Air conditioners: India

This is a collection of articles archived for the excellence of their content.

|

Contents[hide] |

Usage in India

2016- 50: vis-à-vis major nations

From: Vishwa Mohan, Not cool: ACs will make world .5°C warmer by 2100, November 14, 2018: The Times of India

Increasing incomes and urbanisation will see increase in room air conditioning units from 1.2 billion to 4.5 billion in the world by 2050 when India alone may account for one billion units, posing a serious challenge to the global community which is fighting climate change and rising temperatures.

India will, in fact, see a phenomenal growth during the period —from 26.3 million installed stock of room air conditioner (RAC) units in 2016 to over 1 billion in 2050. It means its share will jump from 2.2% of the overall RACs globally to almost 25% in next over three decades.

This projected jump in space cooling requirement will need three times more electricity by that period from the 2016 level in a world that has seen nearly one degree Celsius rise in average temperatures from the preindustrial level. And, if the world continues to carry on with the same air conditioning technology, the temperature of the planet will rise by 0.5 degree through use of cooling units alone by 2100.

These findings are part of a report—Solving the Global Cooling Challenge —which was released by environment minister Harsh Vardhan on the inaugural day of the Global Cooling Innovation Summit here on Monday.

The report, prepared by US-based Rocky Mountain Institute, projects the rise in global energy use for space cooling from RACs from 2,300 Terawatt hours (TWh) in 2016 to 7,700 TWh in 2050. This more than three-fold increase will be driven prominently by the residential sector with India projected to rise as the world’s largest energy user for space cooling in 2050.

Referring to soaring demand for RACs in India, Iain Campbell, senior fellow at Rocky Mountain Institute, said, “This exponential growth needs to be addressed in an efficient and environmentally benign way by developing technologies that reduce climate impact by at least five times than that of the RACs sold today.”

Though per-capita space cooling energy consumption of India is nearly one-fourth of the global average at present, it will increase substantially by 2050 - from 69 kWh in 2016 to 1,140 kWh in 2050.

The two-day summit is to create an ecosystem of public-private-partnership to work for breakthrough innovations in energy efficient cooling technology so that the world would require five times less energy to meet its requirement.

Keeping such demand in view, India on the occasion launched a Global Cooling Prize, an international competition to incentivise development of a residential cooling technology that will have at least five times less climate impact than the standard RAC units available now.

Sales, 2004-14; 2014: Voltas is no. 1

Pankaj Doval, December 06 2014

Voltas topples LG to be No. 1 in AC market

As per 2014, Tatas-owned Voltas has taken the top slot in the Indian air conditioner (AC) market, overtaking Korean white goods giant LG that has dominated the business for over a decade. Latest data from market research firm GfK Nielsen Retail Audit showed that Voltas had a shade over 20% of the pie in September, based on sales at multi-brand and exclusive brand outlets. This was marginally ahead of LG's market share of 19.9%. This is perhaps the first time in recent years Voltas has taken the pole position across the AC segment. However, for the first half of the financial year (AprilSeptember 2014-15), LG continues to lead with a share of 20.5%. Voltas follows with a share of 18.9%. Samsung, the other big player in the AC market, is a distant third. The brand, which has exited the windows AC category , had a share of 12.8% in September and finished the first half with a share of 13.7%, the data showed. This would perhaps be one of the few consumer categories where either of the Korean chaebols are not at the top, considering their popularity among Indian buyers.

The AC market accounts for sales of 3.2 million units annually but has been witnessing tepid growth over the last two years. The penetration of ACs stands at 3-4% in the Indian market. LG said it is working towards protecting its market share leadership.

“Today there are more than 50 brands trying to sell their ACs (more than 70 brands are registered for star-rating labelling at Bureau of Energy Efficiency).With multiple players joining the product categories, our primary objective remains to sustain our leadership position and strengthen our business share across chan nels,“ said Saurabh Baisakhia, business head for ACs at LG India.

The worrying part for the Korean MNCs is also the fact that Voltas already leads in the big-volume multi-brand outlet, which is believed to account for 80-85% of AC industry volumes. Pradeep Bakshi, president and COO of Voltas, said the company's increased penetration in the country has helped the brand capture higher volumes and presence. “This has been an outcome of our ever-increasing reach in distribution, a distinct brand positioning based on consumer insights... and investments in after-sales service.“

Samsung said its exit from the window AC category may have brought down its overall share in the segment.“Samsung exited the window AC category around the end of 2011 and decided to operate only in the split AC segment as that was a growing market.Since then, our market share in the split AC segment has only been growing,“ a company spokesperson said.

