The Ambanis

(→Ambanis) |

(→Dhirubhai's grandchildren) |

||

| (18 intermediate revisions by 3 users not shown) | |||

| Line 10: | Line 10: | ||

[[Category: India |A]] | [[Category: India |A]] | ||

| − | |||

[[Category: Economy-Industry-Resources |A ]] | [[Category: Economy-Industry-Resources |A ]] | ||

| − | |||

| − | = | + | =Religion= |

| + | The following is the gist of a [https://www.quora.com/ Quora] discussion, with the names of the contributors within brackets. | ||

| + | |||

| + | |||

| + | The Amabanis are Vaishnav Modh Gujarati Banias, followers of Shri Shrinath Ji, they follow Hinduism. though their family had a Jain connection in its roots since the time of Dhirubhai's father. Anil Ambani’s wife Tina Ambani is Jain and now Mukesh Ambani’s daughter-in-law is Jain (Atul Singhai) Ambani‘s son has married to a Jain Girl who is a daughter of a ‘Diamond King’ and whose company is called Rosy Blue. | ||

| + | |||

| + | During Akash and Shloka Ambani’s wedding ceremony, the phere ceremony began with the chanting of the Navkar Mantra, (Vaibhav Gadia) Akash Ambani's wife Shloka is from a Jain family. That's why Navkar Mantra was chanted in the ceremony. (Sanjay Jain) But even Mukesh, Neeta and Anant Ambani chanted the navkar mantra. (Vaibhav Gadia) | ||

| + | |||

| + | But during Isha Ambani's pre-wedding a function was organised at Udaipur just a few km from Nathdwara and in that function, Neeta Ambani performed a dance dedicated to Lord Shreenathji…The entire Ambani family visits Nathdwara at least twice in six months | ||

| + | |||

| + | They are Trustees of the Badrinath temple and their family’s name is Chanted in the Aartis of Badrinath temple (Vivek) | ||

| + | |||

| + | =YEAR-WISE DEVELOPMENTS= | ||

| + | |||

| + | =2010: Peace pact= | ||

May 2010 | May 2010 | ||

| − | Warring Ambanis clinch peace pact, agree to compete | + | '''Warring Ambanis clinch peace pact, agree to compete''' |

| − | Brothers Worked Out Deal Themselves | + | ''Brothers Worked Out Deal Themselves'' |

Prabhakar Sinha | Prabhakar Sinha | ||

| Line 28: | Line 40: | ||

New Delhi: If their business war was bitter and no-holds-barred, the peace was equally dramatic. At 5 minutes to 2pm on Sunday, officials of both Reliance Industries Ltd and ADAG (Anil Dhirubhai Ambani Group) were stunned to receive notes stating that the Ambani brothers had decided to scrap their non-compete agreement and effectively bury the hatchet. | New Delhi: If their business war was bitter and no-holds-barred, the peace was equally dramatic. At 5 minutes to 2pm on Sunday, officials of both Reliance Industries Ltd and ADAG (Anil Dhirubhai Ambani Group) were stunned to receive notes stating that the Ambani brothers had decided to scrap their non-compete agreement and effectively bury the hatchet. | ||

| − | + | The peace pact was thrashed out directly between the two brothers, with the blessings of their mother and — apparently — mediation by some spiritual gurus. In fact, Anil Ambani and Kokilaben left for a pilgrimage to Badrinath and Kedarnath on Wednesday last week after the deal was clinched. | |

| − | + | ||

| − | + | The pact was kept a closely-guarded secret, though the Prime Minister’s Office was reportedly kept in the loop and endorsed the development, saying it was in the best interest of the nation for the two brothers to be reconciled. | |

| − | + | On Sunday, the two siblings announced the scrapping of the non-compete clause which was entered into between their respective groups in June 2006, when Dhirubhai Ambani’s business empire was carved out between them. Instead, they have entered into a simpler agreement, which is restricted only to gas-based power generation. Even there, RIL is allowed to set up plants for captive consumption. | |

| − | + | The pact followed a recent directive of the Supreme Court on supply of gas from RIL-owned KG basin to Reliance Natural Resources Ltd for its Dadri power project. ‘‘RIL and RNRL will expeditiously negotiate gas supply arrangements in accordance with the orders of the Supreme Court,’’ both groups said in their respective statements. They also expressed confidence that the development would help create an overall environment of harmony, ‘‘co-operation and collaboration’’ between them. | |

| + | |||

| + | Under the previous agreement, Anil could have ventured almost anywhere except petrochemicals and gas, while Mukesh’s companies were restricted from entering many sectors like finance, telecom, power and infrastructure. But Anil was facing problems in raising funds to expand Reliance Infocomm. | ||

| + | |||

| + | '''WIN-WIN FOR BHAI-BHAI ''' | ||

After SC ruling, both brothers decided to resolve the issue. Mother Kokilaben and some spiritual leaders said to be involved. Deal completed before Anil Ambani and Kokilaben went to Badrinath on Wednesday The Non-Compete Clause | After SC ruling, both brothers decided to resolve the issue. Mother Kokilaben and some spiritual leaders said to be involved. Deal completed before Anil Ambani and Kokilaben went to Badrinath on Wednesday The Non-Compete Clause | ||

| Line 41: | Line 56: | ||

During their Jan 2006 settlement, RIL and ADAG entered into a noncompete clause, under which Mukesh could not enter finance, power, road and construction, and telecom sectors. Anil barred from entering petrochemical and gas sectors | During their Jan 2006 settlement, RIL and ADAG entered into a noncompete clause, under which Mukesh could not enter finance, power, road and construction, and telecom sectors. Anil barred from entering petrochemical and gas sectors | ||

| − | The clause was valid till 2018 for financial sector, and 2015 for others Invoked In The Past | + | The clause was valid till 2018 for financial sector, and 2015 for others |

