ICICI Bank

(→ Money for refinancing Videocon loans was against policy) |

(→ Money for refinancing Videocon loans was against policy) |

||

| Line 147: | Line 147: | ||

The CBI’s enquiry had begun on allegations that the Videocon group received loans worth Rs 3,250 crore from ICICI Bank, which were part of Rs 40,000-crore loans the group secured from an SBI-led consortium of 20 banks. | The CBI’s enquiry had begun on allegations that the Videocon group received loans worth Rs 3,250 crore from ICICI Bank, which were part of Rs 40,000-crore loans the group secured from an SBI-led consortium of 20 banks. | ||

| − | == 2019/ Bonuses, ESOPs, and what Kochhar has to repay == | + | ==2019/ Bonuses, ESOPs, and what Kochhar has to repay== |

[https://timesofindia.indiatimes.com/business/india-business/sacked-with-retrospective-effect-chanda-kochhar-to-lose-esops/articleshow/67764942.cms Sacked with retrospective effect, Chanda Kochhar to lose ESOPs, January 31, 2019: ''The Times of India''] | [https://timesofindia.indiatimes.com/business/india-business/sacked-with-retrospective-effect-chanda-kochhar-to-lose-esops/articleshow/67764942.cms Sacked with retrospective effect, Chanda Kochhar to lose ESOPs, January 31, 2019: ''The Times of India''] | ||

Revision as of 15:37, 1 February 2019

This is a collection of articles archived for the excellence of their content. |

Contents |

HR/ human relations

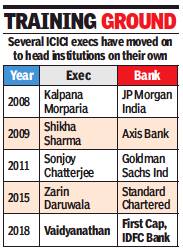

ICICI executives go on to head other banks

Mayur Shetty, Vaidya 5th ICICI-bred exec to head a bank, January 16, 2018: The Times of India

From: Mayur Shetty, Vaidya 5th ICICI-bred exec to head a bank, January 16, 2018: The Times of India

ICICI Group has taken on the mantle of being a leadership factory in the financial sector.

V Vaidyanathan is the latest in the series of ICICI Bank CEO aspirants to head a bank of his own. The merger of Capital First with IDFC Bank will result in Vaidyanathan fulfilling his dream of setting up a universal bank. Over the years, several ICICI Group’s senior executives have moved on to head institutions on their own.

In 2008, Kalpana Morparia, who completed her term on the board as joint managing director, stepped down to head JP Morgan in India.

Shikha Sharma was the next to move out of the group and took charge of Axis Bank in 2009. Sharma headed ICICI Prudential Life Insurance and was a candidate for the top position at ICICI Bank in 2008, which went to Chanda Kochhar — the private lender’s chief finance officer then.

Sharma went on to transform Axis Bank from a branch-oriented institution to a scalable model of ICICI-type business verticals. Around the same time, Renuka Ramnath, head of ICICI Ventures, quit and founded private equity platform Multiples.

Sonjoy Chatterjee, wholetime director of ICICI Bank, quit to head Goldman Sachs’ India operations in 2011. In the same year, Vaidyanathan quit ICICI Pru Life to take over Future Capital — which was rechristened as Capital First. Prior to ICICI Pru Life, he headed the retail lending and card business in ICICI Bank. While putting in his papers, Vaidyanathan said that he would build a new private sector bank. Eight years down the line, he will be achieving his ambition.

In 2015, Zarin Daruwala, former head of corporate banking at ICICI Bank, moved to Standard Chartered Bank to clean up the lender’s corporate loan book.

The most recent former ICICI banker to take over a CEO position is Rajiv Sabharwal — former ED in charge of retail. In September 2017, Tata Capital announced that Sabharwal would join as its CEO and MD from April 2018.

Compared to ICICI, executives in other private groups HDFC Bank and Kotak have tended to stick to their positions long-term.

Earlier the leadership training mantle was held by ANZ Grindlays in the ‘90s and to a certain extent by SBI as the industry opened up.

