Airlines: India

This is a collection of articles archived for the excellence of their content. |

Contents |

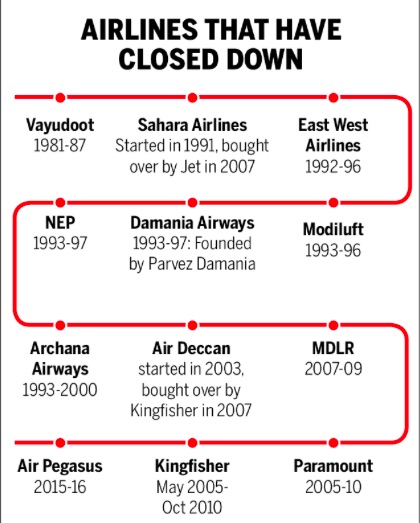

Failed airlines

1996-2019: 12 airlines close down

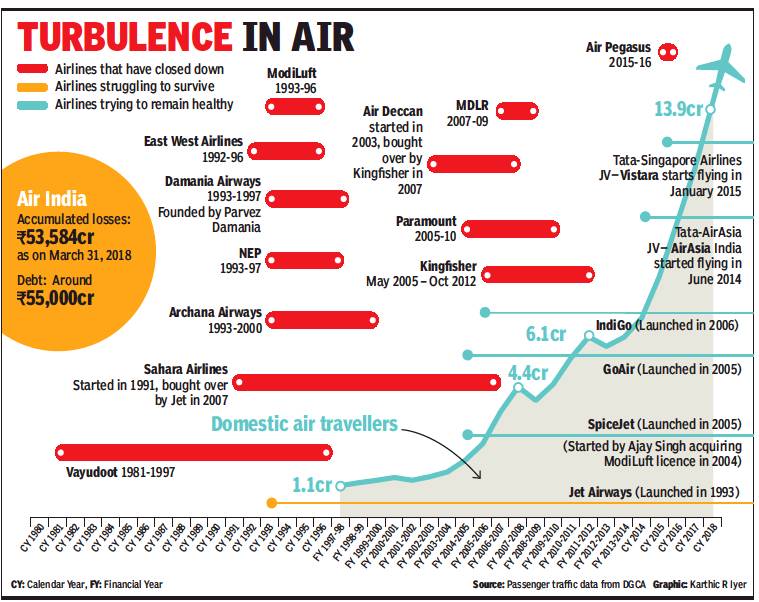

Saurabh Sinha, 12 airlines close down in 21 years, March 27, 2019: The Times of India

From: Saurabh Sinha, 12 airlines close down in 21 years, March 27, 2019: The Times of India

From: Saurabh Sinha, April 13, 2019: The Times of India

Stiff Competition, Below-Cost Fares Take Shine Out Of Steady Rise In Traffic

Naresh Goyal-founded Jet Airways is possibly only the second private airline after SpiceJet to get a shot at reincarnation. The low-cost carrier owes its origin to ModiLuft, which flew from 1993 to 1996. While Indian skies have seen tremendous passenger growth, the country has had its share of airlines that ran out of fuel — 12 in 21 years.

The most prominent failure was Kingfisher. Vijay Mallya, the flamboyant founder of this airline, has sent a series of angry Tweets after Jet minus Goyal was taken over by lender banks. Mallya did manage to get a fair share of Kingfisher debt restructured to equity and banks took a big haircut. He desperately tried in 2011-12 to get the then Congress-led coalition to allow foreign airlines to invest in Indian ones, but failed.

This policy was approved after Kingfisher was shut down in October 2012. That change led to Etihad picking up 24% stake in Jet and Tata Group starting two JV airlines, one each with Singapore Airlines and AirAsia.

“Happy to see that PSU banks have bailed out Jet Airways saving jobs, connectivity and enterprise. Only wish the same was done for Kingfisher…. I invested over (Rs) 4,000 crore into Kingfisher Airlines to save the company and its employees…. The same PSU banks let India’s finest airline with the best employees and connectivity fail ruthlessly… I have placed liquid assets before the Hon’ble Karnataka High Court to pay off the PSU banks and all other creditors. Why do the banks not take my money. It will help them to save Jet Airways if nothing else,” Mallya tweeted from London.

