Banking, India: Loans

This is a collection of articles archived for the excellence of their content. |

Categories/ types of loans

2014-19: how loans to these categories grew

August 27, 2019: The Times of India

From: August 27, 2019: The Times of India

Banks’ consumer durables loans shrink by nearly 60% in 5 years

Banks’ outstanding consumer loans have contracted by nearly 60% over the last 5 years. Part of the reason for this drop is that NBFCs have taken over the consumer durables space. Additionally, credit card EMIs in this category have grown in a big way. As a result, the RBI reduced risk weightage on consumer loans earlier this month to encourage banks to lend more to this segment. Overall, credit card outstanding has more than tripled in 5 years, showing the highest growth in all personal segments.

2014-Aug 19

From: Dec 14, 2019: The Times of India

See graphic:

The growth of credits by and deposits in Indian banks, 2014-Aug 19

2022-23

Mayur Shetty, April 1, 2023: The Times of India

From: Mayur Shetty, April 1, 2023: The Times of India

Mumbai: In an indication that finance companies are playing a greater role in lending to businesses, bank loans to non-banking finance companies (NBFCs) in the first 11 months of FY23 were twice the disbursement to industries.

Banks lend to NBFCs who in turn finance small businesses and individuals. In the first 11 months of the current fiscal (April 2022 to February 2023), banks increased their loans to NBFCs by Rs 2. 8 lakh crore. During the same period, banks lent Rs 1. 35 lakh crore to industries.

Considering that banks grew their overall loan book by Rs 15. 6 lakh crore up to February 2023, the share of NBFCs in incremental lending works out to 18. 5% as against 8. 7% for industries.

The bulk of the bank lending (Rs 6. 3 lakh crore or 40% of incremental advances) went into personal loans. Of this, Rs 2. 3 lakh crore or 14. 5% of total fresh advances were for home loans. For banks, their personal loan book has seen a 20% growth in the first 11 months of FY23, which is nearly thrice the 7% growth in credit to industry.

Credit growth

2022> 23

From: Dec 6, 2022: The Times of India

See graphic:

Distribution of reporting offices according to size of bank credit,2022-23

Credit, city-wise

The metros: 2023

From: April 29, 2025: The Times of India

See graphic:

The share of Indian metropolitan cities in all-India bank credit, 2023

Credit, sector-wise

Telecommunication sector

2015-20, Bank-wise

From: Dec 12, 2019: The Times of India

See graphic:

Bank credit to the telecommunication sector, 2015-20, bank-wise

Loans

Prompt Corrective Action (PCA)

Impact on advances: 2017-20

From: April 14, 2020: The Times of India

See graphic:

The Impact of Prompt Corrective Action on advances: 2017-20

The top borrowers

Cities, 2018

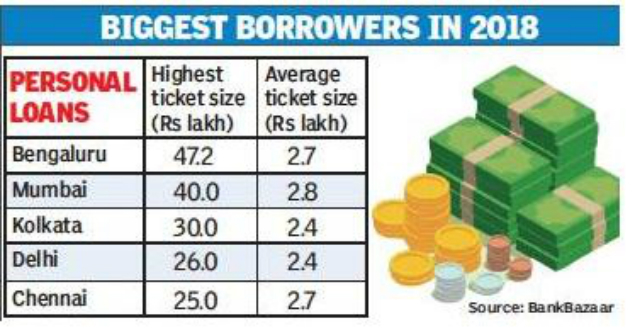

Rachel Chitra, Bengalureans take most personal, car loans, January 23, 2019: The Times of India

From: Rachel Chitra, Bengalureans take most personal, car loans, January 23, 2019: The Times of India

The highest personal loan ticket sizes are in Bengaluru, at Rs 47 lakh, followed by Mumbai (Rs 40 lakh), Delhi (Rs 26 lakh) and Kolkata (Rs 30 lakh), as per data from 1.6 million loan applications in 2018 with BankBazaar, one of India’s biggest online financial services aggregators.

In the average ticket size of personal loans taken, Mumbai (Rs 2.79 lakh) was ahead of Bengaluru (Rs 2.66 lakh) and Chennai, Delhi and Kolkata.

BankBazaar CEO Adhil Shetty said the high number of large loans in Bengaluru is, perhaps, a reflection of larger disposable income and high growth opportunities. He said the city has more first-time salaried borrowers than other metros.

The data is of those who use the online mode. It’s possible that in some of the other cities, a higher proportion of people choose offline modes.

In car loans too, the top segment of Bengalureans takes higher loans than their counterparts elsewhere, suggesting they go for more flashy cars. The highest loan ticket sizes came from Bengaluru, at Rs 49.9 lakh, followed by Chennai at Rs 46.8 lakh, and Delhi at Rs 21.8 lakh.

Highest car purchase by women borrower in 2018 was at Rs 12.9L

Compared to their urban counterparts, borrowers from tier-2 and tier-3 cities restrict themselves to not spending above Rs 20 lakh for a car. Even when it came to average car loan size, rural and semi-urban borrowers were more conservative and borrowed only up to Rs 5.2 lakh, compared to their urban counterparts, who were willing to shell out Rs 5.7 lakh.

The highest car purchase by a woman borrower in 2018 was at Rs 12.9 lakh. In personal loans, Bankbazaar data shows the average ticket size in metros was at Rs 2.6 lakh, lower when compared to Rs 2.8 lakh in non-metros.

“It’s possible urban users have more choices such as credit card, and EMI options for consumer purchases on debit cards, and may not choose a personal loan as their first option,” said Shetty.

In home loans, Delhiites took the highest ticket sizes (Rs 5 crore), followed by Chennai (Rs 2.2 crore), Bengaluru (Rs 1.5 crore) and Mumbai (Rs 1.8 crore).

But this trend could only be an indicator of the buying pattern of younger, tech-savvy individuals. An SBI official said, “We get biggest home loan and car loan requests from Mumbai. It’s possible Mumbaikars prefer directly contacting their banker than going through a third-party aggregator.”

2022

From: Oct 4, 2022: The Times of India

See graphic:

Top retail loans by active loans, FY22

Defaulters’ profile

2018: Up to 24% defaulters had safe credit rating

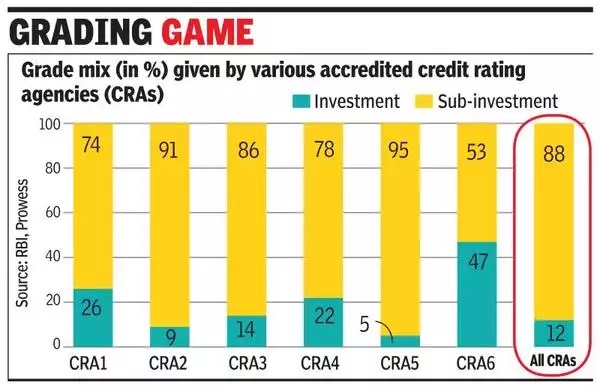

Mayur Shetty, January 13, 2020: The Times of India

From: [https://timesofindia.indiatimes.com/business/india-business/up-to-24-defaulters-had-safe-credit-rating/articleshow/73218832.cms Mayur Shetty, January 13, 2020: The Times of India

MUMBAI: Nearly a fourth of borrowers who defaulted to banks carried an investment grade credit rating up to a quarter before they defaulted, according to a report published in the Reserve Bank of India’s (RBI’s) latest bulletin.

What this means is that ratings of companies have plunged from at least BBB (investment grade) to D (default) in three months. The study has concluded that ratings do not always reflect the asset quality of borrowers in a timely manner and there are concerns over delayed reporting of ratings by banks. But despite the limitations, the report says the use of external ratings in regulations is inevitable and ways to improve agency performance should be explored.

The study was authored by Sukhbir Singh and Pallavi Chavan from RBI’s department of supervision. It covered 560 large borrowers, accounting for about 21% of NPA borrowers and as high as 40% of NPAs as of end-March 2018. About 24% of the sampled NPA exposure from Central Repository of Information on Large Credits (CRILC) carried an investment grade rating just a quarter before becoming non-performing.

Since 2014, the RBI has been maintaining a database of large accounts that have defaulted on the CRILC. These are companies where banks have an exposure of Rs 5 crore and above. According to the authors, an earlier study concerning accredited credit rating agencies (CRAs) shows that the cumulative default rates (CDRs) for the CRAs in India are much higher than those prescribed under the Basel framework (an international standard for banks).

“As a result, the possibility of undercapitalisation in banks cannot be denied, given the application of the same risk weights as prescribed by the Basel Committee on Banking Supervision (BCBS). There is also some evidence on the inability of CRAs to provide timely guidance on the weakening creditworthiness of borrowers,” the report said.