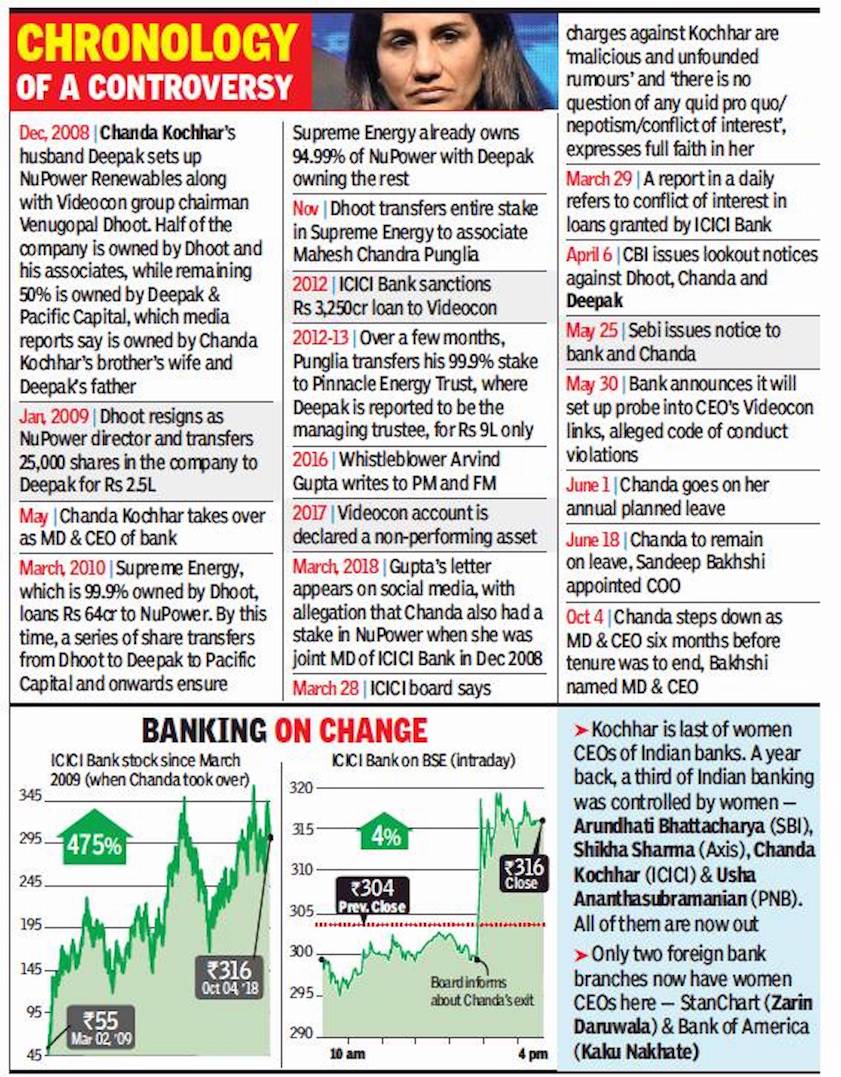

The Kochhar controversy

2018: CEO Kochhar resigns before probe ends

October 5, 2018: The Times of India

From: October 5, 2018: The Times of India

From: October 5, 2018: The Times of India

Chanda Kochhar, who was consistently rated as one of the world’s most powerful women in business, has resigned from ICICI Bank following months of escalating controversy, and amid multiple investigations.

Kochhar, who headed India’s largest private sector bank as chief executive officer & managing director since 2009, was dogged by allegations of quid pro quo deals with borrowers — notably the Dhoots of Videocon — and was on forced leave since June 18 pending the conclusion of an inquiry by former Supreme Court judge B N Srikrishna.