Apart from increasing its reach across the country, Voltas has also been aggressive in attracting top talent and poaching from rivals.

2008-2018

From: January 24, 2019: The Times of India

From: January 24, 2019: The Times of India

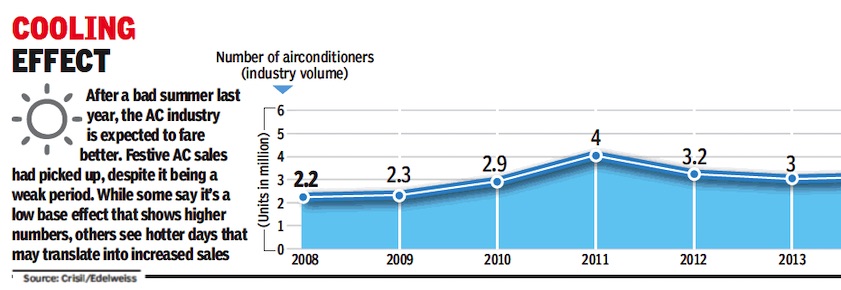

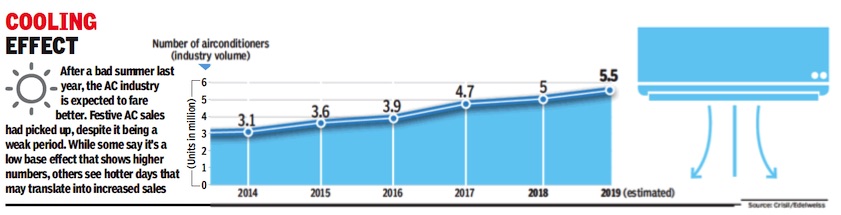

See graphics:

Number of air conditioners (industry volume), 2008-2013

Number of air conditioners (industry volume), 2014-2018

2015-17: rise in sales; 2018: mild- summer depresses sales

Pankaj Doval, Freak weather shrinks AC sales in some states, May 22, 2018: The Times of India

From: Pankaj Doval, Freak weather shrinks AC sales in some states, May 22, 2018: The Times of India

AC makers are sweating it out as freak weather conditions and frequent thunderstorms across several states have kept searing temperatures at bay, leading to lower footfall at showrooms and sluggish sales.

Demand in March-May — peak season for AC sales — has remained weak. According to industry officials, sales are 10-15% lower than last year and a revival looks tough, considering monsoon is set to arrive before time .

The uncharacteristic weather has made the situation tough, said Rahul Tayal, director (strategic business and marketing) at LG India. “Industry volumes have been impacted. The heat wave is missing in north India and in parts of south India.”

Gaurav Sah, business head for ACs at Panasonic India, said, “A weak summer has been the primary reason for low offtake in AC market. Pre-season stocking due to change in energy efficiency rating further impacted the inventory.” He, however, added that Panasonic has registered growth in value terms.

Around 55 lakh ACs were sold in India in 2017, which was 18% higher than 2016. An industry executive said, “AC companies get nearly 60% of sales during this time, which is usually a bumper period.”

States such as Delhi, Rajasthan and Uttar Pradesh have seen frequent bouts of thunderstorms and light rains.

Another executive said, “There has not been a continuous summer because of frequent thunderstorms and other weather phenomenon. States such as Punjab, Delhi-NCR region, UP, Madhya Pradesh, Chhattisgarh and Rajasthan are impacted. In south, there have been intermittent rains in Tamil Nadu and Kerala. This is not good for sales.”

Voltas, which leads the AC market, said companies are shifting focus to other regions that are not touched by adverse weather conditions. “Brands having an extensive national footprint are focusing on markets like central and western India, where the heat now seems to be picking up,” a spokesperson at the Tata-group company said. The slow offtake has triggered discounts, offers and freebies.

2018-22

From: Pankaj.Doval , April 16, 2022: The Times of India

See graphic:

AC sales, 2018-22

See also

Air conditioners: India