The Adani group

(→Adani Enterprises Ltd: the flagship) |

(→HC relief for in ₹29k cr imports case) |

||

| Line 196: | Line 196: | ||

The case deals with a fundamental question regarding the commission of offence punishable under Customs Act, 1962 and whether or not, DRI is entitled to take recourse to the provisions of the Code of Criminal Procedure, 1973 for issuance of the Letter of Rogatory by the Magistrate. The Bombay high court held that this provision of the CrPC is not an independent island on which any investigating/ inquiring authority can jump on without taking recourse to filing of a FIR and hence the letter rogatory issued by the DRI stands quashed. | The case deals with a fundamental question regarding the commission of offence punishable under Customs Act, 1962 and whether or not, DRI is entitled to take recourse to the provisions of the Code of Criminal Procedure, 1973 for issuance of the Letter of Rogatory by the Magistrate. The Bombay high court held that this provision of the CrPC is not an independent island on which any investigating/ inquiring authority can jump on without taking recourse to filing of a FIR and hence the letter rogatory issued by the DRI stands quashed. | ||

| + | |||

| + | ==The higher the PE ratio of an Adani stock, the sharper the fall\ February 2023== | ||

| + | [https://timesofindia.indiatimes.com/business/india-business/adani-stocks-with-higher-price-to-earning-ratios-see-steeper-fall/articleshow/98256087.cms Aseem Gujar, February 27, 2023: ''The Times of India''] | ||

| + | |||

| + | [[File: The higher the PE ratio of an Adani stock was on Jan 24, 2023, the sharper the fall was by 25 February 2023.jpg| The higher the PE ratio of an Adani stock was on Jan 24, 2023, the sharper the fall was by 25 February 2023 <br/> From: [https://timesofindia.indiatimes.com/business/india-business/adani-stocks-with-higher-price-to-earning-ratios-see-steeper-fall/articleshow/98256087.cms Aseem Gujar, February 27, 2023: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | MUMBAI: Adani Group stocks have been falling relentlessly since the damning report by Hindenburg was published on January 24. Over Rs 12 lakh crore in terms of market capitalisation of the Adani scrips has been wiped out, but not all group stocks have fallen in sync. This is where the valuation of individual stocks comes into play. The deep plunge has been possible due to sky-high valuations. | ||

| + | |||

| + | The Adani Total Gas stock has crashed nearly 81% since January 24, while Adani Ports has dived 27% in the same period — the fall is in sync with how overvalued they were. Adani Total Gas stock was trading at a multiple of 844 times its earnings on January 24, a number that not even the best disruptive technology company can boast of, while Adani Ports was at 30 times, according to price-to-earnings (PE) ratios sourced from Refinitiv database. Stocks that had relatively lower valuations have fallen less. ACC, which had a PE ratio of 54, has fallen the least (26%) among the 10 Adani Group stocks, followed by Adani Ports (27%) and Ambuja Cements (31%). | ||

| + | |||

| + | A company’s PE ratio is one of the indicators of how undervalued or overpriced a scrip is in relation to its profit. Technology and consumer brands, apart from other high-growth companies, usually command steeper valuations than infrastructure or state-owned companies. For instance, TCS has a PE ratio of 31, but Tata Steel has 5. Indraprastha Gas has a PE ratio of 18, while Mahanagar Gas has 13 — both these are in the same business as Adani Total Gas. | ||

| + | |||

| + | A stock price indicates the market’s perception. But when there is a meteoric rise in a particular share, as was seen in the case of Adani scrips amid the pandemic, alarm bells start to ring. In May 2021, ET reported that CLSA had dropped coverage on Adani Transmission with the foreign brokerage saying that the stock is driven by speculative interest, keeping valuation at a stratospheric 16 times premium to the sector. That month, Adani Transmission had a PE ratio of 114, which had more than doubled to 351 by January 24 this year. Currently, it is at 73. The May 2021 ET report was quoted by Hindenburg Research in its study. | ||

| + | |||

| + | In November 2022, V K Vijayakumar, chief investment strategist at Geojit Financial Services, had alluded to ‘stratospheric’ valuations too. “A major disconnect between profits and market cap can be seen in the case of Adani stocks. Gautam Adani has proven expertise in executing large infrastructure projects, but the stratospheric valuations of Adani stocks are a matter of concern,” he had said in a report. When contacted, a representative of Geojit Financial Services said the firm doesn’t track Adani Group. | ||

| + | |||

| + | Interestingly, Adani companies may not be a steal deal even after the selloff. Adani Total Gas, which is stuck in a rut of hitting lower circuits since the report, is still available at 156 times its earnings. “Stock-specific actions will continue in Adani Group,” Kranthi Bathini, director (equity strategy) at WealthMills Securities, said. | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|ATHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUP | ||

| + | THE ADANI GROUP]] | ||

| + | [[Category:India|ATHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUP | ||

| + | THE ADANI GROUP]] | ||

| + | [[Category:Pages with broken file links|THE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUP | ||

| + | THE ADANI GROUP]] | ||

=2023= | =2023= | ||

Revision as of 13:45, 5 March 2023

This is a collection of articles archived for the excellence of their content. Readers will be able to edit existing articles and post new articles directly |

