Chocolates: India

This is a collection of articles archived for the excellence of their content. |

Contents |

Sales

2002-18

From: Rupali Mukherjee & Namrata Singh, Choco biz grows in double-digits again, June 12, 2018: The Times of India

Indians are back to their sweet tooth indulgence. After clocking a negative volume growth in 2015, and a low single-digit growth in the subsequent year, the Indian chocolate confectionery market rebounded to a double-digit volume growth in 2017, according to industry reports. In value terms, the chocolate market — an impulse-driven category — witnessed a steady growth of over 12% since 2016, says a report by Mintel Group, shared exclusively with TOI.

The value growth clocked by the Rs 15,600-crore industry in 2017 was 12.4%. In 2016, the growth level was the same at 12.4%, but higher as compared to 9.7% in 2015. In volumes, however, from a high growth rate of 16.6% in 2014, the category witnessed a de-growth of 1.5% in 2015. It returned to a doubledigit growth of 12.3% in 2017, from 4.8% in 2016.

The report said Ivory Coast and Ghana — which account for 60% of cocoa bean supply — feared the spread of the ebola virus in 2014. This led to a significant increase in prices of cocoa. The slow growth for 2015 is due to increasing inflationary conditions in the country.

Mondelez India director marketing (chocolates) Anil Viswanathan concurred that the reason the category faced a challenge in 2015 was commodity costs. “There was a slowdown in growth in 2015 and the category came back on the growth path in 2016 and 2017. Prices of cocoa were significantly higher. Cocoa prices were at unprecedented levels in that particular year. This led to higher product prices. So 2015 was an exception. Otherwise, chocolates is a consistent growth story,” said Viswanathan.

The report talks about India’s per capita chocolate consumption at about 100gm, with urban centres comprising 35% of the chocolate consumption in the country.

‘Indians paying more for better chocolates’

Mintel Food and Drink director of insight, Marcia Mogelonsky, said, “In general, what is most notable is that while Indian consumers continue their love affair with chocolate, they have become more picky. We see that consumers are willing — and many would rather — pay more for better quality chocolate. The key is that they will pay more and eat less, as well as pay more for a small portion of top quality (and more expensive) chocolate than to get poorer quality chocolate at a lower price.”

The chocolate market in India operates primarily on price and the most popular chocolate products are priced at Rs 5 and Rs 10. Mintel said since companies are unable to increase prices to account for inflation and cost increases, typically pack sizes and aspect ratios are adjusted every 12-18 months to give them a higher realisation per tonne of product sold.

Viswanathan said, “We will continue to grow chocolate category, and even though a large part of growth comes at lower price points of Rs 5-10, we invest across segments.” Mondelez, which is a leader in the chocolate market in India, sees India as “growth engine”.

Globally, it seems no one loves chocolate quite as much as the Brits. Average Brit devoured 8.4 kg of chocolate in 2017, followed by Switzerland, which consumed 8.3 kg, and then Germany at 8.2kg, the research said.

Consumption

2011, 19: per capita

From: August 25, 2021: The Times of India

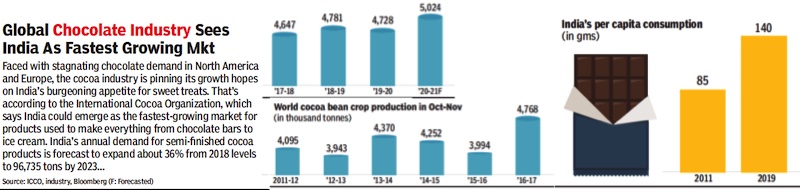

See graphic:

Per capita Consumption of Chocolates in India: 2011, 19

2021: India and the world

From: August 12, 2022: The Times of India

See graphic:

Consumption of Chocolates in India and the world, 2021