The top lenders

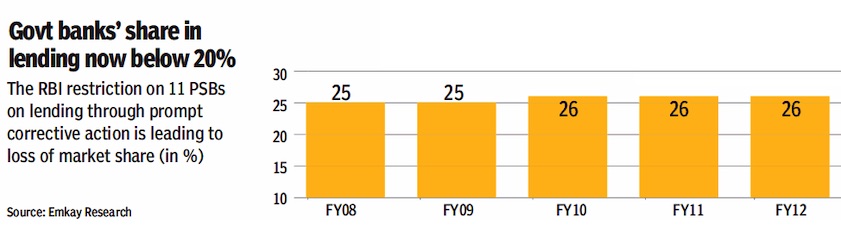

2008-18

From: October 13, 2018: The Times of India

From: October 13, 2018: The Times of India

See graphics:

2008-12: PSB banks’ share in lending

2013-18: PSB banks’ share in lending

2017

SBI, ICICI Bank Are The First Two Lenders

The RBI added HDFC Bank to the list of systemically important banks, or banks that are considered too big to fail.The other banks on the list are the two largest lenders -SBI and ICICI Bank. Since 2015, the central bank has been identifying banks whose failure would impact the whole financial system.These banks are subject to more rigorous regulation and capital requirement.(The Times of India Sept 2017)

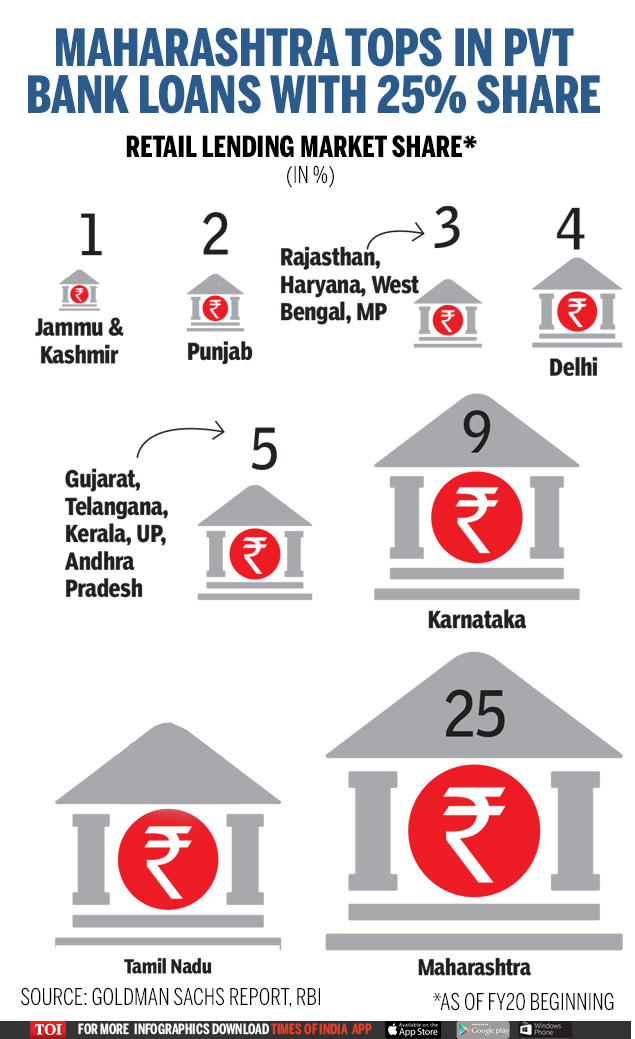

States, 2019

April 29, 2019: The Times of India

From: April 29, 2019: The Times of India

Private lenders gain market share

Private lenders have expanded their retail lending market share by 10 percentage points across top states in four years. The 15 states listed here account for nearly 90% of the loans. Private banks also disbursed 40% of all advances in FY19 as against 30% in FY15. Nearly 75% of the incremental gains have come from western and southern states.

NBFCs

2014-19

See graphic:

Bank loans to NBFCs, 2014-19

Bank-wise figurers for 2019

Loans to gems & jewellery cos

From: Sidhartha, February 19, 2018: The Times of India

See graphic:

Outstanding bank loans to gems and jewellery, 2014-17

Loans to the real estate sector

2013 – 22: India and the world

From: July 27, 2023: The Times of India

See graphic:

2013-22, bank loans to the real estate sector in India and Comparable countries

Gender-wise size of loans, 2018

Rachel Chitra, Loan sizes higher when women borrow, January 23, 2019: The Times of India

From: Rachel Chitra, Loan sizes higher when women borrow, January 23, 2019: The Times of India

The average ticket size of a home loan when women borrow is significantly higher (Rs 27 lakh) than when a man borrows (just under Rs 23 lakh), according to data from 1.6 million loan applications in 2018 on BankBazaar, one of India’s biggest online financial services aggregators.

BankBazaar CEO Adhil Shetty said the higher loan amount when a woman applies could indicate it’s a household with two incomes, unlike when a male applies, where he could be the only breadwinner. Banks also have special loan offers for women, with interest rates many basis points (100bps = 1 percentage point) lower than for men.

When it came to car-buying patterns, the data shows that when a woman is the primary loan applicant, they tend to steer away from big-ticket car purchases. Male borrowers borrowed up to Rs 49.9 lakh for a car, whereas the highest female car loan ticket size was Rs 12.9 lakh.

But in terms of the average car loan size taken by women, it’s significantly higher (Rs 5.5 lakh) than when men are the sole applicants (Rs 5.3 lakh). “Again, I think when women apply, they are an indicator of a double-income household,” said Shetty.

This trend of women boosting the household’s purchasing capacity could be seen across metros. The average ticket size of home loans in Delhi for women borrowers was Rs 28 lakh, compared to male borrowers at Rs 24.5 lakh. In Bengaluru, women borrowed Rs 37.9 lakh — higher than men at Rs 36.9 lakh, and in Chennai women borrowed Rs 34.8 lakh compared to men at Rs 30.1 lakh. However, the situation was the opposite in Mumbai, where men borrowed more in home loans at an average of Rs 32.8 lakh compared to women at Rs 29.7 lakh.

For personal loans, women seem to borrow less than men. The average ticket size for female applicants was Rs 2.7 lakh, compared to men who borrowed Rs 2.8 lakh.

Women seem to now have the firepower for globe-trotting just as much as men — women’s applications for travel credit cards grew 73%, slightly higher than male applications that increased 71.5%. In lifestyle credit cards too, applications from women grew at a 10.5% rate, compared to men at 8%.

Women borrowers

2014-20

March 9, 2021: The Times of India

From: March 9, 2021: The Times of India

Credit-wary women up home loan share…

Reduce Personal Loans, Plastic Money’s Use, Have Higher Credit Score Than Men: Study

Mumbai:

Women have sharply increased their share of home loans, but have turned averse to personal loans and credit cards in the wake of the pandemic. Women are also more closely monitoring their credit scores, according to a study by TransUnion Cibil.

A report released by the credit bureau on Women’s Day shows that in 2019, women accounted for 23% of consumer loans. This dipped by 400 basis points (100bps = 1 percentage point) to 19% in 2020. Similarly, credit card enquiries by women dipped from 13% to 12% during the same period. However, when it comes to home loans, women have increased their share to 11% from 9% in 2019. According to TU Cibil chief operating officer Harshala Chandorkar, this is because of factors like reduced stamp duty for women consumers on a home purchase in some states along with lenders offering better terms & conditions and a lower rate of interest for women borrowers. “Also, the fact that women have a higher average Cibil score than that of men indicates that women have a better credit history and therefore lesser probability of default, which makes them better customers for banks and credit institutions. Improved and easier access to economic opportunities have catalysed the financial inclusion of women in India,” she added.

TU Cibil VP and head (DTC interactive) Sujata Ahlawat said, “With improved levels of education and employment of women across our country, their credit consciousness has also grown. This is corroborated by the fact that we have seen a significant surge in the number of women borrowers who monitor their Cibil score and report. This is a promising indicator of increased awareness and financial literacy among women.” This increased credit consciousness is also evident from data that shows women now constitute 12% of self-monitoring consumers — an increase from10% in 2018.

Women consumers also show better credit history as compared to men, with the average Cibil score of an Indian woman consumer being 719 — higher than that of an average male consumer at 709. Additionally, 61% of the women consumers in TU Cibil’s consumer credit bureau have a score greater than 720, whereas only 56% of male consumers have greater than or equal to that figure. “Increased credit consciousness leads to a positive credit behaviour as consumers understand the impact of their credit activity on their Cibil score and access to finance,” said Ahlawat.

As women turn credit conscious, their overall share in retail loans is increasing too with 4.7 crore active women borrowers. Over the last six years, the share of women borrowers grew to around 28% in September 2020 — up from around 23% in September 2014, which is a compounded annual growth rate (CAGR) of around 16%. In terms of the sanctioned loan amount, women borrowers account for Rs 15.1 lakh crore of retail loans, which has grown at a 12% CAGR over the last six years.

Loans and Defaulters

Number of wilful defaulters

2016 – 21

See graphic:

The Number of wilful bank loan defaulters in India, 2016 – 21

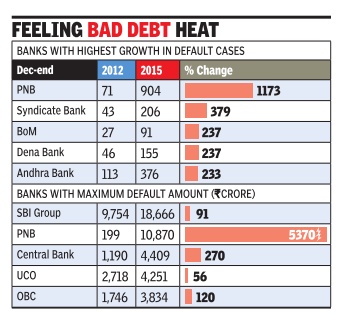

Wilful defaulters:38% rise, 2012- 2015

The Times of India, May 04 2016

The number of wilful defaulters, who have not repaid their loans to public sector banks despite having the ability to do so, shot up by 38% to 7,686 at the end of December 2015, compared to 5,554 in December 2012, with lenders finally starting to issue the tag amid rising bad debt plaguing the Indian economy.

The amount involved in these cases has shot up 2.4 times to Rs 66,190 crore, compared to around Rs 27,750 crore three years ago, the government informed Parliament.

Bankers, however, war ned that some of the banks may still have kept a few firms and their promoters out of the net. “Banks have not done a complete exercise to identify all wilful defaulters in line with RBI guidelines,“ said Deepak Narang, a former executive director of United Bank of India. No one certifies that all the wilful defaulters have been identified. There has been an increase in recent years but not all accounts have been identified,“ Narang said.

