Indian Premier League (IPL)

(→IPL: 2013-2014) |

|||

| Line 42: | Line 42: | ||

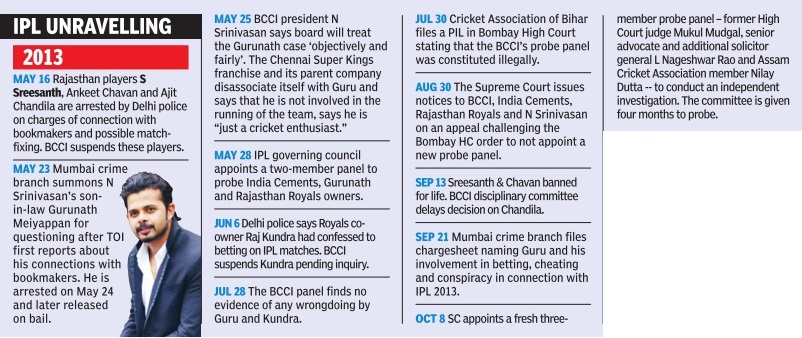

[[File: IPL 2013.jpg|IPL: 2013; Graphic courtesy: [http://epaperbeta.timesofindia.com/Gallery.aspx?id=15_07_2015_034_007_009&type=P&artUrl=LIKE-A-ROW-BEFORE-A-BIG-FILMS-RELEASE-15072015034007&eid=31808 ''The Times of India'']|frame|500px]] | [[File: IPL 2013.jpg|IPL: 2013; Graphic courtesy: [http://epaperbeta.timesofindia.com/Gallery.aspx?id=15_07_2015_034_007_009&type=P&artUrl=LIKE-A-ROW-BEFORE-A-BIG-FILMS-RELEASE-15072015034007&eid=31808 ''The Times of India'']|frame|500px]] | ||

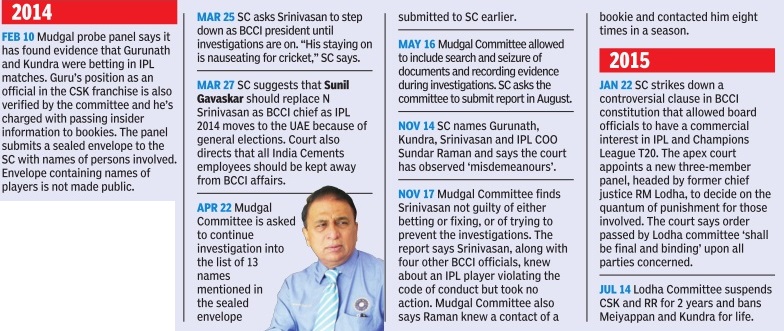

[[File: IPL 2014-2015.jpg|IPL: 2014-2015; Graphic courtesy: [http://epaperbeta.timesofindia.com/Gallery.aspx?id=15_07_2015_034_007_009&type=P&artUrl=LIKE-A-ROW-BEFORE-A-BIG-FILMS-RELEASE-15072015034007&eid=31808 ''The Times of India'']|frame|500px]] | [[File: IPL 2014-2015.jpg|IPL: 2014-2015; Graphic courtesy: [http://epaperbeta.timesofindia.com/Gallery.aspx?id=15_07_2015_034_007_009&type=P&artUrl=LIKE-A-ROW-BEFORE-A-BIG-FILMS-RELEASE-15072015034007&eid=31808 ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | =The IPL numbers= | ||

| + | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=LIKE-A-ROW-BEFORE-A-BIG-FILMS-RELEASE-15072015034007 ''The Times of India''] | ||

| + | |||

| + | ==IPL broadcast rights== | ||

| + | |||

| + | In 2008, the consortium of India's Sony Television network and the Singaporebased World Sports Group (WSG) had secured the rights of the IPL for ten years at a cost of more than $1 billion.As part of the deal, the consortium would pay the BCCI $908 million for the telecast rights and $108 million for the promotion of the tournament. However, in a reworked deal next year, BCCI signed a new deal with MSMPL (Multi Screen Media Pvt Ltd) and World Sport Group (WSG) for Rs 8,200 crore with 80% of the amount to come from MSMPL. Later WSG exited the deal after a one-time payoff. | ||

| + | |||

| + | ==IPL title rights== | ||

| + | |||

| + | DLF had bought the title rights of the IPL for five years in 2008 for Rs 200 crore.In 2013, Pepsi bid for the rights for the next five years and won it at Rs 396 crore. | ||

| + | |||

| + | ==IPL business model== | ||

| + | |||

| + | IPL runs on a Central and Local pool of sponsorships for revenues. Broadcasters, tournament sponsors, title rights holders and bid monies form the central pool. Gate money, in-stadia advertising, franchise sponsors and merchandising make for the Local Pool. The Central Pool revenue is shared by all eight franchises on a percentage basis. The franchise has to fend for itself where Local Pool is concerned. | ||

| + | |||

| + | ==Future== | ||

| + | |||

| + | The players from Royals and CSK franchise cannot be bought by or absorbed in any other franchise. Each team has a limit of 26 players and a fixed purse. For CSK and RR players to participate in IPL, the BCCI will have to float a tender for two fresh teams. There is no restriction if CSK and RR want to sell their franchises ahead of the coming season, after BCCI clearance. A full-fledged auction of all players is now scheduled after the 2016 edition of IPL.Both Royals and CSK have 26 players each and so do most other franchises. CSK has one-year contracts with most of its cricketers, who can go back into the auction pool but other franchises will have to off-load players to be able to buy them. With Kochi Tuskers winning their arbitration with BCCI, they're free to participate in IPL. Some players can be included in the Kochi franchise if they agree to play the tournament. However, one new franchise will still have to be auctioned. If Kochi Tuskers are unwilling to play, BCCI will have to auction two new franchises. IPL broadcast rights are up for a resale in 2017. | ||

