Public Sector Undertakings (PSUs): India

| Line 6: | Line 6: | ||

|} | |} | ||

| − | [[ | + | |

| − | + | ||

| + | |||

| + | = Govt stake in PSUs= | ||

| + | ==As in 2019== | ||

| + | [[File: PSUs- Government's holding, as on August 27, 2019.jpg|Govt stake in select PSUs, As in 2019 <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2019%2F08%2F27&entity=Ar02301&sk=8DE8B590&mode=text Surojit Gupta, August 27, 2019: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | ''' See graphic ''' : | ||

| + | |||

| + | ‘Govt stake in select PSUs, As in 2019 ’ | ||

=Poor corporate governance= | =Poor corporate governance= | ||

| Line 60: | Line 68: | ||

''Profit/ loss-making PSUs <br/> The profitability of PSUs <br/> 2014-18'' | ''Profit/ loss-making PSUs <br/> The profitability of PSUs <br/> 2014-18'' | ||

| + | |||

| + | [[Category:Government|P | ||

| + | PUBLIC SECTOR UNDERTAKINGS (PSUS): INDIA]] | ||

| + | [[Category:India|P | ||

| + | PUBLIC SECTOR UNDERTAKINGS (PSUS): INDIA]] | ||

| + | [[Category:Pages with broken file links|PUBLIC SECTOR UNDERTAKINGS (PSUS): INDIA]] | ||

Revision as of 15:36, 1 April 2021

This is a collection of articles archived for the excellence of their content. |

Contents |

Govt stake in PSUs

As in 2019

From: Surojit Gupta, August 27, 2019: The Times of India

See graphic :

‘Govt stake in select PSUs, As in 2019 ’

Poor corporate governance

The Times of India, Nov 23 2015

Rupali Mukherjee

PSUs fare poorly in corporate governance

Most of top 27 state-run cos violate norms on board independence, audit committees

Conventional wisdom suggests that since it's the government that formulates rules, state-owned companies would be at the forefront of abiding by them. However, according to an analysis by a proxy firm shared exclusively with TOI, it appears that it's the public sector undertakings (PSUs) which have scored poorly on corporate governance norms mandated by the government. These state-owned companies have violated guidelines related to board independence, appointment of audit, nomination and corporate social responsibility committees, and women directors on the board.Proxy advisory firm Stakeholders Empowerment Services (SES) studied the top 27 listed PSUs with a market capitalization of Rs 11,22,036 crore (as on October 26), where the highest market cap was that of ONGC at Rs 2,20,774 crore, and PTC India had the lowest market cap of Rs 1,961crore.

According to the SES analysis, 13 PSUs among the top BSE100 companies accounted for 14.1% of that index's total market cap, and nearly all the PSUs are non-compliant for one reason or other. Among the entire 27 PSUs studied, the analysis says 25 do not meet the criteria for independence of the board, almost 50% failed to constitute a compliant CSR committee, while nearly 25% do not have a woman director.

Moreover, over 80% do not have a compliant audit committee and NRC (nomination and remuneration committee), the analysis adds, saying these PSUs, rather than being role models, have set a bad precedent. LIC Housing Finance is the lone compliant company while the rest (26) are all non compliant in some parameter or the other (see graphic).

J N Gupta, founder and MD of SES, says, “The governmen does not realize that it may be suffering a loss in valuation, as well as shareholders, due to go vernance deficit..“ He adds “(Lack of) Board independen ce and audit committee are two serious violations.“ In terms of violations rela ing to independence of the audit committee, the 16 erring companies are MRPL, BPCL Engineers India, Neyveli Lig nite Corporation, Rural Elec rification Corporation, GAIL India), SJVN, Shipping Cor poration of India, Coal India Oil India, National Alumini um Company , ONGC, IOCL NTPC, HPCL and RCF.

For listed central public sector enterprises (CPSEs) corporate governance guide ines have been mandated by hree government agencies -ministry of corporate affa rs, Sebi and DPE (depart ment of public enterprises) The note states that these gui delines have been made man datory , with slight modifica ion, by all administrative mi nistries to ensure implemen ation and submission of quarterly progress report within 15 days from end of each quarter. In 2007, these guidelines were implemented on a voluntary basis.

