Corporate Affairs: India

This article has been sourced from an authoritative, official readers who wish to update or add further details can do so on a ‘Part II’ of this article. |

Contents

|

The source of this article

INDIA 2012

A REFERENCE ANNUAL

Compiled by

RESEARCH, REFERENCE AND TRAINING DIVISION

PUBLICATIONS DIVISION

MINISTRY OF INFORMATION AND BROADCASTING

GOVERNMENT OF INDIA

Corporate Affairs: India

INDIA'S corporate sector is one of the major driving forces of its economic growth. From major multinational corporations to small and medium enterprises and ranging across a wide diversity of sectors, including manufacturing, construction, telecom and services, corporate sector has played a significant role in the economic development of the country. This growth and development of corporate sector was enabled by the liberal reforms introduced in the country from time to time.

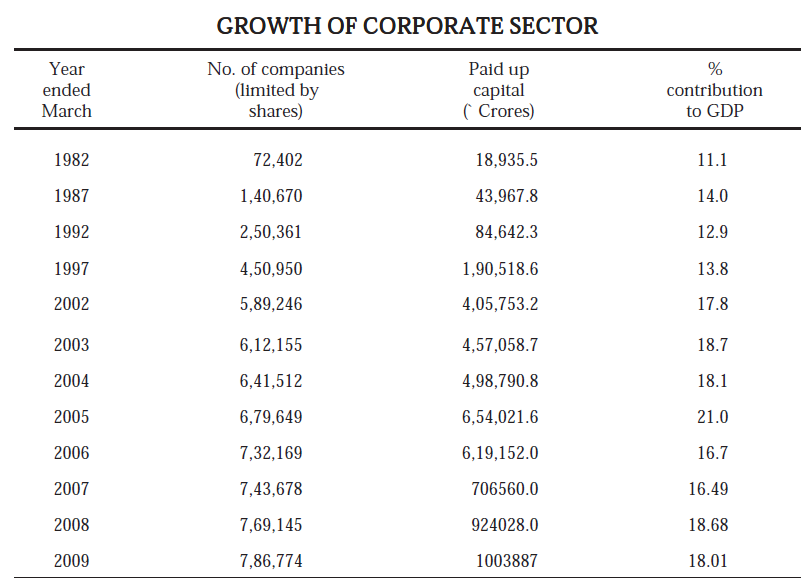

GROWTH OF CORPORATE SECTOR

To meet the expectations of the Corporate Sector and its stakeholders in the changing national and global business environment, Ministry of Corporate Affairs has extended its efforts through a number of initiatives to bring about 'Good Governance'. These initiatives aim at improvement in the legislative framework and administrative set-up to enable easy incorporation and exit of the companies, convenient compliance of regulations with transparency and accountability in corporate governance.

The Ministry is primarily concerned with the administration of the Companies Act, 1956 and other related statutes, and has taken up a series of initiatives to meet the needs of the Indian corporate sector. These initiatives include the implementation and stablization of an ambitious e-governance project known as MCA21 as one of the Mission Mode Projects of the Govt. of India under the National E-governance Plan; comprehensive revision of the Companies Act, 1956 through a wide consultative process; introduction of a new legal framework on the Limited Liability Partnerships; amendments to the Acts governing the three professional Institutes of Chartered Accountants, Cost and Works Accountants and the Company Secretaries; amendments to the Competition Act, 2002; developments and notification of Accounting Standards; creation of physical infrastructure in order to meet the requirements of offices and provide for an efficient work environment; and proposed establishment of the Indian Institute of Corporate Affairs.

The Corporate Sector, apart from creating wealth for the nation, plays a significant role in the national economy by providing investment and employment opportunities to millions of our people in India.

The corporate sector consists mainly of non-government companies which form 99.8 per cent of the total sector whereas government owned companies are a negligible 0.2 per cent. The companies are of three types—companies limited by shares, companies limited by guarantee and companies with unlimited liabilities; companies limited by shares forming the major chunk of the corporate sector (97.9 per cent).

The industrial sectors having major concentration of Indian companies are the manufacturing sector, finance, insurance, real estate and business activities, wholesale and retail trade, hotels and restaurants and construction. Each of the manufacturing sector 26 per cent and finance, insurance, real estate and business sector constitutes 27.58 per cent of the Indian corporate sector. The industrial sector with the activities of wholesale and retail trade, hotels and restaurants forms 14.64 per cent whereas construction forms 8.68 per cent of the corporate sector.

