Economic Affairs: India

This article has been sourced from an authoritative, official readers who wish to update or add further details can do so on a ‘Part II’ of this article. |

The source of this article

INDIA 2012

A REFERENCE ANNUAL

Compiled by

RESEARCH, REFERENCE AND TRAINING DIVISION

PUBLICATIONS DIVISION

MINISTRY OF INFORMATION AND BROADCASTING

GOVERNMENT OF INDIA

ECONOMIC AFFAIRS

The main divisions of the Department of Economic Affairs (DEA) are :

(i) Finance Division,

(ii) Budget Division including Fiscal Responsibility and Budget Management (FRBM),

(iii) Capital Market,

(iv) Bilateral Co-operation and Administration,

(v) Multilateral Institutions,

(vi) Multilateral Relations, and Administration,

(vii) Controller of Aid, Accounts and Audit,

(viii) Economic Division, and

(ix) Directorate of Currency.

The Department inter alia monitors current economic trends and advises the Government on all matters having bearing on internal and external aspects of economic management including prices, credit, fiscal and monetary policy and investment regulations. This Department also supervises policies relating to Nationalised Banks, Life and General Insurance and Security Paper Mills. All the external, financial and technical assistance received by India, except through specialized International Organisation like FAO, ILO, UNIDO and except under International bilateral specific agreement in the field of science and technology, culture and education are also monitored by this Department.

The DEA is also responsible for preparation and presentation to the Parliament of Central Budget and the Budgets for the State Governments under President’s Rule and Union Territory Administrations. The Department, Directorate of Currency (DoC) has the administrative control of the Security Printing and Minting Corporation of India Limited (SPMCIL), a wholly owned Government of India Corporation that manages Government of India Mints, Currency Presses, Security Presses and Security Paper Mill. In addition to formulating and executing policies and programmes relating to designs/ security feature of bank notes and coins and issue of commemorative coins, the DoC has also been mandated to conduct Research and Development activities in this area and indigenization of all materials required for production of bank notes and others security products.

Annual Budget

The Union Budget of India, also called the General Budget, is presented each year on the last working day of February by the Finance Minister of India in Parliament.

Annual Financial Statement

Under Article 112 of the Constitution, a statement of estimated receipts and expenditure of the Government of India has to be laid before Parliament in respect of every financial year which runs from 1st April to 31st March. This statement titled "Annual Financial Statement" is the main Budget document.

The Annual Financial Statement shows the receipts and payments of Government under the three parts in which Government accounts are kept; (i) Consolidated Fund, (ii) Contingency Fund, and (iii) Public Account.

All revenues received by Government, loans raised by it, and also its receipts from recoveries of loans granted by it from the Consolidated Fund. All expenditure of Government is incurred from the Consolidated Fund and no amount can be withdrawn from the Fund without authorisation from Parliament.

Occasions may arise when Government may have to meet urgent unforeseen expenditure pending authorisation from Parliament. The Contingency Fund is an imprest placed at the disposal of the President to incur such expenditure. Parliamentary approval for such expenditure and for withdrawal of an equivalent amount from the Consolidated Fund is subsequently obtained and the amount spent from Contingency Fund is recouped to the Fund. The corpus of the Fund authorised by the Parliament, at Present is Rs 500 crore.

Besides the normal receipts and expenditure of Government which relate to the Consolidated Fund, certain other transactions enter Government accounts in respect of which Government acts more as a banker, for example, transactions relating to provident funds, small savings collections, other deposits, etc. The moneys thus received are kept in the Public Account and the connected disbursements are also made therefrom. Parliamentary authorisation for such payments from the Public Account is, therefore, not required. In a few cases, a part of the revenue of Government is set apart in separate funds for expenditure on specific objects like road development, primary education including mid-day meal scheme etc. These amounts are withdrawn from the Consolidated Fund with the approval of Parliament and kept in the Public Account for expenditure on the specific objects. The actual expenditure proposed on the specific objects is also submitted for vote of Parliament.

Under the Constitution, Budget has to distinguish expenditure on revenue account from other expenditure. Government Budget, therefore, comprises

(i) Revenue Budget; and

(ii) Capital Budget.

Demands for Grants

The estimates of expenditure from the Consolidated Fund included in the Annual Financial Statement and required to be voted by the Lok Sabha are submitted in the form of Demands for Grants in pursuance of Article 113 of the Constitution. Generally, one Demand for Grant is presented in respect of each Ministry or Department, However, in respect of large Ministries or Departments, more than one Demand is presented. Each Demand normally includes the total provisions required for a service, that is, provisions on account of revenue expenditure, capital expenditure, grants to State and Union Territory Governments and also loans and advances relating to the service. In regard to Union Territories without Legislature, a separate Demand is presented for each of the Union Territories. Where the provision for a service is entirely for expenditure charged on the Consolidated Fund, for example, interest payments, a separate

Appropriation, as distinct from a Demand, is presented for that expenditure and it is not required to be voted by Parliament. Where, however, expenditure on a service includes both 'voted' and charged' items of expenditure, the latter are also included in the Demand presented for that service but the 'voted' and 'charged' provisions are shown separately in that Demand. The Demands for Grants are presented to the Lok Sabha along with the Annual Financial Statement.

Finance Bill

At the time of presentation of the Annual Financial Statement before Parliament, a Finance Bill is also presented in fulfilment of the requirement of Article 110 (1) (a) of the Constitution, detailing the imposition, abolition, remission, alteration or regulation of taxes proposed in the Budget. A Finance Bill is a Money Bill as defined in Article 110 of the Constitution. It is accompanied by a Memorandum explaining the provisions included in it.

Appropriation Bill

After the Demands for Grants are voted by the Lok Sabha, Parliament's approval to the withdrawal from the Consolidated Fund of the amounts so voted and of the amount required to meet the expenditure charged on the Consolidated Fund is sought through the Appropriation Bill. Under Article 114(3) of the Constitution, no amount can be withdrawn from the Consolidated Fund without the enactment of such a law by Parliament.

Vote-on-Account

The whole process beginning with the presentation of the Budget and ending with discussions and voting on the Demands for Grants requires sufficiently long time. The Lok Sabha is, therefore, empowered by the Constitution to make any grant in advance in respect of the estimated expenditure for a part of the financial year pending completion of procedure for the voting of the Demands. The Purpose of the 'Vote on Account' is to keep Government functioning, pending voting of 'final supply'. The Vote on Account is obtained from Parliament through an Appropriation (Vote on Account) Bill.

Sources of Revenue

In accordance with the Constitution (Eightieth Amendment) Act, 2000, which has been given retrospective effect from 1.4.1996, all taxes referred to in the Union List, except the duties and taxes referred to in Articles 268 and 269, respectively, surcharge on taxes and duties referred to in article 271 and any cess levied for specific purpose under any law made by Parliament, shall be levied and collected by the Government of India and shall be distributed between the Union and the States in such manner as may be prescribed by the President on the recommendations of the Finance Commission. For the period 2005-2010, the manner of distribution between the Centre and the States has been prescribed in Presidential Orders issued after considering the recommendations of the Thirteenth Finance Commission.

The main sources of Union tax revenue are Customs duties, Union excise duties, Service tax, Corporate and income taxes. Non-tax revenues largely comprise interest receipts, loan repayments, dividends and profits.

Transfer of Resources

The revised estimates of 2010-11, the devolution of tax receipts from the Union Government to the States as their share of taxes and duties was Rs 219,303 crore. In BE 2011-12, this amount has been increased to Rs 263,458 crore. Besides, total grants and loans to States and Union Territories will increase from Rs 173,246 crore in 2010-11 to Rs 201,733 crore in 2011-12. In addition to above resources are also transferred by Union Government to be state level implementing agencies under various scheme and programmes.

Public Debt and Other Liabilities

Public Debt of India is classified into three categories of Union Government liabilities into internal debt, external debt and other liabilities.

Internal debt for Government of India largely consists of fixed tenure and fixed rate government papers (dated securities and treasury bills) which are issued through auctions. These include market loans (dated securities), treasury bills (91, 182 and 364 days) and 14 day treasury bills (issued to State Governments only), cash management bills, special securities issued to the Reserve Bank of India (RBI), Compensation and other bonds, non negotiable and non interest bearing rupee securities issued to international financial institutions and securities issued under market stabilization scheme.

External debt represents loans received from foreign governments and multilateral institutions. The Union Government does not borrow directly for international capital markets. Its foreign currency borrowing takes place from multilateral agencies and bilateral sources, and is a part of official development assistance (ODA). At present, the Government of India does not borrow in the international capital markets.

‘‘Other’’ liabilities category, not a part of public debt, includes other interest bearing obligations of the government, such as post office saving deposits, under small savings schemes, loans raised through post office cash certificates, provident funds and certain other deposits.