He furnished the exam ples of Indian Overseas Bank and United Bank, where the numbers of such defaulters have come down. “How is that possible when the NPA in the system is rising and banks are reporting losses?“ RBI rules require banks to declare a borrower `wilful defaulter' if it has defaulted in repayment despite having the capacity to honour the obligation. Similarly , a defaulter who has diverted or siphoned off the funds, or has disposed off fixed assets or immovable property , can be given the tag.“The default to be categorised as wilful must be intentional, deliberate and calculated,“ the guidelines say .

Under pressure from RBI to act against defaulters, banks have begun to crack the whip only in recent months.As a result, lenders such as PNB have seen a massive spurt in the number of wilful defaulters -from 71 to 904 in three years (see graphic). In value terms too, PNB tops the list in terms of the growth rate with the amount involved jumping from Rs 199 crore at the end of December 2012 to almost Rs 11,000 crore at the end of 2015. Indian Bank and Andhra Bank (over 7times each).

SBI and its associates, which account for nearly a quarter of banking business, are at top of the pile in terms of amount involved but their share is around 28%, compared to 35% at the Dec-end of 2012, indicating that nationalised banks have only now begun to take exercise seriously .

2012-2022: Loan defaults rise 10-fold

July 20, 2022: The Times of India

State-wise break up

Prominent defaulters

The banks affected

From: July 20, 2022: The Times of India

The amount owed by wilful defaulters to Indian banks has risen more than tenfold over the last decade from Rs 23,000 crore on March 31, 2012 to Rs 2. 4 lakh crore on May 31 this year. Data from TransUnion Cibil, a credit information company, shows defaults increased significantly during the lockdown to touch Rs 2. 6 lakh crore in March 2021, but have since come down a little.

The data pertains only to those accounts in which suits have been fi led against wilful defaulters with outstanding amounts of Rs 25 lakh or more. As of May 31, there were over 12,000 such defaults. The amount of Rs 2. 4 lakh crore is 2. 7 times the allocation of Rs 86,200 crore to the health ministry and 42% more than the Rs 1. 4 lakh crore allocated to the rural development ministry, which funds MGNREGA.

Analysis of the 12,000 defaults shows that loans below Rs 1 crore – like those taken by homebuyers – account for just over 1% of the total defaults. On the other hand, over 250 entities that defaulted on more than Rs 100 crore totalled Rs 1. 36 lakh crore or 58% of the total wilful defaults.

Amounts like Rs 100 crore make no intuitive sense to most middle-class folks. So, here’s how you could think about it. If you earn enough to be able to save Rs 10 lakh a year, it would take 1,000 years to save this amount. If parked in a Swiss long-term bond (10 years or more), this money would yield an annual interest of Rs 1. 15 cr or Rs 9. 6 lakh per month. It can buy 200 fl ats worth Rs 50 lakh each or more than 190 kg of gold, both of which can be passed on for generations. According to RBI, wilful defaulters are those who default on loans despite having the capacity to repay. Units that divert the funds for purposes other than the specifi c purpose of the loan also come under this category. Firms that siphon off funds and can’t produce the funds or the assets created by using them are also classifi ed as wilful defaulters.

TOI consolidated the amounts owed by people or companies who had at least one account in which they defaulted for Rs 100 crore or more. Such a consolidation shows that the ABG Group promoted by Rishi Agarwal and others tops this list. The company’s seven loan accounts in different banks add up to Rs 6,382 crore of wilful defaults. Amtek Auto Limited and its subsidiaries, promoted by Arvind Dham, are second with wilful defaults of Rs 5,885 crore. The Sandesara brothers, Nitin and Chetan, on the run for a few years now, are third with the consolidated default of their company, Sterling Global Oil Resources Pvt Ltd, and its subsidiaries amounting to Rs 3,757 crore.

Companies of Kapil and Dheeraj Wadhawan – Dewan Housing Finance Limited and its subsidiaries – have wilfully defaulted on Rs 2,780 crore. Next on the list are brothers Sanjay and Sandeep Jhunjhunwala, whose company Rei Agro Ltd has defaulted on Rs 2,602 crore of bank loans.

Other companies that defaulted on more than Rs 2,000 crore of bank loans are Mehul Choksi’s Gitanjali Gems Ltd, Sanjay Kumar Sureka’s Concast Steel and Power Ltd, Atul Punj’s Punj Lloyd Ltd and Jatin Mehta’s Winsome Diamonds and subsidiaries. Choksi and Mehta have fl ed to the Caribbean islands. Overall, nine companies have defaulted on more than Rs 2,000 crore of loans. Defaults are between Rs 1,500 crore and Rs 2,000 crore for the next seven. Famous among them are Shakti Bhog Foods, Sintex Industries, Rotomac Global, Deccan Chronicle Holdings and S Kumars Nationwide.

2017: wilful defaulters owe ₹1 lakh cr+ to banks

How the debt has grown, 2008-2017

From: Atul Thakur, India’s wilful defaulters owe more than ₹1 lakh cr to banks, February 23, 2018: The Times of India

As on September 30, 2017, more than Rs 1 lakh crore was owed to banks by people or companies characterised as “wilful defaulters”, that is those who are unwilling to pay despite having the capacity to do so. TOI analysed more than 9,000 such accounts for which banks have filed lawsuits for recovery and found that the top 11 debtor groups, each with dues of over Rs 1,000 crore, together had over Rs 26,000 crore outstanding to the banks.

Analysis of the publicly available data for suit-filed accounts (wilful defaulters) of Rs 25 lakh and above shows that Jatin Mehta-promoted Winsome Diamonds & Jewellery Ltd and Forever Precious Jewellery & Diamonds Ltd owed close to Rs 5,500 crore to various banks. Mehta is reported to be now a citizen of St Kitts and Nevis, a tax haven with which India doesn’t have an extradition treaty.

Mehta’s companies are followed by Vijay Mallya’s Kingfisher Airlines, which has to pay back over Rs 3,000 crore under this head. The third in the list is REI Agro, a company owned by Sandip Jhunjhunwala, which, according to news reports, was once listed in London and Singapore stock exchanges and was co-sponsor of an IPL team. It owes Rs 2,730 crore.

Bad loans grew 4-fold to ₹1.1L cr during 2013-2017

Next in the list are the companies owned by Prabodh Kumar Tewari and his family members. The amount outstanding on Mahuaa Media, Pearl Studio Pvt Ltd, Century Communication and Pixion Media Pvt Ltd is Rs 2,416 crore.

The other companies that owe more than Rs 2,000 crore and are unwilling to pay despite having the means, according to the banks, are Zoom Developers Pvt Ltd promoted by Vijay Choudhary, Reid & Taylor (India) Limited & S Kumars Nationwide Limited, both promoted by Nitin Kasliwal, and media baron T Venkatram Reddy’s Deccan Chronicle Holdings Limited.

The data shows the alarming rate at which these bad loans are growing. In the past one year it has increased by about 27%. In the previous three years, it had increased by 38%, 67% and 35%, respectively.

Thus, between September 2013 and September 2017, the amount has quadrupled from Rs 28,417 crore to over Rs 1.1 lakh crore. While some of this would be due to interest being added each year, the quantum of the increase is too large to be entirely or even mainly due to that.

The RBI defines “wilful default” as defaults done despite the borrowers’ paying capacity. Money diverted for purposes other than the specific purpose of finance, or siphoned off and hence not available as assets to the borrower also qualifies as wilful default. Borrowers who have sold fixed assets that they provided as collateral to secure the loan without informing the bank also come under this category.

The cumulative total of more than 50 companies or groups each with over Rs 250 crore of wilful default works out to about Rs 48,000 crore. To put that in perspective, it is only slightly less than the government’s allocation of Rs 52,800 crore for health in the 2018-19 Budget.

Bank-wise analysis of data shows nationalised banks (excluding SBI and associates) constitute about 60% of this money. SBI and its associates account for one-fourth of the total. Private sector banks have also declared over Rs 14,000 crore as wilful defaults.

Defaults by gems, jewels companies, till 2017

From: Chethan Kumar, PNB lost four times more money than SBI did to jewel thieves, February 23, 2018: The Times of India

Highly cash-dependent traders in gems and diamonds have cost banks at least Rs 5,000 crore through 90 defaults, bank-wise and company-wise data on wilful defaulters compiled by the Federation of Bank of India Staff Unions (FBISU) shows.

The top loser is PNB, with just nine defaulters but a loss of Rs 1,790 crore — four times the amount SBI lost.

SBI reported the most number of wilful defaults(15) and lost Rs 410 crore (see table). PNB, incidentally, has lost the most among banks.

According to FBISU data, the total number of wilful defaulters is a little over 5,000, costing banks about Rs 49,000 crore, but the latest RBI data shows the numbers have jumped to 8,915 and Rs 92,376 crore, respectively. Of these wilful defaulters at the end of March 2017, PNB had the most (1,120), followed by SBI (997).

At least two bankers TOI spoke to said the exposure to gems and jewel companies must have also increased multifold. “Given that this data doesn’t include the recent PNB scam, the final number could point to one of the worst frauds the sector has seen,” one of them said.

Small and big loans have remained unpaid, while companies like Winsome, Beautiful Diamonds and Auro Gold Jewellery have defaulted with multiple banks. In some cases, banks are in the process of recovery, while in others investigations are pending.

Among the various means used to exploit banks is changing the names of companies and borrowing.

Data shows that Beautiful Diamonds was earlier called Splendour Gems, while Auro Gold Jewellery Private Limited later dropped the word “Private” from its name. Another firm, Ghanshyandas Gems and Jewels, later became “Ghanshyamdas”.

