Godrej

This is a collection of articles archived for the excellence of their content. |

Contents[hide] |

History

MG Arun , Lock, Stock and Barrel “India Today” 21/8/2017

Established in 1897

Through many of its businesses, from locks, soaps and animal feed to engines powering India's space programmes, the group has played a big role in the evolution of various industries in the country. The group has its roots in India's Independence and swadeshi movement. Founder Ardeshir Godrej failed in a few ventures before striking success with the locks business. Next came security equipment and steel furniture. From soaps, it moved to detergents and personal/ household products. Since vegetable oil was used to make soap, the byproduct, oil cake, was marketed as animal feed. With a large landholding in Vikhroli near Mumbai, the group also forayed into real estate.

The Godrej group enjoys the patronage of 1.1 billion consumers globally and commands a revenue of over $4.1 billion. In 1918, the company launched Chavi, the first soap in the world without animal fat. Another soap, Godrej No. 2, was launched in 1919. Ardeshir's explanation on the name: "If people find No. 2 so good, they'll believe No. 1 to be even better!" The Godrej No. 1 soap was launched in 1922. Godrej products were endorsed by Annie Besant and Rabindranath Tagore. Mahatma Gandhi, in a letter to a Godrej competitor, once wrote: "I hold my brother Godrej in such high regard that if your enterprise is likely to harm him in any way, I regret very much I cannot give you my blessings."

The family tree; history: 1897-2008

June 27, 2019: The Times of India

Godrej may see restructuring as clan differs on biz strategy

‘Younger Gen Will Want To Move In Different Directions’

Mumbai:

Consumer goods-toreal estate conglomerate Godrej could see a restructuring as differences have surfaced between family members over the way forward for the 122-yearold, $5-billion enterprise. Group chairman Adi Godrej and his brother Nadir Godrej are on one side while cousins Jamshyd Godrej and Smitha Godrej Crishna are on the other. A TV report said the clan are also split over the development of a 1,000-acre land parcel they own in Mumbai.

Investment banker Nimesh Kampani and lawyer Zia Mody are advising Jamshyd Godrej while Kotak Mahindra Bank’s chief Uday Kotak and Cyril Shroff of legal firm Cyril Amarchand Mangaldas are assisting Adi Godrej. A Godrej group spokesperson declined to comment on the matter. However, people familiar with the matter confirmed the appointment of top bankers and lawyers to mediate between the two branches of the family. The conflict may be as much a clash of personalities as a difference in world views, especially among the younger Godrejs.

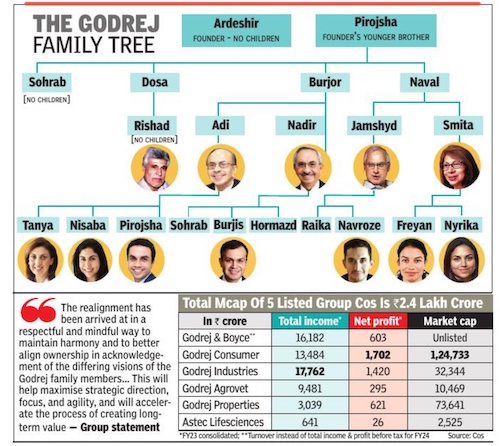

The Godrej group was founded by Ardeshir Godrej and his younger brother Pirojsha Godrej in 1897. Its origins started with the sale of locks after Ardeshir read news reports about rising burglaries in Mumbai. Ardeshir died childless, while Pirojsha had four sons — Sohrab, Dosa, Burjor and Naval. Sohrab had no children. Dosa’s son Rishad is not involved in running of the enterprise, though he is a shareholder. A wildlife enthusiast and photographer, he doesn’t have any children. Burjor’s children are Adi and Nadir, who between them oversee Godrej Properties, Godrej Industries, Godrej Consumer Products and Godrej Agrovet.