| − | BY ANIL AMBANI | + | |

| + | '''Invoked In The Past''' | ||

| + | |||

| + | ''BY ANIL AMBANI '' | ||

June 2006: In the power sector, when Mukesh-led RIL wanted to set up a 2000mw captive power project in its Gurgaon SEZ | June 2006: In the power sector, when Mukesh-led RIL wanted to set up a 2000mw captive power project in its Gurgaon SEZ | ||

| Line 48: | Line 66: | ||

Jan 2008: When RIL wanted to start a non-banking finance company to finance customers of Reliance Digital | Jan 2008: When RIL wanted to start a non-banking finance company to finance customers of Reliance Digital | ||

| − | BY MUKESH AMBANI | + | ''BY MUKESH AMBANI'' |

June 2008: When Anil Ambani was in talks to acquire African telecom major MTN through share swap | June 2008: When Anil Ambani was in talks to acquire African telecom major MTN through share swap | ||

The New Agreement Scraps the no-compete clause except in gas-based power generation, in which RIL cannot venture except for captive consumption | The New Agreement Scraps the no-compete clause except in gas-based power generation, in which RIL cannot venture except for captive consumption | ||

| − | |||

| − | |||

| − | |||

| − | |||

| + | '''Sectors which both groups may enter following new pact''' | ||

| + | |||

| + | ''RIL group:'' Finance, telecom and infrastructure | ||

| + | |||

| + | ''ADAG:'' Will provide Anil financial flexibility to raise funds in telecom sector | ||

| + | From Recrimination To Reconciliation | ||

1999 | NELP takes off. Govt invites global tenders for exploration in oil and gas fields. RIL and NIKO emerge successful bidder of KGD6 | 1999 | NELP takes off. Govt invites global tenders for exploration in oil and gas fields. RIL and NIKO emerge successful bidder of KGD6 | ||

| + | |||

June 18, 2005 | The Ambani brothers reach a settlement to split the Reliance group in a deal brokered by Kokilaben | June 18, 2005 | The Ambani brothers reach a settlement to split the Reliance group in a deal brokered by Kokilaben | ||

| + | |||

Dec 9, 2005 | HC okays RIL demerger scheme. Gas, coal, telecom and financial services businesses go to Anil and Mukesh retains flagship RIL | Dec 9, 2005 | HC okays RIL demerger scheme. Gas, coal, telecom and financial services businesses go to Anil and Mukesh retains flagship RIL | ||

Jan 12, 2006 | The board of directors of RIL approve pact that calls for 28 million units of gas to be supplied to Anil Ambani group and up to 40 million units if the contract with NTPC does not materialise | Jan 12, 2006 | The board of directors of RIL approve pact that calls for 28 million units of gas to be supplied to Anil Ambani group and up to 40 million units if the contract with NTPC does not materialise | ||

| + | |||

Feb-Jul, 2006 | Anil’s RNRL seeks permission from the petroleum ministry to lay pipelines for transporting gas from Kakinada in Andhra Pradesh to Dadri in Uttar Pradesh. RIL asks ministry to approve the gas price at $2.34 per unit based on bids called by NTPC, but the permission is denied | Feb-Jul, 2006 | Anil’s RNRL seeks permission from the petroleum ministry to lay pipelines for transporting gas from Kakinada in Andhra Pradesh to Dadri in Uttar Pradesh. RIL asks ministry to approve the gas price at $2.34 per unit based on bids called by NTPC, but the permission is denied | ||

| + | |||

Nov 8, 2006 | RNRL takes the dispute to court. Later, company wants RIL to be restrained from selling 28 million units of gas to any third party | Nov 8, 2006 | RNRL takes the dispute to court. Later, company wants RIL to be restrained from selling 28 million units of gas to any third party | ||

May 3, 2007 | Company judge restrains RIL from creating third party rights in gas meant for RNRL | May 3, 2007 | Company judge restrains RIL from creating third party rights in gas meant for RNRL | ||

| − | Oct 10, 2007 | Govt okays market price determined by RIL at above $4.2/mmBtu | + | |

| + | Oct 10, 2007 | Govt okays market price determined by RIL at above $4.2/mmBtu | ||

| + | |||

Oct 15, 2007 | Company Judge upholds RNRL’s case, says MoU between parties binding. Directs them to renegotiate gas sale purchase agreement instead of directing a modification of the scheme | Oct 15, 2007 | Company Judge upholds RNRL’s case, says MoU between parties binding. Directs them to renegotiate gas sale purchase agreement instead of directing a modification of the scheme | ||

| + | |||

Dec, 2007 | RIL and RNRL file separate appeals against the judgment. RNRL says court did not give directions for amendment of gas supply agreement to make the scheme workable | Dec, 2007 | RIL and RNRL file separate appeals against the judgment. RNRL says court did not give directions for amendment of gas supply agreement to make the scheme workable | ||

| − | Jan 30, 2009 | Mumbai HC concludes hearing; passes interim order lifting stay on the sale of gas from KGD6 Jun 15, 2009 | HC asks both sides to honour 2005 MoU and arrive at a fresh ‘bankable agreement' within a month to ensure RNRL gets 28 mmscmd gas from RIL, but till then continues Jan 30 order | + | |

| + | Jan 30, 2009 | Mumbai HC concludes hearing; passes interim order lifting stay on the sale of gas from KGD6 | ||

| + | |||

| + | Jun 15, 2009 | HC asks both sides to honour 2005 MoU and arrive at a fresh ‘bankable agreement' within a month to ensure RNRL gets 28 mmscmd gas from RIL, but till then continues Jan 30 order | ||

| + | |||

Jul 3, 2009 | RNRL moves Supreme Court against HC ruling | Jul 3, 2009 | RNRL moves Supreme Court against HC ruling | ||

