Investments and savings (personal): India

(→2011-16: Indians invest more in equity, debt) |

(→2016: FDs top) |

||

| Line 79: | Line 79: | ||

However, 95% of rural survey respondents had bank accounts, 47% life insurance, 29% post office deposits and 11% saved in precious metals. On a positive note, the survey found the investor base in India increasing, as nearly 75% of the respondents said they had participated in securities markets for the first time in the last five years. The survey had a sample size of 50,453 households and using a bootstrapping methodology , it was estimated there were a total of 3.37 crore investor households in India. Of these, 70% reside in urban areas. | However, 95% of rural survey respondents had bank accounts, 47% life insurance, 29% post office deposits and 11% saved in precious metals. On a positive note, the survey found the investor base in India increasing, as nearly 75% of the respondents said they had participated in securities markets for the first time in the last five years. The survey had a sample size of 50,453 households and using a bootstrapping methodology , it was estimated there were a total of 3.37 crore investor households in India. Of these, 70% reside in urban areas. | ||

| + | |||

| + | ==2017== | ||

| + | [http://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2017%2F12%2F13&entity=Ar02717&sk=700FD646&mode=text Indians invested more in stocks than in FDs in FY17, December 13, 2017: ''The Times of India''] | ||

| + | |||

| + | [[File: Total wealth, in FDs & bonds, stocks, insurance, savings deposits, PF, MFs and others, FY16, FY17.jpg|Total wealth, in FDs & bonds, stocks, insurance, savings deposits, PF, MFs and others, FY16, FY17 <br/> From: [http://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2017%2F12%2F13&entity=Ar02717&sk=700FD646&mode=text Indians invested more in stocks than in FDs in FY17, December 13, 2017: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | Indian investors are finally moving from bank fixed deposits (FDs), real estate and gold, the traditional investment products, to equities and mutual funds. In fiscal 2017, Indians invested Rs 8 lakh crore in stocks compared to Rs 3.4 lakh crore in FDs. | ||

| + | |||

| + | At the end of FY17, total investments by Indians in equities at Rs 37.6 lakh crore was just Rs 2.5 lakh crore short of total FDs, pegged at Rs 40.1 lakh crore. This is the closest that the total equity wealth of Indian investors have ever come to bank FDs, a report by Karvy Private Wealth showed. At the end of FY16, the difference was over Rs 7 lakh crore with Rs 36.8 lakh crore in FDs compared to Rs 29.6 lakh crore in stocks, the report showed. | ||

| + | |||

| + | The firm believes total investments by Indians in equities will surpass wealth in bank FDs by the end of the current fiscal. “After losing a bit of traction, financial assets have regained their pole position in FY17. Wealth creation through equities has not been restricted to big institutional investors as individual participation, too, saw a huge jump via the direct as well as mutual funds route,” said Abhijit Bhave, CEO, Karvy Private Wealth. | ||

