Canada- India economic relations

This is a collection of articles archived for the excellence of their content. |

Contents |

The extent of interdependence

2022

From: Sep 25, 2023: The Times of India

From: Sep 25, 2023: The Times of India

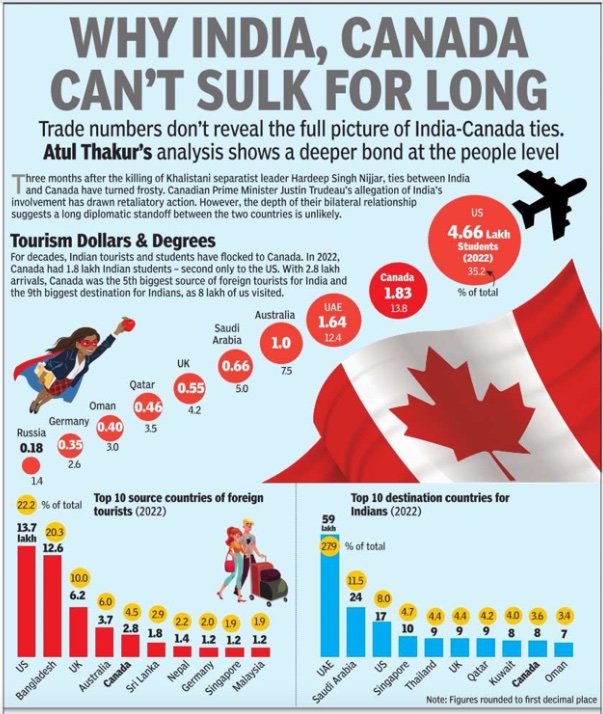

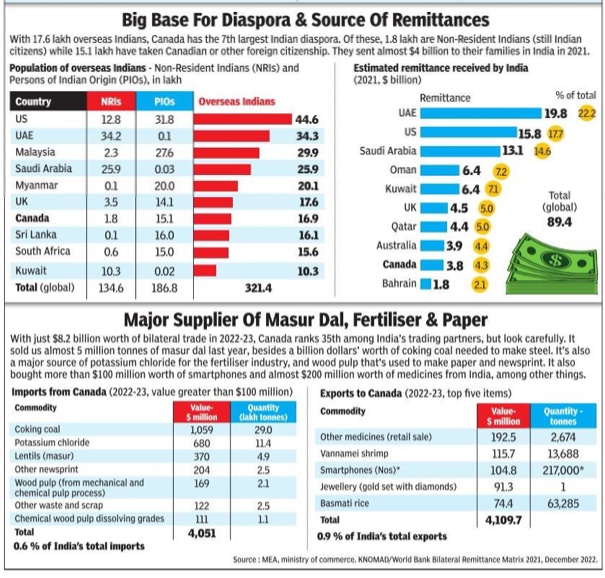

See graphics:

Canada and India: The extent of interdependence, as in 2022- I

Canada and India: The extent of interdependence, as in 2022- II

Business relations

2019 – 2023

From: Sep 20, 2023: The Times of India

See graphic:

Canada – India business relations, 2019 – 2023

Investments, Canada’s

2020-21 to 2022-23

Sukalp Sharma, Sep 22, 2023: The Indian Express

Indian companies in Canada are active in sectors like information technology, software, steel, natural resources, and banking.

While Tim Hortons and McCain Foods might have the biggest brand recall when it comes to Canadian businesses in India, Canadian investments in the country go far beyond coffee chains and frozen snacks. Canadian pension funds, asset management companies, and financial services and insurance players are invested in key sectors of India’s economy, including financial services, financial technology, infrastructure, real estate, information technology and energy, among others.

On the trade front, bilateral trade in goods stood at $8.16 billion in 2022-23, with an almost even split between imports and exports. India’s exports to Canada for the year were $4.11 billion, while imports stood at $4.05 billion.

“More than 600 Canadian companies have a presence in India and over 1,000 Canadian companies are actively pursuing business in the Indian market,” Invest India said. It added that between 2003 and 2019, Mumbai and Bengaluru were among the top 10 destination cities for Canadian outbound investment in Asia Pacific. Canada counts India as a priority market.

The Canada Pension Plan Investment Board (CPPIB) has sizable investments in India across sectors including infrastructure and financial services. It holds stakes in Kotak Mahindra Bank, Indus Towers, Paytm, Zomato, Nykaa, and Delhivery. It also owns US-listed shares of Indian majors like Infosys, Wipro, and ICICI Bank. The CPPIB also has business partnerships with Piramal Enterprises, Shapoorji Pallonji group, and Larsen & Toubro. According to the Invest India website, the CPPIB recently hit $14.8 billion in investments into India.

Caisse de dépôt et placement du Québec (CDPQ) counts India as a strategic market and had invested around $6 billion in India as at the end of 2022, according to its website. Over the past few years, CDPQ has invested in companies like Kotak Mahindra Bank, Edelweiss Group, Piramal Enterprises, TVS Logistics, Azure Power Global, and Apraava Energy. In February 2020, it launched a $300-million private credit platform with a third-party asset manager to invest in India.

