Salaries of legislators (PM, CMs, Ministers, MPs, MLAs...): India

Contents |

President, VP, governors

In 2008

President of India: Rs Rs 50,000 a month

Vice-president of India: Rs 40,000

Governor of a state: Rs 36,000

As in Aug 2016

Prafulla Marpakwar Aug 09 2016 : The Times of India

President of India: Rs 1.5 lakh a month

Vice-president of India: Rs 1.25 lakh

Governor of a state: Rs 1.1 lakh

The salaries of the President, the vice-president and governors were last fixed in 2008.

2018, February

MPs’ salary hike put on auto mode, February 2, 2018: The Times of India

From: MPs’ salary hike put on auto mode, February 2, 2018: The Times of India

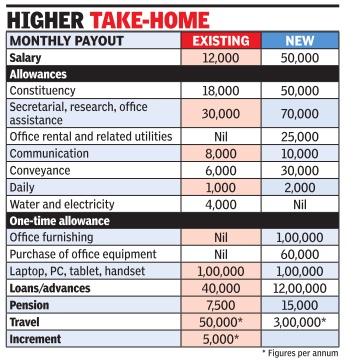

See graphic:

Salaries of President, Vice-President and governors: 2018, February

The FM has announced a hike in salaries of the President, Vice-President and governors, the first time in 12 years. Emoluments are proposed to be revised to Rs 5 lakh for the President, Rs 4 lakh for Vice-President and Rs 3.5 lakh per month for Governors.

Current salary of the President and VP are Rs 1.5 lakh and Rs 1.10 lakh per month respectively, much less than what top bureaucrats and service chiefs get. Laws had not been amended to rectify this anomaly which occurred after the implementation of the 7th Pay Commission’s recommendations two years ago.

Jaitley also proposed a law for an automatic revision of salaries for MPs every five years indexed to inflation. The remuneration of an MP includes a basic salary of Rs 50,000 per month and Rs 45,000 as constituency allowance, apart from other perks. The Centre spends Rs 2.7 lakh on an MP a month. According to PTI, MPs’ salaries will be hiked to Rs 1 lakh from Rs 50,000 from April.

After the implementation of the pay panel’s award on January 1, 2016, the cabinet secretary gets Rs 2.5 lakh per month.

Chief ministers’ salaries

2014

Privy to the CM’s purse?

They Take Home Anything Between 1 & 12L Per Year

Harit Mehta & Chitra Unnithan | TNN

Ahmedabad: Chief ministers in India earn between Re 1 and Rs 12 lakh annually. Earning Rs 96,000 per year, Bengal CM Mamata Banerjee is the ‘poorest’ while Punjab’s Parkash Singh Badal, with a salary of Rs 12 lakh per annum, is ‘richest’.

Tamil Nadu’s J Jayalalithaa takes home a token salary of Re 1, according to Paycheck India, a research initiative of the Indian Institute of Management, Ahmedabad (IIM-A).

While the research at Paycheck India is led by Biju Varkkey, a faculty member of IIM-A, paycheck.in’s technical infrastructure is handled by WageIndicator Foundation, an Amsterdam-based non-profit organization.

At Rs 7,02,260 annually, which is close to Rs 60,000 per month, Gujarat’s Narendra Modi figures at No 6 in the list.

His rival, Bihar’s Nitish Kumar is the second highest paid CM with an annual salary of Rs 11,94,000 which comes to a monthly pay of Rs 99,500.

Paycheck India says it doesn’t have details about the salaries of five CMs: Nabam Tuki (Arunachal Pradesh), Oommen Chandy (Kerala), Naveen Patnaik (Odisha), Akhilesh Yadav (Uttar Pradesh) and Vijay Bahuguna (Uttarakhand).

Maharashtra, 2016

The chief minister will now draw Rs 2.25 lakh a month

Discrepancies between income and assets

2017: Income, assets of MPs don’t match

HIGHLIGHTS

The revelation came in the affidavit filed by the CBDT in response to a petition filed in 2015 by NGO “Lok Prahari".