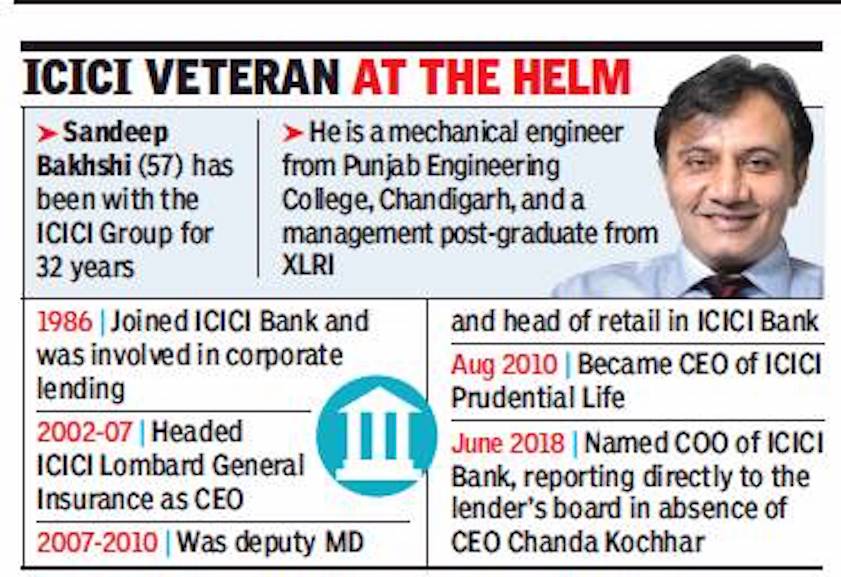

The ICICI Bank board on Thursday decided to accept Kochhar’s resignation ‘with immediate effect’—bringing to an end her 34 years with the bank—and appointed chief operating officer Sandeep Bakhshi as CEO for five years.

Kochhar’s term, her third, was due to end in March 2019.

While the board accepted her resignation, it did not clear her of impropriety.

“The inquiry instituted by the board will remain unaffected by this and certain benefits will be subject to the outcome of the inquiry,” the bank said.

Talk rife of Srikrishna probe not giving Kochhar clean chit

ICICI Bank announced on Thursday that the probe against Chanda Kochhar would continue—six months after the board had, many say rashly, “reposed full faith and confidence” in her and stated there was “no question of any quid pro quo/nepotism/conflict of interest” in her decisions.

At the centre of the storm is her husband Deepak Kochhar and his brother Rajiv, and their financial dealings with a number of business groups that received loans from ICICI Bank. Besides, Srikrishna, the CBI, Enforcement Directorate and Sebi have also been looking into allegations of misconduct and corruption.

Kochhar’s exit, which signalled an end to months of uncertainty, sent the bank’s stock up 4% amid an otherwise plummeting market. “We believe the appointment of a new CEO with a fairly long tenure will provide much needed clarity, direction and continuity to the bank,” said Lalitabh Shrivastawa of Sharekhan.

Ever since she was forced to step aside, there’d been widespread speculation as to whether she would wait for the investigation to end and attempt a comeback even if for just a few months. While there was no clear answer on Thursday as to why she chose to finally throw in the towel now, there’s been a growing sense that the enquiry report might not give her the clean chit she would have hoped for. Also, there’s been talk—which this paper has not been able to independently confirm—of Srikrishna broadening the scope of his enquiry to scrutinise a range of lending decisions. To top it all, the last few months have not been easy for top bankers with the RBI denying Shikha Sharma another term at Axis Bank and trimming Rana Kapoor’s tenure at Yes Bank.

Kochhar's resignation relieves her of the code of conduct rules of the bank. Since there was not much of a future left for her at the bank, the exit frees her to pursue other interests. Kochhar was appointed CEO in the aftermath of the global financial crisis. During her tenure in the bank she was seen to have taken several initiatives to improve workplace conditions for women.

Bakhshi, who was earlier MD and CEO of ICICI Prudential Life Insurance, was inducted in June as COO of the bank for a period of five years—which placed him in pole position to succeed Kochhar, sooner or later.

In a separate move, MD Mallya, who had been nominated director earlier this year, resigned from the board on health grounds.