It further directed administrative ministries to consolidate the reports on a year ly basis and submit a comprehensive status report of compliance with corporate governance guidelines for each financial year by May 31.The guidelines state: “In so far as listed CPSEs are concerned, they have to follow the Sebi guidelines on corporate governance. In addition, they shall follow those provisions in these guidelines which do not exist in the Sebi guidelines, and also do not contradict any of the provisions of the Sebi guidelines.“

Put simply , all listed CPSEs have to follow corpora te governance as prescribed by Sebi. In addition, if the CPSE guidelines are more stringent than Sebi norms, the same should be followed.

SES is of the opinion that discipline begins at the top, with the level of governance being of the highest order so as to create benchmarks for others to emulate. Incidentally, such widespread noncompliance has not been observed in listed PSU banks.

Norms for public sector companies: 2016

The Times of India, Jun 02 2016

Govt wants at least 30% of profit as dividend from PSUs

The finance ministry has issued fresh norms for public sector companies, mandating dividend payout of at least 30% of profit after tax, apart from share buyback, as the government looks to tone up the financial management of state-run companies besides maximizing its revenues. At present, most PSUs pay dividend at lower rates.

The guidelines for capital restructuring of central PSUs have made government nominee directors responsible for financial management and also stipulated that any exemption should be obtained from the finance or the administrative ministry . In recent months, the government has insisted on buyback of shares to use surplus cash with state-run firms as an alternative route to meet its dis investment target.

Now the rules drawn up by recently rechristened department of investment and public asset management (DIPAM) puts far greater emphasis on buybacks. It asked PSUs to look at buybacks if there are no plans to deploy the surplus cash with them.“Buyback of shares improves investor confidence in the company and is likely to help raise capital in future when it requires funds for expan siondiversification for growth,“ the circular said. In the first meeting of the financial year, companies have been asked to look at the cash balance, capex plans, free reserves and other parameters and any surplus to be used for buyback.

Similarly , minimum dividend of 30% of profit after tax or 5% of net worth has been prescribed.

The rules have also prescribed issue of bonus shares if reserves are five times or more than the paid-up equity share capital. If reserves and surplus cross 10 times the equity capital, the PSU has no option but to issue bonus shares to shareholders.

Further, the norms presc ribe a stock split if the market price or the book value of a share crosses 50 times the face value, arguing that small investors would enter the market. “It has been endeavour of the government to encourage participation of small investors in the capital market to increase depth of the market, liquidity and trading volume of the shares. However, high price of shares sometimes acts as a deterrent for the investors to invest in the company . In view of this, the board of central public sector enterprises needs to discuss and decide on the desirability of splitting the share,“ the circular said.

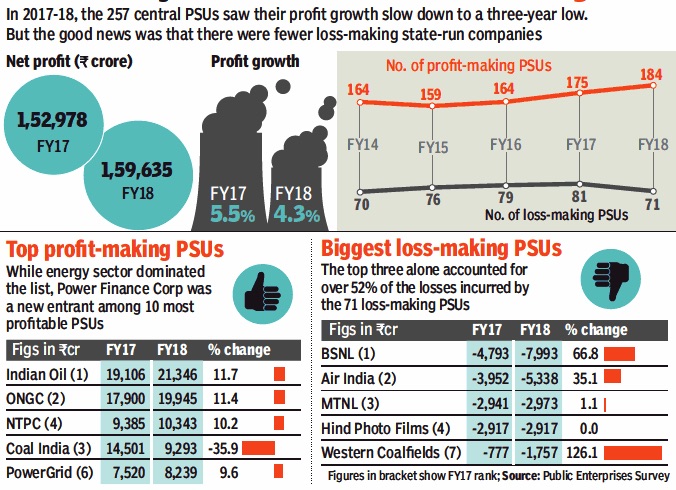

Profit/ loss-making PSUs

2014-18

The profitability of PSUs

2014-18

From: January 21, 2019: The Times of India

See graphic:

Profit/ loss-making PSUs

The profitability of PSUs

2014-18