The NGO had submitted a list of 26 Lok Sabha MPs, 11 Rajya Sabha MPs and 257 MLAs to the tax department seeking verification of their election affidavits.

Property of 7 MPs and 98 MLAs under the scanner of Income Tax department.Property of 7 MPs and 98 MLAs under the scanner of Income Tax department.

NEW DELHI: The Central Board of Direct Taxes (CBDT) informed the Supreme Court that it had found discrepancies between the incomes and assets of several MLAs and a few MPs after verification of their election affidavits.

Referring to assets declared in election affidavits by seven Lok Sabha members and 98 MLAs, the CBDT said, "Verification prima facie with known sources of income has indicated discrepancy and, therefore, these are taken up for further investigation which may include reference to the assessing officer for making assessment."

This revelation came in the affidavit filed by the CBDT in response to a petition filed in 2015 by NGO "Lok Prahari", which had submitted a list of 26 Lok Sabha MPs, 11 Rajya Sabha MPs and 257 MLAs to the tax department seeking verification of their election affidavits while alleging substantial increases in their assets compared to the asset details given by them in previous election affidavits. It had alleged in the SC that the CBDT was taking no action on the information given to the tax department. Seen along with the a development on Friday, when the SC took up a petition for scrutiny and sought the response of the Election Commission and the Union government on a plea for a mechanism to provide for penal consequences for candidates giving false information in election affidavits, the two rulings of the apex court in a space of four days will have a significant impact on making elections fair and transparent.

In the Lok Prahari case, the CBDT said it had entered into an agreement with the EC on verification of asset details of candidates submitted in election affidavits. The categories of affidavits which would be verified are specific cases referred by the EC; cases of phenomenal growth in assets compared to the details given in previous affidavit; cases of winning candidates and veracity of the affidavits compared to the returns of income filed by them; instances where there was no PAN but movable and immovable assets disclosed were in excess of Rs 5 crore; and cases where new immovable assets above a threshold of Rs 2 crore were found compared to the last affidavit.

The CBDT will provide the names of the MPs and MLAs found to have amassed assets disproportionate to their income in a sealed cover on Tuesday to a bench headed by Justice J Chelameswar.

On the list of MPs and MLAs submitted by Lok Prahari to the tax department for verification, the CBDT said in the case of nine Rajya Sabha MPs and 42 MLAs, "the verification reports from Director General of Income Tax are pending". It said no discrepancy was found in affidavits filed by nine Lok Sabha MPs, two Rajya Sabha MPs and 117 MLAs. Explaining its role in verification of election affidavits, the CBDT said, "Given that revenue augmentation is the primary concern of the income tax department, and since increasingly the department is graduating towards non-intrusive methods, the verification of election affidavits is carried out in respect of specific category of such cases, as per agreed parameters between EC and CBDT".

Members of Parliament (MPs)

As in 2016

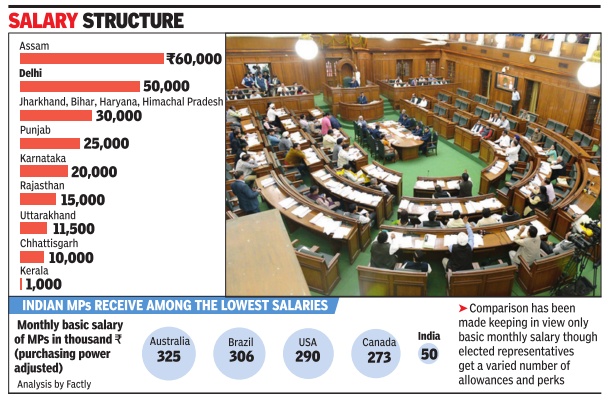

Basic pay Rs 50,000 a month.

MLAs (Members of Legislative Assemblies)

State-wise comparisons: Dec 2015

See graphic, MLAs’ salaries in twelve Indian states...

