs, about 1.2 lakh are operational [Nov 2016].At present only Rs 100 notes are being disbursed from ATMs.

2017: a 0.16 % decrease

From: Rachel Chitra, Banks shutter ATMs as cities go digital, remove 358 over June-Aug, October 28, 2017: The Times of India

Here's one more proof of Indians going off cash. Between June and August in 2017, the total number of ATMs in the country decreased by 358. By itself, it's a minuscule dip of 0.16%.

But it is a very significant change because ATMs increased at a compounded rate of 16.4% over the past four years. Even though growth slowed to 3.6% last year, this is the first time the number of ATMs has declined.

Decreasing ATM use in cities after demonetisation, and the increase in operational costs have forced banks to take a hard look at how they deploy ATMs. SBI, which has the largest ATM network in the country , reduced its ATM count from 59,291 in June this year to 59,200 in August, Punjab National Bank from 10,502 to 10,083, and HDFC Bank from 12,230 to 12,225.

Banks say rentals for a 7x5-sqft kiosk at airports and prime locations in Mumbai can go up to Rs 40,000 a month.Even in metros like Chennai and Bengaluru, ATM site rentals range from Rs 8,000 to Rs 15,000. Add to that the salaries of security staff and ATM operators, maintenance charges and electricity bills, and the total can range from Rs 30,000 to Rs 1 lakh a month.Electricity is a major expense as ATM kiosks have to be kept at 15-18 degrees centigrade through the day .

An SBI official said the bank closed some of the ATMs after the merger with its associate banks. “We had to decide whether the footfall at an ATM justified its running costs. Most of the ATMs we shut down were at places where another SBI parent or associate bank ATM was within a 500-metre radius. Our customers will not be greatly inconvenienced because of this.“

Some other banks have not shut down any ATM but are going slow on expansion plans.“We need to check the viability. For further expansion, we would need to have sufficient volumes to justify the cost,“ said Parthasarathi Mukherjee, CEO of Lakshmi Vilas Bank, which has 981ATMs.

HDFC Bank, which started rationalising its ATM network in July , plans to shift some of its machines to busier locations. “There has been a shift in customer behaviour from cash to electronic payments,“ Paresh Sukthankar, deputy MD of the bank, had told TOI in an earlier interview. “Customers who were earlier using their debit cards only for ATM withdrawals are now using them for transactions at shops. Teller transactions at branches as well as ATMs have seen a reduction or are flattening out.“

The city-centred growth of ATMs is part of the problem.Eight out of every 10 ATMs are located in cities where digital payments have increased after demonetisation.“More than 83% of ATMs are in urban locations, servicing 33% of the nation's population that has access to net banking, wider point-of-sale network, e-wallets, mobile banking apps, etc, for transactions,“ said Sanjeev Patel, CEO, Tata Communication Payment Solutions. “The people who desperately need cash are in rural locations where only 15% of the more than 2 lakh ATMs serve nearly 67% of our population.“ ATM operators say they need to focus on rural areas now. “Urban India has already got onto the digital bandwagon, rural India has not,“ added Patel.

ATM density: 2016, state-wise

The Times of India

ATM density. Compared to around 2,000 people per ATM in some lucky states, including Delhi and Tamil Nadu, more than 11,000 scramble for cash at a single ATM in Bihar and Uttar Pradesh

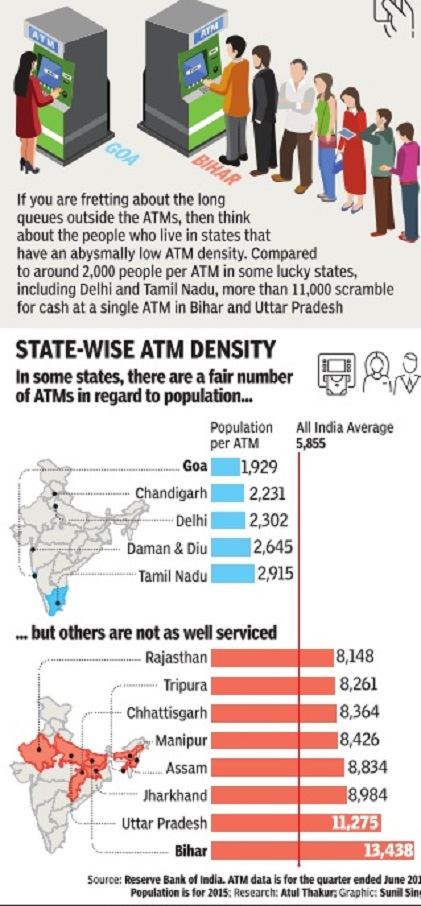

ATM density, 2017: India, China, the world

From: April 2, 2018: The Times of India

See graphic:

ATM density in 2017, in India, China and other major nations

The experience, the management

How money reaches ATMs

See three graphics

ATM: A change in banking experience

The Times of India , Sep 12 2015

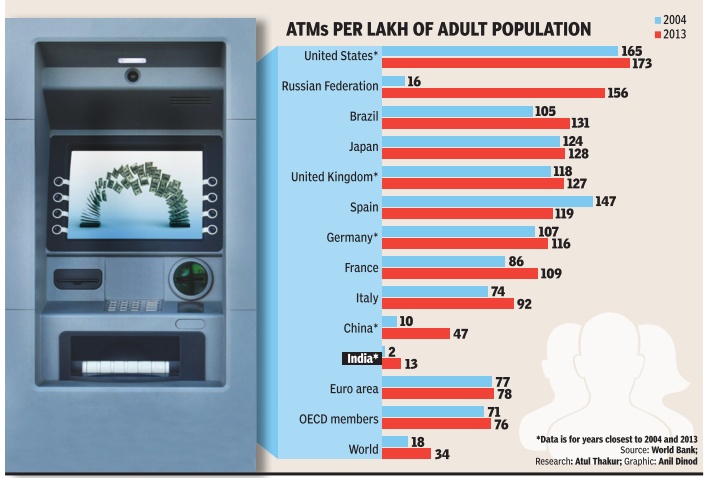

The former chairman of America's Federal Reserve, Paul Volcker, had once famously remarked that the only useful banking innovation was the invention of the ATM. First installed in Enfield Town, North London, in 1967, the machine has radically changed the banking customer's experience. The ATM Industry Association, a global non-profit industry association, estimates that there are over 2.2 million ATMs installed across the world. A comparison with other major economies shows that ATM penetration is among the lowest in India. Compared to a global average of 34 machines per lakh adults, India has only 13 per lakh.

What ATM swipes cost banks

Banks may lose Rs 3,800 crore a year on card swipes: SBI, September 29, 2017: The Times of India

HIGHLIGHTS

SBI has said that banks stand to lose Rs 3,800 crore annually due to the investment in card-swipe machines as costs outstrip revenues

SBI, which had 3.4 lakh machines in October 2016 before demonetisation, increased this to 6.13 lakh by July 2017

The country's largest lender State Bank of India (SBI) has said in a research report that banks stand to lose Rs 3,800 crore annually due to the investment in card-swipe machines as costs outstrip revenues.

As of July, banks had a network of 28.4 lakh card-swipe machines — almost double the 15.1 lakh in existence before demonetisation. SBI, which had 3.4 lakh machines in October 2016 before demonetisation, increased this to 6.13 lakh by July this year.

The key reason behind the loss is that average monthly transactions in a point of sale (PoS) terminal continues to be around 150 per month, while the transaction charges on debit cards have been reduced sharply. "In order to encourage card payments, the government has been pushing banks to install more number of point of sale machines and banks are installing on an average 5,000 PoS a day. But the transactions at PoS are increasing at a much slower pace," said the SBI report. It added that if transactions do not gain momentum, this would raise the question of viability of the business for acquiring banks. Acquiring banks are those who install the card-swipe machines as against the 'issuing banks' — a term used to describe card issuers.

According to the report, the acquiring bank loses money in 'off-us' transactions — a term used to describe those payments where the card-issuing bank is different from the bank that has installed the PoS machine. According to SBI, the loss is very high on a credit card transaction, where the acquiring bank has to pay a large chunk to the credit card-issuing bank. The only transactions where the acquiring bank makes money are the 'on-us' transactions, or the ones where the acquiring bank and the card-issuing bank are the same.

"Though the government has proposed various measures to incentivise the PoS infrastructure and banks are installing PoS terminals, in the long-run the business would be viable only if the transactions at PoS surpass ATM transactions — an enviable task indeed," the report said.