Mergers and acquisitions: India

This is a collection of articles archived for the excellence of their content. |

Mid-2016: M&As up as consolidation sets in

The Times of India, Aug 03 2016

Anand J

Startup M&As surge on funds crunch

As venture funding slows down, startups seem eager to sell themselves off. This is showing up in a surge in mergers & acquisitions (M&As).

In July 2016, there were as many as 36 M&As, almost twice that in June and about three times the January and February numbers, according to data from startup research firm Xeler8. The second quarter of this year saw three big distress sales -FabFurnish, Jabong and Hiree.

Data from Tracxn, another startup research firm, also shows a significant increase from the second half of last year, when funding started slowing down. From 32 M&As in the second half of 2014, the figure went up to 67 in the first half of 2015, to 79 in the second half of last year and was 75 in the first half of this year. The data is collected based on media reports, and announcements in social media, blogs and websites.

Another VC investor, who did not wish to be named, said that in most segments market leaders are emerging. “This was expected. Cash is air for startups. When you don't have money to pay , employees leave and that creates so much negative sentiment in the company that entrepreneurs lose heart,“ he said. While Indian startups raised around $3.5 billion in the first half of 2015, the funding dropped to $2 billion in the first half of 2016, says a report by KPMG and startup research firm CB Insights.

Xeler8 finds that the mostfunded sectors and the ones that attracted the highest number of entrepreneurs -including local commerce and e-commerce -have seen the biggest consolidation. Delhi-NCR, which is estimated to have the highest number of local commerce and e-commerce startups, saw 29 M&A deals in the first half of this year, followed by Bengaluru at 26 and Mumbai at 16.

The year's biggest acquisition was by Quikr, which bought online real estate platform CommonFloor for around $100 million, while the asking price was around $160 million. Myntra acquired Jabong for $70 million.

March 2017, top mergers

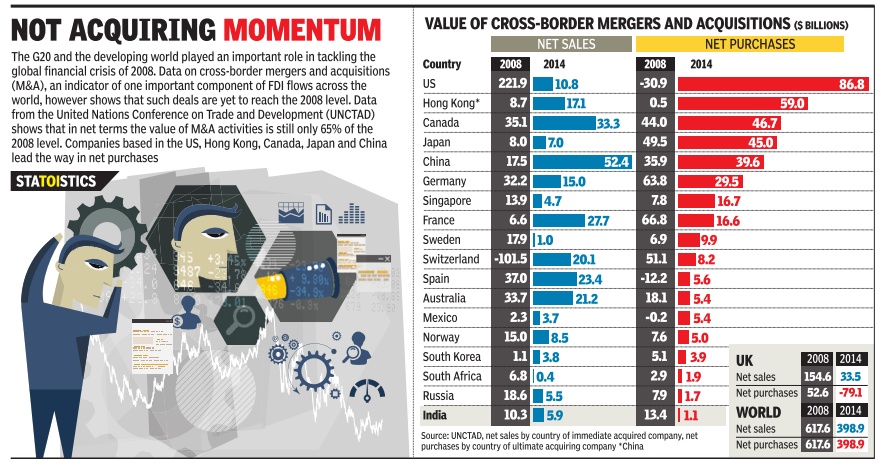

See graphic