Natural Gas: India

(→Asia’s longest underwater hydrocarbon pipeline/ 2023) |

(→Imports) |

||

| Line 123: | Line 123: | ||

(Inputs by Ashley D’Mello) | (Inputs by Ashley D’Mello) | ||

| − | =Imports= | + | =Imports (natural gas in general)= |

==2013-18: imports and consumption== | ==2013-18: imports and consumption== | ||

[[File: The import and consumption of natural gas in India- 2013-18.jpg|The import and consumption of natural gas in India: 2013-18 <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F11%2F21&entity=Ar03015&sk=E752872E&mode=text Sanjay Dutta, November 21, 2018: ''The Times of India'']|frame|500px]] | [[File: The import and consumption of natural gas in India- 2013-18.jpg|The import and consumption of natural gas in India: 2013-18 <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F11%2F21&entity=Ar03015&sk=E752872E&mode=text Sanjay Dutta, November 21, 2018: ''The Times of India'']|frame|500px]] | ||

| Line 167: | Line 167: | ||

Pradhan’s statement underlines an effort to put balm on Moscow’s growing unease over the Modi government’s growing closeness to Washington, especially in areas of defence and now energy. Indian refiners began importing small quantities of US crude last year. In April, GAIL received its first cargo of shale gas from mainland US. The beginning of Russian gas supplies will add to India’s bargaining power with its predominantly West Asian energy suppliers. . | Pradhan’s statement underlines an effort to put balm on Moscow’s growing unease over the Modi government’s growing closeness to Washington, especially in areas of defence and now energy. Indian refiners began importing small quantities of US crude last year. In April, GAIL received its first cargo of shale gas from mainland US. The beginning of Russian gas supplies will add to India’s bargaining power with its predominantly West Asian energy suppliers. . | ||

| + | =Imports (liquefied natural gas)= | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|NNATURAL GAS: INDIA | ||

| + | NATURAL GAS: INDIA]] | ||

| + | [[Category:India|NNATURAL GAS: INDIA | ||

| + | NATURAL GAS: INDIA]] | ||

| + | [[Category:Law,Constitution,Judiciary|NNATURAL GAS: INDIA | ||

| + | NATURAL GAS: INDIA]] | ||

| + | [[Category:Name|ALPHABETNATURAL GAS: INDIA | ||

| + | NATURAL GAS: INDIA]] | ||

| + | [[Category:Pages with broken file links|NATURAL GAS: INDIANATURAL GAS: INDIA | ||

| + | NATURAL GAS: INDIA]] | ||

=LPG (liquefied petroleum gas)= | =LPG (liquefied petroleum gas)= | ||

Revision as of 19:34, 9 February 2024

This is a collection of articles archived for the excellence of their content. Readers will be able to edit existing articles and post new articles directly |

Contents |

City Gas Distribution

2014-18

Dharmendra Pradhan, Gas-based economy fuels cleaner growth, November 22, 2018: The Times of India

From: Dharmendra Pradhan, Gas-based economy fuels cleaner growth, November 22, 2018: The Times of India

LPG and PNG can happily coexist. PNG is an affordable, safe and clean fuel for household kitchens, which also provides the convenience of uninterrupted supply. Besides, the government is utilising LPG saved through the PNG adoption in providing LPG coverage to disadvantaged households and in remote regions. Doubts have been raised in certain quarters about the wisdom in promoting CNG when BS-VI auto fuels will be introduced nationwide in April 2020 since the latter is considered as clean as CNG. Again, we are giving people a choice of clean fuels without favouring any one fuel or technology over another. Generally, CNG is cheaper than petrol or diesel. Also, there are mostly BS-IV or earlier vehicles on our roads which can’t really reap the full benefits of the cleaner BS-VI fuels.

Since April 2014, the number of CNG stations in the country has gone up by 79% to reach 1,450 as of September-end 2018. The growth in the number of domestic PNG connections has been even more impressive at 90% — from 24.72 lakhs to 47.09 lakhs — in the same period. In the Delhi-NCR region, IGL added over 1 lakh new PNG connections in a record seven months in 2018-19.

