Commerce: Indian government data

This article has been sourced from an authoritative, official readers who wish to update or add further details can do so on a ‘Part II’ of this article. |

The source of this article

INDIA 2012

A REFERENCE ANNUAL

Compiled by

RESEARCH, REFERENCE AND TRAINING DIVISION

PUBLICATIONS DIVISION

MINISTRY OF INFORMATION AND BROADCASTING

GOVERNMENT OF INDIA

Commerce: Indian government data

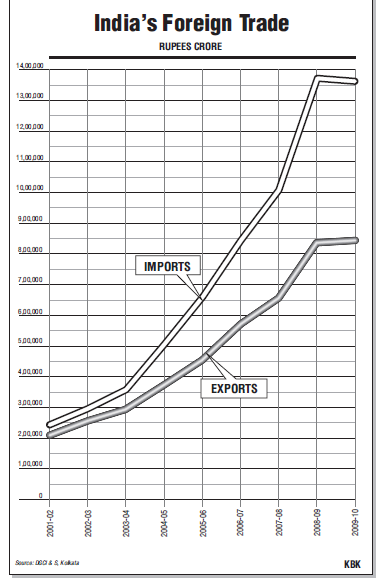

FOREIGN trade sector plays a crucial role in India’s economy growth. The composition and direction of India's foreign trade has undergone substantial changes, particularly, after the liberalization process which began in the early 1990's. Our major exports now includes manufacturing goods such as Engineering Goods, Petroleum Products, Chemicals and allied Products, Gems and Jewellery, Textiles, Electronic Goods, etc. which constitute over 80 per cent of our export basket. On the other hand, major import items constitute capital goods and intermediates which not only support the manufacturing sector but also supplies raw-materials for the export oriented units. Over the years, India's trade with countries of Asia and ASEAN and Africa has gone up substantially. Apart from that, India is now a major player in global trading system and all the major sectors of Indian economy are linked to world outside either directly or indirectly through international trade.

TRADE SCENARIO

In 2010-11, Exports for the year ending March 2011, touched US $ 245.9 billion registering a growth of 37.5%. For the first time the figures have reached the US $ 200 billion mark which was a target set for last financial year. Imports for the same period stood at US $ 350.3 billion and the trade deficit figure has come down to US $ 104.4 billion. Items which registered significant growth are Engineering Goods, petroleum products, drugs and pharmaceuticals, readymade garments, carpet, jute, leather, agricultural exports and allied sectors including tea, coffee, tobacco, spices, cashew, oil meals, fruits and vegetables and marine products.

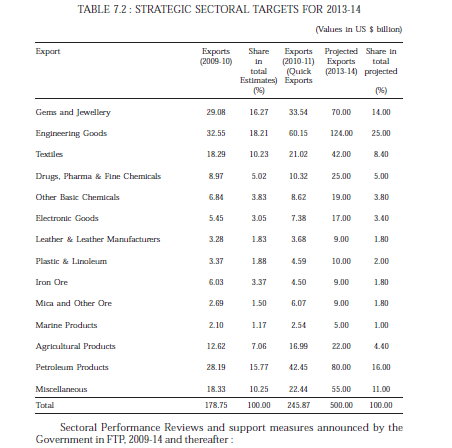

STRATEGY FOR DOUBLING EXPORTS IN NEXT THREE YEARS

The Government came out with this strategy in May 2011. The salient points of this strategy are as under :

The Target: The target is to double the country's merchandise exports in dollar terms over the next three years (2011-12 to 2013-14) from US & 246 billion in 2010- 11 to US $ 500 billion in 2013-14. To realize this, exports have to grow at a compound average growth of 26.7% per annum. The overall strategy to realize this goal is :

Product Strategy

1. Build on our strength in sectors with great growth potential :

l engineering goods

l basic chemical industries and organic and inorganic chemical industries

l pharmaceutical industry (including biotech)

l electronics

2. Promote light manufacturing exports with high value addition :

l leather products and textiles

3. Encourage high employment generating sectors :

l gems and jewellery

l agricultural products

Market Strategy

l Focus on markets in Asia (including ASEAN), Africa and Latin America

l Open up new vistas, both in terms of markets and new products in these new markets

l Retain presence and market share in our "old developed country markets"

l Move up the value chain in providing products in these old developed country markets

Technologies and R&D

Areas and hold out promise for high technology exports :

l Pharmaceuticals

l Electronics

l Automobiles

l Computer and software based smart engineering

l Environmental products; green technology and high-value engineering products.

l High and areas in electronics, aerospace, and engineering products. Building a Brand Image

l thrust for quality up gradation

l expanded certification of export products encouraged, where needed.

l Brand India promotion campaign for key export products.