“The diamond trade is highly cash-dependent and the source of major money laundering. It may be conceivable that diamond merchants resorted to higher borrowing through Nostro accounts overseas to deal with the setbacks caused by constriction of the cash economy,” Tobby Simon of Synergia Foundation, a multidisciplinary think tank, said.

Experts, while pointing out how the total recapitalisation amount PNB received was about Rs 5,473 crore, pushing the bank’s net worth to Rs 20,000 crore, said that assuming the best scenario of recovery (of the Rs 11,300 crore) is 50%, the fraud has wiped out the entire money taxpayers had coughed up to recapitalise the bank.

Among other banks that suffered are Union Bank of India with nine defaults and Oriental Bank of Commerce with eight defaults.

Professor Charan Singh, former RBI chair professor at IIM-B, while calling for a complete overhaul of the banking system, cautioned against politicising the issue. “There’s a need to consider the sentiments of the public. Overreaction in the public domain can only deter depositors from banking, and bankers from lending.”

2018, March: The biggest defaulters

From: Mayur Shetty, Banks face triple whammy: Nirav, NPAs & rising yields, March 26, 2018: The Times of India

See graphic:

The biggest defaulters, as in March 2018

Riot defaulters exempt

The Times of India, May 03 2016

Defaults can't bar Guj riot-hit from special loans: HC

The Gujarat high court has held in a case that a bank cannot deny loan under special policy for 2002riot affected because the applicant had defaulted in payments earlier. The HC has asked the state government and Bank of India to extend loan to a 2002-riot affected trader from Bhavnagar, Usman Ghani Aadhiya, who had defaulted in an earlier loan from the same bank. The bank was refusing to pay him a fresh loan after riots on the ground of his earlier default.

Aadhiya had suffered damage of Rs 5.1lakh to his business in the riots and was thus entitled to a loan at 4% flat interest from a bank according to policy.The HC said it was not permissible for the bank to exclude him from extending the loan because he falls in the category of the riots affected.

Loan defaulters’ rights

The Times of India, Apr 18 2016

PREETI KULKARNI

Five rights loan defaulters should know of

If you have defaulted on loan repayment and the bank wants to repossess your assets, all is not lost

If you have defaulted on a loan, the rules do not give the lender a complete walko ver. Keep the following points in mind if you find yourself in such a situation.

Right to ample notice

A default does not strip you of your rights.Banks have to follow process and give you time to repay dues before repossessing your assets to realise the arrears. Typically, banks initiate such proceedings under the Securitisation and Reconstruction of Financial Assets and Enforcement of Secu-rity Interests (Sarfaesi) Act. If the borrower's account is classified as a non-performing asset, where repayment is overdue by 90 days, the lender has to first issue a 60-day notice.

“If the borrower fails to repay within the notice period, the bank can go ahead with sale of assets. However, in order to sell, the bank has to serve another 30-day public notice mentioning the details of the sale,“ says banking and management consultant V.N.Kulkarni.

Right to ensure fair value

The lender starts the process of auctioning your property to recover dues if you fail to clear what you owe or respond during the 60-day notice period. However, before doing so, they will have to issue another notice specifying the fair value of the secured asset as assessed by the banks' valuers, along with details like reserve price, date and time of auction. “The borrower can object if the property is undervalued. He can justify his objection by conveying any better offer that he may have so that the bank can make a decision,“ says Kulkarni. In other words, you can look for prospective buyers on your own and introduce them to the lender if you think that the property can yield a better price.

Realise balance proceeds

Do not write off your asset mentally the moment it is repossessed. Keep track of the auc tion process. Lenders are required to refund any balance after recovering the dues, which s a real possibility given that property pric es can shoot up beyond the owed amount After recovering the dues and expenses of conducting the auction, the bank has to re und the remaining amount to the borrower as the money belongs to him,“ says Kulkarni

Right to be heard

During the notice period, you can make your representation to the authorised officer and put forth your objections to the repossession notice. “The officer has to reply within seven days, giving valid reasons if he rejects the representation and objections raised by the borrower,“ says Kulkarni.

Frauds below Rs 1L not to be reported to police: CVC

Don't report frauds below Rs 1L to police, CVC asks banks, The Times of India, Jun 17 2017

The Central Vigilance Commission (CVC) has asked public sector banks not to report frauds below Rs one lakh to local police, unless their staff is involved in such crimes. Earlier banks were mandated to report fraud of above Rs 10,000 and below Rs 1 lakh to police.

The decision was taken by the CVC in consultation with the Reserve Bank of India (RBI), taking into account the practical difficulties faced by public sector banks in reporting such categories of cases.

It has been decided that only if staff of the bank is involved in the fraud cases of below Rs 1 lakh and above Rs 10,000, would such cases need to be reported or complaint filed with local police station by the bank branch concerned, the commission said in a directive to chiefs of all the banks.

The cases of frauds of upto Rs one lakh and not below Rs 10,000 are to be scrutinised by banks officials concerned for further necessary action, a senior CVC official said.

As of September 30, 2016, the Non-Performing Assets (NPAs) declared by various scheduled commercial banks stood at a whopping Rs 6,65,864 crore, according to an official data. The NPAs of the country's largest lender State Bank of India is Rs 97,356 crore, followed by Rs 54,640 crore of Punjab National Bank and Rs 44,040 crore of Bank of India, it said. Bank of Baroda has NPAs of Rs 35,467 crore, Canara Bank Rs 31,466 crore, Indian Overseas Bank Rs 31,073 crore, Union Bank of India Rs 27,891crore.

Loans: Bad loans

5 business houses alone owe PSU banks Rs. 1.4 lakh crore

The Times of India, May 06 2016

Adani Group Has Debt Of Rs. 72,000 Crore'

Raising the issue of corporate loans in Rajya Sabha, JD(U) member Pavan Verma said the Adani group had a debt of Rs 72,000 crore -an amount equal to the total debt of farmers in the country. Verma said corporate houses owed about Rs 5 lakh crore to PSU banks and particularly referred to the Adani group, alleging that the company got “unimaginable“ favours. Raising the issue during zero hour, he contended that PSU banks were influenced to give loans to people who were not able to repay them.

“PSU banks are owed abo ut Rs 5 lakh crore by corporate houses and of this, roughly Rs 1.4 lakh crore are owed by just five companies, which include Lanco, GVK, Suzlon Energy , Hindustan Construction Company and a certain company called the Adani group and Adani Power,“ he said.

“I want a reply from the government, are they aware of this or are they not. And if they are aware, what are they doing in this matter. One company owes as much as all the farmers of India,“ he further said.

The amount owed by this group both in terms of its long-term and short-term debt was around Rs 72,000 crore, Verma said, claiming to be quoting from reports. He added that on Wednesday , it was mentioned that the entire amount owed by farmers as crop loans was Rs 72,000 crore.

“I don't know what is the relationship of this government with this business house. I don't even know if they know them, but the owner of this group (Gautam) Adani is seen everywhere the prime minister has gone, every country , China, the UK, the US, Europe, Japan,“ Verma said.

“This company has been given favours which are unimaginable. In Gujarat, their SEZ was approved in spite of the high court's strictures,“ he added.

When deputy chairman P J Kurien warned Verma against making allegations, the JD(U) member said, “I am giving you factual account. It is a high court judgment. It was left to the state government.The UPA government had not approved it and when this government came to power, it was approved.“

Verma said it did not matter if Adani group had the ability to pay this amount, but in the last 2-3 years, the company's net worth had gone up by 85%.

25% of Rs 8 lakh crore bad debt is from just 12 accounts

HIGHLIGHTS

Just 12 accounts responsible for 25% of all NPAs with banks

Lenders will be asked to initiate insolvency proceedings to recover the dues

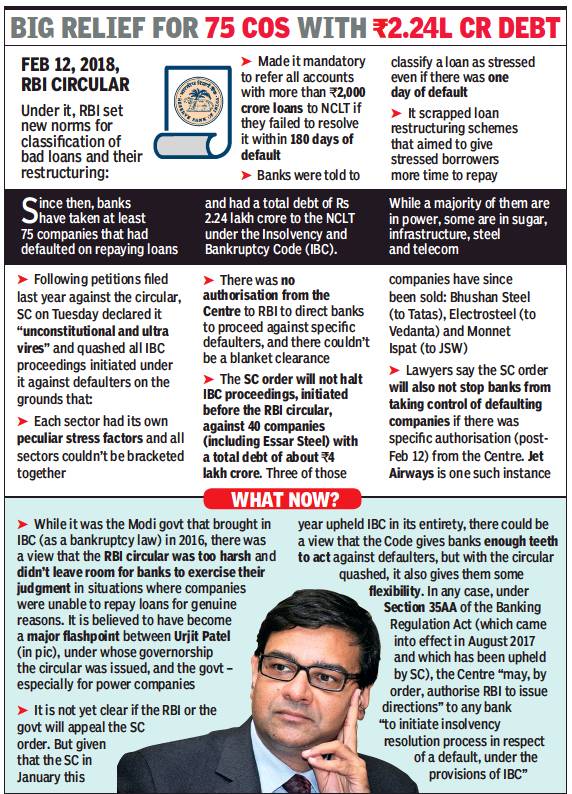

The RBI today identified 12 accounts each having more than Rs 5,000 crore of outstanding loans and accounting for 25 per cent of total NPAs of banks for immediate referral for resolution under the bankruptcy law.

Without naming the defaulters, the Reserve Bank said the lenders will be asked to initiate insolvency proceedings to recover the dues. The banking sector is saddled with non-performing assets (NPAs) worth over Rs 8 lakh crore, of which Rs 6 lakh crore is with public sector banks (PSBs). The Internal Advisory Committee (IAC), the central bank said, has arrived at an objective, non-discretionary criterion for referring accounts for resolution under the Insolvency and Bankruptcy Code (IBC).

