Income Tax India: Expert advice, 2018-19

This is a collection of articles archived for the excellence of their content. |

Contents |

How to reduce tax

February 2, 2018: The Times of India

Like scissor-happy film censors, taxmen are looking to snip off your pay cheque. The Times of India–EY Guide looks at the fine print of the Finance Bill and tells you how you can save your salary from the taxman, with as few cuts as possible

10 things individual taxpayers should know

Standard deduction of 40,000 is introduced but tax exemption for transport allowance of 1,600 per month and annual medical expense reimbursement of 15,000 is taken away – resulting in maximum tax savings of 2,081

Health and education cess @ 4% of income tax (including surcharge) replaces existing education cess and higher education cess @ 3%. Highest tax rate for individuals with taxable income of over 1 crore is up from 35.5% to 35.8% (nearly 36%)

Several reliefs for senior citizens:

(a) deduction for interest income from bank deposits, co-operative societies or post office up from 10,000 to 50,000; (b) deduction for health insurance premium and medical expenditure up from 30,000 to 50,000; and (c) deduction for treatment of specified diseases up from 60,000 to 1 lakh

Exemption on long term capital gains on sale of assets restricted to land or building.

Holding period of notified bonds increased to 5 years. This reduces scope of claiming capital gains tax exemption on sale of securities, jewellery, art etc

Withdrawal from National Pension Scheme is exempt from tax up to 40% of total amount payable for salaried individuals. This benefit is now extended to self-employed individuals also No adjustments to sale consideration on transfer of immovable property where variation between stamp duty value and sale consideration is not more than 5% of latter. This will reduce hardship for genuine transactions in real estate

Long-term capital gains (LTCGs) exceeding 1 lakh on sale of listed equity shares and listed equity-oriented mutual funds to be taxed @ 10% without indexation benefit. However, this will not apply to appreciation up to fair market value as on January 31, 2018. STT on such transaction continues to be levied. This will increase tax burden for long-term investors

Dividend distribution tax introduced @ 10% on dividend payouts to unit holders of equity-oriented funds. Cash available for distribution will decline, resulting in lower dividend payouts

If income in I-T return was lower than the figure in Form 26AS, Form 16A or Form 16, it led to issue of a demand notice. Now, for such mismatch you will not a receive a notice; this will reduce litigation. This beneficial amendment is retrospective from FY 2017-18

If you’ve been laid off and receive a compensation, it will now be taxed as ‘Other Income’. Earlier, one would have argued that it is a non-taxable capital receipt

3 PERSONAL INCOME TAX GOOGLIES YOU SHOULD WATCH OUT FOR

The standard deduction was introduced as an incentive for the salaried class. It gives an additional deduction of 5,800. However, the catch is that an increase by 1% in the cess which will be payable will dampen the benefit that standard deduction has to offer. In fact, those with gross salary of up to 10 lakh will have a mere 150 saving on tax

A drafting error seems to have crept in regarding introduction of tax on LTCGs. Tax at 10% will apply on LTCGs exceeding 1 lakh arising on sale of listed equity shares or units of equity mutual funds. However, there is no specific tax exemption on LTCGs up to 1 lakh. Something is definitely amiss

Women employees have to contribute 8% of their monthly pay towards employee provident fund, for the first three years. This is a reduction from the existing 12% contribution. While it results in a higher take-home, assuming the employee doesn’t make additional investments, it will result in a lower tax deduction under Section 80C and correspondingly, increase the tax liability. It’s unclear whether the condition will apply to existing employees or those who join the EPF scheme for the first time

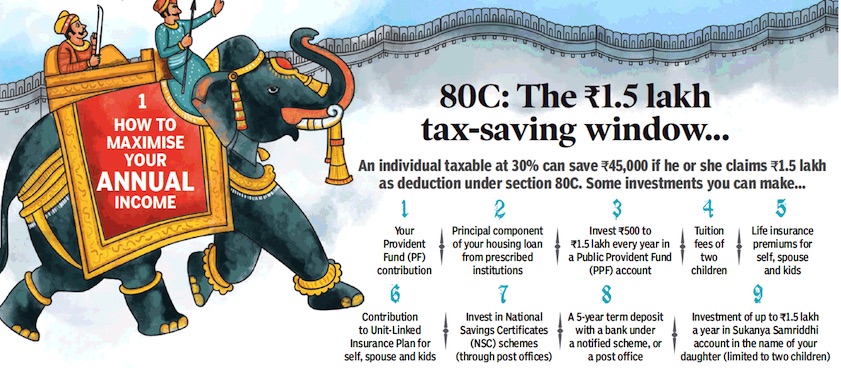

How to maximise your annual income

February 2, 2018: The Times of India

From: February 2, 2018: The Times of India

From: February 2, 2018: The Times of India

See graphics:

How to maximise one's annual income-Part I

How to maximise one's annual income-Part II

How to maximise your lifetime earnings

February 2, 2018: The Times of India

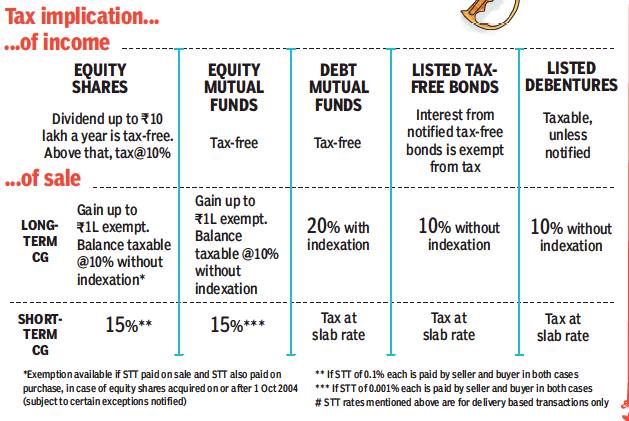

See graphic:

tax implication- i) of income and ii) of sale

Home loans can help you save tax

Before you buy that residential property, brush up on your home economics

Tax benefits on principal

Equated monthly instalments (EMIs) are typically divided into principal (the amount you took as loan) and interest (the cost of servicing the loan). Principal is allowed as a deduction from your gross total income (subject to an overall cap with other eligible investments of 1.5 lakh)

Tax benefits on interest paid

Interest payable on ‘self-occupied’ property is subject to a maximum deduction of 2 lakh under the head ‘Income from House Property’. This reduces your total tax liability. But to claim this, acquisition or construction should be completed within 5 years from the end of the financial year in which the loan was taken. If not, the deduction will be limited to 30,000.

Additional deduction of 50,000 is allowed for first-time home buyers if certain conditions are fulfilled

If you have rented out your property, the difference between the rent you get after adjustment of municipal taxes, standard deduction and interest on housing loan is your ‘loss’. For example, if the annual rent is 5 lakh, after considering standard deduction @30% of gross value (which is generally rent), 3.5 lakh is your loss. As per Finance Act 2017 amendment, you can set off only 2 lakh of such loss against your other income, say salary. The balance (surplus loss of 1.5 lakh), can be carried forward over eight years. However, it can only be set off against your rental income

Why not to go alone on a home loan, and other useful pointers 1 It makes tax sense to purchase the new apartment jointly – say with your spouse, then both of you are entitled to a deduction of 2 lakh each for interest. In case you have a working son/daughter and the bank is willing to split the loan three ways, all three can avail deduction up to 2 lakh each on self- occupied property 2 A ready-to-move flat could cost more. Booking an under-construction flat may work out cheaper as I-T laws permit you to claim the total interest paid during the predelivery period as a deduction in five equal instalments starting from the financial year in which the construction was completed or you acquired your apartment (generally this denotes the date of possession). Of course, the maximum you can claim as a deduction per year continues to be 2 lakh, in case of selfoccupied property 3 Interest on a loan taken from an employer, friend, or even private lender is eligible for deduction, but you should obtain a certificate from the lender. Note that principal repayment is not eligible for deduction under 80C 4 Expense incurred towards repair and maintenance are not allowed as a deduction from income from house property. However, a standard deduction @ 30% of gross value (which is generally the rent received) is allowed to compensate for repair and maintenance expenses of a let-out house property. Also, municipal taxes paid during the financial year is allowed as a deduction 5 It’s best to rent out your second home from an I-T perspective. If you have not let it out, it will still attract tax on its expected market rent (known as deemed value). It’s better to pay tax on rent which you actually earn

Govt takes 10% bite out of capital gains

If you invest in the capital market there is bad news in store. Capital gains in excess of 1 lakh arising on sale of listed shares or units of equity-oriented mutual funds held for over 12 months will be taxable at a concessional rate of 10% without indexation benefit

LONG-TERM CAPITAL GAINS (LTCG)

Capital gain on sale of all listed securities in India mentioned above (other than debtoriented MFs), held for more than 12 months are treated as LTCG. Unlisted securities in India and immovable property have to be held for more than 24 months to qualify for LTCG. In all other types of capital assets, including debt-oriented MFs, sale post 36 months will qualify as LTCG.

SHORT-TERM CAPITAL GAINS (STCG)

When securities (listed/ equity-oriented MF/zero coupon bonds) are held for up to a year, the gain is treated as STCG. For all other type of capital assets, holding up to 24/36 months will qualify as STCG.