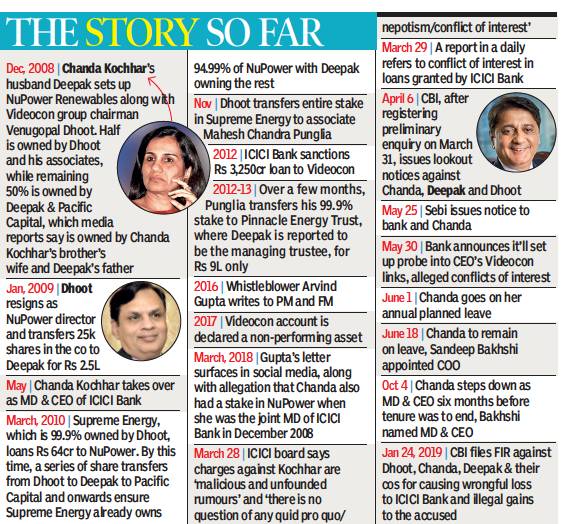

2019: Kochhar, husband booked for taking bribe from Dhoot

From: Neeraj Chauhan, Kochhar, husband booked for taking bribe from Dhoot, January 25, 2019: The Times of India

Got ₹64cr ‘Illegal Gratification’ In Exchange For ₹1,875cr: FIR

The CBI has filed a case against once celebrated banker, former ICICI Bank MD & CEO Chanda Kochhar, her husband Deepak Kochhar and Videocon group managing director Venugopal N Dhoot for alleged irregularities in six high-value loans worth Rs 1,875 crore. The loans to Dhoot’s companies were sanctioned between June 2009 and October 2011.

The CBI booked Kochhar, her husband and Dhoot for criminal conspiracy (to cause loss to ICICI Bank), cheating and corruption, charges serious enough for a jail term of seven years if convicted. The allegations had led to Kochhar’s exit from India's second-largest private sector bank last year.

The agency said loans were illegally given by Kochhar to the Videocon group in lieu of financial favours and in violation of the Banking Regulation Act, RBI guidelines

and the bank’s credit policy. The Kochhars received illegal payments, including a Rs 64 crore transfer from Dhoot, for the favour, the CBI claimed.

The FIR and impending prosecution marks a dramatic fall for Kochhar, once the toast of elite circles, where she was seen as a success story and a social ‘A lister’ who commanded the attention of policy makers in Delhi.

The CBI FIR could have serious ramifications for several top bankers and financial experts, as it says their roles may have to be probed. Big names include Sandeep Bakshi, current CEO-MD of ICICI Bank, K V Kamath, chairman of New Development Bank of BRICS countries; Sonjoy Chatterjee, chairman of Goldman Sachs India; K Ramkumar, ex-executive director of ICICI Bank; N S Kannan, MD & CEO of ICICI Prudential Life; Zarin Daruwala, CEO of Standard Chartered Bank India; Rajiv Sabharwal, MD-CEO of Tata Capital, and Homi Khusrokhan, exboard member of ICICI Bank.

These officials were on various sanctioning committees of ICICI Bank when loans were granted to the Videocon group in violation of rules, leading to losses for the bank.

Kochhar, a Padma Bhushan awardee, was on the sanctioning committees that approved a loan of Rs 300 crore to Videocon International Electronics Ltd and Rs 750 crore to Videocon Industries Ltd, given on August 26, 2009 and October 31, 2011, respectively. These two companies have been named in the FIR along with Deepak Kochhar’s firms.

The CBI raided Videocon offices at Nariman Point, Mumbai, and Aurangabad, apart from Deepak Kochhar’s companies NuPower Renewables Ltd and Supreme Energy Pvt Ltd.

₹64cr to Kochhars was quid pro quo

₹64cr to Kochhars quid pro quo for ₹300cr bank loan to Dhoot, January 25, 2019: The Times of India

Dhoot’s Firm Invested In Kochhar Co A Day After Loan Was Sanctioned: CBI

Loans to Videocon group turned non-performing assets in June 2017. The accusation against the ex-ICICI Bank chief and her spouse, however, date back to 2009

• What is CBI investigating?