Revision as of 18:49, 16 July 2015

Contents |

Indian Premier League: The economics of

Title and authorship of the original article(s)

|

IPL-6 may clock 27% more in ad revenues By Samidha Sharma, Times of India, 2013/03/15 |

This is a newspaper article selected for the excellence of its content. |

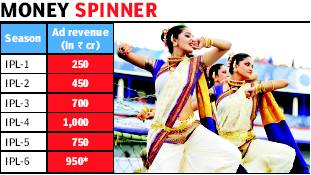

Advertising revenues

Multi Screen Media (MSM), the official broadcaster of Indian Premier League (IPL) has brought on board a total of eight sponsors for the sixth edition of the Twenty20 tournament, which would help it rake in Rs 200 crore more over last year, after lowering its ad rates by 10-15%. Three more sponsors are expected to join over the next two weeks.

The presenting sponsors — PepsiCo and Vodafone — have shelled out around Rs 40-60 crore each while the associate sponsors, which include Tata Photon, Karbonn tablets, Godrej, Samsung Mobiles, Panasonic and Usha Appliances, have paid around Rs 25-30 crore each for being seen on the channel during the tournament.

MSM is looking to earn Rs 950 crore as advertising revenue from IPL-6, up 27% from Rs 750 crore it garnered last year, a senior executive from the company told TOI.

This will be the first time that the IPL will have three feeds — the regular one on SET max, while Sony Six will broadcast a Hindi feed along with an HD one.

Some of the other sponsors likely to be signed on soon for the tournament, which starts on April 3, are Cadbury and Havells — both have had a long-term association with the IPL. This year, MSM has two presenting sponsors and is expected to close nine associate sponsors, up from only five which it managed last year. The channel has also struck large deals with Coca-Cola, Parle Agro, Marico, Berger Paints and Airtel, besides others, filling 70% of its inventory.

“Last year, we had increased the ad rates but could not sell the entire inventory. Our strategy to reduce rates has worked very well and we have seen the interest levels go up. Advertisers from all sectors are on board this year, signaling a revival in sentiments,” said Rohit Gupta, president, MSM.

During 2012, a 10-second ad spot during the IPL had a price tag of Rs 4.5-5.5 lakh, making it a highly premium property. However, reduction in rates has made it far more affordable, said media planners who buy TV airtime for advertisers. “If TV ratings had to fall, it had to fall last year. Now they have stabilized. It is definitely value for money at this rate and with lesser risk,” said Ajit Varghese, MD (South Asia), Maxus, which has bought airtime for telecom major Vodafone.

The IPL reached 170 million eyeballs and clocked an average rating of around 3.27 last year, according to TAM Media Research. MSM’s Gupta said he is expecting the reach to further grow this season. “If there is a big product launch or a new ad campaign, this is a large platform which is a must for any brand. It is a property which is targeted at male audiences, so it works well for brands which directly communicate with this audience group,” said Basabdutta Chowdhury, CEO of Platinum Media, a division of media buying group Madison. This year, soft drink giants PepsiCo is the new title sponsor of the IPL, having paid Rs 396 crore for the next five seasons.

IPL: 2013-2014

The IPL numbers

IPL broadcast rights

In 2008, the consortium of India's Sony Television network and the Singaporebased World Sports Group (WSG) had secured the rights of the IPL for ten years at a cost of more than $1 billion.As part of the deal, the consortium would pay the BCCI $908 million for the telecast rights and $108 million for the promotion of the tournament. However, in a reworked deal next year, BCCI signed a new deal with MSMPL (Multi Screen Media Pvt Ltd) and World Sport Group (WSG) for Rs 8,200 crore with 80% of the amount to come from MSMPL. Later WSG exited the deal after a one-time payoff.

IPL title rights

DLF had bought the title rights of the IPL for five years in 2008 for Rs 200 crore.In 2013, Pepsi bid for the rights for the next five years and won it at Rs 396 crore.

IPL business model

IPL runs on a Central and Local pool of sponsorships for revenues. Broadcasters, tournament sponsors, title rights holders and bid monies form the central pool. Gate money, in-stadia advertising, franchise sponsors and merchandising make for the Local Pool. The Central Pool revenue is shared by all eight franchises on a percentage basis. The franchise has to fend for itself where Local Pool is concerned.

Future

The players from Royals and CSK franchise cannot be bought by or absorbed in any other franchise. Each team has a limit of 26 players and a fixed purse. For CSK and RR players to participate in IPL, the BCCI will have to float a tender for two fresh teams. There is no restriction if CSK and RR want to sell their franchises ahead of the coming season, after BCCI clearance. A full-fledged auction of all players is now scheduled after the 2016 edition of IPL.Both Royals and CSK have 26 players each and so do most other franchises. CSK has one-year contracts with most of its cricketers, who can go back into the auction pool but other franchises will have to off-load players to be able to buy them. With Kochi Tuskers winning their arbitration with BCCI, they're free to participate in IPL. Some players can be included in the Kochi franchise if they agree to play the tournament. However, one new franchise will still have to be auctioned. If Kochi Tuskers are unwilling to play, BCCI will have to auction two new franchises. IPL broadcast rights are up for a resale in 2017.