The 9th CGD bidding round was undertaken after extensive consultations with stakeholders, including state governments and CGD companies, and has proved to be a runaway success. After this round, CGD networks will cover 35% of the country’s area and 46.24% of its population. This round will attract about Rs 70,000 crore in investment.

Similarly, the 10th bidding round is expected to attract an investment of about Rs 50,000 crore. Cumulatively, after the implementation of the 10th bidding round, India will have CGD infrastructure operational in 228 GAs across 402 districts, serving over 70% of the population. India is looking at a robust infrastructure of about 10,000 CNG stations in 10 years from now. This will generate a new economy centred around CGD, and sets of employment opportunities will be created in about 400 districts in the country.

Expectedly, these developments in India’s CGD space have received a positive response from the industry. Several new companies, including from abroad, have entered the sector in recent years. The government has driven a firm message that CNG is a permanent auto-fuel. The response from leading auto-manufacturers has been encouraging and they are coming out with factory-fitted CNG vehicles.

While CNG can be a competitive fuel option for intra-city travel, we also see a bright future for LNG as a transportation fuel, especially for long-haul heavy commercial vehicles. Several companies are working on LNG trucking and LNG refuelling centres. Very soon, we will come across LNG refuelling stations on major industrial corridors in the country.

The government has been engaging stakeholders to address both supply and demand issues. Considerable progress has been made in extending natural gas access to eastern and north-eastern India through the Pradhan Mantri Urja Ganga pipeline and Indradhanush Gas Grid projects. LNG import infrastructure in the country will expand significantly in the near term with commercial operations of two new regas terminals at Mundra and Ennore slated to commence this fiscal. We expect gas supply in India to come not only from domestic fields and imported LNG but also from newer sources such as Bio-methane and Compressed Bio Gas (CBG). Oil marketing companies recently floated an ‘expression of interest’ with 100% offtake guarantee of CBG. The city gas infrastructure around more than 350 districts can receive CBG at any part of the country.

It is well known that the demand for natural gas in India is price-sensitive. The government is trying to increase gas consumption across diverse industries, especially MSMEs such as glass and ceramic units. Representatives of the steel industry have told us that gas-fired steel units are able to produce superior quality of steel. We are working on setting up India’s first-ever Gas Trading Exchange.

All of this, of course, will also promote employment for our youth. All stakeholders, but most importantly the companies, need to come forward to meet this challenge.

Court judgements

2007: SC terms natural gas as "national resource"

From the archives of Dhananjay Mahapatra, The Times of India 2007, 2009

Reliance Industries vs. Reliance Natural Resources Ltd

Govt’s Say Final, Anil Can’t Get Gas Cheap: SC

A toxic, no-holds-barred battle between two estranged brothers that sucked in the Indian government ended with the Supreme Court ruling in favour of Mukesh Ambani’s Reliance Industries. Terming natural gas a ‘‘national resource’’, the court ruled that RIL cannot give gas to Anil Ambani’s Reliance Natural Resources Ltd (RNRL) at a rate lower than the price fixed by the Centre. It also directed RIL, by far India’s largest company, and RNRL to initiate renegotiation of their gas supply master agreement (GSMA) within six weeks and finalize the new terms within another eight weeks.

RNRL was seeking 28 million metric standard cubic metres per day (mmscd) at $2.34 per million metric British thermal unit (mmBtu) for 17 years, to be supplied to its proposed 7,800mw power plant at Dadri in UP. It based its demand on the terms of a June 2005 agreement brokered by mother Kokilaben to divide the corporate empire of Dhirubhai Ambani.

However, RIL argued that it could not supply the gas at less than $4.2 per unit, and that it was bound by the provisions of its productionsharing contract (PSC) between government and RIL, the gas utilization policy (GUP) and the decisions of the empowered group of ministers that determined to whom the gas should be supplied, what quantity and at what price. It also said in court that the MoU was not worth the paper it was written on.

RNRL had got favourable rulings from Bombay high court’s company court, which finalized the demerger scheme based on the family pact, as well as the HC’s division bench. But the SC decisively ruled that PSC, GUP and EGoM decisions would override any private agreement relating to national resources.