The total net liabilities of the Government of India in the BE 2011-12, is estimated at Rs. 43,52,389 crore as against Revised Estimates (RE) Rs. 39,30,805 crore at the end of 2010-11. The estimated public debt in BE 2011-12 includes Internal Debt of Rs. 31,10,618 crore, External Debt of Rs. 1,70,847 crore at Book Value and Other Liabilities of Rs. 10,71,224 crore.

The Reserve Bank manages the public debt of the Central and the State Governments and also acts as a banker to them under the provisions of the Reserve Bank of India Act 1934 (Section 20 and 21). The Reserve Bank also undertakes similar functions for the State Governments by agreement with the Government of the respective State (under section 21 A).

Sovereign debt

2017, 18: India and the world

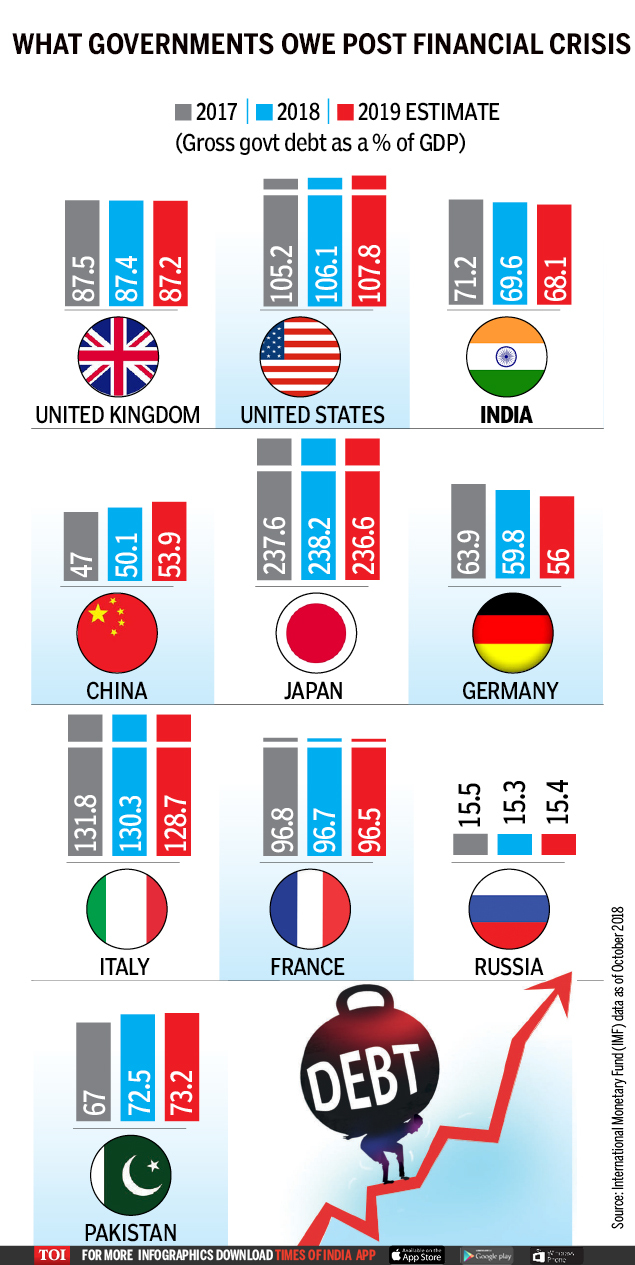

World debt continues to rise, January 23, 2019: The Times of India

From: World debt continues to rise, January 23, 2019: The Times of India

A decade after the Lehman Brothers collapse triggered a global liquidity crisis, IMF has noted that sovereign debt ratios in advanced and emerging economies continue to rise. In 2018, the debt level of the US was a whopping 106.1 per cent of the GDP. Here's a look at the debt levels of some governments after global financial crisis.

New Initiatives in Fiscal Management

Persistent fiscal and concomitant growth in the public debt burden have been identified as the most difficult challenges affecting the country's economic growth prospects. To check the potentially damaging impact the lack of fiscal discipline on macro-economic parameters, the Parliament had passed the Fiscal Responsibility and Budget Management (FRBM) Act 2003 which came into force in July 2004, The FRBM Act, inter alia, mandates the Government to eliminate the revenue deficit by 2007-08. Through an amendment in 2004, the target year has been shifted to 2008-09. The FRBM Rules prescribe a minimum annual reduction in the revenue deficit by 0.5 per cent of GDP.

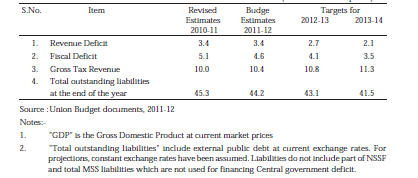

After considerable progress in fiscal consolidation till 2007-08, there was a conscious policy shift in 2008-09 to obviate the impact of global commodity price rise and financial crisis. As a consequence, fiscal deficit went up to a level of 6.0. per cent of GDP in 2008-09. The Budget for 2011-12 estimates the fiscal deficit for 2011-12 at 4.6 per cent of GDP. These levels of expansion were short-term basis. To address such concerns, the Medium Term Fiscal Policy Statement 2010-11 has provided the roadmap with fiscal deficit declining to 4.1 per cent of GDP in 2012-13 and further to 3.5 per cent of GDP in 2013-14.

Fiscal Policy for 2011-12

The Fiscal policy of 2011-12 is guided by the principles of gradual adjustment from the fiscal expansion undertaken during the crises period in 2008-09 and 2009-10. The adjustment path has been slightly front loaded when compared to the recommendations of the 13th FC. The fiscal deficit was estimated at 5.1 per cent and 4.6 percent of GDP as against 5.7 per cent and 4.8 percent for 2010-11 and 2011- 12 respectively projected by the 13th Finance Commission. The fiscal deficit in 2010- 11 is 4.7 per cent as per provisional accounts. This accelerated adjustment will help the government in reducing the debt to GDP ratio at faster pace which in turn will help in unlocking more resources from government revenue in future to be used for developmental programmes instead of debt servicing. In order to achieve the accelerated fiscal consolidation path, the government has focused on expenditure correction in 2011-12.

Budgetary Development 2011-12

Highlights of Budget 2010-11 include

l Hike in gross budgetary support (GBS) for the plan from Rs 373092 crore in 2010-11 (BE) to Rs 441547 crore in 2011-12 (BE), an increase of about 18 per cent.

l The Budget seeks to address the three challenges facing the economy-to lead the economy back to the high GDP growth rate of 9 per cent per annum, to harness economic growth to consolidate, deepen and broaden the agenda for inclusive development and to energise government and improve delivery mechanism.

l The education and health sectors were allocated substantial funds. In 2011- 12 the budget allocation for education was enhanced by 27 per cent to Rs 63363.00 crore while for the Health and Family Welfare it was enhanced by 21 per cent to Rs 30456.00 crore.

Social Sector Programmes

The eight flagship programmes continued to receive high priority, viz. Sarva Sikha Abhiyan; Mid-Day meal Scheme, Rajiv Gandhi Drinking Water Mission; Rural Sanitation; National Rural Health Mission; Integrated Child Development Programme, National Rural Employment Guarantee Scheme and Jawaharlal Nehru National Mission Urban Renewal Mission. Total allocation under these eight flagship schemes was enhanced from Rs 11,0589 crore in 2010-11 to Rs 12,3017 crore in 2011-12 marking an increase in allocation by 11.23 per cent.

Scheme for the Development of Scheduled Castes and Scheduled Tribes

From 2005-06, a separate statement on the schemes for the welfare of Scheduled Castes (SCs) and Scheduled Tribes (STs) is placed in the budget document. From the financial year 2011-12, this Statement is splitted into two parts (i) development schemes for Scheduled Castes and (ii) Developmental Scheme for Scheduled Tribes which shows year-wise Budget Estimates & Revised Estimates of current year and Budget Estimates of next financial year for the developmental schemes for Scheduled Castes and Scheduled Tribes. Keeping in view the commitment of the Government to the welfare of SCs, the allocations under schemes benefiting only SCs have been enhanced by 27.95% in 2011-12 (BE) in comparison with corresponding financial year 2010-11. Similarly, for the schemes for STs, the allocation have been enhanced by 84.29% during 2011-12 (BE) in comparison to corresponding financial year 2010-11.

Benefit to Women (Gender Budgeting)

In BE 2011-12, a total budget provision of Rs 20548.35 crore has been provided for 100 % women specific programmes and Rs 57702.67 crore for schemes where at least 30 per cent allocation is for women specific programmes.

Walfare of Children (Child Budgeting)

A statement 'Provision for Schemes for the Welfare of Children' has been included from the financial year 2009-10. It indicates provision for educational outlays, provisions for child protection etc. The allocation for BE 2011-12 under Welfare of Children is Rs 56749 crore.