State-wise distribution of Indian companies

The three largest states constituting 54.22 per cent of the corporate sector are Maharashtra, Delhi and West Bengal. The top fifteen states having largest concentration of Indian companies are Maharashtra, Delhi, West Bengal, Tamil Nadu, Andhra Pradesh, Gujarat, Karnataka, Uttar Pradesh, Rajasthan, Kerala, Punjab, Madhya Pradesh, Haryana, Bihar and Orissa in that order. These states constitute 95.59 per cent of the sector.

STATUTORY REFORMS

The Ministry has been working on wide ranging reforms in the statutory framework relating to the corporate sector. Some of the major initiatives taken in this direction are as under :

Companies Act

Keeping in view the developments taking place nationally as well as internationally and with a view to modernize the structure for corporate regulation in India and represent a major reform statement by the Government to promote the development of the Indian corporate sector through enlightened regulation, a decision was taken to revise the existing Companies Act, 1956 comprehensively. Accordingly, the Companies Bill, 2009 was introduced in the Lok Sabha on 3rd August, 2009 and was referred to Hon'ble Parliamentary Committee on Fiance for examination and report. The Hon'ble Committee consulted various experts and stakeholders on the provisions of the Bill and received a large number of suggestions. The Committee also heard the Ministry of Corporate Affairs on a number of occasions.

After examination of such suggestions and consultation with various stakeholders, the Committee submitted its report to the Parliament on 31st August, 2010. Various recommendations made by Hon'ble Committee in its report are under examination in this Ministry. Keeping in view such recommendations and other inputs being received, this Ministry has initiated the exercise of revising the Companies Bill, 2009 in consultation with concerned stakeholders. After such examination, consultation and also after obtaining due approvals, the revised Bill would be introduced in the Parliament.

On the basis of the suggestions received and in-house examination of Forms prescribed under Companies' (Central Government's) General Rules & Forms 1956 in the Ministry, a review was undertaken to revise the existing forms which would bring further improvement and enhancement in service delivery under MCA-21 e- Governance Project. Four forms namely Form 1, Form 32, Form DIN I & Form DIN 3 were undertaken for revision and implemented in the system for use by the stakeholders. The objectives of the revision of aforesaid Forms were to make the filing easier and more clarified to the users, to make simple the back- office processing of e-forms for prompt response to the user and to bring further improvement in the e-forms by changing/adding or deleting fields therein to elicit information in accordance with the provisions of the Companies Act, 1956.

Limited Liability Partnerships Act, 2008

The provisions of the newly enacted Limited Liability Partnership Act, 2008 have been notified for implementation with effect from 31 March 2009. The Limited Liability Partnership Rules, 2009 have been notified on 1 April 2009. The provisions relating to conversion of partnership firms, private company and unlisted public company into LLP came into effect from 31 May 2009. LLP is a new business vehicle in the body corporate form and therefore a separate legal entity which limits the liability of the partners to their agreed contribution. Any two or more individuals or bodies corporate may incorporate an LLP for carrying on a lawful business with a view to profit. LLP structure is not restricted to any specific trade, business, profession or service. LLP is a legal entity separate from its partners and has perpetual succession. Ministry of Corporate Affairs has set up a single central Registry at Delhi for registration of LLP and filing of further returns with Registrar LLP on-line on its website namely, www.llp.govin on 1 April 2009. Through the notification no. GSR 914(E) dated 15th November 2010, the Central Govt. has made amendment in Form 10 of LLP Rules, 2010 regarding "Intimation of Changes in Particulars by Designated Partners".

==Convergence of Accounting Standards with International Financial Reporting Standards (IFRS)== Accounting Standards are policy documents relating to various aspects of measurement, treatment, presentation and disclosure of accounting transactions and events. The purpose of Accounting Standards is to standardize diverse accounting policies with a view to eliminate incomparability of financial statements. The objective is to provide a set of standard accounting policies which are in conformity with generally accepted principles and policies.

Competition Act

India has responded to the current world-wide trend of globalization by opening up its economy, removing controls and resorting to liberalisation. As a natural corollary of this, it was felt that the Indian market should be geared to face competition from within the country and outside. It was also felt that the existing Monopolies and Restrictive Trade Practices Act, 1969 has become obsolete in certain respects in the light of international economic developments relating more particularly to competition laws and there is a need to shift out focus from curbing monopolies to promoting competition. Hence the Government decided to enact a new law for bringing competition in the Indian market.