The Times of India Dec 05 2015

Tamil Nadu: 2017

Sivakumar B | MLAs give themselves a 90% pay hike in TN | Jul 20 2017 : The Times of India (Delhi)

2017: MLAs in Tamil Nadu got a 90% hike in their salaries and allowances. The salaries and allowances of 234 MLAs (including the speaker) will increase from Rs 55,000 per month to Rs 1,05,000. An MLA's salary itself has been increased from Rs 8,000 to Rs 30,000; other allowances have also increased considerably.

The MLAs also received a hike in the MLA Constituency Development Fund from Rs 2 crore a year to Rs 2.5 crore.

Among the allowances the MLAs are entitled to, the constituency allowance got the highest increase -from Rs 10,000 to Rs 25,000 a month. The CM also increased his own allowance as well as those of his cabinet colleagues. “Allowances of the CM, the ministers, the speaker, the deputy speaker, the leader of the Opposition and chief whip of the government will also be increased. Former MLAs will get Rs 20,000 as pension -double from the present amount -and families of former MLAs will get Rs 10,000 as family pension,“ said Palaniswami.

Impact on government revenues

2017-18: shortfall of Rs 50,000-crore

GST leaves ₹50,000cr hole in Centre’s pocket this year, February 2, 2018: The Times of India

From: GST leaves ₹50,000cr hole in Centre’s pocket this year, February 2, 2018: The Times of India

The Centre is staring at a Rs 50,000-crore shortfall in goods and services tax collections in 2017-18, but is hoping to more than make up by budgeting a 67% jump in collections in 2018-19 which may help cut rates ahead of the 2019 elections.

The FM said one reason for the shortfall was the Centre will collect indirect taxes only for 11months in the current fiscal. A part of GST paid in March will be credited in April and will be shown as revenue accrued in 2018-19. Lowerthan-estimated collections have been a factor for the Centre missing the fiscal deficit target of 3.2% of GDP and close the year with 3.5%. Though GST rates have been cut for over 200 items since its introduction on July 1, key reasons for revenue slippage was the GST Council’s call to suspend anti-evasion steps like matching invoices of buyers and sellers and the reverse charge mechanism to keep tabs on unregistered businesses. Rollout of e-way bills was deferred till February 1.

The Centre also has to compensate states if growth in collections is less than 14%. It is hoping GST regime will stabilise soon and with a bigger base of taxpayers along with anti-evasion measures revenues will start growing much faster in 2018-19. It has projected over 60% rise in tax revenues in the next fiscal year.

Salaries and Allowances of Ministers Act, 1952

Excerpts:

DEFINITION: In this Act, ‘Minister’ means a member of the Council of Ministers by whatever name called, and include a Deputy Minister.

3(1) Each Minister shall be entitled to receive a salary per mensem, and an allowance for each day during the whole of his term as such Minister at the same rates as are specified in Section 3 of the Salaries, Allowances and Pension of Members of Parliament Act, 1954 with respect to Members of Parliament.

3(2) Each Minister shall be entitled to receive a Constituency Allowance at the same rate as is specified under Section 8 of the said Act with respect to Members of Parliament.

4(1) Residence of Ministers: Each Minister shall be entitled without payment of rent to the use of a furnished residence throughout his term of office and for a period of 3

- (one month) immediately thereafter, and no charge shall fall on the Minister

personally in respect of the maintenance of such residence.

$[ (2) In the event of the death of the Minister, his family shall be entitled to the use of the furnished residence occupied by the Minister:-

(a) for a period of one month immediately after his death, without payment of rent and no charge shall fall on the family of the Minister in respect of the maintenance of such residence, and

(b) for a further period of one month, on payment of rent at such rates as may be prescribed by rules made in this behalf by the Central Government and also charges in respect of electricity and water consumed in that residence during such further period.]

EXPLANATION: For the purpose of this Section ‘residence’ includes the staff quarters and other buildings apartment thereto, and the gardens thereof, and ‘maintenance’ in relation to a residence includes the payment of local rates taxes and to provision of electricity and water.