Details relating to Union Budget are available on the website of Ministry of Finance viz www.finmin.nic.in

Policy Initiatives and Development in the Indian Capital Market

A. Securities Market

Primary Securities Market

Role of an efficient primary market is critical for resource mobilisation by corporates to finance their growth and expansion. Indian primary market witnessed renewed activity in terms of resource mobilisation and number of issues during 2010-11, continuing its momentum from 2009-10. In view of the recovery witnessed in equity markets post global financial crisis, companies, largely public sector with a divestment mandate, entered the primary market during 2010-11. Investors’ response to public issues was encouraging in 2010-11. Capital (equity and debt) was raised to the tune of 67,609 crore through 91 issues during 2010-11, higher than 57,555 crore mobilised through 76 issues during 2009-10.

During 2010-11, 91 issues (81 equity issues and 10 debt issues) accessed the primary market and collectively raised 67,609 crore through public (68) and rights issues (23) as against 57,555 crore raised in 2009-10 through public (47) and rights issues (29). There were 53 IPOs during 2010-11 as against 39 during 2009-10. The amount raised through IPOs during 2010- 11 was at 35,559 crore as compared to 24,696 crore during 2009-10. The share of public issues in the total resource mobilisation stood at 85.9 percent during 2010-11 as compared to 85.5 percent in 2009-10 showing a marginal increase over the previous year.

The share of Rights issues was at 14.1 percent in 2010-11 as compared to 14.5 percent in 2009-10. There were 10 public issues of Non-Convertible Debentures (NCDs) amounting to 9,503 crore in 2010-11 as compared to three issues of 2,500 crore in 2009-10. Continued reforms in the primary market further strengthened investors’ confidence.

Following were the major policy initiatives taken by SEBI relating to the primary market during 2010-11:

i. Encouragement of Retail Investor Participation

In order to increase retail investor participation and to keep pace with inflation, monetary limit on retail individual investor application was increased from 1 lakh to 2 lakh. The limit was enhanced with the objective that retail individual investors who have capacity and appetite to apply for securities worth above 1 lakh should not be constrained.

ii. Reforms in Issue Process

In order to make our markets competitive, SEBI has been constantly reviewing various rules and procedures to make issue process simpler and at the same time safer. Some of the major initiatives in this area include :

a) Reduction in process time lines : In order to lessen the market risk time between issue closure and listing was reduced from 22 days to 12 working days.

b) Enhancement in Application Supported by Blocked Amounts (ASBA) Process : To smoothen the payment/refund process in issues, SEBI has introduced Applications Supported by Blocked Amount (ASBA) Process in issues, wherein application money is blocked in a bank account and debited only to the extent of allotment entitlement while continuing to earn interest.

iii. Introduction of Pre-Announced Fixed Pay Date for Payment of Dividends and for Credit of Bonus Shares

In order to enable investors to manage their cash/securities flows efficiently and to enhance process transparency, it has been decided to mandate companies to have a pre-announced fixed pay date for payment of dividends and for credit of bonus shares.

iv. Amendment to Clause 40A of the Listing Agreement - Requirements in Respect of Minimum Public Share holding in Listed Entities

In order to align the requirements in Clause 40A of the Listing Agreement with the amended Securities Contracts (Regulation) Rules, 1957 on the captioned subject and to specify the manner in which public shareholding may be raised to the prescribed minimum, it was provided that :

a) Listed entities shall agree to comply with the requirements specified in Rule 19(2) and Rule 19A of the Rules.

b) Where the company is required to achieve the level of public shareholding as specified in Rule 19(2) and/or 19A of the Rules, it shall adopt any of the following methods to raise the public shareholding to the required level :-

• issuance of shares to public through prospectus; or

• offer for sale of shares held by promoters to public through prospectus; or

• sale of shares held by promoters through the secondary market.

v. Amendments to Clause 41 of the Listing Agreement

a) Voluntary Adoption of International Financial Reporting Standards

(IFRS), listed entities having subsidiaries were provided an option to submit their consolidated financial results either in accordance with the accounting standards specified in section 211(C) of the Companies Act, 1956, on in accordance with IFRS.

b) Requirement of a Valid Peer Review Certificate for Statutory Auditors

It has been decided that in respect of all listed entities, limited review/ statutory audit reports submitted to the concerned stock exchanges shall be given only by those auditors who have subjected themselves to the peer review process of ICAI and who hold a valid certificate issued by the ‘Peer Review Board’ of the said Institute.

vi Maintenance of a Website by Listed Entities

In order to ensure/enhance public dissemination of all basic information about listed entities, all such entities were mandated to maintain a functional website that contains certain basic, information about them, duly updated for all statutory filings, including agreements entered into with media companies, if any. vii. Disclosures Regarding Agreements with the Media Companies

In order to ensure public dissemination of details of agreements entered into by corporates with media companies, listed entities were mandated to disclose details of such agreements on their websites and also notify the stock exchange of the same for public dissemination.

Mutual Funds

Mutual funds witnessed redemption pressures during 2010-11 due to volatile market conditions. Mutual funds play an important role in mobilising the household savings for deployment in capital markets. The gross mobilisation of resources by all mutual funds during 2010-11 was at Rs 88,59,515 crore compared to Rs 1,00,19,022 crore during the previous year indicating a decrease of 11.6 percent over the previous year.

Redemption also decreased by 10.3 percent to Rs 89,08,921 crore in 2010-11 from Rs 99,35,942 crore in 2009-10. All mutual funds, put together, recorded a net outflow of Rs 49,406 crore in 2010-11 as compared to an inflow of Rs 83,080 crore in 2009-10.

The assets under management by all mutual funds decreased by 6.3 per cent to Rs 5,92,250 crore at the end of March 2011 from Rs 6,31,978 crore at the end of March, 2010. SEBI had taken the following initiatives to improve the functioning of mutual funds :

i. Disclosure of Investor Complaints with Respect to Mutual Funds

To improve transparency in ‘grievance redressal mechanism’, it was decided that mutual funds shall henceforth disclose detailed status of invest or complaints received by them in a prescribed format, on their websites, on the AMFI website as well as in their Annual Reports. These details should have been signed off by the trustees of the concerned mutual fund.

ii. Certification Programme for Sale and/or Distribution of Mutual Fund Products

Earlier, agents/distributors of mutual fund units were required to obtain certification from Association of Mutual Funds in India (AMFI), Under Regulation 3(1) of (Certification of Associated Persons in the Securities Markets) Regulations, 2007, it was decided that from June 01, 2010, the certification examination for distributors, agents or other persons employed or engaged or to be employed or engaged in the sale and/or distribution of mutual fund products, would be conducted by the National Institute of Securities Markets (NISM).

Takeovers

Submission of Report by the Takeover Regulations Advisory Committee : SEBI, vide its order dated September 4, 2009, had constituted the Takeover Regulations Advisory Committee with the mandate to examine and review the Takeover Regulations of 1997 and to suggest suitable amendments to the same, as deemed fit. The Committee was headed by Shri C. Achuthan, Former Presiding Officer of the Securities Appellate Tribunal and comprised of eminent members with expertise in diverse fields, viz., lawyers, industry representatives, investor association representative, merchant bankers, academics and SEBI representatives.

The Committee submitted its report to SEBI on July 19, 2010. Upon review of the existing law governing substantial acquisition of shares and takeovers vis-a-vis international practices, judicial pronouncements and experience gained so far, the Committee proposed substantive changes to the Regulations and consequently thought it fit to comprehensively re-write the Takeover Regulations. The proposed draft Takeover Regulations were also made part of the Committee Report.

The Committee Report was uploaded on the SEBI website for public comments. The public comments so received together with recommendations of the Committee are presently under consideration of the SEBI.

INVESTOR ASSISTANCE AND EDUCATION

SEBI Complaints Redressal System (SCORES)

SEBI is in the process of upgrading the investor grievance redressal mechanism.

The upgraded mechanism SCORES (SEBI Complaints Redressal System) would be a web-based, centralized grievance redress system for SEBI. All grievances will be in electronic mode with facility for online updation of Action Taken Reports by the users. SCORES will reduce grievance process time at SEBI since physical movements of grievances are not required. Similarly the grievance redressal time will be reduced since the entire process is in electronic mode, including action taken report submitted by the company/intermediary. Similarly, the problem of physical storage, maintenance and redressal has also been addressed due to the proposed conversion of physical grievances into electronic mode. As investors can track their grievance redressal status online, multiple correspondences from investors to know the status of their grievances are avoided. SCORES has been developed and the system will be fully functional in the financial year 2011-12.

B. Secondary Market

Equity Finance for Small and Medium Enterprises (SMEs)

A dedicated platform for SMEs is being set up to make available equity capital for small and medium scale industries. Based on finalized regulations, operational guidelines have been finalized by SEBI and BSE and NSE have been given in principle approval by SEBI for launching the same.