| + | |||

May 7, 2010 | SC rules in favour of RIL, giving the brothers six months to renegotiate the deal at the governmentdecided price of $4.2/ mmBtu | May 7, 2010 | SC rules in favour of RIL, giving the brothers six months to renegotiate the deal at the governmentdecided price of $4.2/ mmBtu | ||

| + | |||

May 23, 2010 | Brothers decide to scrap the existing non-compete clause with exception that Mukesh can enter gas-based power generation for captive consumption only | May 23, 2010 | Brothers decide to scrap the existing non-compete clause with exception that Mukesh can enter gas-based power generation for captive consumption only | ||

| − | |||

| − | July 2008 | Anil's RCOM called off merger talks with MTN Group after RIL threatened to block the sale if it wasn’t given the first option to buy shares in RCOM Oct 2007 | ADAG complained to the stock market regulator Sebi that | + | '''OTHER DISPUTES ''' |

| + | |||

| + | July 2008 | Anil's RCOM called off merger talks with MTN Group after RIL threatened to block the sale if it wasn’t given the first option to buy shares in RCOM | ||

| + | |||

| + | Oct 2007 | ADAG complained to the stock market regulator Sebi that | ||

RIL was trying to stall the IPO of | RIL was trying to stall the IPO of | ||

Reliance Power | Reliance Power | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|A | ||

| + | THE AMBANIS]] | ||

| + | [[Category:India|A | ||

| + | THE AMBANIS]] | ||

| + | |||

| + | = Dhirubhai's grandchildren= | ||

| + | ==2014== | ||

| + | [[File: Ambanis.png| |frame|500px]] | ||

| + | ''' Dhirubhai's grandsons step into fathers' shoes ''' | ||

| + | |||

| + | Piyush.Pandey @timesgroup.com | ||

| + | Mumbai: | ||

| + | |||

| + | Aug 08 2014 | ||

| + | |||

| + | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=Dhirubhais-grandsons-step-into-fathers-shoes-08082014023049 The Times of India ] | ||

| + | |||

| + | '' Akash To Help Launch Mukesh's Telecom Venture Rel Jio, Jai Anmol Joins Anil's Fin Co '' | ||

| + | |||

| + | The coincidences are hard to miss. Akash and Jai Anmol, cousins and scions of the country’s leading business family, have joined the now-divided empire originally founded by their grandfather Dhirubhai Ambani, within months of each other. Both are stepping into areas that were the core strengths of Dhirubhai’s sons, their fathers. | ||

| + | |||

| + | Reliance Industries (RIL) chairman Mukesh Ambani’s elder son Akash Ambani recently joined RIL to help launch the conglomerate’s re-entry in telecommunications with Reliance Jio, while Reliance Group chairman Anil Ambani’s son Jai Anmol has joined Reliance Capital. While Akash will be in operations, it’ll be finance for Jai Anmol. When contacted by TOI, officials in both companies confirmed the move. | ||

| + | |||

| + | Rewind to the eighties when the family was still very much together. Mukesh gave up his management studies at Stanford midway to join Reliance Industries in 1981 when his father called him back. Famed for his project management skills, Mukesh initiated Reliance’s backward integration journey from textiles into polyester fibres and further into petrochemicals and petroleum refining, and upstream into oil and gas exploration and production. In the process | ||

| + | |||

| + | he created the world's largest grassroots petroleum refinery in Jamnagar. Two years later, his younger brother Anil after finishing his management at Wharton joined RIL as co-chief executive officer to pioneer financial innovations and lead India Inc's foray into overseas capital markets. | ||

| + | |||

| + | The clock appears to have come a full circle. The cousins, both 22, representing the third generation of the Ambanis, are joining their respective businesses at a time when the next big push is needed for both groups, as they chase growth in an economy struggling to come out of a slowdown. Their fathers had entered the business when they were around 24 and the group needed a big move forward. | ||

| + | |||

| + | Akash, an economics graduate from Brown University , who was first formally seen with his father in 2011 at the signing the $7.2-billion deal with BP Plc, is now involved in rolling out Reliance Jio's complex 4G broadband wireless service offerings, which could redraw the telecommunications landscape. His father did the same more than a decade ago with the launch of Reliance Infocom, now Reliance Communications (part of Anil Ambani's portfolio following the demerger of the Reliance empire in 2005). | ||

| + | |||

| + | On the other hand, Anil Ambani's son Jai Anmol, a graduate from UK's Warwick Business School, has joined Reliance Capital, as he is said to have demonstrated a keen interest in finance. | ||

| + | |||

| + | Jai Anmol is learnt to have been actively involved in the Rs 12,000-crore acquisition of Jaypee Associates’s power assets, where the Adani Group and JSW Group had also thrown in their hats. “Reliance Capital CEO Sam Ghosh is mentoring Jai Anmol for a bigger role in the Reliance Group,” said a company insider. | ||

| + | |||

| + | ==2021== | ||

| + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL/2021/07/05&entity=Ar01501&sk=B71C08B6&mode=text Reeba Zachariah & Sidhartha, July 5, 2021: ''The Times of India''] | ||

| + | |||

| + | [[File: Ambani scions, as in 2021.jpg| Ambani scions, as in 2021 <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL/2021/07/05&entity=Ar01501&sk=B71C08B6&mode=text Reeba Zachariah & Sidhartha, July 5, 2021: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | Anant Ambani, the younger son of Reliance Industries (RIL) chairman Mukesh Ambani, has been appointed as a director of Reliance New Energy Solar and Reliance New Solar Energy, expanding his role in the family business. The two entities were incorporated before RIL unveiled its green energy plans at its annual shareholder meet on June 24. | ||

| + | |||

| + | In February this year, Anant, 26, was inducted as a director of Reliance O2C, where Saudi Aramco is expected to be an investor, and a year before that, he was appointed on the board of Jio Platforms, where his siblings Isha and Akash too are members. RIL didn’t respond to a questionnaire from TOI. | ||