=Saving habits= | =Saving habits= | ||

Revision as of 13:35, 14 December 2017

This is a collection of articles archived for the excellence of their content. |

Contents |

Investment in stock markets, banks, mutual funds, gold

1995-2015

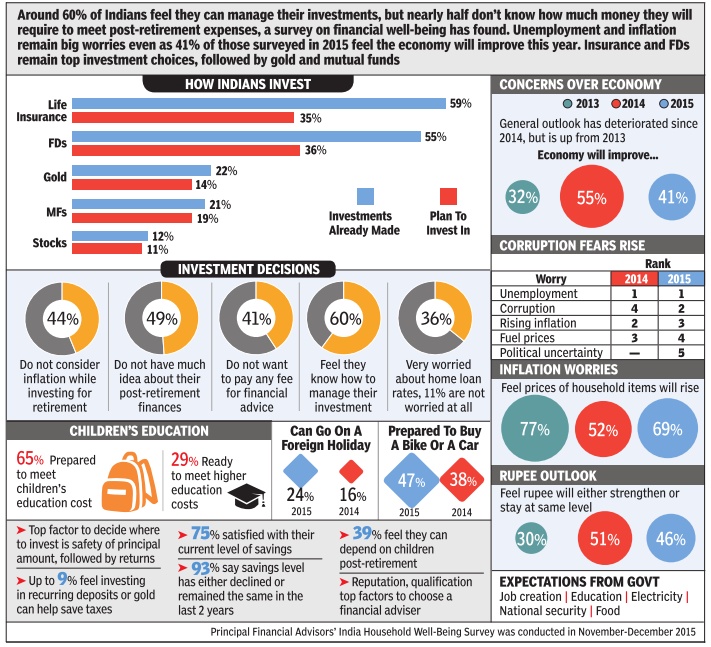

The Times of India, Nov 02 2015

Uma Shashikant

Much has changed in the way India invests since 1995, and mostly for the better

Everyone is celebrating 20-year milestones these days. The nice thing about history is that we can attempt to explain the present by looking at the past, with the benefit of hindsight. What then seemed tough, foolish and difficult, seems pathbreaking today. Then there are things that do not change, ever. It's my turn to do the 20-year flashback this week. Stock markets

In June 1994, a new wholesale market for debt was set up. Funded by institutions, it used the best satellite technologies and tried to create a market where institutions would buy and sell debt securities.But the debt markets in India were not ready for it. The leaders changed course and deployed the systems to create a new equity market. It wasn't easy .

Equity markets were already being served by 20+ stock exchanges, the oldest and largest in the same city as the new one. The new market went ahead nevertheless, permitting trades in equity shares listed on other exchanges on its satellite-linked electronic system.

In 1995, the experiment succeeded.The new market overtook the old in business. The National Stock Exchange (NSE) is an example of how a new entity can bring about positive change. How it can create a new system with higher efficiency , lower costs, wider participation, better technology and higher integrity .NSE modified how investors trade in India, creating a trading, clearing and settlement system on par with the best.

Banks

In January 1995, HDFC Bank opened its first branch in Mumbai. In March 1995, it offered shares to the public in an IPO priced at `10 per share, to mobilise `50 crore. The issue was oversubscribed 55 times and opened to trade at `40. The popular opinion was that the bank would soon merge with its illustrious parent.

All through the 1990s, public sector banks hogged the limelight for their equity offerings. No one gave private sector banks much of a bright prospect.

The PSU banks were well entrenched.They were bankers to the government and public entities. The cost of funds for the public sector banks was low, and the regulatory requirements was uniformly applicable to the new private banks too.If the new banks tried to bring in sophistication and technology , they had to face competition from foreign banks, that held a monopoly over the NRI and remittance businesses, apart from working with the large private corporate treasuries. Where was the room for new private banks? Twenty years on, private banks have built a new retail lending market that is large and growing. They have captured a large share of the institutional business. They offer superior technologies and service, and have managed to do so at a lower cost compared to their public sector counterparts, and have stronger, better and bigger balance sheets.

Mutual Funds

If one looked at mutual funds in 1995, UTI dominated with over 90% market share.While the other players were trying to find their feet, UTI was launching a slew of monthly income plans (MIPs) which promised double digit returns. The other public sector mutual funds were suffering the consequences of faulty product launches in 1991-92. They had sold 7-year closed end equity funds, with the promise of doubling and tripling the returns, and the NAVs were nowhere near target.

The new private sector funds did their best to market their products, but did not mobilise much money from investors who were worried about the lack of liquidity . Mutual funds had to list on the market and it was common for prices to be lower than the NAV . Approvals were tough to get. Banks and institutions were not selling funds, yet.

It was in 1995 the first wave of process innovation hit the mutual fund industry with open-ended funds with account statements and no certificates. Dividend and growth options were offered and banking distribution was tied up. But the struggle was with the idea of assured returns that investors clamoured after.

In 1995, when global investors were asking for depository and T+3 rolling settlement, what we had then seemed rudimentary . Today, the NSE has helped set up several stock markets across the world and is a model for risk management and settlement guarantees. In 1995, it seemed banking belonged to the public sector.Today , the success of private banks has established that PSU banks will have to restructure or fade away .

As for mutual funds, there is enough evidence to establish that a diversified portfolio over the long run beats all other investment options. But investors seem busy trading stocks and investing in bank deposits, and not engaging enough with funds. The plague of new schemes sold with inflated promises and performing schemes staying in the background has not changed. Not in 20 years.