SEBI in May 2010 specified the framework for any company desirous of being recognized as a SME exchange. They have to apply to SEBI fulfilling the following conditions, that it should be a corporatised and demutualised entity; it has a networth of at least Rs. 100 crores; it shall have nationwide trading terminals and an online screen-based trading system; the minimum lot size for trading on the stock exchange shall be one lakh rupees etc.

Further, certain relaxations are provided to the issuers whose securities are listed on SME exchange in comparison to the listing requirements in Main Board, which inter-alia include companies listed on the SME exchange may send to their shareholders, a statement containing the salient features of all the documents, instead of sending full annual Report; secondly, periodical financial results may be submitted on ‘‘half yearly basis’’, instead of ‘‘quarterly basis’’ and SMEs need not publish their financial results, as required in the Main Board and can make it available on their website.

As per the framework for setting up of new exchange or separate platform of existing stock exchange, market making has been made mandatory in respect of all scrips listed and traded on SME exchange. The merchant banker to the issue will undertake market making through a stock broker who is registered as market maker with the SME exchange. The merchant banker shall be responsible for market making for a minimum period of three years from the date of listing of the specified securities.

Review of Ownership and Corporate Governance Norms

SEBI had constituted a Committee under the Chairmanship of Dr Bimal Jalan on February 8, 2010 to examine the issue arising from the ownership and governance of market infrastructure, institutions like depositories, clearing corporations and stock exchanges. The Committee submitted its report on 23rd November, 2010 to SEBI. There port of the Committee has been posted on the website of SEBI and public comments have been received by SEBI. The recommendations of the Committee are being examined by the Government and the SEBI.

UNIDROIT Convention

This Convention is aimed at providing internationally applicable common legal regime which will promote legal certainty and economic efficiency with respect to cross border holding and disposition of securities held with an intermediary. Further, the risks associated with intermediated securities has also necessitated the creation of agreed international rules for intermediated securities in the form of an International Convention so as to appropriately handle issues related to cross-border trading, exchange linkages and clearing and settlement of such transactions through financial sector intermediaries. In view of this, the International Institute for the Unification of Law (UNIDROIT) held Diplomatic Conferences to harmonise the laws in this regard in various jurisdictions. The Conference adopted the agreed text of the UNIDROIT Convention on Substantive Rules for Intermediated Securities and its Final Act on 9th October 2009. The Final Act of the Conference was signed by 37 States including India and the European Community in October 2009.

Securities Trading Using Wireless Technology

SEBI registered brokers who provide Internet Based Trading, as specified by SEBI circular dated January 31, 2000, shall be eligible to provide securities trading using wireless technology. All relevant requirements applicable to internet based trading shall also be applicable to securities trading using wireless technology.

Smart Order Routing (SOR)

On the recommendation of Technical Advisory Committee (TAC) of SEBI and proposals from stock exchanges and market participants, SEBI has introduced the facility of Smart Order Routing (SOR) which allows the brokers trading engines to systematically chose the execution destination based on factors viz. price, cost, speed, likelihood of execution and settlement, size, nature or any other consideration relevant to the execution of the order. This facility would help brokers execute client order efficiently by providing the best price available across multiple stock exchanges. ===Securities Lending And Borrowing Mechanism (SLB===) SEBI vide its circular dated October 7, 2010 extended the contract tenure for securities lending and borrowing, from a period of 30 days to a maximum period of 12 months and providing the facility of early recall and repayment of securities. The dividend amount would be worked out and recovered from the borrower on the book closure/ record dated and passed on to the lender.

Development of Derivatives Markets

• Currency Futures : Since 2008, Currency futures were traded only in USDINR currency pairs. Subsequently, based on the market feedback, trade in three other currency pairs namely Euro-INR, GBP-INR and JPY-INR were introduced at NSE and MCX-SX in February 2010. USE started trading in all four currency pairs in September 2010. Currency futures and options allow exporters to hedge against foreign currency fluctuations in respect of their underlying foreign exchange liabilities.

• Derivative Contracts on Volatility Index : SEBI had in January, 2008 introduced Volatility index and in April 2010 decided to permit Stock Exchanges to introduce derivative contracts on Volatility index, subject to the condition that the underlying Volatility Index has a track record of at least one year and the Exchange has in place the appropriate risk management framework for such derivative contracts.

• Interest Rate Futures (IRF) : On 7th March, 2011, SEBI has permitted stock exchanges to introduce Futures on 91-day Government of India Treasury Bills (T-Bills) in their currency derivative segement.

• Currency Options : Trade in currency options on USD-INR were launched in NSE and USE in October 2010.

• European Style Stock Options : Stock exchanges were provided with the flexibility to offer either European style or American style stock options. After opting for a particular style of exercise, a stock exchange has to offer options contracts of the same style on all eligible stocks. At NSE, European style stock options were introduced for all options contracts expiring on or after January 27, 2011. On BSE, it was introduced for contracts expiring on or after March 17,2011.

• Derivative Contracts on Foreign Stock indices : In January, 2011, SEBI has allowed stock exchanges to introduce derivative contracts (futures and Options) on foreign stock indices in their equity derivative segment.

C. External Market

External Commercial Borrowings (ECB) policy

i. External Commercial Borrowings (ECB) refer to commercial loans in the form of bank loans, buyers’ credit, suppliers’ credit, securitized instruments (e.g. floating rate notes and fixed rate bonds, non-convertible, optionally convertible or partially convertible preference shares) availed of from non-resident lenders with a minimum average maturity of 3 years. The External Commercial Borrowing (ECB) policy is regularly reviewed by the Government in consultation with the Reserve Bank of India (RBI) to reflect the evolving macroeconomic situation, domestic market conditions, sectoral requirements, the external conditions and India’s experience in dealing with them in the country.

ii. The ECB policy is applicable to Foreign Currency Convertible Bonds (FCCBs) and foreign Currency Exchangeable Bond (FCEBs). FCCBs. means a bond issued by an Indian company expressed in foreign currency, and the principal and interest in respect of which is payable in foreign currency. Further, the bonds are required to be issued in accordance with the scheme viz., ‘‘Issue of Foreign Currency Convertible Bonds and Ordinary Shares (Through Depositary Receipt Mechanism) Scheme, 1993", and subscribed by a nonresident in foreign currency and convertible into ordinary shares of the issuing company in any manner, either in whole, or in part, on the basis of any equity related warrants attached to debt instruments.

iii. Foreign Currency Exchangeable Bond (FCEB) means a bond expressed in foreign currency, the principal and interest in respect of which is payable in foreign currency, issued by an Issuing Company and subscribed to by a person who is a resident outside India, in foreign currency and exchangeable into equity share of another company, to be called the Offered Company, in any manner, either wholly, or partly or on the basis of any equity related warrants attached to debt instruments. The FCEB must comply with the ‘‘Issue of Foreign Currency Exchangeable Bonds (FCEB) Scheme, 2008’’, notified by the Government of India, Ministry of Finance, Department of Economic Affairs vide Notification G.S.R.89(E) dated February 15, 2008. The guidelines, rules, etc. governing ECBs are also applicable to FCEBs.

iv. Preference shares (i.e. non-convertible, optionally convertible convertible) for issue of which funds have been received on or after May 1, 2007, would be considered as debt and should conform to ECB policy.

v. Foreign institutional Investors (Flls) investment in Government Securities and Corporate Bonds in India in Rupees are reckoned under the overall ECB limits.

vi. ECBs are being permitted by the Government as an additional source of finance to augment the resources available domestically to Indian corporate for financing import of capital goods, new projects, modernization/expansion of existing production units in real sector - industrial sector including small and medium enterprises (SME) and infrastructure sector - and in the services sector viz. hotels, hospitals and software companies for import of capital goods, for foreign currency and/or rupee capital expenditure. ECBs are approved within an overall annual ceiling, consistent with prudent debt management. Enduses of FCB for working capital, general corporate purpose and repayment of existing rupee loans are not permitted.

vii. A prospective borrower can access ECB under two routes, namely the automatic route and the approval route. A corporate, other than a financial intermediary, registered under the Companies Act, 1956, can access ECB under the automatic route up to US$ 500 million in a financial year both for rupee expenditure and/or foreign currency expenditure for permissible end uses. The borrowers in the services sector viz. hotels, hospitals and software companies can access ECB under the automatic route up to US$ 100 million in a financial year for import of capital goods, for rupee and/or foreign currency capital expenditure and NGOs engaged in micro finance activities up to US$ 5 million in a financial year.

viii. The ECB which is not covered by the automatic route is considered under the approval route on a case-by-case basis by RBI.

ix. ECB policy is operationalised through notifications issued by the Reserve Bank of India (RBI) under the Foreign Exchange Management Act, 1999. These can be accessed on RBI’s website.

x. The norms applicable to ECB are also applicable to Foreign Currency Convertible Bonds (FCCBs) in all respects, except in the case of housing finance companies for which criteria will be notified by RBI.