So, what are the reasons behind the grounding of so many airlines despite steady rise in traffic? Indian airlines operate in a cost-hostile environment. Jet fuel for domestic flights is among the priciest here globally, due to steep taxation. A crippling shortage of infrastructure adds to problems as busiest airports like Delhi, Mumbai and Bangalore and even smaller ones have choked terminals and find it hard to accommodate more flights.

Also, intense competition and the race for market share have led to airlines offering below-cost fares, which has led to a situation of profitless growth. “It is not mismanaged Indian airlines, which are being kept alive on ventilator, even the well-run ones have to constantly dodge the bullet,” said an official.

Few airlines in India, including government-owned Air India, have had luck in finding life after near death. Captain Gopinath-founded Air Deccan, India’s first budget airline, was bought over by Kingfisher in 2007 and the latter was shut down in 2012. Air Sahara was bought by Jet in same year as Deccan and now Jet is on the ventilator of lenders.

SpiceJet is an exception. It had its origin in ModiLuft (1993-1996). Less than a decade later, it was bought by Ajay Singh, who launched it as SpiceJet in 2005, along with UK-based NRI Bhulo Kansagra. In 2008, Kansagra sold his stake to US distress investor Wilbur Ross. Two years later, Ross and Ajay Singh sold their stake to Sun Group’s Kalanithi Maran. In 2015, Maran sold his stake back to Ajay Singh.

Jet Airways (2019) vis-à-vis Kingfisher (2012)

Why Jet Airways flies when Kingfisher Airlines couldn't - Mar 27, 2019 |Times of India

Highlights

Months before Kingfisher Airlines stopped flying (in October 2012), the carrier was in a similar situation as Jet Airways today

The factors that led to the mess were similar, as well — high fuel prices, weak rupee and cut-throat competition

Banks were criticised for not seeing signs of trouble at Kingfisher on time

NEW DELHI: Embattled liquor baron Vijay Mallya lashed out at public sector banks for "double standards" for their intervention to bailout Jet Airways while the same lenders made his Kingfisher airlines "fail ruthlessly". Reacting to the take over of management control (and equity) of the troubled Jet Airways by banks led by the State Bank of India, Mallya said, "...only wish the same was done for Kingfisher".

The similarities

Months before Kingfisher Airlines stopped flying (in October 2012), the carrier was in a similar situation as Jet Airways today. It struggled to pay salaries to its 7,000 employees (as Jet has done since September last year), defaulted on payments to lenders (Jet defaulted on its payments in December) and was forced to cancel flights (due to pilot protests compared to unpaid lease in the case of Jet). When Kingfisher was grounded it had an outstanding debt of Rs 7,000 crore (the figure is over Rs 9,000 crore now). Jet owes about Rs 10,000 crore to lenders.

The factors that led to the mess were similar, as well — high fuel prices, weak rupee and cut-throat competition. Plus, like Kingfisher's acquisition of Deccan Airways accelerated its downfall, a major cause of Jet's financial troubles is believed to be the expensive acquisition of Air Sahara in 2006 (which some say was a move to thwart Kingfisher from acquiring it). While keeping Jet airborne is about the market (it controls a sixth of the domestic aviation market) and (16,000) jobs, the same was true for Kingfisher too (in 2007 the airline had almost the same market share as Jet and Jetlite combined). Banks were criticised for not seeing signs of trouble at Kingfisher on time. While the banks seem more proactive this time, Jet has been in the red (its net worth has been negative too) for over five years.

The difference

For one, banks have learnt some lessons after having burnt their fingers with Kingfisher. While they are still looking to salvage the debt extended to Jet by picking up a stake in the company (as they did in Kingfisher’s case), they have realised that it makes sense to sell a running company (even if it means pumping in some more money) instead of letting it go bankrupt.

Two, Reserve Bank of India's strict norms don't give banks much leeway to delay things. The central bank has scrapped all restructuring plans (a big reason for the delay in debt resolutions and recovery) except that driven by the bankruptcy law and empowered banks to treat payments miss, even by a day, as default. Three, there were no elections when Kingfisher went belly up in 2012 (unlike now) and job creation wasn't as big an issue as it is now.

Passenger satisfaction

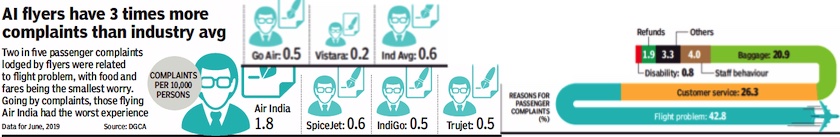

2019: Vistara best, AI worst

From: July 22, 2019: The Times of India

See graphic:

Passenger satisfaction levels in India’s airlines: 2019

Punctuality

2018-19

Manju V, June 28, 2019: The Times of India

Low-cost carrier IndiGo has emerged as the most punctual airline in India, followed by GoAir and AirAsia India, in the rankings released by UK’s air intelligence group OAG.

