Government finances: India

(→2015-16) |

(→Tax base, FY05-FY15) |

||

| Line 11: | Line 11: | ||

[[Category:Economy-Industry-Resources |F ]] | [[Category:Economy-Industry-Resources |F ]] | ||

=Government finances= | =Government finances= | ||

| − | =Tax base | + | =Tax base= |

| + | ==FY05-FY15== | ||

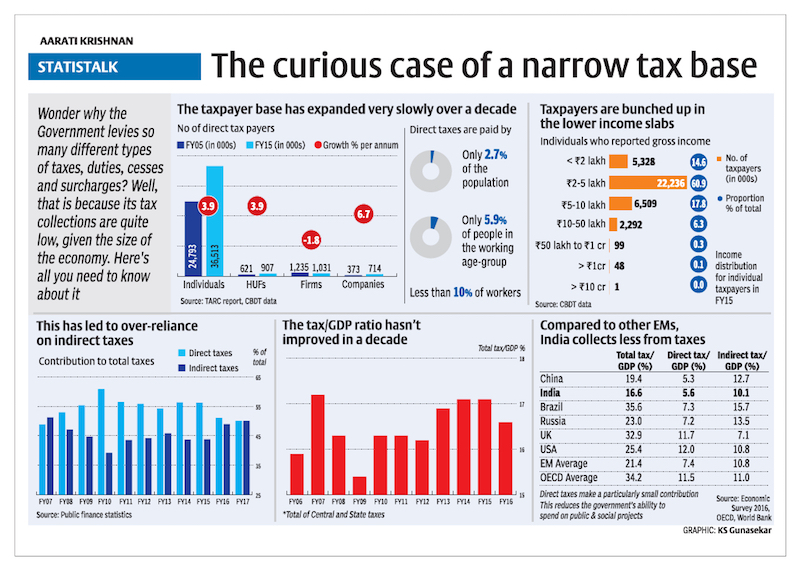

'''Please see graphic''' | '''Please see graphic''' | ||

[[File: Tax base in India, (Economic Survey- 2016, OECD, World Bank).jpg|Tax base in India, (Economic Survey, 2016, OECD, World Bank); [http://www.thehindubusinessline.com/opinion/columns/aarati-krishnan/indias-low-tax-base-problem/article9517768.ece ''The Hindu''], Feb 3, 2017|frame|500px]] | [[File: Tax base in India, (Economic Survey- 2016, OECD, World Bank).jpg|Tax base in India, (Economic Survey, 2016, OECD, World Bank); [http://www.thehindubusinessline.com/opinion/columns/aarati-krishnan/indias-low-tax-base-problem/article9517768.ece ''The Hindu''], Feb 3, 2017|frame|500px]] | ||

| + | |||

=Fiscal deficit= | =Fiscal deficit= | ||

==2015-16== | ==2015-16== | ||

Revision as of 14:16, 16 March 2017

This is a collection of articles archived for the excellence of their content. |

Contents |

Government finances

Tax base

FY05-FY15

Please see graphic

Fiscal deficit

2015-16

The Times of India, Jun 01 2016

The government managed to rein in fiscal deficit marginally below the revised estimate for 2015-16, despite mopping lower than budgeted taxes. But, it also meant that the finance ministry had to curtail spending below the revised estimates for the last financial year. With the provisional estimate of GDP higher than the advance estimate, the Centre's fiscal deficit was estimated at 3.92% of GDP compared to 3.94% in the revised estimate. Against the revised estimate of Rs 5.35 lakh crore of fiscal deficit, the Centre closed the year with a deficit of Rs 5.32 lakh crore, data released by the controller general of accounts showed.

Fiscal deficit is the difference between the government's total spending and receipts, which include tax, non-tax revenue as well as capital receipts such as proceeds from disinvestment.

This was the second year in a row that the government met the fiscal deficit target, but it did not have to significantly cut spending to meet the projections. With private sector investment remaining subdued, the government has been forced to step up public expenditure and lower oil subsidies last year helped keep keep deficit under check.

The government, however, slipped marginally on revenue deficit, which brea ched the revised estimate of Rs 3.41 lakh crore to close the year at a little over Rs 3.42 lakh crore. Revenue deficit is the difference between receipts and expenditure, such as interest payments and other spending to keep assets running. The government is hoping to meet the deficit targets during the current financial year too.

“The fiscal space available to enhance capital spending in 2016-17 has been limited by the Pay Commission and OROP-related (one-rank, one-pension) commitments, despite the revenue augmentation measures introduced in the Budget for 2016-17. The evolving buoyancy of tax and non tax revenues during the current fiscal would critically impact the headroom available to the government to boost spending on identified priorities such as infrastructure creation and PSU bank recapitalization,“ said Aditi Nayar, senior economist at ratings agency ICRA

See also

Government finances: India