ECB Policy Developments in 2011

i. ECB policies have been substantially liberalized to facilitate more external funds to the infrastructure sector to augment the growth potential of the economy.

ii. A separate category of Non-Banking Financial Companies (NBFCs), viz. Infrastructure Finance Companies (IFCs) has been introduced for availing of ECB for on-lending to the infrastructure sector. Thew IFCs are allowed to avail of ECBs, including the outstanding ECBs, up to 50 per cent of their owned funds under the automatic route, subject to compliance with the prudential guidelines already in place and ECBs by IFCs above 50 per cent of the owned funds would be considered under the approval route.

iii. The facility of credit enhancement of raising debt through capital market instruments by entities in the infrastructure sector as also IFCs has been put in place.

iv. The definition of the infrastructure sector has been expanded by including farm level pre-cooling, for preservation or storage of agricultural and allied produce, marine products and meat.

v. A scheme of take-out financing has been permitted through ECB under approval route to enhance availability of credit to the infrastructure sectors, such as sea port and airport, roads including bridges and power sectors for the development of new projects subject to conditions stipulated by RBI in its A.P. (DIR Series) circular no. 04 dated July 22, 2010.

vi. Borrowers in the services sectors, viz., Hotels, Hospitals and Software were hitherto allowed to avail of ECB only up to USD 100 million per financial year under the automatic route, for foreign currency and/or rupee capital expenditure for permissible end-uses. As a measure of further liberalization, ECB beyond USD 100 million has been allowed to the borrowers in these specific services sectors under the approval route.

vii. Corporates engaged in the development of integrated township were permitted to avail of ECB, under the approval route, up to December 31, 2010. viii. Budget speech for 2011-12 announced Government’s intention to create special vehicles in the form of notified infrastructure debt fund (IDF) to attract foreign funds for financing of infrastructure. The primary purpose of setting up of IDFs is to pool resources from long term sources of funds, especially off-shore pension funds, insurance companies, sovereign wealth funds etc. to provide long term debt to infrastructure projects. The High Level Committee on ECB discussed the number of issues related to IDFs in its meeting held on 27th May, 2011 and decided to :

a. include IDFs as eligible borrowers under the ECB guidelines;

b. relax the condition about recognized lenders to IDFs under ECB guidelines to include pension funds, insurance companies, endowment funds, sovereign wealth funds and multilateral development banks (ADB/WB);

c. permit IDFs to utilize fresh ECB for on-lending in INR for infrastructure as defined in ECB policy;

d. allow refinance of existing loans for domestic infrastructure projects. The buy-back of bonds will be possible only after minimum lock-in period of five years for non-resident investors;

e. permit lending by IDFs to domestic infrastructure projects in Rupees only and not in foreign currency;

f. enhance the overall limits for raising ECB by each IDF to US$ 2 billion per year under the approval route.

ix. The global financial crisis brought a dampening effect on global stock prices. As a result, FCCBs issued by Indian companies were trading at deep discounts. Recognizing the potential benefits, RBI, in consultation with GoI had enabled a buy back window, both under automatic and the approval route. Similarly, a six month window was enabled to allow the companies to revise the conversion price of bonds in alignment with market price. Notwithstanding the improvements in FCCB market, in case of a few corporates, the conversion price of FCCBs is still higher and these FCCBs would be coming up for redemption soon.

But many issuers of the FCCBs have not provided adequate liquidity in their balance sheets nor do they have sufficient cash flows to honor the redemption obligations. These companies also have no backstop facility to fall back upon the event of a financial hardship. Hence in order to ease the redemption pressure, RBI has allowed Indian Corporate to raise fresh ECBs under approval route to refinance (not involving change in conversion price)/ restructure their FCCBs. This scheme is valid upto March 2012.

x. The High Level Committee on ECB decided to enhance the over all ECB ceiling for the financial year 2011-12 from US$ 40 billion to US$ 80 billion with the following sub limits :-

a. Pure ECB - US$ 30 billion,

b. Fll investment in Government sec urities - US$ 10 billion, and

c. Fll investment in corporate bond - US$ 40 billion.

xi. During the last financial year (April-March 2011), ECBs registered with the

Reserve Bank amounted to USD 25.776 billion, recording an increase of 18.90 percent over USD 21.678 billion during the same period in 2009-10, thereby acting as an important driver of capital flows. Of this, 63 per cent of the ECBs registered were under the automatic route and the remaining 37 per cent under the approval route.

Fll Investments in Government Securities and Corporate Bonds

Flls registered with SEBI were permitted to invest in Government Securities and corporate bonds up to USD 5 billion and USD 15 billion, respectively. On a review in the context of India’s evolving macro economic situation, its increasing attractiveness as an investment destination and need for additional financial resources for India’s infrastructure sector while balancing its monetary policy, it was decided to increase the limit of Fll investment both in Government securities and corporate bonds by US $ 5 billion would, however, be invested in securities with residual maturity of over five years and corporate bonds with residual maturity of over five years issues by companies in infrastructure sector. Press Release to this effect was issued on 23rd September, 2010.

Further, as per the Budget speech 2011-12, Hon’ble Finance Minister made an announcement to enhance the Fll limit for investment in Corporate Bonds with residual maturity of over five years issued by companies in infrastructure sector, by an additional limit of US $ 20 billion taking the limit to US $ 25 billion. This raised the total limit available to the Flls for investment in corporate bonds to US $ 40 billion. Since most of the infrastructure companies are organised in the form of SPVs, Flls would also be permitted to invest in unlisted bonds with a minimum lock-in-period of three years. However, the Flls will be allowed to trade amongst themselves during the lock-in-period. This budget announcement has been implemented on 31st March 2011.

Foreign Investment in India in equity

ADR/GDR/FCCB Scheme

A scheme was initiated during 1993 named Issue of Foreign Currency Convertible Bond sand Ordinary Shares (Though Depositary Receipt Mechanism) Scheme, 1993 to allow the Indian Corporate Sector to have access to the Global capital markets through issue of Foreign Currency Convertible Bonds (FCCBs/Equity Shares under the Global Depository Mechanism (GDR) and American Depository Mechanism (ADR).

An expert Committee under the Chairmanship of Sh. Saumitra Chauduri, Member, Economic Advisory Council to the Prime Minister was set up by this Department to review/streamline the ADR/GDR policy. The recommendations of the committee were considered and are under implementation.

Foreign institutional Investors (Fll) Scheme

A scheme for attracting portfolio from foreign Institutional Investors (Flls) has been operational since September, 1992. Under this scheme, Flls including institutions such as Pension Funds, Mutual Funds, Investment Trusts, Asset Management Companies, Nominee Companies and Incorporated/Institutional Portfolio Managers or their power of attorney holders are allowed to invest in all the securities traded on the primary and secondary markets.

Such securities would include shares, debentures and warrants issued by companies which are listed/to be listed on the Stock Exchanges in India and the schemes floated by domestic mutual funds. Flls are permitted to invest in Government securities including Treasury Bills. Flls who register themselves as debt Funds with SEBI are permitted to make 100% of their investments in Debt securities of Indian companies. Flls are now permitted to trade in all exchange traded derivative products as approved by SEBI subject to trading limits of trading members and their clients as prescribed by SEBI. Such portfolio investments by Flls are subject to investment ceilings as indicated below:

i) Individual FII/Sub-account 10% of the issued and paid up capital in a company

ii) Aggregate by all FIIs 24% of the issued and paid-up capital in a company which could be increased up to the sectoral cap/statutory ceiling, as applicable, by the Indian company concerned by passing a resolution by its Board of Directors followed by passing of a special resolution to that effect by its General Body

Foreign Venture Capital Investors (FVCIs) scheme

As per SEBI guidelines, any company or trust or a body corporate can apply to carry on any activity as a venture capital fund, except a small negative list which includes NBFC (except those which are engaged in gold financing for jewellery) and activities not permitted under industrial policy of Government of India. A venture capital fund may raise monies from any investor whether Indian, foreign or non-resident Indians by way of issue of units. A VCF has to invest at least 66.67% of the investible funds in unlisted equity shares. However, 33.33% could be invested in, among others, IPOs of an undertaking whose shares are proposed to be listed, Preferential allotment of equity shares of a listed company subject to lock in period of one year, the equity shares or equity linked instruments of financially weak company or a sick.

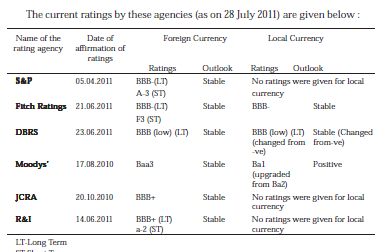

India’s Sovereign Credit Rating

Presently, India’s sovereign debt is rated by six international credit rating agencies namely, Standard and Poor’s (S&P), Moody’s Investor Services, FITCH, Dominion Bond Rating Service (DBRS), Japanese Credit Rating Agency (JCRA) and Rating and Investment Information Inc., Tokyo (R&I). Information flow to these credit rating agencies has been streamlined and the Interact on process has been made more structured.