Toronto-based alternative asset management major Brookfield Asset Management owns and operates infrastructure and real estate assets that include 47 million square feet of office properties, solar and wind energy assets, a construction business, telecom infrastructure assets, and real estate management services. It also has a real estate investment trust (REIT) in India.

Fairfax India Holdings, an arm of Canadian financial holding company Fairfax Financial Holdings, has investments in various Indian companies across sectors like logistics, financial services, shipping, manufacturing, and infrastructure. It is the largest shareholder of the Bangalore International Airport (BIAL), the operator of Bengaluru’s Kempegowda International Airport.

Other major Canadian investors active in India include the likes of the Ontario Teachers’ Pension Plan (OTPP), the Ontario Municipal Employees Retirement System (OMERS), and the British Columbia Investment Management Corporation.

Then there are Canadian companies that have set shop in India, like Sun Life Financial. It is a joint-venture partner with the Aditya Birla group in Aditya Birla Sun Life Asset Management, a financial services major that offers products and services like insurance, mutual funds, asset management, lending, and housing finance, among others.

Other Canadian businesses in India include auto parts and mobility technology player Magna International, which has 13 manufacturing and assembly facilities in India, and the IBI Group, which designs high rise buildings, industrial buildings, schools, hospitals, and other infrastructure projects for integrated cities. The IBI Group has been involved with a few smart city projects in India.

Indian companies in Canada are active in sectors like information technology, software, steel, natural resources, and banking. Major Indian corporates with significant presence in Canada include the likes of Tata Consultancy Services, Aditya Birla group, Wipro, and Infosys.

Trade, agriculture imports

2020-23

Harish Damodaran , Udit Misra, Sep 22, 2023: The Indian Express

India’s total trade with Canada in the last (2022-23) financial year was $8 billion — that’s 0.7% of India’s total trade ($1.1 trillion) with the world. The share has remained this way at least for the past five years, even though the export and import numbers have gone up and down, especially during the Covid year.

Bilateral trade has also been fairly evenly balanced; in 2022-23, for instance, roughly $4 bn of imports were matched by $4 billion of exports even though India enjoyed a tiny trade surplus of $58 million.

Among what India imports from Canada, three categories of goods dominate and account for 46% (that is, almost half) of the total import by value. These are:

1. Mineral fuels, mineral oils and products of their distillation; bituminous substances; mineral waxes.

2. Pulp of wood or of other fibrous cellulosic material; waste and scrap of paper or paperboard

3. Edible vegetables and certain roots and tubers

The top three exports, on the other hand, accounted for only 30% of the total exports. These were:

1. Pharmaceutical products

2. Articles of iron or steel

3. Nuclear reactors, boilers, machinery and mechanical appliances; parts thereof

The major agri imports from Canada

Canada is important to India as a supplier of two major agri-related commodities.

The first is muriate of potash (MOP), the third most consumed fertiliser in India after urea and di-ammonium phosphate. India’s MOP imports totalled 50.94 lakh tonnes (lt) in 2020-21, 29.06 lt in 2021-22 and 23.59 lt in 2022-23, valued at $1,212.67 million, $990.84 million and $1,405.31 million respectively. Canada’s share in these was 16.12 lt ($383.91 million) in 2020-21, 6.15 lt ($185.13 million) in 2021-22 and 11.43 lt ($680.40 million) in 2022-23. Canada was India’s largest MOP supplier last year, followed by Israel, Jordan, Belarus, Turkmenistan and Russia.

The second major item is masur or red lentil. India is a significant importer of pulses, with masur being the biggest after arhar/tur or pigeon-pea. India’s total masur imports stood at 11.16 lt in 2020-21, 6.67 lt in 2021-22 and 8.58 lt in 2022-23, valued at $622.40 million, $528.74 million and $655.48 million respectively. Canada is India’s largest masur supplier, followed by Australia. Masur imports from Canada stood at 9.09 lt ($505.39 million) in 2020-21, 5.23 lt ($408.89 million) in 2021-22 and 4.85 lt ($370.11 million) in 2022-23.

Dal millers and traders are currently keeping a close watch on the ongoing India-Canada standoff, especially in case of any spillover to masur imports.

Masur has, in recent times, emerged as a substitute for arhar/tur similar to yellow/white peas vis-a-vis chana. In many hotels, restaurants, canteens and even homes, red masur dal is being used in place of yellow arhar, including for making sambar. This makes economic sense, especially when masur dal is now retailing at about Rs 100/kg, as against an average of Rs 160-plus for arhar.

Geopolitical worries apart, there are concerns over even the size of the masur crop in Canada. The 2023 crop now being harvested is pegged at around 15.4 lt, down from last year’s 23 lt. It has already led to landed prices of imported masur climbing to $760-770 per tonne, a jump of $100 in the last one month.

Also, till 2017-18, India used to also be a heavy importer of yellow/white peas, which were a substitute for chana (chickpea). In 2015-16, 2016-17 and 2017-18, India imported 22.45 lt, 31.73 lt and 28.77 lt of yellow/white peas valued at $831.96 million, $1,205.58 million and $921.10 million respectively. Again, Canada was the top supplier at 13.69 lt ($503.20 million) in 2015-16, 17.29 lt ($657.71 million) in 2016-17 and 11.70 lt ($396.14 million) in 2017-18.