Contents |

Adani Enterprises Ltd: the flagship

As in 2023/ early Feb

George Mathew , Sandeep Singh, February 4, 2023: The Indian Express

From: George Mathew , Sandeep Singh, February 4, 2023: The Indian Express

Starting as a small-time commodity trading business, Adani Enterprises Ltd (AEL), the flagship of the Adani Group founded by Gautam Adani, went on to incubate half-a-dozen companies and grew through acquisitions. The scorching run of Adani companies led by AEL on the stock exchanges took the Group to the numero uno position in market capitalisation and made Gautam Adani the third richest man in the world before the Hindenburg Research report triggered a collapse in the share prices of Group companies.

AEL stock since Jan 25

As the Adani Enterprises follow-on-public offering (FPO) to raise Rs 20,000 crore opened for subscription on January 25 for anchor investors, US-based Hindenburg Research released a report on the Adani group, accusing the group of “brazen stock manipulation and accounting fraud”.

Even as the Adani group termed the report “maliciously mischievous”, and even said that it was planning to sue Hindenburg, shares of all nine listed group companies came under pressure. Over the last seven trading sessions, they have lost an aggregate of Rs 9.1 lakh crore in market capitalisation — 47.4 per cent of their market cap. The group market cap fell from Rs 19.18 lakh crore on January 24 to Rs 10.07 lakh crore on February 3.

The flagship Adani Enterprises came under huge selling pressure on Wednesday and Thursday. Over the last seven trading sessions, its stock has fallen by 54 per cent.

The group had to call off AEL’s FPO a day after it managed to get full subscription to the issue, following interest from non-institutional investors and family offices of large corporations. The shares were called off after they plunged by over 25 per cent on Wednesday. Gautam Adani said that he would refund the investors’ money, and that the decision was taken to safeguard the interest of investors.

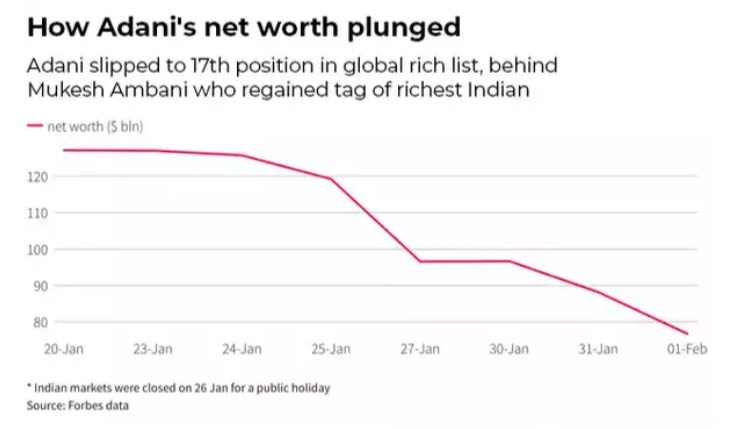

The decline in share prices of the Adani group has led to significant erosion in the net worth of Gautam Adani, who slipped from 3rd spot to 17th spot on the index of global billionaires February 3, with a net worth of $61.7 billion.

AEL growth trajectory

Gautam Adani, then 26 and a school dropout who had done short stints as a diamond sorter and managing a small plastic unit, established AEL as a partnership firm in 1988. It was registered and incorporated in Ahmedabad as Adani Exports Ltd on March 2, 1993; the name was subsequently changed to Adani Enterprises Ltd to reflect changes in its business strategies. A fresh certificate of incorporation was issued by the Registrar of Companies on August 10, 2006.

The company acquired coal mines in India, Indonesia, and Australia, and became the country’s largest private coal importer. The power unit it promoted became the largest private power producer. AEL also entered the ports and airport sectors, and acquired Ambuja Cements and ACC in May 2022.

The company operates and manages seven airports — in Mumbai, Ahmedabad, Lucknow, Mangaluru, Jaipur, Guwahati, and Thiruvananthapuram — and is developing a greenfield airport in Navi Mumbai. As of September 30, 2022, it had 14 road assets, of which three have started commercial operations.