Analysts calculated that while RIL would have earned a profit of Rs 14,940 crore by selling 28mmscmd of gas to RNRL for 17 years at $2.34, it would earn a pre-tax profit of Rs 37,755 crore by selling at $4.2.

Gas And Heartburn the Judgment

SC overturns Bombay HC order, tells RIL and RNRL to start renegotiations within 6 weeks, finalize gas sale master agreement within another 8 weeks Private family agreement or MoU between Mukesh, Anil and their mother Kokilaben is a secret document and does not fall within corporate domain Govt has the power to determine price, quantity and tenure of gas to be supplied from KG basin to any party Production sharing contract between govt & RIL overrides any contract between RIL and any other party RIL’s gas marketing rights not absolute. Hence agreements entered into with RNRL to fix quantity, price and tenure must be in accordance with PSC

Gainers And Losers

Analysts say Reliance would have made a profit of Rs 14,940cr by selling 28mmscmd of gas to RNRL for 17 years at $2.34 per unit. It can make a profit of Rs 37,755cr by selling at $4.2. The SC verdict could thus potentially increase RIL’s profit by Rs 22,815cr over 17 years; govt set to gain Rs 22,415 cr at higher sale price

Huge shadow over Anil’s ambitious Dadri power project. RNRL shares hit 52-week low of 50 before closing at 53, down 23%

RIL market cap rises Rs 7,500cr. ADAG companies together drop Rs 9,000cr

Power ministry terms verdict “fair”, says ruling has no bearing on NTPC-RIL case

RIL’s profit may rise by Rs 22815cr

New Delhi: The SC verdict could thus potentially increase RIL’s profit by Rs 22,815 crore over this period. The government too is set to gain Rs 22,415 crore at the higher sale price.

In a statement, Anil Ambani, who was at the court Friday morning, said the SC had safeguarded the interests of over 25 lakh RNRL shareholders and the company ‘‘looks forward to expeditious and successful renegotiations’’ with RIL. However, investors were not so sanguine. Even as RIL shares surged 2.3% to close at Rs 1,034 after touching an intra-day peak of 1,060, RNRL crashed 23% to close at 53, after plumbing a 12-month low of Rs 50, a drop of almost 27%. Other ADAG scrips were also hammered, with Reliance Infrastructure dropping 7% to 980 and Reliance Power losing 9% to close at 140. While RIL’s market cap increased by Rs 7,500 crore, ADAG companies collectively lost Rs 9,000 crore in market cap.

An RIL press release said, ‘‘RIL sincerely hopes that the clarity of findings of the judgement brings to a permanent closure the incessant distortion of facts and malicious allegations which were being levelled against the government’s policies of regulating and developing the natura; gas sector...’’

The plunge in ADAG scrips followed a 2-1 verdict by a Supreme Court bench comprising Chief Justice K G Balakrishnan and Justices B Sudershan Reddy and P Sathasivam. The CJI and Justice Sathasivam said the only way out for RNRL and RIL was to begin renegotiation of the GSMA. It also killed the possibility of any cheap gas for RNRL by attaching a large number of conditions affirming the dominance of the government’s role and its policies in the framing of any fresh agreement between RIL and RNRL.

Justice Satashivam, writing the 118-page majority judgment, said: ‘‘While renegotiating the terms of GSMA, the following must be kept in mind: a. The terms of the PSC shall have an overriding effect; b. The parties cannot violate the policy of the government in the form of GUP and national interests; c. The parties should take into account the family MoU (memorandum of understanding), even though it is not legally binding. MoU is a commitment which reflects the good interest of both parties; d.Parties must restrict their negotiations within the conditions of government policy as reflected in GUP and EGoM decisions.

Land prices

Biggest deal: 6 acres for Rs 4k cr Nauzer K Bharucha

Mumbai: A six-acre government plot in an upcoming southern Mumbai neighbourhood fetched the highest bid of Rs 4,053 crore from the Lodha Group on Tuesday, setting not only an all-India record, but reaffirming landstarved Mumbai’s numero uno position in the property market. While Mumbai has few open spaces like parks and playgrounds compared to other leading global cities, its real estate is among the priciest in the world.

