Remittances, inward: India

(→2017: Fewer Indians head to Gulf, remittances dip) |

|||

| Line 9: | Line 9: | ||

[[Category:Economy-Industry-Resources |R ]] | [[Category:Economy-Industry-Resources |R ]] | ||

| − | =2015: India, largest remittance recipient= | + | =The quantum (amount) of remittances= |

| + | ==2015: India, largest remittance recipient== | ||

[[File: Nations getting maximum remittances in 2015, India and the world.jpg|Nations getting maximum remittances in 2015, India and the world; Graphic courtesy: [http://epaperbeta.timesofindia.com/Gallery.aspx?id=15_04_2016_026_027_001&type=P&artUrl=REMITTANCES-INDIA-ON-TOP-AGAIN-15042016026027&eid=31808 ''The Times of India''], April 15, 2016|frame|500px]] | [[File: Nations getting maximum remittances in 2015, India and the world.jpg|Nations getting maximum remittances in 2015, India and the world; Graphic courtesy: [http://epaperbeta.timesofindia.com/Gallery.aspx?id=15_04_2016_026_027_001&type=P&artUrl=REMITTANCES-INDIA-ON-TOP-AGAIN-15042016026027&eid=31808 ''The Times of India''], April 15, 2016|frame|500px]] | ||

| Line 28: | Line 29: | ||

"Remittances are an important and fairly stable source of income for millions of families and of foreign exchange to many developing countries," said Augusto Lopez-Claros, Director of the World Bank's Global Indicators Group. | "Remittances are an important and fairly stable source of income for millions of families and of foreign exchange to many developing countries," said Augusto Lopez-Claros, Director of the World Bank's Global Indicators Group. | ||

| + | |||

"However, if remittances continue to slow, and dramatically as in the case of Central Asian countries, poor families in many parts of the world would face serious challenges including nutrition, access to health care and education," Lopez-Claros said. | "However, if remittances continue to slow, and dramatically as in the case of Central Asian countries, poor families in many parts of the world would face serious challenges including nutrition, access to health care and education," Lopez-Claros said. | ||

According to the report, the growth of remittances in 2015 slowed from eight per cent in 2014 to 2.5 per cent for Bangladesh, from 16.7 per cent to 12.8 per cent for Pakistan, and from 9.6 per cent to 0.5 per cent for Sri Lanka. | According to the report, the growth of remittances in 2015 slowed from eight per cent in 2014 to 2.5 per cent for Bangladesh, from 16.7 per cent to 12.8 per cent for Pakistan, and from 9.6 per cent to 0.5 per cent for Sri Lanka. | ||

"Slower growth may reflect the impact of falling oil prices on remittances from GCC countries," the report said. | "Slower growth may reflect the impact of falling oil prices on remittances from GCC countries," the report said. | ||

| + | |||

For example, in the fourth quarter of 2015, year-on-year growth of remittances to Pakistan from Saudi Arabia and the UAE were 11.7 per cent and 11.6 per cent, respectively, a significant deceleration from 17.5 per cent and 42.0 per cent in the first quarter, the report explained. | For example, in the fourth quarter of 2015, year-on-year growth of remittances to Pakistan from Saudi Arabia and the UAE were 11.7 per cent and 11.6 per cent, respectively, a significant deceleration from 17.5 per cent and 42.0 per cent in the first quarter, the report explained. | ||

| Line 38: | Line 41: | ||

Remittances to Nepal rose dramatically in response to the earthquake, by 20.9 per cent in 2015 versus 3.2 per cent in 2014. | Remittances to Nepal rose dramatically in response to the earthquake, by 20.9 per cent in 2015 versus 3.2 per cent in 2014. | ||

| − | =2016: $62.7 billion= | + | ==2016: $62.7 billion== |

[http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=At-63bn-India-top-receiver-of-remittances-16062017011006 At $63bn, India top receiver of remittances, June 16, 2017: The Times of India] | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=At-63bn-India-top-receiver-of-remittances-16062017011006 At $63bn, India top receiver of remittances, June 16, 2017: The Times of India] | ||

Revision as of 11:09, 25 April 2018

This is a collection of articles archived for the excellence of their content. |

Contents |

The quantum (amount) of remittances

2015: India, largest remittance recipient

The Times of India, April 14, 2016

India world’s largest remittance recipient in 2015: World Bank

India was the world's largest remittance recipient in 2015 despite experiencing a $1 billion drop from 2014, the first decline in its remittances since 2009, the World Bank said.

India retained its top spot in 2015, attracting about $69 billion in remittances, down from $70 billion in 2014, the World Bank said in its annual report "Migration and Development Brief".