| + | |||

| + | While Mukesh Ambani, 64, hasn’t yet spelt out succession planning at RIL, questions like ‘who’s next?’ have started popping up within the investor community. In Ambani’s own case, after the death of his father, RIL founder Dhirubhai Ambani, in 2002, there was a feud over succession between him and his brother Anil. | ||

| + | |||

| + | Dhirubhai had not left a will and the family business had to be split, with Mukesh gaining RIL (oil refining and petrochemicals) and Anil getting the energy, finance and telecom units as part of the settlement. | ||

| + | |||

| + | Besides Jio Platforms, Isha and Akash, the 29-year-old twins, are on the board of Reliance Retail Ventures. Both Jio Platforms and Reliance Retail Ventures had attracted billions of dollars in investments and brought on board global names such as Google, Facebook, Silver Lake and Saudi Arabia’s Public Investment Fund to help expand their digital and e-commerce footprint. | ||

| + | |||

| + | With Anant’s latest board appointments, all the three children now have representation in RIL’s key businesses. After the recent separation of the refining and petrochemicals unit to Reliance O2C, RIL looks similar to Tata Sons, the holding company of Tata Group’s diverse businesses. RIL is also paving the way for initial public offerings of Jio Platforms and Reliance Retail Ventures, which are expected to take place in the near future. | ||

| + | |||

| + | Apart from Reliance New Energy Solar and Reliance New Solar Energy, RIL incorporated five other entities since June — Reliance New Energy Storage, Reliance Solar Projects, Reliance Storage, Reliance New Energy Carbon Fibre and Reliance New Energy Hydrogen Electrolysis. Their names indicate that the entities were established for the clean energy game. | ||

| + | |||

| + | =Succession plan= | ||

| + | ==2023, August== | ||

| + | [https://epaper.timesgroup.com/article-share?article=29_08_2023_023_015_cap_TOI Reeba Zachariah, August 29, 2023: ''The Times of India''] | ||

| + | |||

| + | Mumbai : Reliance Industries, India’s largest company in terms of market value, has appointed chairman and managing director Mukesh Ambani’s three children — Isha, Akash and Anant — to the board, an indication that they will eventually helm the oil-to-telecom conglomerate. | ||

| + | |||

| + |

Ambani will be chairman for five more years even as his wife, Nita, has stepped down from the board to focus on philanthropic activities. He said his children have “earned their stripes”. Ambani said Nita would continue to attend RIL board meetings as a permanent invitee in her capacity as the chairperson of Reliance Foundation. At present, the three Ambani children are on the boards of operating business companies. | ||

| + | |||

| + | |||

| + | ===Details=== | ||

| + | [https://epaper.timesgroup.com/article-share?article=29_08_2023_023_015_cap_TOI Reeba Zachariah, August 29, 2023: ''The Times of India''] | ||

| + | |||

| + | |||

| + | This is truly an emotional moment for me because it reminds me of that day in 1977 when my father inducted me into the board of Reliance… Today, I see both my father and me in Isha, Akash and Anant. I see the flame of Dhirubhai shine in all of them,” Ambani said. He said he would mentor them for leadership roles, preparing them for challenges and opportunities. “I shall continue to perform my duties and responsibilities as chairman and managing director for five more years with greater vigour,” he added. | ||

| + | |||

| + |

In recent years, Ambani has been outlining succession plans for various businesses under RIL. Akash (31) is the chairman of Reliance Jio Infocomm, Isha (31) drives the retail business and is on the board of Jio Financial Services — the newest business from RIL — while Anant (28) is involved with the energy unit. RIL said their appointment as non-executive directors will take effect from the date they assume office after shareholder approval. | ||

| + | |||

| + |

Ambani joined the board of RIL in 1977 — the year the company got listed — at the age of 20 and became its CMD after his father and RIL founder Dhirubhai Ambani died in July 2002. The 66-year-old CMD has secured a term till 2029 after his current tenure expires in April 2024. According to company law, if an individual crosses the age of 70 for the CMD position, then it requires a special resolution by shareholders for him to be appointed beyond that limit. | ||

| + | |||

| + |

Monday’s announcement is a clear indication that Ambani, who was in an inheritance dispute with his younger sibling Anil Ambani, is preparing to hand over the reins to his three children. While Ambani got the flagship RIL, Anil secured telecommunications, power and financial services. The two warring brothers subsequently called it a truce, which then allowed Ambani to re-enter telecom and now financial services. | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|A THE AMBANISTHE AMBANISTHE AMBANISTHE AMBANISTHE AMBANISTHE AMBANIS | ||

| + | THE AMBANIS]] | ||

| + | [[Category:India|ATHE AMBANISTHE AMBANISTHE AMBANISTHE AMBANISTHE AMBANISTHE AMBANIS | ||

| + | THE AMBANIS]] | ||

| + | [[Category:Pages with broken file links|THE AMBANISTHE AMBANISTHE AMBANIS | ||

| + | THE AMBANIS]] | ||

| + | |||

| + | =Akash Ambani = | ||

| + | ==2022: takes charge at Reliance Jio== | ||

| + | [https://epaper.timesgroup.com/article-share?article=29_06_2022_001_006_cap_TOI Pankaj Doval , June 29, 2022: ''The Times of India''] | ||

| + | |||

| + | |||

| + | New Delhi: In the first major announcement of succession planning at Reliance Industries — the country’s leading industrial house — 30-year-old Akash Ambani was appointed chairman of Reliance Jio. | ||

| + | |||

| + |

Akash’s father, Mukesh Ambani, aged 65, stepped down from the board of the telecom behemoth, passing on the baton to the family’s next generation.

