Canteen Stores Department

This is a collection of articles archived for the excellence of their content. |

Contents |

Canteens

Profitability, 2014-15

The Times of India, Aug 17, 2016

Neha Tyagi & Sagar Malviya

Army canteens most profitable retail chain in India, ahead of Future & Reliance Retail

HIGHLIGHTS

• Army canteens earned Rs 236 crore during FY14-15, more that Future Retail and Reliance Retail

• Its operating margin is 1%, which it claims on its website is lowest for any retailer in the world

The Canteen Stores Department (CSD), which, incidentally, is a not-for-profit organisation, earned Rs 236 crore during FY14-15, according to a Right to Information query.The Canteen Stores Department (CSD), which, incidentally, is a not-for-profit organisation, earned Rs 236 cror... Read More MUMBAI: Which is the most profitable retail chain in India? Answer: The defence canteen stores. Its earnings exceeded those of all other chains, including Future Retail and Reliance Retail+ . The Canteen Stores Department (CSD), which, incidentally, is a not-for-profit organisation, earned Rs 236 crore during FY14-15, according to a Right to Information query. Comparatively, Avenue Supermart, which runs D'Mart stores, made a profit of Rs 211crore that year, Future Retail made Rs 153 crore and Reliance Retail Rs 159 crore. In terms of sales, too, CSD fared well, with its revenue of Rs 13,709 crore trailing only Future Group and Reliance Retail. The CSD's retail outlets sell 5,300 products ranging from biscuits and beer to shampoos and cars to 12 million consumers — personnel of the army, navy and air force, ex-servicemen and their families. Started in 1948, it is managed by the defence ministry and comprises 3,901unit-run canteens and 34 depots. It has more than 600 suppliers competing to provide a range of products including toiletries and cosmetics, household goods, footwear and accessories, food items, stationery, electronics and consumer durables, liquor and vehicles. "CSD is definitely a critical channel. While we are not as focussed as we should be, there is a lot to be done to increase its contribution to our overall sales," said Krishna Rao, deputy marketing manager at Parle Products. "They expect a higher margin so they can pass on the benefit to the end-consumer." While vendor companies offer slightly better discounts to CSD than to local kiranas, products are still sold at very low prices because the government waives a substantial amount of taxes. CSD's operating margin is 1%, which it claims on its website is lowest for any retailer in the world. For most consumer product and liquor companies, CSD accounts for 5-7% of their total volume sales. It is the biggest customer across South Asia for Hindustan Unilever, the country's largest FMCG company, and United Spirits Ltd. A spokeswoman for USL, India's largest liquor company, said CSD is very important, especially for premium scotch brands such as Johnnie Walker+ and Black Dog. "For any company, a channel as big as CSD is surely their first priority and the company would want to stock its products immediately," Nitish Kapoor, regional director at Reckitt Benckiser South Asia, was quoted as saying in a CSD coffee table book.

Liquor and toiletries

Liquor (26%) and toiletries (23%) account for nearly half of CSD's sales, while auto and white goods contribute 20%. Most companies renegotiated terms of trade after temporary destocking at CSD in 2012 due to internal issues and have now set up dedicated divisions to handle it as a client, similar to modern trade or general trade accounts. Samsonite has almost 180 officials dedicated to CSD. "It is very different in terms of distribution as we have to supply products in far-flung areas compared to demand mostly from civilian consumers in cities. While it is undoubtedly our largest client and as a brand, we take pride in supplying to CSD," said Jai Krishnan, COO at Samsonite South East Asia.

However, experts said e-commerce companies armed with deep discounting are gradually eating into its share. "Markets like Punjab, Uttar Pradesh, Bihar and Jharkhand used to report big army canteen demand, but this has progressively reduced with the emergence of strong ecommerce and retailers, who are selling the entire range and sometimes with promotions," said Videocon Chief Operating Officer CM Singh. For the white-goods segment, defence canteens contributed about 4% three years ago, a share that has halved now. Durable goods makers blame it on the emergence of ecommerce companies, which also offer a wider selection of products than the defence canteens or even big retail chains.

Going online

Namrata Sing, Defence canteen, India's No. 1 retailer, to go online, Aug 16 2017: The Times of India

In Talks With Cos To Launch Latest Products Much Faster

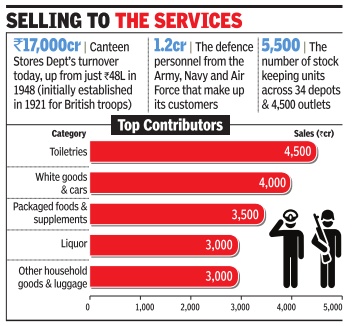

The Canteen Stores Department (CSD) -which supplies goods at concessional rates to defence personnel from the Army , Navy and Air Force -is undergoing a makeover. CSD, which is facing unusual criticism with regard to alleged restrictions being imposed on products, is not only looking at expanding its depots but is also putting in place systems to ensure its 1.2 crore customers get to purchase the latest fast-moving consumer goods (FMCG) off CSD's Unit Retail Canteen (URC) shelves, as do their civilian counterparts from the various modern retailers and kirana stores.