AEL offers mining services including contract mining, development, production-related and other services, as well as integrated resource management services of coal, which involves accessing coal from diverse global pockets and providing just-in-time delivery to Indian customers. It also recently acquired mines to conduct commercial mining activities.

It also manufactures, markets, and brands food FMCG products, and is developing a super-app, “Adani One”, to complement the group’s consumer serving businesses.

According to the prospectus, the company intends to manufacture petrochemicals, copper and similar metals, and strategic military and defence products that enhance India’s self-reliance.

The AEL board

While Gautam Adani is the chairman of the board, his younger brother Rajesh Adani is managing director. Pranav Adani, son of Gautam’s elder brother Vinod Adani, is also on the board.

Other members include M Narendra, former chairman and MD of Indian Overseas Bank; V Subramanian, a former Secretary in the Ministry of New and Renewable Energy; H Nerurkar, a former MD of Tata Steel; Omkar Goswami, founder of CERG Advisory and a former consultant to the World Bank, IMF, ADB, and OECD; Vinay Prakash, CEO of Adani Natural Resources; and Vijaylaxmi Joshi, a former Secretary in the Ministry of Panchayati Raj.

Gautam Adani has two sons — Karan is the CEO of Adani Ports, and Jeet is Vice President (Group Finance).

AEL’s performance

AEL earned revenues of Rs 26,824 crore, and made a net profit of Rs 720.70 crore during fiscal 2022, according to the BSE website. During the second quarter ended September 2022, it reported a revenue of Rs 22,136 crore, and a net profit of Rs 469 crore.

Defence production

Amrita Nayak Dutta, February 12, 2023: The Indian Express

The defence footprint of the Adani Group is spread across multiple companies such as Adani Defence Systems and Technologies Ltd, Ordefence Systems Ltd, Adani Aerospace and Defence Ltd, among others.

Congress leader Rahul Gandhi this week referred to the Adani Group’s defence interests, alleging that the group, which has no experience in this sector, benefited from government patronage.

The Adani Group, a relatively new entrant in the defence sector, has charted an extraordinary growth journey over the last five years, with new subsidiaries diversifying its defence offerings, through acquisitions of both new and legacy companies in the strategic space, as well as through partnerships with foreign private firms.

Subsidiaries, acquisitions

The defence footprint of the Adani Group is spread across multiple companies such as Adani Defence Systems and Technologies Ltd, Ordefence Systems Ltd, Adani Aerospace and Defence Ltd, Adani Naval Defence Systems and Technologies Ltd, Alpha Design Technologies Pvt Ltd, along with PLR Systems Pvt Ltd and Adani-Elbit Advanced Systems India Ltd.

The first four of these were incorporated starting 2015. In 2019, Adani Defence Systems acquired the 2003-incorporated Alpha Design Technologies Pvt Ltd. In 2020, it acquired a majority stake in PLR Systems Private Ltd, making it a joint venture with Israel Weapon Industries (IWI).

In 2018, the group started the joint venture company Adani-Elbit Advanced Systems India Ltd with Israeli firm Elbit Systems.

The Adani Group is currently in the process of acquiring Air Works, one of India’s oldest maintenance repair and overhaul (MRO) units, which will cement its foothold in MRO activities. Range of products

The group actively started its defence businesses in 2018, and has since expanded its offerings in air defence systems, UAVs for various purposes including Intelligence-Surveillance-Reconnaissance, and small arms and ammunition — all of which are of vital importance to the Indian armed forces.

Most of the group’s defence businesses over the last few years have been carried out by Adani Defence Systems and Technologies Ltd, Alpha Design Technologies Pvt Ltd, and PLR Systems Pvt Ltd. Besides the Indian armed forces, and central paramilitary and state police forces, the group’s customers include the armed forces of some foreign countries, including Israel.

“Within a short time, the Company built a comprehensive ecosystem of defence products across small arms, precision guided munitions, unmanned aerial systems, structures, electronics, radars, EW systems and simulators, among others,” the annual report of the company for 2021-22 said. According to the annual report, the company had bagged contracts for over Rs1,000 crore from the Indian armed forces, including the first ever small arms contract awarded to a private sector manufacturer of small arms; besides separate contracts for the delivery of 56 air defence radars to the Army by 2024, and for the supply of seekers for the medium range surface to air missile (MRSAM).

Small arms, ammo

PLR Systems Pvt Ltd manufactures a range of small arms such as TAVOR X95 assault rifles, NEGEV light machine guns and Galil sniper rifles, which are already in service with the Indian armed forces. The PLR Systems website says the TAVOR and Galil rifles were used by Indian special forces during the surgical strikes of 2016. Some of these weapons were earlier imported by India from Israel. Last year the Adani group announced an investment of almost Rs 1,500 crore to set up South Asia’s largest ammunition manufacturing facility in the Uttar Pradesh Defence Corridor.

