The Tata Group

The Times of India

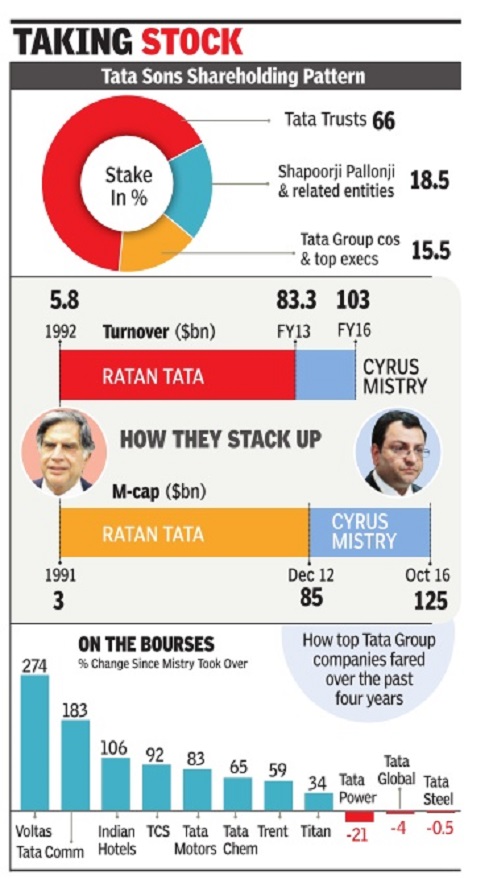

ii) The turnover and market capitalisation of the Tata Group, 1991-2016, under Ratan Tata and Cyrus Mistry.

iii) The performance of Tata companies under Cyrus Mistry, 2012-16.

The Times of India

This is a collection of articles archived for the excellence of their content. Readers will be able to edit existing articles and post new articles directly |

Contents |

The Tata group

Chairman, SDTT was always Chairman, Tata Sons: till Mistry

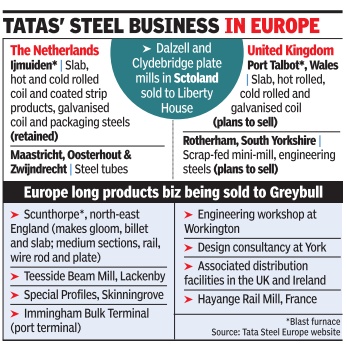

A Diarchy? Ratan Tata Continued To Run Trusts

Sir Dorab Tata, who succeeded the founder of the Group, Jamsetji Tata, as chairman of Tata Sons, set up Sir Dorabji Tata Trust (SDTT) in 1932. Since then, every Tata Sons chairman -Sir Nowroji Saklatvala, J R D Tata and Ratan Tata -has also been chairman of the Trust.Ratan Tata became chairman of SDTT in 1995, four years after he took over as chairman of Tata Sons following JRD's death. He'd already become chairman of the Sir Ratan Tata Trust, the other principal Tata Trust, in 1988.

So, as long as the chairman of Tata Sons was also chairman of either or both the big Tata Trusts, there was little room for conflict; they were one and the same.

Cyrus Mistry was the first Tata Sons chairman in the history of the Group not to be made chairman of the Sir Dorabji Tata Trust (SDTT) which, together with the Sir Ratan Tata Trust, holds the bulk of the 66% that gives the Tata Trusts near-absolute control of the holding company of the Tata Group.

The two positions were decoupled when Mistry became head of Tata Sons while Ratan Tata retained his position at the Trusts. This created a diarchy and sowed the seeds for potential discord over style andor substance, according to a number of promoter-chairmen and professional CEOs TOI spoke with, some of whom didn't wish to be identified speaking even indirectly on the showdown at Bombay House.

Said one of them, “I cannot speak to what happened or who's at fault. But one thing is clear: there was an asymmetry in the power equation. Tata Trusts was, and is, effectively the promoter while Mistry was essentially an executive.“ The fact that Mistry was the first chairman of the group who is not a Tata either by birth or marriage could be a reason why he was not considered for chairmanship of the Trusts, said an old-timer.Or it could have been because of his relative youth, and in time he may have been given dual charge, this person added.

