Chief Executive Officers: India

(→Highest paid professionals and promoters) |

(→2014) |

||

| Line 36: | Line 36: | ||

However , one top CEO, who did not wish to be identified, said CEO pay is out of whack and more due diligence is required while fixing compensation. | However , one top CEO, who did not wish to be identified, said CEO pay is out of whack and more due diligence is required while fixing compensation. | ||

| − | =2014 | + | ==2014== |

| − | + | ||

| − | + | ||

[http://epaperbeta.timesofindia.com//Article.aspx?eid=31808&articlexml=PROFESSIONALS-GAIN-GROUND-IN-M-PAY-CLUB-26122014023046 ''The Times of India''] | [http://epaperbeta.timesofindia.com//Article.aspx?eid=31808&articlexml=PROFESSIONALS-GAIN-GROUND-IN-M-PAY-CLUB-26122014023046 ''The Times of India''] | ||

Revision as of 16:40, 6 August 2016

This is a collection of articles archived for the excellence of their content. |

Contents |

CEO salaries

2015

The Times of India, Jun 06 2016

Namrata Singh & Shubham Mukherjee

Aurobindo gets best value from payout to CEO in 3 yrs

CEO salaries have seen a spike as the occupant of the corner office operates in a challenging VUCA world--volatility , uncertainty , complexity and ambiguity. With CEOs taking home large payouts, there has been a greater scrutiny over hisher performance. The scrutiny has moved from a simplistic calculation of the return on CEO pay over profits to a holistic view covering other key financial parameters. So, which Indian company got the best value for its payout to a CEO?

Aurobindo Pharma extracted the best value from the payout to its CEO, followed by Britannia Industries and Bharat Forge over a three-year period--2012-13 to 2014-15.

In a study commissioned by TOI to global staffing company Randstad, Aurobindo Pharma got an overall score of 386600 based on six parameters. The company paid its CEO, M Govindarajan, an average annual compensation of Rs 9.5 crore, which is above the average CEO salary during the period.

The results for the study , `CEO Compensation & Company Performance', were based on six parameters -returns on compensation (profitCEO pay), change in revenue, operating margin, profit after tax, market capitalization and debt. For the study , the financial performance of BSE100 companies was analysed for the three-year period based on their annual reports. Idea Cellular , Bharat Petroleum, Axis Bank, HCL Technologies, State Bank of India, ICICI Bank and Lupin were the next on the top10 list which were able to maximize gains from CEO payouts. Randstad India MD & CEO Moorthy K Uppaluri said the current CEO compensation structure is set to undergo a paradigm shift with higher emphasis on performance-based pay and stock awards. “CEOs are increasingly accepting such results-driven compensation structures which are outcome based and linked to the company's success. The average CEO salary was Rs 7.6 crore in FY 2015, a17% increase over the previous year's average,“ said Uppaluri.

Britannia Industries, which came second with an overall score of 303, paid an average salary of around Rs 4.3 crore to CEO Varun Berry . Bharat Forge, third on the list with a score of 297, shelled out around Rs 13.2 crore as salary to its CMD B N Kalyani, while Aditya Birla Group company Idea Cellular , which ranked fourth, gave MD Himanshu Kapania around Rs 6.6 crore.

When contacted, Aurobindo Pharma declined to comment. Santrupt Misra, CEO, carbon black business & director , group HR, Aditya Birla Management Corporation, saidthe group does not judge leaders only in terms of financial performance but rather with a more comprehensive set of metrics that include qualitative aspects as well such as leadership and talent development, a strong customer and supplier connect and creating value for stakeholders.

For FY13-FY15, CEO compensation grew by 25%, while revenues increased by 14.6%, ebitda (earnings before interest, tax, depreciation & amortization) margins were flat at 0.3% growth and PAT was up by 12%. Marketcap for the companies grew by 42% while long-term debt on their books increased by16%.

Promoter-owned and run companies had on an average the highest CEO compensation, the study revealed. The average salary paid out to CEOs, for the period, was Rs 6.5 crore. PSUs offered the best return on CEO compensation given the low base of salaries.Nine out of the top 10 companies that offered the best PAT compensation multiple were PSUs. SBI, Coal India and ONGC were the top 3 companies on that parameter.

Harsh Goenka, chairman RPG Enterprises, says “how much is too much“ is currently engaging boards of many Indian companies. “Salaries of CEOs have increased exponentially but so has the complexity . A CEO today is not only a leader , but also astrategist, a tactician, a coach, a troubleshooter , a mediator , an innovator and much more. It is impossible to relate CEO salary with just PAT or one particular matrix, but a combination of them,“ he said.

However , one top CEO, who did not wish to be identified, said CEO pay is out of whack and more due diligence is required while fixing compensation.

2014

Dec 26 2014

India Inc has 96 executives in the million-dollar pay club, a study of top salaries for 2013-14 commissioned by TOI has revealed. The number of professional CEOs in the club has increased from 34 during 2012-13 to 39, finds the study by global executive search firm EMA Partners. In case of promoter CEOs, the number went up marginally from 56 to 57. The study took into account executive compensation in excess of Rs 6 crore per annum for the top 200 listed companies and excluded stock options. Here are the highlights...