TOI in its edition dated May 24 had predicted that the tract of land in Wadala was all set to create a record after the Mumbai Metropolitan Region Development Authority (MMRDA), which controls the land, tweaked tender conditions to allow multiple towers instead of a single ‘iconic’ tower. It also permitted 100% residential construction instead of the earlier stipulation of just commercial. MMRDA officials said this bounty would be redeployed for the city’s transport projects.

In 2008, Delhi-based developer BPTP had bagged a 95-acre plot in Noida for Rs 5,000 crore, but the deal was later called off. Till now, DLF’s bid of Rs 1,750 crore for 350.7 acres in Gurgaon last year was considered the country’s highest. But on Tuesday afternoon, Lodha Group beat this record by several times after it outbid three developers for the Wadala plot by quoting double the reserve price. MMRDA had set a minimum rate of Rs 40,000 per sqm (Rs 1,980 crore) and Lodha put in its bid for a hefty Rs 81,818 per sqm.

The six-acre sprawl located in the Wadala Truck Terminal will allow the developer to utilize an unheard of floor space index of 20; average FSI (ratio of permissible built-up area vis-a-vis plot size) in Mumbai is between 2 and 4. This is because the entire FSI available for the Wadala truck terminal is being used up on this six-acre portion.

MUMBAI ON TOP

At Rs 4,053 crore for 6 acres, this is India’s biggest land deal Till now, DLF’s Rs 1,750-crore bid for 350.7 acres in Gurgaon last year was considered the highest

In 2008, Delhi-based developer BPTP bagged a 95-acre plot in Noida for Rs 5,000 crore, but deal was called off At 10% interest, Lodha to pay over Rs 5,700cr

Clearly, the location is great with the upcoming metro and monorail projects in close vicinity. This site will be by far the most well-connected in the city. With the plot offering a saleable area of close to 80 lakh sq ft, we plan to utilise about 70% of it for residential purposes,’’ Lodha Group’s MD, Abhisheck Lodha, told TOI minutes after he emerged from the bidding process held at the MMRDA headquarters in the Bandra-Kurla Complex. Lodha Group is mainly into constructing high-end apartment buildings in the city.

Other developers in the fray were Piramal Sunteck Realty (Rs 3,465 crore), Indiabulls (3,327 crore) and Dosti Group (Rs 2,251 crore). Perhaps the biggest advantage of this jaw-dropping transaction is the easy payment schedule laid out by the MMRDA. Lodha will have to shell out this humongous amount over five years with a 10% annual interest (which takes the figure to over Rs 5,700 crore). Of this, barely 30% of the amount will have to be paid in the first three years.

The money will come for internal accruals and from the sale of apartments once the booking commences,’’ said Lodha, who is the son of BJP MLA from Malabar Hill, Mangal Prabhat Lodha. The developer has already calculated his profit at Rs 3,036 crore. MMRDA commissioner Ratnakar Gaikwad said, ‘‘I am happy that the plot has fetched twice the amount we had asked for. It shows that the economy is coming out of recession. We hope to get high prices for our other plots at the Bandra-Kurla complex as well. The money will be used for Mumbai’s infrastructure.’’

A property expert said that Lodha should now launch the project quickly within the next nine months after procuring all permissions. ‘‘They must start the bookings early and receive advances from buyers so that it will be easier for them to pay off MMRDA,’’ the expert said.

MMRDA is to lease out the 25,000 sq m Wadala land for 65 years to the highest bidder.

(Inputs by Ashley D’Mello)

Imports (natural gas in general)

2013-18: imports and consumption

From: Sanjay Dutta, November 21, 2018: The Times of India

See graphic:

The import and consumption of natural gas in India: 2013-18

2018: India 2nd largest LPG importer

From: Sanjay Dutta, Pro-poor move makes India 2nd largest LPG importer, April 11, 2018: The Times of India

Demand Rises 8% In 2017-18; China At No. 1

India is the world’s second largest importer of LPG (liquefied petroleum gas) after China and remains ahead of Japan as the Modi government’s drive to provide clean cooking fuel to millions of poor families boosted household demand by nearly 8% in 2017-18.