Harsh Mariwala, promoter-chairman of Marico, told TOI, “One would reckon there was no clarity on the roles between the two (the chairmen of Tata Sons and Tata Trusts).Even though these roles are separate both sides need to be well aligned. If Tata Sons wants a professional CEO, clarity on all aspects is a must.Even if there were any differences between the two, these should have been reconciled through interventions.“

“In politics, there have been situations like Sonia Gandhi and Manmohan Singh, and Bal Thackeray and the Sena-nominated CM for Maharashtra.The Sonia-Manmohan relationship worked for 10 years because there were no illusions as to who wielded the real power.There may have been the occasional disagreement, but there was also mutual respect and trust -and yes, maybe even an element of submissiveness. If and when that breaks down -whether in politics or in business -there's bound to be trouble,“ said the chairman of a blue-chip multinational. “With Ratan Tata remaining chairperson of the Tata Trusts and Cyrus Mistry chairing Tata Sons, there was a dual power structure. Such duality blurs the lines of accountability and creates confusion in the rank and file.Going forward, the group needs to communicate how it proposes to handle the disconnect between the two roles (of leading the Trusts and Tata Sons),“ said Amit Tandon, founder and MD of IiAS (Institutional Investor Advisory Services), which advises on corporate governance and shareholder rights.

According to Vineet Nayar, who was CEO of HCL Technologies, Mistry started off on a weak wicket. “Consider Tata Trusts to be like the executive chairman of an organization, and Tata Sons as CEO. With the powers vested in Tata Trusts, Mistry did not have the powers a normal chairman of a board would have. We do not know if he ever objected to this diluted power situation impacting his ability to impact results of the listed entities where he is chairman,“ he said. “There's no guarantee this won't happen again with the next chairman if there's no clarity on roles and responsibilities,“ said the CEO of a large company .

Harsh Goenka, chairman of RPG Enterprises, said, “Cyrus should have aligned with Ratan Tata who has run the company for so long and is well respected. Considering that Tata Trusts has a large shareholding in Tata Sons, Cyrus should have kept Ratan Tata on the right side.“

Mariwala said, “These are more in the realm of relationship alignment and capability issues...When I stepped down as MD at Marico and handed over day-to-day charge to Saugata Gupta, I gave in writing the role the MD would play and under what circumstances he would consult me or the board. Similarly , Saugata gave in writing what he would do and what he expected from me. Everything was crystal clear, leaving no scope for ambiguity . Given the complexity of handling a group like Tatas, the chairman should have been coached by a top-notch global coach.“

Asked to comment on Mistry's allegations that a board meeting would be kept on hold while directors went out to get instructions from Tata, Mariwala said, “This is not how boards should function.“ The day after he was sacked, Mistry had said in his letter to the Tata Sons board and Tata trustees, “Prior to my appointment, I was assured that I would be given a free hand.The previous chairman was to step back and be available for advice and guidance as and when needed. After my appointment, the Articles of Asso ciation were modified, changing the rules of engagement between the Trusts, the board of Tata Sons, the chairman, and the operating companies. Inappropriate interpretation indeed followed, and as elaborated below, it severely constrained the ability of the group to engineer the necessary turnaround.“

Tata Sons has strongly contested this charge and said Mistry was “fully empowered“ and given “complete autonomy“.

A number of CEOs and HR specialists said the contours of the Tata Sons-Tata Trusts relationship left considerable room for ambiguity and might discourage globally-recognised managerial talent from wanting to head the conglomerate. “There's certainly enormous prestige, but power to effect real change?“ asked the HR director of an Indian conglomerate.

IiAS's Tandon said, “The group must put in place wellarticulated roles, responsibilities and rights, for the structure to work seamlessly . Given its stature, it is responsible and accountable to a much wider set of stakeholders.“

How Tata Sons board changed in 4 yrs

Mumbai: Before the change of guard at Tata Sons in December 2012, the Articles of Association (AoA) relating to appointment and removal of future chairmen were revised. Under the revised rules, Tata Trusts tightened its grip on the Tata Sons board by making it mandatory to seek approval of all directors nominated by the Trusts for appointment or removal of the chairman. The two main trusts, Sir Dorabji Tata Trust and Sir Ratan Tata Trust, were also jointly given the right to nominate one-third of directors on the Tata Sons board. The AoA were amended with the consent of the Mistry family which owns 18.5% of Tata Sons. However, back then it was not known that Mistry, who was a director on the Tata Sons board, would eventually be elevated to head the company.