CEO-median employee salary ratio

The Times of India, Jul 06 2015

Mukesh's pay 205-times RIL's median

Ratio Stands At 439 For ITC's Deveshwar, 89 For Wipro's Premji

Billionaire industrialist and India's richest man Mukesh Ambani has not taken a pay hike for seven years, but his salary is over 205-times that of the median employee remuneration at Reliance Industries (RIL). However, this ratio stands much higher at 439 times in case of ITC executive chairman Y C Deveshwar.

The same ratio stands much lower at 89-times in case of IT major Wipro's chairman and managing director Azim Premji, and just at 19-times for mortgage giant HDFC's chair a man Deepak Parekh for the latest fiscal 2014-15.

However, HDFC Bank's t MD Aditya Puri got a remuner p ation that was 117-times the t median employee pay at the bank, while for ICICI Bank 2 CEO Chanda Kochhar, it was 97 c times and at over 74 times for Axis Bank's managing director and CEO Shikha Sharma.

For IT giant Infosys' CEO Vishal Sikka, his pay was 116 times of the median employee pay at the company . The same ratio for HUL's CEO Sanjiv Mehta was 93 times, but much higher at 293 times for Vedanta Limited's chairman Navin Agarwal.

Listed companies have be gun disclosing these ratios, as also other comparisons such as salary hikes for the top management personnel and an average staff, for the first time pursuant to the new Companies Act and Sebi's latest Corporate Governance Code coming into force.

While a majority of the companies are still in the proc ess of disclosing these details, the disclosures made so far by the top companies show a wide variance in these ratios, while there is also a huge difference between the pay hike figures for the top management per sonnel and an average staff member in many cases.

However, there are a few cases where the increase in the median employee remunera tion is almost equal or even higher than the same for the CEOs and other key manage ment personnel.

In case of RIL, chairman and MD Mukesh Ambani has kept his salary capped at Rs 15 crore for seven years now, while the median remuneration of em ployees increased by 3.7% to Rs 7.29 lakh during 2014-15. The to tal remuneration of key mana gerial personnel, in fact, dipped by 1.9% to Rs 73.28 crore.

Extensions after age 70

Jul 08 2015

Reeba Zachariah & Boby Kurian

Super rich don't want to retire

Wipro's Premji, Lupin's Gupta Among 234 Seeking Extension As New Cos Act Caps Age Of Those In Executive Role At 70

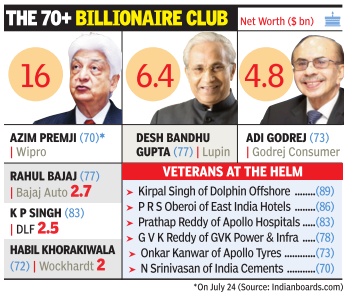

About half a dozen billionaires are among the 234 business leaders who are seeking extension of the retirement age, which has been fixed at 70 years under the revamped Companies Act for those serving in a listed company in an executive role. Wipro boss Azim Premji, who turns 70 on July 24, is seeking a two-year extension as executive chairman and managing director at the company's annual general meeting slated for July 22. With a net worth estimated at over $16 billion, Premji, India's third richest man, emerges the most influential India Inc name seeking continuation of employment under a more stringent Act.

Pharma major Lupin's Desh Bandhu Gupta, with a net worth of $6.4 billion, is another billionaire seeking extension as executive chairman for five years through a special resolution at the company's July 23 AGM. “The new Act requires a proper justification and a special resolution with 75% voting in favour to continue with executive powers beyond 70. An age limit was deemed fit since significant public capital is parked with the country's largely promoter-driven companies,“ said Sai Venkateshwaran, partner and head of accounting advisory services at KPMG. This applies to those with executive functions and not independent directors.

Premji's desire to not hang up his boots is putting the spotlight on the so-called `Club of 70s', which includes the likes of Adi Godrej, KP Singh (of DLF), who have all got extensions under the previous Act to continue to lead their companies.

Wockhardt's Habil Khoraki wala, with a promoter stake worth $2 billion, also sought a similar continuation earlier this year. Adi Godrej continues to steer his family's interest, estimated at $4.8 billion, in Godrej Consumer Products as does K P Singh with a $2.5-billion stake in DLF . Kirpal Singh, 89, who heads Dolphin Offshore Enterprises as chairman, is the oldest executive head currently . Other veterans include P R S Oberoi (86) of EIH and C Prathap Reddy (83) of Apollo Hospitals Enterprises.

Most of them control a signif icant block of shares, giving them enough comfort to seek extensions even under the stringent, new rules. Premji and DLF's Singh control around 74% shares each in their companies, while Godrej has 63% and Lupin's Gupta 46%. L&T Group executive chairman A M Naik, probably the mostinfluential professional executive head past his retirement age, sought continuation under the old rules and has two more years at the helm unless he seeks another extension.

Wipro's special resolution recalls how Premji, who joined the business in the 1960s, turned a $2-million business into a $7.5-billion entity and India's third largest software exporter.While Premji's extension is set to sail through in the upcoming shareholder meeting, there have been minority investor rebellions against older executive heads in some of the lesserknown listed companies.

Some minority shareholders of Ultramarine & Pigments have written to the company that its executive chairman R Sampath, who is past 70, should step down. But the company said it has robust legal advice stating no requirement for a fresh ratification until Sampath's current tenure under the old Act ends.