External finances: India

This is a collection of articles archived for the excellence of their content. |

Contents |

Balance of payments

A backgrounder

What India pays the world & what it gets bacl, October 1, 2018: The Times of India

From: What India pays the world & what it gets bacl, October 1, 2018: The Times of India

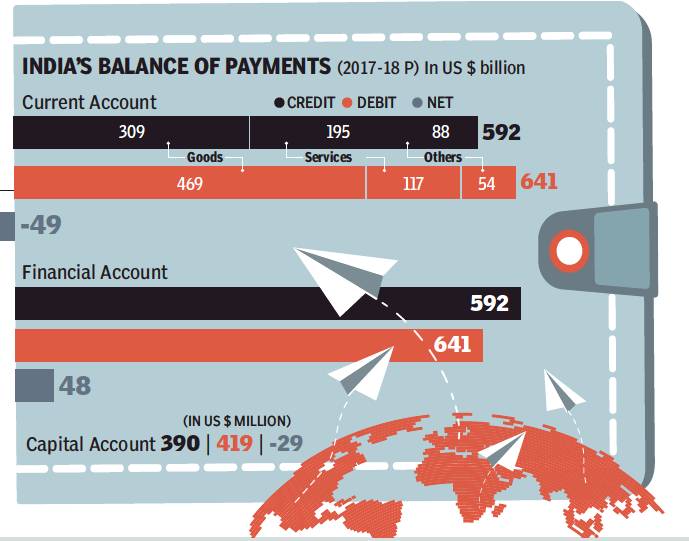

Amid galloping oil prices and a slowing foreign investment, India’s current account deficit for 2017-18 has touched $48bn, the highest since 2012-13. The value of what India imports vastly exceeds what it exports, spelling concern for our balance of payment (BoP) position. But what is BoP and how is it determined...

What is balance of payment?

Balance of payment is simply a record of all international transactions done by the residents, companies or the government of a country with rest of the world. The transactions are recorded as credits and debits. For instance, entries like Indians spending to buy foreign goods or spending money in foreign trips will be recorded as debit from the Indian account. Similarly foreigners spending money to buy Indian goods or for tourism will be shown as credit to the Indian account.

What is current account deficit?

Current account is a part of the overall balance of payment and reflects a country’s international trade. It primarily measures net trade in goods and services along with all other earnings or payments that are required to be completed in a defined time period. Latest data shows India has a $48 billion current account deficit. India’s exports, which are much lower than imports, is the main cause of current account deficit. Another major component of India’s deficit is foreign investment income, where profits are repatriated to a company’s origin country. India is in surplus in trade in services and a net gainer of remittances. These two surplus components, however, are not large enough to offset the trade deficit.

What services bring current account surplus to India?

The detailed analysis of service component of current account deficit shows that the largest component of India’s services surplus comes from IT industries. Similarly, India is a net exporter of travel meaning foreigners visiting India spend more money than Indians visiting foreign countries. India has to send abroad a significant amount of money for use of intellectual property. India is a net importer of recreational services that include services in film, music industry and so on.

What are the capital and financial account components of balance of payment?

Earlier balance of payment consisted only of current and capital account. The capital account indicated if the country was a net importer or exporter of capital. Recently IMF has bifurcated capital account into capital and financial account. According to IMF’s definition the capital account measures credit and debit for nonproduced nonfinancial assets and capital transfers. These include entries like land sold to embassies, sales of lease and licences and so on.

International loans

Poor utilisation: 2009-15

The Times of India, Aug 19 2016

India's failure to start development projects on schedule and draw international loans in time has led to the government paying over Rs 600 crore by way of commitment charges in 2010-16. Commitment charges are a fee charged by a lender to a borrower for an unused credit line or undisbursed loan. These charges on undrawn balance of external loans are paid on principal amount rescheduled for drawal on later dates.

A study of the undrawn balance year after year, for which India has been paying additional commitment charges, indicates that the NDA regime's track record in meeting deadlines of projects has been as bad as its predecessor.A comptroller and auditor general (CAG) report, tabled in Parliament last month, shows the undrawn balance of external loans in 2014-15 was Rs 2,10,099 crore.

The penalty paid as commitment charges in 2014-15 was Rs 111 crore. This was Rs 117 crore in 2013-14 and Rs 93 crore the year before that. In the six years between 2009-10 and 2014-15, India has paid over Rs 600 crore as commitment charges making the loans costlier than available in international market.

“The need for payment of commitment charges points towards inadequate planning of the loanscredits without proper linkages with the requirement leading to avoidable payment of commitment charges,“ the CAG says in its report.

India had an external debt of Rs 3.66 lakh crore (as of 31st March 2015), of which Rs 2.37 lakh crore (or 65%) was unutilised committed loans. An earlier study by finance ministry had found that between 1991 and 2009, the government had paid Rs 1,400 crore as commitment charges for unutilised loans.

The sectors that lag behind in matching the pace of the expenditure committed by the government while negotiating the loans include urban development (Rs 33,700 crore), atomic energy (Rs 31,300 crore), roads (Rs 29,500 crore), power (28,500 crore), railways (25,100 crore), water supply & sanitation (Rs 14,900 crore) among others.