Disinvestment: India

| Line 11: | Line 11: | ||

[[File: Disinvestment of public sector assets in India, 2011-15.jpg|Disinvestment of public sector assets in India, 2011-15; Graphic courtesy: [http://epaperbeta.timesofindia.com/Gallery.aspx?id=27_10_2015_025_017_010&type=P&artUrl=Divestment-dept-seeks-cut-in-target-27102015025017&eid=31808 ''The Times of India''], October 27, 2015|frame|500px]] | [[File: Disinvestment of public sector assets in India, 2011-15.jpg|Disinvestment of public sector assets in India, 2011-15; Graphic courtesy: [http://epaperbeta.timesofindia.com/Gallery.aspx?id=27_10_2015_025_017_010&type=P&artUrl=Divestment-dept-seeks-cut-in-target-27102015025017&eid=31808 ''The Times of India''], October 27, 2015|frame|500px]] | ||

| + | |||

| + | [[File: PSUs disinvested between 1999 and 2017 and the amount obtained from their sale.jpg| PSUs disinvested between 1999 and 2017 and the amount obtained from their sale; [http://epaperbeta.timesofindia.com/Gallery.aspx?id=08_05_2017_017_004_008&type=P&artUrl=NITI-Aayog-to-recommend-more-PSUs-for-strategic-08052017017004&eid=31808 The Times of India], May 8, 2017|frame|500px]] | ||

=Year-wise progress= | =Year-wise progress= | ||

Revision as of 10:03, 27 June 2017

This is a collection of articles archived for the excellence of their content. |

Year-wise progress

2014-17

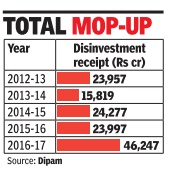

Govt tops divestment target, nets over Rs 46k cr, April 1, 2017: The Times of India

The government has managed to scale its budget target for disinvestment and closed the financial year (2016-17) with record receipts of Rs 46,247 crore, compared with the revised estimate of Rs 45,500 crore after it deployed all tools at its disposal.

Although the mop-up is lower than the budget estimate of over Rs 67,000 crore, the shortfall is on account of the Centre's inability to push through strategic sales, including easier options such as ITDC hotels, many of which are to be sold to state governments. It has, however, booked the sale of shares such as L&T, which were held by the Specified Undertaking of the erstwhile Unit Trust of India, as strategic sale which help the government raise Rs 10,779 crore.

But, this is by far a record year for disinvestment, surpassing the 2014-15 level of Rs 24,277 crore. The department of investment and public asset management (Dipam) used all instruments -from initial public offer and follow-on issues to offer for sale via stock exchanges, block deals, exchange traded fund and share buybacks -to raise the funds, which will provide some cushion to the government . If the tax proceeds are in line with the revised estimates, the government may actually end up bettering the fiscal de ficit target of 3.5% of GDP during 2016-17. In any case it has prodded several PSUs, led by oil firms, coal and power sector firms, to cough up special dividend.

This year's disinvestment receipts also include Rs 530 crore from sale of shares to employees of six public sector companies -IndianOil, NTPC, Engineer's India Ltd, NHPC, DCIL and Concor -after the government managed to get Sebi to tweak rules to make the issues more attractive.

The rules allow for allotting 5% of the shares to employees and came with a cap of Rs 2 lakh, which often left shares unsold. The government managed to convince the market regulator to raise the ceiling to Rs 5 lakh. But, the enhanced limit could only be used if shares were unsold after all bidders for up to Rs 2 lakh investment had been exhausted.