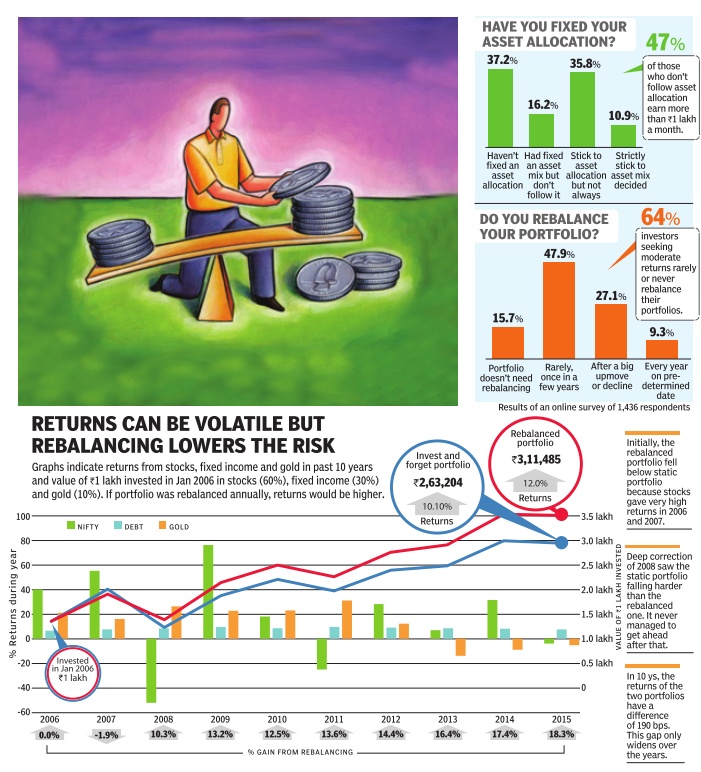

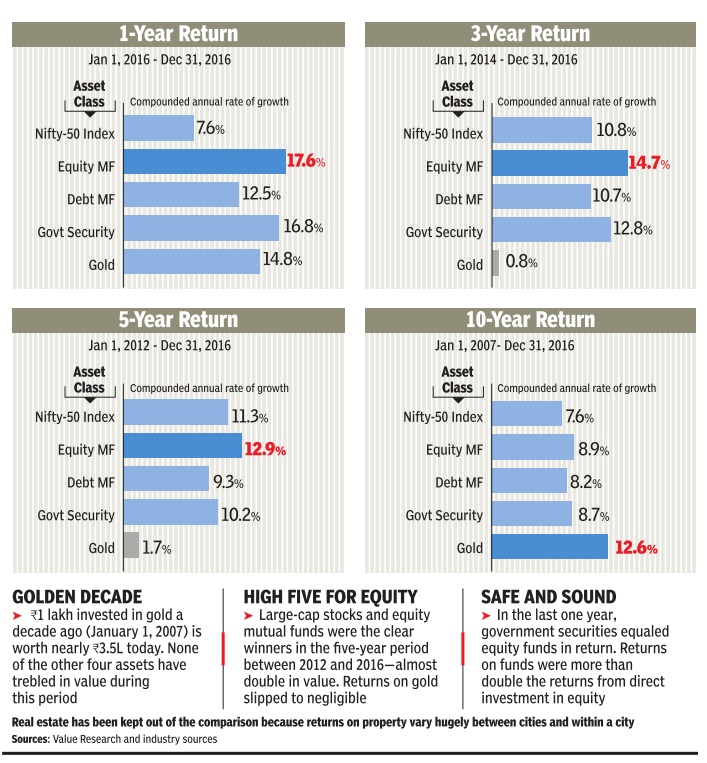

2007-16

The Times of India, Feb 02 2017

No one asset outperforms others consistently over time. In the past one year, equity mutual funds and government securities gave higher returns than other assets. Over 10 years, it's gold that beats all other asset classes. For consistent long-term gains, put your eggs in several baskets. Of course, returns is only one of the three criteria to look for before investing--safety and liquidity are the other two. Government securities, the safest investment option, matched returns from equity funds last year. But this is a rare occurence

2016: FDs top

FDs most preferred saving option: Survey, April 6, 2017: The Times of India

More than 95% households prefer to park their money in bank deposits, while less than 10% opt to invest in mutual funds or stocks. Life insurance was the second most preferred investment vehicle, followed by precious metals, post office savings instruments and real estate, a survey by Sebi showed. It also showed that mutual funds came in at the sixth place (9.7%), followed by stocks (8.1%), pension schemes, company deposits, debentures, derivatives and commodity futures (1%) as investment vehicles for the urban households. Respondents were allowed to select multiple options.

The survey , conducted across urban and rural areas of the country , showed that among rural households, not even 1% of the survey respondents were investors, while even the awareness about mutual funds and equities was dismal at just 1.4%.