Adani Defence has also ventured into the highly technical sphere of manufacturing long range glide bombs for the Indian Air Force, as well as the Very Short Range Air Defence (VSHORAD) System and other precision guided munition as a development and production partner with the Defence Research and Development Organisation (DRDO).

Aerospace and avionics

As per the annual report of Adani Enterprises Ltd (AEL), Alpha Design Technologies Ltd (ADTL) — which is involved in manufacturing satellite and ground equipment, electronic warfare and military communications equipment, and aerospace assembly — has operationalised a simulator for the IAF’s MiG-29 aircraft in Adampur under a 20-year Build Operate Maintain contract.

Last year, Elbit Systems and the Bangalore-based ADTL formed a joint venture company called Vignan Technologies, which has started a facility for R&D and innovation.

ADTL is also the first Indian offset partner for Israel Aerospace Industries (IAI) for production of Air Defence Fire Control Radars, 66 of which have been delivered to the Army. ADTL is also understood to be manufacturing combat net radio sets for the Army’s armoured vehicles, and upgrading its old radio sets.

The Adani-Elbit joint venture is manufacturing a range of unmanned platforms, including the Hermes 900 Medium Altitude Long Endurance UAV, which it looks to export, as well as offer to the Indian armed forces when the services issue a Request for Proposal.

Adani Defence and Elbit set up a private UAV facility in 2018 in Hyderabad for manufacturing the Hermes 900 Medium Altitude Long Endurance UAV.

The Adani group is also manufacturing counter-drone systems. It conducted the first live demonstration of the state-of-the-art Rudrav counter drone system at Ahmedabad’s Sardar Vallabhbhai International Airport.

The company had been in partnership talks with the Swedish aerospace and defence company Saab in 2017 to make the Gripen E fighter in India. However, last month Saab said it will not go ahead with the agreement.

YEAR-WISE DEVELOPMENTS

1993-2005: The allotment of [mainly government] land to the Adani group

4 Gujarat CMs have given land to Adani

TNN | Apr 16, 2014 The Times of India

Records show the Adani group first got wasteland in Mundra from the Cogress-backed Chimanbhai Patel government in 1993 and then from another Cogress-supported government headed by Shankersinh Vaghela in 1997.

The group subsequently got more wasteland from BJP governments headed by Keshubhai Patel in 1999 and Narendra Modi in 2005. While it has been alleged that land given to Adani was of the size of Vadodara, the Ahmedabad-based group has got 7,350 hectares, as against Vadodara city's area of 15,900 hectares.

The largest chunk — 5,590 hectares at Rs 14.50 per sqm — was handed over to the group in 2005 by the Modi regime for development of an SEZ. Adani group officials insist that the entire stretch where the Adani port and SEZ is now located was completely barren.

2010: Rajesh Adani gets bail

February 28, 2010: The Indian Express

The Central Bureau of Investigation (CBI) today arrested Rajesh S Adani,the Managing Director of the Rs 26,000 crore Adani Enterprises Ltd,on the charges of evasion of customs duty and undervaluation fraud tentatively pegged at Rs 1.7 crore in Goa. The CBI team from Goa picked him from his home at Vastrapur in Ahmedabad around 7 am.

Later in the evening,Adani was granted interim bail from the Gujarat High Court.

Designated senior counsel B B Naik who appeared for Rajesh Adani,said Rajesh’s elder brother Vasant Adani had moved a habeaus corpus petition in the Gujarat High Court seeking that he should be produced before the court immediately as CBI has detained him without providing any reasons or details. The next hearing in the case is posted for March 2.

The CBI had originally planned to present Adani at the Rural Magistrates Court here to seek a transit remand and a large crowd of media persons and lawyers of the Adani group waited for them there to turn up. But,the investigating agency changed its plans at the last moment and a CBI team flew with Adani to Mumbai in the evening en route to Goa where they said he will be presented before a magistrate. CBI sources said this was because the situation was getting heated up in Gujarat.

Rajesh Adani is the younger brother of the groups founder chairman Gautam Adani,who figures among the 10 richest Indians in the Forbes list.

Rishiraj Singh,CBI deputy director (Western region),told The Sunday Express that Rajesh Adani was arrested for undervaluation fraud related to import of naphta and petroleum products in Goa during 2006-2007. Singh said CBI sleuths also raided Adanis home and premises during the day. According to Singh,the CBI sleuths had also raided the Mumbai home of the co-accused in the case,Ramakant Pilani,who heads a Mumbai-based firm Ganseh Benzoplast Ltd,but failed to nab him.