The Competition Act, 2002 was passed by the Parliament in the Winter Session of 2002 and received the assent of President in January 2003. Consequent upon a challenge to certain provisions of the Act and the observations of the Hon'ble Supreme Court of India, the Act was amended by the Competition (Amendment) Act, 2007. The Competition Act, 2002 as amended, provides for setting up of the Competition Commission of India (CCI) comprising a Chairperson and a minimum of two and maximum of six members. In addition, it also provides for establishment of a Competition Appellate Tribunal to hear and dispose of appeals against the orders of the Commission and also to adjudicate on the claims of compensation that may arise from the findings of the Commission or orders of the Appellate Tribunal.

In accordance with the provisions of the Amendment Act the Competition Commission of India and the Competition Appellate Tribunal have been established. The provisions of the Competition Act relating to anti-competitive agreements and abuse of dominant position have been brought into force with effect from 20 May 2009 and the Commission has started dealing with cases under the provision. Competition Act lays responsibility on the Competition Commission of India to take appropriate measure for the promotion of competition advocacy, creating awareness and imparting training about competition issues. In pursuance of these objectives, the Commission organizes interactive meeting, workshops and seminars, etc. with different regulatory bodies, policy makers, trade organizations, consumer associations and the public at large to create awareness of competition issues. The Commission also develops research capability in the area of competition economics, law and policy among the various stakeholders, ministries/departments, research community, regulators, lawyers, industries, etc.

Investor Education and Protection Fund (IEPF)

The Ministry of Corporate Affairs has established the Investor Education and Protection Fund (IEPF) under the provision of Section 205C of the Companies Act, 1956 with the objectives of promoting investors' awareness and protection of their interests. Under this initiative, the Ministry while promoting the concept of prudent and informed investment decision making, also provides services related to making available informational and educational content for investors, investor grievance redressal and technical assistance to organizations engaged in investor education activities. The activities undertaken through the aegis of IEPF include the following :

l Providing (simple user friendly) educational and awareness content to all the investors through the website www.lepf.gov.in.

l Providing the material Registry of economic offenders through the website www.watchoutinvestors.com which covers all entities who have been found to be guilty under different economic laws of the country.

l Providing on-line investor grievance redressal facility through the website www.watchoutunvestors.com.

l Undertaking investor awareness programmes in partnership with Institute of Chartered Accountants of India (ICAI), Institute of Company Secretaries of India (ICSI) and Institute of Cost and Works Accountants of India (ICWAI) specifically targeting investors in tier-II and tier-III cities.

l Providing technical/financial assistance to voluntary organizations for undertaking investor awareness related activities.

l Undertaking multi-lingual media campaigns to reach out to investors across the country.

(some dated facts, retained only to show the range of Ministry activities)

The Ministry organized India Investor Week from July 12-17, 2010 in order to bring a national focus on the subject of investor awareness. The Ministry also observed "Investor Day" in Bhubaneswar on 28th August, 2010 in partnership with the Department of Public Enterprises of the Government of Orissa. On this occasion, the Ministry's investor education website, www.iepf.gov.in was launched in Oriya along with the booklet "A beginner's Guide to the Capital Market". The Ministry's initiative on investor awareness is progressing well. Over 3500 programmes have been organized in different parts of the country till November, 2010 by partner organizations. The financial support was given to only professional institute, namely ICSI, ICAI and ICWAI.

"India Corporate Week" was organised from December 14-21, 2010 with the theme "Sustainable Business", It was inaugurated by Hon'ble Prime Minister of 14th December, 2010 in Vigyan Bhawan, New Delhi.

National Foundation for Corporate Governance

Ministry of Corporate Affairs has set up National Foundation for Corporate Governance (NFCG) as a not-for-profit Trust to provide a platform to deliberate issues relating to good corporate governance and to sensitize corporate leaders on the importance of good corporate governance practices, to facilitate exchange of experiences and ideas between corporate leaders, policy makers, regulators, law enforcing agencies and non-government organizations.

The NFCG has a three-tier structure for its management, viz, the Governing Council under the Chairmanship of Minister of Corporate Affairs, the Board of Trustees and the Executive Directorate.