Essential Support

Essential policy support needed to realize the ambitious export targets for 2013-14 and beyond is :

l Stable policy environment:Continuation of existing incentive schemes

l Preferential access to new markets:Putting in place conducive trading arrangements

l Reduction in transaction coast:Implementation of recommendations of

Task Force

l Substantial step up in overall Plan support

l Priority strengthening of trade related infrastructure.

Sectoral Performance Reviews and support measures announced by the

Government in FTP, 2009-14 and thereafter :

Sectoral Performance reviews

l As promised in Foreign Trade Policy (FTP), to continue regular interaction with stakeholders to maintain a close watch on the performance of the policy in the field, a number of interactions were held with members of Board of Trade, Open Houses with exporters and sectoral reviews with EPCs. Constant dialogues were held with all key stakeholders in industry and the exporting community for sectoral assessment of exports at regular intervals.

l The first review was undertaken in December 2009 and thereafter in February 2010, which demonstrated that some sectors were still facing difficulties. Need-based additional support measures were announced in January 2010 and March 2010 for selected product groups/products.

l Sectoral reviews were continued in the current financial year 2010-11, and the first such review for 2010-11 was undertaken in July 2010. It was observed that despite the measures announced in the FTP and additional support extended in January and March, 2010, some sectors continued to face difficulties. Accordingly, need based additional initiatives were undertaken in the Annual Supplement 2010-11 to FTP 2009-14, announced on 23rd August, 2010.

l Second sectoral performance review was conducted during November- December, 2010. Accordingly, to enhance competitiveness for products which are labour intensive, technology intensive and value added, further export incentives were undertaken on 11th February, 2011.

Support Measures announced

l As an immediate relief, the Government provided a policy environment through a mix of measures including fiscal incentives, institutional changes, procedural rationalization, and efforts for enhanced market access across the world and diversification of export markets. Towards achieving these objectives, several steps were announced in the Policy.

l Trade Policy Measures taken by the Government in 2009-10 and 2010-11 focused on reviving exports and exports related employment. Many measures were undertaken at the time of release of the FTP, 2009-14, announcements made by January/March, 2010 and in the Annual Supplement to FTP released in August, 2010.

l Additional measures were taken on 11.2.2011 to help the exports sector in general and the employment intensive sectors effected by the World recession, in particular. Export incentives were announced for more than 600 products (in respect of their exports with effect from 1/1/2011) in labour intensive and/or technology intensive sectors like agriculture, chemicals, carpets, engineering, electronics and plastics to enhance their competitiveness.

l The report of the Task force on Transaction Cost has been released by the Finance Minister on 8th February, 2011. Action on 23 issues by different Ministries is likely to reduce transaction cost to the tune of Rs. 2,100 crores in perpetuity. Each recommendation is specific and in respect of many recommendations necessary Government orders have already been issued on the day of release of the Report.

MULTILATERAL TRADE ISSUES AND INITIATIVES

The Doha Round of WTO Talk

India supports an open, equitable, predictable, non-discriminatory and rules-based multilateral trading regime and believes that such a regime best serves the needs of developing countries. The World Trade Organisation (WTO) provides a solid and stable framework for global trade relations. The Doha Round of trade negotiations in the World Trade Organisation (WTO) provides a historic opportunity to correct distortions in global trade and to improve and strengthen the rules to enable developing countries to play a greater role in world trade.

The Doha Round has been underway since 2011. The negotiating mandate of the Round as agreed to by all the members of the WTO is contained in the Doha Ministerial Declaration of 14 November 2011; further elaborated and complemented by the General Council Decision of 1 August, 2004 and the Hong Kong Ministerial Declaration of 18 December 2005.

The negotiations cover several areas such as agriculture, market access for non-agricultural products, services, trade-related aspects of intellectual property rights, rules (covering antidumping and subsidies), trade facilitation, etc. These are all part of a single undertaking, i.e. "nothing is agreed until everything is agreed".

After an intensive phase of negotiations during 2007 and 2008, the talks have not made much progress. In July 2008, a mini-Ministerial meeting was convened in Geneva with the objective of finalizing modalities for Agriculture and Non- Agricultural Market Access (NAMA). However, the meeting ended without an agreement on any issue.

Although discussions resumed again in the latter part of 2008, it soon became evident that there were major differences in positions and finally, the talks paused in December 2008. Thereafter, there was little activity in the negotiations until well into 2009.