"In particular, the IAC recommended for IBC reference of all accounts with fund and non-fund based outstanding amount greater than Rs 5,000 crore, with 60 per cent or more classified as non-performing by banks as of March 31, 2016," the RBI said in a statement. The IAC noted that under the recommended criterion, 12 accounts with about 25 per cent of the current gross NPAs of the banking system would qualify for immediate reference under IBC, it said.

The apex bank, based on the recommendations of the IAC, will accordingly be issuing directions to banks to file for insolvency proceedings under the IBC in the identified accounts.

Such cases will be accorded priority by the National Company Law Tribunal (NCLT).

2012-18

From: May 22, 2019: The Times of India

See graphic:

Share of stressed loans, 2012-18

2014: loans to coal sector…

… and scrapping of coal block allotments

Power sector bad loans may rise

Mumbai:

TIMES NEWS NETWORK

The Times of India Sep 25 2014

The Supreme Court verdict scrapping all but four coal block allotments has added to the bad loan headache of the banking industry .

Although bank exposure to coal mining sector is estimated to be below Rs 20,000 crore, the biggest fear is that coalfuelled power plants may stop producing power and default on loans. Bank exposure to power companies is around Rs 5.16 lakh crore and accounts for 9% of their loans. A large chunk of these depend on coal.

Shares of leading public sector banks dipped sharply on Monday over fears that their bad loans would rise following the Supreme Court order.

Bank of India and Canara Bank, which have large exposures to the power segment (relative to their loan book) fell 5.6% and 5%, respectively , to Rs 263 and Rs 358. Punjab National Bank, which is estimated to have the largest exposure to coal mining, fell 4.3% to Rs 927. The State Bank of India, one of the largest lenders to power in absolute terms, saw its share price fall 2.7% to Rs 2,487. Even without the coal block cancellation, several power projects and steel companies are under stress and are undergoing restructuring. Stoppage of fuel to these projects could tip them into the non-performing assets category , considering that imported coal is four times as expensive as domestic coal. Reacting to the SC order, SBI chairman Arundhati Bhattacharya said, “We believe that uncertainty is possibly the worst enemy of growth. We are glad that this is over with the SC verdict on coal blocks allocation. We now look forward for a quick plan of action for ensuring that coal supplies are not disrupted and, thereafter, a swift and transparent bidding process for reallocation.“

According to IDBI Bank chairman MS Raghavan, the bank has an exposure of close to Rs 2,000 core to the companies affected by the Supreme Court order. The bank is still assessing the impact of the verdict.

In the private sector, ICICI Bank has loans to power and steel companies that are dependent on coal supply . Earlier in an interview to TOI, Chanda Kochhar, MD & CEO of ICICI Bank, had said it was important to ensure that back-end projects that depend on coal keep producing. “The government has been talking about finding ways of reallocating coal. As long as coal is produced and power and steel plants get it, that ensures the viability of the power project; where it is allocated, who owns it and who mines it is not the primary thing. Banks had mainly extended assistance to either power or iron and steel projects,“ Kochhar had said. While deciding to cancel all but four coal blocks allotted since 1993, The Supreme Court brushed aside Coal Producers Association's (CPA) estimate that Rs 9 lakh crore linked to them would come to naught.

The CPA, through senior advocate K K Venugopal, had said that loans worth Rs 2.5 lakh advanced by banks and financial institutions would become non-performing assets. It had said that SBI has an exposure of up to Rs 78,263 crore.

Venugopal had said that apart from huge losses to other PSU banks like PNB and Union Bank, public sector entities like Rural Electricity Corporation and PFC would experi ence an even higher exposure than banks. The financial implication narrated by CPA covered many other aspects.“Huge investments up to about Rs 2.9 lakh crore have been made in 157 coal blocks as on December 2012, investments in the end-use plants have been made to the extent of about Rs 4 lakh crore, which employ 10 lakh people,“ CPA had said.

The CPA had warned of many other adverse effects -the country's dependence on coal as a primary source of fuel for up to 60% for power generation might result in inflationary trends; 28,000 mw of power capacity would be affected due to de-allocation; closure of coal mines would result in an estimated loss of Rs 4.4 lakh crore in terms of loss of royalty , cess, direct and indirect taxes; coal imports would go up even more in financial year 2016-17 to the extent of Rs 1.4 lakh crore.

A bench of Chief Justice R MLodha and Justices Madan B Lokur and Kurian Joseph cited arguments of attorney general Mukul Rohatgi to counter adverse economic fallout predicted by CPA. “It was submitted by the AG that all aspects, including the economic implications or fallout of the cancellation of coal block allotments and the possible adverse impact that it may have on other socio-economic factors, have been taken into consideration and it is only after that the affidavit has been filed by the Union of India,“ the bench said.

2018/ Loans to the power sector

‘RBI excess capital identified by panel may back power loans’, April 4, 2019: The Times of India

The Bimal Jalan committee has to submit its report on the appropriate level of reserves to be maintained by the RBI. According to a report by Bank of America Merrill Lynch, the panel will identify excess capital of $14 billion to $42 billion, which can be used to address stressed loans in power sector.

The Supreme Court quashed a circular from the RBI forcing banks to initiate insolvency proceedings against defaulting companies. This order has paved the way for restructuring of loans to the power sector. While this is a relief to both lenders and borrowers it does not address the issue. Lenders did not want to start insolvency proceedings as projects were under implementation and would not find takers.

According to BoAML, the finance ministry should be able to form a much-needed public sector asset reconstruction or asset management company that manages banks’ nonperforming assets (NPAs) in power with the Supreme Court ruling against the February 12 RBI circular, which had adopted a one-size-fits-all approach. This had also been proposed by RBI deputy governor Viral Acharya earlier.

“Our power analyst estimates that auctioning these power NPLs will need a haircut of 75%, that is $9 billion (Rs 63,000 crore) more. Banks can then transfer the $9 billion of cleaned-up power NPLs to the ARC/AMC. This can be done by either the government recapitalizing banks by an additional Rs 7,000 crore or it can deploy excess RBI economic capital set to be identified by the Jalan committee next week,” said Indranil Sen Gupta, India Economist with Bo-AML.

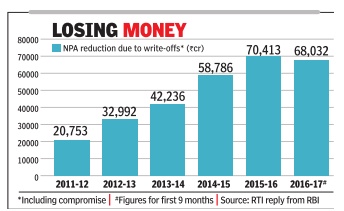

Priority sector more creditworthy than corporates/ 2016

Priority sector loans, long seen as a socialist burden on banks, have turned out to be more credit worthy than advances to large corporates. During April-December 2016, banks had written off loans worth Rs 35,587 crore to large industries as against write-offs of Rs 32,445 crore of advances in the priority sector.

Also, banks could recover only Rs 16,717 crore from large industries who are in default as against Rs 25,070 crore from the priority sector.

An RBI response to a Right to Information (RTI) filing shows that inability to make timely recoveries from large businesses is forcing banks to take a huge hit on their earnings. Banks had written off Rs 68,032 crore of bad loans in the first nine months of FY17 -close to 97% of total write-offs in the whole of FY16. Given that the fourth quarter writeoffs in FY17 had been significant, the total write-offs in the last three years have crossed Rs 2 lakh crore.

CARE Ratings chief economist Madan Sabnavis said, “After the asset quality review norms were put in place by the RBI, bad loans and provisioning have risen steeply . As banks started realising a part of these bad lo ans cannot be recovered, they also started writing off more to clean their balance sheets.“ He added the situation is a result of bad lending decisions and governance issues among banks, which was supported by the “system“.

In the first nine months of FY2017, scheduled commercial banks (SCBs) wrote off Rs 35,587 core worth of loans to large industries, compared to Rs 6,628 crore written off by lenders to farm loans, Rs 8,106 crore toward MSME loans and Rs 17,711 crore wrote off to the other priority sectors.

A loan write-off does not mean that the borrower goes scot free as all recovery proceedings continue. A balance sheet write-off indicates that even if the borrower does not repay , the bank has set aside own funds to repay depositors. Similarly , the farm loan waiver announcement by state governments is not included in `write-offs' by banks. “The loan is always there in the books. They are just moved from sub-standard to standard when the government waives and makes good the loan outstanding. Only that amount of the agriculture loan is written off which is not made good by the government,“ said a senior public sector banker in charge of priority sector banking.

2017: Bad loans at record Rs 9.53 lakh crore

HIGHLIGHTS

Unpublished data show that bad loans in banks have reached a record Rs 9.53 lakh crore by end-June

The stressed loans have risen 5.8 per cent in last six months

Stressed loans as a percentage of total loans reached 12.6 per cent at end-June, the highest level in at least 15 years

The bad loans of banks hit a record Rs 9.53 lakh crore at the end of June, unpublished data shows, suggesting Asia's third-largest economy is no nearer to bringing its bad debt problems under control.

A review of Reserve Bank of India (RBI) data obtained through Right To Information (RTI) applications show banks' total stressed loans - including non-performing and restructured or rolled over loans - rose 4.5 per cent in the six months to end-June. In the previous six months they had risen 5.8 per cent.

While banks remain the main source of funding for companies in India, the stubborn bad debt problem has eaten into bank profits and choked off new lending, especially to smaller firms, at a time when an economy that depends on them is stalling.