IndiGo scored an annual OTP (on-time performance) record of 81% for the 39,295 flights operated between June 2018 and May 2019. The survey assigned star ratings to airlines and airports, ranging from one star to five stars. Airlines and airports with the best on-time performance, for example, the top 10%, received five stars, it said. “IndiGo (81.5%) is the largest low-cost carrier to earn four stars with Jetstar Asia (84.6 %), Thai AirAsia (83.8%) and Solaseed (83.7%) also achieving 4 stars,” said the OAG survey GoAir scored 80% for the 7,058 flights operated in the same period. Both these carriers were given a four star status. AirAsia India with 80% and Vistara with 75% received three stars, while AirIndia with 62% got a one star.

Asian carriers led the rankings with the region being home to 8 of the 13 airlines achieving a 5 star status this year. Within Asia, Japan was the star performer as three out of the top five airlines were Japanese. All Nippon Airways was the region’s largest airline to achieve a five star status.

The top three global airports with best punctuality records were US’s Hilo (94%), followed by Belarus’s Minsk (93%) and Japan’s Nagoya Komaki (92%).

The major Indian airports though didn’t do well in punctuality ratings with Delhi airport (scoring a 76%) and Mumbai (75%), both of whom received a two star status.

Among airports, Nagpur topped the list of most punctual airports with 82% scored for the 22,731flights it handled between June 2018-May 2019.

Punctuality/ OTP

India vis-à-vis the world

2025

Saurabh.Sinha, Sep 24, 2025: The Times of India

From: Saurabh.Sinha, Sep 24, 2025: The Times of India

Depending on which airline you choose to fly, the travel time mentioned in the ticket for a Delhi-Mumbai flight can be less than two hours or stretch to almost three. How’s that possible? Most airlines fly either Boeing or Airbus planes, so they fly at roughly the same speed, more or less at the same altitude, and follow similar routes. So, how do you account for the extra one hour of flying time? That’s where OTP comes in. No, not the one-time password you are so familiar with, but On-Time Performance. Airlines, which, understandably, make a virtue out of punctuality, have long since realised that the safest way to ensure an on-time (or even before-time) performance is by inflating the journey time. That makes late arrival rather difficult.

Basically, airlines do a careful calculation of all factors at play from before a plane takes off till it lands. To be fair, there are many factors an airline doesn’t control. Like bad weather or congestion on the ground and in air before landing in some choked airport like Delhi or Mumbai. Some, though, are very much the responsibility of airlines, like ensuring there are no snags and taking care of other logistical issues like making sure crew are present.

Wide Margins

Technically, a flight needs to be pushed back from the boarding gate within 15 minutes of its scheduled departure time to be counted as an on-time departure for the purpose of flight statistics, which are maintained by the Directorate General of Civil Aviation (DGCA). The scheduled departure and arrival time of a flight is calculated keeping the historical and seasonal flying time (from getting airborne to touchdown) between the origin and destination city pairs and the taxi time at either airport. This is known as the “chocks off” to “chocks on” time, referring to the wedges placed in front and behind aircraft wheels before it is pushed back and after it lands to prevent accidental rolling when parked.

“The usual Delhi-Mumbai flying time is one hour and 40 minutes. Add to that 10 minutes of taxi each at IGIA (Delhi) and CSMIA (Mumbai), giving a total time of two hours. Then, to factor in airport congestion and hovering at destination, the taxi time was increased to, from 20 to, say, 27 minutes. Some airlines added further buffer to their block time — the time an aircraft can start taxiing to the time it comes to a halt at its destination — to ensure they can announce an on-time arrival,” said one pilot. If these inflated flying times are about airlines being smart, it is also a practice that has been driven by growing competition and hectic schedules.

Therefore, unless you are flying on a particularly bad weather day, or a particularly unreliable airline with poor aircraft maintenance/unpaid employees/jet fuel suppliers, or to and from particularly choked airport/s, you are unlikely to miss the boast of “another on-time arrival” on touchdown at the destination by the crew. Queries to big and upcoming airlines — Air India, IndiGo and Akasa — on this issue went unanswered. It was in 2003 that Indian skies started getting low-cost carriers (LCCs) that democratised air travel. And, with that, air traffic, terminal and runway congestion, too, became a fact of life.