| ||

| + | |||

| + | This is the first instance of one of Mukesh and wife Nita Ambani’s three children — Akash, Isha (twins) and Anant (27 years) — assuming a leadership role in a key company of the group. | ||

| + | |||

| + | |||

| + | ''' Akash on telco’s board since 2014, old-timer Pawar names Jio’s MD ''' | ||

| + | |||

| + | Akash and Isha are already on the board of the group’s fastest-growing new-age units -Jio and Reliance Retail -while Anant (the youngest of the three) is on board of Jio Platforms along with the other two children. When it comes to the parent company, Reliance Industries, though, the children are yet to join the board where only Mukesh and Nita represent the family. Mukesh also continues to be the chairman of Jio Platforms and Reliance Retail Ventures Ltd, the companies that hold all the digital and retail assets of the group. | ||

| + | |||

| + |

Akash and Isha had been particularly visible during most of the corporate announcements related to the telecom and the retail entities for the past few years, and Mukesh had always credited his children for being the main driving force towards the group’s diversification into newage businesses. In fact, Akash had joined the board of Reliance Jio in 2014, while he was in his early twenties.

In a filing to exchanges on Tuesday, Jio announced that Akash has taken over as the chairman after the board approved the decision on Monday, elevating him from the position of non-executive director. Mukesh’s resignation from Jio was also accepted with immediate effect, while group old-timer Pankaj Pawar was appointed as the MD of Jio for 5 years. | ||

| + | |||

| + |

Akash had completed his schooling in Mumbai from the Dhirubhai Ambani school, and later went on to graduate from Brown University with a major in Economics. | ||

| + | |||

| + |

Apart from chalking out the launch and growth strategies for the group’s expansion in telecom and retail, Akash has also been credited with the mega fund-raise in Jio Platforms in 2020, which surprisingly came in the middle of the raging pandemic as the company raised Rs 1.5 lakh cro- re (on a valuation of Rs 4.6 lakh crore) from top companies such as Facebook, Google, Intel, KKRand Silver Lake. | ||

| + | |||

| + |

The period after the funding had also triggered talks around succession planning within the group, though officially the companies did not make any comments on the issue. The market had already been abuzz with a possible succession planning as official media announcements of Jio Platforms generally carried the quotes of Akash, while announcements related to retail had comments from Isha. This had triggered speculation that Isha may be groomed to head the retail business. | ||

| + | |||

| + |

Reliance Jio had started as afledgling telecom challenger when it began commercial operations in September of 2016, though it disrupted the entire business model of the industry as it made voice calling virtually free and led to a crash in prices of mobile data/internet. | ||

| + | |||

| + |

At the close of FY22, Reliance’s digital business unit — comprising mainly of Jio — had a turnover of Rs 1 lakh crore, roughly contributing around 13% to Reliance turnover of Rs 7.9 lakh crore. | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|A THE AMBANISTHE AMBANISTHE AMBANIS | ||

| + | THE AMBANIS]] | ||

| + | [[Category:India|ATHE AMBANISTHE AMBANISTHE AMBANIS | ||

| + | THE AMBANIS]] | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|A THE AMBANISTHE AMBANISTHE AMBANISTHE AMBANIS | ||

| + | THE AMBANIS]] | ||

| + | [[Category:India|ATHE AMBANISTHE AMBANISTHE AMBANISTHE AMBANIS | ||

| + | THE AMBANIS]] | ||

| + | [[Category:Pages with broken file links|THE AMBANIS | ||

| + | THE AMBANIS]] | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|A THE AMBANISTHE AMBANISTHE AMBANISTHE AMBANISTHE AMBANIS | ||

| + | THE AMBANIS]] | ||

| + | [[Category:India|ATHE AMBANISTHE AMBANISTHE AMBANISTHE AMBANISTHE AMBANIS | ||

| + | THE AMBANIS]] | ||

| + | [[Category:Pages with broken file links|THE AMBANISTHE AMBANIS | ||

| + | THE AMBANIS]] | ||

| + | |||

| + | =See also= | ||

| + | [[The Ambanis ]] <> [[Anil Ambani]] <> [[Mukesh Ambani ]] | ||

Latest revision as of 18:51, 5 September 2023

This is a collection of articles archived for the excellence of their content. Readers will be able to edit existing articles and post new articles directly |

Contents |

[edit] Religion

The following is the gist of a Quora discussion, with the names of the contributors within brackets.

The Amabanis are Vaishnav Modh Gujarati Banias, followers of Shri Shrinath Ji, they follow Hinduism. though their family had a Jain connection in its roots since the time of Dhirubhai's father. Anil Ambani’s wife Tina Ambani is Jain and now Mukesh Ambani’s daughter-in-law is Jain (Atul Singhai) Ambani‘s son has married to a Jain Girl who is a daughter of a ‘Diamond King’ and whose company is called Rosy Blue.

During Akash and Shloka Ambani’s wedding ceremony, the phere ceremony began with the chanting of the Navkar Mantra, (Vaibhav Gadia) Akash Ambani's wife Shloka is from a Jain family. That's why Navkar Mantra was chanted in the ceremony. (Sanjay Jain) But even Mukesh, Neeta and Anant Ambani chanted the navkar mantra. (Vaibhav Gadia)

But during Isha Ambani's pre-wedding a function was organised at Udaipur just a few km from Nathdwara and in that function, Neeta Ambani performed a dance dedicated to Lord Shreenathji…The entire Ambani family visits Nathdwara at least twice in six months

They are Trustees of the Badrinath temple and their family’s name is Chanted in the Aartis of Badrinath temple (Vivek)

[edit] YEAR-WISE DEVELOPMENTS

[edit] 2010: Peace pact

May 2010

Warring Ambanis clinch peace pact, agree to compete

Brothers Worked Out Deal Themselves

Prabhakar Sinha

New Delhi: If their business war was bitter and no-holds-barred, the peace was equally dramatic. At 5 minutes to 2pm on Sunday, officials of both Reliance Industries Ltd and ADAG (Anil Dhirubhai Ambani Group) were stunned to receive notes stating that the Ambani brothers had decided to scrap their non-compete agreement and effectively bury the hatchet.