After Mistry became chairman in December 2012, the character of the Tata Sons board changed. Following the retirement of a number of top Tata executives, Harvard Business School dean Nitin Nohria and former defence secretary Vijay Singh joined the board as Tata Trusts' representatives, while Farida Khambata, a financial strategist, and Ronen Sen, former Indian envoy to US, came in as independent directors.

Ishaat Hussain, who had worked under Ratan Tata, continued as director. This was the arrangement till August 2016, barely months before Mistry was sacked, when more directors were nominated, altering once again the composition of the board. TVS chairman Venu Srinivasan was brought in as a residual director, industrialist Ajay Piramal as independent director, and Amit Chandra, Bain Capital MD and brother-in-law of Nitin Nohria, as a representative of Tata Trusts.

The group as in Oct 2016

AFP | Oct 25, 2016 Steel to salt: 10 key facts about Tata Group

India's largest conglomerate Tata Sons is back in the hands of Ratan Tata after the sudden sacking of Cyrus Mistry. Here are key things you need to know about the Indian giant.

1. It is arguably India's most famous family conglomerate. Established by Parsi industrialist Jamsetji Tata in 1868, the sprawling steel-to-salt conglomerate is now worth more than $100 billion and operates in more than 100 countries globally. Tata Sons is the holding company of the Tata Group.

2. There are very few areas into which Tata has not ventured, with the group dealing in everything from salt and tea to watches, luxury cars and opulent five-star hotels.

3. Its most high-profile companies are India's largest carmaker Tata Motors, which owns Britain's Jaguar Land Rover, the IT outsourcing giant Tata Consultancy Services (TCS), Tata Steel, Tata Global beverages and Tata Chemicals.

4. The Tata Group is also in telecommunications through its company Tata Teleservices while its hotel chain runs Mumbai's Taj Mahal Palace and other high-end establishments.

5. Tata's tentacles have stretched across the globe in recent years as it went on a buying spree, picking up a number of major names including Britain's Tetley Tea and the Anglo-Dutch steel firm Corus.

6. Ratan Tata, the media-shy septuagenarian, has taken interim charge, four years after making way for Mistry, and is leading the hunt for a new successor.

7. Tata took the reins of the group in 1991 and led it for 21 years during which he was credited with driving its expansion abroad in the 2000s.

8. Each Tata company operates independently and has its own board of directors answerable to shareholders. Notable CEOs include Guenter Butschek at Tata Motors and Natarajan Chandrasekaran of TCS.

9. Like many businesses, it's facing major headwinds in the form of the sluggish global economy, volatile currencies and fluctuating commodity prices. Tata Group's revenue slipped 4.6 percent for the financial year ended March while a number of its firms have their own problems. Tata Steel is the most notable. It's struggling to find a buyer for its huge loss-making British assets, with 15,000 jobs in the UK at risk, while TCS profits are down as clients tighten their purse strings.

10. Tata Motors is also bearing the brunt of weak sales of its luxury unit Jaguar Land Rover, while Japanese mobile services provider NTT Docomo is demanding Tata coughs up a $1.17 billion arbitration payment awarded at an international hearing.

The Tata- Mistry relationship, 1936-2016

The Tata-Mistry relationship is perhaps best described Facebook style: It's complicated. Cyrus Mistry's family and the Tatas have at times been friends, and at other times frenemies since the time Cyrus's grandfather Shapoorji Mistry acquired a sizable stake in Tata Group's main holding company , Tata Sons in 1936.

A Tata observer said that the Mistry family's holding in Tata Sons and their presence on the board has often been a matter of discomfort for the Tatas. “Cyrus's removal as company chairman could be a master stroke that may put pressure on the Mistrys to check them out from Tata Sons,“ the observer said. But that may be a trifle optimistic.Tata Sons is currently one of India's richest privately held companies. Mistrys' 18.5% stake in Tata Sons is worth billions of dollars, and Tatas may find it an uphill task to buy them out, just as they have found it in the past. Tata Sons is the holding company of hundreds of unlisted and nearly 30 listed companies. The listed companies alone are valued at about Rs 8.3 lakh crore (about $125 billion). Going by the value of only the listed companies within the Tata fold, the 18.5% stake held by the Mistry family would be worth about $23 billion.