In September 2009, India sent out a strong signal of support for the Doha Round by taking the initiative to host an informal Ministerial meeting of about 30 WTO Member countries in New Delhi, in order to re-energies the Doha Round. The objective was to remove the impediments coming in the way of multilateral discussions and to provide clear directions to negotiators to re-energise the multilateral process at the WTO.

There was unanimous affirmation of the need to expeditiously conclude the Doha Round, particularly in the then prevailing global economic situation. Ministers collectively re-affirmed that development remained at the heart of the Doha Round. Multilateral discussions resumed in the WTO soon after the New Delhi meeting. However, these discussions did not lead to any breakthrough; in fact there was not even any substantive discussion on the specific issues.

The early months of 2010 also went by without any substantive discussion in Geneva. At a stocktaking exercise of negotiators held in the WTO in March 2010, Members in general expressed a willingness to continue working towards an early conclusion of the Round, based on established principles of multilateral engagement and building upon the progress already made.

Throughout 2009 and 2010, while there was little substantive action in Geneva, the Doha Round featured on the agenda of almost every major international meeting, at which there were strong affirmations of political support for an early conclusion of the Doha Round. At the Seoul Summit of the G-20 in November 2010, leaders committed to directing negotiations to engage in across-the-broad negotiations to promptly bring the Doha Development Round to a successful, ambitious, comprehensive, and balanced conclusion consistent with its mandate and building on the progress already achieved. The message conveyed was that the opportunity afforded by the year 2011 must not be lost.

Following the directions of leaders at the G-20 Seoul Summit, discussions in the WTO took place in accordance with an agreed Work Programme aimed at concluding the Doha Round in 2011. However, the progress was again slow and gaps in positions remained wide.

In order to take the Doha agenda forward, the DG, WTO and Chairpersons of various Negotiating Groups brought out comprehensive reports on 21st April 2011 detailing both the progress made as well as the wide gaps remaining on many WTO issues.

In light of the persistent lack of progress in the talks, from May 2011 onwards, WTO Members have been discussing the possibility of selectively concluding some of the issues covered in the Doha Development Agenda as an 'Early Harvest' package in time for a regular Ministerial Conference of the WTO scheduled to be held in December 2011.

The intention is to focus on developmental issues, particularly issues important for the Least Developed Countries (LDCs), such as Duty-Free market access and the associated rules of origin, LDC waiver on Services, cotton subsidies, etc. In addition, some other issues are also being discussed for inclusion in the package, such as, trade facilitation, export competition issues in agricultural trade, a monitoring mechanism for special and differential provisions for developing countries, fisheries subsidies and environmental goods and services.

In these discussions India has consistently underlined the need for the package to have pronounced development content and a clear focus on issues of core interest to LDCs, including duty free quote free access, reduction in cotton subsidies, Aidfor- ==Trade and related issues==. Turning to the content of the Doha Round negotiations, the main negotiating issues and the key elements from India's perspective in the Round are summarized in the subsequent paragraphs.

Agriculture continues to be a means of livelihood for large sections of the population in India. India's priority in the Agriculture negotiations has been to safeguard the interests of low income and resource poor agricultural producers, in terms of their food and livelihood security and rural development needs. A substantial and effective reduction in trade-distorting domestic support, the elimination of all forms of agricultural export subsidies and improvements in the transparency and predictability of agricultural trade would be important achievements of this Round.

Further, it is important for India and other developing countries to be able to protect the interests of their nascent and vulnerable industries, including micro, small and medium enterprises, employment intensive sectors, industries employing socially and economically vulnerable sections such as women, traditional artisans and fishermen, as well as industries in the rural, semi urban, economically disadvantaged and geographically inaccessible regions of the country. Another important area being discussed in the Doha Round is services trade.

The high growth rate achieved by the Indian economy over the last decade or so owes much to the growth of the services sector in the country. The services sector contributes around 60% to the GDP of the country, 35% to employment, 25% to total trade, around 40% to exports, 20% to imports and accounts for more than 50% of FDI into the country. As per the RBI's Balance of Payments data, India's services exports grew from US $ 17 billion in 2001-02 to US $ 102 billion in 2008-09.

The Doha Round negotiations also aim to clarify and improve the Antidumping Agreement and the Agreement on Subsidies and Countervailing Measures (ASCM), while preserving the basic concepts, principles and effectiveness of these Agreements. New disciplines for fisheries subsidies, prohibition of certain forms of fisheries subsidies that contribute to overcapacity and over-fishing and appropriate and effective special and differential treatment for developing and least-developed Members are some of the issues being discussed in the Round.