The peace pact was thrashed out directly between the two brothers, with the blessings of their mother and — apparently — mediation by some spiritual gurus. In fact, Anil Ambani and Kokilaben left for a pilgrimage to Badrinath and Kedarnath on Wednesday last week after the deal was clinched.

The pact was kept a closely-guarded secret, though the Prime Minister’s Office was reportedly kept in the loop and endorsed the development, saying it was in the best interest of the nation for the two brothers to be reconciled.

On Sunday, the two siblings announced the scrapping of the non-compete clause which was entered into between their respective groups in June 2006, when Dhirubhai Ambani’s business empire was carved out between them. Instead, they have entered into a simpler agreement, which is restricted only to gas-based power generation. Even there, RIL is allowed to set up plants for captive consumption.

The pact followed a recent directive of the Supreme Court on supply of gas from RIL-owned KG basin to Reliance Natural Resources Ltd for its Dadri power project. ‘‘RIL and RNRL will expeditiously negotiate gas supply arrangements in accordance with the orders of the Supreme Court,’’ both groups said in their respective statements. They also expressed confidence that the development would help create an overall environment of harmony, ‘‘co-operation and collaboration’’ between them.

Under the previous agreement, Anil could have ventured almost anywhere except petrochemicals and gas, while Mukesh’s companies were restricted from entering many sectors like finance, telecom, power and infrastructure. But Anil was facing problems in raising funds to expand Reliance Infocomm.

WIN-WIN FOR BHAI-BHAI

After SC ruling, both brothers decided to resolve the issue. Mother Kokilaben and some spiritual leaders said to be involved. Deal completed before Anil Ambani and Kokilaben went to Badrinath on Wednesday The Non-Compete Clause

During their Jan 2006 settlement, RIL and ADAG entered into a noncompete clause, under which Mukesh could not enter finance, power, road and construction, and telecom sectors. Anil barred from entering petrochemical and gas sectors

The clause was valid till 2018 for financial sector, and 2015 for others

Invoked In The Past

BY ANIL AMBANI

June 2006: In the power sector, when Mukesh-led RIL wanted to set up a 2000mw captive power project in its Gurgaon SEZ

Jan 2008: When RIL wanted to start a non-banking finance company to finance customers of Reliance Digital

BY MUKESH AMBANI

June 2008: When Anil Ambani was in talks to acquire African telecom major MTN through share swap The New Agreement Scraps the no-compete clause except in gas-based power generation, in which RIL cannot venture except for captive consumption

Sectors which both groups may enter following new pact

RIL group: Finance, telecom and infrastructure

ADAG: Will provide Anil financial flexibility to raise funds in telecom sector From Recrimination To Reconciliation

1999 | NELP takes off. Govt invites global tenders for exploration in oil and gas fields. RIL and NIKO emerge successful bidder of KGD6

June 18, 2005 | The Ambani brothers reach a settlement to split the Reliance group in a deal brokered by Kokilaben

Dec 9, 2005 | HC okays RIL demerger scheme. Gas, coal, telecom and financial services businesses go to Anil and Mukesh retains flagship RIL

Jan 12, 2006 | The board of directors of RIL approve pact that calls for 28 million units of gas to be supplied to Anil Ambani group and up to 40 million units if the contract with NTPC does not materialise

Feb-Jul, 2006 | Anil’s RNRL seeks permission from the petroleum ministry to lay pipelines for transporting gas from Kakinada in Andhra Pradesh to Dadri in Uttar Pradesh. RIL asks ministry to approve the gas price at $2.34 per unit based on bids called by NTPC, but the permission is denied

Nov 8, 2006 | RNRL takes the dispute to court. Later, company wants RIL to be restrained from selling 28 million units of gas to any third party

May 3, 2007 | Company judge restrains RIL from creating third party rights in gas meant for RNRL

Oct 10, 2007 | Govt okays market price determined by RIL at above $4.2/mmBtu

Oct 15, 2007 | Company Judge upholds RNRL’s case, says MoU between parties binding. Directs them to renegotiate gas sale purchase agreement instead of directing a modification of the scheme

Dec, 2007 | RIL and RNRL file separate appeals against the judgment. RNRL says court did not give directions for amendment of gas supply agreement to make the scheme workable

Jan 30, 2009 | Mumbai HC concludes hearing; passes interim order lifting stay on the sale of gas from KGD6

Jun 15, 2009 | HC asks both sides to honour 2005 MoU and arrive at a fresh ‘bankable agreement' within a month to ensure RNRL gets 28 mmscmd gas from RIL, but till then continues Jan 30 order

Jul 3, 2009 | RNRL moves Supreme Court against HC ruling

May 7, 2010 | SC rules in favour of RIL, giving the brothers six months to renegotiate the deal at the governmentdecided price of $4.2/ mmBtu

May 23, 2010 | Brothers decide to scrap the existing non-compete clause with exception that Mukesh can enter gas-based power generation for captive consumption only

OTHER DISPUTES

July 2008 | Anil's RCOM called off merger talks with MTN Group after RIL threatened to block the sale if it wasn’t given the first option to buy shares in RCOM

Oct 2007 | ADAG complained to the stock market regulator Sebi that RIL was trying to stall the IPO of Reliance Power

[edit] Dhirubhai's grandchildren

[edit] 2014

Dhirubhai's grandsons step into fathers' shoes

Piyush.Pandey @timesgroup.com Mumbai:

Aug 08 2014

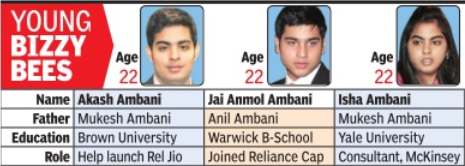

Akash To Help Launch Mukesh's Telecom Venture Rel Jio, Jai Anmol Joins Anil's Fin Co

The coincidences are hard to miss. Akash and Jai Anmol, cousins and scions of the country’s leading business family, have joined the now-divided empire originally founded by their grandfather Dhirubhai Ambani, within months of each other. Both are stepping into areas that were the core strengths of Dhirubhai’s sons, their fathers.

