The Ambanis

This is a collection of articles archived for the excellence of their content. Readers will be able to edit existing articles and post new articles directly |

2010: Peace pact

May 2010

Warring Ambanis clinch peace pact, agree to compete

Brothers Worked Out Deal Themselves

Prabhakar Sinha

New Delhi: If their business war was bitter and no-holds-barred, the peace was equally dramatic. At 5 minutes to 2pm on Sunday, officials of both Reliance Industries Ltd and ADAG (Anil Dhirubhai Ambani Group) were stunned to receive notes stating that the Ambani brothers had decided to scrap their non-compete agreement and effectively bury the hatchet.

The peace pact was thrashed out directly between the two brothers, with the blessings of their mother and — apparently — mediation by some spiritual gurus. In fact, Anil Ambani and Kokilaben left for a pilgrimage to Badrinath and Kedarnath on Wednesday last week after the deal was clinched.

The pact was kept a closely-guarded secret, though the Prime Minister’s Office was reportedly kept in the loop and endorsed the development, saying it was in the best interest of the nation for the two brothers to be reconciled.

On Sunday, the two siblings announced the scrapping of the non-compete clause which was entered into between their respective groups in June 2006, when Dhirubhai Ambani’s business empire was carved out between them. Instead, they have entered into a simpler agreement, which is restricted only to gas-based power generation. Even there, RIL is allowed to set up plants for captive consumption.

The pact followed a recent directive of the Supreme Court on supply of gas from RIL-owned KG basin to Reliance Natural Resources Ltd for its Dadri power project. ‘‘RIL and RNRL will expeditiously negotiate gas supply arrangements in accordance with the orders of the Supreme Court,’’ both groups said in their respective statements. They also expressed confidence that the development would help create an overall environment of harmony, ‘‘co-operation and collaboration’’ between them.

Under the previous agreement, Anil could have ventured almost anywhere except petrochemicals and gas, while Mukesh’s companies were restricted from entering many sectors like finance, telecom, power and infrastructure. But Anil was facing problems in raising funds to expand Reliance Infocomm.

WIN-WIN FOR BHAI-BHAI

After SC ruling, both brothers decided to resolve the issue. Mother Kokilaben and some spiritual leaders said to be involved. Deal completed before Anil Ambani and Kokilaben went to Badrinath on Wednesday The Non-Compete Clause

During their Jan 2006 settlement, RIL and ADAG entered into a noncompete clause, under which Mukesh could not enter finance, power, road and construction, and telecom sectors. Anil barred from entering petrochemical and gas sectors

The clause was valid till 2018 for financial sector, and 2015 for others

Invoked In The Past

BY ANIL AMBANI

June 2006: In the power sector, when Mukesh-led RIL wanted to set up a 2000mw captive power project in its Gurgaon SEZ

Jan 2008: When RIL wanted to start a non-banking finance company to finance customers of Reliance Digital

BY MUKESH AMBANI

June 2008: When Anil Ambani was in talks to acquire African telecom major MTN through share swap The New Agreement Scraps the no-compete clause except in gas-based power generation, in which RIL cannot venture except for captive consumption

Sectors which both groups may enter following new pact

RIL group: Finance, telecom and infrastructure

ADAG: Will provide Anil financial flexibility to raise funds in telecom sector From Recrimination To Reconciliation

1999 | NELP takes off. Govt invites global tenders for exploration in oil and gas fields. RIL and NIKO emerge successful bidder of KGD6

June 18, 2005 | The Ambani brothers reach a settlement to split the Reliance group in a deal brokered by Kokilaben

Dec 9, 2005 | HC okays RIL demerger scheme. Gas, coal, telecom and financial services businesses go to Anil and Mukesh retains flagship RIL

Jan 12, 2006 | The board of directors of RIL approve pact that calls for 28 million units of gas to be supplied to Anil Ambani group and up to 40 million units if the contract with NTPC does not materialise

Feb-Jul, 2006 | Anil’s RNRL seeks permission from the petroleum ministry to lay pipelines for transporting gas from Kakinada in Andhra Pradesh to Dadri in Uttar Pradesh. RIL asks ministry to approve the gas price at $2.34 per unit based on bids called by NTPC, but the permission is denied

Nov 8, 2006 | RNRL takes the dispute to court. Later, company wants RIL to be restrained from selling 28 million units of gas to any third party

May 3, 2007 | Company judge restrains RIL from creating third party rights in gas meant for RNRL