Naval’s children are Jamshyd Godrej and Smitha Godrej Crishna. Jamshyd is the chairman of Godrej & Boyce, the unlisted holding company of the conglomerate. Smitha is not involved in the running of the business but her husband (Vijay Crishna) and daughter (Nyrika Holkar) are. Adi’s three children Tanya, Nisaba and Pirojsha are involved with the business, so are Nadir’s two children except the youngest Hormusji. His eldest son Burjis is with Godrej Agrovet and the second one Sohrab is with Godrej Industries. Jamshyd’s son Navroze is a non-executive director of Godrej & Boyce while daughter Raika is yet to make a formal entry into the group.

Most of the family members sit on the boards of group companies. They also directly or indirectly hold stakes in all the group entities. The family (Adi, Jamshyd, Nadir, Smitha and Rishad) own between 9% and 10% each in Godrej & Boyce, while about 24% is held by a philanthropic trust created by the family and 27% is owned by Godrej Investments. Godrej & Boyce is the largest private land owner in Mumbai. Government records show its holdings in Vikhroli, Nahur and Kurla aggregate 3,401 acres. In recent years, the group has been commercially developing large residential projects on these lands. The real estate business seems to be the primary cause of differences. Although a large chunk of it is a well-protected mangrove sprawl in Vikhroli, the state slum authority estimates that at least 300 acres near Vikhroli station have been encroached upon. Godrej acquired the land in the eastern suburbs sometime in the early 1940s from the Bombay high court receiver. This land was originally given by the East India Company to Parsi merchant Framjee Banaji in the1830s and came up for sale in 1941-42. After acquiring this land, the Godrej group started buying adjoining plots by negotiating with 200 plot owners. In the past decade, the group has become one of the leading real estate players in Mumbai.

A source close to Godrejs said there have been no visible undercurrents due to the differences. “They attend board meetings and are cordial towards each other,” said the source. Another person who knows the family, told TOI, “It was just a matter of time, the younger generation would want to move in different directions. They are fast movers and there is bound to be friction if the others can’t keep up,’’ said this person, not wishing to be identified.

“Adi is flamboyant with an international social scene. He is very clever and a sharp businessman with deep knowledge of the commodity market. Jamshyd, on the other hand, is much lower on the radar and does not enjoy society life. He prefers sailing the seas to anything else, and is simple and very hard working,’’ said the source.

“Adi’s children are all hands on in the business, very pushy and sharp. Under son Pirojsha, the Godrej Properties stock has been booming,’’ said a leading property market expert. Jamshyd, sources said, is probably grooming his niece, Nyrika. “Nyrika is a lawyer and works with Jamshyd,’’ said insiders.

Mangroves

2021

Namrata Singh & Nauzer Bharucha, Nov 10, 2021: The Times of India

The Jamshyd Godrej-controlled Godrej & Boyce Manufacturing Company (G&B) will continue to retain the around 3,401 acres of land that it owns, even as a division in the family business is expected to conclude soon.

The Godrej family is synonymous with landholdings and the maintenance of what is the largest privately managed mangrove belt in the city.

Of the 3,401 acres located in the eastern suburbs of Mumbai, roughly1,750 acres of mangroves are part of the Soonabai Pirojsha Godrej Foundation.

A few years ago, when talks of a separation began between the two families — Adi Godrej, Nadir Godrej and family (Godrej Industries and associates) and Jamshyd Godrej and extended family — real estate was a moot point which brought to the fore questions about how the asset will be divided.

Sources close to the family told TOI it has been decided that G&B which owns the real estate will retain it as well. TOI has learnt that senior directors across group companies have been sworn to secrecy not to talk about the negotiations. Besides, there is an embargo on them not to sell or trade in Godrej stocks till then. An insider, when contacted by this newspaper, said it makes sense for G&B to retain the entire land.

“While the probability of apportioning the land through a separate vehicle was discussed, it was difficult to execute it as it would attract a huge stamp duty payment based on the ready reckoner value of the land,” said the source. “The 5% stamp duty would kick in even if the land were to be transferred from one group company to another,” said the source.

The decision to vest the land in G&B will in turn boost the valuations of the company, said sources. It could make the family business separation an expensive proposition for Jamshyd Godrej’s side. Turnover wise, the unlisted G&B (Rs 11,400 crore in 2019-20) is half the size of Godrej Industries & associate companies (around Rs 21,000 crore). It is not clear whether Godrej Properties, which is part of Godrej Industries and associate companies, would continue to benefit by developing properties on land owned by G&B, following the family separation.

