Aditya Birla Group

This is a collection of articles archived for the excellence of their content. |

Contents |

Market capitalisation

As in 2024

May 25, 2024: The Times of India

From: May 25, 2024: The Times of India

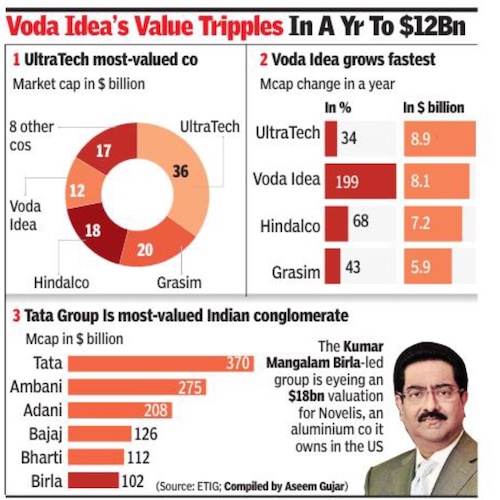

Mumbai : The market capitalisation of Aditya Birla Group companies crossed $100 billion for the first time riding on a rally in shares of UltraTech, Hindalco, and Vodafone Idea.

The combined valuation of the 12 companies in the group stood at nearly Rs 8.5 lakh crore, which translates to over $102 billion. The group’s market capitalisation during the current year has improved by 11%, which is more than twice the gain in Nifty or the sensex.

Although there are a dozen listed companies, nearly 35% of the group’s valuation comes from UltraTech, which has a market capitalisation of Rs 2.95 lakh crore — making it the third most valuable cement company in the world. UltraTech shares have been on the upswing after it reported a 35% increase in net profit for the March quarter.

Grasim Industries, which accounts for 20% of the group’s value in the stock market, has seen its market capitalisation double in the last three years. Grasim has a sizable share in the global man-made fi- bre market. Besides announcing a capacity expansion, the company has also announced a diversification into the paints business. Grasim is also the holding company for UltraTech and Aditya Birla Capital, which houses the group’s financial services businesses.

In percentage terms, the biggest gainer in the group has been Vodafone Idea, which has nearly tripled its market capitalisation in a year. This included the equity expansion following its Rs 18,000-crore follow-on public offer. The listed financial services businesses of the group — Aditya Birla Capital, Aditya Birla Sun Life AMC, and Aditya Birla Money — contribute to nearly 9% of the group’s valuation.

Fashion and Retail

YEAR-WISE DEVELOPMENTS

2021

Sabyasachi, Tarun Tahiliani

John Sarkar, February 25, 2021: The Times of India

From: John Sarkar, February 25, 2021: The Times of India

Weeks after picking up a majority stake in Indian couture brand Sabyasachi, Aditya Birla Fashion and Retail (ABFRL) has struck a deal with New Delhi-based fashion designer Tarun Tahiliani, that will give it around 34% stake in the latter’s luxury business and 80% stake in a new entity that will develop and launch affordable premium ethnic wear and accessories.

While the new brand, to be co-created by ABFRL and Tahiliani, aims to build a Rs 500-crore business in five years with more than 250 stores across the country, ABFRL will have the option to increase its stake in the designer’s luxury business (Goodview Properties), for which it will pay Rs 67 crore, to 51% in the next few years.

“Ethnic wear is going to be an important category as confident Indians rediscover their culture and heritage,” said Ashish Dikshit, MD at ABFRL.