“About two decades back, the total travel time from Delhi to Mumbai was given as 1 hour and 55 minutes. Then, congestion checked in and planes would routinely get delayed on ground and in air. Some smart private airlines started adding a buffer to the journey time to report on-time arrivals. Soon, almost everyone started to do the same, at least on city pairs with choked airports,” said a pilot with over four decades of flying experience. Which brings us to today, when the exact same aircraft type often has different travel times on the same sector. But there’s more here than would appear obvious.

Bragging Rights

Arriving ahead of or on schedule triggers a virtuous cascading effect for the airline: the plane can then operate its next flight on time as well with the same buffer for the flight after and so on. That is unless it’s caught in a big weather event like heavy rain or fog or develops a snag en-route or on landing and has to be grounded for checks and maintenance. But there are other reasons why there can be no fixed or standard travel time between two destinations common to all airlines.

How long it takes to fly between any two destinations depends on a number of things, like the routings given (direct or not), weather, wind flow and airport congestion. “If an aircraft gets tailwinds, it will reach its destination faster while headwinds will slow it down. Winters see strong west-to-east jetstreams, which means an Ahmedabad-Kolkata flight could take 10-15 minutes less than the Kolkata-Ahmedabad journey and a LondonDelhi nonstop can take up to two hours less than the Delhi-London,” said a senior commander.

DGCA issues monthly reports for domestic air travel that include, among other data points, OTP data of scheduled domestic airlines based on inputs from six metro airports — Delhi, Mumbai, Bengaluru, Hyderabad, Chennai, and Kolkata. This “data” is crucial for airlines to project themselves as punctual in the eyes of the domestic traveller.

But tinkering with travel times is not done just for reasons of OTP. Sometimes, Indian carriers that operate long hauls, say between Delhi and London, report an under 10-hour flying time to ensure they can make do with two pilots. Reporting journey time of over 10 hours means they will have to fly with three pilots, which adds to their cost and also requires them to inform DGCA. The regulator routinely flags this issue with Indian carriers whenever it detects anomalies over under-reporting of travel time with a view to carrying fewer than required pilots.

When it comes to reporting inflated travel times on domestic routes, it may suit the airline well, though it also creates several problems on ground.

Blame Game

Airlines and operators of busy airports blame each other for air traffic congestion, which is among the potential delays factored in while inflating journey times. While airlines say delays in getting clearance for take-off from or landing at choked hubs is beyond their control, airport operators say that flights failing to operate on time upsets their slot allocation and accentuates OTP issues.

“Airport slots are given per schedules filed by airlines. If airlines don’t adhere to that and planes come ahead of, or after, the time they were supposed to land, then it overlaps with the slot given to some other airline. While some mismatch is understandable depending on weather conditions and routings on a given day, what we see is significant distortion in schedules,” said a senior official at one of India’s busiest airports. But going ahead, things could improve as India is now seeing a boom in airport infra with Delhi-NCR and Mumbai MMR going to get their secondary airports and Hyderabad and Bengaluru adding to their facilities. Many constrained places like Patna and Chennai, too, will get second airports.

On the airline front, India is now seeing well-funded players like IndiGo and Tata’s Air India Group along with emerging players like Akasa, Star Air and others. These airlines focus on maintaining their young fleets, which, along with added airport infra, should cut down delays to an extent that airlines don’t need to inflate travel times in a desperate bid to win brownie points with flyers.

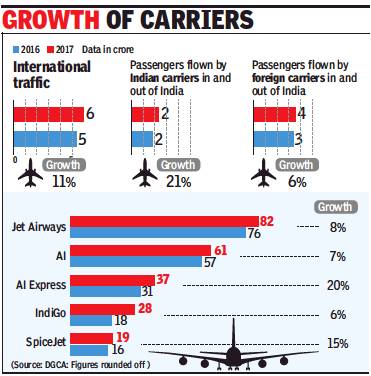

2017 (international)

See graphics :

International airlines' ranks, market-shares, 2017

International Airlines price and service, as on June 10, 2017

international traffic,

passengers flown by Indian carriers in and out of India,

passengers flown by foreign carriers in and out of India, 2016-17

From: Saurabh Sinha, Indian carriers’ share in int’l traffic up by 2.6%, February 21, 2018: The Times of India

This is one “made by Indians” programme that is showing the desired results.

