Housing: India

(→=2012-13: accounts decrease but amount disbursed increase) |

|||

| Line 9: | Line 9: | ||

[[Category:Government |H ]] | [[Category:Government |H ]] | ||

[[Category: Economy-Industry-Resources |H ]] | [[Category: Economy-Industry-Resources |H ]] | ||

| − | + | ||

{| Class="wikitable" | {| Class="wikitable" | ||

Revision as of 22:14, 29 August 2017

This is a collection of articles archived for the excellence of their content. |

This is a collection of articles archived for the excellence of their content. |

Contents |

Affordable housing

2017: Budget homes drive growth

Govt Sops Boost Sales Of Flats Below Rs 30 Lakh

After years of selling pricey luxury homes that boasted amenities like signature golf courses and jacuzzis, builders finally seem to be moving toward modest apartments to suit middle-class pockets. A clear indicator of this is the sharp uptick in home loans driven by sales of houses costing below Rs 30 lakh. The cue for builders to change tack came from this year's Budget, which offered tempting tax and interest concessions for the affordab le housing segment.

This year, almost half of all bank credit comprised loans to housing, given the almost non-existent corporate loan demand. According to HDFC chairman Deepak Parekh, the corporation's January loan applications rose 21% over December. February applications were another 24% higher, and March was 44% more than the previous month.

“What is driving this growth is not high-value property but affordable homes, considering that the corporation's average loan size is Rs 25.6 lakh. This is the first time in several quarters that HDFC's average loan size has dropped from Rs 26 lakh, he said.

Property experts said Ahmedabad was the largest contributor of such homes (costing less than Rs 30 lakh), followed by Pune (up to Rs 50 lakh) and areas in the Mumbai Metropolitan Region like Badlapur, Ambernath, Vasai-Virar, Dombivli, Kalyan, Panvel, Ulwe and Taloja.

Housing finance providers are now expecting the affordable home segment to grow at 25% given the subsidy under the Pradhan Mantri Awas Yojana (PMAY). The scheme, available until December 2017, provides 4% subsidy on home loans of up to Rs 9 lakh for those with an income of up to Rs 12 lakh per year, and 3% subsidy on loans of up to Rs 12 lakh for those earning up to Rs 18 lakhper year.

Pankaj Kapoor, MD of Liases Foras, a real estate research firm, said on a quarteron-quarter basis, maximum sales growth (31%) was reported in the affordable segment (properties priced below Rs 25 lakh), while the ultraluxury segment witnessed a 4% decline in sales. The October to December 2016 period saw a slump following demonetisation, but demand between January and March 2017 was healthy .

Developer Niranjan Hiranandani said sales at his Thane project for flats below 600 sq ft had been good. “There will be a further surge when more projects start hitting the market and people start getting the tax benefits, he said.

Mortgage company Indiabulls Housing told investors that for a borrower seeking Rs 24 lakh, the effective rate he or she will pay works out to only 0.42% after factoring all tax breaks and subsidies.

“Effective home loan rate in the mid-income affordable housing segment is at near-zero levels. With rental yields at 3.2%, home ownership is very affordable and much cheaper than renting a house,“ a company official said.

According to Subhash Chennuri, senior consultant with consulting firm FSG, more finance is being made available for housing units which are as low or even below Rs 12 lakh.

The PMAY scheme comes on the back of the Union budget proposals. Besides, developers who build affordable homes are exempted from paying taxes on their profits for five years starting 2016 instead of three years.These are for 300 sq ft homes in the four metro cities and 600 sq ft in non-metro areas.

2017, decline in non-budget housing demand

Rachel Chitra, Housing demand slows despite good loan deals, June 7, 2017: The Times of India

Top 8 Cities See 16% Dip In Launches From 2016

Top eight cities witnessed residential launches of about 25,800 units in the first quarter of 2017, registering a 16% decline from the corresponding period last year, said Cushman & Wakefield. Other than affordable housing, most segments like mid and high-end saw a sharp decline. This trend is expected to continue over the next two-to-three quarters, as large sets of unsold inventory continue to burden the real estate market.