The CBI’s charge is that ICICI Bank sanctioned credit facilities of Rs 3,250 crore to Videocon group companies — Trend Electronics, Century Appliances, Kail, Value Industries and Evan Fraser & Co. On September 7, 2009, the bank disbursed Rs 300 cr to Videocon International and the next day a company originally floated by Dhoot, transferred Rs 64 crore into NuPower Energy a company floated by Chanda Kochhar’s spouse Deepak Kochhar.

• Who are the accused?

The accused individuals are VN Dhoot, Chanda Kochhar and Deepak Kochhar Chanda was a part of the credit committee when loans were sanctioned to Videocon. The FIR also names NuPower Renewables floated by Deepak Kochhar and Dhoot’s companies which include Videocon International Videocon Industries, Supreme Energy and other unknown individual and unknown public servants.

• What is the role of the companies?

NuPower was set up in December 2008 as a JV between Kochhar and Dhoot. Supreme Energy (SEL) was Dhoot’s company, incorporated in July 2008. The control of this company was transferred to Deepak Kochhar after Dhoot stepped down in 15.1.2009. SEL was transferred by selling its shares to Pinnacle Energy Trust a company managed by Deepak Kochhar. SEL’s Rs 64 crore investment in September 2009 was the first major capital infusion into NuPower.

• What is the amount involved?

The FIR states that total loans worth Rs 3,250 crore were sanctioned to Videocon. CBI has pegged the value of misappropriated amount Rs 1,730 crore – the outstanding term loan as on April 26, 2012.

• Why are other ICICI Bank officials named?

CBI has named eight other officials who were part of the sanctioning committee. Sandeep Bakhshi, K Ramkumar, Sonjoy Chatterjee, NS Kannan, Zarin Daruwala, Rajiv Sabharwal, KV Kamath, Homi KhusrokhanThe report does not make any allegations against the officials but calls for an investigation into their role.

Money for refinancing Videocon loans was against policy

Neeraj Chauhan, January 25, 2019: The Times of India

From: Neeraj Chauhan, January 25, 2019: The Times of India

Videocon group companies were given loans totalling Rs 1,875 crore, which turned non-performing assets (NPAs), after Chanda Kochhar took charge of the bank as MD and CEO on May 1, 2009, according to an FIR registered by CBI.

Apart from a loan of Rs 300 crore given to Videocon International Electronics Ltd (VIEL) and Rs 750 crore to Videocon Industries Ltd (VIL), other loans given to Videocon group included Rs 175 crore to Millennium Appliances India Ltd (MAIL) on June 30, 2009, Rs 240 crore to Sky Appliances Ltd (SAL) on November 17, 2010, Rs 110 crore to Techno Electronics Ltd (TEL) on November 17, 2010, and Rs 300 crore to Applicomp India Ltd (AIL) on May 30, 2011.

The loans given to SAL, TEL and AIL were for the purpose of enabling them to repay unsecured loans availed by these companies from VIL. A loan was also sanctioned to VIL for refinancing the existing loans of the company, which was against the credit policy of the bank during the relevant period.

“These loans have turned NPAs, resulting in wrongful loss to ICICI Bank and wrongful gain to Videocon group and the Kochhars. The role of senior ICICI Bank officers may also be investigated. ICICI Bank had also released the security available in the form of FDR of Rs 50 crore in the accounts of SAL and TEL without any justification,” the CBI said.

The accounts of Videocon and its group companies were declared NPAs on June 30, 2017. The agency turned its preliminary enquiry (PE), registered in December 2017, into an FIR after it concluded that Kochhar had indeed connived with her husband and Dhoot and there was a “quid pro quo”. TOI had first reported the registration of PE against Deepak Kochhar and Dhoot on March 31 last year.

The CBI’s enquiry had begun on allegations that the Videocon group received loans worth Rs 3,250 crore from ICICI Bank, which were part of Rs 40,000-crore loans the group secured from an SBI-led consortium of 20 banks.