The GDP grew at its slowest pace in three years in April-June quarter - a concern for the government which faces elections in 2019 and has pledged to create millions of new jobs before then. Banks are having to take higher provisions to account for more defaulters being pushed into bankruptcy and margins are likely to be squeezed further by proposed new rules to encourage commercial banks to pass on central bank interest rate cuts.

To be sure, the bulk of India's bad loans are in the state banks and stem from lending to large conglomerates, especially in steel and infrastructure. But analysts say the rise in bad loans among small firms, and even retail borrowing, is worrying and will do little to encourage new loans to help fuel growth.

"On the corporate side, we think it's a recognition cycle which is nearing an end," said Alka Anbarasu, senior analyst at Moody's Investor Service, referring to more bad loans being recognised as such, as banks come under pressure from the RBI and other regulators. "But it's really those data points beyond corporate that are causing some worry."

Anbarasu forecast weak quarters ahead for banks before profitability picks up, and several senior bankers from public sector lenders - which account for more than two-thirds of Indian banking assets - agreed the months ahead would be strained.

Stressed loans as a percentage of total loans reached 12.6 per cent at end-June, according to the RBI data, the highest level in at least 15 years.

Higher provisions, weaker loans

Part of the issue for banks and the government is a strict provisioning regime: the RBI wants banks to provide for at least 50 per cent of the secured loans to companies taken to bankruptcy proceedings, and 100 per cent for the unsecured part.

A dozen of the biggest such cases account for nearly Rs 1.78 lakh crore, or a quarter of total non-performing assets.

For those companies, banks will need to provide Rs 18,000 crore on top of existing provisions, according to July estimates from India Ratings and Research, the local affiliate of Fitch Ratings. More than 20 other sizeable companies are at risk of being taken to bankruptcy court.

Bankers say these and other pressures - including rising government bond yields that forced banks to post mark-to-market losses - have added to the squeeze, and hit new loans.

According to RBI data, new loans grew at just about 5 percent in the year to March, the lowest growth rate in more than six decades. Several banks have already cut back their loan books to conserve capital.

"What are they (RBI) thinking while they're taking these steps all at the same time?" said a treasurer at a state-run bank, who didn't want to be named due to the sensitivity of the issue. "Do they want banks to wind up their businesses, or do they want to save the banks?"

Treasury income accounted for 22.7 per cent of banks' operating profits in the last financial year, doubling its share from a year earlier, India Ratings estimates.

"The almost zero treasury income will hit provisioning ability and, in turn, make it more difficult for weaker banks to give loans as capital becomes more scarce," said Soumyajit Niyogi, an associate director at the rating agency.

A senior policymaker, who requested anonymity as the discussions are not public, said the government would have to help to sufficiently capitalise the banks.

Fitch Ratings estimates Indian banks will need Rs 4.24 lakh crore of additional capital by March 2019 to meet Basel III global banking rules. Moody's expects the top 11 state lenders alone will need nearly Rs 98,000 crore. The government has just Rs 19,500 crore left in its budget for bank recapitalisation.

"We think capitalisation is the biggest challenge for the banks at the moment, given that earnings will remain subdued and will not support any capital generation," said Moody's Anbarasu.

2017-18: Wilful defaulters form 14% of PSB bad loans

Mayur Shetty, Wilful defaulters form 14% of PSB bad loans, January 8, 2018: The Times of India

From: Mayur Shetty, Wilful defaulters form 14% of PSB bad loans, January 8, 2018: The Times of India

With 53%, Vijaya Bank On Top Of RBI List

Around 14% of the bad loans in public sector banks (PSBs) are due to wilful defaulters. The total gross non-performing assets (NPAs) of 21 PSBs stood at Rs 7.33 lakh crore as on September 30, 2017. Of this, Rs 1.01 lakh crore of loans were termed as those in wilful default.

Wilful defaults have an element of malfeasance as it broadly means that the borrower has reneged on the agreement on usage of funds or has not paid despite having resources.

Recovery from such accounts are difficult because in many cases the money is siphoned off from the books of the defaulting company and most of them are being fought in courts. Some of the largest cases of wilful default are Kingfisher Airlines, Zoom Developers, Winsome Diamonds and Varun Industries.

Of the 9,025 cases of wilful defaults in PSU banks, lenders have filed cases against 8,423 for recovery of Rs 95,384 crore of NPAs. They have also filed 1,968 police complaints in cases of loan amounts totalling 31,807 crore. In 6,937 accounts, representing an outstanding of Rs 87,458 crore, banks have also initiated proceedings to attach and sell assets under the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act.

Data released by the RBI in response to a Parliament query shows that Vijaya Bank has the highest share of wilful defaulters in its books. The Bengaluru-based banks had NPAs worth Rs 6,649 crore as on September 30, 2017. Of this loans amounting to Rs 3,537 crore were on account of wilful defaults. Punjab National Bank has the highest share of wilful defaults in its books among the larger banks. Of its bad loans worth Rs 57,630 crore, 25% are on account of borrowers who have deliberately defaulted.

The implication for a business or promoter being declared a wilful defaulter is that they will never be able to get bank loans as long as they have the tag. For a lender, declaring a borrower as a wilful defaulter is a complicated process with senior bankers having to give a hearing to the borrower. In several cases, courts have ruled against the labelling of the borrower due to shortcomings in the process.

Among banks with small percentage of wilful defaulters among NPA accounts are Punjab & Sind Bank (4%), Bank of Maharashtra (5%) and Syndicate Bank (5.4%).

As on September 30, 2017, leading corporate houses accounted for approximately 77% of the total gross NPA from domestic operations for banks in India.

How ‘haircuts’ help in dealing with bad loans

July 9, 2018: The Times of India

From: July 9, 2018: The Times of India

As the government looks to reel in the likes of Nirav Modi and Vijay Mallya, who have sought shelter on foreign shores after leaving behind huge outstanding loans in India, a panel has come up with recommendations to help state-run banks achieve faster resolution of their non-performing assets. A look at these bad loans and how deep the problem is...

How are haircuts a solution to the NPA crisis?

One reason private and foreign banks have a lower level of NPAs is they have the flexibility to cut their losses by selling off assets in a bad loan for whatever it is worth. In the case of public sector banks, selling a loan or a company for less than the outstanding loan was not feasible as it would trigger action by Central Vigilance Commission, Central Bureau of Investigation and Comptroller and Auditor General. It is only now that the bankruptcy code provides a framework for selling assets at a discount to the loan amount (taking a haircut).

What caused this pile-up?

Post global financial crisis, RBI and the gover nment relaxed lending nor ms to stimulate the economy and allowed banks to lend more to projects as part of a countercyclical measure. The government also allowed banks to ‘restructure’ project loans that were going into default by giving borrowers more time and more money. Loans of these troubled borrowers were classified as ‘restructured’ and not NPAs.

How much money would banks lose if they took haircuts on NPAs?

Losses reported by banks so far include the part-provisions made on existing NPAs. According to CLSA, the top-32 NPAs facing action under the bankruptcy code account for Rs 4 lakh crore or 45% of total NPAs. CLSA estimates the haircut on these loans are less than 60%. Banks must make provisions for at least half the loan amount in case of bankruptcy.

What is the NPA crisis?

NPAs or non-performing assets are loans for which borrowers are unable to meet repayment obligations. Ideally, these should be within 2% of total assets (loans) for banks. Bad loans beyond this level are difficult to manage as banks work with narrow margins and the interest spread they earn is not enough to make up for the losses from defaults. For public sector banks it has reached crisis level with gross NPAs at 14.6% — almost three times the level of 4.9% for private banks.

Why did NPAs blow out in FY18?

In 2017, the new insolvency law came into effect. It provided a resolution mechanism for bad loans, enabling companies to be sold. Earlier under Securitisation and Reconstruction of Financial Assets and Enforcement of Securities Interest Act, 2002, lenders could sell assets but not businesses as a whole. With a mechanism in place, RBI removed restructuring schemes, asking banks to come clean on bad loans. As a result, provisions rose to Rs 3.2 lakh crore in FY18 from Rs 2 lakh crore in FY17, surpassing operating profits of banks.

What are the haircuts that are talked about?

Under the Bankruptcy Code, borrowers unable to repay their dues face insolvency proceedings in the National Company Law Tribunal. Under the insolvency process, a resolution professional is appointed to invite bids for the bankrupt business. The difference between the best bid and the borrower’s total outstanding dues is the haircut.

NPAs in 2018-19

From: Dec 3, 2019: The Times of India

See graphic:

2018-19: NPAs grew in the housing sector, but remained stable in other sectors.

CVC finds many flaws in sale of bad debt/ 2019

Sidhartha, March 18, 2019: The Times of India

From: Sidhartha, March 18, 2019: The Times of India

Review Points To Several Lapses In Deals, Govt Orders Scrutiny

In high season for sale of bad loans to asset reconstruction companies (ARCs), the Central Vigilance Commission (CVC) has pointed to several irregularities in transactions involving non-performing loan accounts, prompting the government to initiate action against errant executives.

“Instances have come to the notice of the commission, wherein prudence has not been observed, while taking decision on sale of stressed asset to ARCs. Irregularities have been noticed in estimating the value of underlying securities (which) is much higher that the value at which the assets were sold to ARCs, post-sale realisation from assets, management fees and expenses charged by ARCs, etc,” the CVC said after an analysis of 302 cases of over Rs 50 crore from 2014-15 to 2017-18.

In at least 48 cases, assets were sold to ARCs below the realisable value of securities that the borrower had given as security at the time of availing of the loan. In several cases, banks were found to be fixing the reserve price without factoring in the accrued interest, resulting in banks having to take a deeper haircut, the CVC said in its report to the government. It also said that in case of companies that are sold as a “going concern”, the primary value of stocks and equipment were not factored in, while fixing the reserve price.

