Income Tax India: Expert advice, 2018-19

(Created page with "{| Class="wikitable" |- |colspan="0"|<div style="font-size:100%"> This is a collection of articles archived for the excellence of their content.<br/> </div> |} [[Category:Ind...") |

(→How to maximise your annual income) |

||

| Line 52: | Line 52: | ||

==How to maximise your annual income== | ==How to maximise your annual income== | ||

[https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F02%2F02&entity=Ar00602&sk=D4B12800&mode=image February 2, 2018: ''The Times of India''] | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F02%2F02&entity=Ar00602&sk=D4B12800&mode=image February 2, 2018: ''The Times of India''] | ||

| + | |||

| + | [[File: How to maximise one's annual income-Part I.jpg|How to maximise one's annual income-Part I <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F02%2F02&entity=Ar00602&sk=D4B12800&mode=image February 2, 2018: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | [[File: How to maximise one's annual income-Part II.jpg|How to maximise one's annual income-Part II <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F02%2F02&entity=Ar00602&sk=D4B12800&mode=image February 2, 2018: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | '''See graphics''': | ||

| + | |||

| + | ''How to maximise one's annual income-Part I'' | ||

| + | |||

| + | ''How to maximise one's annual income-Part II'' | ||

Revision as of 15:38, 5 February 2018

This is a collection of articles archived for the excellence of their content. |

How to reduce tax

February 2, 2018: The Times of India

Like scissor-happy film censors, taxmen are looking to snip off your pay cheque. The Times of India–EY Guide looks at the fine print of the Finance Bill and tells you how you can save your salary from the taxman, with as few cuts as possible

10 things individual taxpayers should know

Standard deduction of 40,000 is introduced but tax exemption for transport allowance of 1,600 per month and annual medical expense reimbursement of 15,000 is taken away – resulting in maximum tax savings of 2,081

Health and education cess @ 4% of income tax (including surcharge) replaces existing education cess and higher education cess @ 3%. Highest tax rate for individuals with taxable income of over 1 crore is up from 35.5% to 35.8% (nearly 36%)

Several reliefs for senior citizens:

(a) deduction for interest income from bank deposits, co-operative societies or post office up from 10,000 to 50,000; (b) deduction for health insurance premium and medical expenditure up from 30,000 to 50,000; and (c) deduction for treatment of specified diseases up from 60,000 to 1 lakh

Exemption on long term capital gains on sale of assets restricted to land or building.

Holding period of notified bonds increased to 5 years. This reduces scope of claiming capital gains tax exemption on sale of securities, jewellery, art etc

Withdrawal from National Pension Scheme is exempt from tax up to 40% of total amount payable for salaried individuals. This benefit is now extended to self-employed individuals also No adjustments to sale consideration on transfer of immovable property where variation between stamp duty value and sale consideration is not more than 5% of latter. This will reduce hardship for genuine transactions in real estate

Long-term capital gains (LTCGs) exceeding 1 lakh on sale of listed equity shares and listed equity-oriented mutual funds to be taxed @ 10% without indexation benefit. However, this will not apply to appreciation up to fair market value as on January 31, 2018. STT on such transaction continues to be levied. This will increase tax burden for long-term investors

Dividend distribution tax introduced @ 10% on dividend payouts to unit holders of equity-oriented funds. Cash available for distribution will decline, resulting in lower dividend payouts

If income in I-T return was lower than the figure in Form 26AS, Form 16A or Form 16, it led to issue of a demand notice. Now, for such mismatch you will not a receive a notice; this will reduce litigation. This beneficial amendment is retrospective from FY 2017-18

If you’ve been laid off and receive a compensation, it will now be taxed as ‘Other Income’. Earlier, one would have argued that it is a non-taxable capital receipt

3 PERSONAL INCOME TAX GOOGLIES YOU SHOULD WATCH OUT FOR

The standard deduction was introduced as an incentive for the salaried class. It gives an additional deduction of 5,800. However, the catch is that an increase by 1% in the cess which will be payable will dampen the benefit that standard deduction has to offer. In fact, those with gross salary of up to 10 lakh will have a mere 150 saving on tax

A drafting error seems to have crept in regarding introduction of tax on LTCGs. Tax at 10% will apply on LTCGs exceeding 1 lakh arising on sale of listed equity shares or units of equity mutual funds. However, there is no specific tax exemption on LTCGs up to 1 lakh. Something is definitely amiss

Women employees have to contribute 8% of their monthly pay towards employee provident fund, for the first three years. This is a reduction from the existing 12% contribution. While it results in a higher take-home, assuming the employee doesn’t make additional investments, it will result in a lower tax deduction under Section 80C and correspondingly, increase the tax liability. It’s unclear whether the condition will apply to existing employees or those who join the EPF scheme for the first time

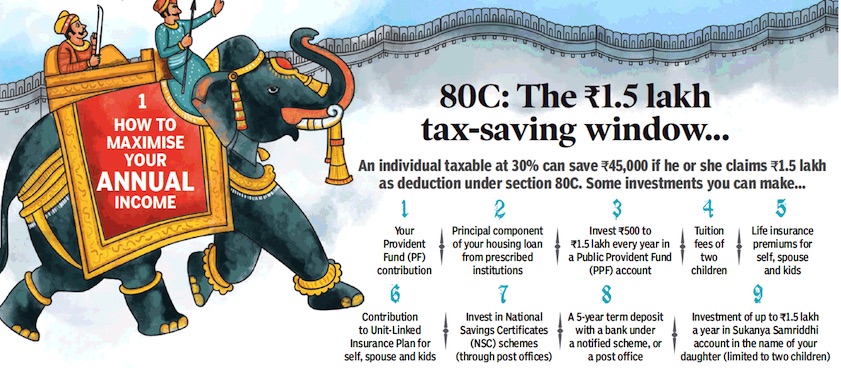

How to maximise your annual income

February 2, 2018: The Times of India

From: February 2, 2018: The Times of India

From: February 2, 2018: The Times of India

See graphics:

How to maximise one's annual income-Part I

How to maximise one's annual income-Part II