Most cities including Chennai and Hyderabad saw a decline, while Mumbai and Ahmedabad were the only markets which saw growth.Delayed launches in many cities was not so much due to a lack of inventory , but because developers want better price realisation for their unsold stock. Developers have also started bundling in incentives and add-ons to clear inventory backlog.

This trend of declining in terest in residential apartments -despite lower rates on mortgage loans --has been seen since last March, when the government announced the Real Estate Regulatory Act (RERA), 2016.

Decline in launches has peaked when demonetisation was announced last No vember, said Cushman & Wakefield. In this tepid environment, affordable housing has seen the biggest increases -with share in total launches up 30% from 25% earlier; compared to decline in the share of high-end and luxury segments to 11% from 13% during the same period.

“With mild change in end user sentiments due to news of downsizing in IT ITeS segment, sales velocity is expected to reduce. A gradual improvement in buyer sentiment is expected towards the second half of 2017 as the impact of real estate reforms will begin to play out in the market. Capital values which are already reduced in selected locations within markets such as Delhi NCR, Bengaluru and Mumbai, will continue to remain under pressure in the coming quarter as the markets readjust in the post RERA and GST regime,“ said Anshul Jain, managing director, Cushman & Wakefield.

“We expect investors' and homebuyers' interest to revive in the residential sector post the enforcement of RERA and GST as transparency and accountability improves,“ he added.

With cities like Chennai seeing a 6% decline in sales, developers have launched a higher number of subvention schemes such as paying 5% now, 95% on delivery .

“Some developers are going a step further and offering assurances of compensation refund of difference, if prices decline in the future,“ he added.

Environmental clearance

Housing projects without green nod illegal: SC

The Times of India, January 16, 2016

Dhananjay Mahapatra

In a jolt to hundreds of builders who have completed housing projects without environment clearance, the Supreme Court on Friday termed such constructions illegal, conceding that it might have committed a mistake by previously staying a National Green Tribunal (NGT) order halting construction of these projects.

The tribunal had struck down the UPA government's `office memorandum' (order) in 2012 and the amendment to it in 2013, which had condoned construction carried out by builders without obtaining prior environ ment clearance.

The NGT had termed the government order illegal and imposed a penalty of Rs 76.19 crore on seven private builders in Tamil Nadu for raising housing complexes without environment clearance. But the SC later stayed the NGT order and allowed builders to carry on with construction activity despite not having green clearance.

A builder approached the court seeking to join the bandwagon of those benefiting from the stay and carrying on with construction activity. But this proved the proverbial last straw on the camel's back and the court ran out of patience. The Supreme Court on Friday termed housing projects without environment clearance illegal.

A bench of Chief Justice T S Thakur and Justice R Banumathi told senior advocate Rajiv Dutta, who appeared for a builder, Satila Sehkari Awas Samiti, “How can these huge projects be permitted to come up without prior environment clearance? The NGT appears to have passed the correct order.“ When Dutta said many build ers were carrying on construction activity after the SC's stay of NGT's order, the bench said, “We will post this petition along with the other pending petitions and examine vacation of the earlier order granting stay on NGT order.We prima facie feel it was a mistake to grant stay.“

Turning its attention to those carrying on with construction, the bench said, “There should be some respect for law. You have obtained stay and are merrily constructing. This is a doubled-edged problem. One, you are polluting the environment. Two, you are seducing innocent buyers with the promise of a home in a construction that is illegal.

“The court can have no sympathy for those who violate law and thy for those who violate law and pollute the environment. Least that should be done is to vacate the stay.

These are huge projects creating huge environmental problem.“ The bench rejected Dutta's request for issuance of notice on the petition and tagged it with other pending pleas.