Shapoorji had acquired Tata Sons shares from the heirs of eminent financier FE Dinshaw in 1936, seven years after Cyrus' father was born.Dinshaw had lent nearly Rs 1 crore to Tata Sons to finance its power unit in 1926 but the latter couldn't repay the amount and, subsequently, the loan got converted into 12.5% stake of Tata Sons. Later, Shapoorji bought some more shares from JRD Tata's siblings, thus increasing his stake to 18.5%.

The story goes that JRD Tata's siblings in a fit of anger had sold their shares to the builder, who has made some famous Bombay landmarks like the Brabourne Stadium and SBI headquarters. Not much is known about why Nowroji Saklatvala, who was chairman of Tata Sons between 1932 and 1938, did nothing to prevent the stake sale. JRD Tata, who succeeded Saklatvala, is reportedly said to have been upset with the entry of a non-Tata family (Shapoorji) into Tata Sons.Mistrys' large shareholding gave them one seat on the board of Tata Sons.

After Shapoorji's death in 1975, Pallonji (Cyrus' father) took his position at Tata Sons.While Shapoorji was believed to have had a tumultuous relationship with the Tatas, Pallonji had a much friendlier relationship with the family . Also, he never interfered with the functioning of Tata Sons. A year after Pallonji stepped down in 2005, Cyrus, his youngest son, took his position at Tata Sons. And in November 2011, Cyrus was named chairman of Tata Sons, the first non-Tata to head the company.

On October 24 afternoon, the 80-year-old relationship between the Tatas and the Mistrys turned bitter again.

The Times of India

The Times of India

The Times of India

Partha Sinha & Reeba Zachariah, Cyrus owns Rs 1,000cr TCS shares, Nov 02 2016 : The Times of India

Cyrus Mistry , the ousted chairman of Tata Sons, holds nearly Rs 1,000crore worth of stocks of Tata Consultancy Services (TCS), the crown jewel within the Tata Group, the software major's annual report showed.Mistry also holds small stakes in other group companies -Tata Motors, Indian Hotels, Tata Global, Tata Chemicals and Tata Power -company filings showed. He's still the chairman of all these and some other group companies.

The stocks owned by Mistry is in addition to the 18.5% stake that his family , Shapoorji Pallonji (SP) Group, holds in Tata Sons, the Tata Group's holding company .Going by the value of stakes held by Tata Sons in the group's listed entities, and calculating SP group's stake on a pro-rata basis, the worth of SP Group's holding on November 1 was Rs 81,140 crore. Of this, SP Group's stake in TCS itself is worth Rs 63,158 crore, that is more than three-fourths of the total value. Other companies which contribute substantially to the value of holding by Mistry's family in Tata Sons are Tata Motors (Rs 7,983 crore), Tata Communications (Rs 1,500 crore), Tata Steel (Rs 2,279 crore), Titan (Rs 1,281 crore) and Tata Power (Rs 1,234 crore).

Other than direct holding in 15 listed companies, Tata Sons has indirect control over several other listed companies in which it holds stakes through group companies.For example, Indian Hotels holds controlling stake in Oriental Hotels and Benares Hotels, while Tata Steel controls Tata Sponge Iron and Tata Chemicals holds majority stake in Rallis India.

Tata Group also holds majority stakes in several unlisted companies through Tata Sons, which have not been valued.

LIC: the largest institutional investor

The stake of the Life Insurance Company of India in Tata group companies, Nov. 2016 The Times of India

LIC likely to back board decisions, Nov 02 2016 : The Times of India

PSU Largest Institutional Investor In Tata Group Cos

Life Insurance Corporation (LIC) is the largest institutional investor in the Tata Group with stocks worth about Rs 37,000 crore. The life insurer has substantial minority stakes in Tata Steel (13.6%) and Tata Power (13.1%).