The PM may flag the success of the Ujjwala scheme — one of his government’s flagship programmes aimed at delivering “energy justice” to the poor — to emphasise the potential of India’s energy market and need for an equitable global pricing regime when he addresses policymakers and oil industry captains at the 16th International Energy Forum ministerial here on Wednesday. The IEF is a 72-nation group accounting for 90% of global supply and demand for oil and gas.

India beat Japan in 2016 to become the world’s third-largest crude oil consumer after the US and China. Both International Energy Agency and Opec see India as the main driver of growth in global oil demand for the next decade.

Data indicates India’s imports of LPG in 2017-18 surpassing 11 million tonnes in 2016-17 on the back of Ujjwala adding volume to demand.

Only recently, international media reports quoting shipping data pegged India’s LPG imports at 2.4 million tonnes in December, exceeding China’s 2.3 million tonnes for the first time. But India still trails China’s average monthly import of 2.7 million tonnes with 1.7 million tonne.

While a monthly import spike may be caused by a variety of factors, the signs of consumption growth are, nevertheless, all there. Not surprising then that the rapid progress of the Ujjwala scheme under oil minister Dharmendra Pradhan’s watch, is estimated to push up household demand for LPG to more than 27 million tonne by 2022, up from more than 18 million tonne now.

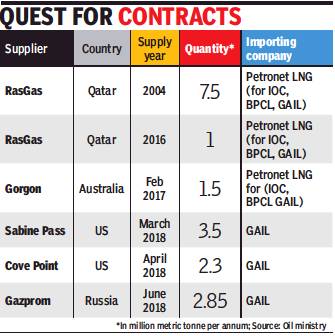

Sources of import, 2004-18

Sanjay Dutta, India balances US ties with Russia gas deal, June 5, 2018: The Times of India

From: Sanjay Dutta, India balances US ties with Russia gas deal, June 5, 2018: The Times of India

Country Gets Gas Supplies Under $25-Billion Agreement

India started receiving long-term gas supplies from Russia’s Gazprom, the world’s top publiclylisted natural gas company, under a $25-billion deal that indicates New Delhi’s quest for newer routes towards energy security and balancing ties with Washington and Moscow.

“Today will be remembered as a golden day for India’s energy security roadmap,” oil minister Dharmendra Pradhan said after receiving ‘LNG Kano’, the cryogenic ship carrying the first cargo of LNG (liquefied natural gas) under a 20-year deal with state-run GAIL.

Recalling Russia’s extended contribution in developing India’s oil and gas sector, Pradhan said the long-term gas supply establishes an energy bridge between the two countries as part of PM Modi and President Vladimir Putin’s plan for forging closer strategic economic cooperation.

Pradhan said India will import gas worth $1.5 billion a year under the deal signed by GAIL in 2012, a year after the state-run utility tied up long-term supplies from two US shale gas projects. All of India’s long-term gas deals are in operation, with Gazprom offering the most competitive terms.

Pradhan’s statement underlines an effort to put balm on Moscow’s growing unease over the Modi government’s growing closeness to Washington, especially in areas of defence and now energy. Indian refiners began importing small quantities of US crude last year. In April, GAIL received its first cargo of shale gas from mainland US. The beginning of Russian gas supplies will add to India’s bargaining power with its predominantly West Asian energy suppliers. .

Imports (liquefied natural gas)

LPG (liquefied petroleum gas)

India 2nd-biggest LPG user

Sanjay Dutta, At 19m tonnes|yr, India 2nd-largest LPG user in world, Feb 7, 2017: The Times of India

India has become the second-largest domestic LPG (liquefied petroleum gas) consumer in the world due to the Central government's rapid rollout of clean fuel plan for poor households and fuel subsidy reforms.

LPG consumption by households has reached 19 million tonnes, registering an annual growth rate of 10%.Consumption is expected to rise 20 million tonnes, backed by expanding consumer base in urban areas and rapid rollout of the `Ujjwala' scheme for providing LPG connections free of cost to five crore poor households by 2019.