On July 7, the NGT had quashed the 2012 Office Memorandum and the 2013 amendment to it and set up a high-powered body to supervise implementation of its order that all projects required prior environment clearance under the Environment Protection Act.

‘Kuccha’ houses

Kuccha/ Kutcha means ‘raw’ or ‘incomplete.’ These are houses made of mud, thatch and other traditional materials.

People living in kuccha houses: First beneficiaries of Indira Awas Yojana

The Times of India, Jul 04 2015

2.37cr people still living in kuccha homes

One big number in the socio-economic caste census is 2.37 crore. This is the tally of rural households that lives in dwellings with “one or less room, kuccha walls and kuccha roof “.

The number of such households constitute 13.25% of the 17.91 crore rural households.

What makes the number important is the ongoing scheme that seeks to provide housing to the poor -Indira Awas Yojana.

The fresh finding lays the ground for targeting of families the census has found to be living in kuccha houses. It is evident that these households would be the first claimants for Indira Awas Yojana .

But they may just be `first among the unequals' since the Indira Awas Yojana target is the larger bloc of “below poverty line“ (BPL) and not just those who live with kuccha houses.

That BPL list of beneficiaries may not change much in the coming months since the Narendra Modi government has not yet decided on how to reconfigure the list of poor as is prevalent for last so many decades.

Loans

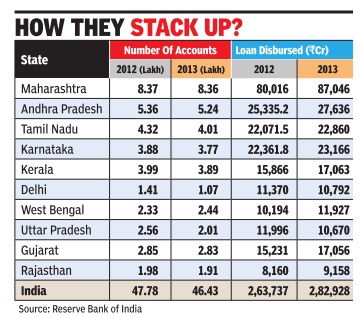

2012-13: accounts decrease but amount disbursed increase

Jan 03 2015

B Sivakumar

The housing market in 2013 seems to have catered to high-end users more than the middle class. As a result, while the number of housing loan accounts with commercial banks dropped by 2.7% between 2012 and 2013, the total amount disbursed through such loans increased by 7.3%, according to data just released by the Reserve Bank of India.

Realtors and bankers TOI spoke to felt the number of accounts had fallen due to the high price of real estate in cities, which was dissuading the lower income groups. On the other hand, the number of people going in for housing loan amounts ranging from Rs 2 crore to Rs 8 crore increased.

In 2012, the total number of housing loan accounts with all scheduled commercial banks was 47.78 lakh. In 2013, it came down to 46.43 lakh. During the same period, the total loan amount disbursed under this category increased from Rs 2.6 lakh crore to Rs 2.8 lakh crore.

The reduction in the number of accounts year-on-year is unusual. In 2011, the number of accounts was 47.32 lakh, which went up to 47.78 lakh in 2012, with the disbursed amount also increasing from Rs 2.5 lakh crore to Rs 2.6 lakh crore.

“There is a general perception that housing projects will be delayed and this has dissuaded many from investing in multi-storey apartments. The other reason could be the price of apartments in urban areas. The price of apartments within cities has not come down and only people who can afford in crores opt to invest in purchase of apartments,“ said Confederation of Real Estate Developers' Associations of India (Credai) Tamil Nadu chapter president NNandakumar.

Input costs have also increased by 8% to 25% in the last few years. This has increased construction costs and coupled with rising land prices, the cost of an apartment has also gone up significantly in urban areas, said Nandakumar. Almost all states and Union territories have seen a drop in the number of accounts. For example, Delhi had 1.41 lakh housing loan accounts in 2012 but in 2013, the number dropped to 1.06 lakh accounts. In Maharashtra, the number of accounts in 2012 was 83.67 lakh and it dropped to 83.60 lakh though the amount disbursed went up from Rs 83,674 crore to Rs 87,046 crore.