The NFCG has been sponsoring orientation programmes for Directors through the various Institutes of Excellence and has been organizing seminars and conferences to propagate the need for following good corporate governance practices.

Over the last few years, NFCG has undertaken various initiatives to create awareness about the importance of implementing good corporate governance practices both at the level of individual corporations and for the economy as a whole. Following are some of the initiatives undertaken by the NFCG during the current year.

1. National Seminar on Corporate Governance on 20th February, 2010.

2. National Seminar on Corporate Governance: The Way Forward on 20th February, 2010

3. National Conference on Corporate Governance & the Role of Independent Directors on 10th March, 2010.

4. Conference on CSR-From Awareness to Leadership: Making CSR an Actionable Business on 20th March, 2010.

5. National Conference on Inclusive & Responsible-The Next Face of India Inc. on 24th March, 2010.

6. Seminar on Limited Liability Patnership on -27th March, 2010.

7. National Seminar-Corporate Compliance Management and Due Diligence on 27th March, 2010.

8. Seminar on Limited Liability Partnership on 28th March, 2010.

9. Developing Corporate Governance Norms for SMEs (completed and submitted in June, 2010).

Serious Frauds Investigation Office (SFIO)

Serious Fraud Investigation Office (SFIO) has been set up by the Government of India in the Ministry of Corporate Affairs by way of resolution dated 2.7.2003 after it was approved by the Cabinet vide its note dated 9.1.2003. This office was set up after considering the recommendation of the Naresh Chandra Committee to investigate corporate frauds of serious and complex nature on the line. The SFIO is a multi-disciplinary investigating Agency, wherein experts from banking sector, capital market, company law, law, forensic audit, taxation, information technology etc. work together to unravel a corporate fraud.

At present, SFIO is carrying out investigation under provisions of the Companies Act, 1956 from Sections 235 to 247. However, as approved by the Cabinet, a separate legislation would be enacted for SFIO in second phase to provide adequate powers and reach to this organization. For this purpose, Vepa Kamesam Committee set up by Ministry of Corporate Affairs to look into the issue related to SFIO and make suitable recommendation has already submitted the report in April 2009. The recommendations of the Committee are under examination in Ministry of Corporate Affairs.

During the period from 1st April 2010 to 31st December 2010, six cases were ordered for investigation under section 235/237 of the Companies Act, 1956 by the Central Government under separate orders. So far, 79 cases have been referred to SFIO for investigation. Out of these, SFIO has submitted investigation reports in 52 cases till 31.12.2010, two cases have been either stayed or dismissed by Courts and the remaining 25 cases (as per Para 3.1 and 3.2 above) are under investigation. Till 31.12.2010, 823 cases of prosecution have already been filed in the different Courts against the persons involved in fraudulent activities in the companies.

Indian Institute of Corporate Affairs (IICA)

Indian Institute of Corporate Affairs (IICA) has been set up to be a holistic thinktank, capacity building, see delivery Institute to help corporate growth, reforms through synergized knowledge management, partnerships and problem solving in a one-stop-shop mode. The Institute would provide support to the Ministry in review/revision of existing corporate laws, rules and regulations, as well as in framing of new ones, as per requirements of a dynamic economic environment. In addition, it would provide the much-needed training to the officers of Indian Corporate Law Service (ICLS) and other officials working for the Ministry, and support organizational reforms initiatives. IICA would also help in continuous improvement of service delivery in diverse areas like MCA21, corporate governance, corporate social responsibility, investor education and protection, etc. This is the first-ever Plan Scheme of the Ministry and involves an outlay of Rs 211.00 crore over the Eleventh Plan period.

MCA21 e-Governance Project

The Ministry of Corporate Affair has implemented MCA21 e-Governance Project. It is one of the Mission Mode Projects of the Government of India under the National e-Governance Plan. The Project envisages easy and secure on-line access to all registry related services provided by the MCA, including registration and filling of documents, throughout the country for all the corporate and other stakeholders at any time and in a manner that best suits them. During the year, e-stamping has been introduced in MCA21 portal. This has enabled the stakeholders to make payment of stamp duty on MCA21 portal itself.