During 2011 (as on 28.7.2011), S&P, Fitch Ratings and R&I have maintained

their previous ratings. On 23.6.2011, DBRS have upgraded its outlook for foreign

currency as well as local currency from negative to stable.

Other Initiatives

Financial Stability and Development Council (FSDC)

Many financial products are also hybrid and cut across regulatory domains. At present there are multiple regulators in India, each regulating specific products. This leads to silo structures, which do not encourage coordination across the broad spectrum of the financial sector and lead to sub-optimal outcome. Accordingly, with a view to strengthening and instituionalising financial stability architecture in the country and take up the development issues of the sector with out prejudice to the autonomy of the regulators, the government in its budget 2010-11, announced the creation of an apex-level Financial Stability and Development Council (FSDC).

The Chairman of the Council is the Fiance Minister of India and its members include the heads of the financial sector regulatory authorities; Finance Secretary and/ or Secretary, Department of Economic Affairs (DEA); Secretary, Department of Financial Services; and the Chief Economic Advisor. A Sub-Committee of FSDC has also been set up under the chairmanship of Governor, RBI.

The Council has already met thrice to discuss issues important for our economic growth. During its third meeting held on 27th July 2011, FSDC discussed issues relating to state of the Indian Economy Short term Prospects and Challenges, Sovereign Credit Rating of India: Issues and Way Forward and Monitoring Financial Stability. The sub committee of FSDC has also met twice, last meeting having been held on 24th May 2011.

Financial Sector Legislative Reforms Commission (FSLRC)

Finance Minister, in 2010-11 Budget, inter alia, announced the proposal to set up a Financial Sector Legislative Reforms Commission. The resolution notifying the constitution of the Commission was issued on March 24th, 2011. The setting up of this Commission is the result of a felt need to simplify and with a view to rewrite financial sector legislations, including subordinate legislations, in tune with the requirements of the future to bring in greater clarity and synergy.

There are a large number of Acts (about 60 have been identified) and multiple Rules and Regulations that govern the financial sector in India today. Large number of amendments to these Acts done at different times has increased the ambiguity and complexity of the system. This architecture is sub-optimal in addressing issues of an increasingly dynamic, complex and inter-connected financial world. The Commission will review, with a view to rewrite, financial sector legislations making them more consistent with each other. This will result in removing ambiguity, regulatory gaps and overlaps among the various legislations. This will also make legislations more coherent and dynamic as well as bring them in tune with changing financial landscape. The long run outcome of this process would be efficient financial intermediation that would enhance growth.

The Commission is chaired by justice B.N. Srikrishna, former Judge of the Supreme Court of India and has members having expertise in the fields of finance, economics, law and other relevant fields. The Commission has its headquarters at Delhi and will submit its Report to the Finance Minister within 24 months of the date of notification.

Financial Action Task Force (FATF)

The Financial Action Task Force (FATF) is an inter-governmental policy making body, that has a ministerial mandate to establish international standards for combating money laundering and terrorist financing. India joined the Financial Action Taks Force (FATF) as its 34th member in June, 2010. At present, FATF has 36 members comprising of 34 countries and two organizations namely, the European Union and the Gulf Cooperation Council. At the time of joining FATF, India gave an Action Plan to over come certain deficiencies in a time bound manner. The items of the Action Plan were divided into immediate short term and Medium term items, which were to be completed by June, 2010 March, 2011 and March, 2012 respectively. India has completed the Immediate and Short term Action Plan items within the stipulated time and the same have been ack nowledged by the FATF technical onsite team which visited India in April, 2011.

India participated in the Financial Action Task Force (FATF) plenary and working group meetings held in Mexico City, Mexico from 20-24 June 2011. The plenary meeting discussed India’s Follow up Report of the FATF technical onsite team which visited India in April 2011 to assess India’s fulfillment of its Short term Action Plan and if it is on track to fulfil its Medium term commitments. The FATF secretariat commended India’s commitment to a strong anti-money laundering (AML) combating financing of terrorism (CFT) regime and acknowledged that India has made significant progress on all action points as per the time schedule. This view was shared by the FATF Plenary.

EURASIAN GROUP

-in December 2010, India became 9th member of the Eurasian Group, which is a Financial Action Task Force (FATF) styled regional body, responsible for enforcing global standards on AML and CFT. The other members are Russia, China, Turkmenistan, Serbia, Tajikistan, Uzbekistan, Belarus and Kazakstan. The group also has 16 nations and 15 organisations as observer. India is leading the project, ‘Money laundering through Securities Market’ in the EAG. India also participated in the joint FATF-EAG high level mission to Tajikistan with regard to its asset repatriation program. India is committed at the highest of the Government to adopt, enforce and contribute to international best practices in AML and CFT.

Financial Stability Board (FSB)

The Financial Stability Forum (FSF) was established by the G7 Finance Ministers and Central Bank Governors in 1999 to promote international financial stability through enhanced information exchange and international cooperation in financial market supervision and surveillance. It decided as its plenary meeting in London on 11-12 March, 2009 to broaden its membership and to invite as new members the G20 countries that were not initially in the FSF. These included Argentina, Brazil, China, India, Indonesia, Korea, Mexico, Russia, Saudi Arabia, South Africa and Turkey. In order to mark a change and convey that the FSF will play a more prominent role in this direction in the future, the FSF was re-launched as the Financial Stability Board (FSB) on April 2, 2009, with an expanded membership and a broadened mandate to promote financial stability.

FSB comprises of national financial authorities (central banks, supervisory authorities and finance ministries) from the G20 countries, as well as international financial institutions, international regulatory and supervisory groupings, committees of central bank experts and the European Central Bank. Regular interaction with the Financial Stability Board takes place through periodic conference calls and meetings. Information is exchanged with FSB member jurisdictions frequently as per international requirements. Capital Markets Division of the Ministry of Finance coordinates with the domestic financial sector regulators and other agencies to consolidate and share India’s views with the FSB who in turn share it with the G-20 that continuously monitors the working of the FSB.

Financial Stability Assessment Programme

India’s Financial Sector Assessment Programme (FSAP) was initially done by IMF/ World Bank in 2000-2001 but it was not made public as it was part of the Pilot FSAP assessment of 12 countries. The Committee on Financial Sector Assessment (CFSA) - co-chaired by Deputy Governor RBI and Finance Secretary-completed a selfassessment in 2009. There port is in public domain and is hosted on the RBI website http://www.rbi.org.in/Scripts/bs_viewcontent.aspx?Id=1966). FSB members have committed to, inter-alia, undertaking periodic peer reviews. As a member of FSB, India requested IMF/World Bank to conduct such a review by way of full-fledged Financial Sector Assessment Programme (FSAP). First Mission of the FSAP visited India during June 15 to July 1, 2011 for India’s FSAP evaluation.

Bilateral Co-operation with Countries/Organizations

1. India-UK Development Cooperation

The Government of UK has been providing bilateral assistance to India since 1958. UK is the largest provider of grant assistance to India. Development assistance from UK is largely administered by its Department for International Development (DFID). DFID has been providing bilateral development assistance for implementing Central and State Sector projects. DFID also provides assistance to Multilateral Institutions, namely, World Bank, Asian Development Bank (ADB), United Nations Children’s Fund (UNICEF), World Health Organisation (WHO) for implementing programmes in India. Besides, DFID through its civil society programmes, viz. Poorest Areas Civil Society Programme (PACS) and International Non-Government Organisation Partnership Agreements Programme (IPAP) supports Indian NGOs.

DFID focuses its development assistance in the area of education, health & HIV/ AIDS, urban-slum improvement and rural livelihoods with the aim to achieve the target of Millennium Development Goals (MDGs). Apart from supporting national programmes like Sarva Shiksha Abhiyan (SSA), Reproductive & Child Health (RCH), National AIDS Control Programme (NACP), DFID supports three focal States, i.e., Bihar, Orissa and Madhya Pradesh in the identified priority areas.

2. Indo-Italy Bilateral Cooperation

Italy has been providing concessional assistance to India since 1981. Prior to 1981, Italy was providing suppliers’ credit to importers directly. Bilateral agreement on Technical Cooperation concluded in February, 1981 whereby Italy agreed to provide experts’ services and related equipment on grant basis for specific projects. Government of Italy is providing an interest free loan amounting to Euro 2,58,22,84,495 for Water Supply and Solid Waste Management Projects in 16 selected towns of West Bengal, with repayment period of 39 years, including a grace period of 19 years. The project was signed on 10th January, 2006. A loan amount of Rs 1857 crore has been disbursed till date.

3. Indo-Norway Bilateral Cooperation

The Norwegian Bilateral Development Assistance Programme in India began in 1952 with traditional fisheries project in Kerala by way of technical assistance and financial support. Since 1970, Norwegian assistance has been received as grants for technical cooperation and local cost projects, mainly in social and environment sectors.