Tata Sons holds 31.35% in steel major and 33.01% in the automobile maker. LIC also holds 9.8% in Tata Global Beverages, 8.8% in Indian Hotels and 7.1% in Voltas. Historically, LIC has played a passive role in promoter-led companies and has been relatively more active in professionally managed companies without any identifiable promoter such as L&T, Axis Bank and ITC.

Despite having a large stake, LIC does not have a board position in most of the companies. However, former LIC chairman D K Mehrotra is on the board of Tata Steel.

LIC acting chairman V K Sharma was one of the few institutional investors that Ratan Tata had met after the ouster of Mistry .

Indian institutions had not interfered even in the '90s when Ratan Tata consolidated his control over the group.

Tata Group's overseas takeovers

As in 2006

Times of India [ 20 Oct, 2006 PTI ]

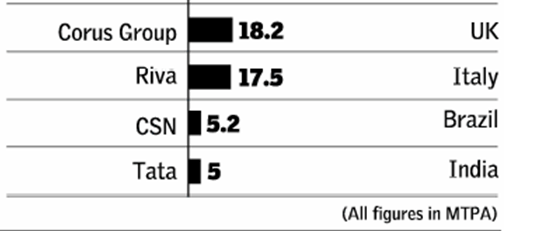

Snapshot of Tata Group's takeovers abroad NEW DELHI: Tata Steel's successful move to acquire its much bigger rival Corus Group is the latest in a series of takeovers abroad executed by India's largest and one of the oldest corporate groups.

The acquisitions have meant that 30 per cent of the group's revenues today come from overseas operations.

Following are the major acquisitions by Tata Group companies in the past few years:

- Tata Tea acquires 30% in US' Glaceau (Energy Brands) in August 2006 for $677 mn

- Tata Tea buys 33 per cent in South African tea company Joekels through its subsidiary Tetley Group

- Tata Tea acquires US-based Eight'O clock coffee company for $220 mn (Rs 1,050 cr) in June 2006

- Tata Chemicals picks 63.5% in UK's Brunner Mond Group for Rs 508 crore in December 2005

- Tata Steel acquires Millennium Steel of Thailand in December 2005 for $404 mn (Rs 1,800 crore)

- TCS buys out Chilean BPO firm Comicorn for $23 mn (Rs 107.02 crore) in November 2005

- TCS acquires Sydney-based FNS in October 2005

- Tata Technologies purchases INCAT International, UK in October 2005 for $91 mn (Rs 411 crore)

- Tata Tea acquires Good Earth Corp in October 2005 for around $32 mn

- Tata Auto Comp (TACO) takes over German auto components maker Wundsch Weidinger

- VSNL acquires Teleglobe International in July 2005 for $239 mn

- Tata Steel buys Singapore's NatSteel in August 2004 for over Rs 1,300 crore.

- VSNL takes over Tyco Global Network for $150 mn (Rs 690 crore)

- Tata Chemical acquires Moroccan company Indo-Maroc Phosphore for Rs 166 crore

- Tata Motors picks 21% stake in Spain's Hispano Carrocera for Rs 70 crore

- Tata Tea buys Tetley, UK in February 2000 for Rs 1,870 crore

- Tata Motors takes over Daewoo Commercial Vehicle Company of Korea in March 2004 for Rs 459 crore.

Acquisitions

INDIA ON SONG, TAKES CORUS ALONG

Tatas Outgun Brazilians, Take World By Storm

Mumbai: India’s high noon came when it was midnight in London. In the duel between the Tatas and Brazil’s CSN for Anglo-Dutch steelmaker Corus, the Indians held their nerve as the auction went into the ninth and final round. CSN bid 603 pence to a share; the Tatas, who had made an offer of 590p in the eighth round, upped it by 18p to 608p. The Brazilians blinked.

For $12 billion, Rs 54,000 crore if you will, Tata Steel created history when it finally secured the scalp it wanted so badly — that of Anglo-Dutch steelmaker Corus, forged out of what was once the mighty British Steel — to carve out for itself a chunk of the global steel industry.