Other large remittance recipients in 2015 were China, with $64 billion, the Philippines ($28 billion), Mexico ($25 billion) and Nigeria ($21 billion). "Remittances to India, the (South Asian) region's largest economy and the world's largest remittance recipient, decreased by 2.1 per cent in 2015, to $68.9 billion. This marks the first decline in remittances since 2009," the World Bank report said.

Officially recorded remittances to developing countries amounted to $431.6 billion in 2015, an increase of 0.4 per cent over $430 billion in 2014. The growth pace in 2015 was the slowest since the global financial crisis, the report said.

Global remittances, which include those to high-income countries, contracted by 1.7 per cent to $581.6 billion in 2015, from $592 billion in 2014, the World Bank said.

"Remittances are an important and fairly stable source of income for millions of families and of foreign exchange to many developing countries," said Augusto Lopez-Claros, Director of the World Bank's Global Indicators Group.

"However, if remittances continue to slow, and dramatically as in the case of Central Asian countries, poor families in many parts of the world would face serious challenges including nutrition, access to health care and education," Lopez-Claros said. According to the report, the growth of remittances in 2015 slowed from eight per cent in 2014 to 2.5 per cent for Bangladesh, from 16.7 per cent to 12.8 per cent for Pakistan, and from 9.6 per cent to 0.5 per cent for Sri Lanka.

"Slower growth may reflect the impact of falling oil prices on remittances from GCC countries," the report said.

For example, in the fourth quarter of 2015, year-on-year growth of remittances to Pakistan from Saudi Arabia and the UAE were 11.7 per cent and 11.6 per cent, respectively, a significant deceleration from 17.5 per cent and 42.0 per cent in the first quarter, the report explained.

Also, deprecation of major sending country currencies (for example, the euro, the Canadian dollar and the Australian dollar) vis-a-vis the US dollar may be playing a role, it noted.

Remittances to Nepal rose dramatically in response to the earthquake, by 20.9 per cent in 2015 versus 3.2 per cent in 2014.

2016: $62.7 billion

At $63bn, India top receiver of remittances, June 16, 2017: The Times of India

Indians working across the globe sent home $62.7 billion in 2016, making India the top remittance-receiving country surpassing China, according to a UN report.

The `One Family at a Time' study by the UN International Fund for Agricultural Development (IFAD) said about 200 million migrants globally sent more than $ 445 million in 2016 as remittances to their families, helping to lift millions out of poverty.

It said 80% of remittances are received by 23 countries, led by India, China, the Philippines, Mexico and Pakistan.The top 10 sending countries account for almost half of annual flows, led by the US, Saudi Arabia and Russia.

The study said India was the top receiving country for remittances in 2016 at $62.7 billion, followed by China ($61 billion), the Philippines ($30 billion) and Pakistan ($20 billion).

In the decade between 2007 and 2016, India surpassed China to become the top receiving country for remittances. In 2007, India was on the second spot, behind China, with $ 37.2 billion in remittances.

Impact on Kerala

2016: Gulf remittances

The Times of India, May 06 2016

Subodh Varma

The simmering crisis in the Gulf region, an impact of plummeting oil prices and global economic woes, is sending ripples across the seas to pollbound Kerala. There are over 2.4 million Keralites working abroad of which 85% work in the Gulf region, according to the Kerala Migration Study (KMS 2014) by Centre for Development Studies, Thiruvananthapuram. That's over 2 million emigrant workers.

The remittances sent home by this huge workforce is estimated at Rs 24,374 cr while total remittances, which include investment flows etc.add up to over Rs 71,142 cr as per the study. About 19% households currently had an emigrant member while another 29% had in the past.

Remittances make up over a third of the net state domestic product -20% more than the revenue income of the state government and five times the funds the Centre gives the state.

But all this is changing. Since 2014, remittances inflow started faltering; it has since dipped by over Rs 23,350 cr in 2015 (World Bank). This follows a smaller slip in 2014. Can this likely impact the elections? The decline is not big, it will not have a big effect says S Irudaya Rajan, CDS professor and a co-author of the study . The impact will be visible if the decline continues for three to five years, he believes, adding that the emigrant Keralite does play a significant role in elections.

“In earlier elections, about 10,000 emigrants came back to vote. But more importantly , the 2.4 million Keralites working abroad have their wives, brothers, sisters and parents, estimated to be about 10 million votes in Kerala. They can change the political scenario of Kerala, if they influence their families,“ Irudaya Rajan said.

The long term trends of emigration are not very rosy says the KMS analysis. Emigration is likely to decline not because of external factors but due to Kerala's contracting youth population, better education, higher wages in India and prospects in other states.

