Consumers: India

This is a collection of articles archived for the excellence of their content. Readers will be able to edit existing articles and post new articles directly |

Contents |

Consumers

Country Of Consumers

Indians are already spending big. But the next 20 years will see them spending bigger. A new upwardly mobile middle class will be responsible for reshaping global consumer markets, says a new study by McKinsey Global Institute

That India is passing through exciting times is a known fact. What is not known is that major unprecedented changes are underway, especially for India’s growing middle class. The economic growth will reshape the lifestyles of Indian families and within two decades, India will be a nation of upwardly mobile middle class, says a new study by McKinsey Global Institute (MGI). The study, as reported by Diana Farrell and Eric Beinhocker in Newsweek magazine, predicts that India will surpass Germany as the world’s fifth largest consumer market.

As the huge middle class moves up the ladder, there are bound to be changes at other levels of society. The poor, those who earn less than Rs 90,000 a year and include subsistence farmers and unskilled labourers, move up into a class called the aspirers. This group comprises mainly of small shopkeepers, farmers with their own modest landholdings and semiskilled industrial workers, and the income level ranges between Rs 90,000-200,000. The group is expected to shrink from 41% of the population to 36%.

The new middle class will be made up of two groups, who have been classified as seekers (earning between Rs 200,000-500,000) and strivers (Rs 500,000-1 million). Right now the middle class is about 50 million people but by 2025, the numbers would expand dramatically to 583 million people. Their incomes will increase to Rs 51.5 trillion — 11 times the level of today and 58% of total Indian income.

The global Indians (those earning more than Rs 1 million ) will be the other major spending force of the emerging consumer market. At present there are only 1.2 million global Indian households who have a spending capacity of some Rs 2 trillion. This segment will balloon into 9.5 million people with a spending power of Rs 14.1 trillion.

Equally significant will be the change in spending patterns. From spending a chunk of their income on necessities, the new middle class will spend on high-end commodities, eating out and travelling. Households that can afford discretionary consumption will grow from the present eight million to 94 million by 2025. Already the trend can be seen among the global Indians and even the existing middle class. Conscious of brands, opting for packaged foods, regular users of credit cards — young Indians are shifting from necessities to choice-based shopping. The study predicts a rise of 12% in spending on cars.

Like China, India’s market will be based more on volume than on per capita spending. While luxury-goods makers may be able to sell to India’s global consumers with little modification to their products, those selling to India’s new middle class will need to be innovative to square the difference between the rising aspirations of consumers and their stillmodest pocketbooks.

The rise in consumerism will be further helped by people becoming ‘connected’ via mobile phones, the internet and TVs, and as advertising becomes a more prominent part of people’s lives. Before India embarked on its programme of economic reforms, the country had only 0.8 fixed telephones per 100 people, and virtually no mobile phones. While fixedline penetration has almost tripled to 2.2 per 100 people, the real growth story has been in mobile, which has exploded and is expected to reach 211 million subscribers by the year-end. India’s mobile market is currently growing even faster than China’s, and the overall communications spending is expected to continue growing at a very rapid 13.4% per year over the next two decades. Other fast-growing categories will include transport, education and health care. It is a testimony to the determination of Indians to work for a more prosperous future that the highest priorities will be these “economically enabling” areas of spending that boost productivity and economic growth. Indians will spend more of their disposable income on these categories than consumers in just about any other country. But the boost in private health-care spending, which is expected to double from 7% of all consumer spending today to 13% in 2025 also shows the weak underbelly of the nation’s growth story.

The signs of the changing times are already around us. It’s just a matter of time before the change becomes evident. Only this time around we won’t be taken by surprise. THE NEW EMERGING CLASSES

Deprived

Earn: Rs 90,000/year They Are: Subsistence farmer/unskilled labourers

Aspirers

Earn: Rs 90,000-200,000 They Are: Small shopkeepers, farmers, semi-skilled industrial and service workers

Seekers

Earn: Rs 200,000-500,000 They Are: Young college graduates, mid-level government officials, traders

Strivers

Earn: Rs 500,000-1 million They Are: Senior government officials, managers of large businesses, professionals and rich farmers

Global Indians

Earn: Over Rs 1 million They Are: Senior corporate executives, large business owners, politicians, high-end professionals and big agricultural land o

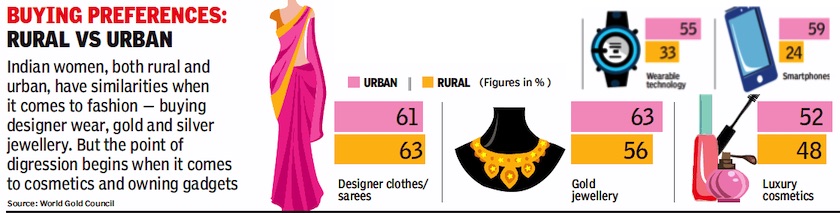

Rural vs. urban

Women’s preferences, 2019?

From: June 5, 2020: The Times of India

See graphic:

Rural and urban women’s fashion preferences, presumably as in 2019.