SET-OFF PROVISIONS FOR CAPITAL LOSSES ARE RATHER RESTRICTIVE

• Loss from transfer of a long-term capital asset can be set off against gain from transfer of any other long-term capital asset in the same year. But, long-term capital loss cannot be set off against short-term capital gains

• Loss from transfer of a short-term capital asset can be set off against gain from transfer of any other capital asset in the same year

• Any unutilised capital loss after absorption in the same year can be further carried forward to next eight years and be utilised under the same conditions as above

• You should file your I-T return before July 31 to carry forward any losses

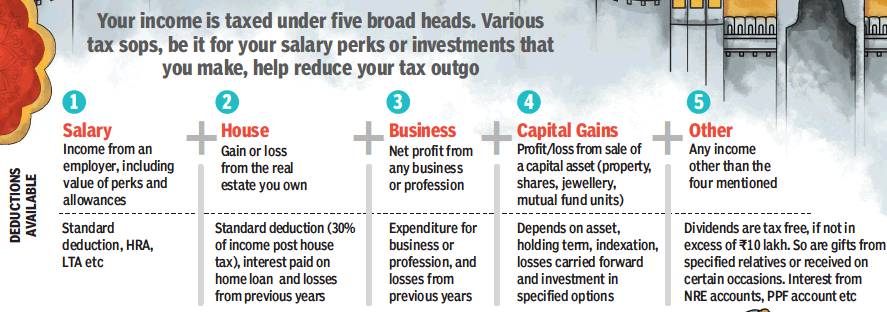

How to maximise your monthly income

February 2, 2018: The Times of India

From: February 2, 2018: The Times of India

See graphic:

Tax deductions available on salary, house, business, capital gains and other sections

House rent allowance (HRA)

This is the most common CTC component. Those staying in rented accommodation can avail of an exemption against the HRA received and only the balance will be taxable

THE EXEMPTION IS LIMITED TO THE LOWEST AMONG

1 Rent 2 50% of salary* where the paid less house is situated either in Delhi, 10% of Mumbai, Kolkata or Chennai, salary* and 40% of salary in other cities 3 Actual HRA received

If your CTC doesn’t contain HRA, deduction for rent paid is available from gross taxable income, subject to various limits & conditions (maximum deduction 5,000 pm)

If you live in a house you own, the HRA component is fully taxable *Salary means basic salary and dearness allowance

What if accommodation is provided by the employer?

Tax implications depend on: Type of accommodation – hotel, serviced apartment, leased accommodation Whether the property is owned by the employer or leased by the employer for you Whether the accommodation is furnished or not Your salary level The city/town where you have been provided accommodation

Depending on a combination of factors, you may check with a tax adviser which is more beneficial to you – claiming HRA or living in your employer’s flat

Leave travel concession (LTC)

LTC exemption is allowed in respect of two domestic journeys taken in a block of four years. The new block commenced on January 1, 2018. Restrictions apply. Eg. If you are travelling by air, it is limited to economy class airfare for the shortest route to your destination.

No exemption is available for hotel and local conveyance expenses.

LEAVE ENCASHMENT

If you haven’t availed of your entitled leave, you may have an option to get it encashed – your employer may permit this only on retirement or resignation. The maximum aggregate exemption available in a lifetime is 3 lakh

CLUBBING ADDS TO TAX

Income from investments made in the name of your minor child or spouse could be added to your taxable income resulting in higher outgo

FICTITIOUS INCOME

If you haven’t let out your second home, notional rent is added to your taxable income

Reimbursements

Reimbursements of your telephone expenses, including data charges, are exempt. There is no cap on the maximum amount that can be claimed for phone expenses. However, your employer may put an internal cap. In addition, if you get meal vouchers, such as Sodexo coupons, these are exempt from tax to the extent of 50 per meal. You could also claim children’s education allowance (restricted to two children) – albeit a small tax break of 100 per child and an additional 300 for hostel expenses, if any. Exemption on reimbursement of medical expenses up to 15,000 is no longer available.

Car perquisites: The perquisite value of a car benefit provided by an employer depends on who owns the car, the capacity of the engine, whether you or the employer pays for maintenance, running cost (including fuel), driver, and if the use is official or personal. Some employers also offer car on lease, which could bring down your tax.

Transport allowance: Any such allowance paid by employer to meet your daily conveyance needs between office and home was tax exempt up to 1,600 per month till FY 2017-18. You need to pay tax from FY 2018-19.

Employee Provident Fund (EPF)

PF withdrawal after rendering five or more years of continuous services is tax free. However, interest earned on accumulated balance in PF account after end of employment/retirement is taxable. However, no minimum number of years of service is required for tax-free withdrawals to cover expenses for illnesses like cancer or TB or surgeries