Over and above the 3,401 acre land which belongs to G&B, there is a separate land parcel on which the Godrej Group has been in dispute with the state government since 1973 over who controls the land. The state claims the land belongs to it and had filed a suit against G&B in that year. The dispute is pending before the Bombay high court. In response to TOI’s query on this matter, the Godrej family said in a joint statement: “The Godrej family has been working on a long-term strategic plan for the group for the last few years to ensure best value for its shareholders. As part of this exercise, we have also sought advice from external partners. These discussions between the family remain ongoing.”

Restructuring

As in 2021

Oct 30, 2021: The Times of India

From: Oct 30, 2021: The Times of India

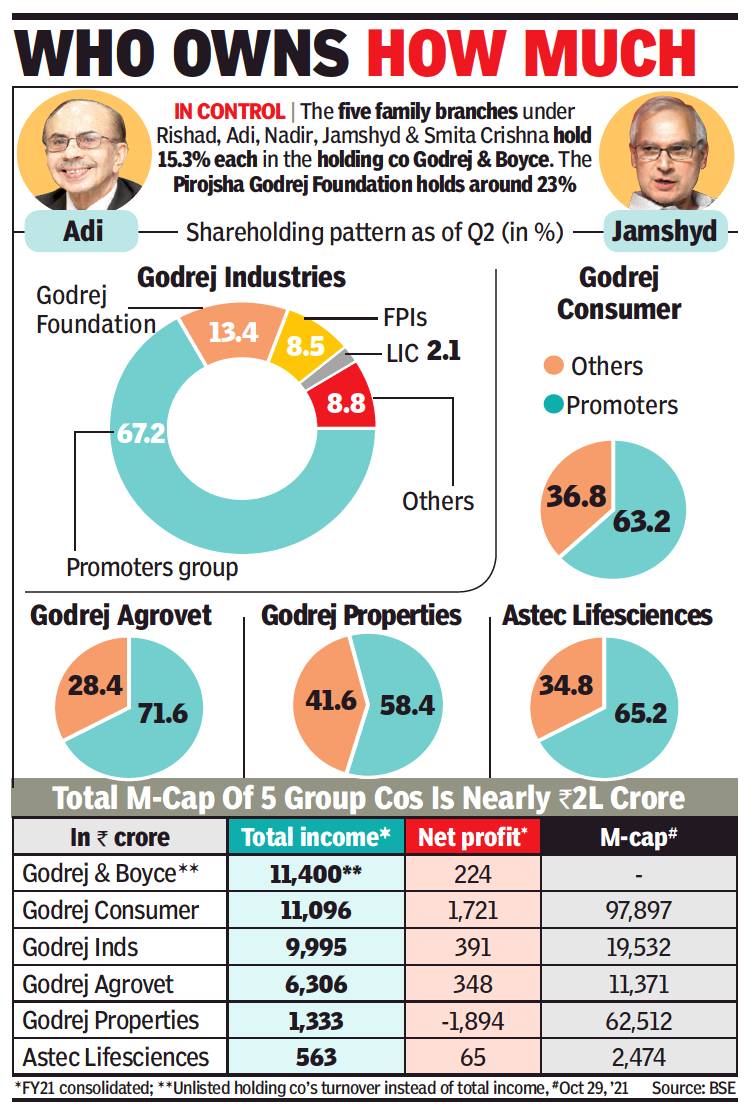

A process of restructuring that the 124-yearold, $4-billion Godrej Group initiated a few years ago is said to have progressed and is likely to see an amicable settlement. According to sources close to the family, although the needle has moved quite a bit on the possible division into two factions — Adi Godrej, Nadir Godrej & family (Godrej Industries & associates) on the one side, and Jamshyd Godrej & family (Godrej & Boyce, or G&B) on the other — the exercise is restricted to the realm of how cross-holdings would be untangled.