However, 95% of rural survey respondents had bank accounts, 47% life insurance, 29% post office deposits and 11% saved in precious metals. On a positive note, the survey found the investor base in India increasing, as nearly 75% of the respondents said they had participated in securities markets for the first time in the last five years. The survey had a sample size of 50,453 households and using a bootstrapping methodology , it was estimated there were a total of 3.37 crore investor households in India. Of these, 70% reside in urban areas.

2017

Indians invested more in stocks than in FDs in FY17, December 13, 2017: The Times of India

From: Indians invested more in stocks than in FDs in FY17, December 13, 2017: The Times of India

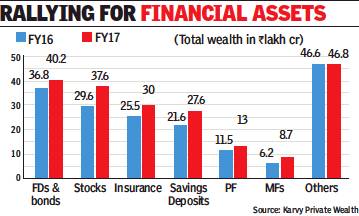

Indian investors are finally moving from bank fixed deposits (FDs), real estate and gold, the traditional investment products, to equities and mutual funds. In fiscal 2017, Indians invested Rs 8 lakh crore in stocks compared to Rs 3.4 lakh crore in FDs.

At the end of FY17, total investments by Indians in equities at Rs 37.6 lakh crore was just Rs 2.5 lakh crore short of total FDs, pegged at Rs 40.1 lakh crore. This is the closest that the total equity wealth of Indian investors have ever come to bank FDs, a report by Karvy Private Wealth showed. At the end of FY16, the difference was over Rs 7 lakh crore with Rs 36.8 lakh crore in FDs compared to Rs 29.6 lakh crore in stocks, the report showed.

The firm believes total investments by Indians in equities will surpass wealth in bank FDs by the end of the current fiscal. “After losing a bit of traction, financial assets have regained their pole position in FY17. Wealth creation through equities has not been restricted to big institutional investors as individual participation, too, saw a huge jump via the direct as well as mutual funds route,” said Abhijit Bhave, CEO, Karvy Private Wealth.

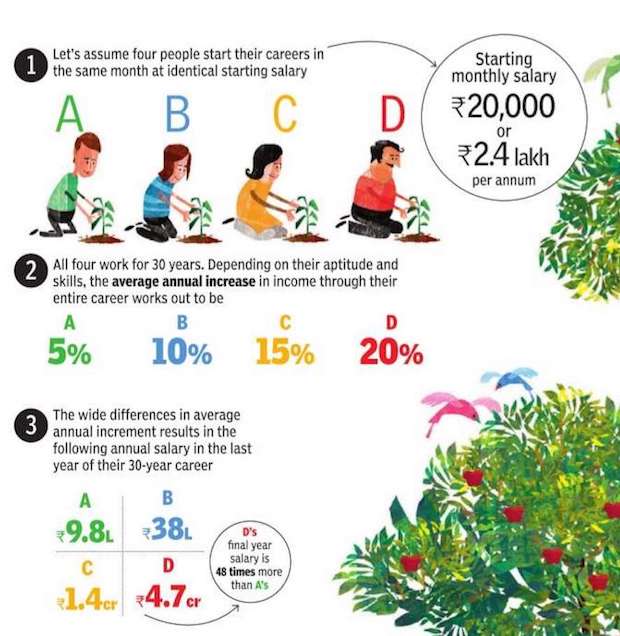

Saving habits

2011-16: Indians invest more in equity, debt

Allirajan M, Indians invest more in equity, debt, Sep 29 2016 : The Times of India

Indian households are increasingly putting more money in equities and debentures. Investments by households in shares and debentures jumped 72.2% year-on-year (yo-y) or by `38,491crore to `91,763 crore in 2015-16, Reserve Bank of India (RBI) data showed.

In contrast, their investments in bank deposits advanced by a mere 3.8% y-o-y or by `22,594 crore to around `6.16 lakh crore.

Household investments in shares and debentures have surged more than five times between 2012-13 and 2015-16. But their savings in bank deposits have moved up by a measly 7.1% during the timeframe, RBI data showed. Incidentally, households held a record `6.48 lakh crore in bank deposits in 2013-14. Household investments in life insurance products, another favourite, increased 9.8% y-o-y to around `2.72 lakh crore.

The interest in equities and debentures has been growing at a robust pace over the last three years. The steady decline in interest offered by banks for deposits following a series of rate cuts by the RBI has acted as a dampener for those looking to invest in traditional instruments such as FDs. Though there have been corrections, equity markets have risen steadily in last three years with benchmark indices hitting new highs.