Last year, 5.9 crore people flew in and out of India — up 11.3% from 5.3 crore in 2016. Indian carriers saw their share in this traffic going up to 38.6%, up a significant 2.6% in just one year from 36% in 2016. The jump came mainly on the back of a solid 58% increase in international passengers flown by IndiGo, followed by soon-to-be-privatised Air India express which saw 20% jump in this traffic.

Since the liberal grant of bilaterals to the Gulf, especially Dubai, by the previous UPA regime had become a controversy, the Modi government has not given more flying rights despite demand from all big players like Emirates, Qatar Airways and Etihad. As a result, the 11% growth in international traffic to and from India seen in 2017 over 2016 is mainly a result of more passengers being carried by Indian airlines.

Five Indian airlines fly abroad — Air India, AI Express, Jet Airways, IndiGo and SpiceJet. In 2016, these five accounted for 1.9 crore of the 5.3 crore passengers who flew in and out of India, which means a share of 36% in overall traffic. In 2017, they accounted for 2.3 crore of the 5.9 crore international traffic which saw their share go up to 38.6% — a jump of 2.6% in just a year.

But where the ‘tortoise’ of Indian carriers of overtook the ‘hare’ of foreign carriers is in these numbers. The five desi airlines saw 21% jump in international passengers in 2017 over 2016 while the growth for foreign carriers was less than a third at 5.9%.

To be sure, a major part of this growth in passenger carriage by Indian carriers is to nearby countries where the single aisle planes of IndiGo (A-320) and AI Express (B-737) fly. The medium and long haul market is dominated by foreign airlines as only AI (up to US and Australia) and Jet (farthest destination being Toronto) fly to the distant places.

“IndiGo has been growing aggressively by adding flights to nearby countries which has seen this mega jump in its international traffic. Had the engine crisis on the Airbus A-320 Neo not slowed down delivery of new planes to IndiGo and GoAir (which does not fly abroad currently), this year would have seen a much bigger jump in share of Indian carriers in overall international traffic to and from the country. GoAir has officially blamed delayed delivery of Neos as the reason for its launch of international flights getting postponed,” said an airline official who did not wish to be quoted.

Combined with the domestic traffic of 11.7 crore, India saw 17.6 crore air travellers last year — up 15.8% from 15.2 crore in 2016.

The growth comes mainly on account of planes flying fuller as major Indian airports like Delhi and Mumbai face a crippling shortage of aviation infrastructure and are unable to handle more flights.

What airlines find hard to believe is the slow rate at which airport capacity is being added in India despite the country being the world’s fastest growing aviation market. A case in point is Delhi which despite having adequate free land has not not built a single new runway or terminal since 2010 when IGI Airport got its third airstrip and terminal 3. Mumbai’s airport has no place to augment infra and now the mega city can get more flights only when the second airport gets ready in Navi Mumbai.

2018, Oct

The market share and aircraft occupancy of airlines in India.

From: November 23, 2018: The Times of India

See graphic:

The number of domestic passengers flown by airlines in India in October 2017 and 2018.

The market share and aircraft occupancy of airlines in India.

2018 vis-à-vis 2017

Saurabh Sinha, AI, arm narrows gap with Jet-Etihad, March 13, 2019: The Times of India

From: Saurabh Sinha, AI, arm narrows gap with Jet-Etihad, March 13, 2019: The Times of India

IndiGo Pips Air India Express To Become Fourth Largest In International Travel

India saw 6.3 crore international travellers last year, up 7.3% from 5.9 crore in 2017. While Jet Airways remained the single-largest airline for flying people in and out of India, its financial troubles coupled with the downsizing of partner Etihad, saw the two airlines together account for 1.06 crore international travellers, down from 1.1 crore in 2017. In fact, the Air India and AI Express together flew almost as many people in and out of India last year as the Jet-Etihad combine, with the latter ahead by just 20,000 passengers. Incidentally, the AIAI Express carried more than 1 crore international passengers for the first time last year.

The year also saw some significant shake-ups in the top-10 list of standalone airlines for international travel. While Jet, AI and Emirates retained the top three in 2018 like 2017, IndiGo pipped AI Express to become the fourth-largest international player in India last year. On the back of adding a-plane-a-week in 2018 and deploying additional capacity on international routes, IndiGo saw its overseas passengers number swell 48% to 41.8 lakh from 28.3 lakh in 2017. AI Express swapped places with IndiGo and became the fifth biggest player.