The country's largest retail network, which closed the fiscal year 2016-17 with a turnover of Rs 17,000 crore, is also working with partner companies on a model that would reduce the time lag and inconvenience involved in the purchase of white goods. The objective is to make sure cardholders get the latest range of white goods to choose from, which is not the case today . Spearheading these changes is Air-Vice Marshal M Baladitya, chairman, board of administration and general manager of CSD, who is hopeful of executing these plans by Diwali this year. “We want our customers to get the option of buying a product from our URCs the same day when the product is launched in the market. At present, products are made available with a lag effect, which can even extend to a year. We are working on shortening the time taken to launch new products. So instead of two board meetings in a year, we will now meet six times for faster clearance of new product introductions.We are already in talks with leading FMCG companies like Hindustan Unilever and Procter & Gamble to ensure our customers get to sample their products as soon as they are launched,“ Baladitya told TOI in an exclusive interview.

On white goods, CSD is talking to leading consumer durable makers to smoothen the process. Today , it's a longdrawn process which results in a lag effect.

CSD plans to ensure documents are transmitted online and, once the depot issues an authority letter, the consumer can pick up the white goods from the nearest dealer anywhere in the country . Most white goods companies have dealer outlets across major ci ties and towns, which covers 80% of CSD's customer base.

“We want to make the entire range of white goods brands available online on the CSD website. Customers can choose what they want to buy and make an online payment directly to the white goods company via internet banking. We are talking to all leading consumer durable companies to facilitate the same. Most of them have agreed to come on board,“ said Baladitya.

Between Leh and Port Blair, CSD currently has 34 depots and 4,500 outlets, reaching out to jawans even in the most difficult terrains.CSD is now looking at adding depots in places like Bhubaneswar (Orissa), Danapar (Bihar) and Himachal Pradesh, where none exist.

CSD was first started in 1921 for British troops. From a turnover of Rs 48 lakh in 1948, when India gained independence, to Rs 17,000 crore today, CSD has certainly come a long way . So when CSD was blamed for the volume decline at some of the FMCG companies for the pre-GST June quarter this year, it came as a setback.

Baladitya denied any plan whatsoever to impose restric whatsoever to impose restrictions on products. He said CSD is merely working on belt-tightening measures against misuse of entitlements.

Imported items

2020: ban on imported finished goods

John Sarkar, October 24, 2020: The Times of India

In a major blow to companies ranging from FMCG and liquor to consumer durables and footwear, the government-controlled Canteen Stores Department (CSD), which operates canteens for the defence forces, is set to ban all ‘direct imported’ items.

‘Direct imported’ items would include those that are shipped from other countries in finished form. In the liquor segment, for instance, Scotch brands that are bottled in Scotland will be banned but those that have imported ingredients, but bottled in India, will continue to occupy the shelves.

Out of the 5,500 items sold by the CSD, around 420 are imported, according to the Manohar Parrikar Institute For Defence Studies and Analyses. Among all the countries, China accounts for a bulk of the imported items such as toilet brushes, electric kettles, sandwich toasters, laptops and ladies’ handbags.

The move is part of an effort to support PM Narendra Modi’s Atmanirbhar Bharat Abhiyan that has been launched to promote domestic manufacturing, industry experts said. TOI has reviewed a copy of the order that has instructed army canteens to stop procurement of directly imported items. “We have received the order and are working out the formalities,” a senior official said. “It will take some time to implement.” The hardest hit will be companies that sell premium products such as imported liquor, high-end smartphones and consumer durables. “Imported liquor has very high margins,” said a senior industry executive.

“Out of 10 bottles sold at army canteens, four are usually for people who don’t work in the armed forces such as friends and family. Companies that have a high exposure of imported items at army canteens will be the most affected.” CSD, which is one of the largest retail chains, caters to 12 million customers.

Management issues

2017: `average strength of unit' estimates create shortages

Yeshika Budhwar, Why Army canteens are running dry, September 21, 2017: The Times of India

Personnel, Veterans Slam New System That Ignores `Floating Populations'

Army canteens have been facing a severe stock crunch in the past two months due to a change in the stock procurement system, which has drastically reduced the estimated number of customers. This in turn has led to inconvenience for serving and retired personnel, who said there was no need for the new system. According to Army officials, canteens of the Canteen Stores Department (CSD) earlier would submit estimated stock requirements based on the `authorised strength' of personnel in their area, that is, the exact number of personnel posted in with a unit or Army formation. Under the new system, which became operational from August 1, canteens have to place estimates based on `average strength' of a unit in an area. This does not take into account other personnel who might be in the area during that period. The effect, said officials, is that stock requested, and supplied, has declined considerably , leading to canteens going out of stock very early every month.

“In the past, if 450 personnel were posted in a regiment, then we would register a demand for that number. Now we have to send a request based on the average strength in a month, which is between 200 and 250. The new system doesn't take into account the floating population, that is, personnel in transit from or to elsewhere, due to which we often face shortage of goods,“ said a serving officer in charge of running a unit-run canteen (URC).

Adding to the confusion is the fact that none of the canteens can deny a customer with a `smart card', used for shopping at these establish ments. “Now we do not have enough stock, but we can't turn anyone away if they have a smart card. Since the first priority of a unit or formation is to cater to personnel posted here, veterans and personnel posted elsewhere but present here may not get to buy goods. There are other measures which can be taken to ensure more transparency in canteens, since that appears to be the whole point of this change,“ said the officer.