Norway, being a non G-8 and non-EU country, ODA from Norway is not acceptable in accordance with the existing policy on Bilateral Development Cooperation.

The First Annual Bilateral Meeting between Senior Officers of the ministries of Finance of India and Norway was held on 22-23 May, 2009 to explore bilateral cooperation between the two nations. The meeting was centered around the international economic outlook, including the financial crisis; Macro-economic and monetary policies in India; Policies and prospects in Norway; Renewal of the Bilateral tax treaty; The Norwegian pension Fund-Global and investments in Asia and India; Climate Policies, including Norwegian Purchases of CDM Projects in India.

The 2nd annual bilateral meeting between Senior Officers of the ministries of Finance of India and Norway was held on 1st October, 2010 in North Block, New Delhi. The meeting was centered around the General update on economic developments, including the handling of issues emerging from the financial crisis; Norwegian Government Pension Fund-Global; Tax Havens and illegal financial flows; G20 and IMF; Climate change, green economic growth and CDM and bilateral double taxation agreement. The 3rd Annual Bilateral Meeting between Senior Officers of the Ministries of Finance of India and Norway was held on 9-10th June, 2011.

4. Indo-Austria Bilateral Cooperation

India and Austria enjoy a close and friendly economic relationship. Presently, there is no activity under bilateral development cooperation programme between India and Austria. As per the existing guidelines, Austria being EU & non-G8 country, need to commit a minimum annual development assistance of US$ 25 million to India Austria has not responded to the existing policy on the Bilateral Development Cooperation.

Subsequent to the meeting between Mr. Josef Proll, Federal Minister of Finance, Austria and Hon’ble FM on 18th February, 2010. Austria desired to enter into negotiations for a possible future financial cooperation with India through Austrian Soft Loan Scheme for financing of commercially non-viable projects/sectors, e.g., infrastructure, automotive industries, hydropower, clean energy and energy efficiency/transportation. This is under consideration.

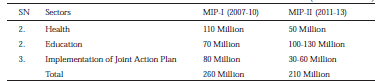

5. European Union (EU) Development Cooperation

The European Union (EU) provides assistance through Development Cooperation in form of grants. The priority areas include environment, public health and education. EU implements development cooperation programmes through Country Strategy Paper (CSP). The CSP is based on EU objectives, on the policy agenda of the partner country and on an analysis of the country/region situation. The current CSP for the 2007-2013 covers Multiannual Indicative Programme-I (MIP-I) for the period 2007-2010 and Multiannual Indicative Programme-II (MIP-II) for the period 2011-2013.

An Memorandum of Understanding (MoU) for MIP-I was signed between India and EU on November 30, 2007 during the 8th India-EU Summit held in New Delhi for an amount of Euro 260 million, while MoU for MIP-II was signed on February 22, 2011 at New Delhi for an amount of Euro 210 million. Thus for CSP 2007-13, the total amount of EC grants of Euro 470 million.

Department of Commerce is the nodal ministry for implementation of Joint

Action Plan (JAP). JAP provides the necessary framework for deeper cooperation

and engagement through adoption of specific measures in various sectors, viz.,

Industrial Policy, Science & Technology, Finance & Monetary Affairs, Environment,

Energy, Information & Communication Technologies, Transport, Shipping, Space

Technology, Pharmaceuticals & Biotechnology, Agriculture, Customs, Employment

and Social Policy, Business Cooperation and Development Cooperation.

The major programmes of Government of India which receive EU aid along with other development partners are Sarv Shiksha Abhiyan (SSA) and National Rural Health Mission (NRHM)/Reproductive Child Health (RCH). India-EU Sub Commission on Development Cooperation is a forum at which bilateral issues relating to development cooperation with EU are discussed. The last meeting of India-EU Sub Commission on Development Cooperation was held at New Delhi on May 4, 2011. The annual meeting is held alternatively between Delhi and Brussels. The Sub Commission on Development Cooperation reports to India-EU Joint Commission.

6. Indo-German Development Cooperation

The Federal Republic of Germany (FRG) and been providing both financial and technical assistance to India since 1958. The German Federal Ministry for Economic Cooperation & Development (BMZ) provides funds for financial and technical Cooperation, while the German Federal Ministry for the Environment, Nature Conservation and Nuclear Safety (BMU) provides funds for Technical Cooperation. Financial Assistance is provided in the form of soft loan, reduced interest loan as well as grants routed through KfW, the German Government’s Development Bank. The technical assistance is provided in the form of grant in the form of experts, equipments, consultancy etc. through the GIZ (earlier GTZ) - a fully-owned corporation of German Government.

The Strategic Framework for Indo German Bilateral Development Cooperation acts as a guiding framework for bilateral development partnership. The objective is to focus on making greatest possible impact on national development processes and poverty reduction and supplementing efforts to solve global structural problems like environmental degradation and climate change. In alignment with our Plan priorities and development agenda, priority areas to be focused under Indo German bilateral development cooperation are :

i) Energy, including energy efficiency, renewable energy, sector reforms.

ii) environment, including urban and industrial environmental protection, natural resources

iii) Sustainable Economic Development, including rural financing, social security systems, SME development and financing.

Main projects being funded under German assistance include programmes for promotion of energy efficiency, support to SME sector, promotion of new and renewable energy sources, financial assistance to NABARD/SIDBI/REC/IREDA, natural resource management, climate change adoption etc. For the year 2010, the total commitment from Germany, under bilateral development cooperation, amounted to nearly Euro 500 million.

7. India-France Development Cooperation

The Government of France has provided development assistance to India through French Embassy in New Delhi since 1968. Earlier, the French assistance was provided as Treasury Loan, which was ‘tied’ to supply of goods and services from France. In view of our policy on development co-operation of 2004 and also in terms of Paris Declaration on Aid Effectiveness (signed by both countries), ‘tied’ assistance form was discontinued.

In 2006, Government of France proposed to provide untied development assistance to India through the French agency for Development (AfD). In this regard, an Inter-governmental Agreement was signed between the two Governments on January 25, 2008 during the State visit of French President Nicholas Sarkozy to India. In pursuance of the inter-governmental Agreement, an Memorandum of Understanding (MoU) was signed between the Department of Economic Affairs and AfD on September 29, 2008. The MoU covers the mutual understanding on priority areas, portfolio procedures, financial instruments, concessionality, etc. The AfD portfolio is focussed at projects contributing to the sustainable management of global public goods, inter alia (i) energy efficiency, renewable energy and public transport (ii) the preservation of biodiversity, and (iii) limitation of the spread of emerging and contagious diseases.

Main projects being funded under AfD assistance include programmes for promotion of biodiversity, urban development projects to improve water supply, transportation, credit lines for environment programmes, financial assistance to organisations like IREDA, SIDBI etc. For the year 2010, the total commitment from AfD, under bilateral development cooperation, amounted to nearly Euro 125 million.

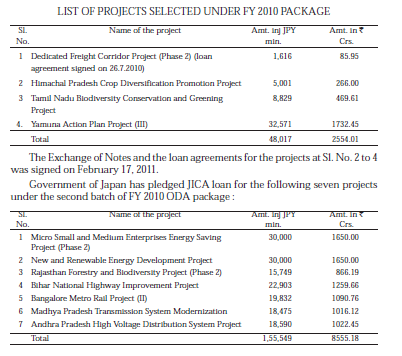

8. Indo-Japan Bilateral Relations

India has received a commitment from Government of Japan for Official Development Assistance (ODA) for loan of Yen 203.566 billion (Rs. 11197.81 crores approx) for FY 2010-11. With this, the cumulative ODA loan from Government of Japan has reached Yen 3320.369 billion on commitment basis, till 31st March, 2011. Notes were exchanged between Government of India and Government of Japan on February 17, 2011 for the FY 2010 JICA ODA loan package. The details of the projects are as under :

The Exchange of Notes for this package was to be signed by end March, 2011. Post earthquake, Government of Japan has postponed the signing of exchange of notes for these projects. The notes are expected to be exchanged in next financial year, i.e., FY 2011.

Government of Japan provides assistance under Grant Aid and Technical Cooperation Programme. There are seven ongoing projects under Grant Aid, Technical Cooperation and Development Study Programmes, in the field of health, education, environment, etc. There are four ongoing Model Projects in the field of energy conservation/alternative energy source under Green Aid Plan of Government of Japan. Apart from this, Government of Japan also provides assistance to NGOs for implementation of Project.