India places great importance on the simplification, rationalization, harmonisation and modernization of trade procedures to mitigate risk of major bottlenecks along transport chains and at national frontiers, with a view to promoting cross-border trade, reducing trading costs and bringing greater predictability to traders. The negotiations in this area aim to clarify and improve relevant aspects of the General Agreement on Tariffs and Trade 1994; enhance technical assistance and support for capacity building in this area; and to formulate provisions for effective cooperation between Customs or any other appropriate authorities. India has been actively participating in the trade facilitation negotiations towards a balanced, effective and development oriented outcome.

INDIA'S INITIATIVES FOR DEVELOPING COUNTRIES

India became the first developing country to extend Duty Free Quota Free (DFQF) access in all LDCs in line with the WTO's Hong Kong Ministerial mandate. India's Duty Free Tariff Preference (DFTP) Scheme for LDCs came into effect in April 2008 with tariff reductions spread over five years. This Scheme covers about 92.5 per cent of global exports of all LDCs and provides duty free and preferential tariff access on 94 per cent of India's tariff lines. 27 countries (19 of which are from Africa) are already availing of the market access and the rest are in the process of completing their documentation for joining the scheme.

India's Aid-for-Trade (AFT) efforts are aimed at helping developing countries, particularly least-developed countries, to develop the trade-related skills and infrastructure that is needed to implement and benefit from WTO agreements and to expand their trade. India has been actively involved with this initiative. India is contributing to AfT through its Indian Technical and Economic Cooperation (ITEC)

Programme under the Ministry of External Affairs

The implementation of various capacity-building programmes is in full swing such as enhancement of ITAEC scholarships, training for mid to senior level WTO negotiators from all LDCs, and training for those countries which are in the process of acceding to the WTO. Such capacity building training programmes are organized by the Centre for WTO Studies, New Delhi, from to time.

India has recently conceptualized a programme for focused training/other assistance, under Aid for Trade, for four LDCs, namely Malawi, Lesotho, Zambia and Ethiopia in Africa. A process of need assessment and project formation is underway.

=FREE TRADE AGREEMENTS (FTAS) PREFERENTIAL TRADE AGREEMENTS (PTAS) ==

India's continued growth needs both an expanding domestic market as well as access to raw materials and large markets of the world. Recognizing that Regional Trade Agreements (RTAs) materials and large markets of the world. Recognizing that Regional Trade Agreements (RTAs) would continue to feature permanently in world trade. India got engaged with its trading partners/blocks with the intention of expanding its export market since early part of this decade and began concluding. In principle agreements to move, in some cases, towards Comprehensive Economic Cooperation Agreements (CECA) which covers FTA in goods (i.e. having a zero customs duty regime within a fixed time frame on items covering substantial trade and a relatively small negative list of sensitive items on which no or limited duty concessions are available), services, investment and identified areas of economic cooperation.

So far, India has concluded 10 Free Trade Agreements (FTAs), 5 limited scope Professionals Trade Agreements (PTAs) and is in the process of negotiating/ expanding 17 more Agreements. India's important trade engagements are briefly listed in this section. India Japan CEPA came into force from August 1, 2011.

PTAs ALREADY SIGNED

S. Name of the Agreement Date of Signing of Date of

No. the Agreement Implement of the Agreement

1. Asia Pacific Trade Agreement (APTA) July, 1975 (revised 1st November, 1976 (Bangladesh, China India, Republic Agreement signed on of Korea, Sri Lanka) 2nd November, 2005

2. Global System of Trade Preferences (GSTP) April, 1988 April, 1989 (Algeria, Argentina, Bangladesh, Benin, Bolivia, Brazil, Cameroon, Chile, Colombia, Cuba, Democratic People's Republic of Korea, Ecuador, Egypt, Ghana, Guinea, Guyana, India, Indonesia, Iran, Iraq, Libya, Malaysia, Mexico, Morocco, Mozambique, Myanmar, Nicaragua, Nigeria, Pakistan, Peru, Philippines, Republic of Korea, Fomania, Singapore, Sri Lanka, Sudan, Thiland, Trinidad and Tobago, Tunisia, Tanzania, Venezuela, Vietnam, Yogoslavia, Zimbabwe)

3. India-Afghanistan 6thMarch, 2003 May, 2003

4. India-MERCOSUR 25th January, 2004 June 1, 2009 5. India-Chile 8tj March, 2006 September, 2007

FTAs/PTAs UNDER NEGOTIATION

(as in 2012)

S. No. Name of the Agreement Status

1. India-EUBTIA (Austria, Belgium, Bulgaria, Cyprus, Czech Republic, Denmark, Estonia Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, United Kingdom)

Negotiations launched on 28th June 2007 in the areas of Goods, Services, Investment, Sanitary and Phyto-sanitary Measures, Technical Barriers to Trade, Trade Facilitation and Customs Cooperation, Competition, IPR & GIs, etc.