A case in this regard was registered in January 2008 by the Goa Anti-Corruption Bureau of the CBI. Singh added that cases have been filed against nine senior officials of the Goa Customs in the same case.

This is the second time that Rajesh Adani had been arrested. In 1999,the Directorate of Revenue Intelligence had arrested him at Bhuj charging him with a similar duty evasion fraud worth Rs 1.4 crore. Soon after his arrest and orders of the local magistrate to remand him,Adani had claimed to have backache and spent time at a Bhuj hospital,until an appeal was moved at the Gujarat High Court which allowed him bail.

This time,CBI decided to take Adani to the Civil Hospital in Gandhinagar for a full check up,and then to the Cardiology department of the Ahmedabad Civil Hospital,before presenting him before the local magistrate to seek the transit remand to take him to Goa.

Dipak Damor,SP CBI (Gujarat),said the CBI team from Goa had arrived on Friday evening but arrested Adani from his home only in the morning. The CBI decided to take him for medical examination before the transit so as to avoid any claims of medical complications later.

The Adani group,meanwhile,issued a statement claiming that the petroleum products that they imported were on behalf of the license and permission holders and it was the latter who were responsible for fulfilling all formalities and the payment of duties.

It observed that the Customs had not issued any showcause notice to Rajesh Adani or the Adani group in this regard and maintained that the CBI had issued his arrest memo without providing any reasons or details.

Significantly,the Adani group statement also claimed that Rajesh Adani was not responsible for any day-to-day business operations. On the other hand,the groups website says: He (Rajesh Adani) is in charge of day-to-day operations of the Company and has been responsible for developing the business relationships of the Company. He also handles the marketing and finance aspects of the Company.”

Meanwhile,Adanis residence 14,Surajya Bungalows,Vastrapur remained deserted except for armed private security personnel. The guards said his family left immediately after the CBI sleuths had arrived at the house.

Imported consignments

- Three consignments of imported naptha and furnace oil were kept by the Adani group at a warehouse in Goa,which was licenced to store only restricted items. According to CBI officials,the licence of the warehouse had expired as well. CBI sources said Adani Enterprises Ltd had reportedly been trading with Ganesh Benzoplast for a long time and is suspected to have stored other earlier consignments there as well.

- CBI officials said these consignments were kept at the Goa warehouse after being imported by Adani Enterprises Ltd,earlier known as Adani Exports.

- CBI sources said they are now verifying all the documents of the Advani group’s imports in the recent past. The details of the warehouses where the group stores imported goods are now being ascertained,said an official.

2019

HC relief for in ₹29k cr imports case

Oct 18, 2019: The Times of India

A Bombay high court order has brought to a halt an overseas investigation by the Directorate of Revenue Intelligence into the alleged Rs 29,000-crore overvaulation of Indonesian coal imports by the Adani Group.

The high court quashed all Letters Rogatory (LR) sent by DRI to 14 countries, including Singapore and UAE, seeking information into the alleged overvaluation. An LR is a formal request to another country, seeking judicial assistance in accessing information on an offshore entity in a probe.

DRI is probing at least 40 companies, including the Essar Group, for overvaluation of imports. TOI was the first to report on the scam in its December 14, 2014, edition.

Making it clear that it hasn’t gone into the merits of the LRs, the high court said: “We have only dealt with the contention as to whether it was permissible for the magistrate to issue such a Letter Rogatory without following the procedure mandated under the Criminal Procedure Code.”

The DRI began probing a non-cognisable offence without obtaining the necessary permission from the magistrate and in such circumstances, the LRs issued do not meet the test, said a bench of Justices Bharati Dangre and Ranjit More.

Implication

The case deals with a fundamental question regarding the commission of offence punishable under Customs Act, 1962 and whether or not, DRI is entitled to take recourse to the provisions of the Code of Criminal Procedure, 1973 for issuance of the Letter of Rogatory by the Magistrate. The Bombay high court held that this provision of the CrPC is not an independent island on which any investigating/ inquiring authority can jump on without taking recourse to filing of a FIR and hence the letter rogatory issued by the DRI stands quashed.

The higher the PE ratio of an Adani stock, the sharper the fall\ February 2023

Aseem Gujar, February 27, 2023: The Times of India

From: Aseem Gujar, February 27, 2023: The Times of India

MUMBAI: Adani Group stocks have been falling relentlessly since the damning report by Hindenburg was published on January 24. Over Rs 12 lakh crore in terms of market capitalisation of the Adani scrips has been wiped out, but not all group stocks have fallen in sync. This is where the valuation of individual stocks comes into play. The deep plunge has been possible due to sky-high valuations.