Reliance Industries (RIL) chairman Mukesh Ambani’s elder son Akash Ambani recently joined RIL to help launch the conglomerate’s re-entry in telecommunications with Reliance Jio, while Reliance Group chairman Anil Ambani’s son Jai Anmol has joined Reliance Capital. While Akash will be in operations, it’ll be finance for Jai Anmol. When contacted by TOI, officials in both companies confirmed the move.

Rewind to the eighties when the family was still very much together. Mukesh gave up his management studies at Stanford midway to join Reliance Industries in 1981 when his father called him back. Famed for his project management skills, Mukesh initiated Reliance’s backward integration journey from textiles into polyester fibres and further into petrochemicals and petroleum refining, and upstream into oil and gas exploration and production. In the process

he created the world's largest grassroots petroleum refinery in Jamnagar. Two years later, his younger brother Anil after finishing his management at Wharton joined RIL as co-chief executive officer to pioneer financial innovations and lead India Inc's foray into overseas capital markets.

The clock appears to have come a full circle. The cousins, both 22, representing the third generation of the Ambanis, are joining their respective businesses at a time when the next big push is needed for both groups, as they chase growth in an economy struggling to come out of a slowdown. Their fathers had entered the business when they were around 24 and the group needed a big move forward.

Akash, an economics graduate from Brown University , who was first formally seen with his father in 2011 at the signing the $7.2-billion deal with BP Plc, is now involved in rolling out Reliance Jio's complex 4G broadband wireless service offerings, which could redraw the telecommunications landscape. His father did the same more than a decade ago with the launch of Reliance Infocom, now Reliance Communications (part of Anil Ambani's portfolio following the demerger of the Reliance empire in 2005).

On the other hand, Anil Ambani's son Jai Anmol, a graduate from UK's Warwick Business School, has joined Reliance Capital, as he is said to have demonstrated a keen interest in finance.

Jai Anmol is learnt to have been actively involved in the Rs 12,000-crore acquisition of Jaypee Associates’s power assets, where the Adani Group and JSW Group had also thrown in their hats. “Reliance Capital CEO Sam Ghosh is mentoring Jai Anmol for a bigger role in the Reliance Group,” said a company insider.

[edit] 2021

Reeba Zachariah & Sidhartha, July 5, 2021: The Times of India

From: Reeba Zachariah & Sidhartha, July 5, 2021: The Times of India

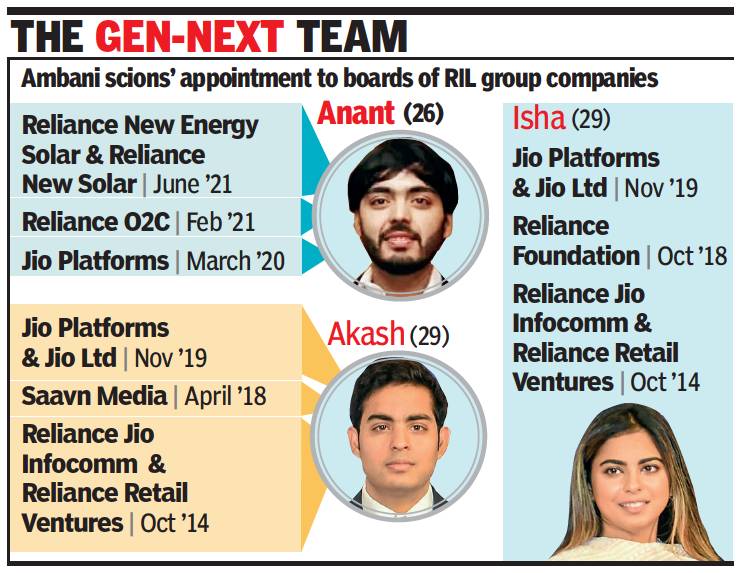

Anant Ambani, the younger son of Reliance Industries (RIL) chairman Mukesh Ambani, has been appointed as a director of Reliance New Energy Solar and Reliance New Solar Energy, expanding his role in the family business. The two entities were incorporated before RIL unveiled its green energy plans at its annual shareholder meet on June 24.

In February this year, Anant, 26, was inducted as a director of Reliance O2C, where Saudi Aramco is expected to be an investor, and a year before that, he was appointed on the board of Jio Platforms, where his siblings Isha and Akash too are members. RIL didn’t respond to a questionnaire from TOI.

While Mukesh Ambani, 64, hasn’t yet spelt out succession planning at RIL, questions like ‘who’s next?’ have started popping up within the investor community. In Ambani’s own case, after the death of his father, RIL founder Dhirubhai Ambani, in 2002, there was a feud over succession between him and his brother Anil.

Dhirubhai had not left a will and the family business had to be split, with Mukesh gaining RIL (oil refining and petrochemicals) and Anil getting the energy, finance and telecom units as part of the settlement.

Besides Jio Platforms, Isha and Akash, the 29-year-old twins, are on the board of Reliance Retail Ventures. Both Jio Platforms and Reliance Retail Ventures had attracted billions of dollars in investments and brought on board global names such as Google, Facebook, Silver Lake and Saudi Arabia’s Public Investment Fund to help expand their digital and e-commerce footprint.