The thirteen rounds of negotiations have been held till date. 13th round was held during 30th March-6th April, 2011 in New Delhi.

2. India-ASEAN CECA-Services and Investment Agreement (Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand and Vietnam) Negotiations on Trade in Services and Investment are under way.

9 meetings of Negotiating Groups have been held so far

3. India-Sri Lanka CEPA FTA in goods implemented from March 2000 Negotiations on Investments and Services are underway.

4. India-Thailand CECA Early Harvest Scheme on 82 items implemented. 20 Meetings of the Trade Negotiations Committee (TNC) hav ebeen held so far. 20th TNBC meeting was ehld in April 28-30, 2011.

5. India-Mauritius CECPA The last round (tenth) was held on October, 2006

6. India EFTA BTIA (Iceland, Norway, Liechtenstein and Switzerland)

8 rounds of negotiations have been held so far, 8th round was held in June, 2011 in Delhi.

7. India-New Zealand FTA/CECA The anaugural round of FTA/CECA negotiation was held in April, 2010 in New Delhi. So far four rounds of negotiations have been held. The fourth round was held during 7-11 March, 2011 in New Delhi.

8. India-Isreal FTA Two rounds of FTA/CECA negotiation was ehld in April, 2010 in New Delhi. So far four roudns of negotiations have been held. The fourth round was held during 7-11 March, 2011 in New Delhi.

9. India-Singapore CECA Second review of India-Singapore CECA was launched in May, 2010. Three rounds of reivew metings have been held so far.

10. India-SACU PTA (South Africa, Botswana, Lesotho, Swaziland and Namibia) Five rounds of negotiations have been held so far 5th round was held in OCt 2010

11. India-Mercosur PTA (Argentina, Brazil, Paraguay and Uruguay)

The PTA is being expanded by wodening product coverage and deepening preferences. Second meeting of Joint Administrative Committee on India-Mercosur PTA took place in June 2010.

12. India-Chile PTA The PTA is being expanded by widening product coverage and deepening preferences. Three meetings for expansion of the India-Chile PTA have taken palce so far. The 3rd meeting was held in 30 June-1 July, 2011 in Chile.

13. BIMSTEC CECA (Bangladesh, India, Myanmar, Sri Lanka, Thailand, Bhutan and Nepal)

19 meetings of the Trade Negotiation Committee (TNC) have taken place. 19th meeting was held in Bangkok from 21 to 23, February 2011. Texts of the agreements on trade in goods, rules of Origin, customs cooperation and trade facilitation have been finalized. Negotiations on the agreements on service and investments are continuing.

14. India-Gulf Cooperation Council (GCC) Framework Agreement (Saudi Arabia, Oman, Kuwait, Bahrain, Qaar and Yemen). Two rounds of negotiations have been held so far. The 2th round was held in September 9-10, 2008

15. India-Canada FTA Inaugural round of negotiation was held in November, 2010. Second round was held in July, 2011.

16. India-Indoneais Comprehensive Economic Cooperation Agreement (CECA) Commencement of negotiation on Indonesia- India CECA was announced on 25th January 2011 during the visit of Indonesian President to NEw Delhi. The inaugural round of negotiations is yet to be held.

17. India-Austraila 17th TERC on 20th April, 2011has approved the constitution of a Trade Negotiating Committee (TNC) and launching of negotiations for India- FTA with Australia. The inaugural round of negotiations is yet to be held.

INDIA-EU BTIA NEGOTIATIONS

The European Union comprises of 27 Member states. The European Commission is the administrative body for the European Union having the competence to negotiate trade and investment agreements.

l Chronology of Events in the India-EU negotiations for a Broad-Based

Bilateral Trade and Investment Agreement.

The chronology of the events related to the India-EU negotiations for a Broad- Based Bilateral Trade and Investment Agreement is :

September, 2005:The 6th India-EU Summit held in New Delhi decided to establish a High-Level Trade Group (HLTG) to explore ways and means to widen and broaden the economic relationship and explore possibility of a trade and investment agreement.

October, 2006:The HLTG presented its report to the 7th India-EU Summit at Helsinki. The Summit decided that the two sides should enter into negotiations for the trade and investment agreement.

April, 2007:the Summit recommended commencement of negotiations in October, 2006, but the EC was not in a position to commence the negotiations as it needed an authorization from the Council of the EU. This authorization was granted in April, 2007.

