Axis Bank

This is a collection of articles archived for the excellence of their content. |

CEOs

Shikha Sharma (1980-2018)

Axis Bank chief to cut tenure by 30 mths, step down in Dec, April 10, 2018: The Times of India

From: Axis Bank chief to cut tenure by 30 mths, step down in Dec, April 10, 2018: The Times of India

From: Axis Bank chief to cut tenure by 30 mths, step down in Dec, April 10, 2018: The Times of India

Move Follows RBI Asking Board To Rethink 4th Term

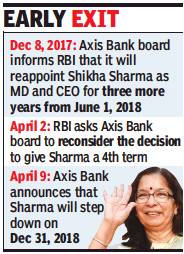

Axis Bank chief Shikha Sharma, the longest serving woman CEO in the financial sector, will step down in December 2018 – two-and-ahalf years before her term was due to end. The announcement came after the Reserve Bank of India raised questions on the board’s proposal to appoint her for a fourth term from July 2018.

On December 8, 2017, the board had informed the RBI of its decision to reappoint Sharma as MD and CEO for three more years from June 1, 2018. However, in a surprise announcement, Axis Bank said on Monday that Sharma, who has been the CEO of the thirdlargest private sector bank since 2009, “had requested the board to reconsider the period of her reappointment as MD and CEO of the bank to be revised from June 1, 2018 up to December 31, 2018”.

While the reasons for her stepping down early have not been disclosed, many believe that it has to do with the RBI communication to the board raising questions on her reappointment for a fourth term. The first sign of a run-in with the regulator had come last month when RBI announced that it had imposed a penalty of Rs 3 crore on Axis Bank for non-compliance with its directions on Income Recognition and Asset Classification (IRAC) norms back in fiscal 2016. The IRAC norms pertain to disclosing bad loans on a bank’s books.

Several banks have reported bad loans that were at divergence to what the central bank had subsequently discovered following an audit. In the case of Axis, the divergence was large and occurred for two consecutive years. For FY16, RBI’s classification of Axis Bank’s NPAs were 156% higher, or Rs 9,478 crore, compared with the bank’s own classification. The divergence was at Rs 5,632 crore for FY17.

Sharma (59) has been a CEO since 2000 when she took charge of ICICI Prudential Life Insurance, which she headed until 2009. Sharma, who was one of the candidates to succeed K V Kamath at ICICI Bank, then moved out to take charge of Axis Bank.

In Axis Bank, Shikha brought in multinational bankers, restructured operations to create business verticals, acquired a merchant banking firm and built up a large mutual fund business. The first half of her tenure saw shareholders being richly rewarded as the bank pursued aggressive growth. However, in the second half the corporate loans that helped the bank grow quickly in initial years turned out to be a drag on its earnings.