The Adani Total Gas stock has crashed nearly 81% since January 24, while Adani Ports has dived 27% in the same period — the fall is in sync with how overvalued they were. Adani Total Gas stock was trading at a multiple of 844 times its earnings on January 24, a number that not even the best disruptive technology company can boast of, while Adani Ports was at 30 times, according to price-to-earnings (PE) ratios sourced from Refinitiv database. Stocks that had relatively lower valuations have fallen less. ACC, which had a PE ratio of 54, has fallen the least (26%) among the 10 Adani Group stocks, followed by Adani Ports (27%) and Ambuja Cements (31%).

A company’s PE ratio is one of the indicators of how undervalued or overpriced a scrip is in relation to its profit. Technology and consumer brands, apart from other high-growth companies, usually command steeper valuations than infrastructure or state-owned companies. For instance, TCS has a PE ratio of 31, but Tata Steel has 5. Indraprastha Gas has a PE ratio of 18, while Mahanagar Gas has 13 — both these are in the same business as Adani Total Gas.

A stock price indicates the market’s perception. But when there is a meteoric rise in a particular share, as was seen in the case of Adani scrips amid the pandemic, alarm bells start to ring. In May 2021, ET reported that CLSA had dropped coverage on Adani Transmission with the foreign brokerage saying that the stock is driven by speculative interest, keeping valuation at a stratospheric 16 times premium to the sector. That month, Adani Transmission had a PE ratio of 114, which had more than doubled to 351 by January 24 this year. Currently, it is at 73. The May 2021 ET report was quoted by Hindenburg Research in its study.

In November 2022, V K Vijayakumar, chief investment strategist at Geojit Financial Services, had alluded to ‘stratospheric’ valuations too. “A major disconnect between profits and market cap can be seen in the case of Adani stocks. Gautam Adani has proven expertise in executing large infrastructure projects, but the stratospheric valuations of Adani stocks are a matter of concern,” he had said in a report. When contacted, a representative of Geojit Financial Services said the firm doesn’t track Adani Group.

Interestingly, Adani companies may not be a steal deal even after the selloff. Adani Total Gas, which is stuck in a rut of hitting lower circuits since the report, is still available at 156 times its earnings. “Stock-specific actions will continue in Adani Group,” Kranthi Bathini, director (equity strategy) at WealthMills Securities, said.

2023

The Hindenburg Research report and its impact/ Jan-Feb

February 2, 2023: The Times of India

From: February 2, 2023: The Times of India

From: February 2, 2023: The Times of India

From: February 2, 2023: The Times of India

From: February 2, 2023: The Times of India

From: February 2, 2023: The Times of India

From: February 2, 2023: The Times of India

From: February 2, 2023: The Times of India

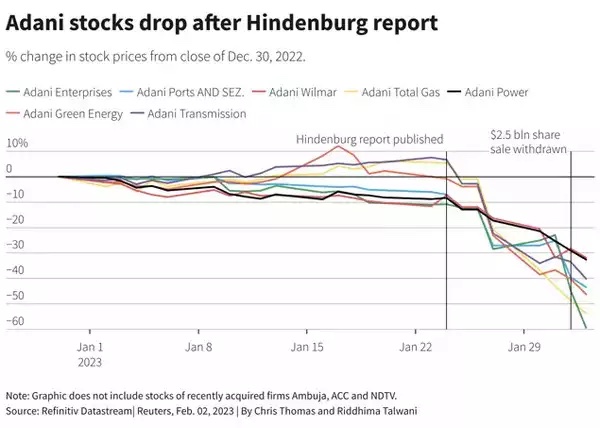

Hindenburg released its report 2 days before Adani Enterprises' Rs 20,000 crore FPO was about to open. The company had already raised Rs 5,985 crore by allotting shares to anchor investors.

In the report, Hindenburg accused Adani Group of a "brazen stock manipulation and accounting fraud scheme." It cited 2 years of research, including talks with former senior executives of the company and reviews of several documents.

The report comprised 32,000 words and alleged various kinds of frauds and account manipulations by Adani Group companies over the years. It said that key listed Adani companies have taken on substantial debt, including pledging shares of their inflated stocks for loans, putting the entire group on precarious financial footing.

It also said that seven Adani listed companies have an 85% downside on a fundamental basis due to what it called "sky-high valuations”.

Further, the report highlighted accounting irregularities and sketchy dealings enabled by virtually non-existent financial controls. "Adani Enterprises has had 5 chief financial officers over the course of 8 years, a key red flag indicating potential accounting issues," it said.

