Freshworks

This is a collection of articles archived for the excellence of their content. Additional information may please be sent as messages to the Facebook community, Indpaedia.com. All information used will be gratefully acknowledged in your name.

This is a collection of articles archived for the excellence of their content. |

YEAR-WISE DEVELOPMENTS

2021: listing, valuation

Sindhu Hariharan, Sep 23, 2021: The Times of India

From: Sindhu Hariharan, Sep 23, 2021: The Times of India

From: Sindhu Hariharan, Sep 23, 2021: The Times of India

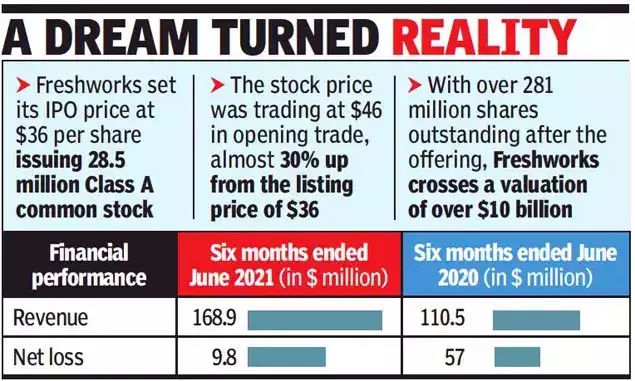

CHENNAI: Founded in Chennai and now headquartered in California, customer service software maker Freshworks got listed on the Nasdaq stock exchange raising more than $1billion from the public and markets valuing the company roughly at more than $10 billion. In the process, 500 of its employees have become millionaires.

The stock traded at a high of $46.67 per share on opening trade on Wednesday, almost 30% up from the listing price of $36. Freshworks’ IPO involves issue of 28.5 million shares (Class A stock) at $36 per share. Owing to positive sentiment, the IPO price was fixed above the expected price range of $32 to $34 per share.

In addition, Freshworks has granted underwriters a 30-day option to purchase up to an additional of 2.85 million shares of Class A common stock at the IPO price minus underwriting discounts and commissions.

“When we started in Chennai in 2011, we didn’t dream of this…We have increased the audacity of our dreams over time. I am excited about what this means for Indian SaaS and I believe we are going to see more global product companies from India after this,” Freshworks founder Girish Mathrubootham said in a press conference.

He added that the IPO gives him a great sense of fulfilment as more than 76% of Freshworks’ employees hold shares in the company and they have earned it. “More than 500 of our employees in India are crorepathis now, and 70 of them are under 30 years of age,” he said. Mathrubootham along with his family and a large “kudumba” of employees and investors of Freshworks rang the bell at the Nasdaq trading floor.

Freshworks intends to use the net proceeds from the offering for general corporate purposes including working capital, operating expenses, and capex, and to scout for inorganic opportunities.

As a founder-led business that is free cash flow positive, shrinking its losses and is known for having a great corporate culture, the SaaS firm has received the thumbs up from most SaaS and market analysts. Snowflake, Asana and Zoom are some of the recent SaaS biggies that have had a good run in the US markets.

Interestingly, the dollar-based net revenue retention of Freshworks, a measure of customer stickiness, stands at 118% which is a big plus for a company that counts small and mid-size businesses as its largest customer category.

Among Freshworks’ key shareholders are Tiger Global and Accel India that own around 26% and 25% respectively. Accel was the first investor to back Freshworks and has consistently backed the company in successive rounds. VC firm Sequoia Capital has a 12% stake in Freshworks, founder Mathrubootham holds around 7%, and Google owns 8% stake in it.

Freshworks CFO Tyler Sloat said that while it is natural for VCs to exit over time, the current set of VC investors are extremely bullish on what Freshworks can do in the future.

“[It’s an] amazing day for all the founders across the globe in dreaming big and executing towards that dream. Congrats FRSH. Great to have partnered with @mrgirish from day 1 of this company. Go @Accel_India,” Shekhar Kirani of Accel India, the first institutional backer of Freshworks, tweeted.

“We are fortunate to be partners in this industry-defining company, along with Accel, Tiger Global and CapitalG. Having led or co-led three financing rounds, our investment in Freshworks represents Sequoia India’s single largest investment from its India/SEA funds,” Mohit Bhatnagar and Carl Eschenbach of Sequoia said in a note. Freshworks is headquartered in San Mateo, California, but majority of its product and engineering staff are based in Chennai. Cognizant and Sify Technologies are the other tech companies with large presence in Chennai and listed on Nasdaq.