“The main reason for drop in housing loan accounts is the high price of property . Not many in the middle income group are able to afford houses in the city and there are many apartments with big builders awaiting customers,“ said Nallaperumal Pillai, chief manager of SBI personal banking division. Previously many would seek loan amounts ranging from Rs 15 to Rs 20 lakh but in the last few years, the amount has gone up to Rs 1 crore or more, said Pillai.

National Building Code (NBC)

2016

The Times of India, June 7, 2016

Ambika Pandit

The new National Building Code (NBC) will, for the first time, have a detailed chapter on making buildings and urban sites “accessible“ and “barrierfree“ for the elderly and persons with disabilities. Most buildings and public spaces are inaccessible to India's disabled, estimated at 2.68 crore, and the ministry of social justice and empowerment is keen to make “accessibility“ a focus area in the draft code.

The National Building Code, 2005, is under review and the draft is likely to be finalised soon. At a recent meeting of state ministers and secretaries (disability affa irs) here, the Union ministry said a dedicated chapter in the NBC will bolster efforts to address lack of access.

The NBC, which comes under the Bureau of Indian Standards, is not binding, but provides a national benchmark for construction activities. The code is adopted by state and local bodies. The draft chapter on accessibility says the requirements set out in the code “apply to all buildings and facilities open to and used by the public, including all forms of public housing by the governmentcivic bodies or private developers“. It does not apply to private residences.

The chapter takes into ac count a range of disabilities to make planning inclusive, including hearing disabilities, heart and lung diseases, and epilepsy . It elaborates that access would include planning designated cycleand motor-vehicle parking lots near a building's main entrance, accessible path to the entrance, appropriate external lighting, accessible external furniture (seats, bins etc), accessible information at the entrance to the site, suitable drop-off point near the main entrance, and easy access to information desks, lifts and toilet compartments.

The code also brings attention to the need for slipresistant walking surfaces, and important information communicated via two senses or more.

Number of buildings in India

2011: 30 crore buildings

Mar 02 2015

Census defines a house as a building or part of a building having a separate main entrance from a road, common courtyard, stairs and so on.According to the 2011 Census, there were about 30 crore such buildings in the country. About 71% were used for living, 7.5% were vacant, 5.3% were used as offices, shops while 2.6% were used for more than one purpose. India had about 30 lakh places of worship, a number higher than the combined total of schoolscolleges and hospitalsdispensaries.

Size of the average house

2011

See graphic, ' All India, %of total households '

Utilisation of Central funds

2017

UP slow in seeking funds to house poor: Centre, Feb 23, 2017: The Times of India

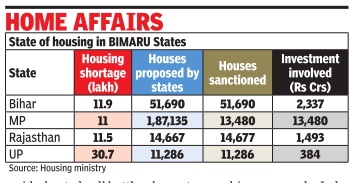

Challenging CM Akhilesh Yadav's development claims, the Centre has said UP has been one of the slowest in submitting proposals for housing for the poor despite having the highest shortfall.

“UP accounts for nearly 16% of the national housing shortage but the state submitted only 11,286 proposals. The Centre has approved them but these are a fraction of the shortage of 30.7 lakh houses in the state,“ urban development minister Venkaiah Naidu.

Its record of submissions is also the least among the four socalled BIMARU states. “Smaller states like Nagaland and Mizoram have got more houses sanctioned than UP under the PM Awas Yojna,“ he said.

Naidu's comments come amid a heated poll battle where BJP and SP-Congress are slugging it out with Akhilesh taking on PM Modi's attack that UP's development was both stunted and biased in favour of certain communities.

Naidu said the SP government had sent the proposals close to the election. “It is astonishing that the UP government did not send any proposals for long. We wrote 14 let ters seeking proposals. I also wrote to the CM. But still no result,“ Naidu said.

He said the state had been equally selective in power generation data and had for some time now stopped providing data on power cuts. “Imagine UP seeking and getting only Rs 384 crore out of the total Rs 25,819 crore. Isn't it plain and simple injustice to the poor of UP,“ Naidu asked.