The moot point remains as to whether — and, more importantly, how — the huge land holdings under the unlisted G&B would be divided? Sources said there’s no discussion on a division of the land holdings yet. Close to 3,401 acres are housed under G&B, the holding company which clocked a turnover of Rs11,400 crore and a net profit of Rs 224 crore in 2019-20. Although G&B is one-third the size of Godrej Industries & associate companies, the land holdings can boost G&B’s valuation significantly, said sources.

G&B and Godrej Industries & associate companies have been operating independently for decades, although family members sit on the boards of group companies and directly or indirectly hold stakes in group entities. Adi Godrej, who recently stepped down from the listed companies’ boards, continues to be on the board of G&B.

A joint statement from the two sides stated, “The Godrej family has been working on a long-term strategic plan for the group for the last few years to ensure best value for its shareholders. As part of this exercise, we have also sought advice from external partners. These discussions between the family remain ongoing.” A source told TOI the process is being deliberated “in a very amicable way”.

TOI had, in its edition dated June 27, 2019, reported about the move towards a split. TOI had reported that investment banker Nimesh Kampani and lawyer Zia Mody are advising Jamshyd Godrej while Kotak Mahindra Bank’s Uday Kotak and Cyril Shroff of legal firm Cyril Amarchand Mangaldas are assisting Adi Godrej.

The Godrejs have not had disputes of the kind seen in other family businesses because of a policy that has been followed from one generation to the other, where every member’s shareholding gets equally divided among the member’s children. That leaves no scope for dispute. The thinking that’s now driving a restructuring is keeping the future of the group — as also the next few generations — in mind. For one, the structure was getting too complex.

Members of the fourth generation of Godrejs are already in leadership positions. Adi Godrej’s daughter Nisaba is chairing the board of Godrej Consumer Products, while son Pirojsha is chairman of Godrej Properties. Pirojsha is said to be the one driving the talks on the future of the group. Adi Godrej’s eldest daughter Tanya Dubash is chief brand officer of the group.

On the other hand, while Jamshyd’s son Navroze is said to be pursuing his personal interests, Smita and Vijay Crishna’s daughter Nyrika Holkar, a qualified solicitor, is executive director at G&B and is leading the digital strategy for the group. Increasingly, Nyrika is being seen as a successor to Jamshyd at G&B.

2024: The split

May 2, 2024: The Times of India

Reeba Zachariah, May 2, 2024: The Times of India

From: Reeba Zachariah, May 2, 2024: The Times of India

From: May 2, 2024: The Times of India

See graphics:

The 2024 split in the Godrej family business

The Godrej family tree

Mumbai:The Godrej family has reached a settlement to split the Rs 59,000-crore, 127-year-old locks-to-land development group to “better align ownership in acknowledgement of the differing visions of family members”.

Adi Godrej and his brother Nadir Godrej will gain complete ownership over the group’s five listed entities – Godrej Consumer Products, Godrej Properties, Godrej Industries, Godrej Agrovet and Astec Lifesciences – while Jamshyd and his sister Smita will fully control Godrej & Boyce. TNN

The Godrejs have reached a settlement to split the Rs 59,000-crore ($7 billion) locks-to-land development group to “better align ownership in acknowledgement of the differing visions of the family members”.

While Adi Godrej and his brother Nadir Godrej will gain complete ownership over the five listed entities of the Godrej Group — Godrej Consumer Products, Godrej Properties, Godrej Industries, Godrej Agrovet and Astec Lifesciences —Jamshyd and his sister Smita will fully control the closelyheld Godrej & Boyce.

Adi and Nadir, together with their children, have been managing the five entities, while Jamshyd, his sister Smita and their families have been leading Godrej & Boyce, which is into appliances, aerospace, locking solutions and construction.

Their other cousin Rishad, who too owns a stake in the Godrej companies, however, has no formal role in the conglomerate. Their grandfather, along with his brother, had established the Godrej Group 127 years ago.

The two branches have held shares across the group and sat on each other’s companies’ boards. But now, they’ll transfer their equity interests after having stepped down from the boards to facilitate a clean separation.