5. There shall be paid a sumptuary allowance to each Minister at the following

rates, namely: The rates given below have been revised since

(a) The Prime Minister - Rupees three thousand per mensem;

(b) every other Minister - who is a Member of the Cabinet: Rupees two thousand per mensem;

(c) a Minister of State - Rupees one thousand per mensem;

(d) a Deputy Minister - Rupees six hundred per mensem.

6. Travelling and daily allowance to Ministers:

Minister shall be entitled to:-

(a) travelling allowance for himself and the members of his family and for the transport of his and his family’s effects –

(i) in respect of journey to Delhi from his usual place of residence outside Delhi for assuming office; and

(ii) in respect of the journey from Delhi to his usual place of residence outside Delhi on relinquishing office; and

(b) travelling and daily allowance in respect of tours undertaken by him in the discharge of his official duties, whether by sea, land or air.

(1A) A Minister shall be entitled to traveling allowance in respect of not more than twelve return journeys performed, during each year, within India, for himself and his family, whether travelling together or separately at the same rates at which travelling allowance is payable to such Minister under clause (b) of sub-section (1) in respect of tours referred to in that clause, subject to the overall entitlement of forty eight single journeys in each year.

(2) Any travelling allowance under this Section may be paid in cash or free official transport provided in lieu thereof.

7. Medical treatment etc. to Minister – Subject to any rules made in this behalf by the Central Government, a Minister and the members of his family shall be entitled free of charge to accommodation in hospitals maintained by the Government and also to medical treatment.

8. Advance to Ministers for purchase of motor car – There may be paid to any Minister by way of a repayable advance such sum of money as may be determined by rules made in this behalf for the purchase of a motor car in order that he may be able to discharge conveniently and efficiently the duties of his office.

9. Minister not to draw salary or allowances as Members of Parliament – No person in receipt of a salary or allowance under this Act shall be entitled to receive any sum out of funds provided by Parliament by way of salary or allowances in respect of his membership of either House of Parliament.

10. Notification respecting appointment etc., of Ministers to be conclusive evidence thereof - The date on which any person became or ceased to be a Minister shall be published in the Official Gazette, and any such notification shall be conclusive evidence of the fact that he became, or ceased to be, a Minister on that date for all purposes of this Act.

10A. Notwithstanding anything contained in the Income Tax Act, 1961, the value of rent free furnished residence (including maintenance thereof) provided to a Minister under sub-section (1) of section 4 shall not be included in the computation of his income chargeable under the head ‘Salaries’ under section 15 of the Income Tax Act, 1961. (3) Notwithstanding anything contained in section 11 of the Principal Act, as it stood immediately before the commencement of this Act, no rule made, or purporting to have been made by the Central Government under that Section with retrospective effect and no action taken or things done in accordance with the rule so made, at any time before the commencement of this Act, shall be deemed to be invalid or ever to have been invalid by reason only of the fact that the Central Government had no power to make such rule retrospectively under that section.

12. Regularisation of certain payments – All salaries paid or payable for the period commencing on the 14th day of May, 1952, and ending with the commencement of this Act to Ministers described as Minister of Cabinet rank (but not Member of the Cabinet), all charges incurred before the commencement of this Act in respect of the accommodation provided in any hospital maintained by the Central Government for or on the medical treatment of any Minister or any member of his family and all payments made before such commencement by way of travelling or daily allowances to any Deputy Minister, shall be deemed to have been properly paid payable or incurred or made.

13. Repeal of Act LIII of 1947 – The Salaries of Ministers Act, 1947 is hereby repealed.

Salary, Allowances and Pension of Members of Parliament Act, 1954

EXTRACTS

3. Salaries and Daily Allowances: A member shall be entitled to receive a salary at the rate of sixteen thousand rupees per mensem (w.e.f. 14-9-2006) during the whole of his term of office and subject to any rules made under this Act and allowances at the rate of one thousand rupees (w.e.f. 14-9-2006) for each day during any period of residence on duty.