The Ujjwala scheme has turned India into an example for energy experts from other emerging economies still struggling to provide clean fuel to their rural folks. No wonder the World LPG Association (WLPGA) -so far focused on developed economies -has chosen to hold its Asia summit in Delhi.

Barely nine months after being launched by the PM in May 2016, the scheme has covered 1.6 crore poor households, topping the target set for the entire 2016-17 financial year on the back of a massive rural outreach push. “It simply beats me how they achieved this,“ WLPGA Yagiz Eyuboglu told a curtain-raiser session on Monday in a compliment to oil minister Dharmendra Pradhan.

“When we assumed office, we had a system of misdirected subsidies, rich and uppermiddle class were entitled to LPG subsidies. There were many duplicate connections and the subsidized LPG was diverted to commercial and industrial segments. As a result poorest of the poor never had access to LPG. In 2014, almost half of Indian households didn't have LPG connections. We decided to change the LPG landscape in India,“ Pradhan said, giving an insight into the government's thinking behind the reforms.

Pradhan said reforms in the subsidy mechanism -elimination of ghost consumers and direct subsidy transfer -saved an estimated Rs 21,000 crore, or $3.2 billion, in the two years of the Modi government. During this time, he said, Rs 40,000 crore, or $6.5 billion, in subsidy has been transferred directly to bank accounts of consumers.

Direct benefit transfer: 2015, ‘16

Govt transfers Rs 40k cr to a|cs of LPG users, Feb 8, 2017: The Times of India

The government has transferred Rs 40,000 crore, or $6.5 billion, into bank accounts of household LPG consumers in the two years since it refreshed the cooking gas subsidy regime to plug leakages, according to oil minister Dharmendra Pradhan.

The weeding out of some 3.3 crore (33 million) ghost accounts as part of the reform process resulted in savings of Rs 21,000 crore, or $3.2 billion, in subsidy payout, which has helped the government to spend more on social sector projects and bring clean fuel to poor households.

As a pointer to the success of the reforms in the direct benefit transfer scheme for LPG DBTL, which is now known as PaHAL, Pradhan told the Asia LPG Summit curtain-raiser on Monday that sale of commercial LPG cylinders jumped nearly 40% in 2015-16 against a near-stagnant growth earlier.

Commercial cylinders are sold at market rate and used by shops and establishments such as hotels, restaurants and neighbourhood sweetmeat shops etc. Before the government took up the reforms, subsidised domestic cylinders were being diverted for commercial use. The government currently transfers Rs 184. 29 per cylinder as subsidy .

“Nearly 6.3 million new LPG connections have been released to poor families in 2015-16... We have set a target to provide 50 million LPG connections over a period of three years to poor households, with a budgetary support of Rs 8,000 crore,“ he said, adding that the 15 million target for 2016-17 was achieved in less than eight months.

“I am confident that we will exceed this target. We have already increased the national LPG coverage to 70 per cent and we may even reach 85 per cent in 2 years,“ he added.

The Modi government initiated a combination of steps to improve the subsidy delivery mechanism, beginning with elimination of bogus connections through an intensive customer verification drive.

Pradhan said DBTL was launched in 2014 wherein subsidy was directly paid into the bank accounts of the beneficiaries. “This made the process transparent and plugged the subsidy leakages which were otherwise being misused through ghost accounts.“

Natural gas (CNG, PNG)

City gas operators profiteer due to monopoly

Sanjay Dutta, City gas operators making windfall due to monopoly?, March 3, 2017: The Times of India

Cos Earn Even More Than Gas Producers

Are gas sellers making more than their fair share for CNG and PNG in the absence of competition in the market and differential regulatory frameworks? A look at the per unit realisation of two of the largest city gas distribution companies, Indraprastha Gas Ltd in Delhi and Mahanagar Gas Ltd in Mumbai, appears to suggest so.