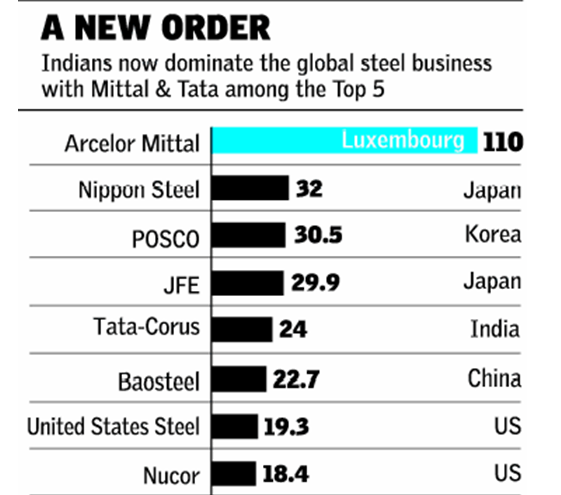

This acquisition makes the 100-year-old Tata Steel the fifth largest steel producer in the world, with an annual output of around 25 million tonnes and 87,000 employees on its rolls — a dramatic departure from only a day ago when it was ranked 56th.

The acquisition also marks the emergence of India Inc as a potent force in the global business. It was only last year that Mittal Steel headed by Lakshmi Mittal forged a blockbuster $32.4 billion deal to create Arcelor Mittal, the world’s largest steel company. ‘‘I believe this will be the first step in ensuring that Indian industry can step outside the shores of India in an international market and acquit itself as a global player,’’ said Ratan Tata, chairman, Tata Group.

While Corus Steel’s fate was eventually decided during the course of a single night, the process to find a buyer for the beleaguered European company had started in October 2005, when its bankers, Credit Suisse, set up Project England, the code name for a potential sale.

At that time, Corus was trading on the London Stock Exchange (LSE) at 300 pence a share. ‘‘We didn’t go to them, they came to us, much before Mittal started talking to Arcelor,’’ said Ratan Tata, one of the earlier suitors wooed by Corus.

EMPIRE STRIKES BACK

A hundred years ago, the chief of British railways had poked fun at Jamsetji’s steel dreams...

A Big Deal: Winners, Losers

Rs 54,000 Crore

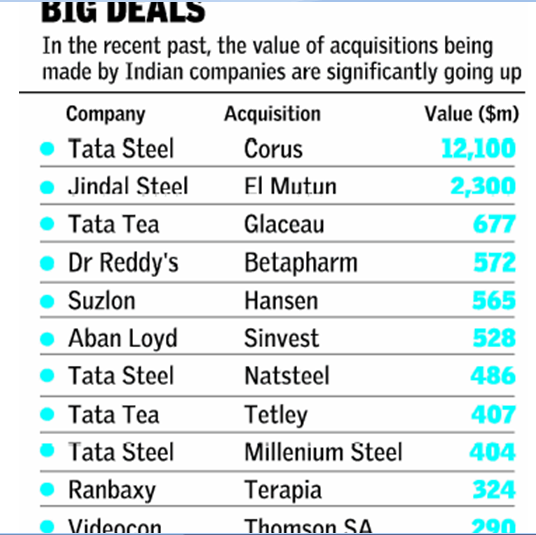

Tatas to pay $12 bn (Rs 54,000 crore) to acquire Corus at 608 pence (Rs 526 ) per share, which is about 34% higher than its original offer of 455p (Rs 389) made on October 20. It’s also 70% higher than Corus’s average share price over the year prior to the original Tata offer. Tata Steel’s share price, at the end of trading on Jan 31 (Wed) is about 9% down from when it made the first offer while Corus’ is up 27% Tata Steel shareholders have lost, at least in the short-term, while Corus shareholders have gained big-time with shares at seven-year high

Where will the money come from

Of the $12bn, $4.1 bn will be pumped in as cash through the equity route by Tata Steel. The rest will be in the form of debt raised from three banks, ABN Amro, Credit Suisse & Deutsche Bank. The equity will be bridge financed

Market is not happy

The Times of India

CLSA, one of the largest foreign brokerage houses in India, has put a ‘sell’ advice on Tata Steel, saying it had paid too much for Corus. Tata Steel stock closed almost 11% lower at Rs 464 from Tues closing