There were an estimated seven lakh migrants living in other states of India in 2014 while about four lakh Keralites had returned back to the state after working in other states.While these numbers are small compared to emigrants going abroad, but adding the two together, the total number of Keralites seeking work outside the state is enormous. This is an indication of the severe employment crisis in the state which will cast a shadow on the electoral process.

Remittances and the global oil economy

2016

Remittances slip on oil, down $1.5 billion

Subodh Varma

Global economic slow down and turmoil has led to a decline in remittances -money sent from Indians working abroad -in 2015, an estimate by the World Bank indicates.

Although India still continues to be the topmost remittance receiving country , the flow was $68.9 billion in 2015, a dip of about $1.5 billion over 2014.

This is the first time since the global financial crisis of 2008-09 that remittances have gone down.

Falling oil prices, sluggish growth in the United States, slowing economies in Europe and adverse currency exchange rates have contributed to this decline, said DilipRatha, who heads the World Bank unit responsible for studying global migration and remittances.

“India gets remittances from all over the world but the bulk comes from the oil producing Gulf countries, US and also Europe. The effect of oil glut and resultant downswing of economies in the Gulf countries has had some delayed impact on remittances,“ he told.

The effect of global economic turmoil was becoming evident in remittance flows to India since 2013 when yearly growth plummeted to just 1.7% over 2012. In 2014, inflows increased by just 0.6% . The last time remittances had declined was in 2009.

For countries where clear data is not available, the number of migrants from a country , and the cost of living in both the source and receiving countries are used to work out an estimate of remittances, Ratha explained. The data also does not capture money flows through informal channels, like hawala.

A notable feature of India's inbound remittances is the $9 billion coming in from the neighbours. These are based on estimates made by UN of Indian born people residing in these countries.

2017: Fewer Indians head to Gulf, remittances dip

Region Loses Attraction As Economies Slow

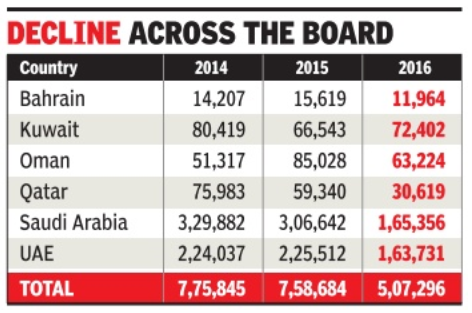

The number of Indian workers emigrating to the Gulf for work has dropped in the past couple of years, possibly due to slowing economies of countries part of the Gulf Cooperation Council (GCC), which have been hit by weaker oil prices. The decline has been significant between 2014 and 2016.

According to official figures, the number of Indian workers emigrating to the GCC countries was 775,845 in 2014 and fell to 507,296 in 2016.Though disruptions due to the Islamic State were largely in Iraq-Syria, the instability affected perceptions about the region as a whole.

The reduced flow of Indian workers to the Gulf is seen to have impacted remittances from these countries. While the breakup is not available, overall remittances as recor ded in India's balance of payments statistics fell slightly from $69,819 million in 2014-15 to $65,592 million in 2015-16.

In terms of number of Indians emigrating, Saudi Arabia showed a sharp decline from 329,882 in 2014 to 165,356 in 2016, almost a 50% drop.Part of this is attributable to a slowing Saudi economy due to low oil prices. But for the past few years, Saudi Arabia has been following what the Indian government calls a `Saudiisation' policy , which is aimed at employing more Saudi nationals rather than foreigners.

“This is to encourage the private sector to employ greater number of Saudi nationals as well as to reducing reliance on expatriate workers. Further, against the backdrop of declining oil prices, the Saudi government has introduced a number of new taxesVAT to augment the sources of government revenue,“ the foreign ministry told Parliament this week.

One of these is the dependant tax, which started on July 1, reported by TOI earlier. From this year, Saudi Ara bia has begun levying a de pendant tax on non-nationals residing in the kingdom. The tax rate is SR 100 (Rs 1,700 approx) per month on each dependent. It will be increased to SR 200 in 2018, SR 300 in 2019 and SR 400 in 2020 per dependent member of the expatriate family ,“ Saudi government said. There are around 3 million Indians in Saudi Arabia.

For now, official figures do not show any noticeable impact on Indians there. Indian officials had, however, raised the issue with a visiting Saudi delegation on July 11, the MEA told the House.

In Bahrain, a construction company employing nearly 1,500 Indians laid off around 700 workers but was unable to repatriate them after clearing their dues due to the financial crisis. All such stories have an adverse impact on worker mobility. Indians also continue to get duped by fake recruiting agents. Instances of mistreatment of Indian workers could have added to the slowdown.