According to a report by Kotak Institutional Equities, monopoly situation and differential regulatory frame works allows city gas distribution firms to earn more than gas producers such as state-run ONGC and Oil India Ltd, who have to sink billions of dollars in risk capital for discovering and developing fields. Kotak Equities is a division of institutional brokers Kotak Securities.

Profitability of IGL and MGL has gone up over the past few quarters as they have been able to retain the benefits of the decline in price of domestic gas and “earn quite high RoAE (return on average equity) as their business es are not regulated,“ the Kotak report said. Other industry analysts said while the regulator allows a return of 12% on investments made by city gas distribution networks, their earning ranges between 18-20%. In contrast, AGLSouthern Company of the US earns 11.68% and UK's Centrica makes 12.9% on capital employed.

One of the main reasons for the high profitability of city gas distribution business is the monopoly situation. Both IGL and MGL do not have competition, nor do other firms where city gas projects are running. Norms allow market exclusivity for three years to a company that existed before the PNGRB Act came into being.In new projects, which are bid out, companies are given exclusivity for five years.

Pipelines

Asia’s longest underwater hydrocarbon pipeline/ 2023

Kangkan Kalita, April 24, 2023: The Times of India

Guwahati:The government’s efforts to make natural gas available in the North-East received a major fillip, with Asia’s longest underwater hydrocarbon pipeline beneath the mighty Brahmaputra, connecting river island Majuli with Jorhat in upper Assam, completed by the Indradhanush Gas Grid Limited (IGGL).

The Herculean task of laying the 24-inch diameter pipeline by horizontal directional drilling (HDD) method was completed on Friday, IGGL CEO Ajit Kumar Thakur said.

The completion of the Brahmaputra HDD marks a major milestone in the North East Gas Grid (NEGG) project, connecting the northeast with the National Gas Grid (NGG). Thakur said IGGL had now achieved more that 71% physical progress of the project and would be able to complete the Guwahati-Numaligarh section of NEGG by February 2024.

IGGL is implementing the 1,656-km-long NEGG natural gas pipeline project, being constructed at a cost of Rs 9,265 crore. The length of the pipeline across the main water channel of the Brahmaputra river is 4,080 metres. This is the longest river crossing by any hydrocarbon pipeline of 24-inch diameter and above in Asia and the second longest in the world, according to Thakur.

Pricing

Low pricing chokes gas discoveries; imports rise

Sanjay Dutta, November 21, 2018: The Times of India

India is losing out on a third of its current natural gas production due to inadequate pricing, even as the government’s drive to raise share of gas in the country’s energy basket is pushing up imports.

Announcements made from time-to-time by ONGC and OIL, indicate the two pillars of the country's hydrocarbons production could be sitting over discoveries that can supply 30 mcmd (million cubic meters per day) of gas. This is enough to generate 6,000 mega watt, roughly Delhi’s daily consumption, or run CNG and PNG services in six cities/ markets the size of Delhi-NCR But the companies can’t start production from these discoveries as they cannot recover costs in a market without pricing and marketing freedom. The current price of $3.36 per unit, set by the government, does not cover the cost to begin pumping, which needs at least $6.

India produces about 90 million cubic meters per day of gas and plans to double output by 2022 to reduce reliance on imports and reduce the economy’s carbon footprint.

Industry watchers said these discoveries can help the country reach its goal as they are on land, in shallow waters or in the periphery of existing fields and easier to bring into production quickly. In contrast, waiting for the big-ticket deep sea and ultra-deep sea discoveries to come on stream will cost $10 billion and time.

The problem lies with the pricing formula brought in by the government in October 2014, which offers higher price for gas produced from only difficult discoveries and does not cover the 30 mcmd reserves.

While the companies grapple with the conundrum, there is a renewed move in the government to strip them of 118 small producing discoveries – 113 of ONGC and 5 of OIL accounting for 10% of their output – for auctioning. Many of these operate through budget and infrastructure of larger fields and may not offer value proposition in isolation. Another concern is that wildcatters and small players have been known to damage reservoirs irretrievably in quest of making a quick buck.

Production, consumption, imports

2016-20

From: June 6, 2020: The Times of India

See graphic:

Production and consumption of natural gas in India, and imports by India, 2016-20.