Adi and Nadir will divest their shares in Godrej & Boyce to Jamshyd and Smita, while Smita and Jamshyd will transfer their shares in Godrej Consumer Products and Godrej Properties to Adi and Nadir. Rishad, who is a bachelor, will reportedly distribute his assets equally among the other family members upon his death. He couldn’t be contacted for immediate comments. Both sides will continue to use the Godrej brand for their respective businesses, according to a late evening statement from the family. Adi, Nadir, Jamshyd, Smita and Rishad own around 10% each in Godrej & Boyce, while about 24% is held by Pirojsha Godrej Foundation — a philanthropic trust created by the family — and 27% by Godrej Investments. The five listed companies have a market capitalisation of Rs 2.4 lakh crore ($29 billion), revenues of over Rs 41,750 crore ($5 billion) and profit of Rs 4,175 crore ($500 million). Godrej & Boyce has a revenue of nearly $2 billion and a pretax profit of $72 million.

“The shareholding realignment in Godrej companies has been arrived at in a respectful and mindful way to maintain harmony,” the statement said. The realignment will be implemented after the relevant regulatory approvals have been obtained.

Godrej & Boyce and its affiliates will now be controlled by Jamshyd, Smita’s daughter Nyrika Holkar, and their immediate families. Godrej Industries and the other four listed companies will be controlled by Adi, Nadir and their immediate families.

Adi’s son Pirojsha will be the executive vice chairperson of GIG (Godrej Industries Group) and will succeed Nadir Godrej as chairperson in August 2026, the statement added. It remains to be seen how the group’s real estate assets worth over Rs 3,000 crore, held under Godrej & Boyce, will be split between the two sides. Godrej Properties has been developing some of the Godrej & Boyce land. The split comes even as the fourth generation of the family has been deeply involved in the affairs of the conglomerate.

Commenting on the future outlook, Jamshyd Godrej said: “Since 1897, Godrej & Boyce has always been driven by the strong purpose of nation building. With this future-facing family agreement now in place, we can further drive our growth aspirations with fewer complexities and focus on leveraging our core strengths in high tech engineering and design-led innovation across our strong portfolio of strategic, consumer and emerging businesses.”

Nadir Godrej said, “Godrej was founded in 1897 to help build economic independence for India. This deep purpose of innovating for a cause the values of trust and respect and the belief in trusteeship and making communities that the companies operate in stronger and better continue to form the bedrock of who we are 125 years later. We look forward to building on this legacy with focus and agility.” “The Godrej family settlement was ‘locked’ today with the elegance and dignity that the family is known for. No controversies, just all clean like their soaps,” said a post from RPG Group’s Harsh Goenka on X.

‘Non-compete ‘ clause

Reeba Zachariah, May 2, 2024: The Times of India

Mumbai: The Godrej family has agreed not to compete among themselves for six years except in the real estate business, following a split in the 127-year-old locks-tol and development group. After the non-compete period, they are free to venture into each other’s domain but not under the Godrej brand.

Adi Godrej and his younger brother Nadir, as part of the family settlement agreement, will have exclusive rights to use the Godrej brand in FMCG (cosmetics, cleaning supplies, toiletries, foods, beverages), financial services, pharmaceuticals, diagnostics, and chemicals businesses.

Their cousin Jamshyd and his sister Smita Crishna will have exclusive rights to use the Godrej brand in defence, consumer durables, medical devices, construction materials, interior design, electric mobility, software services and security products businesses. However, both groups can use the brand name in the real estate develop- ment & marketing business. Jamshyd and Smita have interests in real estate through the unlisted Godrej & Boyce while Adi and Nadir control the listed Godrej Properties.

None of the Godrej group companies will have to pay royalty for the brand. The non-compete period came into play on April 30. According to the agreement, after the six-year period, “a family group can enter into the exclusive business of the other family group, without the use of the Godrej brand including in their corporate names”.

Both the groups, however, can venture into areas where neither has a presence, using the Godrej brand with group-level differentiators, as these have been agreed upon as shared spaces for business. For instance, medical services, hospitals, hospitality and education.

Non-compete covenants are standard in family settlement agreements. In March, the TVS family executed a memorandum of understanding to avoid competition among themselves for a defined period.