8. A member shall be entitled to such constituency allowance and to such housing, telephone, water, electricity facilities or such amount in cash in lieu of all or any of such facilities as may be prescribed by rules under Section 9.

The Members of Parliament (Constituency Allowance) Rules, 1986.

EXTRACTS

2. Amount of Constituency Allowance: A member shall be entitled to receive the Constituency Allowance under section 8 of the Salary, Allowances and Pension of Members of Parliament Act, 1954 (30 of 1954) at the rate of rupees twenty thousand per mensem (w.e.f. 12-12-2006).

Amendments to the Act after 1976 sought to be quashed

AmitAnand Choudhary| SC: Why not junk perks for ex-MPs? | Mar 23 2017 : The Times of India

They seem unreasonable, guidelines needed: Court

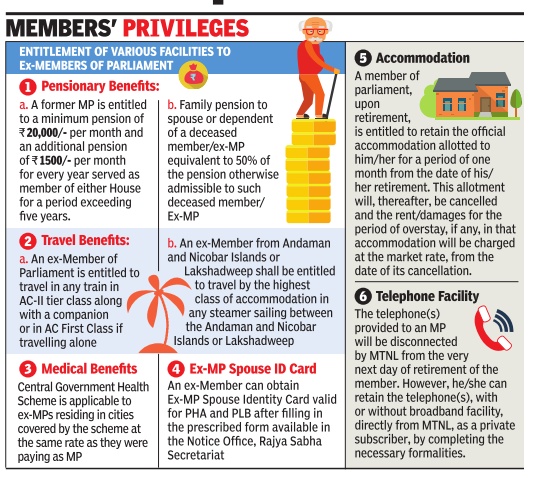

The Supreme Court raised a question mark over benefits and pension for former MPs and MLAs, observing that these facilities on the face of it seem unreasonable and asked the Centre why this should not be scrapped.

A bench of Justices J Chelameswar and S Abdul Nazeer favoured framing of guidelines for extending allowances to former legislators.

The court stressed the need for guidelines while saying there was nothing wrong in providing some financial assistance to ensure former legislators do not live a life in penury after leaving office.

The court direction came on a petition filed by NGO Lok Prahari, seeking to do away with unnecessary allowances and perks to former lawmakers which is being paid from tax payers' money.

Advocate Kamini Jaiswal, appearing for the NGO, contended that pension is provided to government officials out of funds contributed by the employee and government but former law makers are paid pension out of the Consolidated Fund of India that they have not contributed to.

“Pension is given for the purpose of providing financial assistance to a retired person but 80% MPs are crorepatis and do not require pension. It is a largesse given to them and there are no guidelines and law to regulate facilities provided to them,“ she told the bench. She said the issue of providing pension to former MPs was discussed by the constituent assembly while framing the Constitution and was rejected. Jaiswal said that earlier former law makers were entitled for pension only after completing four years. The law was subsequently amended and an exMP became eligible to claim pension after being a member of the House even for a day.

Jaiswal said the apex court had in 1976 upheld the law to grant pension to former law makers but the many unreasonable amendments were since brought in through the Salary , Allowances and Pension of Members of Parliament Act. She pleaded all changes in the Act after 1976 be quashed.The court, after a brief hearing, said issues raised by the petitioner needed examination and issued a notice to the Centre. It said facilities and allowances given to them must be reasonable and not arbitrary.

The petitioner approached the SC after the Allahabad HC dismissed its plea.

“While Governors do not have the facility of pension at all, an MP even for a day and his spouse get pension for life.While even serving judges of the Supreme Court and high courts do not have the facility of free airtrain travel for their spouses even on official tours, ex-MPs enjoy unlimited free train travel for life in AC-II with a companion 365 days a year,“ the petition said.

See also

Salaries of legislators (PM, CMs, Ministers, MPs, MLAs...): India

Assets of legislators (PM, CMs, Ministers, MPs, MLAs...): India