SpiceJet moved from number 9 in 2017 to 7 in 2018 by overtaking Qatar Airways and Oman Air for international travel to and from India last year. Sri Lankan, which is successfully replicating the Gulf airlines’ model of flying people between India and rest of the world through their hubs, occupied the number 9 slot. Qatar Airways, which was the seventh largest international airline in terms of flying passengers to and from India in 2017, is now at number 10.

GoAir became the sixth Indian carrier to start flying abroad (after AI, AI Express, Jet, IndiGo and SpiceJet) last October. It saw 42,478 international flyers last year. The request of Tata Group JV airlines, Vistara and AirAsia India to start flights abroad is being reviewed by the government.

In 2018, Indian carriers accounted for 40% of the international passengers to and from India, up from 38.6% in 2017.

“The 7.2% growth of international travel could have been much more but was constrained by two factors. One was India not hiking flying rights of airlines like Emirates, Qatar Airways, Singapore Airlines and Turkish. And, second was the slot constraints at Indian airports, especially three metros — Delhi, Mumbai and Bangalore — which makes it very difficult to add flights there. As a result, we have seen a rather subdued growth,” said a senior airline official.

Rank in Asia

2022: IndiGo tops

From: Nov 9, 2023: The Times of India

See graphic:

Annual passengers in 2022

Technical issues

In-flight engine shutdowns: 2020-25 July

Sunny Baski, July 15, 2025: The Times of India

Hyderabad : Sixty-five inflight engine shutdowns in five years. Eleven “Mayday” distress calls from aircraft cockpits in 17 months, excluding the London-bound AI-171 that crashed in Ahmedabad on June 12 and a diverted domestic IndiGo flight.

These numbers, obtained by TOI through a Right to Information (RTI) query to the Directorate General of Civil Aviation (DGCA), suggest a scary reality: engine malfunctions plague airlines operating in India at the rate of nearly one incident a month.

Aircraft Accident Investigation Bureau’s report mentioning fuel cut-off to engines of the crashed AI Boeing 787-8 Dreamliner fits the broader pattern of technical failures being handled by experienced pilots — until one crops up that is unmanageable.

DGCA data covers all engine shutdowns, including failures during take-off and mid-air. “A total of 65 incidents related to in-flight shutdown of engines from 2020 to 2025 (till date) were reported across India,” states the aviation regulator’s RTI reply.

In all 65 of these instances, pilots were able to safely manoeuvre aircraft to the nearest airport with a single, unaffected engine. Experts attribute engine shutdowns to technical issues ranging from low fuel to turbine malfunction and faulty electronic components.

“Primary causes of engine shutdowns include blocked fuel filters, fuel contamination with water, interrupted fuel supply to engines, and foreign objects entering engine stack, all of which can halt flight operations,” Capt C S Randhawa, president of the Federation of Indian Pilots, told TOI . The RTI data shows that between Jan 1, 2024, and May 31, 2025, there were Mayday calls from 11 flights, reporting various technical glitches and seeking emergency landing. Besides AI-171, the list doesn’t include a June 19 IndiGo flight from Guwahati to Chennai that had to be redirected to Bengaluru due to congestion at the destination, only for the aircraft to report low fuel around 35km before landing.

RTI data reveals that four of the 11 flights issued distress calls due to technical glitches and landed at Hyderabad. Airline Pilots’ Association of India states that Mayday signals are exclusively used in life-threatening situations, distinguishing them from “Pan Pan” urgency alerts.

“Flight crew initiate MAYDAY calls when confronted with critical emergencies such as aircraft fires, engine failures or situations posing imminent danger, necessitating immediate landing or grounding as continued flight becomes unsafe,” said Anil Rao, secretary of ALPA India. AX Joseph, director of air safety at DGCA, said the aviation regulator was responsible for promulgating “civil aviation requirements, circulars, aeronautical information circulars and public notices for compliance by the stakeholders to ensure safe operations”.

While experts say that inflight engine shutdowns and Mayday calls aren’t uncommon across the world, India’s position in global aviation safety standards may not be confidence-inspiring. The International Civil Aviation Organisation has ranked the country 48th in its worldwide safety oversight mechanism.

See also

Airlines: India