YEAR-WISE DEVELOPMENTS

2021

Adi, 79, leaves board as chairman, director

Namrata Singh, August 14, 2021: The Times of India

From: Namrata Singh, August 14, 2021: The Times of India

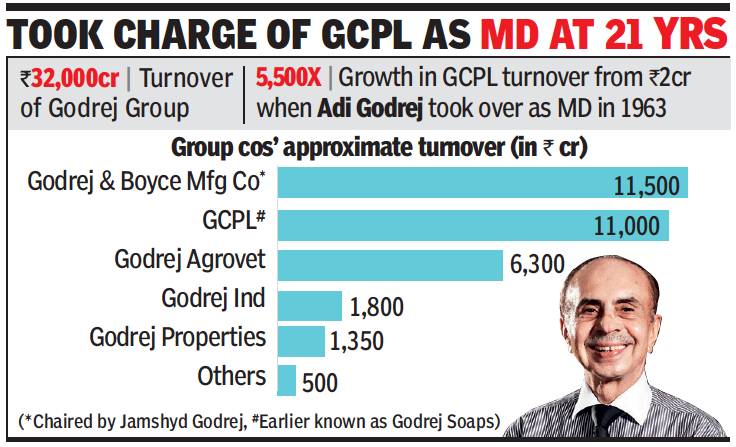

Adi Godrej is stepping down from the board of Godrej Industries — both as chairman and director — which makes it the last of the listed firms of the Rs 32,000-crore Godrej Group where the 79-year-old patriarch has passed on the baton to his successors.

Godrej Industries said these changes to its board will be effective October 1. His younger brother, Nadir Godrej, who is managing director of Godrej Industries, will take over as CMD of the company. Godrej Industries is the holding company, which has interests in consumer goods, agriculture, real estate, chemicals and financial services, other than incubating new businesses.

ABG, as Adi Burjorji Godrej is known, will, however, continue as chairman of the 124-year-old diversified Godrej Group and chairman emeritus of Godrej Industries.

Over the decades, ABG has nurtured the growth of these companies with his hands-on leadership style, and has also brought in topnotch professional talent to compete with multinational rivals. Under his leadership, the soaps business of Godrej has been a formidable competitor to market leader Hindustan Unilever (HUL).

Godrej Group is a conglomeration of different legal entities, some of which are listed on the stock exchanges. It is controlled by the Godrej family, with Adi Godrej’s cousin Jamshyd Godrej heading Godrej & Boyce Manufacturing Company. The part of the Group which was so far managed by Adi Godrej (Godrej Industries, Godrej Consumer Products, Godrej Properties and Godrej Agrovet) has gradually passed on to the next generation of leaders. The part of the group which was overseen directly by ABG is now over Rs 20,000-crore combined.

At a young age of 21, when Adi Godrej had taken over the reins of the erstwhile Godrej Soaps (now GCPL), as MD in 1963, the turnover was a little over Rs 2 crore. Under his leadership, where new marketing skills and strategies were deployed, the turnover of the company shot up to nearly Rs 8 crore in 1967, a growth described as “a watershed in its history” in the book on Godrej’s hundred years by B K Karanjia. By 1995, Godrej Soaps’ turnover was at a striking distance of Rs 600 crore.

Under ABG, the group has also gained broader global insights through shortterm tie-ups with MNCs like Procter & Gamble, Sara Lee and Pilsbury, among others. ABG’s leadership style was different from his predecessors and mentors, although the core purpose was strictly adhered to. If pre-Independence the Godrej Group was known for its swadeshi push, ABG looked at MNC rivals like HUL as customers to whom the group supplied raw materials for making soap.

In 2017, Godrej had stepped down from the board of Godrej Properties as well, while at Godrej Agrovet, the board is chaired by Nadir Godrej. His son, Pirojsha Godrej heads Godrej Properties.

“It has been a privilege to serve Godrej Industries for over four decades, during which we have delivered strong results and transformed our company. I am grateful to our board for their support and guidance; to all our team members whose passion, commitment and hard work has driven our success; and to all our customers, business partners, shareholders, investors, and communities, for their continued partnership. I am very confident that our best years are ahead of us, and I look forward to Nadir and our team achieving our exciting aspirations,” said Godrej.