Government finances: India

This is a collection of articles archived for the excellence of their content. |

Contents |

Government finances

Tax base

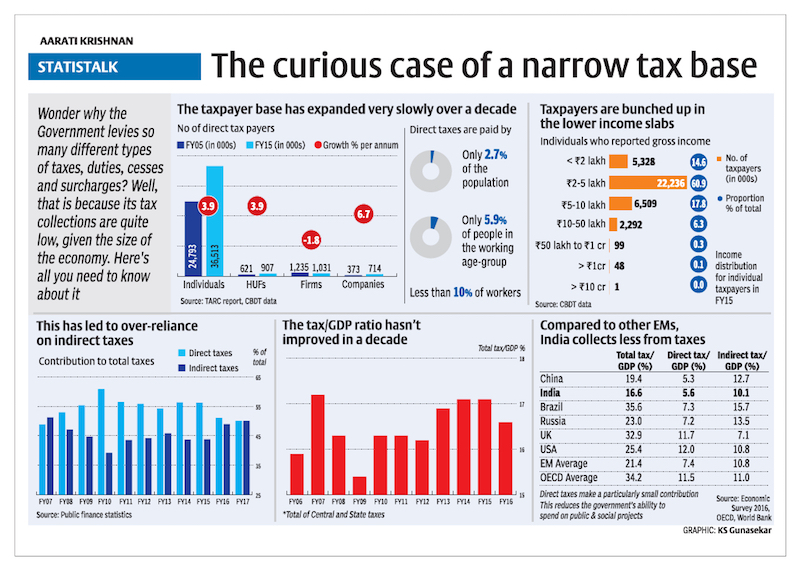

The curious case of a narrow tax base:FY05-FY15

Please see graphic

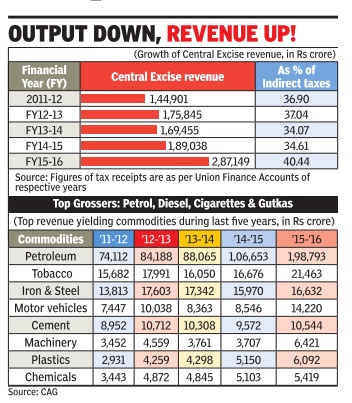

40% Of Indirect Taxes are From petrol, diesel

Mopped Up 40% Of Indirect Tax Kitty From Fuels

The massive jump in excise duty on petrol and high speed diesel helped the government mop up nearly 40% of its indirect tax kitty from the two auto fuels in 2015-16, compared to 34% in the previous financial year.

A study by the Comptroller and Auditor General (CAG) showed that Union excise duty collection shot up almost 70% from Rs 1.69 lakh crore during 2013-14 to Rs 2.87 lakh crore in 2015-16, with a majority of the contribution being from petrol, diesel, cigarettes and gutka. The indirect tax kitty includes duties from customs, central excise and service tax.

Excise revenue from petroleum products, which made up for 52% of collections in 2013-14, went up to almost 69% during 201516 as the government resorted to a massive increase in levies in the wake of falling global prices.

The central excise duty on petrol and high speed diesel increased from Rs 1.2 per litre and Rs 1.46 per litre to Rs 8.95 per litre and Rs 7.96 per litre respectively during the last two financial years. Revenue from petroleum products went up from Rs 88,000 crore in 2013-14 to Rs 1.99 lakh crore in 2015-16. Tax on sin goods (mainly tobacco products) at Rs 21,000 crore was second highest contributor to indirect taxes.

Compared to countries like Pakistan and Sri Lanka, India has one of the highest retail prices of fuel oil in the subcontinent. The high price of petrol and diesel in India was contrary to the international trend in crude oil prices that crashed from a high of $112 a barrel in 2014 to as low as $30.

Though the lower oil prices substantially reduced India's oil bill as the country depends on 80% imports, domestic prices were kept high by increasing central excise duties. The excess revenue earned was meant to fund government's social sector schemes. The CAG, which tabled its report in Parliament on Friday, however, highlighted the issue by pointing out how the government has been losing major revenue by giving exemptions to industry . The revenue forgone on account of different exemptions come up to more than Rs 2 lakh crore a year which the auditor has said need to be rationalised.

The revenue forgone for FY2016 on excise duties was Rs 2.25 lakh crore -Rs 2.06 lakh crore as general exemptions and Rs 19,000 crore as area-based exemptions. This was over 78% of total revenue earning from central excise.

The auditor has observed that though the main objective behind issue of exemption orders is to deal with circumstances of exceptional nature, but this objective was not properly defined. “As such, the duty forgone on account of issue of special exemption orders is not being calculated towards revenue forgone figures,“ it noted.

Fiscal deficit

2015-16

The Times of India, Jun 01 2016

The government managed to rein in fiscal deficit marginally below the revised estimate for 2015-16, despite mopping lower than budgeted taxes. But, it also meant that the finance ministry had to curtail spending below the revised estimates for the last financial year. With the provisional estimate of GDP higher than the advance estimate, the Centre's fiscal deficit was estimated at 3.92% of GDP compared to 3.94% in the revised estimate. Against the revised estimate of Rs 5.35 lakh crore of fiscal deficit, the Centre closed the year with a deficit of Rs 5.32 lakh crore, data released by the controller general of accounts showed.

Fiscal deficit is the difference between the government's total spending and receipts, which include tax, non-tax revenue as well as capital receipts such as proceeds from disinvestment.

This was the second year in a row that the government met the fiscal deficit target, but it did not have to significantly cut spending to meet the projections. With private sector investment remaining subdued, the government has been forced to step up public expenditure and lower oil subsidies last year helped keep keep deficit under check.

The government, however, slipped marginally on revenue deficit, which brea ched the revised estimate of Rs 3.41 lakh crore to close the year at a little over Rs 3.42 lakh crore. Revenue deficit is the difference between receipts and expenditure, such as interest payments and other spending to keep assets running. The government is hoping to meet the deficit targets during the current financial year too.

“The fiscal space available to enhance capital spending in 2016-17 has been limited by the Pay Commission and OROP-related (one-rank, one-pension) commitments, despite the revenue augmentation measures introduced in the Budget for 2016-17. The evolving buoyancy of tax and non tax revenues during the current fiscal would critically impact the headroom available to the government to boost spending on identified priorities such as infrastructure creation and PSU bank recapitalization,“ said Aditi Nayar, senior economist at ratings agency ICRA

See also

Government finances: India