Similarly, in 55 cases, assets were sold within a year of the date of the account turning into a non-performing asset (NPA), without banks initiating recovery action under the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act.

In all, 22 irregularities and gaps in regulations have been pointed out by the vigilance body, prompting the government to swing into action.

The department of financial services has written to all staterun banks, asking them to analyse all accounts of over Rs 50 crore and initiate action after examining accountability of executives and lodge complaints with law enforcement agencies.

While bankers acknowledged that there may be instances of improper transactions, they said the latest advisory is prompting many lenders to go slow on asset sales — which typically peak at the year-end. Some of the bankers said this may result in several loans, which would have been sold, remaining on their balance sheets.

2019: Stressed assets in India, major economies

From: Dec 8, 2019: The Times of India

See graphic:

2019: Bad loan ratio in India, Brazil, Canada, China, Germany, Italy, Japan, the UK and the USA.

Loans: Education loans

Education loan specialists grow faster

Mayur Shetty|Edu loans attract specialist lenders|Jul 12 2017: The Times of India (Delhi)

Edu loans attract specialist lenders

Mumbai

Pvt Players Positive On Growing Biz

Education loans advanced by banks have grown by a measly 2.7% in FY17--half as much as the average growth rate of all loans.But that's only half the story .Specialist lenders are growing rapidly and private players are looking at this segment. Education loan specialists like HDFC Credila and Avanse have seen growth rates ranging from 40% to 70% in disbursements even as new age lenders like InCred Finance are eyeing the sector. Ajay Bohora, co-founder and CEO of HDFC Credila, says it's clear there is great demand. The shift in government focus to primary schooling has resulted in private in stitutions filling the gap in tertiary education. Secondly , in India and globally , cost of attendance (fees and other expenses) for tertiary education has been rising faster than inflation which is taking it out of reach of the middle class. HDFC Credila has disbursed Rs 1,300 crore of loans in FY17, which is slightly lower than the Rs 1,800 crore increase in the education loan portfolio of banks.

Bankers say they have pulled back from education loans because bad loans are high(7-8%). This is particularly true for the sub-Rs 4 lakh category where banks do not demand any security.

According to a senior PSU bank official, the reasons for the defaults are two-fold. One, engineering and management institutions have mushroomed but the quality of education has not been up to the mark. Two, many students relocate after graduation and their loans turn into NPAs.

“A lot of education loans are probably camouflaged as personal loans or loans against property ,“ said Prashant Bhonsle who heads the education loan vertical at InCred Finance. According to Bhonsle, students are rushed for time and at many banks it is faster to get a personal loan or a loan against property .The downside is that the interest paid cannot be claimed as deduction under Section 80E of the I-T Act. Also, repayment of such loans begins immediately , unlike education loans where there is a repay ment holiday . Also, education loans have tenures ranging from one to 12 years depending on course duration.

According to Rajnish Kumar, MD, State Bank of India, the outlook for education loans has improved with the government introducing a credit guarantee scheme for borrowings up to Rs 7.5 lakh in 2015. “The recovery problems that we faced in the south are now behind us and we will be growing the portfolio,“ said Kumar.

The ground reality is that unsecured education loans are a viable business only in segments where employment is certain. As a result, only those who qualify for top management or engineering institutes can expect to cover fees through bank financing without collateral. For others, a loan above Rs 7 lakh would invariably require property as collateral from parents.

Private lenders are positive as they have the skills and they can be selective.“Appraising a loan application is not easy because there are over 700 universities in India--some, like the University of Pune, have over 600 affiliated colleges, with each having 20-30 courses--and for credit assessment it's important to know the employment opportunities for each course,“ said Bohora.

It is not just finance companies, even lenders like Axis Bank, which was earlier a small player in education loans, has now created a new vertical for this product and is planning to grow. “We have grown 100%, although on a small base, and we see potential in this business,“ said Rajiv Anand, head of retail at Axis Bank. However, the bank is focusing on higher education in premier institutions like IIMs where both employment opportunities and fees are high. “The advantage for us is that we have good banking relationships with several trusts and educational institutions which makes it easier to partner with them for education loans,“ said Anand.

2017: Defaults highest in govt designed education loans

Mayur Shetty, Defaults highest in govt-designed education loans, Aug 30, 2017: The Times of India

The government-designed education loan scheme, which accounted for half of all education loans five years ago, now amounts to only a fifth. The scheme provides for loans up to Rs 4 lakh without collateral.

Banks are withdrawing from this segment, which is seeing the highest level of defaults. A study by TransUnion Cibil shows that defaults in education loans are lowest (below 1%) on big ticket loans of over Rs 15 lakh, which are typically taken for post-graduate MBA programmes in reputed institutes.

TOI had earlier reported how lenders were shifting focus on high-value loans as defaults in the sub-Rs 4 lakh category rose. The reasons cited by banks are now borne out by the data released by Cibil, which shows that the industry has experienced a default ratio of 8.1% on loans below Rs 4 lakh. Incidentally, most of these smaller-ticket education loans were disbursed by public sector banks.

According to Harshala Chandorkar, chief operating officer of TransUnion CIBIL the pattern of defaults raises the question whether the market is lagging in creating new job opportunities for those graduating from category II and III academic institutions.

"While delinquencies may be still better than the overall ratio of non-performing assets of many banks, the defaults are much higher than in other personal loan segments whether it is home loans, consumer durable loans, or even credit card outstanding," she said. Incidentally, the defaults that are now being experienced by banks are in respect of defaults witnessed on loans disbursed a few years earlier as education loans contain a moratorium, giving them time until they start earning to repay the loan.

TransUnion CIBIL research also indicate that since 2012, the number of new education loans disbursed annually has been showing flat to negative growth. The overall amount of loans disbursed has been showing a steady positive growth. This growth is driven by a marked shift towards loans of ticket size over Rs 15 lakh, which currently amount to over half the loan amount disbursed.

2015>’17: Defaults increase 47% on weak job market

Education loan defaults soar 47% on weak job mkt, December 23, 2017: The Times of India

From: Education loan defaults soar 47% on weak job mkt, December 23, 2017: The Times of India

A weak job market and wilful default by even those in well-paying jobs have hit the education loan portfolio of state-run banks with non-performing assets soaring by almost 47% between March 2015 and last March, data shared in Parliament showed.

The finance ministry told the Lok Sabha that NPAs, or bad debt, went up from Rs 3,536 crore at the end of March 2015 to Rs 5,192 crore on March 31, 2017. The surge took place in 2015-16, with the pace slowing down during the last financial year. The problem is so acute for at least five lenders that the stock of bad loans has more than doubled, with UCO Bank and Indian Bank leading the pack. At the same time, the increase in loan flow has also been less than 10% during this two-year period.

‘Absence of guarantees makes it easy to default’

But what is even worse is that there was only 3.4% riseduring 2016-17, on the back of a 5.6% growth in the previous year, indicating that either demand was tepid or banks were reluctant to lend. Bankers, however, said that they had not gone slow on education loans.

They said that defaults were rising as several students had not found good jobs, especially when it came to those who pursuedMBAsor engineering degrees.

However, there are cases where even students from good colleges who were employed by leading companies are refusing to pay.

For instance, an engineer with a global technology giant stop repaying theloan and was tracked down through social media. When confronted, he cleared the dues, said a bank executive. “The problem isthe absence of security and guarantees, which makes it easy todefault,” he added.

The government toldParliament that to reduce the incidence of NPA in education loans, the IBA Model Education Loan Scheme has been modified to factor in the the needs of students. The changesinclude a repayment holiday or a moratorium of course period plus one year, additional moratorium to account for spells of under-employment or unemployment, and extension of the repayment period to 15 years to reduce the equated monthly instalment.

The Centre has also launched a CreditGuaranteeFund Scheme for Education Loans (CGFEL) for loans upto Rs 7.5 lakh to provide guarantee up to75% of thedefault amount.

2018: 9% PSB loans turned bad

9% PSB edu loans turned bad in FY18, January 5, 2019: The Times of India

Nearly 9% of the education loans extended by public sector banks were categorised as NPAs in the last financial year, according to the government.

“According to information provided by the Indian Banks’ Association (IBA), NPAs of PSBs increased from 7.2% as on March 31, 2016 to 8.9% as on March 31, 2018,” minister of state for finance Shiv Pratap Shukla said in a written reply to the Lok Sabha. He was replying to a question whether NPAs in education sector rose to 9% during the two years period (2016-18). As of March 31, 2015, the bad loans in the education sector stood at 5.7%, the minister said.