The revenue collected by way of stamp duty is remitted to RBI at the end of the week and the RBI remit the same to respective States Government within a day's time. E-Governance system for LLP was made operational on 1st April 2009. The system was designed and developed by NIC. All e-Forms except Form 11 (Annual Returns of LLP) is available for users for filing. Payment via credit card is also enabled. Currently there are 1055 LLPs registered as on 31st March, 2010 including conversion from companies & firms. 5246 DPINS are allocated. It is planned to introduce other modes of payments like net banking & challan, as in MCA21.

During the year 2009-10, a number of initiatives were taken in this direction. 17 e-forms were revised and a new e-form 68 was introduced for rectification of mistakes made in form IA, 1 and 44 to improve the operational efficiency and enhance compliance. Operation of the system was switched over from the Data Centre in Delhi to the Disaster Recovery Centre in Chennai to establish that the disaster recovery centre is fully geared to handle full MCA21 processing in case of a diaster. Following operational statistics bring out the stability in the system, increased volume of filings and improved compliance:

INTERNATIONAL COOPERATION

International Cooperation involving interaction with foreign government authorities/organizations/institutions is essential, as the Indian business environment is getting increasingly integrated with the global business environment.

It enables the professionals as well as the Ministry to understand the developments taking place in the world. Also to showcase the initiatives of the Ministry in the areas of corporate governance, corporate social responsibility and the development of the accounting profession, interactions were undertaken by the Ministry with International Organizations like George Washington University Law School, International Federation of Accountants (IFAC), Indian Medical Association (IMA), US India Business Council (USIBC) in USA, Global Reporting Initiatives (GRI), Institute of Certified Management Accountants Sri Lanka (ICMASL) at Colombo, European Academy of Business in Society (EABIS), Federal Antimonopoly Service (FAS) of Russia, World Bank Institute at Belgium, and Organisation for Economic Cooperation and Development (OECD).

PART II

Corporate governance

2018: Kotak panel recommendations accepted

Sebi asks listed cos to split CMD post, March 29, 2018: The Times of India

From: Sebi asks listed cos to split CMD post, March 29, 2018: The Times of India

Makes It Mandatory To Disclose Reasons For Auditors’ Resignation And Their Perks

The Sebi board took a slew of key decisions which included separating the posts of managing director (MD)/ chief executive officer (CEO) and chairman, making it mandatory for listed companies to disclose reasons for the resignation of auditors and fees paid to them, and reducing the number of companies in which a person could be director to 8 from 10.

Accepting the Uday Kotak panel recommendations on corporate governance, Sebi also directed the top 1,000 listed companies to have a minimum six directors. It asked the top 100 listed companies to webcast annual general meetings. The Sebi board cut costs for some mutual fund schemes. It has decided to strengthen rules that govern trading in the derivatives market, mainly by retail investors.

The Sebi’s decision to separate the posts of MD/CEO and that of the chairman of board of directors would lead to stricter scrutiny of the management by its board, industry professionals said. Currently, several companies have merged the two posts as chairman-cum-MD, leading to some overlapping of the board and the management, which could lead to conflict of interests. The Sebi recommendation will come into effect from April 1, 2020 for top 500 listed entities.

The Sebi board said that all listed companies will have to disclose the expertise of its directors and should have at accepted, some have been referred to government agencies and other regulators.

A release from the regulator said, “The board decided to refer certain recommendations to various agencies (government, other regulators, professional bodies, etc), considering that the matters involved relate to them. Such recommendations, inter alia, include strengthening the role of ICAI, internal financial controls, adoption of Ind-AS, treasury stock, governance aspects of PSEs (public sector enterprises), etc.”

The Sebi approved expanding the eligibility criteria for independent directors, enhanced the role of audit, nomination and remuneration, and risk management committees of the board of a listed least one independent woman director. All these were part of the series of recommendations given by the Sebi-appointed Kotak committee. Sebi chairman Ajay Tyagi said that while a large number of recommendations by the committee were modification, 15 with some modifications, while eight have been referred to government agencies and other departments.

Tyagi also said that in the derivatives market, a framework has been approved that will take care of product suitability for every retail investor who trades in the derivative market. “Individual investors may freely take exposure in the market (cash and derivatives) up to a computed limit based on their disclosed income under their Income Tax Return (ITR) over a period of time. For exposure beyond the computed limit, the intermediary would be required to undertake rigorous due diligence and take appropriate documentation from the investor,” the release said. company. It also said that companies will now have to disclose details about utilisation of funds raised through qualified institutional placement (QIP) and preferential issues.