With Anant’s latest board appointments, all the three children now have representation in RIL’s key businesses. After the recent separation of the refining and petrochemicals unit to Reliance O2C, RIL looks similar to Tata Sons, the holding company of Tata Group’s diverse businesses. RIL is also paving the way for initial public offerings of Jio Platforms and Reliance Retail Ventures, which are expected to take place in the near future.

Apart from Reliance New Energy Solar and Reliance New Solar Energy, RIL incorporated five other entities since June — Reliance New Energy Storage, Reliance Solar Projects, Reliance Storage, Reliance New Energy Carbon Fibre and Reliance New Energy Hydrogen Electrolysis. Their names indicate that the entities were established for the clean energy game.

[edit] Succession plan

[edit] 2023, August

Reeba Zachariah, August 29, 2023: The Times of India

Mumbai : Reliance Industries, India’s largest company in terms of market value, has appointed chairman and managing director Mukesh Ambani’s three children — Isha, Akash and Anant — to the board, an indication that they will eventually helm the oil-to-telecom conglomerate.

Ambani will be chairman for five more years even as his wife, Nita, has stepped down from the board to focus on philanthropic activities. He said his children have “earned their stripes”. Ambani said Nita would continue to attend RIL board meetings as a permanent invitee in her capacity as the chairperson of Reliance Foundation. At present, the three Ambani children are on the boards of operating business companies.

[edit] Details

Reeba Zachariah, August 29, 2023: The Times of India

This is truly an emotional moment for me because it reminds me of that day in 1977 when my father inducted me into the board of Reliance… Today, I see both my father and me in Isha, Akash and Anant. I see the flame of Dhirubhai shine in all of them,” Ambani said. He said he would mentor them for leadership roles, preparing them for challenges and opportunities. “I shall continue to perform my duties and responsibilities as chairman and managing director for five more years with greater vigour,” he added.

In recent years, Ambani has been outlining succession plans for various businesses under RIL. Akash (31) is the chairman of Reliance Jio Infocomm, Isha (31) drives the retail business and is on the board of Jio Financial Services — the newest business from RIL — while Anant (28) is involved with the energy unit. RIL said their appointment as non-executive directors will take effect from the date they assume office after shareholder approval.

Ambani joined the board of RIL in 1977 — the year the company got listed — at the age of 20 and became its CMD after his father and RIL founder Dhirubhai Ambani died in July 2002. The 66-year-old CMD has secured a term till 2029 after his current tenure expires in April 2024. According to company law, if an individual crosses the age of 70 for the CMD position, then it requires a special resolution by shareholders for him to be appointed beyond that limit.

Monday’s announcement is a clear indication that Ambani, who was in an inheritance dispute with his younger sibling Anil Ambani, is preparing to hand over the reins to his three children. While Ambani got the flagship RIL, Anil secured telecommunications, power and financial services. The two warring brothers subsequently called it a truce, which then allowed Ambani to re-enter telecom and now financial services.

[edit] Akash Ambani

[edit] 2022: takes charge at Reliance Jio

Pankaj Doval , June 29, 2022: The Times of India

New Delhi: In the first major announcement of succession planning at Reliance Industries — the country’s leading industrial house — 30-year-old Akash Ambani was appointed chairman of Reliance Jio.

Akash’s father, Mukesh Ambani, aged 65, stepped down from the board of the telecom behemoth, passing on the baton to the family’s next generation.

This is the first instance of one of Mukesh and wife Nita Ambani’s three children — Akash, Isha (twins) and Anant (27 years) — assuming a leadership role in a key company of the group.

Akash on telco’s board since 2014, old-timer Pawar names Jio’s MD

Akash and Isha are already on the board of the group’s fastest-growing new-age units -Jio and Reliance Retail -while Anant (the youngest of the three) is on board of Jio Platforms along with the other two children. When it comes to the parent company, Reliance Industries, though, the children are yet to join the board where only Mukesh and Nita represent the family. Mukesh also continues to be the chairman of Jio Platforms and Reliance Retail Ventures Ltd, the companies that hold all the digital and retail assets of the group.

Akash and Isha had been particularly visible during most of the corporate announcements related to the telecom and the retail entities for the past few years, and Mukesh had always credited his children for being the main driving force towards the group’s diversification into newage businesses. In fact, Akash had joined the board of Reliance Jio in 2014, while he was in his early twenties. In a filing to exchanges on Tuesday, Jio announced that Akash has taken over as the chairman after the board approved the decision on Monday, elevating him from the position of non-executive director. Mukesh’s resignation from Jio was also accepted with immediate effect, while group old-timer Pankaj Pawar was appointed as the MD of Jio for 5 years.

Akash had completed his schooling in Mumbai from the Dhirubhai Ambani school, and later went on to graduate from Brown University with a major in Economics.

Apart from chalking out the launch and growth strategies for the group’s expansion in telecom and retail, Akash has also been credited with the mega fund-raise in Jio Platforms in 2020, which surprisingly came in the middle of the raging pandemic as the company raised Rs 1.5 lakh cro- re (on a valuation of Rs 4.6 lakh crore) from top companies such as Facebook, Google, Intel, KKRand Silver Lake.

The period after the funding had also triggered talks around succession planning within the group, though officially the companies did not make any comments on the issue. The market had already been abuzz with a possible succession planning as official media announcements of Jio Platforms generally carried the quotes of Akash, while announcements related to retail had comments from Isha. This had triggered speculation that Isha may be groomed to head the retail business.

Reliance Jio had started as afledgling telecom challenger when it began commercial operations in September of 2016, though it disrupted the entire business model of the industry as it made voice calling virtually free and led to a crash in prices of mobile data/internet.

At the close of FY22, Reliance’s digital business unit — comprising mainly of Jio — had a turnover of Rs 1 lakh crore, roughly contributing around 13% to Reliance turnover of Rs 7.9 lakh crore.

[edit] See also

The Ambanis <> Anil Ambani <> Mukesh Ambani