2019/ Bonuses, ESOPs, and what Kochhar has to repay

Sacked with retrospective effect, Chanda Kochhar to lose ESOPs, January 31, 2019: The Times of India

From: Sacked with retrospective effect, Chanda Kochhar to lose ESOPs, January 31, 2019: The Times of India

Ten months after the board of ICICI Bank declared it reposed “full faith and confidence” + in Chanda Kochhar, MD and CEO at the time, and “there was no question of...nepotism, favouritism or quid pro quo”, it decided to terminate her services with retrospective effect. It asked her to repay over Rs 10 crore in bonuses since April 2009, and said it would revoke her stock options, the current market value of which is around Rs 346 crore (the loss to her would be the difference between the market value and the price at which the options were allotted).

The move follows a report by former Supreme Court judge + , B N Srikrishna, which found Kochhar guilty of violating the bank’s code of conduct in disbursing loans to Videocon group. Kochhar had gone on “leave” on June 18 last year pending completion of the enquiry, but on October 4, put in her papers, perhaps sensing which way the wind was blowing.

In a statement issued here, ICICI Bank said the enquiry report concluded that Kochhar was “in violation of the bank’s code of conduct, its framework for dealing with conflict of interest and fiduciary duties, and in terms of applicable Indian laws, rules and regulations”.

This was because of her failure to effectively deal with conflict of interest and due disclosure or recusal requirements.

Legal action needed to recover bonuses

A report by former SC judge, B N Srikrishna has found Chanda Kochhar guilty of violating ICICI Bank’s code of conduct. Though it has not been made public, it comes on the heels of the Central Bureau of Investigation (CBI) filing a first information report against Venugopal Dhoot, Videocon Industries, and Chanda and Deepak Kochhar on charges that loans were disbursed in return for favours.

According to sources, the report did not indict the bank’s board, which had appointed Cyril Amarchand Mangaldas to examine allegations first made by whistleblower Arvind Gupta in 2106. Gupta, in a letter to all authorities — including the finance ministry and Reserve Bank of India — had alleged that there was an “illicit banking and commercial relationship between Videocon Group of Venugopal Dhoot and ICICI Bank’s MD & CEO Chanda Kochhar’s family-owned NuPower Renewable Group steered by her husband Deepak Kochhar for amassing wrongful personal gains”. While the law firm cleared Kochhar in 2016, it subsequently withdrew its report in October 2018 after being informed by the bank of the fresh allegations against its CEO. Kochhar went on leave on June 18, 2018 and resigned on October 4.

While the board will have to initiate proceedings to recover the bonuses, the options allotted to her under the employee stock option plan can be revoked as these are within the control of the bank. Kochhar has received close to 94 lakh options over 10 years. These options entitle the holder to buy shares at a fixed price. Employees typically exercise their rights to purchase when there is a substantial appreciation in the value of the shares. Legal experts said the action by the bank would not have any impact on the criminal proceedings undertaken by the CBI.

Senior management compensation

2016, 2017

`ICICI CEO drew Rs 6.09cr remuneration in 2016-17', May 31 2017: The Times of India

ICICI Bank has said its managing director and CEO Chanda Kochhar has drawn Rs 6.09 crore as total remuneration in 2016-17.

However, total remuneration of Rs 7.84 crore, including Rs 2.2 crore as performance bonus, was due to her for the fiscal ended March 2017.

The performance bonus is paid to the top management after clearance from the regulator RBI and it is staggered over next few years.

“Remuneration comprises various components including basic salary , allowances and perquisite, PF, superannuation allowances, gratuity and performance bonus. Payment of performance bonus is deferred over a multi-year period,“ ICICI Bank said in a statement.

“So the total compensation paid to our MD and CEO in FY17 stood at Rs 6.09 crore not Rs 7.84 crore,“ it said. According to latest annual report, the monthly basic salary for Kochhar will be within the range of Rs 1,350,000-Rs 2,600,000.

In her message, Kochhar said ICICI Bank is focused on capitalising on growth opportunities. At the same time, the bank is taking steps to address challenges in environment.

“Our large size, capital base, robust funding profile, extensive distribution network, diversified portfolio, presence across the financial services sector and leadership in technology , position us very well to leverage the growth opportunities across the economy ,“ Kochhar said.