June, 2007:Negotiations commenced in June 2007.

Thirteen rounds of negotiations have been held so far, alternately in Brussels and New Delhi. This 13th Round of negotiations was held from 30th March to 6th April 2011 in New Delhi. A meeting of the Commerce Secretary & EU's DG Trade was held on 3rd June, 2011 at London. A meeting was also held on 13th and 14th June 2011 at Delhi between the Chief Negotiators and experts of both India and EU. Sector-specific intercessional. Digital Video Conferences (DVCs) have also been held frequently on a regular basis between the two sides.

Both sides have intensified negotiations with a view to closing negotiations in 2011.

AREAS COVERED IN THE NEGOTIATIONS

These negotiations cover Trade in Goods, Sanitary & Photo-sanitary Measures and Technical Barriers to Trade, Trade in Services, Investment, Intellectual Property Rights and Geographical Indications. Competition Policy, Customs and Trade Facilitation, Trade Defence, Dispute Settlement, Government Procurement and Sustainable Development.

Negotiations are being carried out as per mandate received from TERC (Trade & Economic Relations Committee).

TRADE WITH COUNTRIES IN SUB-SAHARAN AFRICA (SSA) REGION

Since independence India has had cordial and friendly trade relations with countries in Sub-Saharan Africa (SSA) Region, consisting of Eastern, Western, Central and Southern Africa. India's trade with SSA Region since 2006-07 is given in the table below :

Total trade with countries in SSA Region during 2009-10 amounted to US $

31022.10 million with exports amounting to US $ 10307.79 million and imports at

US $ 20715.10 million. The total provisional trade during April-December, 2010 has

been US $ 29849.61 million with exports at US $ 11438.80 million and imports

amounting to US $ 18410.81 million. The corresponding figures during April-

December 2009 were US $ 22340.97 million (total trade), US $ 7678.88 million

(exports) and US $ 14662.09 million (imports) respectively.

=PREFERENTIAL TRADE AGREEMENT (PTA) WITH SOUTHERN AFRICA CUSTOMS UNION (SACU)=

The Southern African Customs Union (SACU), the oldest Custom Union of the world, comprises of South Africa, Lesotho, Swaziland, Botswana and Namibia. India and SACU have expressed their intent to enter into a Preferential Trade Agreement (PTA) with the aim of promoting expansion of trade between the two parties and providing mechanism to negotiate and conclude a comprehensive Free Trade Agreement within a reasonable time. India and SACU have commenced negotiations for PTA in October, 2007 and five meetings of the negotiating teams have taken place so far. Fifth round of negotiations on India-SACU PTA was held in New Delhi on 7-8, October, 2010.

FOCUS AFRICA PROGRAMME

The "Focus Africa" Programme was initially launched with focus on seven countries of Sub-Saharan African (SSA) Region, viz., South Africa, Nigeria, Mauritius, Tanzania, Kenya, Ghana and Ethiopia. With a view to further widen and deepen India's trade with Africa, the scope of this programme was further extended to include Angola. Botswana, Ivory-Coast, Madagascar, Mozambique, Senegal, Seychelles, Uganda, Zambia, Namibia and Zimbabwe, along-with the six countries of North Africa, viz., Egypt, Libya, Tunisia, Sudan, Morocco and Algeria. Under this Programme, the Government extends assistance to exporters and Export Promotion Councils etc. to visit countries in Africa and organize trade fairs and also sponsors African trade delegations to visit India. A number of export promotion activities were conducted by various Export Promotion Councils and Apex Chambers with grant under MDA and MAI Scheme. A mega event. 'The India Show' was held in South Africa from 29th August, 2010 to 1st September, 2010. Another major event, 'Namaskar Africa', organized during 14 to 15th October, 2010 at Nairobi, Kenya, was inaugurated by Sh. Anand Sharma, Commerce and Industry Minister of India.

BILATERAL COOPERATION

The Doha Round of trade and economic cooperation between India and African countries are reviewed through Joint Commissions and Joint Trade Committees (JTCs). Business to Business interactions have also been encouraged between Apex Indian Chambers and their African counterpart Chambers with a view to further enhance trade & investment relations between India and African Countries. The 6th meeting of the India-Kenya Joint Trade Committee (JTC) was held in Nairobi on 12-13 October, 2010. During the meting, both sides agreed to make all possible efforts to achieve a target of bilateral trade of US $ 2.5 billion in the next 3 years, up from the bilateral trade of US $ 1.5 billion in 2009-10. The key sectors identified for bilateral cooperation were agriculture including agro-processing; drugs and pharmaceuticals; infrastructure development sectors like road, rail, and energy including generation, transmission and distribution of power, airport; Information and Communication Technology (ICT); oil & gas; manufacturing; and healthcare. The 2nd Meeting of India-Ghana Joint Trade Committee held on 20-21st January, 2011 at New Delhi. Both countries reviewed the developments in their bilateral trade and noted that the volume of bilateral trade has grown from US $ 279 million to US $ 537 million in 2009-10. Both the sides agreed that they would strive to achieve a bilateral trade target of US $ 1 billion by 2013.