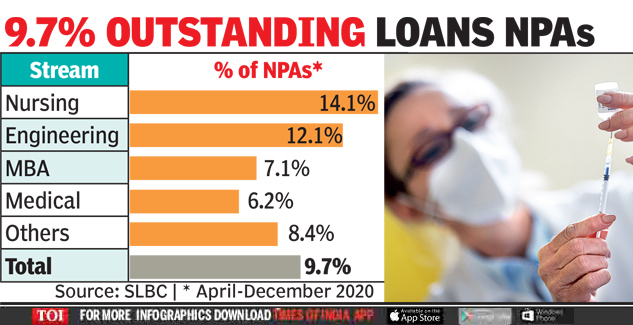

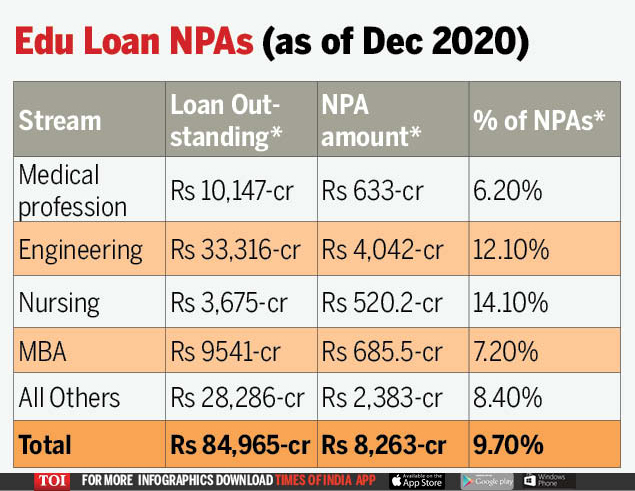

Defaulting categories: 2020

Chethan Kumar, March 22, 2021: The Times of India

From: Chethan Kumar, March 22, 2021: The Times of India

From: Chethan Kumar, March 22, 2021: The Times of India

Education loan NPAs: Nursing, engg students bigger defaulters than those in MBA, medicine

BENGALURU: Nursing and engineering are among the top contributors to education loan bad debt, which was estimated at 9.7% of the outstanding education loans at the end of December, 2020.

According to data compiled from all the state-level bankers’ committees (SLBCs), as of December-end (third quarter of this fiscal), Rs 8,263 crore belonging to more than 3.5 lakh accounts that have availed education loans have been classified as non-performing assets (NPAs) out of the total education loan outstanding of Rs 84,965 crore that more than 23.3 lakh accounts borrowed. Stream-wise data shows that of the Rs 84,965 crore total outstanding amount, loans to medical students is Rs 10,147 crore (11.9%), engineering students is Rs 33,316 crore (39.2%), nursing Rs 3,675 crore (4.3%), MBA Rs 9,541 crore (11.2%) and all other streams together Rs 28,286 crore (33.2%).

NPAs against the outstanding loan amount, nursing tops the list with over 14%, followed by 12.1% in engineering, 7.1% in MBA and 6.2% in medical. Other streams together have 8.4% of the outstanding loans as NPAs. Doraswamy C, former convener of Andhra Pradesh SLBC, says: “Education is a priority lending sector, and beneficiaries must be sincere in returning the money they borrowed. But that does not happen in many cases. From evasion to negligence, there are many reasons for this. Besides, delays in interest subsidies payment by the Centre and other systemic problems also hurt honest re-payers.”

Education expert AS Seetharamu says: “The time needed to find employment for an engineering student is more than that for a medical professional. Nearly 30% of engineering students drop out annually and campus placements have been dipping. In cases of nurses, most leave the country and the banks don't find them. Visas need to be linked to education loans. Domestically, they avail loans in one place but work in another.”

States’ Performance

Further, distribution of education NPAs across the country shows that the eastern and southern regions, led by Bihar and Tamil Nadu, have emerged as the worst performers, while northern and western regions are the best.

Compared to the national average of 9.7% of NPAs, it is 14.2% in the eastern region and 11.9% in the southern region. It is only 3.3% and 3.9% in the northern and western regions, respectively, while it is 6.1% and 6.8% in the central and northeastern regions.

Other Sectors

While all this data is for the first three quarters of this fiscal, data from previous years shows how the education sector is among the top contributors to NPAs after industry and agriculture.

At 21%, 16.7% and 13.6% in fiscals 2018, 2019 and 2020, respectively, the industry sector tops the table, followed by the agriculture sector — 7.8%, 8.9% and 10.3%. Comparatively, the figures for the education sector stand at 8.1%, 8.3% and 7.6% for the said three years.

NPAs in the housing and automobile sectors were under 2% for all years, while it was 2.1%, 2% and 1.5% for the retail sector.

Loans: Home Loans/ Housing loans

Home loan closure checklist

The Times of India, Apr 18 2016

Home loan closure checklist

1 Refer to the `list of documents to submit' when making the application for a loan, and make sure that all the original documents are recovered.

2 Ensure that the documents are complete and received in good condition, in the pre sense of a bank official, before signing the acknowledgement.

3 Take an NOC from the lender, specifying the address of the property against which the loan was taken, name of the borrower and the loan account number.

4 Request the lender to inform CIBIL re garding the closure of the loan account.

The process should take about 30 days from the date of loan closure.

5 Ensure that any lien is removed after the clo sure of the loan. An existing lien will create problems during the sale of the property.

Home loan growth slows, affordable segment rises

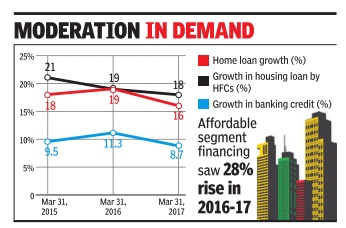

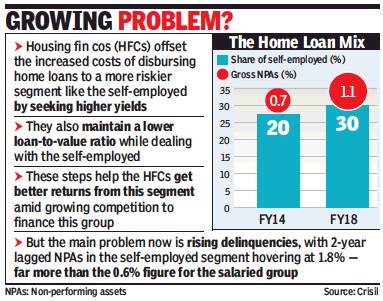

Even as housing credit growth moderated to 16% in 2016-17 as against 19% in 2015-16, the affordable housing segment holds promise, according to rating agency ICRA report.

The report said that lowering of interest rates and various government initiatives -Prime Minister Awas Yojana (PMAY), according infrastructure status, to boost affordable housing will increase the demand for the segment, which may see credit growth of up to 30%. As against an overall growth of 16% in the housing loan sector, total disbursal of credit in the affordable segment grew at 28% to Rs 1.2 lakh crore in 2016-17.

Despite moderation, the 16% credit growth in housing loan sector is still a bright spot in the economy if one sees it in the backdrop of growth in the non-food credit of entire banking sector which is languishing at 8.7% in 2016-17 as against 10.9% in 2015-16.

“While the slowdown was across both HFCs and banks, the decline in the pace of growth of banks was higher declining from 19% in 2015-16 to 16% in 2016-17 -largely because they were operationally tied up in second half of 2016-17 on account of demonetization,“ according to the report. Housing finance companies' (HFCs) loan portfolio also dipped to 18% in 2016-17 from 19% in the previous year.

Growth (of home loans)

2013-18: 2,700%

From: Mayur Shetty, Affordable home finance cos multiply Loan Book Grows 27X In Less Than 5 Years To ₹27,000Cr, June 6, 2018: The Times of India

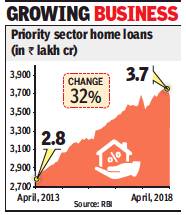

Loans for affordable housing have seen sharp growth in less than five years. Home loans by affordable housing finance companies have grown from Rs 1,000 crore as of March 2013 to Rs 27,000 crore as of December 2017. This has led to an explosion in housing finance companies (HFCs) focusing on the small-ticket segment. As many as 26 HFCs have registered with the National Housing Bank — with self-constructed homes accounting for bulk of the loans.

There are 77 registered HFCs, of which 26 are focused exclusively on affordable housing. According to the ‘State of affordable housing 2018’ report by FSG Consulting, one of the drivers of growth in this segment was the credit-linked subsidy (CLS) under the Pradhan Mantri Awas Yojana (PMAY) that provides an upfront reduction of up to Rs 2.67 lakh for a loan of Rs 6 lakh.

According to FSG MD Ashish Karamchandani, while the PMAY does bring down costs, it has little impact on affordability. Only after a customer has availed a loan, does he know that he will receive a subsidy, and hence he cannot factor it into his purchase decision. “If the subsidies under the credit-linked scheme are based on a sanctioned plan, it will increase the affordability allowing those with lower income to purchase houses,” he said.

Also, the PMAY is not reaching out to all the intended beneficiaries. “Many low-income households are excluded from the credit-linked subsidy benefits because of the location of their new homes. As a bulk of low-income housing is being constructed on the peripheries of around 4,500 urban areas notified for CLS, which come under the purview of gram panchayats, they are not eligible unless notified by state governments,” said Karamchandani. This is a big impediment as 60% of demand for affordable housing finance is for self-constructed properties, and these are largely happening on the outskirts of cities — in areas classified as rural.

There is also a problem in the incentive structure for HFCs. Under present norms, if the loan is below Rs 6 lakh, the HFC cannot charge a processing fee, and gets only a flat fee of Rs 3,000. HFCs are therefore not keen on seeing the home loan amount go down below Rs 6 lakh.

“One solution is to have geospatial coding on all places eligible for subsidy on the map, so as to enable the HFC confirm to the aspiring borrower that he is eligible,” said Karamchandani. Besides, taking a relook at the CLS for urban housing, Karamchandani says that there is a need to relook at the beneficiaryled construction (BLC) scheme, which provides for home improvement to enable upgrading slum housing.

2016-22

From: Dec 3, 2022: The Times of India

See graphic:

Home loan growth in India, 2016- 22

Rates, 2012- 23

From: June 10, 2023: The Times of India

See graphic:

Home loan rates, September 2022- March 2023; QoQ change in rates in Q4, FY12-FY23

Rates, 2014-18

From: Mayur Shetty, Your home loan’s got costlier. SBI, ICICI have upped rates, September 2, 2018: The Times of India

Unlikely To Raise Rates Again: HDFC

Bank borrowings which include home loans and other retail and business loans have become more expensive from September 1. The country’s largest publicsector lender State Bank of India and largest private lender ICICI Bank have increased by 20 and 15 basis points respectively their benchmark rate against which all home loans are priced.