Oct 10, 2007 | Govt okays market price determined by RIL at above $4.2/mmBtu

Oct 15, 2007 | Company Judge upholds RNRL’s case, says MoU between parties binding. Directs them to renegotiate gas sale purchase agreement instead of directing a modification of the scheme

Dec, 2007 | RIL and RNRL file separate appeals against the judgment. RNRL says court did not give directions for amendment of gas supply agreement to make the scheme workable

Jan 30, 2009 | Mumbai HC concludes hearing; passes interim order lifting stay on the sale of gas from KGD6

Jun 15, 2009 | HC asks both sides to honour 2005 MoU and arrive at a fresh ‘bankable agreement' within a month to ensure RNRL gets 28 mmscmd gas from RIL, but till then continues Jan 30 order

Jul 3, 2009 | RNRL moves Supreme Court against HC ruling

May 7, 2010 | SC rules in favour of RIL, giving the brothers six months to renegotiate the deal at the governmentdecided price of $4.2/ mmBtu

May 23, 2010 | Brothers decide to scrap the existing non-compete clause with exception that Mukesh can enter gas-based power generation for captive consumption only

OTHER DISPUTES

July 2008 | Anil's RCOM called off merger talks with MTN Group after RIL threatened to block the sale if it wasn’t given the first option to buy shares in RCOM

Oct 2007 | ADAG complained to the stock market regulator Sebi that RIL was trying to stall the IPO of Reliance Power

2014: Dhirubhai's grandchildren

Dhirubhai's grandsons step into fathers' shoes

Piyush.Pandey @timesgroup.com Mumbai:

Aug 08 2014

Akash To Help Launch Mukesh's Telecom Venture Rel Jio, Jai Anmol Joins Anil's Fin Co

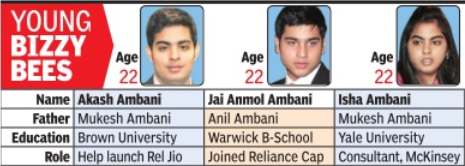

The coincidences are hard to miss. Akash and Jai Anmol, cousins and scions of the country’s leading business family, have joined the now-divided empire originally founded by their grandfather Dhirubhai Ambani, within months of each other. Both are stepping into areas that were the core strengths of Dhirubhai’s sons, their fathers.

Reliance Industries (RIL) chairman Mukesh Ambani’s elder son Akash Ambani recently joined RIL to help launch the conglomerate’s re-entry in telecommunications with Reliance Jio, while Reliance Group chairman Anil Ambani’s son Jai Anmol has joined Reliance Capital. While Akash will be in operations, it’ll be finance for Jai Anmol. When contacted by TOI, officials in both companies confirmed the move.

Rewind to the eighties when the family was still very much together. Mukesh gave up his management studies at Stanford midway to join Reliance Industries in 1981 when his father called him back. Famed for his project management skills, Mukesh initiated Reliance’s backward integration journey from textiles into polyester fibres and further into petrochemicals and petroleum refining, and upstream into oil and gas exploration and production. In the process

he created the world's largest grassroots petroleum refinery in Jamnagar. Two years later, his younger brother Anil after finishing his management at Wharton joined RIL as co-chief executive officer to pioneer financial innovations and lead India Inc's foray into overseas capital markets.

The clock appears to have come a full circle. The cousins, both 22, representing the third generation of the Ambanis, are joining their respective businesses at a time when the next big push is needed for both groups, as they chase growth in an economy struggling to come out of a slowdown. Their fathers had entered the business when they were around 24 and the group needed a big move forward.

Akash, an economics graduate from Brown University , who was first formally seen with his father in 2011 at the signing the $7.2-billion deal with BP Plc, is now involved in rolling out Reliance Jio's complex 4G broadband wireless service offerings, which could redraw the telecommunications landscape. His father did the same more than a decade ago with the launch of Reliance Infocom, now Reliance Communications (part of Anil Ambani's portfolio following the demerger of the Reliance empire in 2005).

On the other hand, Anil Ambani's son Jai Anmol, a graduate from UK's Warwick Business School, has joined Reliance Capital, as he is said to have demonstrated a keen interest in finance.

Jai Anmol is learnt to have been actively involved in the Rs 12,000-crore acquisition of Jaypee Associates’s power assets, where the Adani Group and JSW Group had also thrown in their hats. “Reliance Capital CEO Sam Ghosh is mentoring Jai Anmol for a bigger role in the Reliance Group,” said a company insider.

See also

The Ambanis <> Anil Ambani <> Mukesh Ambani