Citing evidence of stock manipulation, Hindenburg gave reference to Sebi's investigation and prosecution of more than 70 listed entities and individuals over the years, including Adani promoters, for pumping Adani Enterprises' stock.

Hindenburg also has short positions in Adani companies through US-traded bonds and non-Indian-traded derivative instruments.

Adani denied allegations

Caught in the corporate-cum-stock market storm, Adani Group issued a statement on January 29 against Hindenburg's allegations few days later and likened the damning allegations to a "calculated attack" on India, its institutions and growth story.

Stating that all accusations were nothing but a lie, the group said that 68 of the 88 questions posed by Hindenburg were already addressed by it through annual reports of various group companies, offer documents and stock market disclosures.

Of the remaining 20 questions, 16 were relating to public shareholders and their sources of funds, while the rest four were baseless allegations, it added.

"The report is rife with conflict of interest and intended only to create a false market in securities," Adani Group claimed.

It also highlighted that mala fide intentions were apparent given the timing of the report when Adani Enterprises was about to undertake the largest equity FPO.

"Needless to say that Hindenburg has created these questions to divert the attention of its target audience while managing its short trades to benefit at the cost of investors," they added.

In addition, the group said that at various points in the report, it was clear that Hindenburg Research didn't have a good understanding of the Indian legal system, the accounting practices and how the fund-raising processes work in the Indian capital market.

As an example, it said that Hindenburg Research had falsely claimed that Emerging Market Investment DMCC gave a loan of $1 billion to Mahan Energen.

In reality, "Emerging Market acquired the $1-billion 'unsustainable debt' of Mahan Energen from its lenders for $100 as part of a resolution plan duly approved by the National Company Law Tribunal (NCLT) under the Indian Bankruptcy Code. These are mala fide attempts to question bona fide transactions," the rebuttal noted.

Hindenburg's counter statement

In response to Adani's rebuttal, Hindenburg on January 30, dismissed charges that its report was a "calculated attack on India".

In its defence, the US short seller said that fraud cannot be obfuscated by nationalism or a bloated response that ignored key allegations.

Standing by its report that alleged "fraud" at the second largest conglomerate in India run by the world's then-third richest man, Hindenburg said it disagrees with Adani group's assertion of its report being an attack on India.

"To be clear, we believe India is a vibrant democracy and an emerging superpower with an exciting future," it said. "We also believe India's future is being held back by the Adani Group, which has draped itself in the Indian flag while systematically looting the nation.”

A "fraud is fraud, even when it's perpetrated by one of the wealthiest individuals in the world," it said, adding, "Adani also claimed we have committed a 'flagrant breach of applicable securities and foreign exchange laws'. Despite Adani's failure to identify any such laws, this is another serious accusation that we categorically deny.”

Hindenburg said it "found Adani's lack of direct and transparent answers" on the allegations of use of offshore entities "telling".

Market rout continues

On January 24, the day Hindenburg released this report, a share of Adani Enterprise costed Rs 3,442.75 at close of day's trade. Today, the stock is priced at Rs 1,564.70, that is, a fall of 54.55% in just 6 sessions.

On Thursday as well, the stock tanked 26.5%. Most of the other group firms also declined.

If we look at Adani Ports, the stock has declined 39%, Adani Power 26.43%, Adani Transmission 43.49%, Adani Green Energy 45.75%, Adani Total Gas 56%, and Adani Wilmar fell by 26.46%. Cumulatively, in 6 days, stocks have faced an combined erosion of over Rs 8.76 lakh crore.

Global rankings fall

As a result of this massive drag in stock prices of companies, Gautam Adani's position in Forbes real-time global richest ranking has slipped to 17.

Adani has now lost his tag as richest Asian person. His wealth now stands at $64.2 billion.

However, according to Bloomberg Billionaires Index, Adani is placed at 13th position with a total wealth of $72.1 billion.

In September last year, Adani's wealth had surged to over $155 billion, making him the 2nd richest person in global billionaires ranking and the first Indian (and Asian) to break into the top 3 list. In a little over two and half years, Gautam Adani's wealth had galloped over 13 times. In January 2020 just before the onset of Covid pandemic, his net worth was about $10 billion.

Adani withdraws FPO

Seeing the beating Adani group companies suffered on the bourses since last week, the Board of Directors of the group decided to call fully subscribed FPO of Adani Enterprises. In a regulatory statement to the bourses, Adani Group said that it has decided not to proceed with FPO in the interest of its subscribers.

"Given the unprecedented situation and the current market volatility the company aims to protect the interest of its investing community by returning the FPO proceeds and withdraws the completed transaction," Adani Group said in its official release.