9. Government of India supported Exim Bank Lines of Credit extended to foreign countries

In the year 2010-11 (i.e. April, 2010 to March 2011), following proposals for extension of GOI supported lines of credit to be routed through the Exim Bank of India have been approved :

i. US$ 25 million credit line to the Government of Mozambique

ii. US$ 42 million credit line to the Government of DR Congo

iii. US$ 382.37 million credit line to the Government of Sri Lanka

iv. US$ 61.60 million credit line to the Government of Kenya

v. US$ 41.60 million credit line to the Government of Comoros

vi. US$ 15 million credit line to the Government of Cambodia

vii. US$ 48.50 million credit line to the Government of Mauritius

viii. US$ 213.31 million credit line to the Government of Ethiopia

ix. US$ 72.55 million credit line to the Government of Lao PDR

x. US$ 20 million credit line to the Government of Mozambique

xi. US$ 168 million credit line to the Government of DR Congo

xii. US$ 150 million credit line to the ECOWAS Bank Investment & Development (EBID)

xiii. US$ 50 million credit line to the Government of Malawi

xiv. US$ 40 million credit line to the Government of Maldives

xv. US$ 10 million credit line to the Government of Swaziland

xvi. US$ 27.50 million credit line to the Government of Senegal

xvii. US$ 91 million credit line to the Government of Ethiopia

xviii. US$ 80 million credit line to the Government of Burundi

India and the International Monetary Fund (IMF)

International Monetary Fund (IMF) was established along with the International Bank for Reconstruction and Development at the Conference of 44 nations held at Bretton Woods, New Hampshire, USA in July 1944. The IMF came into formal existence in December 1945, when its first 29 member countries signed its Article of Agreement. It began operations on March 1, 1947. At present, 187 nations are members of IMF.

India is a founder member of the IMF. Finance Minister is the ex-officio Governor on the Board of Governors of the IMF, which is the highest decisionmaking body of the IMF. RBI Governor is the Alternate Governor at the IMF. India is represented at the IMF by an Executive Director, currently Dr. Arvind Virmani, who also represents three other countries as well, viz. Bangladesh, Sri Lanka and Bhutan.

IMF was created to promote international monetary cooperation; facilitate the expansion and balanced growth of international trade; promote exchange stability; assist in the establishment of a multiateral system of payments; make its general resources temporarily available to its members experiencing balance of payments difficulties under adequate safeguards, and to shorten the duration and lessen the degree of disequilibria in the international balances of payments of members.

Since the IMF was established, its purposes have remained unchanged but its operations - which involve surveillance, financial assistance and technical assistance - have developed to meet the changing needs of its member countries in an evolving world economy.

Board of Governors

The Board of Governors is the highest decision-making body of the IMF. It consists of one Governor and one Alternate Governor from each member country. For India, Finance Minister is the ex-officio Governor on the Board of Governors of the IMF. Governor, RBI is India’s Alternate Governor. The Board of Governors usually meets once a year to discuss the work of the respective institutions at the Annual meetings, which are generally held in September/October. These Annual Meetings have customarily been held in Washington D.C. USA, for two consecutive years and in another member country in the third year.

International Monetary and Financial Committee

The International Monetary and Financial Committee (IMFC) of the Board of Governors is an advisory body made up of 24 IMF Governors, Ministers, or other officials of comparable rank, representing the same constituencies as in the IMF’s Executive Board.

Executive Board

The day-to-day management of the IMF is carried out by the IMF’s 24-member Board of Executive Directors, who are appointed/elected by member countries/ group of countries.

Quota

Upon joining the IMF, each country is allocated a quota based approximately on the relative size of its economy. The quota determines the country’s financial contribution to the IMF, its voting power and ability to access IMF financing. Quota subscriptions generate most of the IMF’s financial resources.

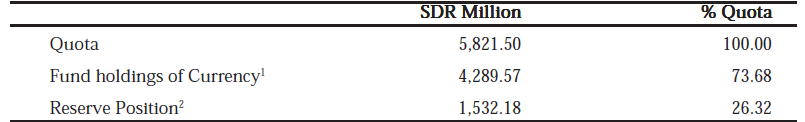

India’s current quota in the IMF is SDR (Special Drawing Rights) 5,821.5 million in the total quota of SDR 237 billion, giving it a share holding of 2.44%. However, based on voting share, India (together with its constituency countries, viz., Bangladesh, Bhutan and Sri Lanka) is ranked 22nd in the list of 24 constituencies.

2 Share of a India’s quota paid in reserve assets, i.e. SDRs or usable currencies

The IMF’s Board of Governors conducts general quota reviews at regular

intervals (usually every five years). Any changes in quotas must be approved by an

85 percent majority of the total voting power, and a member’s quota cannot be

changed without its consent. There are two main issues addressed in a general quota

review: the size of an overall increase and the distribution of the increase among

the members.

The Board of Governors at the IMF has adopted the resolution on ‘‘Fourteenth General Review of Quotas and Reform of the Executive Board of the IMF’’ on 16th December 2010. When the resolution becomes effective, the total size of Fund quotas would increase by 100 per cent from the 2008 quota and voice reform to approximately SDR 476.8 billion.

Significantly, the reforms will lead to a realignment of quota shares of member countries, with the shifts to dynamic Emerging Market and Developing Countries (EMDCs) and from over - to under-represented countries while protecting the voting share of the poorest members.

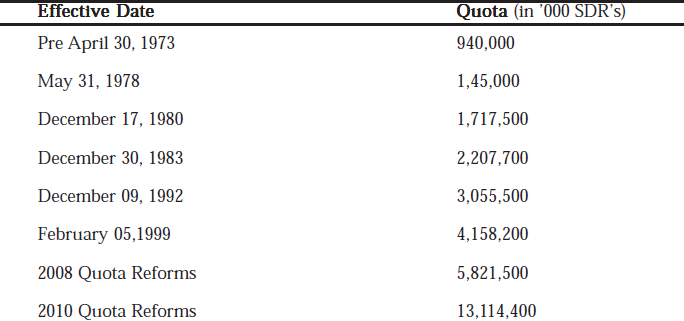

There will be four EMDCs (Brazil, China, India, and Russia) among the 10 largest shareholders in the IMF, with, India’s quota share expected to increase from the current 2.44% to 2.75%, once the reforms become effective. This would make India the 8th largest quota holding country at the IMF. As can be seen from the table below, India’s quota has been increasing overtime :

The quota largely determines a member’s voting power in IMF decisions. Each IMF member’s votes are comprised of basic votes plus one additional vote for each SDR 100,000 of quota. The 2008 reform fixed the number of basic votes at 5.502 percent of total votes. India currently has 58,954 votes (2.35% of the total). Based on voting share, India (together with its constituency countries, viz., Bangladesh, Bhutan and Sri Lanka) is ranked 22nd in the list of 24 constituencies.

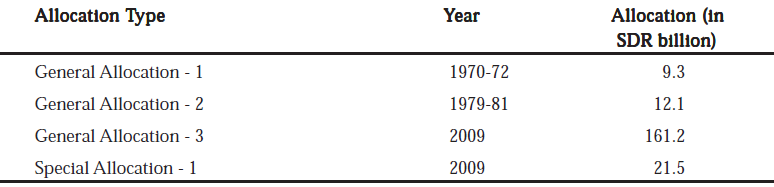

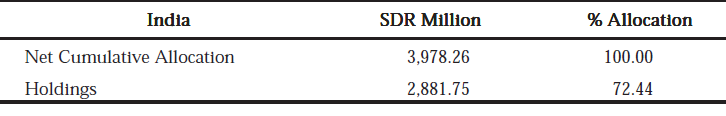

General and Special SDR Allocations by IMF

SDR is on international reserve asset, created by the IMF in 1969 to supplement its member countries', official reserves. Its value is based on a basket of four key international currencies, and SDRs can be exchanged for freely usable currencies. Under its Articles of Agreement, the IMF may allocate SDRs to members in proportion to their IMF quotas. These members must be participants in the SDR department of the IMF (all Fund members need not necessarily be participants in the SDR department of IMF, although at present all are).

Such an allocation provides each member with an asset (SDR holdings) and an

equivalent liability (SDR allocation). If a member’s SDR holdings rise above its

allocation, it earns interest on the excess; conversely, if it holds fewer SDRs than

allocated, it pays interest on the shortfall. In India’s case, the holdings are less than

the allocation as a result of which India is paying interest.

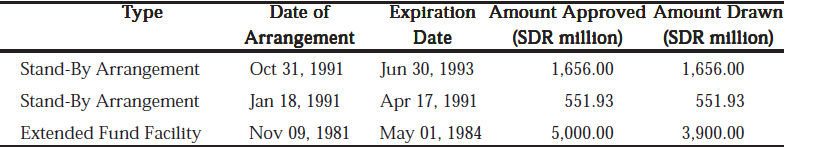

Borrowings by India

Lending Arrangements, which are similar to a line of credit, are approved by the IMF Executive Board to support a country’s adjustment program. The arrangement requires the member to observe specific terms in order to eligible to receive a disbursement. The IMF lends under Stand-by and Extended arrangements, and at reduced rates, under Poverty Reduction and Growth Trust arrangements. India has taken assistance from IMF three times. However, repayment of all the loans taken from the IMF has been completed on May 31, 2000. India is now a contributor to the IMF.