INDIA-AFRICA TRADE MINISTERS' MEETING

Prior to the 2nd Africa-India Forum Summit held in Addis Ababa, Ethiopia on 24-25 May, 2011, the 'India-Africa Trade Ministers' Meeting was held at Addis Ababa, Ethiopia on 21st May, 2011. From the African side, the 'Trade and Industry Ministers' of Equatorial Guinea, Ethiopia, Namibia, Senegal, South Africa and Swaziland and representatives of many other African countries and the 'Regional Economic Communities' (RECs) attended the meeting.

Pursuant to the 'India-Africa Trade Minister Meet', a 'Joint Statement of India- Africa Trade Ministers' was issued. The Indian and African Ministers expressed confidence that the bilateral trade between Africa and India will reach US $ 70 bullion by 2015. The Ministers agreed on having an 'India-Africa Trade Ministers' Dialogue' as an annual event. They further agreed that effective implementation of the trade-related initiatives taken by the Indian Government in Africa, such as the 'Duty Free Tariff Preference Scheme', Cluster Development Studies, and various Capacity Building and Technical Assistance Programmes will contribute to the strengthening of the Trade relationship between Africa and India. The Ministers agreed that they were committed to the core principles of Special and Differential (S&D) Treatment and obtaining more preferential treatment for all LDCs in the WTO Doha negotiations.

SECOND AFRICA-INDIA FORUM SUMMIT

The 2nd Africa-India Forum Summit was held at Addis, Ethiopia from 24-25 May, 2011. The Summit was attended by the Heads of State representing the continent of Africa, the representatives of the African Union (AU) and its institutions and the Prime Minister of Republic of India.

The 'Addis Ababa Declaration' issued at the 2nd Africa-India Forum Summit took note with satisfaction the meeting of the Trade Ministers from African countries and India in Addis Ababa and took note of the Joint Statement issued by the Trade Ministers and lent its support to the ideas enunciated therein as indicators of our future corporation.

Prior to the Summit, and as one of the concurrent events organized as part of the Summit, 'India Show' was held in Addis Ababa, Ethiopia. The theme of the 'India Show', held from 20th to 22nd May, 2011 was "Africa & India: Partners in Progress-Friends Forever".

SPECIAL ECONOMIC ZONES (SEZs)

India was one of the first in Asia to recognized the effectiveness of the Export Processing Zone (EPZ) model in promoting exports, with Asia's first EPZ set up in Kandla in 1965. Seven more zones were set up thereafter. However, the zones were not able to emerge as effective instruments for export promotion on account of the multiplicity of controls and clearances, the absence of world-class infrastructure, and an unstable fiscal regime. While correcting the shortcomings of the EPZ model, some new features were incorporated in the Special Economic Zones (SEZs) Policy announced in April 2000. This policy intended to make SEZs an engine for economic growth supported by quality infrastructure complemented by an attractive fiscal packaged, both at the Centre and the State level, with the minimum possible regulations. All the 8 Export Processing Zones (EPZs) located at Kandla and Surat (Gujarat), Santa Cruz (Maharashtra), Cochin (Kerala), Chennai (Tamil Nadu), Visakhapatnam (Andhra Pradesh), Falta (West Bengal) and Noida (Uttar Pradesh) have been converted into Special Economic Zones.

In order to impart stability to SEZ regime and to achieve generation of greater economic activity and employment through the establishment of SEZs, Special Economic Zone Act, 2005 has been enacted in February 2006 supported by SEZ Rules, 2006.

The main objectives of the SEZ Act are :

(a) generation of additional economic activity

(b) promoting of exports of goods and services

(c) promotion of investment from domestic and foreign sources

(d) creation of employment opportunities

(e) development of infrastructure facilities.

