Bank of Baroda

This is a collection of articles archived for the excellence of their content. |

Contents |

Merger with Dena, Vijaya banks

2019

Mayur Shetty, Vijaya and Dena make BoB 2nd largest PSB, April 1, 2019: The Times of India

After Merger, Dena And Vijaya CEOs To Head IOB, Canara Bank Respectively

From: Mayur Shetty, Vijaya and Dena make BoB 2nd largest PSB, April 1, 2019: The Times of India

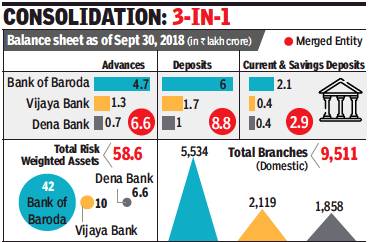

With Dena and Vijaya banks merging into Bank of Baroda (BoB) from April 1, the state-owned institution has consolidated its position as the second-largest public sector lender on all fronts after SBI. The bank now has a balance sheet of over Rs 15 lakh crore, 9,500 branches and 13,400 ATMs.

For corporate borrowers of Dena Bank, the merger comes as a major relief. These customers were earlier finding it difficult to obtain loans as their bank was facing lending restrictions under RBI’s prompt corrective action (PCA). Dena Bank CEO Karnam Sekar is tipped to join Chennai-based Indian Overseas Bank, while R A Sankara Narayanan, CEO, Vijaya Bank, is likely to take charge of Canara Bank in Bengaluru.

Branches of Dena and Vijaya banks, which were both founded by Indian entrepreneurs in the 1930s and nationalised in 1969 and 1980 respectively, will retain their identity for a few months.

While they will continue to display their erstwhile signage, it will now include a strip which says ‘Now Bank of Baroda’.

BoB, in a statement, said that new branches will get the benefit of its technological prowess in artificial intelligence and analytics to boost cross-selling.

It will also provide forex services to customers of Vijaya and Dena banks. Bank of Baroda CEO P S Jayakumar, whose term was to end in September 2018, had been given an extension to see through the merger.

BoB also promised to maintain the best of the merging banks. “Unique programmes of Vijaya Bank like plantation financing will be available to customers of the other two banks,” said BoB in a statement.

This is the first three-way merger of banks in India. Among PSU banks, while SBI has maintained its leadership for decades, the number two position has moved between banks. PNB, BoB, Bank of India, Canara Bank have all occupied the number two position on various parameters at different points of time. The merger puts BoB in the clear lead. Borrowers of the smaller banks stand to gain as BoB has a lower lending rate, which will apply for all new loans.

Scams

Ashok Vihar, Delhi, forex scam of 2015

See graphic:

Bank of Baroda: The Ashok Vihar, Delhi, forex scam of 2015, highlights