SPEEDBREAKERS

The British Steel Workers Union has vowed to oppose the deal tooth and nail

The Benefits

Triples Tata Steel’s capacity to almost 28m tonnes from 8.7 million in an industry where consolidation appears inevitable in order to leverage scales Gives it access to high-value Euroopean market; also it can ride on the back of a renowned brand Acquisition cost’s about $710 per tonne whereas greenfield would have cost $1200 per tonne, say Tatas

The Dangers

Tatas have paid a heavy price. The final offer is nine times Corus’ earnings before interest, tax, depreciation and amortisation (EBIDTA), while Mittal paid less than five times Arcelor’s earnings It now needs to service a very large debt burden Integration can be a problem in such acquisitions, because of both distance and culture

It’s by far the biggest takeover in the history of India Inc 2nd biggest acquisition in global steel, behind Mittal’s Steel’s $38.3bn takeover of Arcelor last year

Lifts Tata Steel from 56th to 5th in global steel sweepstakes with combined revenue of $24.4bn. Two of the top 5 are now in Indian hands; Lakshmi Mittal’s Mittal-Arcelor is No. 1

Tatas overtake the Mukesh Ambani-Reliance Group to become India’s largest business house. Revenues vault from Rs 70,509 cr last year to Rs 148,885 cr, compared to Reliance’s Rs 88,965 cr. Combined m-cap, at Rs 299,075 cr, is higher than Reliance’s Rs 228,677 cr

When we first talked about acquiring Corus, many thought it was an audacious move for an Indian company to make a bid for a European steel company much larger than itself. That was something which had not happened before...This will be the first step in ensuring that Indian industry can step outside the shores of India in an international market and acquit itself as a global player

Research and development

The Times of India, May 14 2015

Reeba Zachariah

Tatas bet on innovation with $2.6bn R&D spend

In what could be the highest research and development (R&D) expenditure by an Indian conglomerate, the salt-to-software Tata Group spends Rs 16,000 crore, or $2.6 billion, on innovations as the Cyrus Mistry-led enterprise bets big on new technologies to boost growth. The diversified Indian multinational spends 2.5% of its revenue on R&D, which is much higher than the government's R&D spend of 0.9% of the country's gross domestic product (GDP).

A significant amount of the total R&D expenditure by the $103-billion conglomerate goes into automotive, software, materials and metallurgy, with Tata Motors being the most lavish spender within the group. The other major spenders within the group are Tata Steel, Tata Consultancy Services (TCS) and Tata Global Beverages.

The group's research bill has gone up by 28% from Rs 12,500 crore three years ago.

While Nano remains its flag-bearer of innovation, the group's other path-breaking products include Titan Edge, the thinnest watch, and Tata Swach, the world's low-cost water purifier. The conglomerate, under the Tata Innovista programme, has been con ducting research in several areas like products, services, processes, digitization and design, expecting them to deliver billions of dollars in revenue.

Launched in 2006, the Tata Innovista programme promotes innovation across Tata companies worldwide. Over the past decade, it has seen a 15-fold increase in innovation across 70 companies. The top innovation projects this year are expected to deliver an estimated benefit of $1.1 billion annually , the Tata Group said.

Tata trusts

Philanthropic activities, 2005-16

Aid from Tata Trusts up 10-fold in 10 yrs, Oct 29 2016 : The Times of India

Tata Trusts, which hold the controlling stake in Tata Sons and earn dividends from investments in group companies, spent Rs 750 crore ($125 million) in 2015-16 on philanthropic activities. It makes the Trusts the leading foundations in the country .

Tracing their history back to 1892 when the first Trust was established by group founder Jamsetji Tata, they are a cluster of eight charities which disburse money for welfare measures in diverse areas, including education, healthcare, energy and technology .

Expenditure has grown steadily over the years. The Tata Trusts, including the flagship the Sir Dorabji Tata Trust and the Sir Ratan Tata Trust, had, in all, disbursed Rs 260 crore (nearly $52 million) in 2008-09, a jump of 242% from Rs 76 crore in 2005-06.