2017: even the poor and young want real estate, gold

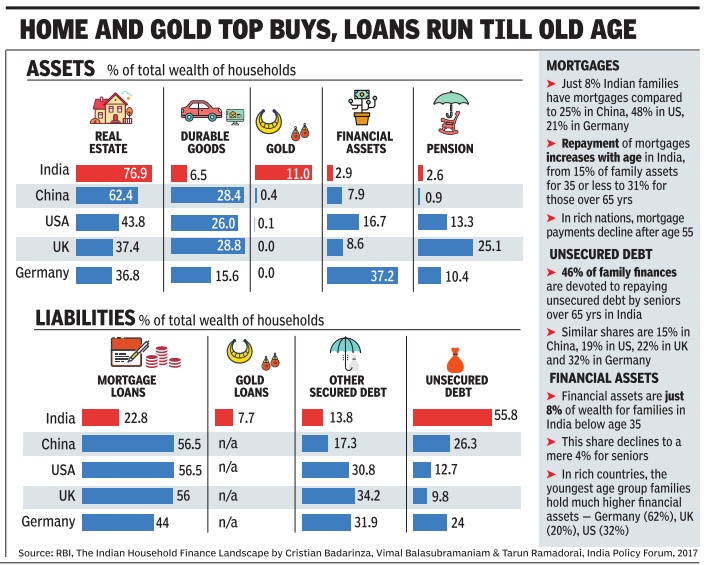

Indian families borrow and invest in very different ways than families in the US, UK or Germany , and even those in China. The depth of these differences, across all ages and economic levels, is revealed in a recent report on household finances prepared by the RBI.

It shows that a major proportion of household wealth in Indian families is kept as real estate or gold, even among younger families, and even by the poorest 40% of population.

This is not the case in other countries. Institutional borrowings by Indian families are low in early life and go on increasing leaving many retired persons with a debt overhang, unlike advanced countries where mortgages reduce after retirement.And, pensions are virtually absent in India while in most Western countries they are a major asset in old age.

More than three quarters of family wealth is invested in real estate (land and dwelling units) by an average Indian family compared to just 44% in the US, and 37% in UK and Germany . In China, about 62% of wealth goes into real estate. Even among the poorest 20% of the population, 59% have some land or dwelling unit in India, while in China, the similar proportion is 61%.

But in the rich countries a minuscule share of the poorest quintile has real estate -4% in US, and less than 1% in UK and Germany .

This may sound bizarre considering India's poverty but here is the thing: average value of the main residence in the poorest Indian households is Rs 22,000, while it is Rs 15 lakh in Germany and Rs 3.7 lakh in the US.

The RBI report is talking of proportion of different types of family wealth. Their absolute values are obviously very different.

Besides real estate, the other main target of investment in India is gold. About 11% of family wealth goes into buying gold. Families in other countries spend virtually nothing on this, with the Chinese spending a mere 0.4% of their wealth on gold. Indian families also have gold loans amounting to about 8% of their total liabilities, again a feature not found anywhere else.

“Most households use debt to cope with emergency expenses, such as hospitalisation, or property damage due to a natural disaster. The interest rates on unsecured debt are very high. Therefore, households prefer to put their savings in real estate and gold, which can also be used as collateral,“ RBI's Household Finance Committee chairman Tarun Ramadorai of Imperial College, London, told TOI. Detailed data on countries drawn from various surveys is available in a paper by Ramadorai and coauthors published in 2017.

Although 73% of families in India have financial assets like cash, bank accounts and pension accounts, they hold very small amounts adding up to just 5% of their total wealth, he added.

Medical emergencies, especially among the elderly , are one of the main reasons why families in India seek loans at usurious rates from money lenders. Such unsecured loans make up nearly 56% of all liabilities for Indian families, much higher than China at 26%, US (13%) and Germany (24%). The RBI report notes that “some of these risks could be mitigated through strengthening the public provision of health and social welfare services.“

Indian families are also exceptional in that housing loans are low in early life and rise beyond retirement ages.In other countries such loans rise in middle age but fall off at retirement. This happens because Indian families borrow later in life and it is customary to bequeath property to future generations who in turn look after the elderly.

These traditional structures are increasingly under pressure from shifting demographic patterns, social norms, and changing economic conditions, introducing risks to economic well-being especially as households age, the report says.