The Rs 20,000 crore worth FPO was fully subscribed just a day ago as investors pumped funds into the flagship firm. However, the flagship company of the Adani Group had a lacklustre start to its FPO, with only a 1% subscription on the first day of the share sale. The offer was opened for public subscription from January 27-31.

But, it managed to get investors on the last day of the share close on Tuesday.

Total bids for 5.1 crore shares were received, against the offer size of 4.6 crore shares, on January 31, the third and final day of retail bidding, representing a 112% subscription. This excludes the Rs 5,985-crore anchor book, a part of the QIB portion, that was completely subscribed a day before the FPO had opened on January 28.

Adani Group said that it will return money to investors and thanked them for their support and commitment towards the group.

The fundraising was critical for Adani, not just because it was seen as a move to cut his group's debt, but also because it is was being seen by some as a gauge of confidence at a time when the tycoon faces one of his biggest business and reputational challenges. RBI, Sebi start scrutiny

The Securities and Exchange Board of India (Sebi) has started examining the constant crash in shares of Adani Group.

It is also looking into any possible irregularities in a share sale by its flagship company, a Reuters report said.

Sebi is undertaking a full-scale examination of the fall in shares, a source told Reuters, declining to be identified as the matter is confidential.

Meanwhile, Reserve Bank of India (RBI) has also sought details about lenders' exposures to the Adani Group.

Country's largest lender SBI had said it's exposure to Adani group is fully secured by cash generating assets, in an attempt to assuage investor concerns.

Another public sector lender Bank of Baroda has said its total exposure to the embattled group stood at Rs 7,000 crore, which are also fully secured.

Government-owned life insurance behemoth Life Insurance Corporation (LIC) has disclosed of having an exposure of Rs 36,474.78 crore to Adani group's debt and equity, and added that the amount is less than one per cent of its total investments.

Share of mutual funds in Adani

Mutual funds from India and elsewhere hold just 3.4% of Adani Enterprises, 2.8% of Adani Total Gas and 3.6% of Adani Green Energy. Promoters of the companies hold most of the shares.

Adani Enterprises and Adani Port are constituents of the Nifty 50, so they are automatically in portfolios of some exchange-traded funds (ETFs) and index funds. But active funds have very little exposure to Adani stocks and are largely unscathed by their fall. US-listed iShares MSCI India ETF , which at the end of December had a combined holding of $172 million in Adani Transmission, Adani Total Gas and Adani Enterprises, has lost 2.7% over the past week.

Among active funds, the Kotak Balanced Advantage fund , which has positions in Adani Enterprises and Adani Ports and Special Economic Zone, has shed just 0.5%.

Exposure to debts

According to analysts quoted by Reuters, the shock to the system comes because of Adani's heft and influence, rather than exposure.

His conglomerate spans ports, coal mines, food businesses, airports and lately media, and before the rout its seven companies had accounted for more than 6% of the National Stock Exchange market value.

While the Adani Group has total gross debt of Rs 2.2 lakh crore ($26.86 billion), top banks have said their credit exposures to the group are small, as per a Reuters report. Shares of the firm are closely held, mutual funds have low exposure too.

"Everybody’s keeping a very close eye on those debts," Pankaj Pathak, a fund manager at Quantum Asset Management told Reuters. "But on the domestic debt side, we hardly see any impact on the broader corporate bond market because of what is happening in Adani," he said, pointing to the limited ownership of those bonds.

Citigroup, Credit Suisse worry

As regulators step in, banks are distancing themselves, with Citigroup's wealth unit saying it has stopped extending margin loans to its clients against Adani securities, and Bloomberg News reporting that Credit Suisse had done likewise.

Investment research firm TS Lombard said the Adani allegations had "hastened the decline we expected in Indian equities as foreign investors rebalance their portfolios on China’s reopening" but that the declines would be limited for several reasons, including Adani being “too unique to fail”.

When one of mightiest conglomerates of a country calls off its fully subscribed follow on public offer (FPO), stating that it would be "morally incorrect", it is sure to spook investors.

The Gautam Adani-led Adani Group, who's stocks were one of the key drivers of stock markets since the past 3 years, is now finding it hard to even stay in the positive zone. And, all of it happened in just 1 week.

In other words, a major part of his over $100 billion earnings in the last 3 years was wiped out in the last week.

The fall has been so massive that the group's market losses have now swelled to over $100 billion, sparking worries about their potential systemic impact.

The market rout started January 25, after a US short-seller Hindenburg Research published a report alleging stock manipulation by the Adani Group and raised concerns about high debt and valuations.

(With inputs from agencies)