The Trusts had recently expressed concerns about being “more and more dependent“ on a couple of group firms in the Tata stable to generate income for their activities, but that has not been allowed to come in the way of their work. In the last decade alone, financial aid to various sectors has increased 10 times from Rs 76 crore to Rs 750 crore. For comparison, Ford Foundation, the oldest foreign foundation in India, gave grants worth $133 million (Rs 891 crore, by current ex change rate) in the region covering India, Nepal and Sri Lanka over an eight-year period from 2006 to 2014.

The Tata charities, which helped build many of Mumbai's best-known institutions, have scaled up their activities and spread to different parts of the country. Ratan Tata, who heads the trusts, said in the 2014-15 annual report, “In recent years, Tata Trusts have also adopted an approach that focuses on national issues that impact the lives of many.“ Programmes supported by the Trusts now reach out in 17 states through a network of over 450 partner organisations and at least 25% of the corpus is spent on healthcare.

When the initiative started, Jamsetji began with the J N Tata Endowment Scheme for Higher Education to send abroad future administrators, scientists, doctors, lawyers and engineers, according to author R M Lala (The Heartbeat of a Trust), the erstwhile chronicler of the group.

Jamsetji died seven years before the Indian Institute of Science, funded by his charities, opened at Bangalore. Later, the Dorab Tata Trust (named after the founder's son and his successor as group chairman) would fund Tata Memorial Hospital, Tata Institute of Fundamental Research, Tata Institute of Social Sciences and National Centre for Performing Arts.

2006-2015: Expansion, contraction

The Times of India, Mar 31 2016

Reeba Zachariah & Namrata Singh

10 yrs on, economics trumps Tata Group's global ambition

Former Tata Group chairman Ratan Tata catapulted the Indian conglomerate onto the global big league with iconic acquisitions in Tetley tea, Pierre Hotel in New York, Jaguar Land Rover and Corus Steel.His successor Cyrus Mistry , on the other hand, appears to be more keen on stemming losses by knocking off under-performing assets. While the approach of the two leaders seems to be different, in reality it is largely driven by the prevailing economic environment.

Back in 2006, the group's ambitions were soaring and it wanted to capture the global share of the steel market.Finances were not a constraint and it was facing challenges in expanding in the domestic market. In a bid to de-risk the business, Ratan Tata set his sights on overseas assets. It was a logical game plan then and, to meet this dream, Tata Steel got into a huge bidding war with Brazil's CSN for Corus. Outbidding CSN to win this crown jewel of Britain certainly put India and the Tata Group on the global map.

Cut to the present: The environment for Mistry is different. Falling steel prices, rising operational costs, softening demand for steel and Chinese competition has deteriorated Tata Steel's UK operations, forcing the 47-year-old Mistry to consider a sale of the business. His strategy is backed by management experts who believe the CEO should frame his strategy and capabilities in accordance with the growth phase of an organization.

Tata Steel's books are laden with $11-billion debt. On Wednesday , the company sa d it will explore all options or portfolio restructuring, ncluding the potential divestment of the UK business n whole or in parts. The UK business is losing around 1 million pounds a day .

When Tata Steel acquired Corus (now Tata Steel Europe), it was critiqued for being an “expensive deal“ that the Tatas entered into when market valuations were at their peak. Ratan Tata then defended the deal and told German weekly Der Spiegel “those who accuse us of having paid oo much are making a very short-sighted judgement“.He had his own reasons to believe so. Back then, Tata Steel wanted to expand its capacity and global presence and it saw Corus doing both of these in one shot. But hings did not materialize as per the company's plans.The 2008 financial crisis resulted in a decline in demand for steel and prices dipped.This led to production cuts, restructuring and sale of assets in a bid to keep the business afloat.

Commenting on whether Commenting on whether the company had any regret about acquiring Corus, Koushik Chatterjee, CFO, Tata Steel, said, “One has to go back to that time when we were in an environment where the demand conditions and the robustness of the demand positions in developed countries were much more stable than emerging mar kets like India.“ Describing the situation now, he said, “There are factors and structures on which companies have no control. It can happen to any country, to any company and in any sector.“

Tata Steel has written off around $3 billion on its UK operations, which employs about 15,000 people. The Tata Group is currently UK's biggest manufacturer, with almost 40,000 workers, accor ding to The Economist.

Cyrus Mistry, 2012-16

See the page Cyrus Mistry