In short span of about five years since SEZs Act and Rules were notified in February, 2006, formal approvals have been granted for setting up of 584 SEZs out of which 381 have been notified. Out of the total employment provided to 6,76,608 persons in SEZs as a whole 5,41,904 persons is incremental employment generated after February, 2006 when the SEZ Act has come into force. This is apart from million of man days of employment created by the developer for infrastructure activities. Physical exports from the SEZs has increased from Rs. 2,20,711.39 crore in 2009-10 to Rs. 3,15,867.85 crore in 2010-11, registering a growth of 43.11%. There has been overall growth of export of 2180% over past eight years (2003-04 to 2010-11). The total investment in SEZs till 31st March, 2011 is Rs. 2,02,809.54 crore approximately, including Rs. 1,98,774.03 crore in the newly notified zones. 100% FDI is allowed in SEZs through automatic route.

A total of 133 SEZs are making exports. Out of this 76 are IT/ITES, 17 Multi product and 40 other sector specific SEZs. The total number of units in these SEZs is 3,290. A copy of the fact sheet in SEZ is enclosed.

IMPACT OF THE SCHEME

The overwhelming response to the SEZ scheme is evident from the flow of investment and creation of additional employment in the country. The SEZ scheme has generated tremendous response amongst the investors, both in India and abroad. In addition to earning of foreign exchange and development of infrastructure, SEZs have also created a significant local area impact in terms of direct as well as indirect employment, emergence of new activities, changes in consumption pattern and social life, human development facilities such as education, healthcare etc. \==STEPS TAKEN TO SPEED UP IMPLEMENTATION OF SEZ PRODUCTS== The SEZ Act, 2005, provides for setting up of Single Window Clearance Mechanism for speedy implementation of SEZ Products. Accordingly, the State Governments are also requested time and again to finanalize their SEZ Act to provide hassle free environment to the investors. SEZ rules and procedures are reviewed from time to time to facilitate the speedy implementation of SEZ projects. Comprehensive guidelines have bene issued regarding energy conversation in SEZs. These guidelines provide for optimization of use of energy, power utilization, water efficiency, waste management, site preservation and restoration, IT infrastructure etc.

MMTC LIMITED

MMTC Limited is India's largest trading company with a present annual business turnover of about US$ 15 billion. It is the largest exporter of Minerals and Areas from India, leading exporter/importer of Agro commodities, single largest importer/ supplier of Bullion, a major player in the coal and Hydrocarbons and Non-Ferrous Metals imports by the country and one of the India's largest buyers of Finished Fertilizers and Fertilizer Raw Materials. The Company commands extensive market coverage in over 65 countries in Asia, Europe, Africa, Oceania and America etc. The domestic network of MMTC in India spread across in number of officers, warehouses and retail outlets.

MMTS currently holding the No. 1 rank amongst Trading Companies in India, has in 2000-10 further improved upon its already impressive performance by achieving record level top line consecutively in the seventh year by registering its highest ever turnover of 68,687 crores. This best ever business turnover, since its inception in 1963 includes exports of 3,672 crores highest ever imports of 63,152 crores and domestic trade of 1,862 crores. MMTCD earned net profit after tax of 113 crores during 2010-11.

As a strategy to diversify and add value to its trading operations, MMTS had earlier set up Neelachal Ispat Nigam Ltd. (NINL)—an Iron and Steel Plant of 1.1 million tonnes per annum capacity and 0.8 million tonne Coke Ovens and by product unit with captive power plants, jointly with the Government of Orissa at a total capital outlay of nearly 2000 crores. The construction of Phase II of the project with an estimated cost of 1,855 crores is under progress.

MMTC has opened a new foreign office in Johanesburg, South Africa in January, 2011 to promote business in precious metals, semi precious stones, coal etc. MMTC has entered into clean power sector that is environment and eco-friendly by setting up and operating a 15 MW Wind Power farm in Karnataka since 2007.

State Trading Corporation of India (STC) LTD

The State Trading Corporation of India Ltd. (STC) is a premier International trading company of the Government of India with over five decades of experience in undertaking exports, imports and domestic marketing operations.

STC has an equity of Rs. 60 crore, of which, about 91% is held by the Govt. of India and the balance 9% by Financial Institutions/Mutual Funds/Public. The Corporation has manpower strength of about 860. The Corporation owns tank farms, godowns and warehousing capacities at various locations in India.

Traditionally, STC had been undertaking export/import of agricultural commodities. Over the past decade, it has diversified into many non-agricultural items such as exports of steel raw materials, iron ore, gold jewellery and imports of bullion, hydrocarbons, minerals, metals fertilisers, petro-chemicals, etc. During 2010-11, STC achieved a turnover of the order of Rs 20,000 crore. In fact, the turnover of the Corporation has grown by a compounded average growth rate of more than 34$ over the past decade.

See also

Commerce: Indian government data